The North America Critical Infrastructure Protection Market was valued at USD 35.67 billion in 2023 and is expected to grow to USD 54.17 billion by 2030, representing a compound annual growth rate (CAGR) of 6.15 % during the forecast periodNorth America Critical Infrastructure Protection Market Overview:

Critical Infrastructure Protection (CIP) involves safeguarding the infrastructure of crucial sectors within organizations. This process aims to guarantee that organizations operating in vital industries, including agriculture, energy, food, and transportation, are shielded from cyber threats, natural disasters, and terrorist threats, ensuring the resilience and security of their critical infrastructures. The North America Critical Infrastructure Protection market is characterized by a dynamic and resilient landscape, driven by an increasing demand for security measures across key sectors such as energy, transportation, water, communications, and government facilities. In response to emerging threats, the market is expected integration of advanced technologies, particularly cybersecurity solutions and smart infrastructure. The growing frequency and complexity of cyberattacks, coupled with the need to modernize aging infrastructure, are key drivers of North America Critical Infrastructure Protection market growth. Substantial investments in fortifying critical assets and deploying advanced physical and cybersecurity measures are being made in the United States and Canada. Major market players, including Honeywell, Siemens, General Electric, and Schneider Electric, are actively contributing to the market's evolution through the development of comprehensive solutions. The adoption of advanced sensors, Internet of Things (IoT) devices, and analytics tools is gaining momentum, facilitating real-time monitoring and predictive maintenance. Collaborative initiatives between government agencies and private sector entities are fostering the development of resilient infrastructure networks. The market is also witnessing an increased adoption of cloud-based solutions for enhanced scalability and accessibility. Despite these advancements, challenges persist, including regulatory complexities and the need for a coordinated approach to comprehensively address the evolving threat landscape. As North America continues its dedication to upgrading and securing critical infrastructure, the market is poised for further growth, with a focus on innovation and collaboration to successfully navigate emerging risks and challenges.To know about the Research Methodology :- Request Free Sample Report

North America Critical Infrastructure Protection Market Dynamics:

The Integration of Smart Technologies, Including IoT Sensors in Transportation Systems Boosting the Market Growth Rising frequency and sophistication of cyber threats driving the growth of North America Critical Infrastructure Protection Market. For instance, cyber-attack on Ukraine's power grid serves as stark reminders of the vulnerabilities in critical infrastructure, particularly in the energy and utility sectors. Simultaneously, the imperative to modernize aging infrastructure, exemplified by water crises such as those in Flint, Michigan, fuels investments in advanced technologies for water infrastructure security. The integration of smart technologies, including the deployment of IoT sensors in transportation systems, is another driving force. Major cities in North America, leveraging smart traffic management systems, exemplify the resilience and efficiency gains achievable through such integrations. Government investments play a pivotal role, with initiatives such as the substantial infrastructure plan in the United States directing funds towards fortifying critical assets in transportation, energy, and communication sectors. Private sector innovations, such as Siemens' advancements in industrial control systems, contribute significantly by providing cutting-edge solutions for energy and manufacturing facilities. The deployment of IoT sensors, especially in the energy sector through smart grids, enhances real-time monitoring capabilities, improving overall security and reliability. Moreover, the adoption of cloud-based solutions, as demonstrated by Microsoft Azure's cybersecurity services, adds scalability, accessibility, and efficient threat detection to the critical infrastructure protection landscape. Collaborative endeavors between the public and private sectors, such as the Multi-State Information Sharing and Analysis Center (MS-ISAC), foster robust partnerships, enabling the sharing of threat intelligence and bolstering overall cybersecurity resilience. Natural disaster preparedness, stemming from experiences like Hurricane Katrina, reinforces investments in resilient infrastructure for effective disaster response and recovery. The stringent regulatory compliance requirements, such as those mandated by the North American Electric Reliability Corporation (NERC) standards, propel critical infrastructure operators to implement robust security measures, driving North America Critical Infrastructure Protection Market growth through compliance-driven investments. Budget Limitations Restricting Growth Potential in North America Critical Infrastructure Protection Market Strict government regulations hindering the market growth especially with constantly evolving cybersecurity standards such as NIST, demands ongoing adaptation and impede North America Critical Infrastructure Protection Market growth. Financial limitations, observed in municipalities with tight budgets, hinder the implementation of robust security measures and advanced technologies, limiting market growth potential. The interconnected nature of critical systems, particularly evident in the energy sector, introduces vulnerabilities that require a comprehensive security approach, potentially slowing market advancements. The integration of security into older utility infrastructure poses a hurdle, necessitating substantial investments for compatibility against modern threats, potentially inhibiting market growth. Human factors, exemplified by social engineering attacks on personnel, underscore the need for ongoing training to enhance awareness and counter insider threats, presenting challenges to market growth. The SolarWinds cyber-attack highlights supply chain security challenges, emphasizing the importance of comprehensive risk management as a growth constraint. The rise of ransomware and other emerging threats demands adaptive strategies, while the shortage of skilled cybersecurity professionals acts as a barrier to effective implementation, affecting market growth. Barriers to collaboration between public and private sectors, including information sharing hurdles, impede the creation of cohesive and resilient infrastructure networks, limiting overall market growth. Geopolitical tensions and nation-state threats introduce complexities, urging heightened vigilance and international cooperation against sophisticated cyber threats, further constraining growth of North America Critical Infrastructure Protection Market.North America Critical Infrastructure Protection Market Segment Analysis:

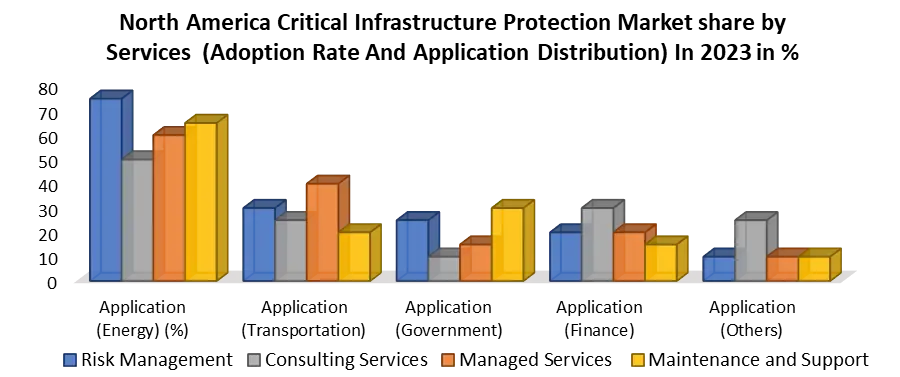

Based on Service, Risk Management Services dominated the North America Critical Infrastructure Protection Market in 2023 and is expected to maintain its dominance over the forecast period. It plays an important role in enhancing cybersecurity preparedness, ensuring proactive measures against evolving threats. The adoption of these services is notably high in sectors such as energy, transportation, and government facilities, where the emphasis is on preventive risk mitigation. Managed Services exhibit a growing trend, particularly in the energy and utility sectors, as organizations increasingly opt for outsourced solutions to bolster their critical infrastructure security. Consulting Services play a crucial role in guiding organizations through complex regulatory landscapes, with widespread adoption in industries such as finance and telecommunications, where adherence to compliance standards is paramount. Maintenance and Support Services witness substantial adoption across various sectors, ensuring the continuous functionality of critical infrastructure components. This service segment is particularly vital in the transportation sector, where uninterrupted operation is crucial.

North America Critical Infrastructure Protection Market Scope: Inquiry Before Buying

North America Critical Infrastructure Protection Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 35.67 Bn. Forecast Period 2024 to 2030 CAGR: 6.15% Market Size in 2030: US $ 54.17 Bn. Segments Covered: by Type Bio pesticides Bio fertilizer Bio stimulants by Growth mechanism Hydroponics Aeroponics Aquaponics by Crop Type Leafy Green Pollinated Plants Nutraceutical Plant by Application Indoor Outdoor North America Critical Infrastructure Protection Leading Key Players:

1. Honeywell International Inc. - Charlotte, North Carolina, USA 2. General Dynamics Corporation - Reston, Virginia, USA 3. Raytheon Technologies Corporation - Waltham, Massachusetts, USA 4. Lockheed Martin Corporation - Bethesda, Maryland, USA 5. Northrop Grumman Corporation - Falls Church, Virginia, USA 6. Booz Allen Hamilton Inc. - McLean, Virginia, USA 7. Symantec Corporation (now part of Broadcom Inc.) - Mountain View, California, USA 8. Cisco Systems, Inc. - San Jose, California, USA 9. IBM Corporation - Armonk, New York, USA 10. Leidos Holdings, Inc. - Reston, Virginia, USAFAQ:

1] Which are major key players are covered in the North America Critical Infrastructure Protection Market report? Ans. The Major Key Players covered in the North America market report are Honeywell International Inc., General Dynamics Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation 2] Which Country is expected to hold the highest share in the North America Critical Infrastructure Protection Market? Ans. The United States is expected to hold the highest share in the North America market. 3] What is the market size of the North America Critical Infrastructure Protection Market by 2030? Ans. The market size of the North America market by 2030 is expected to reach USD 54.17 Billion. 4] What was the market size of the North America Critical Infrastructure Protection Market in 2023? Ans. The market size of the North America market in 2023 was valued at USD 35.67 Billion.

1. North America Critical Infrastructure Protection Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. North America Critical Infrastructure Protection Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End User Segment 2.3.4. Revenue (2023) 2.3.5. Manufacturing Locations 2.4. Leading North America Critical Infrastructure Protection Market Companies, by Market Capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. North America Critical Infrastructure Protection Market: Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.2.1.1. Drivers 3.2.1.2. Restraints 3.2.1.3. Opportunities 3.2.1.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Technological Roadmap 3.7. Regulatory Landscape 3.8. Analysis of Government Schemes and Initiatives for Critical Infrastructure Protection Industry 3.9. Key Opinion Leader Analysis 3.10. The Pandemic Impact on North America Critical Infrastructure Protection Market 4. North America North America Critical Infrastructure Protection Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America North America Critical Infrastructure Protection Market Size and Forecast, By Component (2023-2030) 4.1.1. Security technologies 4.1.2. Services 4.2. North America North America Critical Infrastructure Protection Market Size and Forecast, By Security Technology (2023-2030) 4.2.1. Physical security 4.2.2. Network security 4.2.3. Radars 4.2.4. Vehicle identification management 4.2.5. Chemical, Biological, Radiological and Nuclear Defense (CBRNE) 4.2.6. Supervisory Control and Data Acquisition (SCADA) security 4.2.7. Secure communication 4.2.8. Building management systems 4.2.9. Others 4.3. North America North America Critical Infrastructure Protection Market Size and Forecast, By Service (2023-2030) 4.3.1. Risk management services 4.3.2. Managed services 4.3.3. Consulting services 4.3.4. Maintenance and support services 4.4. North America North America Critical Infrastructure Protection Market Size and Forecast, By End User (2023-2030) 4.4.1. Transportation systems 4.4.2. Energy and power 4.4.3. Sensitive infrastructures and enterprises 4.5. North America North America Critical Infrastructure Protection Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States North America Critical Infrastructure Protection Market Size and Forecast, By Component (2023-2030) 4.5.1.1.1. Security technologies 4.5.1.1.2. Services 4.5.1.2. United States Critical Infrastructure Protection Market Size and Forecast, By Security Technology (2023-2030) 4.5.1.2.1. Physical security 4.5.1.2.2. Network security 4.5.1.2.3. Radars 4.5.1.2.4. Vehicle identification management 4.5.1.2.5. Chemical, Biological, Radiological and Nuclear Defense (CBRNE) 4.5.1.2.6. Supervisory Control and Data Acquisition (SCADA) security 4.5.1.2.7. Secure communication 4.5.1.2.8. Building management systems 4.5.1.2.9. Others 4.5.1.3. United States Critical Infrastructure Protection Market Size and Forecast, By Service (2023-2030) 4.5.1.3.1. Risk management services 4.5.1.3.2. Managed services 4.5.1.3.3. Consulting services 4.5.1.3.4. Maintenance and support services 4.5.1.4. United States Critical Infrastructure Protection Market Size and Forecast, By End User (2023-2030) 4.5.1.4.1. Transportation systems 4.5.1.4.2. Energy and power 4.5.1.4.3. Sensitive infrastructures and enterprises 4.5.2. Canada 4.5.2.1. Canada Critical Infrastructure Protection Market Size and Forecast, By Component (2023-2030) 4.5.2.1.1. Security technologies 4.5.2.1.2. Services 4.5.2.2. Canada Critical Infrastructure Protection Market Size and Forecast, By Security Technology (2023-2030) 4.5.2.2.1. Physical security 4.5.2.2.2. Network security 4.5.2.2.3. Radars 4.5.2.2.4. Vehicle identification management 4.5.2.2.5. Chemical, Biological, Radiological and Nuclear Defense (CBRNE) 4.5.2.2.6. Supervisory Control and Data Acquisition (SCADA) security 4.5.2.2.7. Secure communication 4.5.2.2.8. Building management systems 4.5.2.2.9. Others 4.5.2.3. Canada Critical Infrastructure Protection Market Size and Forecast, By Service (2023-2030) 4.5.2.3.1. Risk management services 4.5.2.3.2. Managed services 4.5.2.3.3. Consulting services 4.5.2.3.4. Maintenance and support services 4.5.2.4. Canada Critical Infrastructure Protection Market Size and Forecast, By End User (2023-2030) 4.5.2.4.1. Transportation systems 4.5.2.4.2. Energy and power 4.5.2.4.3. Sensitive infrastructures and enterprises 4.5.3. Mexico 4.5.3.1. Mexico Critical Infrastructure Protection Market Size and Forecast, By Component (2023-2030) 4.5.3.1.1. Bio pesticides 4.5.3.1.2. Security technologies 4.5.3.1.3. Services 4.5.3.2. Mexico Critical Infrastructure Protection Market Size and Forecast, By Security Technology (2023-2030) 4.5.3.2.1. Physical security 4.5.3.2.2. Network security 4.5.3.2.3. Radars 4.5.3.2.4. Vehicle identification management 4.5.3.2.5. Chemical, Biological, Radiological and Nuclear Defense (CBRNE) 4.5.3.2.6. Supervisory Control and Data Acquisition (SCADA) security 4.5.3.2.7. Secure communication 4.5.3.2.8. Building management systems 4.5.3.2.9. Others 4.5.3.3. Mexico Critical Infrastructure Protection Market Size and Forecast, By Service (2023-2030) 4.5.3.3.1. Risk management services 4.5.3.3.2. Managed services 4.5.3.3.3. Consulting services 4.5.3.3.4. Maintenance and support services 4.5.3.4. Mexico Critical Infrastructure Protection Market Size and Forecast, By End User (2023-2030) 4.5.3.4.1. Transportation systems 4.5.3.4.2. Energy and power 4.5.3.4.3. Sensitive infrastructures and enterprises 5. Company Profile: Key Players 5.1. Honeywell International Inc. - Charlotte, North Carolina, USA 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. General Dynamics Corporation - Reston, Virginia, USA 5.3. Raytheon Technologies Corporation - Waltham, Massachusetts, USA 5.4. Lockheed Martin Corporation - Bethesda, Maryland, USA 5.5. Northrop Grumman Corporation - Falls Church, Virginia, USA 5.6. Booz Allen Hamilton Inc. - McLean, Virginia, USA 5.7. Symantec Corporation (now part of Broadcom Inc.) - Mountain View, California, USA 5.8. Cisco Systems, Inc. - San Jose, California, USA 5.9. IBM Corporation - Armonk, New York, USA 5.10. Leidos Holdings, Inc. - Reston, Virginia, USA 6. Key Findings 7. Industry Recommendations 8. North America Critical Infrastructure Protection Market: Research Methodology