The Monoethylene Glycol (MEG) Market size was valued at USD 35.12 Billion in 2023 and the total Debt Collection Software revenue is expected to grow at a CAGR of 6.2 % from 2024 to 2030, reaching nearly USD 53.51 Billion by 2030 Monoethylene Glycol (MEG) is an organic compound commonly used as a raw material in the production of polyester fibres, resins, and antifreeze. MEG, a key ingredient in the production of polyester fibers, resins, and antifreeze, finds extensive application in industries such as textiles, automotive, and packaging. The increasing demand for polyester Fibers in the textile industry, particularly in emerging economies like China and India, is a driving the growth of Monoethylene Glycol (MEG) Market. The automotive sector's expansion, coupled with the rising construction activities worldwide, further boosts the demand for MEG-based products. Recent developments in the market include strategic collaborations and expansion initiatives by key players to strengthen their market presence. For instance, in 2023, SABIC, a global leader in diversified chemicals, announced plans to expand its MEG production capacity in the Middle East, aiming to meet the growing demand for polyester fibers and resins in the region.To know about the Research Methodology:-Request Free Sample Report Technological advancements and innovations in MEG production processes, focusing on sustainability and cost-effectiveness, are driving market growth. Companies are increasingly investing in research and development to enhance product quality, reduce production costs, and minimize environmental impact. The growing trend towards bio-based MEG, derived from renewable feedstocks, reflects the industry's commitment to sustainability and environmental responsibility. Monoethylene Glycol (MEG) Market is expected for continued growth, driven by increasing industrial applications, strategic investments, and technological advancements aimed at meeting evolving consumer demands while addressing environmental concerns.

Monoethylene Glycol (MEG) Market Dynamics:

Rising demand for PET bottles in the beverage industry, particularly in emerging markets like India and China, is a key driver propelling Monoethylene Glycol (MEG) market growth The rising demand for PET bottles within the beverage industry driving the growth of Monoethylene Glycol (MEG) market. Leading Monoethylene Glycol (MEG) Market players like Coca-Cola are expanding globally, increasingly relying on PET packaging, especially in emerging markets such as India and China. This trend necessitates a corresponding increase in MEG consumption as a crucial component in PET production. The textile industry's expansion, particularly in the Asia-Pacific region with countries such as Bangladesh and Vietnam emerging as manufacturing hubs, further fuels MEG demand. As MEG serves as a vital raw material in polyester fiber production, it plays a pivotal role in meeting the growing demand for synthetic fibers and textiles globally. The automotive sector's growth, particularly in the realm of electric vehicles (EVs), contributes significantly to the Monoethylene Glycol (MEG) Market growth. Companies like Tesla and major automakers' electrification initiatives drive the demand for MEG-based materials, notably polyester fibers used in car interiors. Urbanization and the subsequent surge in construction activities, particularly evident in regions such as China experiencing rapid urban development, further drive MEG consumption for polyester-based construction materials, thus bolstering the market. The booming packaging industry, driven by e-commerce and FMCG sectors, serves as a significant growth driver for MEG. Companies like Amazon's global expansion drive the need for PET packaging, thereby stimulating MEG consumption for packaging materials. The complexity of legal and regulatory frameworks acts as a barrier, hampering the growth of the market Fluctuations in crude oil prices directly influence MEG production costs, causing pricing instability and diminished profitability hampering the growth of Monoethylene Glycol (MEG) market. Heightened scrutiny on MEG production's environmental footprint, particularly concerning carbon emissions and water usage, presents challenges in maintaining sustainability and regulatory compliance, urging the need for more eco-friendly production processes. Intensified competition from alternative materials like bio-based glycols and recycled PET constrains MEG market growth. Companies investing in these alternatives pose a significant threat to traditional Monoethylene Glycol (MEG) producers, altering market share dynamics and profitability. Stringent environmental regulations governing MEG production and usage further compound challenges, necessitating costly process modifications to comply with restrictions on chemicals such as ethylene oxide. Trade tensions and tariffs on MEG imports and exports also disrupt supply chains, raising operational costs and impacting market dynamics and profitability for producers. Rapid advancements in production technologies, particularly in bio-based MEG production, present alternative, sustainable options, challenging traditional MEG producers' dominance.Monoethylene Glycol (MEG) Market Segment Analysis:

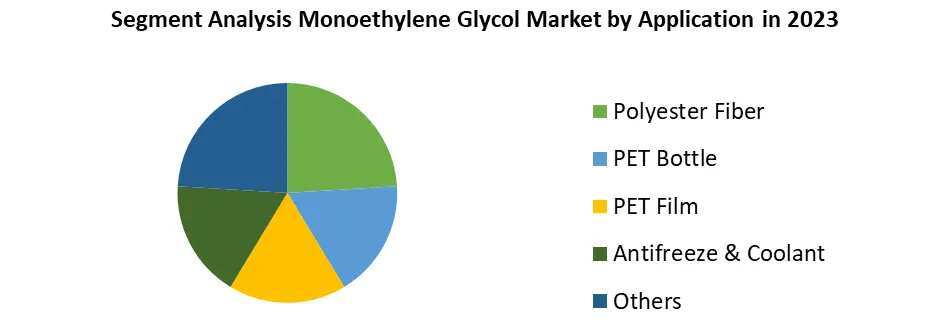

Based on Applications, Polyester fibre production dominated the Monoethylene Glycol (MEG) Market in 2023, driven by the robust demand for textiles and apparel globally. PET bottle manufacturing follows closely, buoyed by the growing preference for lightweight, durable packaging solutions in the beverage and food industries. PET film production also maintains a significant share, supported by its usage in packaging, electrical, and industrial applications. The antifreeze and coolant segment expected steady adoption, particularly in automotive and HVAC systems. While these applications constitute the primary demand drivers, other niche applications such as solvent production, chemical intermediates, and pharmaceuticals contribute to the overall MEG market.

Monoethylene Glycol (MEG) Market Regional Insights:

Asia Pacific Dominated the Monoethylene Glycol (MEG) Market The Asia-Pacific region dominated the global Monoethylene Glycol (MEG) market in 2023, driven by growing textile and automotive activities, particularly in countries like China, India, and Japan. China, in particular, stands out as a major consumer and producer of MEG and its derivative, PET, benefiting from abundant raw material availability and low-cost production. The country hosts prominent PET resin manufacturers like PetroChina Group and Jiangsu Synganglion, with capacities exceeding 2 million tons, driving the demand for MEG. China's thriving textile industry, coupled with its status as the world's largest clothing exporter, further propels MEG demand. India also contributes significantly to the region's Monoethylene Glycol (MEG) Market, with substantial production capacities. The Asia-Pacific region serves as the largest automotive manufacturing hub, with robust production growth driving additional demand for MEG. These factors collectively indicate a positive outlook for MEG demand in the region throughout the forecast period.Monoethylene Glycol (MEG) Market Scope: Inquire before buying

Global Monoethylene Glycol (MEG) Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 35.12 Bn. Forecast Period 2024 to 2030 CAGR: 6.2% Market Size in 2030: US $ 53.51 Bn. Segments Covered: by Process Oxidation of Ethylene Bio-Based Monoethylene Glycol Production by Application Polyester Fiber PET Bottle PET Film Antifreeze & Coolant Others by End Use Industry Textile Packaging Plastic Automotive and Transportation Other End-user Industries Monoethylene Glycol (MEG) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Monoethylene Glycol (MEG) Market Key Players:

Major Contributors in the Debt Collection Software Service Providing: 1. SABIC 2. Formosa 3. Dowdupont 4. BASF 5. MEGlobal 6. Sinopec 7. Shell 8. Reliance 9. SIBUR 10. PTTGC 11. Royal Dutch Shell 12. AkzoNobel 13. The Dow Chemicals 14. Mitsubishi Chemical 15. Lotte Chemical Corporation 16. Zhenhai Refining & Chemical Co., Nan Ya Plastics Corporation 17. LyondellBasell Industries 18. ExxonMobil Corporation 19. Chemtex Speciality Limited 20. India Glycols FAQs: 1] Which region is expected to hold the highest share in the Global Monoethylene Glycol (MEG) Market? Ans. Asia Pacific region is expected to hold the highest share in the Monoethylene Glycol (MEG) Market. 2] What is the market size of the Global Monoethylene Glycol (MEG) Market by 2030? Ans. The market size of the Monoethylene Glycol (MEG) Market by 2030 is expected to reach US$ 53.51 Billion. 3] What is the forecast period for the Global Monoethylene Glycol (MEG) Market? Ans. The forecast period for the Monoethylene Glycol (MEG) Market is 2024-2030. 4] What was the market size of the Global Monoethylene Glycol (MEG) Market in 2023? Ans. The market size of the Monoethylene Glycol (MEG) Market in 2023 was valued at US$ 35.12 Billion.

1. Monoethylene Glycol (MEG) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Monoethylene Glycol (MEG) Market: Dynamics 2.1. Monoethylene Glycol (MEG) Market Trends by Region 2.1.1. North America Monoethylene Glycol (MEG) Market Trends 2.1.2. Europe Monoethylene Glycol (MEG) Market Trends 2.1.3. Asia Pacific Monoethylene Glycol (MEG) Market Trends 2.1.4. Middle East and Africa Monoethylene Glycol (MEG) Market Trends 2.1.5. South America Monoethylene Glycol (MEG) Market Trends 2.2. Monoethylene Glycol (MEG) Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Monoethylene Glycol (MEG) Market Drivers 2.2.1.2. North America Monoethylene Glycol (MEG) Market Restraints 2.2.1.3. North America Monoethylene Glycol (MEG) Market Opportunities 2.2.1.4. North America Monoethylene Glycol (MEG) Market Challenges 2.2.2. Europe 2.2.2.1. Europe Monoethylene Glycol (MEG) Market Drivers 2.2.2.2. Europe Monoethylene Glycol (MEG) Market Restraints 2.2.2.3. Europe Monoethylene Glycol (MEG) Market Opportunities 2.2.2.4. Europe Monoethylene Glycol (MEG) Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Monoethylene Glycol (MEG) Market Drivers 2.2.3.2. Asia Pacific Monoethylene Glycol (MEG) Market Restraints 2.2.3.3. Asia Pacific Monoethylene Glycol (MEG) Market Opportunities 2.2.3.4. Asia Pacific Monoethylene Glycol (MEG) Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Monoethylene Glycol (MEG) Market Drivers 2.2.4.2. Middle East and Africa Monoethylene Glycol (MEG) Market Restraints 2.2.4.3. Middle East and Africa Monoethylene Glycol (MEG) Market Opportunities 2.2.4.4. Middle East and Africa Monoethylene Glycol (MEG) Market Challenges 2.2.5. South America 2.2.5.1. South America Monoethylene Glycol (MEG) Market Drivers 2.2.5.2. South America Monoethylene Glycol (MEG) Market Restraints 2.2.5.3. South America Monoethylene Glycol (MEG) Market Opportunities 2.2.5.4. South America Monoethylene Glycol (MEG) Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Monoethylene Glycol (MEG) Industry 2.8. Analysis of Government Schemes and Initiatives For Monoethylene Glycol (MEG) Industry 2.9. Monoethylene Glycol (MEG) Market Trade Analysis 2.10. The Global Pandemic Impact on Monoethylene Glycol (MEG) Market 3. Monoethylene Glycol (MEG) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 3.1.1. Oxidation of Ethylene 3.1.2. Bio-Based Monoethylene Glycol Production 3.2. Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 3.2.1. Polyester Fiber 3.2.2. PET Bottle 3.2.3. PET Film 3.2.4. Antifreeze & Coolant 3.2.5. Others 3.3. Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 3.3.1. Textile 3.3.2. Packaging 3.3.3. Plastic 3.3.4. Automotive and Transportation 3.3.5. Other End-user Industries 3.4. Monoethylene Glycol (MEG) Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 4.1.1. Oxidation of Ethylene 4.1.2. Bio-Based Monoethylene Glycol Production 4.2. North America Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 4.2.1. Polyester Fiber 4.2.2. PET Bottle 4.2.3. PET Film 4.2.4. Antifreeze & Coolant 4.2.5. Others 4.3. North America Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1. Textile 4.3.2. Packaging 4.3.3. Plastic 4.3.4. Automotive and Transportation 4.3.5. Other End-user Industries 4.4. North America Monoethylene Glycol (MEG) Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 4.4.1.1.1. Oxidation of Ethylene 4.4.1.1.2. Bio-Based Monoethylene Glycol Production 4.4.1.2. United States Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Polyester Fiber 4.4.1.2.2. PET Bottle 4.4.1.2.3. PET Film 4.4.1.2.4. Antifreeze & Coolant 4.4.1.2.5. Others 4.4.1.3. United States Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 4.4.1.3.1. Textile 4.4.1.3.2. Packaging 4.4.1.3.3. Plastic 4.4.1.3.4. Automotive and Transportation 4.4.1.3.5. Other End-user Industries 4.4.2. Canada 4.4.2.1. Canada Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 4.4.2.1.1. Oxidation of Ethylene 4.4.2.1.2. Bio-Based Monoethylene Glycol Production 4.4.2.2. Canada Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Polyester Fiber 4.4.2.2.2. PET Bottle 4.4.2.2.3. PET Film 4.4.2.2.4. Antifreeze & Coolant 4.4.2.2.5. Others 4.4.2.3. Canada Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 4.4.2.3.1. Textile 4.4.2.3.2. Packaging 4.4.2.3.3. Plastic 4.4.2.3.4. Automotive and Transportation 4.4.2.3.5. Other End-user Industries 4.4.3. Mexico 4.4.3.1. Mexico Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 4.4.3.1.1. Oxidation of Ethylene 4.4.3.1.2. Bio-Based Monoethylene Glycol Production 4.4.3.2. Mexico Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Polyester Fiber 4.4.3.2.2. PET Bottle 4.4.3.2.3. PET Film 4.4.3.2.4. Antifreeze & Coolant 4.4.3.2.5. Others 4.4.3.3. Mexico Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 4.4.3.3.1. Textile 4.4.3.3.2. Packaging 4.4.3.3.3. Plastic 4.4.3.3.4. Automotive and Transportation 4.4.3.3.5. Other End-user Industries 5. Europe Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.2. Europe Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.3. Europe Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4. Europe Monoethylene Glycol (MEG) Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.1.2. United Kingdom Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.2. France 5.4.2.1. France Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.2.2. France Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.3.2. Germany Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.4.2. Italy Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.5.2. Spain Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.6.2. Sweden Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.7.2. Austria Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 5.4.8.2. Rest of Europe Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.2. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.1.2. China Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.2.2. S Korea Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.3.2. Japan Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.4. India 6.4.4.1. India Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.4.2. India Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.5.2. Australia Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.6.2. Indonesia Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.7.2. Malaysia Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.8.2. Vietnam Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.9.2. Taiwan Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 6.4.10.2. Rest of Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 7.2. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 7.4. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 7.4.1.2. South Africa Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 7.4.2.2. GCC Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 7.4.3.2. Nigeria Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 7.4.4.2. Rest of ME&A Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 8.2. South America Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 8.3. South America Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry(2023-2030) 8.4. South America Monoethylene Glycol (MEG) Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 8.4.1.2. Brazil Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 8.4.2.2. Argentina Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Monoethylene Glycol (MEG) Market Size and Forecast, by Process (2023-2030) 8.4.3.2. Rest Of South America Monoethylene Glycol (MEG) Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Monoethylene Glycol (MEG) Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Monoethylene Glycol (MEG) Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Monoethylene Glycol (MEG) Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. SABIC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Formosa 10.3. Dowdupont 10.4. BASF 10.5. MEGlobal 10.6. Sinopec 10.7. Shell 10.8. Reliance 10.9. SIBUR 10.10. PTTGC 10.11. Royal Dutch Shell 10.12. AkzoNobel 10.13. The Dow Chemicals 10.14. Mitsubishi Chemical 10.15. Lotte Chemical Corporation 10.16. Zhenhai Refining & Chemical Co., Nan Ya Plastics Corporation 10.17. LyondellBasell Industries 10.18. ExxonMobil Corporation 10.19. Chemtex Speciality Limited 10.20. India Glycols 11. Key Findings 12. Industry Recommendations 13. Monoethylene Glycol (MEG) Market: Research Methodology 14. Terms and Glossary