Monoethylene Glycol (MEG) Market size was valued at USD 40.81 Bn. in 2024, and the total Monoethylene Glycol (MEG) Market revenue is expected to grow by 7.27% from 2025 to 2032, reaching nearly USD 71.55 Bn.Monoethylene Glycol (MEG) Market Overview:

Monoethylene Glycol (MEG) is a colourless, sweet-flavoured, syrup-like liquid used as a crucial building block for polyester fibers and antifreeze. Its chemical formula is C₂H₆O₂. It is a versatile compound that quietly plays a key role in powering everything from textiles and plastic bottles to car engines. Owing to its numerous uses in the production of polyester fibres, PET plastic bottles, and car coolants, where Monoethylene Glycol (MEG) is a critical ingredient, also utilized in the world petrochemical sector. Further, China, being at the frontline of production and consumption, thus, demand for textiles and packaging, mainly in Asia-Pacific, is on the rise, which is approximately 60% of Global consumption, thus, has established MEG's significance. Thus, the Monoethylene Glycol (MEG) industry is subjected to challenges such as unstable oil prices and plastics environmental regulations, and technological innovations such as bio-based MEG are becoming viable alternatives that are environmentally friendly. Key players in the Monoethylene Glycol (MEG) market include SABIC, Sinopec, Dow, and BASF, which are investing in environmentally friendly developments and capacity expansions in an effort to keep pace with economic trends.To know about the Research Methodology:-Request Free Sample Report Technological advancements and innovations in MEG production processes, focusing on sustainability and cost-effectiveness, are driving market growth. Companies are increasingly investing in research and development to enhance product quality, reduce production costs, and minimize environmental impact. The growing trend towards bio-based MEG, derived from renewable feedstocks, reflects the industry's commitment to sustainability and environmental responsibility. Monoethylene Glycol (MEG) Market is expected for continued growth, driven by increasing industrial applications, strategic investments, and technological advancements aimed at meeting evolving consumer demands while addressing environmental concerns.

Monoethylene Glycol (MEG) Market Dynamics:

Rising demand for PET bottles in the beverage industry, particularly in emerging markets like India and China to drive Monoethylene Glycol (MEG) market growth

The rising demand for PET bottles within the beverage industry is driving the growth of the Monoethylene Glycol (MEG) market. Leading Monoethylene Glycol (MEG) Market players like Coca-Cola are expanding globally, increasingly relying on PET packaging, especially in emerging markets such as India and China. This trend necessitates a corresponding increase in MEG consumption as a crucial component in PET production. The textile industry's expansion, particularly in the Asia-Pacific region, with countries such as Bangladesh and Vietnam emerging as manufacturing hubs, further fuels MEG demand. As MEG serves as a vital raw material in polyester fibre production, it plays a pivotal role in meeting the growing demand for synthetic fibres and textiles globally. The automotive sector's growth, particularly in the realm of electric vehicles (EVs), contributes significantly to the Monoethylene Glycol (MEG) Market growth. Companies like Tesla and major automakers' electrification initiatives drive the demand for MEG-based materials, notably polyester fibres used in car interiors. Urbanisation and the subsequent surge in construction activities, particularly evident in regions such as China experiencing rapid urban development, further drive MEG consumption for polyester-based construction materials, thus bolstering the market. The booming packaging industry, driven by e-commerce and FMCG sectors, serves as a significant growth driver for MEG. Companies like Amazon's global expansion drive the need for PET packaging, thereby stimulating MEG consumption for packaging materials.The complexity of legal and regulatory frameworks to restrain the Monoethylene Glycol (MEG) Market

Fluctuations in crude oil prices directly influence MEG production costs, causing pricing instability and diminished profitability, hampering the growth of the Monoethylene Glycol (MEG) market. Heightened scrutiny on MEG production's environmental footprint, particularly concerning carbon emissions and water usage, presents challenges in maintaining sustainability and regulatory compliance, urging the need for more eco-friendly production processes. Intensified competition from alternative materials like bio-based glycols and recycled PET constrains MEG market growth. Companies investing in these alternatives pose a significant threat to traditional Monoethylene Glycol (MEG) producers, altering market share dynamics and profitability. Stringent environmental regulations governing MEG production and usage further compound challenges, necessitating costly process modifications to comply with restrictions on chemicals such as ethylene oxide. Trade tensions and tariffs on MEG imports and exports also disrupt supply chains, raising operational costs and impacting market dynamics and profitability for producers. Rapid advancements in production technologies, particularly in bio-based MEG production, present alternative, sustainable options, challenging traditional MEG producers' dominance.Monoethylene Glycol (MEG) Market Segment Analysis:

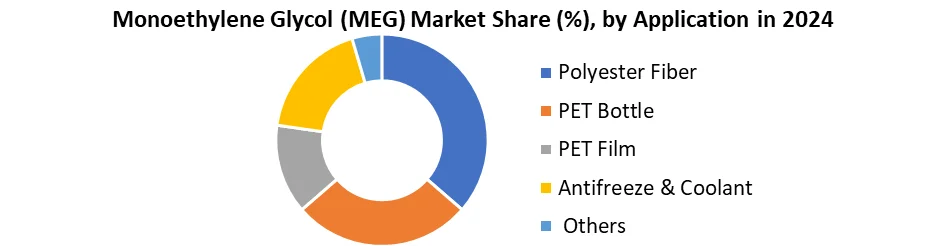

Based on Applications, Polyester fibre production dominated the Monoethylene Glycol (MEG) Market in 2024, driven by the robust demand for textiles and apparel globally. PET bottle manufacturing follows closely, buoyed by the growing preference for lightweight, durable packaging solutions in the beverage and food industries. PET film production also maintains a significant share, supported by its usage in packaging, electrical, and industrial applications. The antifreeze and coolant segment are expected to experience steady adoption, particularly in automotive and HVAC systems. While these applications constitute the primary demand drivers, other niche applications such as solvent production, chemical intermediates, and pharmaceuticals contribute to the overall MEG market.

Monoethylene Glycol (MEG) Market Regional Insights:

Asia Pacific Dominated the Monoethylene Glycol (MEG) Market in 2024 The Asia-Pacific region dominated the global Monoethylene Glycol (MEG) market in 2024, driven by growing textile and automotive activities, particularly in countries like China, India, and Japan. China, in particular, stands out as a major consumer and producer of MEG and its derivative, PET, benefiting from abundant raw material availability and low-cost production. The country hosts prominent PET resin manufacturers like PetroChina Group and Jiangsu Synganglion, with capacities exceeding 2 million tons, driving the demand for MEG. China's thriving textile industry, coupled with its status as the world's largest clothing exporter, further propels MEG demand. India also contributes significantly to the region's Monoethylene Glycol (MEG) Market, with substantial production capacities. The Asia-Pacific region serves as the largest automotive manufacturing hub, with robust production growth driving additional demand for MEG. These factors collectively indicate a positive outlook for MEG demand in the region throughout the forecast period.Monoethylene Glycol (MEG) Market Competitive Landscape:

The Global Monoethylene Glycol (MEG) market is characterized by fierce rivalry between long-standing petrochemical majors and new entrants, each drawing on unique strengths. Petrochemicals majors SABIC and Sinopec reign supreme through vertical integration and size, with SABIC taking advantage of Middle Eastern ethane cost leadership and Sinopec holding almost one-third of China's huge MEG capacity. Competitors such as Reliance Industries fight on operational performance, having recently commissioned a 750K-ton plant to supply India's thriving textile industry, whereas Western majors such as Dow Chemical concentrate on specialty antifreeze uses and environmentally friendly Monoethylene Glycol (MEG) growth. The market is witnessing a strategic transition in the direction of differentiation, with the success of bio-based MEG makers such as India Glycols among environmentally sensitive buyers, replicating the premiumization pattern in consumer markets. Regional dynamics come into play, with Chinese overcapacity putting pressure on global prices while Southeast Asian demand increases by 5-7% per year. Similar to Dyson and iRobot in the vacuum space, leading MEG players are sinking significant amounts into R&D (15-20% of revenues for some) to create sustainable production processes and gain alliances with leading polyester and packaging companies, guaranteeing loyalty in a rising environment of heightened regulation.Monoethylene Glycol (MEG) Market Key Developments:

January 2025 - SABIC of Saudi Arabia started operations of its blue Monoethylene Glycol (MEG) carbon capture facility in Jubail with 50% lower production emissions and retaining 99.9% purity for textile applications. February 2025 - Sinopec of China commissioned its Xinjiang coal-to- Monoethylene Glycol (MEG) facility successfully to full capacity of 1.2 million metric tons annually using proprietary gasification technology that saved costs by $150/ton. March 2025 - India's Reliance Industries started up its BioGlycol biorefinery at Jamnagar, the world's first sugarcane-based 200,000-ton per annum Monoethylene Glycol (MEG) manufacturing unit for sustainable polyester applications. April 2025 - Dow USA's Chemical and The Coca-Cola Company introduced their joint RENUVA recycled MEG product portfolio in Texas, recycling 50,000 tons/year of PET waste into food-grade Monoethylene Glycol (MEG) through cutting-edge glycolysis. May 2025 - India Glycols Limited launched FlexiGlycol, its bio-MEG formulation for aviation de-icing that complies with new EU winter operation sustainability criteria. June 2025 - LyondellBasell's Houston circular economy centre shipped its first cargo of waste-plastic-based Monoethylene Glycol (MEG) to prominent European fibre manufacturers, with ISCC PLUS certification.Monoethylene Glycol (MEG) Market Key Trends:

Category Key Trend Example Product/Initiative Market Impact Sustainable Production Low-carbon Monoethylene Glycol (MEG) technologies SABIC’s blueMEG (carbon capture) Reduces emissions by 50%; aligns with EU Carbon Border Tax (2026) Alternative Feedstocks Coal/biomass-to Monoethylene Glycol (MEG) conversion Sinopec’s Xinjiang coal-based MEG plant Cuts costs by $150/ton; supplies 15% of China’s polyester demand Bio-Based MEG Renewable Monoethylene Glycol (MEG) for circular textiles Reliance’s BioGlycol (sugarcane-derived) Targets luxury brands (e.g., Patagonia, H&M); 20% premium pricing Recycled MEG PET waste-to- Monoethylene Glycol (MEG) upcycling Dow/Coca-Cola’s RENUVA recycled MEG Meets FDA food-grade standards; $180/ton cost savings vs. virgin MEG Regional Reshoring Localized Monoethylene Glycol (MEG) for supply chain security LyondellBasell’s Houston circular hub First ISCC+ certified waste-derived MEG for EU fiber producers Monoethylene Glycol (MEG) Market Scope: Inquire before buying

Global Monoethylene Glycol (MEG) Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 40.81 Bn Forecast Period 2025 to 2032 CAGR: 7.27% Market Size in 2032: USD 71.55 Bn. Segments Covered: by process Oxidation of Ethylene Bio-Based Monoethylene Glycol Production by Application Polyester Fiber PET Bottle PET Film Antifreeze & Coolant Others by End User Industry Textile Packaging Plastic Automotive and Transportation Other End-user Industries Monoethylene Glycol (MEG) Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Monoethylene Glycol (MEG) Market, Key Players:

North America 1. Dow Chemical (Midland, Michigan, USA) 2. ExxonMobil (Spring, Texas, USA) 3. LyondellBasell (Houston, Texas, USA) 4. Shell (The Hague, Netherlands) Europe 5. BASF (Ludwigshafen, Germany) 6. SABIC (Riyadh, Saudi Arabia) 7. SIBUR (Moscow, Russia) 8. AkzoNobel (Amsterdam, Netherlands) Asia-Pacific 9. Sinopec (Beijing, China) 10. Reliance Industries (Mumbai, India) 11. Formosa Plastics (Taipei, Taiwan) 12. PTTGC (Bangkok, Thailand) 13. Mitsubishi Chemical (Tokyo, Japan) 14. Lotte Chemical (Seoul, South Korea) Middle East 15. SABIC (Riyadh, Saudi Arabia) 16. MEGlobal (Dubai, UAE) India 17. India Glycols (Dehradun, India) 18. Chemtex Speciality (Mumbai, India)Frequently Asked Questions:

1. Which region is expected to hold the highest share in the Global Monoethylene Glycol (MEG) Market? Ans. Asia Pacific region is expected to hold the highest share in the Monoethylene Glycol (MEG) Market. 2. What is the market size of the Global Monoethylene Glycol (MEG) Market by 2032? Ans. The market size of the Monoethylene Glycol (MEG) Market by 2032 is expected to reach US$ 71.55 Billion. 3. What is the forecast period for the Global Monoethylene Glycol (MEG) Market? Ans. The forecast period for the Monoethylene Glycol (MEG) Market is 2025-2032. 4. What was the market size of the Global Monoethylene Glycol (MEG) Market in 2024? Ans. The market size of the Monoethylene Glycol (MEG) Market in 2024 was valued at US$ 40.81 Billion.

1. Monoethylene Glycol (MEG) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Monoethylene Glycol (MEG) Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Computer-Aided Detection Market: Dynamics 3.1. Region-wise Trends of Computer-Aided Detection Market 3.1.1. North America Computer-Aided Detection Market Trends 3.1.2. Europe Computer-Aided Detection Market Trends 3.1.3. Asia Pacific Computer-Aided Detection Market Trends 3.1.4. Middle East and Africa Computer-Aided Detection Market Trends 3.1.5. South America Computer-Aided Detection Market Trends 3.2. Monoethylene Glycol (MEG) Market Dynamics 3.2.1. Monoethylene Glycol (MEG) Market Drivers 3.2.1.1. Rising Prevalence of Chronic Diseases 3.2.1.2. Growing Adoption for AI and Machine Learning 3.2.2. Monoethylene Glycol (MEG) Market Restraints 3.2.3. Monoethylene Glycol (MEG) Market Opportunities 3.2.3.1. Advanced Tools 3.2.3.2. Growth in the healthcare market 3.2.4. Monoethylene Glycol (MEG) Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Political 3.4.2. Economical 3.4.3. Legal 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Monoethylene Glycol (MEG) Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 4.1.1. Oxidation of Ethylene 4.1.2. Bio-Based Monoethylene Glycol 4.1.3. Production 4.2. Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 4.2.1. Polyester Fiber 4.2.2. PET Bottle 4.2.3. PET Film 4.2.4. Antifreeze & Coolant 4.2.5. Others 4.3. Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 4.3.1. Textile 4.3.2. Packaging 4.3.3. Plastic 4.3.4. Automotive and Transportation 4.3.5. Other End-user Industries 4.4. Monoethylene Glycol (MEG) Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 5.1.1. Oxidation of Ethylene 5.1.2. Bio- Based Monoethylene Glycol 5.1.3. Production 5.2. North America Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 5.2.1. Polyester Fiber 5.2.2. PET Bottle 5.2.3. Telecardiology 5.2.4. Antifreeze & Coolant 5.2.5. Others 5.3. North America Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 5.3.1. Textile 5.3.2. Packaging 5.3.3. Plastic 5.3.4. Automotive and Transportation 5.3.5. Other End-user Industries 5.4. North America Monoethylene Glycol (MEG) Market Size and Forecast, By Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 5.4.1.1.1. Oxidation of Ethylene 5.4.1.1.2. Bio- Based Monoethylene Glycol 5.4.1.1.3. Production 5.4.1.2. United States Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Polyester Fiber 5.4.1.2.2. PET Bottle 5.4.1.2.3. PET Film 5.4.1.2.4. Antifreeze & Coolant 5.4.1.2.5. Others 5.4.1.3. United States Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 5.4.1.3.1. Textile 5.4.1.3.2. Packaging 5.4.1.3.3. Plastic 5.4.1.3.4. Automotive and Transportation 5.4.1.3.5. Other End-user Industries 5.4.2. Canada 5.4.2.1. Canada Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 5.4.2.1.1. Oxidation of Ethylene 5.4.2.1.2. Bio- Based Monoethylene Glycol 5.4.2.1.3. Production 5.4.2.2. Canada Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Polyester Fiber 5.4.2.2.2. PET Bottle 5.4.2.2.3. PET Film 5.4.2.2.4. Antifreeze & Coolant 5.4.2.2.5. Others 5.4.2.3. Canada Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 5.4.2.3.1. Textile 5.4.2.3.2. Packaging 5.4.2.3.3. Plastic 5.4.2.3.4. Automotive and Transportation 5.4.2.3.5. Other End-user Industries 5.4.3. Mexico 5.4.3.1. Mexico Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 5.4.3.1.1. Oxidation of Ethylene 5.4.3.1.2. Bio- Based Monoethylene Glycol 5.4.3.1.3. Production 5.4.3.2. Mexico Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 5.4.3.2.1. Polyester Fiber 5.4.3.2.2. PET Bottle 5.4.3.2.3. PET Film 5.4.3.2.4. Antifreeze & Coolant 5.4.3.2.5. Others 5.4.3.3. Mexico Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 5.4.3.3.1. Textile 5.4.3.3.2. Packaging 5.4.3.3.3. Plastic 5.4.3.3.4. Automotive and Transportation 5.4.3.3.5. Other End-user Industries 6. Europe Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.2. Europe Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.3. Europe Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4. Europe Monoethylene Glycol (MEG) Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.1.2. United Kingdom Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.2. France 6.4.2.1. France Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.2.2. France Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.3.2. Germany Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.4.2. Italy Monoethylene Glycol (MEG) Market Size and Forecast, By Application(2024-2032) 6.4.4.3. Italy Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.5.2. Spain Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.6.2. Sweden Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.7.2. Austria Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 6.4.8.2. Rest of Europe Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.2. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4. Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By Country (2024-2032) 7.4.1. China 7.4.1.1. China Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.1.2. China Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.2.2. S Korea Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.3.2. Japan Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.4. India 7.4.4.1. India Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.4.2. India Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.5.2. Australia Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.6.2. Indonesia Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.7.2. Philippines Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.8.2. Malaysia Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.9.2. Vietnam Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.10.2. Thailand Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 7.4.11.2. Rest of Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 8. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 8.2. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 8.4. Middle East and Africa Monoethylene Glycol (MEG) Market Size and Forecast, By Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 8.4.1.2. South Africa Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 8.4.2.2. GCC Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 8.4.3.2. Nigeria Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 8.4.4.2. Rest of ME&A Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 9. South America Monoethylene Glycol (MEG) Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 9.2. South America Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 9.3. South America Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 9.4. South America Monoethylene Glycol (MEG) Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 9.4.1.2. Brazil Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 9.4.2.2. Argentina Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Monoethylene Glycol (MEG) Market Size and Forecast, By Process (2024-2032) 9.4.3.2. Rest of South America Monoethylene Glycol (MEG) Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Monoethylene Glycol (MEG) Market Size and Forecast, By End User Industry (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. SABIC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Formosa 10.3. DowDupont 10.4. BASF 10.5. MEGlobal 10.6. Sinopec 10.7. Shell 10.8. Reliance 10.9. SIBUR 10.10. PTTGC 10.11. Royal Dutch Shell 10.12. AkzoNobel 10.13. The Dow Chemicals 10.14. Mitsubishi Chemical 10.15. Lotte Chemical Corporation 10.16. Zhenhai Refining & Chemical Co., Nan Ya Plastics Corporation 10.17. LyondellBasell Industries 10.18. ExxonMobil Corporation 10.19. Chemtex Speciality Limited 10.20. India Glycols 11. Key Findings 12. Analyst Recommendations 13. Computer-Aided Detection Market: Research Methodology