HVAC Systems Market size was valued at US$ 142.71 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 5.8% through 2022 to 2029, reaching nearly US$ 211.77 Bn.HVAC Systems Market Overview:

HVAC stands for heating and cooling both residential and commercial buildings, as well as the many systems used to move air between indoor and outdoor locations. They are the systems that keep you warm and comfortable in the winter and cool and refreshing in the summer. Heat Pumps, Furnaces, Boilers, and Unitary Heaters are the types of heating equipment. Humidifiers, Dehumidifiers, Air Purifiers, Air Filters, Ventilation Fans, and Air Handling Units are the types of ventilation equipment. Room Air Conditioners, Unitary Air Conditioners, Chillers, Coolers, Cooling Towers, and VRF Systems are the types of cooling Equipment.To know about the Research Methodology :- Request Free Sample Report

HVAC Systems Market Dynamics:

The launch of new technologically enhanced products that are energy-efficient and can be remotely accessed is driving the growth of the global HVAC systems market. Moreover, the global market is expected to be driven by the usage of natural refrigerants such as CO2, as well as increased initiatives by governments throughout the world to promote energy-efficient products. A paradigm shift toward the use of energy-efficient air conditioners that minimize prices and power waste is expected to maintain HVAC demand. The demand for HVAC systems has increased as customer’s preferences for comfort have shifted. Companies are manufacturing products that not only meet the customer's comfort demands, but also provide a number of additional benefits. IoT-enabled heating and cooling systems allow for real-time monitoring of the system's functionality and condition. These HVAC systems also notify consumers or management when a system fails, exhibits unexpected behaviour, or is nearing the end of its maintenance cycle, lowering repair costs. One of the major factors driving the rising adoption of heating and cooling technology is climate change. This is due to the uncertainty of weather and rising temperatures, many consumers see HVAC equipment as a good investment. Furthermore, HVAC systems enhance the aesthetic value of both residential and commercial buildings. Companies are manufacturing the products that are attractive to the eye and provide a variety of design possibilities. During the forecast period, increased product demand is expected as a result of improved designs and changing client preferences. These are the key drivers that are expected to boost the growth of the global HVAC Systems market during the forecast period 2023-2029.HVAC Systems Market Segment Analysis:

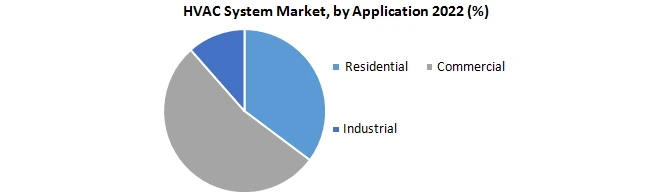

Based on the Cooling Equipment, the market is segmented into Room Air Conditioners, Unitary Air Conditioners, Chillers, Coolers, Cooling Towers, and VRF Systems. VRF Systems segment is expected to hold the largest market share of xx% by 2029. Many commercial buildings, from small stores and cafes to major office buildings and public places, use VRF systems. VRF zoning ensures that energy is only used to cool or heat occupied offices. This is due to the VRF systems have silent indoor units and can maintain exact temperature control, they provide the most comfortable and productive working environment. These are the key benefits that are expected to boost the growth of the VRF Systems segment in the global market during the forecast period 2023-2029.Based on the Application, the market is segmented into Residential, Commercial, and Industrial. Commercial segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. HVAC systems help to improve employee productivity, working conditions, and minimize health risks caused by improper humidity levels by providing optimum temperatures and ventilation in offices. Due to this, the use of HVAC systems in commercial buildings is expected to rise in tandem with the rising building stock.

Global HVAC Systems Market Regional Insights:

Asia Pacific dominates the Global HVAC Systems market during the forecast period 2023-2029. Asia Pacific is expected to hold the largest market share of xx% by 2029. China, India, and Japan are the key countries that boost the growth of the HVAC systems market in the Asia Pacific region. This is due to the growing population and increasing construction activities in China, India, and Japan. These are the major factors that drive the growth of this region in the Global market during the forecast period 2023-2029. North America and Europe are expected to grow rapidly at a CAGR of xx% and xx% during the forecast period 2023-2029. This is due to the region's thriving tourist and real estate industries. Subsidies and tax breaks are being offered by the governments of both regions to support the usage of energy-efficient systems. Due to this reasons, present customers are upgrading to new energy-efficient systems in addition to new developments. The objective of the report is to present a comprehensive analysis of the Global HVAC Systems Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global HVAC Systems Market dynamic, structure by analyzing the market segments and project the Global HVAC Systems Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global HVAC Systems Market make the report investor’s guide.Global HVAC Systems Market Scope: Inquire before buying

Global HVAC Systems Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 142.71 Bn. Forecast Period 2023 to 2029 CAGR: 5.8% Market Size in 2029: US $ 211.77 Bn. Segments Covered: by Heating Equipment Heat Pumps Furnaces Boilers Unitary Heaters by Ventilation Equipment Humidifiers Dehumidifiers Air Purifiers Air Filters Ventilation Fans Air Handling Units by Cooling Equipment Room Air Conditioners Unitary Air Conditioners Chillers Coolers Cooling Towers VRF Systems by Implementation Type New Construction Retrofit by Application Residential Commercial Industrial Global HVAC Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Daikin 2. United Technologies 3. Johnson Controls 4. Ingersoll-Rand 5. LG Electronics 6. Electrolux 7. Emerson 8. Honeywell 9. Lennox 10.Nortek 11.Samsung Electronics Co. Ltd. 12.Toshiba Corporation 13.Mitsubishi Electric Corporation 14.Midea Group Co. Ltd. 15.Gree Electric 16.Panasonic Corporation 17.Carrier Global Corporation 18.SKM Air Conditioning LLC 19.Petra Engineering Industries Co. 20.Thermax Limited 21.Thermal Care Inc. 22.The Arctic Chiller Group Ltd. 23.Qingdao Haier Co. Ltd.Frequently Asked Questions:

1] What segments are covered in Global Market report? Ans. The segments covered in Global HVAC Systems Market report are based on Heating Equipment, Ventilation Equipment, Cooling Equipment, Implementation Type, and Application. 2] Which region is expected to hold the highest share in the Global Market? Ans. Asia Pacific is expected to hold the highest share in the Global HVAC Systems Market. 3] Who are the top key players in the Global Market? Ans. Daikin, United Technologies, Johnson Controls, Ingersoll-Rand, LG Electronics, and Electrolux are the top key players in the Global HVAC Systems Market. 4] Which segment holds the largest market share in the Global market by 2029? Ans. VRF Systems segment hold the largest market share in the Global HVAC Systems market by 2029. 5] What is the market size of the Global HVAC Systems market by 2029? Ans. The market size of the Global HVAC Systems market is US $211.77 Bn. by 2029. 6] What was the market size of the Global HVAC Systems market in 2020? Ans. The market size of the Global HVAC Systems market was worth US $142.71 Bn. in 2022.

1. Global HVAC Systems Market: Research Methodology 2. Global HVAC Systems Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global HVAC Systems Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global HVAC Systems Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global HVAC Systems Market Segmentation 4.1 Global HVAC Systems Market, by Heating Equipment(2022-2029) • Heat Pumps • Furnaces • Boilers • Unitary Heaters 4.2 Global HVAC Systems Market, by Ventilation Equipment(2022-2029) • Humidifiers • Dehumidifiers • Air Purifiers • Air Filters • Ventilation Fans • Air Handling Units 4.3 Global HVAC Systems Market, by Cooling Equipment(2022-2029) • Room Air Conditioners • Unitary Air Conditioners • Chillers • Coolers • Cooling Towers • VRF Systems 4.4 Global HVAC Systems Market, by Implementation Type(2022-2029) • New Construction • Retrofit 4.5 Global HVAC Systems Market, by Application(2022-2029) • Residential • Commercial • Industrial 5. North America HVAC Systems Market (2022-2029) 5.1 Global HVAC Systems Market, by Heating Equipment(2022-2029) • Heat Pumps • Furnaces • Boilers • Unitary Heaters 5.2 Global HVAC Systems Market, by Ventilation Equipment(2022-2029) • Humidifiers • Dehumidifiers • Air Purifiers • Air Filters • Ventilation Fans • Air Handling Units 5.3 Global HVAC Systems Market, by Cooling Equipment(2022-2029) • Room Air Conditioners • Unitary Air Conditioners • Chillers • Coolers • Cooling Towers • VRF Systems 5.4 Global HVAC Systems Market, by Implementation Type(2022-2029) • New Construction • Retrofit 5.5 Global HVAC Systems Market, by Application(2022-2029) • Residential • Commercial • Industrial 5.6 North America HVAC Systems Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific HVAC Systems Market (2022-2029) 6.1. Asia Pacific HVAC Systems Market, by Heating Equipment(2022-2029) 6.2. Asia Pacific HVAC Systems Market, by Ventilation Equipment(2022-2029) 6.3. Asia Pacific HVAC Systems Market, by Cooling Equipment(2022-2029) 6.4. Asia Pacific HVAC Systems Market, by Implementation Type(2022-2029) 6.5. Asia Pacific HVAC Systems Market, by Application(2022-2029) 6.6. Asia Pacific HVAC Systems Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa HVAC Systems Market (2022-2029) 7.1 Middle East and Africa HVAC Systems Market, by Heating Equipment(2022-2029) 7.2. Middle East and Africa HVAC Systems Market, by Ventilation Equipment(2022-2029) 7.3. Middle East and Africa HVAC Systems Market, by Cooling Equipment(2022-2029) 7.4. Middle East and Africa HVAC Systems Market, by Implementation Type(2022-2029) 7.5. Middle East and Africa HVAC Systems Market, by Application(2022-2029) 7.6. Middle East and Africa HVAC Systems Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America HVAC Systems Market (2022-2029) 8.1. Latin America HVAC Systems Market, by Heating Equipment(2022-2029) 8.2. Latin America HVAC Systems Market, by Ventilation Equipment(2022-2029) 8.3. Latin America HVAC Systems Market, by Cooling Equipment(2022-2029) 8.4. Latin America HVAC Systems Market, by Implementation Type(2022-2029) 8.5. Latin America HVAC Systems Market, by Application(2022-2029) 8.6. Latin America HVAC Systems Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European HVAC Systems Market (2022-2029) 9.1. European HVAC Systems Market, by Heating Equipment(2022-2029) 9.2. European HVAC Systems Market, by Ventilation Equipment(2022-2029) 9.3. European HVAC Systems Market, by Cooling Equipment(2022-2029) 9.4. European HVAC Systems Market, by Implementation Type(2022-2029) 9.5. European HVAC Systems Market, by Application(2022-2029) 9.6. European HVAC Systems Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Daikin 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. United Technologies 10.3. Johnson Controls 10.4. Ingersoll-Rand 10.5. LG Electronics 10.6. Electrolux 10.7. Emerson 10.8. Honeywell 10.9. Lennox 10.10. Nortek 10.11. Samsung Electronics Co. Ltd. 10.12. Toshiba Corporation 10.13. Mitsubishi Electric Corporation 10.14. Midea Group Co. Ltd. 10.15. Gree Electric 10.16. Panasonic Corporation 10.17. Carrier Global Corporation 10.18. SKM Air Conditioning LLC 10.19. Petra Engineering Industries Co. 10.20. Thermax Limited 10.21. Thermal Care Inc. 10.22. The Arctic Chiller Group Ltd. 10.23. Qingdao Haier Co. Ltd.