The MLOps Market size was valued at USD 3.31 Bn in 2023 and is expected to reach USD 34.4 Bn by 2030, at a CAGR of 39.7%Global MLOps Market Overview

MLOps is a paradigm that aims to deploy and maintain machine learning models in production reliably and efficiently. MLOps includes aspects such as best practices, sets of concepts, as well as a development culture when it comes to the end-to-end conceptualization, implementation, monitoring, deployment, and scalability of machine learning products. The detailed elaboration and structural information as well as forecasted market size has provided in comprehensive way to understand a better overview, aspects, methods and scope of the MLOps Market.To know about the Research Methodology :- Request Free Sample Report

MLOps Market Methodology and Scope

The MLOps market analysis report covers the global market, with a focus on North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa regions. The report provides an in-depth analysis of the market size, growth, and segmentation based on deployment mode (on-premises and cloud-based), organization size (SMEs and large enterprises), industry vertical (BFSI, healthcare, retail, telecommunications, and others), and region. Global report provides insights into the market's drivers, restraints, opportunities, and challenges, and a detailed analysis of the competitive landscape, including key players' profiles, their product offerings, and strategies. The report also provides an analysis of the market's trends and future outlook, including growth opportunities and challenges. The report's scope is limited to MLOps platforms and services that are designed to manage and deploy machine learning models in production environments. The research methodology used in the analysis of the MLOps market involved a combination of primary and secondary research. Primary research involved interviews with key stakeholders in the industry of leading companies. These interviews were conducted via phone, email, and in-person meetings. Secondary research involved an extensive analysis of industry reports, company websites, and other relevant sources of information. The research covered a comprehensive analysis of the market, including market drivers, restraints, opportunities, and challenges. The analysis included a detailed study of the market's size, growth, and segmentation, as well as competitive landscape analysis. The market was segmented based on the deployment mode, organization size, industry vertical, component, application, and region.MLOps Market Dynamics

Increasing adoption of machine learning: Machine learning is being adopted across various industries, including healthcare, retail, BFSI, and telecommunications. This has resulted in a growing demand for MLOps platforms and services that can help organizations manage and deploy their machine learning models. Utilizing obsolete machine learning models helps update models in sectors such as fraud, underwriting, Customer management, etc. Need for continuous model monitoring and optimization: Machine learning models require constant monitoring and optimization to ensure their accuracy and effectiveness. MLOps platforms provide automated model management, monitoring, and optimization processes, making it easier for organizations to maintain their models. Growing demand for automated machine learning: Automated machine learning (AutoML) is a growing trend in the machine learning industry, as it allows organizations to automate the process of model building and deployment. It boosts the performance of ML specialists relieving them of repetitive tasks and enables even non-experts to experiment with smart algorithms. MLOps platforms and services offer AutoML features, which are in high demand among organizations looking to streamline their machine learning processes. AutoML takes care of routine operations within data preparation, feature extraction, and model optimization during the training process, and model selection. Increasing adoption of cloud computing: Cloud computing is becoming increasingly popular among organizations as it offers scalable and cost-effective data storage, processing, and management solutions. MLOps platforms are often cloud-based, which is driving the growth of the MLOps market. Cloud Computing helps organizations, especially small businesses, to save their time, and resources, avoid high investment, and get benefited from third-party expertise. Adopting cloud tech allows us to reduce our carbon footprint to easily scale up and down as per business requirements. Cloud computing offers businesses a host of applications under services such as 1. Software as a service (SaaS) This type of cloud adoption involves using cloud-based software applications, such as Google Workspace or Salesforce. An organization that switches from using Microsoft Office to Google Workspace for its productivity needs. 2. Platform as a service (PaaS) This type of cloud adoption involves using cloud-based platforms, such as Heroku or Azure, to develop and deploy applications. An organization that uses PaaS to build and deploy a new customer relationship management (CRM) system. 3. Infrastructure as a service (IaaS) This cloud adoption involves using cloud-based infrastructure, such as servers, storage, and networking, to host applications and workloads. An organization that uses Amazon Web Services (AWS) to host their website. 4. Hybrid cloud: This type of cloud adoption involves using a combination of on-premises infrastructure and cloud services. An organization uses on-premises servers for certain workloads, such as its accounting software, and uses the cloud for other workloads, such as its CRM system. Focus on DevOps culture: The adoption of DevOps practices in the IT industry is driving the growth of the MLOps market, as MLOps platforms and services are often integrated with DevOps workflows. This allows organizations to automate their machine-learning processes and streamline their development pipelines. DevOps culture involves closer collaboration and shared responsibility between development and operations for the products they create and maintain. This helps companies align their people, processes, and tools toward a more unified customer focus. Lack of skilled professionals: MLOps requires a specific set of skills and expertise, which is difficult to find. Lack of clarity in the role and responsibility of MLOps engineers at the organizational level, especially in startups. The shortage of skilled professionals in the MLOps field is a significant restraint to the growth of the market. The complexity of machine learning models: Machine learning models can be complex and challenging to manage and deploy in production environments. In machine learning, model complexity often refers to the number of features or terms included in a given predictive model, as well as whether the chosen model is linear, nonlinear, and so on. It can also refer to the algorithmic learning complexity or computational complexity. MLOps platforms and services must be able to handle these complexities, which restrain the market’s growth. Data privacy and security concerns: Machine learning models require access to large amounts of data, which can raise privacy and security concerns. The challenge of ‘inference control’ is the ability to share extracts from large-scale datasets for various studies/research projects without revealing privacy-sensitive information about individuals in the dataset. Organizations must ensure that their MLOps platforms and services are secure and compliant with data privacy regulations, which restrain the MLOps market’s growth. Integration with legacy systems: Many organizations have legacy systems that are not compatible with modern MLOps platforms and services. This is a restraint for the adoption of MLOps, as organizations must invest in upgrading their existing systems to integrate with MLOps solutions. High implementation costs: MLOps platforms and services is expensive to implement and maintain, which is a restraint for small and medium-sized enterprises (SMEs) with limited budgets. Growing demand for explainable AI: Explainable AI is becoming increasingly important in the machine learning industry, as organizations seek to understand how their models make decisions. MLOps platforms and services that offer explainable AI features have significant growth opportunities. Integration with edge computing: Edge computing is becoming popular among organizations as it allows them to process data closer to the source, reducing latency and improving performance. MLOps platforms and services that integrate with edge computing have significant growth opportunities. Increased adoption of MLOps in SMEs: MLOps platforms and services are often associated with large enterprises, but there is a growing demand for affordable solutions among SMEs. MLOps vendors that provide cost-effective solutions for SMEs have significant growth opportunities. Expansion into emerging markets: Emerging markets such as Asia-Pacific and Latin America offer significant growth opportunities for MLOps vendors. These markets are experiencing a rapid digital transformation, and the adoption of machine learning is growing.MLOps Market Segmentation Analysis

Deployment Mode: MLOps platforms are deployed either on-premises or in the cloud. On-premises deployment involves the installation of MLOps software and infrastructure on the customer's premises. On-premise software requires that an enterprise purchases a license or a copy of the software to use it because the software itself is licensed and the entire instance of the software resides within an organization’s premises. Cloud-based deployment, on the other hand, involves the use of cloud infrastructure and services to host and manage the MLOps platform. A cloud-based server utilizes virtual technology to host a company’s applications offsite. There are no capital expenses, data is backed up regularly, and companies only have to pay for the resources they use. Organization Size: The MLOps market caters to organizations of all sizes, from small and medium-sized enterprises (SMEs) to large enterprises. SMEs typically have lower IT budgets and require more affordable MLOps solutions, while larger enterprises typically have more complex ML workflows and require more robust MLOps solutions. Industry Vertical: The MLOps market caters to a wide range of industry verticals, including BFSI, healthcare, retail, telecommunications, and others. Different industry verticals have different ML use cases and requirements, such as MLOps helping banks to scale ML models, lower operational costs, and deal with urgent data management challenges such as accountability, transparency, and ethics. MLOps enables multitalented teams to work together more efficiently and to get more done in a standardized manner. And MLOps platforms need to be tailored to meet these specific needs. Component: The MLOps market is segmented based on the various components of an MLOps platform, such as model deployment, model training, model management, data management, and monitoring and governance. Many companies have automatized ML pipelines but fail to bring models into compliance with legal requirements. According to an Algorithmia-Study from 2023, 56 percent of respondents considered the implementation of model governance to be one of the biggest challenges for successfully bringing ML applications into production. The three main components of MLOps that are necessary include decreasing time to deployment, increasing scalability, and reducing error percentages. Application: The MLOps market is also segmented based on the specific applications of MLOps, such as fraud detection, predictive maintenance, recommendation engines, and others. MLOps has been used for fraud detection, where ML models are trained to detect fraudulent activity in real time. This model application uses MLOps practices to assist in detecting fraudulent credit card transactions and fraudulent insurance claims. Predictive healthcare is another lucrative and essential industry that uses MLOps to simplify the creation and implementation of necessary machine learning models, such as those that predict patient outcomes or identify potential health issues before they become serious.Competitive Landscape of the MLOps Market

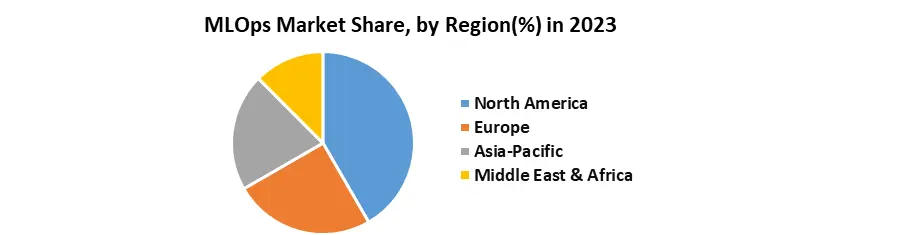

Amazon Web Services (AWS) - AWS is a cloud computing platform that provides a wide range of MLOps services, including SageMaker, a fully-managed service that helps developers and data scientists build, train, and deploy machine learning models. Recently, AWS launched SageMaker Clarify, a new tool that helps developers detect bias in their ML models. In 2023, AWS also acquired a startup company, E8 Storage, which specializes in high-performance storage infrastructure for ML and analytics applications. AWS and DataRobot announced a collaboration in 2023 to make it easier for customers to build and deploy ML models in the cloud. Google Cloud Platform (GCP) - GCP offers several MLOps tools, including AutoML, a suite of tools that allows users to build custom machine learning models without having to write any code. In 2023, Google Cloud acquired a startup company, Databricks, which provides a unified data analytics platform for data engineering, machine learning, and analytics. GCP and SAP announced a partnership in 2023 to integrate SAP's business applications with GCP's AI and ML services. Microsoft Azure - A cloud-based service that helps users build, train, and deploy ML models. Recently, Azure launched Azure Applied AI Services, a suite of pre-built AI models and workflows that can be easily integrated into existing business applications. Microsoft Azure and NVIDIA announced a collaboration in 2023 to integrate NVIDIA's GPUs with Azure's AI services. IBM - A platform that helps data scientists and developers build, train, and deploy ML models. In 2023, IBM acquired startup company WDG Automation, which specializes in intelligent automation software. IBM and Palantir announced a partnership in 2023 to integrate Palantir's Foundry platform with IBM's Watson Studio. DataRobot - DataRobot offers an end-to-end automated machine learning platform that helps users build, deploy, and manage ML models. Recently, DataRobot announced a new product called DataRobot AI Cloud, which provides a unified environment for building and deploying ML models. HPE - HPE provides MLOps services through its Ezmeral software platform, which includes tools for managing and deploying ML models. In 2023, HPE acquired startup company Determined AI, which specializes in open-source ML training platforms.North America is currently the largest market for MLOps, primarily driven by the presence of major technology companies and startups in the region. The US is the largest market in North America due to a large number of enterprises and startups that are investing in MLOps to enhance their AI capabilities. The market in this region is expected to continue to grow due to the increasing demand for AI-based solutions across various industries, such as healthcare, finance, and retail. Europe is the second-largest market for MLOps, driven by the increasing adoption of AI-based solutions across various industries, such as automotive, manufacturing, and healthcare. The UK and Germany are the largest MLOps markets in the region due to the presence of major technology companies and startups that are investing in MLOps to enhance their AI capabilities. The market in this region is expected to continue to grow due to the increasing demand for AI-based solutions and the presence of a large number of established enterprises. The Asia-Pacific region is the third-largest market for MLOps, primarily driven by the increasing adoption of AI-based solutions across various industries, such as healthcare, finance, and retail. The market in this region is expected to grow at a high rate due to the increasing investments in AI-based solutions and the presence of a large number of startups and enterprises in countries such as China, Japan, and India.

Regional Analysis of the MLOps Market

MLOps Market Scope: Inquire before buying

Global MLOps Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.31 Bn. Forecast Period 2024 to 2030 CAGR: 39.7% Market Size in 2030: US $ 34.4 Bn. Segments Covered: By Deployment Mode On-Premises deployment Cloud-Based Deployment By Organization Size Small & Medium Sized enterprises (SMEs) Large Enterprises By Industry Vertical BFSI Manufacturing IT and Telecom Retail and E-commerce Energy and Utility Healthcare Media and Entertainment Others By Component Model Deployment Model Training Model Management Data Management Monitoring and Governance Global MLOps Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)MLOps Market Key Players

1. Microsoft 2. Amazon 3. Google 4. IBM 5. Dataiku 6. Lguazio 7. Databricks 8. DataRobot, Inc. 9. Cloudera 10. Modzy 11. Algorithmia 12. HPE 13. Valohai 14. Allegro AI 15. Comet 16. FloydHub 17. Paperpace 18. Cnvrg.ioFrequently Asked Questions of the MLOps Market

1. What are the challenges of MLOps? Ans: Lack of talent, Getting started, Data, Security, and Scaling up is the biggest challenges of the MLOps Market. 2. What are the key components of MLOps? Ans: Exploratory data analysis (EDA), Data Prep and Feature Engineering, Model training and tuning, Model review and governance, Model inference and serving, Model monitoring, and automated model retraining. 3. What is the market size of the MLOps market? Ans: The MLOps market size is projected to grow from USD 3.31 billion in 2023 to USD 34.4 billion by 2030, at a CAGR of 39.7 % during the forecast period. 4. What are the five main challenges of machine learning? Ans: Lack of training data, Poor quality of data, Data overfitting, Data underfitting, Irrelevant features. 5. Which companies use MLOps? Ans: Amazon SageMaker, Domino Data Lab, Valohai, Iguazio, H2O MLOps, MLflow, Neptune.ai, Cloudera Data Platform.

1. MLOps Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. MLOps Market: Dynamics 2.1. MLOps Market Trends by Region 2.1.1. North America MLOps Market Trends 2.1.2. Europe MLOps Market Trends 2.1.3. Asia Pacific MLOps Market Trends 2.1.4. Middle East and Africa MLOps Market Trends 2.1.5. South America MLOps Market Trends 2.2. MLOps Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America MLOps Market Drivers 2.2.1.2. North America MLOps Market Restraints 2.2.1.3. North America MLOps Market Opportunities 2.2.1.4. North America MLOps Market Challenges 2.2.2. Europe 2.2.2.1. Europe MLOps Market Drivers 2.2.2.2. Europe MLOps Market Restraints 2.2.2.3. Europe MLOps Market Opportunities 2.2.2.4. Europe MLOps Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific MLOps Market Drivers 2.2.3.2. Asia Pacific MLOps Market Restraints 2.2.3.3. Asia Pacific MLOps Market Opportunities 2.2.3.4. Asia Pacific MLOps Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa MLOps Market Drivers 2.2.4.2. Middle East and Africa MLOps Market Restraints 2.2.4.3. Middle East and Africa MLOps Market Opportunities 2.2.4.4. Middle East and Africa MLOps Market Challenges 2.2.5. South America 2.2.5.1. South America MLOps Market Drivers 2.2.5.2. South America MLOps Market Restraints 2.2.5.3. South America MLOps Market Opportunities 2.2.5.4. South America MLOps Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For MLOps Industry 2.8. Analysis of Government Schemes and Initiatives For MLOps Industry 2.9. MLOps Market Trade Analysis 2.10. The Global Pandemic Impact on MLOps Market 3. MLOps Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 3.1.1. On-Premises deployment 3.1.2. Cloud-Based Deployment 3.2. MLOps Market Size and Forecast, by Organization Size (2023-2030) 3.2.1. Small & Medium Sized enterprises (SMEs) 3.2.2. Large Enterprises 3.3. MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 3.3.1. BFSI 3.3.2. Manufacturing 3.3.3. IT and Telecom 3.3.4. Retail and E-commerce 3.3.5. Energy and Utility 3.3.6. Healthcare 3.3.7. Media and Entertainment 3.3.8. Others 3.4. MLOps Market Size and Forecast, by Component (2023-2030) 3.4.1. Model Deployment 3.4.2. Model Training 3.4.3. Model Management 3.4.4. Data Management 3.4.5. Monitoring and Governance 3.5. MLOps Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America MLOps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 4.1.1. On-Premises deployment 4.1.2. Cloud-Based Deployment 4.2. North America MLOps Market Size and Forecast, by Organization Size (2023-2030) 4.2.1. Small & Medium Sized enterprises (SMEs) 4.2.2. Large Enterprises 4.3. North America MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 4.3.1. BFSI 4.3.2. Manufacturing 4.3.3. IT and Telecom 4.3.4. Retail and E-commerce 4.3.5. Energy and Utility 4.3.6. Healthcare 4.3.7. Media and Entertainment 4.3.8. Others 4.4. North America MLOps Market Size and Forecast, by Component (2023-2030) 4.4.1. Model Deployment 4.4.2. Model Training 4.4.3. Model Management 4.4.4. Data Management 4.4.5. Monitoring and Governance 4.5. North America MLOps Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1.1.1. On-Premises deployment 4.5.1.1.2. Cloud-Based Deployment 4.5.1.2. United States MLOps Market Size and Forecast, by Organization Size (2023-2030) 4.5.1.2.1. Small & Medium Sized enterprises (SMEs) 4.5.1.2.2. Large Enterprises 4.5.1.3. United States MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.1.3.1. BFSI 4.5.1.3.2. Manufacturing 4.5.1.3.3. IT and Telecom 4.5.1.3.4. Retail and E-commerce 4.5.1.3.5. Energy and Utility 4.5.1.3.6. Healthcare 4.5.1.3.7. Media and Entertainment 4.5.1.3.8. Others 4.5.1.4. United States MLOps Market Size and Forecast, by Component (2023-2030) 4.5.1.4.1. Model Deployment 4.5.1.4.2. Model Training 4.5.1.4.3. Model Management 4.5.1.4.4. Data Management 4.5.1.4.5. Monitoring and Governance 4.5.2. Canada 4.5.2.1. Canada MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.2.1.1. On-Premises deployment 4.5.2.1.2. Cloud-Based Deployment 4.5.2.2. Canada MLOps Market Size and Forecast, by Organization Size (2023-2030) 4.5.2.2.1. Small & Medium Sized enterprises (SMEs) 4.5.2.2.2. Large Enterprises 4.5.2.3. Canada MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.2.3.1. BFSI 4.5.2.3.2. Manufacturing 4.5.2.3.3. IT and Telecom 4.5.2.3.4. Retail and E-commerce 4.5.2.3.5. Energy and Utility 4.5.2.3.6. Healthcare 4.5.2.3.7. Media and Entertainment 4.5.2.3.8. Others 4.5.2.4. Canada MLOps Market Size and Forecast, by Component (2023-2030) 4.5.2.4.1. Model Deployment 4.5.2.4.2. Model Training 4.5.2.4.3. Model Management 4.5.2.4.4. Data Management 4.5.2.4.5. Monitoring and Governance 4.5.3. Mexico 4.5.3.1. Mexico MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.3.1.1. On-Premises deployment 4.5.3.1.2. Cloud-Based Deployment 4.5.3.2. Mexico MLOps Market Size and Forecast, by Organization Size (2023-2030) 4.5.3.2.1. Small & Medium Sized enterprises (SMEs) 4.5.3.2.2. Large Enterprises 4.5.3.3. Mexico MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.3.3.1. BFSI 4.5.3.3.2. Manufacturing 4.5.3.3.3. IT and Telecom 4.5.3.3.4. Retail and E-commerce 4.5.3.3.5. Energy and Utility 4.5.3.3.6. Healthcare 4.5.3.3.7. Media and Entertainment 4.5.3.3.8. Others 4.5.3.4. Mexico MLOps Market Size and Forecast, by Component (2023-2030) 4.5.3.4.1. Model Deployment 4.5.3.4.2. Model Training 4.5.3.4.3. Model Management 4.5.3.4.4. Data Management 4.5.3.4.5. Monitoring and Governance 5. Europe MLOps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.2. Europe MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.3. Europe MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.4. Europe MLOps Market Size and Forecast, by Component (2023-2030) 5.5. Europe MLOps Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.1.2. United Kingdom MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.1.3. United Kingdom MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.1.4. United Kingdom MLOps Market Size and Forecast, by Component (2023-2030) 5.5.2. France 5.5.2.1. France MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.2.2. France MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.2.3. France MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.2.4. France MLOps Market Size and Forecast, by Component (2023-2030) 5.5.3. Germany 5.5.3.1. Germany MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.3.2. Germany MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.3.3. Germany MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.3.4. Germany MLOps Market Size and Forecast, by Component (2023-2030) 5.5.4. Italy 5.5.4.1. Italy MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.4.2. Italy MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.4.3. Italy MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.4.4. Italy MLOps Market Size and Forecast, by Component (2023-2030) 5.5.5. Spain 5.5.5.1. Spain MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.5.2. Spain MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.5.3. Spain MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.5.4. Spain MLOps Market Size and Forecast, by Component (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.6.2. Sweden MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.6.3. Sweden MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.6.4. Sweden MLOps Market Size and Forecast, by Component (2023-2030) 5.5.7. Austria 5.5.7.1. Austria MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.7.2. Austria MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.7.3. Austria MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.7.4. Austria MLOps Market Size and Forecast, by Component (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.8.2. Rest of Europe MLOps Market Size and Forecast, by Organization Size (2023-2030) 5.5.8.3. Rest of Europe MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.8.4. Rest of Europe MLOps Market Size and Forecast, by Component (2023-2030) 6. Asia Pacific MLOps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.2. Asia Pacific MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.3. Asia Pacific MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.4. Asia Pacific MLOps Market Size and Forecast, by Component (2023-2030) 6.5. Asia Pacific MLOps Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.1.2. China MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.1.3. China MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.1.4. China MLOps Market Size and Forecast, by Component (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.2.2. S Korea MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.2.3. S Korea MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.2.4. S Korea MLOps Market Size and Forecast, by Component (2023-2030) 6.5.3. Japan 6.5.3.1. Japan MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.3.2. Japan MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.3.3. Japan MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.3.4. Japan MLOps Market Size and Forecast, by Component (2023-2030) 6.5.4. India 6.5.4.1. India MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.4.2. India MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.4.3. India MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.4.4. India MLOps Market Size and Forecast, by Component (2023-2030) 6.5.5. Australia 6.5.5.1. Australia MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.5.2. Australia MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.5.3. Australia MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.5.4. Australia MLOps Market Size and Forecast, by Component (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.6.2. Indonesia MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.6.3. Indonesia MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.6.4. Indonesia MLOps Market Size and Forecast, by Component (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.7.2. Malaysia MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.7.3. Malaysia MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.7.4. Malaysia MLOps Market Size and Forecast, by Component (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.8.2. Vietnam MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.8.3. Vietnam MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.8.4. Vietnam MLOps Market Size and Forecast, by Component (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.9.2. Taiwan MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.9.3. Taiwan MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.9.4. Taiwan MLOps Market Size and Forecast, by Component (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.10.2. Rest of Asia Pacific MLOps Market Size and Forecast, by Organization Size (2023-2030) 6.5.10.3. Rest of Asia Pacific MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.10.4. Rest of Asia Pacific MLOps Market Size and Forecast, by Component (2023-2030) 7. Middle East and Africa MLOps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 7.2. Middle East and Africa MLOps Market Size and Forecast, by Organization Size (2023-2030) 7.3. Middle East and Africa MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 7.4. Middle East and Africa MLOps Market Size and Forecast, by Component (2023-2030) 7.5. Middle East and Africa MLOps Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.1.2. South Africa MLOps Market Size and Forecast, by Organization Size (2023-2030) 7.5.1.3. South Africa MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.1.4. South Africa MLOps Market Size and Forecast, by Component (2023-2030) 7.5.2. GCC 7.5.2.1. GCC MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.2.2. GCC MLOps Market Size and Forecast, by Organization Size (2023-2030) 7.5.2.3. GCC MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.2.4. GCC MLOps Market Size and Forecast, by Component (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.3.2. Nigeria MLOps Market Size and Forecast, by Organization Size (2023-2030) 7.5.3.3. Nigeria MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.3.4. Nigeria MLOps Market Size and Forecast, by Component (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.4.2. Rest of ME&A MLOps Market Size and Forecast, by Organization Size (2023-2030) 7.5.4.3. Rest of ME&A MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.4.4. Rest of ME&A MLOps Market Size and Forecast, by Component (2023-2030) 8. South America MLOps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 8.2. South America MLOps Market Size and Forecast, by Organization Size (2023-2030) 8.3. South America MLOps Market Size and Forecast, by Industry Vertical(2023-2030) 8.4. South America MLOps Market Size and Forecast, by Component (2023-2030) 8.5. South America MLOps Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.1.2. Brazil MLOps Market Size and Forecast, by Organization Size (2023-2030) 8.5.1.3. Brazil MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.1.4. Brazil MLOps Market Size and Forecast, by Component (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.2.2. Argentina MLOps Market Size and Forecast, by Organization Size (2023-2030) 8.5.2.3. Argentina MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.2.4. Argentina MLOps Market Size and Forecast, by Component (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America MLOps Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.3.2. Rest Of South America MLOps Market Size and Forecast, by Organization Size (2023-2030) 8.5.3.3. Rest Of South America MLOps Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.3.4. Rest Of South America MLOps Market Size and Forecast, by Component (2023-2030) 9. Global MLOps Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading MLOps Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Microsoft 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Amazon 10.3. Google 10.4. IBM 10.5. Dataiku 10.6. Lguazio 10.7. Databricks 10.8. DataRobot, Inc. 10.9. Cloudera 10.10. Modzy 10.11. Algorithmia 10.12. HPE 10.13. Valohai 10.14. Allegro AI 10.15. Comet 10.16. FloydHub 10.17. Paperpace 10.18. Cnvrg.io 11. Key Findings 12. Industry Recommendations 13. MLOps Market: Research Methodology 14. Terms and Glossary