The Milk Protein Market size was valued at USD 9.8 Bn in 2022 and the market is expected to reach USD 15.5 Bn by 2029 at a CAGR of 6.14 %.Milk Protein Market Overview

Milk Protein is a complex protein found in milk, with high nutritional qualities such as amino acid, calcium, and other essential nutrients. It is extracted by the ultrafiltration and membrane filtration processes. This is a complete protein with the essential nutrients needed for the human body. This source is enriched with branched-chain-amino acid (BCAAs), which is the key nutrient for protein synthesis and muscle recovery in the body. In addition, this milk protein supports bone health and improves bone density, boosting immunity, and fat loss. The compounds present in this source help activate our antibodies to fight infections and provide anti-inflammatory properties. Protein is a valuable ingredient in the food and beverage industry, used in the manufacturing of protein bars, protein smoothies, cheese, yogurt, and shakes. The increased use of protein is driven by the sports and fitness industry. Consumers demand and growing popularity of plant-based milk protein and the protein manufacturers has increased the need for technological development in the production of milk protein.To know about the Research Methodology :- Request Free Sample Report The government in various countries especially in the Netherlands and the United States has implemented certain regulatory measures in the production, sourcing, labeling, and advertising of products. In addition, this regulation is further focused on maintaining proper quality and meeting the standards of content in milk protein. Proper labeling has been made compulsory due to the lactose intolerant consumers, and the major health effect of lactose products on them. Thanks to the rising awareness of health benefits and maintaining a proper fit body due to the high risk of chronic diseases like diabetes and obesity in countries like China, India, and Japan the demand for milk protein products has witnessed a rapid surge.

Milk Protein Market Dynamics

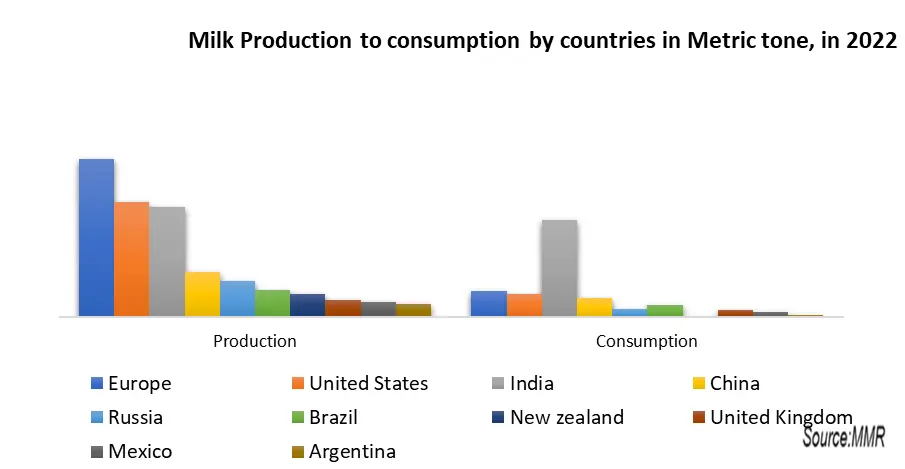

Rising demand for protein-rich foods This rise in the demand for protein-rich foods and beverages has driven the milk protein market significantly in recent years. Growing awareness of health benefits and a fit body, due to the increase in chronic disease is been a major driving factor. The high quality of protein that is being delivered to consumers by the manufacturers has raised the market growth. Better the quality of protein, absorption rate, and increased solubility in the body gives better results. The health benefits of Protein include muscle recovery, muscle gain and growth, and weight and fat loss. The rising need for more clean and good quality of protein with the use of natural ingredients has been a trend for the development of products and items. Protein sources have also been seen to improve the immune system and its function for better digestibility. Milk Protein being the complete source of nutrition having amino acids for muscle growth and strength is a good source for athletes and fitness enthusiasts. The application of Milk protein-based products has increased and thus has led the market to grow significantly. Dairy products use these Protein in products like cheese and yogurt to promote the use and thus raise the market growth. The rising disposable income of the middle-class population is also a driving factor for the growth of the Milk Protein market.High Cost of Raw Materials The initial high cost of raw materials needed for the manufacturing of milk protein. The cost of milk which is the key ingredient is rising due to the shortage in some regions such as Jamaica, China, Taiwan, South Korea, and others. Dairy farming is a labor-based activity, and the labor charges have been increasing due to market conditions, inflation, and the implementation of labor laws in countries. The initial cost of cattle breeding along with the transportation and storage cost of milk is also increasing, which significantly has raised the cost of milk and the cost of production of milk. Also, the geographical and political pressure such as the Ukraine-Russia war has impacted the rise in the price of milk and milk supply around the world. Genetics of cattle is also a restraining factor affecting the milk protein market growth, as the milk production quality depends on the breed and this affects the fats and protein content of milk, which simultaneously increases the price of milk protein. Innovative milk protein products The need for more innovative new protein products is a major opportunity for the companies to stay competitive in the milk protein market. This is a whole and complete protein source and is manufactured from high blending and ultrafiltration processes with other products. The consumer's demand for Plant-based protein sources is increasing, so the innovative ideas for manufacturing plant-based milk protein is an alternative trend and gaining popularity across the world. This needs continuous investment in the research and development of new methods and techniques for new product development for the evolving consumer market base. Emerging technology such as high-pressure processing (HPP), and membrane filtration has made their position in the production of sustainable milk protein. This technological development has already shown a positive impact on the new milk protein product development for consumers, which has ultimately raised the demand for healthy and nutritious food products and raised the plant-based product making it an alternative to dairy products. Fluctuation in the price of raw material The production of milk protein is highly susceptible to price fluctuations in raw materials due to the daily variations in milk prices. These fluctuations directly lead to increased prices for both milk protein and products derived from it. Milk protein manufacturing is significantly impacted by the volatility of raw material prices, particularly the daily fluctuations in milk prices across the world. These fluctuations directly translate into higher prices for milk protein and related products. Government regulation from the sourcing of milk, processing, labeling, and advertising of milk protein affects the business. In the United States, the FDA imposes certain regulations regarding the safety of milk protein and quality. This regulation has affected the companies by sales and making them follow regulatory standards. This regulation is made compulsory so that lactose-tolerant consumers are made clear of the content. The increased competition between companies for manufacturing more plant-based products and using other sources of protein like soy milk-based protein. These sources are often less expensive and reduce the prices of products by reducing the overall competition in the market. The initial high cost of investment in the research and development of more new and plant-based products is also a challenging factor for the growth of the market.

Milk Protein Market Segment Analysis

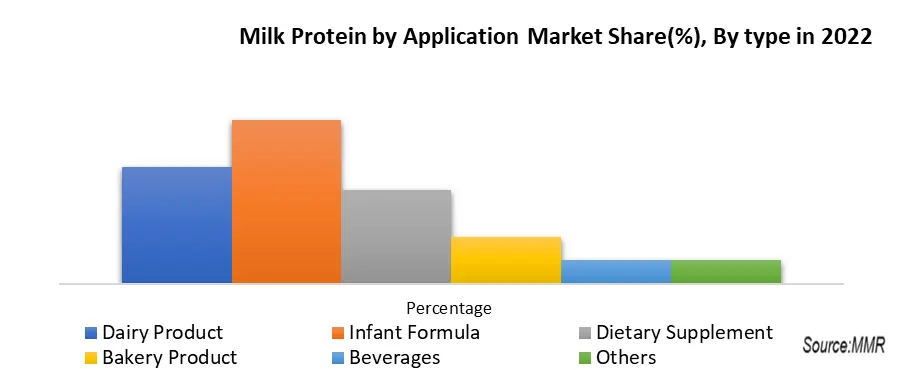

Based on Protein type, Whey Protein held the largest market share globally in 2022. Whey protein has key applications, where it is used in sports nutrition and the fitness industry. Whey protein has advantages and values, as whey is a dry powder form of milk protein with a quick absorption rate and high solubility rate for providing better results. Whey protein products such as protein isolates, which is a pure form of protein with high nutritional content, and whey concentrates, these both types contain a good amount of amino acids which are required and essential for muscle growth and recovery. The whey has a fast fat absorption rate which helps any bodybuilder to gain muscle and lose fat simultaneously. Casein is a slow-digesting protein that is used in the process of muscle growth. Casein is a versatile ingredient that is being used in several protein products such as sports nutrition bars and beverages, and others. This casein protein being a slower digestive type of protein, is used in powders and protein bars that are manufactured especially for fitness enthusiast to provide continuous and sustained energy in their body. Milk protein Hydrolysates is a pure form of protein and a hydrolyzed type that is cut down into smaller parts, making it better for digestion and absorption in the body. Protein Hydrolysates is a proper and exact alternative for protein sources in infant formula and in adult food and beverages. Hydrolysates also have benefits such as keeping skin hydrated and reducing allergies and skin infections like rashes and dark spots.Based on the Application, dairy products segments held the largest market share for the milk protein market in 2022. The dairy product is the main application of milk protein with various advantages. The protein used in dairy products is isolates which is the purest form of milk protein. This product has excellent benefits with high nutritional content and products being accepted globally. Dairy products have a well-established consumer base, with potential customers from the fitness industry. Milk protein products like cheese, protein yogurt, and ice cream are some of the most used and globally demanded products with a high acceptance rate. Milk protein products have increased demand in the sports and fitness nutrition industry, which is also a key driving factor for the growth of the market. These are used in a variety of uses in the sports and fitness industry for the production of protein bars, protein drinks, and shakes. The products are valued and are in high demand due to their properties like rapid absorption and promoting muscle repair and growth. Beverages contribute a smaller part to the growth of the market but have witnessed continuous and steady growth in recent years. Protein beverages like protein shakes, smoothies, and protein energy drinks are some examples of beverages. The beverages witnessed growth due to the properties of liquid protein intake like high and improved solubility and increased nutritional value.

Milk Protein Market Regional Analysis

North America region gives unique factors that have been rising the milk protein market. North America is the largest market share and is expected to grow significantly in the forecast period. Government organizations in North America such as The Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA) have set standards for the manufacturing of protein with proper labeling, making use of permitted additives only, and proper manufacturing practices. FDA maintains the Grade ‘A’ quality of Pasteurized Milk Ordinance (PMO) to regulate the milk protein production and the protein manufacturer. The Canadian Regulations also act under the FDA rules and make sure that the safety and quality are followed and maintained. The United States has witnessed strong growth in the use of milk protein products due to growing awareness of the health benefits of natural and organic protein sources. The growing demand for protein-rich foods products and beverages, especially in the sports and fitness and supplements industry is a major driving factor for the growth of the market. The increasing appeal for plant-based and organic sources of protein rather than animal-based is another factor contributing to the market growth. This is a high-quality and rich source of protein, which makes it a popular source and ingredient for the manufacturing of protein products. Plant-based alternatives such as the use of soy milk have increased the quality of production of natural and organic milk protein, which is increasing the popularity of protein and protein products in this region.The European milk protein market witnesses constant growth at a rate of 27.27 % and is expected to grow significantly at a CAGR of 4.2 % during the forecast period. Milk protein product sales have increased in recent years, thus the need for new product development raises the market demand in the European region. Germany, France, the United Kingdom, and Italy have dominated the milk protein market and products derived from it. Poland offers various opportunities for this market. The growing demand for ready-to-eat food products and more convenient food and beverages is a key driving factor for the growth of the market in the EU region. The Netherlands has a very strong dairy product industry with more advanced manufacturing facilities. This country has a keen focus on establishing more sustainable food production units and facilities. The government regulations in this country are strong enough and keep emphasizing Good Manufacturing Practices (GMP) to ensure the quality and safety of products manufactured.

Competitive Landscape The global milk protein market is a dynamic and highly competitive landscape, characterized by a diverse range of players across various regions. Major industry leaders include Arla Foods, Glanbia Plc, Fonterra Co-operative Group, FrieslandCampina, DMK Deutsches Milchkontor GmbH, Lactalis, Saputo Inc., Hochdorf Holding AG, Meiji Holdings Co., Ltd., and Royal FrieslandCampina N.V. These key players are constantly engaged in strategic initiatives to strengthen their market positions, including product portfolio expansion, research and development investments, and mergers and acquisitions. Price competition is a prevalent factor in the market, as milk protein is considered a commodity ingredient. Players strive to offer competitive pricing to attract customers and expand their market share. Additionally, product quality plays a crucial role in influencing customer preferences. Players are committed to maintaining high-quality standards through rigorous quality control measures and innovative production processes. Moreover, innovation is a driving force in the market, with players continuously developing new and improved milk protein ingredients to cater to the evolving needs of customers. The Hilmar Cheese Company the company has key developments in the field of research and development and patented several innovative technologies in the improved efficiency of manufacturing of Milk Protein and products. The most advanced patent of Hilmar Company is the UF filtration that separates the protein component from another component, which is more efficient and more energy-saving than the old Milk Protein manufacturing method. Research and development investments are essential for creating novel products and expanding the application range of milk protein. Price competition, product quality, and innovation will continue to be key factors shaping the competitive dynamics of the global milk protein market.

Milk Protein Market Scope : Inquire Before Buying

Global Milk Protein Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 9.8 Bn. Forecast Period 2023 to 2029 CAGR: 6.14% Market Size in 2029: US $ 15.5 Bn. Segments Covered: by Protein Type Milk Protein Concentrates Milk Protein Hydrolysates Milk Protein Casein Others by Form Dry Liquid by Application Dietary Supplement Infant Formula Bakery Products Dairy Products Beverages Others Milk Protein Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Milk Protein Market

1. Hilmar Cheese Company, Inc 2. Nestle 3. Saputo Inc. 4. Glanbia plc. 5. Fonterra Co-operative Group Ltd 6. Arla Foods 7. Alpavit 8. Wheyco GmbH 9. Carbery Group 10. LACTALIS 11. Olam International 12. Davisco Foods International, Inc. 13. Milkaut SA 14. Leprino Foods Company 15. Maple Island Inc. 16. Kerry Group plc. 17. Havero Hoogwegt Group 18. Amco Protein FAQ 1] What segments are covered in the Global Milk Protein Market report? Ans. The segments covered in the Global Milk Protein Market report are based on Product and Application. 2] Which region is expected to hold the highest share in the Global Milk Protein Market? Ans. North America region is expected to hold the highest share in the Global Milk Protein Market. 3] What is the market size of the Global Milk Protein Market by 2029? Ans. The market size of the Global Milk Protein Market by 2029 is expected to reach US$ 15.5 Bn. 4] What is the forecast period for the Global Milk Protein Market? Ans. The forecast period for the Global Milk Protein Market is 2023-2029. 5] What was the market size of the Global Milk Protein Market in 2022? Ans. The market size of the Global Milk Protein Market in 2022 was valued at US$ 9.8 Bn.

1. Milk Protein Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Milk Protein Market: Dynamics 2.1. Preference Analysis 2.2. Milk Protein Market Trends by Region 2.2.1. North America Milk Protein Market Trends 2.2.2. Europe Milk Protein Market Trends 2.2.3. Asia Pacific Milk Protein Market Trends 2.2.4. Middle East and Africa Milk Protein Market Trends 2.2.5. South America Milk Protein Market Trends 2.3. Milk Protein Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Milk Protein Market Drivers 2.3.1.2. North America Milk Protein Market Restraints 2.3.1.3. North America Milk Protein Market Opportunities 2.3.1.4. North America Milk Protein Market Challenges 2.3.2. Europe 2.3.2.1. Europe Milk Protein Market Drivers 2.3.2.2. Europe Milk Protein Market Restraints 2.3.2.3. Europe Milk Protein Market Opportunities 2.3.2.4. Europe Milk Protein Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Milk Protein Market Drivers 2.3.3.2. Asia Pacific Milk Protein Market Restraints 2.3.3.3. Asia Pacific Milk Protein Market Opportunities 2.3.3.4. Asia Pacific Milk Protein Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Milk Protein Market Drivers 2.3.4.2. Middle East and Africa Milk Protein Market Restraints 2.3.4.3. Middle East and Africa Milk Protein Market Opportunities 2.3.4.4. Middle East and Africa Milk Protein Market Challenges 2.3.5. South America 2.3.5.1. South America Milk Protein Market Drivers 2.3.5.2. South America Milk Protein Market Restraints 2.3.5.3. South America Milk Protein Market Opportunities 2.3.5.4. South America Milk Protein Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Milk Protein Industry 2.8. Analysis of Government Schemes and Initiatives For Milk Protein Industry 2.9. The Global Pandemic Impact on Milk Protein Market 2.10. Milk Protein Price Trend Analysis (2021-22) 2.11. Global Milk Protein Market Trade Analysis (2017-2022) 3. Milk Protein Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 3.1.1. Milk Protein Concentrates 3.1.2. Milk Protein Hydrolysates 3.1.3. Milk Protein Casein 3.1.4. Others 3.2. Milk Protein Market Size and Forecast, by Form (2022-2029) 3.2.1. Dry 3.2.2. Liquid 3.3. Milk Protein Market Size and Forecast, by Application (2022-2029) 3.3.1. Dairy Product 3.3.2. Dietary Supplement 3.3.3. Bakery Products 3.3.4. Infant Formula 3.3.5. Beverages 3.3.6. Others 3.4. Milk Protein Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Milk Protein Market Size and Forecast by Segmentation (by Value) (2022-2029) 4.1. North America Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 4.1.1. Milk Protein Concentrates 4.1.2. Milk Protein Hydrolysates 4.1.3. Milk Protein Casein 4.1.4. Others 4.2. North America Milk Protein Market Size and Forecast, by Form (2022-2029) 4.2.1. Dry 4.2.2. Liquid 4.3. North America Milk Protein Market Size and Forecast, by Application (2022-2029) 4.3.1. Dairy Product 4.3.2. Dietary Supplement 4.3.3. Bakery Products 4.3.4. Infant Formula 4.3.5. Beverages 4.3.6. Others 4.4. North America Milk Protein Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 4.4.1.1.1. Milk Protein Concentrates 4.4.1.1.2. Milk Protein Hydrolysates 4.4.1.1.3. Milk Protein Casein 4.4.1.1.4. Others 4.4.1.2. United States Milk Protein Market Size and Forecast, by Form (2022-2029) 4.4.1.2.1. Dry 4.4.1.2.2. Liquid 4.4.1.3. United States Milk Protein Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Dairy Product 4.4.1.3.2. Dietary Supplement 4.4.1.3.3. Bakery Products 4.4.1.3.4. Infant Formula 4.4.1.3.5. Beverages 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 4.4.2.1.1. Milk Protein Concentrates 4.4.2.1.2. Milk Protein Hydrolysates 4.4.2.1.3. Milk Protein Casein 4.4.2.1.4. Others 4.4.2.2. Canada Milk Protein Market Size and Forecast, by Form (2022-2029) 4.4.2.2.1. Dry 4.4.2.2.2. Liquid 4.4.2.3. Canada Milk Protein Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Dairy Product 4.4.2.3.2. Dietary Supplement 4.4.2.3.3. Bakery Products 4.4.2.3.4. Infant Formula 4.4.2.3.5. Beverages 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 4.4.3.1.1. Milk Protein Concentrates 4.4.3.1.2. Milk Protein Hydrolysates 4.4.3.1.3. Milk Protein Casein 4.4.3.1.4. Others 4.4.3.2. Mexico Milk Protein Market Size and Forecast, by Form (2022-2029) 4.4.3.2.1. Dry 4.4.3.2.2. Liquid 4.4.3.3. Mexico Milk Protein Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Dairy Product 4.4.3.3.2. Dietary Supplement 4.4.3.3.3. Bakery Products 4.4.3.3.4. Infant Formula 4.4.3.3.5. Beverages 4.4.3.3.6. Others 5. Europe Milk Protein Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.2. Europe Milk Protein Market Size and Forecast, by Form (2022-2029) 5.3. Europe Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4. Europe Milk Protein Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.1.2. United Kingdom Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.1.3. United Kingdom Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.2. France 5.4.2.1. France Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.2.2. France Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.2.3. France Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.3.2. Germany Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.3.3. Germany Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.4.2. Italy Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.4.3. Italy Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.5.2. Spain Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.5.3. Spain Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.6.2. Sweden Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.6.3. Sweden Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.7.2. Austria Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.7.3. Austria Milk Protein Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 5.4.8.2. Rest of Europe Milk Protein Market Size and Forecast, by Form (2022-2029) 5.4.8.3. Rest of Europe Milk Protein Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Milk Protein Market Size and Forecast by Segmentation (by Value) (2022-2029) 6.1. Asia Pacific Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.2. Asia Pacific Milk Protein Market Size and Forecast, by Form (2022-2029) 6.3. Asia Pacific Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Milk Protein Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.1.2. China Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.1.3. China Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.2.2. S Korea Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.2.3. S Korea Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.3.2. Japan Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.3.3. Japan Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.4.2. India Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.4.3. India Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.5.2. Australia Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.5.3. Australia Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.6.2. Indonesia Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.6.3. Indonesia Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.7.2. Malaysia Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.7.3. Malaysia Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.8.2. Vietnam Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.8.3. Vietnam Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.9.2. Taiwan Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.9.3. Taiwan Milk Protein Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Milk Protein Market Size and Forecast, by Form (2022-2029) 6.4.10.3. Rest of Asia Pacific Milk Protein Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Milk Protein Market Size and Forecast by Segmentation (by Value) (2022-2029 7.1. Middle East and Africa Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 7.2. Middle East and Africa Milk Protein Market Size and Forecast, by Form (2022-2029) 7.3. Middle East and Africa Milk Protein Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Milk Protein Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 7.4.1.2. South Africa Milk Protein Market Size and Forecast, by Form (2022-2029) 7.4.1.3. South Africa Milk Protein Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 7.4.2.2. GCC Milk Protein Market Size and Forecast, by Form (2022-2029) 7.4.2.3. GCC Milk Protein Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 7.4.3.2. Nigeria Milk Protein Market Size and Forecast, by Form (2022-2029) 7.4.3.3. Nigeria Milk Protein Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 7.4.4.2. Rest of ME&A Milk Protein Market Size and Forecast, by Form (2022-2029) 7.4.4.3. Rest of ME&A Milk Protein Market Size and Forecast, by Application (2022-2029) 8. South America Milk Protein Market Size and Forecast by Segmentation (by Value) (2022-2029) 8.1. South America Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 8.2. South America Milk Protein Market Size and Forecast, by Form (2022-2029) 8.3. South America Milk Protein Market Size and Forecast, by Application (2022-2029) 8.4. South America Milk Protein Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 8.4.1.2. Brazil Milk Protein Market Size and Forecast, by Form (2022-2029) 8.4.1.3. Brazil Milk Protein Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 8.4.2.2. Argentina Milk Protein Market Size and Forecast, by Form (2022-2029) 8.4.2.3. Argentina Milk Protein Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Milk Protein Market Size and Forecast, by Protein Type (2022-2029) 8.4.3.2. Rest Of South America Milk Protein Market Size and Forecast, by Form (2022-2029) 8.4.3.3. Rest Of South America Milk Protein Market Size and Forecast, by Application (2022-2029) 9. Global Milk Protein Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Protein Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Structure 9.4.1. Market Leaders 9.4.2. Market Followers 9.4.3. Emerging Players 9.5. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hilmar Cheese Company, Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Nestle 10.3. Saputo Inc. 10.4. Glanbia plc. 10.5. Fonterra Co-operative Group Ltd 10.6. Arla Foods 10.7. Alpavit 10.8. Wheyco GmbH 10.9. Carbery Group 10.10. LACTALIS 10.11. Olam International 10.12. Davisco Foods International, Inc. 10.13. Milkaut SA 10.14. Leprino Foods Company 10.15. Maple Island Inc. 10.16. Kerry Group plc. 10.17. Havero Hoogwegt Group 10.18. Amco Protein 11. Key Findings 12. Industry Recommendations 13. Milk Protein Market: Research Methodology