Global Medical Suction Devices Market expected to hit USD 1275.09 Mn by 2029 from USD 865 Mn in 2022 at a CAGR of 5.7 % during the forecast periodMedical Suction Devices Market Overview

Medical suction devices help a patient to breathe when an individual is unable to clear secretions due to a lack of consciousness or an ongoing medical procedure. Basically, it clears blockages from a patient’s airway. The growth in the aging population and the rise in respiratory diseases driving the need for emergency care. These factors are expected to drive the demand for Medical Suction Devices.To know about the Research Methodology :- Request Free Sample Report

Medical Suction Devices Market Research Methodology

The bottom-up approach is used to estimate the size of the Medical Suction Devices Market by value and volume. The report includes major driving factors of the market along with its restraints, opportunities and regional scope in top geographic regions such as North America, Asia Pacific, South America, Middle East and Africa and Europe. The report involves an analysis of the market through segments: type, Machine, Portability and application along with their multiple sub-segments. The report provides detailed information about the competitive benchmarking of the major Medical Suction Devices Key Players. The report has listed twenty major Medical Suction Devices Key Companies along with their mergers and acquisitions and business strategies. Primary and secondary research methods were used to collect data. Primary data were collected from an interview with market leaders and opinions from business owners. Secondary data were gathered from annual reports and paid databases. Collected data were later analyzed by SWOT analysis and PESTLE analysis.Medical Suction Devices Market Dynamics

Drivers: The noticeable growth in chronic pulmonary and respiratory diseases due to air, water and another form of pollution needs emergency care within a few minutes. The suction devices help to remove obstructions such as mucus, saliva blood or secretions when a patient is out of consciousness or in an ongoing medical procedure. These diseases mostly happen because of irregularities in the lungs’ airways and airflows. This usually happens since lung tissues may damage or mucus may block the airways or Mucus may block the damage. This is expected to drive the Medical Suction Devices Market throughout the forecast period. The growing healthcare industry across the world demands Medical Suction Devices, which will be used in clinical procedures such as obstetrics, endoscopy, dental and gastroenterology. And Medical suction instruments are technically advanced and widely used in surgical operations to increase the safety, efficiency and accuracy in surgical or clinical operations. Also the increased spending and awareness regarding the importance of healthcare sector infrastructure development especially after the pandemic thing. These factors are expected to drive the growth of the Medical Suction Devices Market. The continuous investment and research and developments by major Medical Suction Devices Key Players have been driving the market growth. For instance, Laerdal Medical developed its reusable suction device, which is lightweight, easy to operate and splashproof. These suction devices include features such as ease of operation and visual support with LED display, it also comes with canister options. These features are expected to drive the demand for Medical Suction instruments across the world and proportionally drive the Medical Suction Devices Market. The prime growth driver of the Medical Suction Devices Market is the rising old-age population with diabetes and chronic diseases and the declining prices of Medical Suction Instruments. The geriatric population needs Medical Suction instruments mostly as they are more likely to have illnesses. This is expected to drive the market growth. The market is highly commoditized and the limited reimbursement policies are expected to limit the market growth. The report involves drivers and restraints of the Medical Suction Devices Market in detail along with its socio-political aspects across the region.

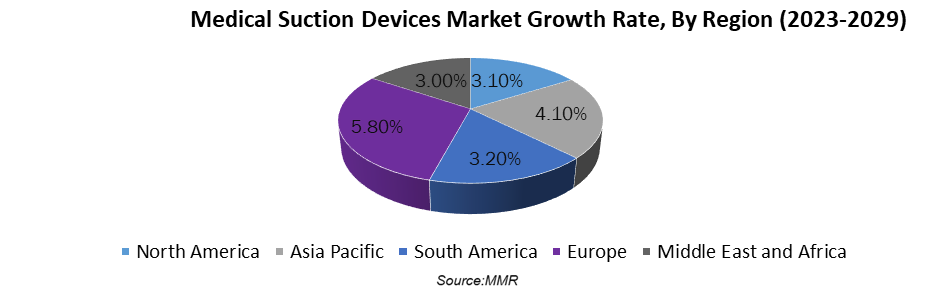

Medical Suction Devices Market Regional Insights

North America held the largest share of the Medical Suction Devices Market in 2022 and is expected to grow at a CAGR of 3.1 percent throughout the forecast period (2023-2029). In 2021, the United States spend almost USD 187.6 billion on healthcare. The shift from traditional healthcare to home healthcare along with the increased demand for compact and portable suction devices has been driving the growth of the Medical Suction Devices Industry. The continuous developments in the field of medical devices resulted in the decline of Medical Suction Instrument prices. The region is exposed to a rising number of chronic diseases due to changing lifestyles, which is expected to drive the demand for mobile suction devices. Asia Pacific is expected to grow at a significant CAGR of 4.1 percent in the Medical Suction Devices Market during the forecast period. USD 5.7 million were awarded to four projects in research in Australia and the Asia Pacific aiming to improve health outcomes for chronic diseases. The MMR report provides details regarding such key developments in major geographic regions, which are expected to drive the Market. Medical Suction Devices have high demand particularly in developing and low-income economies since the rate of chronic respiratory disease, heart disease and diabetes is high in those regions. Europe is expected to grow at a CAGR of 5.8 percent during the forecast period in Medical Suction Devices Market. Chronic respiratory diseases were the third leading cause of mortality in England. The need for portable, automatic and home suction devices has increased in the region after the pandemic. The growth is expected to be driven by the rising importance of technologies in the healthcare sector such as machine learning, augmented reality, 5G and digitalization and is also driving the Europe Market. Middle East and Africa are expected to hold the 3 percent of share in the Medical Suction Devices Market. Turkish Cooperation and Coordination Agency (TIKS) provided medical equipment such as suction devices, pregnancy test, hemoglobin analyzers and others to LeDeG Foundation working in Ethiopia for maternal and infant health and chronic respiratory diseases. These factors are propelling the growth of the region’s market. South America Market is expected to grow at a CAGR of 3.2 percent during the forecast period. The North of Mexico has the highest mortality rate due to lung cancer, the growing number of nosocomial infections and the growth in geriatric population in the region. These factors are expected to drive the South America Market. Medical Suction Devices Market Competitive Landscape Global medical devices manufacturer, Medela on May 20, 2020, announced the launch of new suction pumps and a production line in the US, where 10,000 units are to be produced. The advanced Breast pump with a backpack is a major flagship product of the Medela Company and suction pumps are among its product family. The report provides a detailed benchmarking of the major Medical Suction Devices Key Players based on their revenues, products, market share and subsidiaries in various regions, recent developments and past five years’ growth rate. Medela is expected to produce portable suction devices and shipped to local hospitals and healthcare facilities to meet their demand.Based on Type AC-powered devices segment held the largest share in the Medical Suction Devices Market in 2022. The dual-powered devices segment is expected to hold the largest revenue share in the market during the forecast period (2023-2029). The increasing demand for suction devices at home is driving the growth of dual-powered suction devices. It offers a wide vacuum range, a wide operating and storage temperature range. The dual-powered devices can operate in extreme weather conditions along with features such as LED battery condition indicators and color-coded vacuum gauges. These features are expected to drive the Dual-powered suction devices segment in Market. Based on Machine Primarily, ordinary electric suction machines are the ones, which are commonly used only for drawing blood, water, abscess and sputum and not for other treatments. Now with technological improvements various suction machines introduced to the market such as artificial abortion electric suction, gastric lavage electric suction and others. Among them, artificial abortion electric suction machine held the highest share in 2022 and is expected to grow at a significant rate in Medical Suction Devices Market. It includes features such as automatic negative pressure control to maintain a set negative pressure range, equipped with manual and foot switches and electrostatic spraying. These factors are driving the demand for artificial abortion electric suction machines in the healthcare sector. Based on Application The surgical uses of medical suction devices are the dominating segment of the market. As the patient relies on outside support for breathing during the surgery to avoid any issues and for safety purposes. An Airway clearing and research and diagnostics held second and third place respectively in terms of revenue share. Based on End-User The hospital segment held the largest share in the Medical Suction Devices Market and is expected to dominate the market. The growing healthcare infrastructure across the world with advanced medical equipment coupled with technologies such as big data, AI and ML driving the demand for easy-to-handle, safe and portable medical suction devices. Portable suction devices have high demand from homes and pre-hospitals and clinics for primary aid. This increased demand has been driving the other segments of end-users.

Medical Suction Devices Market Segment Analysis:

Medical Suction Devices Market Scope: Inquire before buying

Medical Suction Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 865 Mn. Forecast Period 2023 to 2029 CAGR: 5.7 % Market Size in 2029: USD 1275.1Bn. Segments Covered: by Type AC-powered Devices Battery-powered Devices Dual-powered Devices Manually operated Devices by Machine Ordinary Electric Suction Artificial Abortion Electric Suction Gastric Lavage Electric Suction by Portability Hand Handled Devices Wall Mounted Devices by Application Airway Clearing Surgical Research and Diagnostics by End User Hospital Home Clinics Pre-hospitals Others Medical Suction Devices Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Medical Suction Devices Key Players include:

1. Allied Healthcare Products, Inc. 2. MEDICOP d.o.o. 3. Integra Biosciences AG 4. Labconco Corporation 5. Asahi Kasei Corporation 6. Precision Medical, Inc. 7. Amsino International, Inc. 8. Medela AG 9. ATMOS MedizinTechnik GmbH & Co. KG 10.Laerdal Medical 11.Drive Medical 12.ZOLL Medical Corporation 13.Welch Vaccum 14.Amsino International Inc. 15.Olympus Corporation 16.SSCOR 17.GPC Medical Ltd. 18.Bharat Surgical Company 19.Monarch Meditech 20.Anand Medicaids Pvt. Ltd. Frequently Asked Questions: 1] What is the growth rate of the Medical Suction Devices Market? Ans. The Medical Suction Devices Market is growing at a CAGR of 5.7 % during the forecast period. 2] Which region is expected to dominate the Medical Suction Devices Market? Ans. North America is expected to dominate the Market during the forecast period from 2023 to 2029. 3] What is the expected Medical Suction Devices Market size by 2029? Ans. The size of the Market by 2029 is expected to reach USD 1275.1 Mn. 4] Who are the top players in the Medical Suction Devices Market? Ans. The major key players in the Market are Agile Actors, Xros Inc., Cyxtera Technologies Inc. and Equinix Inc. 5] Which factors contributed to the growth of the Market in 2022? Ans. The Medical Suction Devices Market is expected to grow due to the rising prevalence of respiratory diseases.

1. Global Medical Suction Devices Market: Research Methodology 2. Global Medical Suction Devices Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Medical Suction Devices Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Medical Suction Devices Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Medical Suction Devices Market Segmentation (by Value USD and Volume Units) 4.1 Global Medical Suction Devices Market, by Type (2022-2029) • AC-powered Devices • Battery-powered Devices • Dual-powered Devices • Manually operated Devices 4.2 Global Medical Suction Devices Market, by Machine (2022-2029) • Ordinary Electric Suction • Artificial Abortion Electric Suction • Gastric Lavage Electric Suction 4.3 Global Medical Suction Devices Market, by Portability (2022-2029) • Hand Handled Devices • Wall Mounted Devices 4.4 Global Medical Suction Devices Market, by Application (2022-2029) • Airway Clearing • Surgical • Research and Diagnostics 4.5 Global Medical Suction Devices Market, by End User (2022-2029) • Hospital • Home • Clinics • Pre-hospitals • Others 5. North America Medical Suction Devices Market(2022-2029) (by Value USD and Volume Units) 5.1 North America Medical Suction Devices Market, by Type (2022-2029) • AC-powered Devices • Battery-powered Devices • Dual-powered Devices • Manually operated Devices 5.2 North America Medical Suction Devices Market, by Machine (2022-2029) • Ordinary Electric Suction • Artificial Abortion Electric Suction • Gastric Lavage Electric Suction 5.3 North America Medical Suction Devices Market, by Portability (2022-2029) • Hand Handled Devices • Wall Mounted Devices 5.4 North America Medical Suction Devices Market, by Application (2022-2029) • Airway Clearing • Surgical • Research and Diagnostics 5.5 North America Medical Suction Devices Market, by End User (2022-2029) • Hospital • Home • Clinics • Pre-hospitals • Others 5.6 North America Medical Suction Devices Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Medical Suction Devices Market (2022-2029) (by Value USD and Volume Units) 6.1. European Medical Suction Devices Market, by Type (2022-2029) 6.2. European Medical Suction Devices Market, by Machine (2022-2029) 6.3. European Medical Suction Devices Market, by Portability (2022-2029) 6.4. European Medical Suction Devices Market, by Application (2022-2029) 6.5. European Medical Suction Devices Market, by End User (2022-2029) 6.6. European Medical Suction Devices Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Medical Suction Devices Market (2022-2029) (by Value USD and Volume Units) 7.1. Asia Pacific Medical Suction Devices Market, by Type (2022-2029) 7.2. Asia Pacific Medical Suction Devices Market, by Machine (2022-2029) 7.3. Asia Pacific Medical Suction Devices Market, by Portability (2022-2029) 7.4. Asia Pacific Medical Suction Devices Market, by Application (2022-2029) 7.5. Asia Pacific Medical Suction Devices Market, by End User (2022-2029) 7.6. Asia Pacific Medical Suction Devices Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Medical Suction Devices Market (2022-2029) (by Value USD and Volume Units) 8.1 Middle East and Africa Medical Suction Devices Market, by Type (2022-2029) 8.2. Middle East and Africa Medical Suction Devices Market, by Machine (2022-2029) 8.3. Middle East and Africa Medical Suction Devices Market, by Portability (2022-2029) 8.4. Middle East and Africa Medical Suction Devices Market, by Application (2022-2029) 8.5. Middle East and Africa Medical Suction Devices Market, by End User (2022-2029) 8.6. Middle East and Africa Medical Suction Devices Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Medical Suction Devices Market (2022-2029) (by Value USD and Volume Units) 9.1. South America Medical Suction Devices Market, by Type (2022-2029) 9.2. South America Medical Suction Devices Market, by Machine (2022-2029) 9.3. South America Medical Suction Devices Market, by Portability (2022-2029) 9.4. South America Medical Suction Devices Market, by Application (2022-2029) 9.5. South America Medical Suction Devices Market, by End User (2022-2029) 9.6. South America Medical Suction Devices Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Allied Healthcare Products, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. MEDICOP d.o.o. 10.3. Integra Biosciences AG 10.4. Labconco Corporation 10.5. Asahi Kasei Corporation 10.6. Precision Medical, Inc. 10.7. Amsino International, Inc. 10.8. Medela AG 10.9. ATMOS MedizinTechnik GmbH & Co. KG 10.10. Laerdal Medical 10.11. Drive Medical 10.12. ZOLL Medical Corporation 10.13. Welch Vaccum 10.14. Amsino International Inc. 10.15. Olympus Corporation 10.16. SSCOR 10.17. GPC Medical Ltd. 10.18. Bharat Surgical Company 10.19. Monarch Meditech 10.20. Anand Medicaids Pvt. Ltd.