Mammography Workstation Market size was valued at US$ 9.28 Bn in 2021 and the total revenue is expected to grow at 6.7% through 2022 to 2029, reaching nearly US$ 15.59 Bn.Mammography Workstation Market Overview:

Breast cancer is becoming more common, and technological advancements in the field of mammography are propelling the mammography workstation market forward. Breast cancer is the most frequent malignancy among women. Furthermore, due to the availability of enhanced mammography diagnostic techniques, there has been an increase in breast cancer awareness and early identification of the disease. This factor is boosting the demand for mammography workstations.To know about the Research Methodology :- Request Free Sample Report

Mammography Workstation Market Dynamics:

The market is being driven by the rising incidence of breast cancer and technical advancements in the field of mammography. Breast cancer claimed the lives of about 0.6 million women in 2021, accounting for almost 15% of all cancer fatalities, according to the WHO. Furthermore, the availability of upgraded mammography diagnostic instruments, as well as increased awareness about breast cancer and early identification of disease, are pushing the demand for mammography workstations. Breast cancer detection by mammography increased to 34.7 per 100 tests, according to the Breast Cancer Surveillance Consortium. The market for mammography workstations is also being driven by an increasing number of new product launches and quick FDA approvals. The Food and Drug Administration (FDA) in the United States has announced additional efforts to update breast cancer screening to empower patients and encourage decision-making. New assessment categories have been added, quality requirements have been updated, and tissue density norms have been improved. The amount of money spent on research to develop new technology for early breast cancer detection has increased dramatically. Many government-funded programs are focusing on medical technology development in its early stages, as well as data analysis and generation. These market participants are concentrating on developing next-generation mammography workstations that cover a broad range of radiological applications. Furthermore, artificial intelligence and machine learning have evolved in a way that has increased diagnosis quality. This technique aids the radiologist in the early detection of breast cancer as well as risk prediction in mammography.Mammography Workstation Market Segment Analysis:

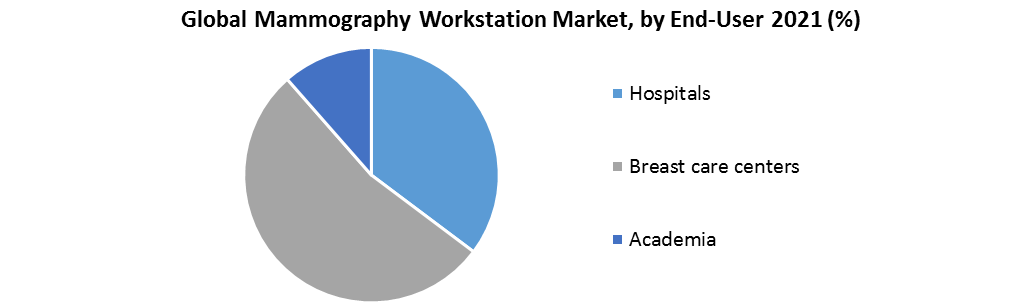

The Diagnosis Screening segment is anticipated to adhere to the growth of the Mammography Workstation Market. In 2021, the diagnosis screening segment dominated the mammography workstation market, accounting for roughly 39.3 % of total revenue. The extensive usage of mammography workstations in diagnostic screening accounts for this segment's large market share. Asymptomatic women undergo diagnostic screening to detect breast cancer at an early stage when it is still treatable. Furthermore, the industry is being boosted by an increase in the number of breast screening programmers. BreastScreen Australia, for example, is a nationwide breast cancer screening programmer that offers free mammograms every two years to women over the age of 50. Hence, this element is likely to boost the growth of the market in the forecast period. The hospital's segment is supplementing the growth of the Mammography Workstation Market. In 2021, the hospital's sector led the mammography workstations market, accounting for 42.4 % of revenue. This is due to an increase in breast cancer screenings and technological developments in mammography workstations. Furthermore, rising healthcare funding and several government changes are propelling the industry forward. Many OECD countries have implemented a mammography workstation-based breast cancer screening program. As a result, the aforementioned elements are helping to drive segment growth. During the projected period, the fastest-growing segment is expected to be breast care centers. The rising awareness of breast care centers and the expanding network of breast centers is the segment's main driver. These facilities offer comprehensive diagnostic and preventative health care. The Breast Centers Network, for example, is the world's first international network of clinical centers dedicated to breast cancer treatment and diagnosis. The European School of Oncology is working on an initiative to improve and promote breast cancer care around the world.

Mammography Workstation Market Regional Insights:

North America dominated the mammography workstations market in 2021, accounting for 48.2% of revenue, and is likely to continue to do so over the forecast period. In North America, the mammography workstation market is being boosted by a growing senior population and a growing number of product launches. Also, the majority of breast cancer patients are found in America, and this factor is projected to boost the mammography market in the region. Continuous technical improvement in the field of mammography, as well as quick FDA approvals, are helping the region to grow. Furthermore, the presence of significant players in the sector is boosting the market's expansion in the region. Further, increasing investment in the healthcare industry and enhancing breast examination is further estimated to lift the growth of the market. The objective of the report is to present a comprehensive analysis of the Mammography Workstation Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Mammography Workstation Market dynamics, structure by analyzing the market segments and project the Mammography Workstation Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Mammography Workstation Market make the report investor’s guide.Mammography Workstation Market Scope: Inquire before buying

Global Mammography Workstation Market Base Year 2021 Forecast Period 2022-2029 Historical Data CAGR Market Size in 2021 Market Size in 2029 2017 to 2021 6.7% US$ 9.28 Bn US$ 15.59 Bn Segments Covered by Modality • Multimodal • Standalone by Application • Diagnostic screening • Advance imaging • Clinical review by End-Use • Hospitals • Breast care centers • Academia Regions Covered North America • United States • Canada • Mexico Europe • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest of Europe Asia Pacific • China • S Korea • Japan • India • Australia • Indonesia • Malaysia • Vietnam • Taiwan • Bangladesh • Pakistan • Rest of APAC Middle East and Africa • South Africa • GCC • Egypt • Nigeria • Rest of ME&A South America • Brazil • Argentina • Rest of South America Mammography Workstation Market Key Players

• Hologic • Fujifilm • Siemens Healthcare • GE Healthcare • Philips Healthcare • Modi Medicare • Aycan Medical Systems • LLC • MILLENSYS • Trivitron Healthcare. • Hologic Inc. (US), • Barco (Belgium) • Konica Minolta, Inc. (Japan) • Benetec Advanced Medical Systems (Belgium) • PLANMED OY (Finland) • Sectra AB (Sweden) • Modi MediCareFAQs:

1. What is the Mammography Workstation Market value in 2021? Ans: The Mammography Workstation Market value in 2021 was estimated as 9.28 Billion USD. 2. Which segment is likely to dominate the Mammography Workstation Market growth? Ans: The hospital's segment dominated the market for mammography workstations and accounted for the largest revenue share of 42.4% in 2021. This is owing to the rising number of breast screenings and technological advancements in the field of mammography workstations. 3. Which Region is expected to dominate the Mammography Workstation Market during the forecast period? Ans: North America dominated the mammography workstation market with a share of 28.9% in 2021. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives. 4. What are the factors driving the Mammography Workstation market? Ans: Key factors that are driving the mammography workstation market growth include increasing medicare reimbursement for telehealth services, reducing emergency room visits and hospitalization rates, and technological innovation in communication technology across the world. 5. Who are the key players in the Mammography Workstation Market? Ans: Some key players operating in the mammography workstation market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Application 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Application 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Application 2.3.2. Primary Research 2.3.2.1. Data from Primary Application 2.3.2.2. Breakdown of Primary Application 3. Executive Summary: Mammography Workstation Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2021 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Mammography Workstation Market 3.4. Geographical Snapshot of the Mammography Workstation Market, By Manufacturer share 4. Mammography Workstation Market Overview, 2021-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The threat of Substitute Grades 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Mammography Workstation Market 5. Supply Side and Demand Side Indicators 6. Mammography Workstation Market Analysis and Forecast, 2021-2029 6.1. Mammography Workstation Market Size & Y-o-Y Growth Analysis. 7. Mammography Workstation Market Analysis and Forecasts, 2021-2029 7.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 7.1.1. Multimodal 7.1.2. Standalone 7.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 7.2.1. Diagnostic screening 7.2.2. Advance imaging 7.2.3. Clinical review 7.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 7.3.1. Hospitals 7.3.2. Breast care centers 7.3.3. Academia 8. Mammography Workstation Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2021-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Mammography Workstation Market Analysis and Forecasts, 2021-2029 9.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 9.1.1. Multimodal 9.1.2. Standalone 9.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 9.2.1. Diagnostic screening 9.2.2. Advanced imaging 9.2.3. Clinical review 9.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 9.3.1. Hospitals 9.3.2. Breast care centers 9.3.3. Academia 10. North America Mammography Workstation Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2021-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Mammography Workstation Market Analysis and Forecasts, 2021-2029 11.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 11.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 11.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 12. Canada Mammography Workstation Market Analysis and Forecasts, 2021-2029 12.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 12.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 12.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 13. Mexico Mammography Workstation Market Analysis and Forecasts, 2021-2029 13.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 13.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 13.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 14. Europe Mammography Workstation Market Analysis and Forecasts, 2021-2029 14.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 14.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 14.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 15. Europe Mammography Workstation Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2021-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K Mammography Workstation Market Analysis and Forecasts, 2021-2029 16.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 16.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 16.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 17. France Mammography Workstation Market Analysis and Forecasts, 2021-2029 17.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 17.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 17.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 18. Germany Mammography Workstation Market Analysis and Forecasts, 2021-2029 18.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 18.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 18.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 19. Italy Mammography Workstation Market Analysis and Forecasts, 2021-2029 19.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 19.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 19.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 20. Spain Mammography Workstation Market Analysis and Forecasts, 2021-2029 20.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 20.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 20.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 21. Sweden Mammography Workstation Market Analysis and Forecasts, 2021-2029 21.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 21.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 21.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 22. CIS Countries Mammography Workstation Market Analysis and Forecasts, 2021-2029 22.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 22.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 22.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 23. Rest of Europe Mammography Workstation Market Analysis and Forecasts, 2021-2029 23.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 23.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 23.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 24. Asia Pacific Mammography Workstation Market Analysis and Forecasts, 2021-2029 24.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 24.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 24.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 25. Asia Pacific Mammography Workstation Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2021-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Mammography Workstation Market Analysis and Forecasts, 2021-2029 26.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 26.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 26.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 27. India Mammography Workstation Market Analysis and Forecasts, 2021-2029 27.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 27.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 27.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 28. Japan Mammography Workstation Market Analysis and Forecasts, 2021-2029 28.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 28.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 28.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 29. South Korea Mammography Workstation Market Analysis and Forecasts, 2021-2029 29.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 29.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 29.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 30. Australia Mammography Workstation Market Analysis and Forecasts, 2021-2029 30.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 30.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 30.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 31. ASEAN Mammography Workstation Market Analysis and Forecasts, 2021-2029 31.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 31.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 31.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 32. Rest of Asia Pacific Mammography Workstation Market Analysis and Forecasts, 2021-2029 32.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 32.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 32.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 33. Middle East Africa Mammography Workstation Market Analysis and Forecasts, 2021-2029 33.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 33.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 33.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 34. Middle East Africa Mammography Workstation Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2021-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Mammography Workstation Market Analysis and Forecasts, 2021-2029 35.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 35.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 35.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 36. GCC Countries Mammography Workstation Market Analysis and Forecasts, 2021-2029 36.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 36.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 36.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 37. Egypt Mammography Workstation Market Analysis and Forecasts, 2021-2029 37.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 37.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 37.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 38. Nigeria Mammography Workstation Market Analysis and Forecasts, 2021-2029 38.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 38.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 38.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 39. Rest of ME&A Mammography Workstation Market Analysis and Forecasts, 2021-2029 39.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 39.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 39.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 40. South America Mammography Workstation Market Analysis and Forecasts, 2021-2029 40.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 40.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 40.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 41. South America Mammography Workstation Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2021-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Mammography Workstation Market Analysis and Forecasts, 2021-2029 42.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 42.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 42.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 43. Argentina Mammography Workstation Market Analysis and Forecasts, 2021-2029 43.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 43.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 43.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 44. Rest of South America Mammography Workstation Market Analysis and Forecasts, 2021-2029 44.1. Market Size (Value) Estimates & Forecast By Modality, 2021-2029 44.2. Market Size (Value) Estimates & Forecast By Application, 2021-2029 44.3. Market Size (Value) Estimates & Forecast By End-Use, 2021-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Mammography Workstation Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 45.2.2. New Grade Launches and Grade Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment, and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Merck & Co., Inc. 45.3.1.1. Financial Overview 45.3.1.2. Geographic Footprint 45.3.1.3. Grade Portfolio 45.3.1.4. Business Strategy 45.3.1.5. Recent Developments 45.3.2. Hologic 45.3.3. Fujifilm 45.3.4. Siemens Healthcare 45.3.5. GE Healthcare 45.3.6. Philips Healthcare 45.3.7. Modi Medicare 45.3.8. Aycan Medical Systems 45.3.9. LLC 45.3.10. MILLENSYS 45.3.11. Trivitron Healthcare. 45.3.12. Hologic Inc. (US), 45.3.13. Barco (Belgium) 45.3.14. Konica Minolta, Inc. (Japan) 45.3.15. Benetec Advanced Medical Systems (Belgium) 45.3.16. PLANMED OY (Finland) 45.3.17. Sectra AB (Sweden) 46.Primary Key Insight