Audiology Devices Market was valued at US$ 11.63 Bn. in 2022 and is expected to reach US$ 16.80 Bn during the forecast period and the market size is expected to grow at a CAGR of 5.39 % through the forecast period.Audiology Devices Market Overview:

Audiology devices are electronic equipment that are used by audiologists to diagnose and treat hearing impairment or hearing loss. Hearing aids are also used to monitor and research hearing. Hearing loss or impairment is frequently related with old age and is becoming a global problem. Audiology devices are expected to rise in popularity due to cost-effective and efficient gadgets, technological improvements, and widespread acceptance of innovative devices among the older population. These devices are now equipped with smart sensors that make them more user-friendly. Furthermore, numerous businesses are producing wireless hearing aids, which are gaining momentum in the audiology equipment industry.To know about the Research Methodology:-Request Free Sample Report The report explores the Global Audiology Devices Market segments (Product, Disease, End User and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022. The report investigates the Global Audiology Devices Market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Global Audiology Devices Market contemporary competitive scenario.

COVID-19 Impact on Audiology Devices Market:

The market was negatively affected by COVID-19. As a result of the epidemic, deaf or hard-of-hearing hospital patients faced additional obstacles. Furthermore, the demand for audiology devices was on the decline. The market's growth is also limited by the constraints associated with therapies. The COVID-19 epidemic, on the other hand, has expedited the implementation of telehealth over the world. Many healthcare professionals are converting to tele-audiology to avoid dealing with patient traffic, which is expected to boost the market.Audiology Devices Market Dynamics:

Drivers: High Prevalence of Hearing Problems: The most major driver driving the growth of this market is the increased incidence of hearing impairment and loss among populations, particularly among the elderly. As the world's population grows, so does the percentage of people who have hearing problems, which is predicted to drive the market's overall growth. Market expansion is also predicted to be fueled by technical advancements, cost-effective and efficient technologies (such as wireless gadgets), and widespread acceptance of novel devices among the senior population. Furthermore, government measures to make hearing aids more accessible buffer the market's growth throughout the anticipated time. Restraints/Challenges: The stigma associated with deafness is projected to stymie market expansion. High prices associated with hearing impairment solutions, particularly those based on surgery, are also expected to pose a challenge to the audiology devices market throughout the forecast period. Opportunities: Improvements in diagnostic performance and treatment decisions, such as developments in PC-based audiometers and hybrid audiometers, can readily be integrated with standard computers and operating systems, providing profitable prospects to market players from 2022 through 2029. Furthermore, a favourable regulatory environment will boost the growth rate of the audiology devices market in the future.Audiology Devices Market Segment Analysis:

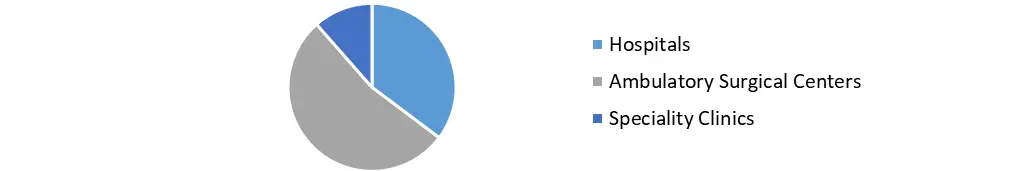

Based on Product, Hearing Aid segment held major share of the market in 2022 and is likely to grow at high CAGR in the forecast period. Hearing aids dominated the market, but cochlear implants are expected to increase at a fast rate because to the lower risk of infection, advancements in implantation procedures, shorter operating times, and less difficulties, as well as improved patient hearing. Based on the End User, Speciality clinics segment held major share of the market in 2022 and is likely to grow at high CAGR in the forecast period.Audiology Devices Market, by End User in 2022(%)

Audiology Devices Market Regional Insights:

The North America region dominated the market with xx% share in 2022. The Asia Pacific region is expected to witness significant growth through the forecast period. The progress of audiology equipment, an increase in the number of audiologists, and the launch of innovative digital platforms by current providers are all factors contributing to market growth in the United States. Patient compliance increases as a result of the introduction of patient-centric audiology systems that make product handling easier, resulting in market growth. Over the projected period, the Asia Pacific region is expected to grow at the fastest rate. The growing senior population and age-related hearing difficulties, constantly improving healthcare infrastructure, rising health-care expenditures, and increased product awareness are all factors contributing to market expansion. The objective of the report is to present a comprehensive analysis of the Audiology Devices Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Market dynamic, structure by analyzing the market segments and projecting the Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Market make the report investor’s guide.Audiology Devices Market Scope: Inquire before buying

Global Audiology Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 11.63 Bn. Forecast Period 2023 to 2029 CAGR: 5.39% Market Size in 2029: US $ 16.80 Bn. Segments Covered: by Product Cochlear Implants BAHA/BAHS Diagnostic Devices Hearing Aids by Disease Otosclerosis Meniere’s Disease Acoustic Tumors Otitis Media by End User Hospitals Ambulatory Surgical Centers Speciality Clinics Audiology Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Audiology Devices Market, Key Players are

1. Benson Medical Instruments 2. MED-EL 3. William Demant 4. AMBCO 5. Cochlear 6. Nurotron BioProduct 7. Sivantos 8. WIDEX 9. Sonova 10. MedRX, 11. Medtronic 12. Starkey Hearing Technologies 13. GN Store Nord Frequently Asked Questions: 1] What segments are covered in the Global Audiology Devices Market report? Ans. The segments covered in the Global Audiology Devices Market report are based on Product, End User and Disease. 2] Which region is expected to hold the highest share in the Global Audiology Devices Market? Ans. North America region is expected to hold the highest share in the Global Audiology Devices Market. 3] What is the market size of the Global Audiology Devices Market by 2029? Ans. The market size of the Global Audiology Devices Market by 2029 is expected to reach US$ 16.80 Bn. 4] What is the forecast period for the Global Audiology Devices Market? Ans. The forecast period for the Global Audiology Devices Market is 2023-2029. 5] What was the market size of the Global Audiology Devices Market in 2022? Ans. The market size of the Global Audiology Devices Market in 2022 was valued at US$ 11.63 Bn.

1. Audiology Devices Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Audiology Devices Market: Dynamics 2.1. Audiology Devices Market Trends by Region 2.1.1. North America Audiology Devices Market Trends 2.1.2. Europe Audiology Devices Market Trends 2.1.3. Asia Pacific Audiology Devices Market Trends 2.1.4. Middle East and Africa Audiology Devices Market Trends 2.1.5. South America Audiology Devices Market Trends 2.2. Audiology Devices Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Audiology Devices Market Drivers 2.2.1.2. North America Audiology Devices Market Restraints 2.2.1.3. North America Audiology Devices Market Opportunities 2.2.1.4. North America Audiology Devices Market Challenges 2.2.2. Europe 2.2.2.1. Europe Audiology Devices Market Drivers 2.2.2.2. Europe Audiology Devices Market Restraints 2.2.2.3. Europe Audiology Devices Market Opportunities 2.2.2.4. Europe Audiology Devices Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Audiology Devices Market Drivers 2.2.3.2. Asia Pacific Audiology Devices Market Restraints 2.2.3.3. Asia Pacific Audiology Devices Market Opportunities 2.2.3.4. Asia Pacific Audiology Devices Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Audiology Devices Market Drivers 2.2.4.2. Middle East and Africa Audiology Devices Market Restraints 2.2.4.3. Middle East and Africa Audiology Devices Market Opportunities 2.2.4.4. Middle East and Africa Audiology Devices Market Challenges 2.2.5. South America 2.2.5.1. South America Audiology Devices Market Drivers 2.2.5.2. South America Audiology Devices Market Restraints 2.2.5.3. South America Audiology Devices Market Opportunities 2.2.5.4. South America Audiology Devices Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Audiology Devices Industry 2.8. Analysis of Government Schemes and Initiatives For Audiology Devices Industry 2.9. Audiology Devices Market Trade Analysis 2.10. The Global Pandemic Impact on Audiology Devices Market 3. Audiology Devices Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Audiology Devices Market Size and Forecast, by Product (2022-2029) 3.1.1. Cochlear Implants 3.1.2. BAHA/BAHS 3.1.3. Diagnostic Devices 3.1.4. Hearing Aids 3.2. Audiology Devices Market Size and Forecast, by Disease (2022-2029) 3.2.1. Otosclerosis 3.2.2. Meniere’s Disease 3.2.3. Acoustic Tumors 3.2.4. Otitis Media 3.3. Audiology Devices Market Size and Forecast, by End User (2022-2029) 3.3.1. Hospitals 3.3.2. Ambulatory Surgical Centers 3.3.3. Speciality Clinics 3.4. Audiology Devices Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Audiology Devices Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Audiology Devices Market Size and Forecast, by Product (2022-2029) 4.1.1. Cochlear Implants 4.1.2. BAHA/BAHS 4.1.3. Diagnostic Devices 4.1.4. Hearing Aids 4.2. North America Audiology Devices Market Size and Forecast, by Disease (2022-2029) 4.2.1. Otosclerosis 4.2.2. Meniere’s Disease 4.2.3. Acoustic Tumors 4.2.4. Otitis Media 4.3. North America Audiology Devices Market Size and Forecast, by End User (2022-2029) 4.3.1. Hospitals 4.3.2. Ambulatory Surgical Centers 4.3.3. Speciality Clinics 4.4. North America Audiology Devices Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Audiology Devices Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Cochlear Implants 4.4.1.1.2. BAHA/BAHS 4.4.1.1.3. Diagnostic Devices 4.4.1.1.4. Hearing Aids 4.4.1.2. United States Audiology Devices Market Size and Forecast, by Disease (2022-2029) 4.4.1.2.1. Otosclerosis 4.4.1.2.2. Meniere’s Disease 4.4.1.2.3. Acoustic Tumors 4.4.1.2.4. Otitis Media 4.4.1.3. United States Audiology Devices Market Size and Forecast, by End User (2022-2029) 4.4.1.3.1. Hospitals 4.4.1.3.2. Ambulatory Surgical Centers 4.4.1.3.3. Speciality Clinics 4.4.2. Canada 4.4.2.1. Canada Audiology Devices Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Cochlear Implants 4.4.2.1.2. BAHA/BAHS 4.4.2.1.3. Diagnostic Devices 4.4.2.1.4. Hearing Aids 4.4.2.2. Canada Audiology Devices Market Size and Forecast, by Disease (2022-2029) 4.4.2.2.1. Otosclerosis 4.4.2.2.2. Meniere’s Disease 4.4.2.2.3. Acoustic Tumors 4.4.2.2.4. Otitis Media 4.4.2.3. Canada Audiology Devices Market Size and Forecast, by End User (2022-2029) 4.4.2.3.1. Hospitals 4.4.2.3.2. Ambulatory Surgical Centers 4.4.2.3.3. Speciality Clinics 4.4.3. Mexico 4.4.3.1. Mexico Audiology Devices Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Cochlear Implants 4.4.3.1.2. BAHA/BAHS 4.4.3.1.3. Diagnostic Devices 4.4.3.1.4. Hearing Aids 4.4.3.2. Mexico Audiology Devices Market Size and Forecast, by Disease (2022-2029) 4.4.3.2.1. Otosclerosis 4.4.3.2.2. Meniere’s Disease 4.4.3.2.3. Acoustic Tumors 4.4.3.2.4. Otitis Media 4.4.3.3. Mexico Audiology Devices Market Size and Forecast, by End User (2022-2029) 4.4.3.3.1. Hospitals 4.4.3.3.2. Ambulatory Surgical Centers 4.4.3.3.3. Speciality Clinics 5. Europe Audiology Devices Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.2. Europe Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.3. Europe Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4. Europe Audiology Devices Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.1.3. United Kingdom Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.2. France 5.4.2.1. France Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.2.3. France Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.3.3. Germany Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.4.3. Italy Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.5.3. Spain Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.6.3. Sweden Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.7.3. Austria Audiology Devices Market Size and Forecast, by End User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Audiology Devices Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Audiology Devices Market Size and Forecast, by Disease (2022-2029) 5.4.8.3. Rest of Europe Audiology Devices Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific Audiology Devices Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.3. Asia Pacific Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific Audiology Devices Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.1.3. China Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.2.3. S Korea Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.3.3. Japan Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.4. India 6.4.4.1. India Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.4.3. India Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.5.3. Australia Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.6.3. Indonesia Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.7.3. Malaysia Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.8.3. Vietnam Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.9.3. Taiwan Audiology Devices Market Size and Forecast, by End User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Audiology Devices Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Audiology Devices Market Size and Forecast, by Disease (2022-2029) 6.4.10.3. Rest of Asia Pacific Audiology Devices Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa Audiology Devices Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Audiology Devices Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Audiology Devices Market Size and Forecast, by Disease (2022-2029) 7.3. Middle East and Africa Audiology Devices Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa Audiology Devices Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Audiology Devices Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Audiology Devices Market Size and Forecast, by Disease (2022-2029) 7.4.1.3. South Africa Audiology Devices Market Size and Forecast, by End User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Audiology Devices Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Audiology Devices Market Size and Forecast, by Disease (2022-2029) 7.4.2.3. GCC Audiology Devices Market Size and Forecast, by End User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Audiology Devices Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Audiology Devices Market Size and Forecast, by Disease (2022-2029) 7.4.3.3. Nigeria Audiology Devices Market Size and Forecast, by End User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Audiology Devices Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Audiology Devices Market Size and Forecast, by Disease (2022-2029) 7.4.4.3. Rest of ME&A Audiology Devices Market Size and Forecast, by End User (2022-2029) 8. South America Audiology Devices Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Audiology Devices Market Size and Forecast, by Product (2022-2029) 8.2. South America Audiology Devices Market Size and Forecast, by Disease (2022-2029) 8.3. South America Audiology Devices Market Size and Forecast, by End User(2022-2029) 8.4. South America Audiology Devices Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Audiology Devices Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Audiology Devices Market Size and Forecast, by Disease (2022-2029) 8.4.1.3. Brazil Audiology Devices Market Size and Forecast, by End User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Audiology Devices Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Audiology Devices Market Size and Forecast, by Disease (2022-2029) 8.4.2.3. Argentina Audiology Devices Market Size and Forecast, by End User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Audiology Devices Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Audiology Devices Market Size and Forecast, by Disease (2022-2029) 8.4.3.3. Rest Of South America Audiology Devices Market Size and Forecast, by End User (2022-2029) 9. Global Audiology Devices Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Audiology Devices Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Benson Medical Instruments 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. MED-EL 10.3. William Demant 10.4. AMBCO 10.5. Cochlear 10.6. Nurotron BioProduct 10.7. Sivantos 10.8. WIDEX 10.9. Sonova 10.10. MedRX, 10.11. Medtronic 10.12. Starkey Hearing Technologies 10.13. GN Store Nord. 11. Key Findings 12. Industry Recommendations 13. Audiology Devices Market: Research Methodology 14. Terms and Glossary