The Global Lotus Extract Market was valued at US$ 69.58 million in 2022 and is projected to reach US$ 123.96 million by 2029, growing at a CAGR of 8.6% from 2023 to 2029.Lotus Extract Market Overview and Scope

The global lotus extract market encompasses the cultivation, extraction and utilization of the valuable components derived from lotus plants. Lotus extracts are used in pharmaceuticals, cosmetics, food and drinks and personal care, attracting attention. The market has grown and innovated as consumers learn about lotus extracts' health advantages and adaptability. The report analyses the global lotus extract market, including production, distribution, usage and growth prospects. The report covers lotus plant culture, extraction, refining and product development. Natural and organic ingredients and traditional medicine and wellness products are driving market expansion. To understand the lotus extract market, the report provides complete market predictions, geographical perspectives and industry segmentation. It examines market leaders' R&D, product and collaboration strategies. The research examines lotus extract extraction and processing technology and regulatory changes. Sustainable lotus extract farming and packaging are examined in the report. Manufacturers, suppliers, distributors and investors can use the analysis to make informed decisions in this changing market. This study helps organisations and professionals capitalise on the lotus extract market's growth and overcome its hurdles.To know about the Research Methodology :- Request Free Sample Report

Lotus Extract Market Dynamics

Lotus Extract Market Drivers: The global lotus extract market is driven by several key factors that contribute to its robust growth. One of the primary drivers is the increasing consumer awareness and preference for natural and organic ingredients. Lotus extracts are perceived as clean and sustainable alternatives, appealing to consumers who seek healthier and environmentally friendly products. The growing interest in traditional medicine and wellness practices has also boosted the demand for lotus extracts, as they are believed to possess various therapeutic properties. The versatility of lotus extracts in applications across industries such as pharmaceuticals, cosmetics, food and beverages and personal care has further fuelled market growth. Restraints: Despite the market's positive growth trajectory, there are certain restraints that pose challenges to the global lotus extract market. The limited availability of lotus plants in certain regionsmakes the sourcing of raw materials challenging and this scarcity leads to increased costs and potential supply chain disruptions. Another restraint is the complex extraction process involved in obtaining high-quality lotus extracts, which requires specialized equipment and expertise. The regulatory landscape governing herbal and natural extracts varies across countries and pose compliance challenges for market players operating globally. Opportunities in the Lotus Extract Market: The global lotus extract market presents several opportunities for growth and innovation. The increasing demand for natural and plant-based ingredients provides an opportunity for lotus extract manufacturers to develop new formulations and expand their product portfolios. The rising interest in herbal and Ayurvedic remedies creates a market for lotus extract-based products in the pharmaceutical and nutraceutical sectors. The growing demand for natural and sustainable ingredients in the cosmetics and personal care industry opens avenues for lotus extract as a key ingredient in skincare, haircare and other beauty products. Strategic collaborations and partnerships with industry stakeholders enhance market opportunities. Challenges in the Lotus Extract Market: The challenges in the global lotus extract market include maintaining consistent quality and purity of lotus extracts, as variations in cultivation and extraction techniques can impact the final product. Market players need to invest in research and development to optimize extraction processes and ensure standardized quality. Educating consumers about benefits and applications of lotus extracts is crucial, as the market is still emerging and awareness varies across regions. Adapting to evolving regulatory requirements and navigating intellectual property rights related to lotus extract products can pose challenges for industry players. Trends in the Global Lotus Extract Market: The global lotus extract market is witnessing prominent trends, shaping its landscape such as the integration of lotus extracts into clean-label and natural product formulations. Consumers are increasingly seeking transparent ingredient lists and products free from artificial additives, creating opportunities for lotus extract manufacturers to cater to this demand. New applications of lotus extracts are being experimented like their use in functional foods, beverages and dietary supplements, shaping industry trends. Sustainable sourcing practices and eco-friendly packaging solutions are gaining importance, aligning with the growing consumer focus on environmental consciousness.Lotus Extract Market Segment Analysis

The global lotus extract market is segmented into several categories, including product type, application, extraction method, end-use industry and region. In terms of product type, lotus extract is derived from lotus flowers, leaves, or roots, each with its specific applications and benefits. Lotus flower extracts find applications in cosmetics, perfumery and aromatherapy, while lotus leaf extracts are commonly used in pharmaceuticals and nutraceuticals. Lotus root extracts, on the other hand, are valued in the food and beverage industry. Regarding applications, lotus extracts have diverse uses. They are employed in pharmaceuticals for herbal medicines and therapeutic formulations. In cosmetics and personal care products, such as skincare and haircare items, lotus extracts offer potential benefits for skin and hair health. In the food and beverage industry, they serve as natural flavourings, additives, or functional ingredients, enhancing the taste and nutritional composition of products. Lotus extracts are also used in the development of nutraceuticals, including dietary supplements and health drinks. The extraction method plays a crucial role in obtaining lotus extract. Solvent extraction involves using solvents like ethanol or water to isolate the bioactive components, while supercritical fluid extraction techniques, such as supercritical carbon dioxide extraction, ensure the extraction of bioactive compounds while maintaining their integrity.The end-use industry for lotus extract includes traditional medicine, where it is utilized in systems like Ayurveda or Traditional Chinese Medicine for its therapeutic properties. In the cosmeceutical industry, lotus extracts find applications in skincare and beauty products. Aromatherapy is another sector that harnesses the captivating fragrance of lotus for relaxation, stress relief and mood enhancement. Regionally, the lotus extract market varies across different parts of the world. In North America, countries like the United States and Canada have significant demand, while Europe, including the United Kingdom, Germany, France and Italy, showcases its own dynamics and regulatory landscape. The Asia Pacific region, encompassing countries such as China, India, Japan and South Korea, holds cultural significance and emerging opportunities. South America, including Brazil, Mexico and Argentina, offers market potential and reflects local consumer trends. The Middle East and Africa region, with countries like the United Arab Emirates, South Africa and Egypt, presents unique growth opportunities and local utilization practices. Understanding these segment categories enables stakeholders to gain valuable insights into the global lotus extract market. It helps them identify target markets, discern consumer preferences and develop effective strategies tailored to specific industries and regions.Lotus Extract Market Regional Analysis

The regional analysis of the global lotus extract market covers key regions including North America, Europe, Asia Pacific, South America and the Middle East & Africa. Thorough examination of regional dynamics and market trends provides valuable insights into the acceptance and growth of lotus extracts across different industries. In North America, lotus extracts are gaining traction in various sectors, particularly in cosmetics, personal care and nutraceuticals. Consumers in the United States and Canada are increasingly seeking natural and plant-based ingredients, driving the demand for lotus extracts. The region showcases a growing trend towards clean and sustainable beauty products, which presents opportunities for the utilization of lotus extracts in skincare, haircare and wellness-focused formulations. In Europe, the awareness of natural and botanical ingredients in cosmetics and personal care products is driving the market for lotus extracts. Countries like Germany, the United Kingdom and France are leading in the adoption of lotus extracts. The demand for organic and natural cosmetic products, including those incorporating lotus extracts, is on the rise in Europe. The food and beverage industry in Europe is exploring the use of lotus extracts as natural flavourings and functional ingredients, catering to the increasing consumer preference for clean label and health-conscious products. Asia Pacific holds the largest market share in the lotus extract market, driven by the cultural significance of lotus and its use in traditional medicines and rituals. Countries such as China, India and Japan have a long history of utilizing lotus extracts in traditional medicine systems like Ayurveda and Traditional Chinese Medicine. The region presents immense growth potential, with a rising population, changing consumer lifestyles and increased disposable income. The demand for lotus extracts is expected to grow in various industries, including pharmaceuticals, cosmetics and food and beverages, as companies develop tailored products to meet local preferences. South America, with a focus on countries like Brazil and Argentina, is emerging as an important market for lotus extracts. The beauty and personal care industry in South America is witnessing a growing trend towards natural and plant-based ingredients, opening opportunities for lotus extracts. The utilization of lotus extracts in traditional medicine and wellness products is gaining popularity among consumers, driving market growth.The Middle East & Africa region exhibits a growing inclination towards natural and herbal products, including lotus extracts. Countries such as Saudi Arabia and the United Arab Emirates are witnessing an increased demand for lotus extracts in cosmetics, personal care and traditional medicine. Consumer preferences for clean labels, organic ingredients and traditional remedies contribute to the market potential in this region. In-depth research on regional market trends, consumer preferences and regulatory frameworks empowers industry stakeholders to make informed decisions, tailor their products to regional needs and identify growth opportunities in the global lotus extract market. This comprehensive analysis aids in establishing strategic partnerships, complying with regional regulations and capitalizing on the market potential for long-term success.

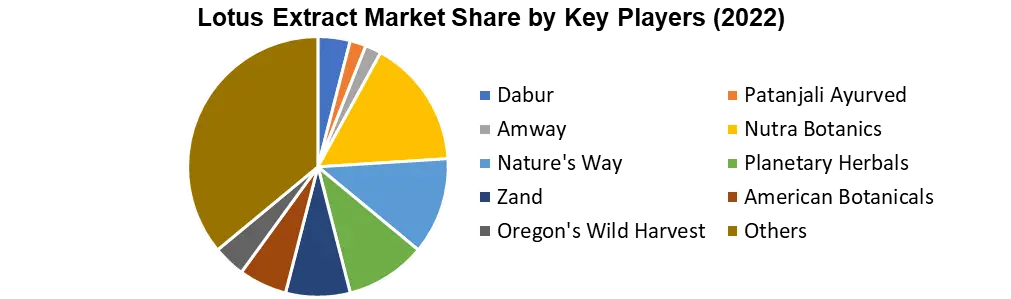

Lotus Extract Market Competitive Analysis

Due to rising industry demand for natural and botanical ingredients, the global lotus extract market is becoming highly competitive. Established enterprises and new entrants compete for market share and differentiation in the market. Lotus extract market leaders serve cosmetics, pharmaceuticals, food & beverage and nutraceuticals with a variety of products and uses. Lotus extract companies must innovate constantly. They invest in R&D to improve extraction methods, lotus extract quality and purity and new uses. Companies develop innovative extraction technologies to extract bioactive substances without compromising their efficacy. Companies also innovate lotus extract compositions to fulfil industry needs. Market participants use strategic alliances and cooperation to increase market reach and synergy. Lotus extract makers, suppliers and end-use industries often collaborate. Partnerships improve distribution, visibility and market penetration. Mergers and acquisitions consolidate market position, acquire technological competence and gain new customers. Lotus extract companies are responding to consumer demand for health and wellness goods. Lotus extract products are made with natural components, clean labelling and less additives and preservatives. Lotus extracts with antioxidant or anti-inflammatory qualities are in high demand, leading enterprises to innovate and create value-added solutions. Sustainability drives lotus extract market rivalry. From raw materials to packaging, supply chains are becoming more sustainable and market players prioritise eco-friendly packaging, recyclable packaging and responsible sourcing, requiring ethical sourcing and fair trade certifications. Companies entering the lotus extract sector face considerable regulatory and quality challenges. Product quality and consumer trust depend on extraction, ingredient labelling and safety certification compliance. Quality control, certifications and lab testing help companies meet regulations and acquire a competitive edge. Technology shapes lotus extract market competition. Advanced extraction methods, automation in production and data-driven analytics give companies an edge in efficiency, product quality and pricing. Digital marketing and personalization enable companies differentiate their products and generate brand loyalty. The lotus extract market study covers competition landscape, key players, market trends, technical advances and growth opportunities. It helps organisations examine market dynamics, evaluate their competitive stance and design successful lotus extract market strategies.Lotus Extract Market Scope: Inquire before buying

Lotus Extract Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2021 Market Size in 2022: US $ 69.58 mn. Forecast Period 2023 to 2029 CAGR: 8.6% Market Size in 2029: US $ 123.96 mn. Segments Covered: by Product Type 1. Lotus Flower Extract 2. Lotus Leaf Extract 3. Lotus Root Extract by Application 1. Pharmaceuticals 2. Cosmetics and Personal Care 3. Food and Beverages 4. Nutraceuticals by Extraction Method 1. Solvent Extraction 2. Supercritical Fluid Extraction by End-Use Industry 3. Traditional Medicine 4. Cosmeceuticals 5. Aromatherapy Lotus Extract Market, by Region

1. North America (United States, Canada and Mexico) 2. Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) 3. Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) 4. Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) 5. South America (Brazil, Argentina Rest of South America)Lotus Extract Market Key Players

The captured list of leading manufacturers of Lotus extract industry has been compiled after an analysis of multiple factors. It is not an exhaustive list based only on market share ranking. After a regional analysis, a competitive analysis and other such considerations, the company profiles were selected based on a variety of factors. The comprehensive report contains information on the position of each company inthe market fromlocaland global perspective. 1. Nutra Botanics 2. Nature's Way 3. Herbal Science 4. Source Naturals 5. Swanson Health Products 6. Herb Pharm 7. Gaia Herbs 8. Planetary Herbals 9. Zand 10. American Botanicals 11. Starwest Botanicals 12. Frontier Natural Products 13. Oregon's Wild Harvest 14. Herb Pharm 15. Traditional Medicinals 16. Earth's Finest 17. Herbs of Gold 18. Himalaya Herbals 19. Dabur 20. Patanjali Ayurved 21. Amway 22. Herbalife 23. Nu Skin Enterprises 24. Avon Products 25. Mary Kay FAQs 1. How big is the Lotus extract market? Ans: Lotus extract industry was valued at US$ 69.58 million in 2022. 2. What is the growth rate of the Lotus extract industry? Ans: The forecasted CAGR of the Lotus extract market is 8.6%. 3. What are the segments for the Lotus extract market? Ans: Factors on which the market is segmented include Product Type, Application, Extraction Method, End-Use Industry and Region. 4. Which is the largest end-user industry in the Lotus extract market? Ans: Cosmetics industry is the largest end-user segment and predicted to have a high growth rate over the forecast period. 5. Is it profitable to invest in the Lotus extract market? Ans: There is a significant growth rate in this market and there are various factors to be analysed like the driving forces and opportunities of the market which has been discussed extensively in Maximize’s full report. That would help in understanding the profitability in the market.

Table of Contents 1. Lotus extract Market: Research Methodology 2. Lotus extract Market: Executive Summary 3. Lotus extract Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Lotus extract Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Lotus extract Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Lotus extract Market Size and Forecast, by Product Type(2022-2029) 5.1.1. Lotus Flower Extract 5.1.2. Lotus Leaf Extract 5.1.3. Lotus Root Extract 5.2. Lotus extract Market Size and Forecast, by Application(2022-2029) 5.2.1. Pharmaceuticals 5.2.2. Cosmetics and Personal Care 5.2.3. Food and Beverages 5.2.4. Nutraceuticals 5.3. Lotus extract Market Size and Forecast, by Extraction Method(2022-2029) 5.3.1. Solvent Extraction 5.3.2. Supercritical Fluid Extraction 5.4. Lotus extract Market Size and Forecast, by End-Use Industry(2022-2029) 5.4.1. Traditional Medicine 5.4.2. Cosmeceuticals 5.4.3. Aromatherapy 5.5. Lotus extract Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Lotus extract Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Lotus extract Market Size and Forecast, by Product Type(2022-2029) 6.1.1. Lotus Flower Extract 6.1.2. Lotus Leaf Extract 6.1.3. Lotus Root Extract 6.2. North America Lotus extract Market Size and Forecast, by Application(2022-2029) 6.2.1. Pharmaceuticals 6.2.2. Cosmetics and Personal Care 6.2.3. Food and Beverages 6.2.4. Nutraceuticals 6.3. North America Lotus extract Market Size and Forecast, by Extraction Method (2022-2029) 6.3.1. Solvent Extraction 6.3.2. Supercritical Fluid Extraction 6.4. North America Lotus extract Market Size and Forecast, by End-Use Industry (2022-2029) 6.4.1. Traditional Medicine 6.4.2. Cosmeceuticals 6.4.3. Aromatherapy 6.5. North America Lotus extract Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Lotus extract Market Size and Forecast (by Value USD and Volume Units) 7.1. EuropeLotus extract Market Size and Forecast, by Product Type(2022-2029) 7.1.1. Lotus Flower Extract 7.1.2. Lotus Leaf Extract 7.1.3. Lotus Root Extract 7.2. EuropeLotus extract Market Size and Forecast, by Application(2022-2029) 7.2.1. Pharmaceuticals 7.2.2. Cosmetics and Personal Care 7.2.3. Food and Beverages 7.2.4. Nutraceuticals 7.3. EuropeLotus extract Market Size and Forecast, by Extraction Method (2022-2029) 7.3.1. Solvent Extraction 7.3.2. Supercritical Fluid Extraction 7.4. EuropeLotus extract Market Size and Forecast, by End-Use Industry (2022-2029) 7.4.1. Traditional Medicine 7.4.2. Cosmeceuticals 7.4.3. Aromatherapy 7.5. Europe Lotus extract Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Lotus extract Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia PacificLotus extract Market Size and Forecast, by Product Type(2022-2029) 8.1.1. Lotus Flower Extract 8.1.2. Lotus Leaf Extract 8.1.3. Lotus Root Extract 8.2. Asia PacificLotus extract Market Size and Forecast, by Application(2022-2029) 8.2.1. Pharmaceuticals 8.2.2. Cosmetics and Personal Care 8.2.3. Food and Beverages 8.2.4. Nutraceuticals 8.3. Asia PacificLotus extract Market Size and Forecast, by Extraction Method (2022-2029) 8.3.1. Solvent Extraction 8.3.2. Supercritical Fluid Extraction 8.4. Asia PacificLotus extract Market Size and Forecast, by End-Use Industry (2022-2029) 8.4.1. Traditional Medicine 8.4.2. Cosmeceuticals 8.4.3. Aromatherapy 8.5. Asia Pacific Lotus extract Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Lotus extract Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and AfricaLotus extract Market Size and Forecast, by Product Type(2022-2029) 9.1.1. Lotus Flower Extract 9.1.2. Lotus Leaf Extract 9.1.3. Lotus Root Extract 9.2. Middle East and AfricaLotus extract Market Size and Forecast, by Application(2022-2029) 9.2.1. Pharmaceuticals 9.2.2. Cosmetics and Personal Care 9.2.3. Food and Beverages 9.2.4. Nutraceuticals 9.3. Middle East and AfricaLotus extract Market Size and Forecast, by Extraction Method (2022-2029) 9.3.1. Solvent Extraction 9.3.2. Supercritical Fluid Extraction 9.4. Middle East and AfricaLotus extract Market Size and Forecast, by End-Use Industry (2022-2029) 9.4.1. Traditional Medicine 9.4.2. Cosmeceuticals 9.4.3. Aromatherapy 9.5. Middle East and Africa Lotus extract Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Lotus extract Market Size and Forecast (by Value USD and Volume Units) 10.1. South AmericaLotus extract Market Size and Forecast, by Product Type(2022-2029) 10.1.1. Lotus Flower Extract 10.1.2. Lotus Leaf Extract 10.1.3. Lotus Root Extract 10.2. South AmericaLotus extract Market Size and Forecast, by Application(2022-2029) 10.2.1. Pharmaceuticals 10.2.2. Cosmetics and Personal Care 10.2.3. Food and Beverages 10.2.4. Nutraceuticals 10.3. South AmericaLotus extract Market Size and Forecast, by Extraction Method (2022-2029) 10.3.1. Solvent Extraction 10.3.2. Supercritical Fluid Extraction 10.4. South AmericaLotus extract Market Size and Forecast, by End-Use Industry (2022-2029) 10.4.1. Traditional Medicine 10.4.2. Cosmeceuticals 10.4.3. Aromatherapy 10.5. South America Lotus extract Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Nutra Botanics 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Nature's Way 11.3. Herbal Science 11.4. Source Naturals 11.5. Swanson Health Products 11.6. Herb Pharm 11.7. Gaia Herbs 11.8. Planetary Herbals 11.9. Zand 11.10. American Botanicals 11.11. Starwest Botanicals 11.12. Frontier Natural Products 11.13. Oregon's Wild Harvest 11.14. Herb Pharm 11.15. Traditional Medicinals 11.16. Earth's Finest 11.17. Herbs of Gold 11.18. Himalaya Herbals 11.19. Dabur 11.20. Patanjali Ayurved 11.21. Amway 11.22. Herbalife 11.23. Nu Skin Enterprises 11.24. Avon Products 11.25. Mary Kay 12. Key Findings 13. Industry Recommendation