Frozen Bakery Market size was valued at US$ 30.62 Bn. in 2023 and the Frozen Bakery Market revenue is expected to grow at 5.9% through 2024 to 2030, reaching nearly US$ 38.28 Bn.Frozen Bakery Market Overview:

Frozen bakery items have a frozen shelf life of 6 to 18 months by restricting the movement of the water contained in the product and converting the water into ice crystals which kept frozen bakery items fresh for a long time. The global frozen bakery market is growing due to the high demand of specific frozen bakery products, including frozen bread, frozen pizza crust, frozen pastries, frozen cakes, and frozen patisserie. Frozen bakery products are becoming an increasingly essential part of people's daily diets all across the world, particularly in the United States and Europe. People's hectic lifestyles have benefited bread manufacturing which has been driven to develop new products to fulfil growing demand. Revenue of frozen bakery products have increased as a result of rising frozen bakery product consumption over the forecast period in Asia Pacific, the Middle East, and Africa. The growth of frozen bakery market is worked by the busy schedules and increased knowledge of nutritional data. The lifestyle of population contributed to the growth of frozen bakery Market sector because these products require less time to bake and cook, making them easily prepared. This seeing an increase in demand for frozen bakery items as a result. The demand for ready-to-eat and convenience foods has increased in recent years, leading to an explosion in demand for frozen bakery items, this trend is expected to continue and eventually the number of working women is are increasing demand for frozen baked goods and this trend continue during the Forecast period. The need for frozen bakery goods has shoot up as a result of the rising demand for convenience and ready-to-eat foods in recent years. It is expected that this tendency will hold throughout the forecast period. The need for frozen baked stuffs is rising as more women enter the workforce, also the growing Frozen Bakery Market is attributed to changing consumer lifestyles. Most retail stores sell popular frozen bakery items including cookies, cakes, pastries, and sweet desserts. This is one of the main effects creating in plenty of customers and raising the demand for the products. Popular frozen bakery items like cakes, cookies, pastries, and sweet desserts are available in the majority of retail establishments. This is one of the primary factors bringing in a large number of clients and increasing the demand for the goods. Because these items are readily made and take less time to bake and cook, the growing frozen bakery market segment can be attributed to changing consumer lifestyles.To know about the Research Methodology :- Request Free Sample Report

Frozen bakery market Dynamics:

Drivers - Rising Urbanization and Inclination towards Convenience Foods More than half of the world's population now lives in cities, and almost every country is getting more urbanized. Additionally, the need for convenience foods grows fast owing to changing lifestyles, an increase in the number of nuclear families, an increase in the proportion of working women, and less time for meal preparation. These factors support the increased growth of the frozen bakery market since frozen bakery products are easily portable and have a long shelf life. The rise in per capita income and the growing tendency of having snacks between meals are the primary factors driving demand for frozen bakery products. Frozen Bakery Products are a strong trend among millennial. Nowadays, young consumers are willing to spend more money on convenient food alternatives because they have less time to cook throughout the day. The growing demand for high-quality, organic, gluten-free, and vegan bakery items get open up new prospects in frozen bakery market. It saves time to prepare dishes from scratch, which is laborious, while premade bakery items are easily found in the freezer. Frozen bakery Market are becoming more and more popular among consumers, particularly those with hectic schedules, as a convenient way to prepare meals. Multiple Types of Freezing Equipment Choices Box Freezers, also known as carton freezers, are excellent for item that can be pushed around and have a hard outside surface, such as a tray or box. This usually corresponds to things that have longer retention lengths since the surrounding box insulates the product and has retention times of up to 24 hrs. And because of this advantages large scale Frozen bakery Market product are stored. Spiral Freezer has wide variety of products that must be handled individually, barefoot, or on trays and have retention durations of up to 4 hours. This freezer are used in small scale production. Refrigerant is circulated via plates that are sandwiching the product in Plate Freezers, allowing for direct freezing and cooling. This technology is used in products shaped like boxes and rectangles to provide conductive cooling, which is superior to convective cooling, and the Frozen bakery market get new advantage. Restraints: Disturb food texture like there have been several issues raised by the manufacturing of bread from frozen dough. These include a progressive loss of dough strength, an increase in fermentation time and a drop in CO2 retention capacity, a decrease in yeast activity, a decrease in loaf volume, and a change in the finished product's texture, Long-term freezing and storage of sweetened liquids can also result in the formation of sugar crystals. After defrosting, the product exhibit frost burns, whitening or yellowing, or sponginess around the edges, and flavour get change. Health consciousness and the need for fresh products are connected to each other. People in industrialized and some emerging nations are now much more conscious of their health, and they only choose to consume healthy products. Therefore, people choose freshly baked goods over those from frozen bakeries from Frozen bakery Markets. This serves to constrain the product. But most people prefer to visit cafés and restaurants, where they order frozen bakery goods and serve their patrons freshly baked pastries without even realizing it. Additionally, the packed food contains some nutrients, which is helping to establish the market for frozen baked goods. Opportunity: Quick Serving Restaurants To Open New Avenues For Ready-To-Bake Products Ready-to-bake frozen bakery items are account for more than 20% of Frozen bakery Market total sales by 2030. Growing fast-food chains in the US, Canada, Germany, France, the UK, and Japan open up new markets for goods including cakes, pastries, and bread-based sweets. Pre-baked goods that need less preparation time are driving the frozen bakery market. Additionally, freezing technology has given the most well-known preservation solutions to the bread sector by extending product shelf life. Challenges: Quality and Taste Consistency: It is quite struggling to keep frozen bread products tasting and looking the same. When it comes to frozen baked goods, consumers demand the same degree of freshness, flavour, and texture as they do with freshly baked goods. Precise freezing and packaging techniques, cautious formulations, and deliberate ingredient selection are necessary to maintain the quality and taste consistency of frozen bakery items over their entire shelf life. Demand for Clean tags and the additives: As consumers place a higher priority on their health and wellbeing, there is a growing Frozen bakery market for products with neat packaging that are devoid of synthetic additives. However, preservatives are frequently needed for frozen baked goods in order to preserve shelf stability and stop microbiological growth while being stored. It might be difficult to strike a compromise between giving items a respectable shelf life and satisfying customer expectations for clear tags. In order to create clear tag formulations that satisfy customer preferences and guarantee the safety and quality of frozen bakery Market need to think outside the box and experiment with different preservation techniques. Affordable prize of Product: Because, The Global Frozen Bakery Market is led by the 18–30 age group they have limited funds, this age group may prioritize price and frozen foods are often budget-friendly and easily accessible to this age group is help to grow frozen Food manufactures work easy, another side, the easy payment options, attractive discounts offer makes more number of consumers.Frozen bakery market Segment Analysis:

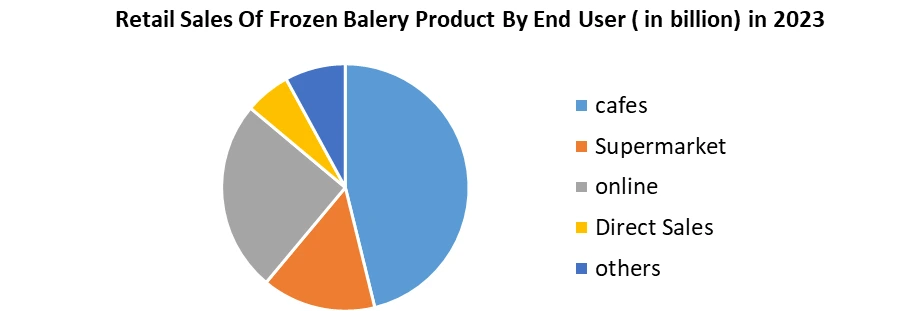

By Product Types, Pizza crust is a vital and significant segment of the Global Frozen Bakery Market, indicating its status as a standard and adaptable part of the business. Its wonderful flavour combination, easily adjustable toppings, and ease of use are the main reasons for its appeal. Pizza is popular option for quick lunches, get-togethers, celebrations, and even comfort food. As the basis of the meal, the pizza dough plays a vital role in providing the right texture and flavour profile. By 2030, the Bread and Roll Segment is expected to generate more than USD 16 billion in Frozen bakery Market, in recent years, the bread and rolls have different option like they are made up of wheat which is healthier and attract the consumers who are health conscious. There has been a surge in the desire for healthier frozen bread and a rise in bread consumption by restaurants such as Pizza Hut, Burger King, Dominos, and other food chains, which will open up new opportunities for frozen food manufacturers in the next years. Moreover, the volume of bread consumption per capita can be used to assess the standard of living in different countries or regions. There is a certain dependence in the consumption of bread, the higher the standard of living, as the income grows, people consume more expensive bread. The Frozen bakery Market segments are set to increase at a faster rate in the frozen pizza crust segment. In Western countries, a lot of people enjoy eating frozen pizza on a regular basis. Throughout the forecast period, these factors determine the type segment. In order to avoid wasting time, to have all preparation work completed, and to avoid using additives during manufacture, frozen cookies, Croissants, Cakes & pastries are made easily accessible for Households, Bakers, etc. By Consumption/ Consumption Type, additionally there has been a visible surge in the intake of ready-to-eat and ready-to-bake foods, leading to a substantial growth of the frozen bakery market. In the Global frozen Bakery Market is made up of the age categories under 18, 18–30, 30-45, 45 & above. The Global Frozen Bakery Market is dominated by the 18–30 age group because of their hectic schedules and penchant for quick, easy solutions. Also, they have a greater preference to experiment with new food items and discover different cuisines, which makes the wide range of options provided by frozen foods extremely tempting. The frozen bakery market items is divided more two categories: Low calorie and gluten-free. This Consumption holds a significant portion of the Global Frozen Bakery Market, however during the forecast period, the both categories are successful to grow rapidly. The general public is talking a lot about gluten-free products and how they help with digestion and help people lose weight. Also, market participants are starting to introduce their sectors for sugar-free and gluten-free frozen bakery items as a result of the increased demand for sugar-free products.By End users, the Frozen Bakery Market is divided into segments like convenience shops, hypermarkets, supermarkets, artisan bakers, bakery chains, hotels, restaurants, and catering (HORECA). Frozen bakery market sales through hypermarkets and supermarkets accounted for more than 43% of total sales in 2022. Hypermarkets and supermarkets focus on all types of frozen bakery products. The growing customer preference for visiting hypermarkets and supermarkets for high-quality products is expected to improve market growth during the forecast period. Online Frozen bakery market places are playing an increasingly important role in the frozen bakery market, influencing the direction of the sector and changing how customers find and buy frozen baked goods. Multiple factors that emphasize the ease of use, accessibility, and shifting consumer habits in the digital age are what are driving this growth. Retail, the restaurant sector, and the food processing (cafes and Catering) sector are examples of end users. In 2023, 50.16% of the Frozen bakery market is expected to be accounted for by the food service industry segment. In 2023, the industry with the largest Frozen bakery market share, 46.48%, is catering. This is because the catering industry serves a wide range of establishments, including five-star hotels, luxury restaurants, retail stores, and cafes.

Frozen Bakery Market Regional Insights:

Europe has the largest frozen bakery market in products. The frozen Bakery items in the area is expanding as a result of an increase in catering and tourism. Countries such as the United Kingdom, Italy, France, Spain, and Germany have emerged as the most profitable markets for a frozen bakeries in Europe. Gluten-free products are now available in a variety of flavours allowing them to gain popularity throughout the world. Furthermore, the increased demand for ready-to-eat, and frozen bakery products, particularly for the breakfast menu is boosting the region and the bulk of frozen bakery product sales in Europe are attributed to the retail Frozen bakery Market powerful and well-organized distribution network.Meanwhile, in Asia pacific, the growing impact of the West culture on the everyday lives of men and women lead to growth in the frozen bakery market in recent years. Besides this, the rising disposable income of people and their willingness to spend on ready-to-eat food products are boosting the Frozen Bakery market in Asia Pacific during the forecast period. Due to Asian consumers varied preferences for flavours, large manufacturers are driving the frozen bakery market by creating goods with reduced sugar, carbs, and fat content that are innovative in taste. In South America, the Frozen Bakery Market grow in various types during the forecast period, bakeries and cakes are expected to grow at the fastest rate. The food service industry's growing need for food and its variations is the changes that are supporting the growth of the cakes and bakeries market.

Competitive Landscape:

Providing a range of frozen bakery ingredients in ready-to-bake and ready-to-prove forms, to support in the manufacture of the final product. Advanced production knowledge and a distribution network give manufacturers a competitive advantage when it comes to diversifying their product, Also frozen bakery market with the fastest growth is Europe. Within Western nations, the majority of individuals prefer frozen pizza for their daily lunch. Following Europe, major growth is anticipated in North America and the Asia Pacific region throughout the forecast period. The frozen bakery market in North America, assisting members in a worthwhile system to develop strategies that are effective over the long run. The business strategies supporting client products, segmentation, pricing, and distribution, they improve the process of making choices and also The main players in the industry concentrate on offering consumers interesting and exotic flavours while making sure that the packaging and consumption are convenient. The frozen bakery market in South America is dominated by large firms that own a significant portion of the sector, with regional and local manufacturers holding the remaining market shares. Because of its strong brand image, wide distribution network, and loyal client base, other players are highly present.Frozen Bakery Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 30.62 Bn. Forecast Period 2024 to 2030 CAGR: 5.9% Market Size in 2030: US $ 38.28 Bn. Segments Covered: by Product Type Bread and Rolls Buns Pizza crusts Dough Cakes Cookies Donuts Others by Consumption Ready-to-prove Ready-to-bake Ready-to-eat by Category Gluten free Low calorie Sugar free Others by End-User Convenience stores Hypermarkets & supermarkets Hotels, Restaurants & Catering (HORECA) Online Direct sale Others Frozen Bakery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Frozen Bakery Market Key Players

1. Cole’s Quality Foods Inc., (Michigan, United State.) 2. General Mills Inc., Minneapolis, (Minnesota, United State.) 3. Flowers Foods, (Thomasville, Georgia, United State.) 4. Europastry S.A., (USA) 5. General Waffle Manufactory, (Sint-Agatha-Berchem) 6. Vandemoortele NV 7. Associated British Foods plc., London, (United kingdom) 8. Bridgford Foods Corporation, (Anaheim, California, United State.) 9. Premier Foods plc. (St. Albans Hertfordshire) 10. Cargill Incorporated, (Wayzata, Minnesota, United State.) 11. Alpha Baking Company Inc. 12. Kellogg Company 13. LantmannenUnibake International, 14. Grupo Bimbo S.A.B. de C.V., (Mexico City, Mexico.) 15. Aryzta A. G., ( Zurich, Switzerland) 16. Tree House Foods, Inc., (Oak Brook, Illinois, United States) 17. Dnb. co. in (U.S.) 18. Danone SA (France) 19. Sunbulah Group.(Saudi Arabia) 20. Rhodes International Inc. FAQs: 1. Which is the potential market for Frozen Bakery in terms of the region? Ans. In the Asia Pacific region, increasing western influence on the lifestyle, the rising disposable income of people, and their willingness to spend on ready-to-eat food products are expected to drive the market. 2. What is expected to drive the growth of the Frozen Bakery market in the forecast period? Ans. The Rising Urbanization and Inclination toward Convenience Foods are boosting the market growth over the forecast period. 3. What is the projected market size & growth rate of the Frozen Bakery Market? Ans. The Frozen Bakery Market size was valued at US$ 30.62 Bn Bn. in 2023 and the total Frozen Bakery revenue is expected to grow at 5.9 % through 2024 to 2030, reaching nearly US$ 38.28 Bn. 4. What segments are covered in the Frozen Bakery Market report? Ans. The segments covered are Type, Product, End-user, and Region. 5. Which key factors will influence the frozen bakery market growth? Ans. Increasing demand for convenience foods and rising spending capacity are some major trends that guide frozen bakery products market growth. 6. What was the global frozen bakery products market size in 2023? Ans. The frozen bakery products market was valued at USD 30.62 Bn billion in 2023.

1. Frozen Bakery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Frozen Bakery Market: Dynamics 2.1. Frozen Bakery Market Trends by Region 2.1.1. North America Frozen Bakery Market Trends 2.1.2. Europe Frozen Bakery Market Trends 2.1.3. Asia Pacific Frozen Bakery Market Trends 2.1.4. Middle East and Africa Frozen Bakery Market Trends 2.1.5. South America Frozen Bakery Market Trends 2.1.6. Preference Analysis 2.2. Frozen Bakery Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Frozen Bakery Market Drivers 2.2.1.2. North America Frozen Bakery Market Restraints 2.2.1.3. North America Frozen Bakery Market Opportunities 2.2.1.4. North America Frozen Bakery Market Challenges 2.2.2. Europe 2.2.2.1. Europe Frozen Bakery Market Drivers 2.2.2.2. Europe Frozen Bakery Market Restraints 2.2.2.3. Europe Frozen Bakery Market Opportunities 2.2.2.4. Europe Frozen Bakery Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Frozen Bakery Market Drivers 2.2.3.2. Asia Pacific Frozen Bakery Market Restraints 2.2.3.3. Asia Pacific Frozen Bakery Market Opportunities 2.2.3.4. Asia Pacific Frozen Bakery Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Frozen Bakery Market Drivers 2.2.4.2. Middle East and Africa Frozen Bakery Market Restraints 2.2.4.3. Middle East and Africa Frozen Bakery Market Opportunities 2.2.4.4. Middle East and Africa Frozen Bakery Market Challenges 2.2.5. South America 2.2.5.1. South America Frozen Bakery Market Drivers 2.2.5.2. South America Frozen Bakery Market Restraints 2.2.5.3. South America Frozen Bakery Market Opportunities 2.2.5.4. South America Frozen Bakery Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Key Opinion Leader Analysis For Frozen Bakery Industry 2.9. Analysis of Government Schemes and Initiatives For Frozen Bakery Industry 2.10. The Global Pandemic Impact on Frozen Bakery Market 2.11. Frozen Bakery Price Trend Analysis (2021-22) 2.12. Global Frozen Bakery Market Trade Analysis (2017-2022) 2.12.1. Global Import of Frozen Bakery 2.12.2. Global Export of Frozen Bakery 3. Frozen Bakery Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Bread and Rolls 3.1.2. Buns 3.1.3. Pizza crusts 3.1.4. Dough 3.1.5. Cakes 3.1.6. Cookies 3.1.7. Donuts 3.1.8. Others 3.2. Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 3.2.1. Ready to bake 3.2.2. Ready to eat 3.2.3. Others 3.3. Frozen Bakery Market Size and Forecast, by End User (2023-2030) 3.3.1. Convenience stores 3.3.2. Hypermarkets & supermarkets 3.3.3. Hotels, Restaurants & Catering (HORECA) 3.3.4. Online 3.3.5. Direct sale 3.4. Others et Size and Forecast, by Category (2023-2030) 3.4.1. Gluten free 3.4.2. Low calorie 3.4.3. Sugar free 3.4.4. Others 3.5. Frozen Bakery Market Size and Forecast, by Region (2023-2030 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Frozen Bakery Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Frozen Bakery Market Size and Forecast, by Product Type(2023-2030) 4.1.1. Bread and Rolls 4.1.2. Buns 4.1.3. Pizza crusts 4.1.4. Dough 4.1.5. Cakes 4.1.6. Cookies 4.1.7. Donuts 4.1.8. Others 4.2. North America Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 4.2.1. Ready to bake 4.2.2. Ready to eat 4.2.3. Others 4.3. North America Frozen Bakery Market Size and Forecast, by End User (2023-2030) 4.3.1. Convenience stores 4.3.2. Hypermarkets & supermarkets 4.3.3. Hotels, Restaurants & Catering (HORECA) 4.3.4. Online 4.3.5. Direct sale 4.3.6. Others 4.4. Frozen Bakery Market Size and Forecast, by Category (2023-2030) 4.4.1. Gluten free 4.4.2. Low calorie 4.4.3. Sugar free 4.4.4. Others 4.5. North America Frozen Bakery Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 4.5.1.1.1. Bread and Rolls 4.5.1.1.2. Buns 4.5.1.1.3. Pizza crusts 4.5.1.1.4. Dough 4.5.1.1.5. Cakes 4.5.1.1.6. Cookies 4.5.1.1.7. Donuts 4.5.1.1.8. Others s 4.5.1.2. United States Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 4.5.1.2.1. Ready to bake 4.5.1.2.2. Ready to eat 4.5.1.2.3. Others 4.5.1.3. United States Frozen Bakery Market Size and Forecast, by End User (2023-2030) 4.5.1.3.1. Convenience stores 4.5.1.3.2. Hypermarkets & supermarkets 4.5.1.3.3. Hotels, Restaurants & Catering (HORECA) 4.5.1.3.4. Online 4.5.1.3.5. Direct sale 4.5.1.3.6. Others 4.5.1.4. Frozen Bakery Market Size and Forecast, by Category (2023-2030) 4.5.1.4.1. Gluten free 4.5.1.4.2. Low calorie 4.5.1.4.3. Sugar free 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 4.5.2.1.1. Bread and Rolls 4.5.2.1.2. Buns 4.5.2.1.3. Pizza crusts 4.5.2.1.4. Dough 4.5.2.1.5. Cakes 4.5.2.1.6. Cookies 4.5.2.1.7. Donuts 4.5.2.1.8. Others 4.5.2.2. Canada Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 4.5.2.2.1. Ready to bake 4.5.2.2.2. Ready to eat 4.5.2.2.3. Others 4.5.2.3. Canada Frozen Bakery Market Size and Forecast, by End User (2023-2030) 4.5.2.3.1. Convenience stores 4.5.2.3.2. Hypermarkets & supermarkets 4.5.2.3.3. Hotels, Restaurants & Catering (HORECA) 4.5.2.3.4. Online 4.5.2.3.5. Direct sale 4.5.2.3.6. Others 4.5.2.4. Frozen Bakery Market Size and Forecast, by category(2023-2030) 4.5.2.4.1. Gluten free 4.5.2.4.2. Low calorie 4.5.2.4.3. Sugar free 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 4.5.3.1.1. Bread and Rolls 4.5.3.1.2. Buns 4.5.3.1.3. Pizza crusts 4.5.3.1.4. Dough 4.5.3.1.5. Cakes 4.5.3.1.6. Cookies 4.5.3.1.7. Donuts 4.5.3.1.8. Others 4.5.3.2. Mexico Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 4.5.3.2.1. Ready to bake 4.5.3.2.2. Ready to eat 4.5.3.2.3. Others 4.5.3.3. Mexico Frozen Bakery Market Size and Forecast, by End User (2023-2030) 4.5.3.3.1. Convenience stores 4.5.3.3.2. Hypermarkets & supermarkets 4.5.3.3.3. Hotels, Restaurants & Catering (HORECA) 4.5.3.3.4. Online 4.5.3.3.5. Direct sale 4.5.3.3.6. Others 4.5.3.4. Frozen Bakery Market Size and Forecast, by Category(2023-2030) 4.5.3.4.1. Gluten free 4.5.3.4.2. Low calorie 4.5.3.4.3. Sugar free 4.5.3.4.4. Others 5. Europe Frozen Bakery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.3. Europe Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4. Europe Frozen Bakery Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.1.3. United Kingdom Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.1.4. United Kingdom Frozen Bakery Market Size and Forecast, by Industry Vertical(2023-2030) 5.4.2. France 5.4.2.1. France Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.2.3. France Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.3.3. Germany Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.4.3. Italy Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.5.3. Spain Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.6.3. Sweden Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.7.3. Austria Frozen Bakery Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 5.4.8.3. Rest of Europe Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Frozen Bakery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.3. Asia Pacific Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Frozen Bakery Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.1.3. China Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.2.3. S Korea Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.3.3. Japan Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.4.3. India Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.5.3. Australia Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.6.3. Indonesia Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.7.3. Malaysia Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.8.3. Vietnam Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.8.4. Vietnam Frozen Bakery Market Size and Forecast, by Industry Vertical(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.9.3. Taiwan Frozen Bakery Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 6.4.10.3. Rest of Asia Pacific Frozen Bakery Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Frozen Bakery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 7.3. Middle East and Africa Frozen Bakery Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Frozen Bakery Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 7.4.1.3. South Africa Frozen Bakery Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 7.4.2.3. GCC Frozen Bakery Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 7.4.3.3. Nigeria Frozen Bakery Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 7.4.4.3. Rest of ME&A Frozen Bakery Market Size and Forecast, by End User (2023-2030) 8. South America Frozen Bakery Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. South America Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 8.3. South America Frozen Bakery Market Size and Forecast, by End User (2023-2030) 8.4. South America Frozen Bakery Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 8.4.1.3. Brazil Frozen Bakery Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 8.4.2.3. Argentina Frozen Bakery Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Frozen Bakery Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Frozen Bakery Market Size and Forecast, by Consumption (2023-2030) 8.4.3.3. Rest Of South America Frozen Bakery Market Size and Forecast, by End User (2023-2030) 9. Global Frozen Bakery Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Frozen Bakery Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cole’s Quality Foods Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Details on Partnership 10.1.7. Recent Developments 10.2. General Mills Inc., Minneapolis, (Minnesota, United State.) 10.3. Flowers Foods, (Thomasville, Georgia, United State.) 10.4. Europastry S.A., (USA) 10.5. General Waffle Manufactory, (Industrial area Sint-Agatha-Berchem) 10.6. Vandemoortele NV 10.7. Associated British Foods plc., London, (United kingdom) 10.8. Bridgford Foods Corporation, (Anaheim, California, United State.) 10.9. Premier Foods plc. (St. Albans Hertfordshire) 10.10. Cargill Incorporated, (Wayzata, Minnesota, United State.) 10.11. Alpha Baking Company Inc. 10.12. Kellogg Company 10.13. Lantmannen Unibake International, 10.14. Grupo Bimbo S.A.B. de C.V., (Mexico City, Mexico.) 10.15. Aryzta A. G., ( Zürich, Switzerland) 10.16. Tree House Foods, Inc., (Oak Brook, Illinois, United States) 11. Key Findings 12. Industry Recommendations 13. Frozen Bakery Market: Research Methodology