The Liqueur Market size was valued at USD 141.98 Billion in 2025 and the total Liqueur revenue is expected to grow at a CAGR of 4.9% from 2026 to 2032, reaching nearly USD 198.45 Billion by 2032.Liqueur Market Overview

The liqueur market is a sweetened and flavoured alcoholic drinks segment of the beverage industry. Liqueurs combine spirits with fruits, herbs, spices, or cream. France, Italy and Germany are major liqueur producers and consumers in Europe. North America and Asia-Pacific have shown a rise in liqueur demand due to evolving consumer tastes and a booming cocktail culture. The market has expanded geographically beyond traditional strongholds. Fruit (such cherries and raspberries), herbal (like Chartreuse and Jägermeister), cream (like Baileys Irish Cream) and coffee (like Kahla) are common liqueur types. Because of their adaptability, liqueurs can be enjoyed neat, over ice, or as an ingredient in cocktails and other mixed drinks. The product is a popular option for many events because it appeals to a diverse spectrum of consumers. Liqueur market has seen a rise in premiumization and craft offerings, following the trend of other alcoholic beverage segments. The demand for unique and high-quality products is growing, resulting in the rise of craft liqueur producers who offer artisanal and small-batch options. Craft liqueurs are becoming popular among enthusiasts who value traditional methods and high-quality ingredients. These liqueurs are known for their distinct flavour profiles and attention to detail. Health and wellness trends impact the liqueur market. Increasing health awareness among consumers has led to a rise in demand for beverages with reduced sugar and alcohol content. Brands are introducing lighter or "skinny" liqueur options with reduced sugar content or lower alcohol levels in response to this trend. These options are for those who seek to indulge in liqueurs while keeping a healthy lifestyle.To know about the Research Methodology :- Request Free Sample Report Liqueur Market Report Scope The Liqueur market study aims to provide a comprehensive overview, taking into account various factors that influence the liqueur industry. The report begins by segmenting the market based on liqueur types, flavors, distribution channels and geographic regions. This segmentation allows for a detailed understanding of market dynamics and demand trends across different sectors, catering to consumer preferences for specific liqueur flavors, distribution preferences and regional variations in consumption patterns. By analyzing historical data and providing future forecasts, the report enables stakeholders to make informed decisions regarding investments, growth strategies and product development in the liqueur market. Assessing revenue generation, market size and adoption rates of liqueurs, businesses can evaluate growth potential and align their strategies accordingly. The report examines the market share, competitive landscape and profiles of prominent players in the liqueur market. It highlights their market position, product portfolios, business strategies and recent advancements, facilitating an understanding of the competitive landscape and identifying opportunities for collaboration or partnerships. This analysis assists stakeholders in making strategic decisions and staying competitive in the liqueur market. The report provides a regional overview of the liqueur market, exploring market trends, consumer demand and expansion opportunities in key regions such as North America, Europe, Asia-Pacific and other emerging markets. This geographical perspective assists stakeholders in gaining insights into specific market dynamics, regional preferences for liqueur flavors and identifying potential opportunities for growth and market entry. The research study delves into market developments, industry trends and technological innovations in the liqueur market. Factors such as evolving consumer preferences, the emergence of craft and premium liqueurs, health-conscious trends and regulatory frameworks are discussed as they significantly impact market growth. The report offers strategic recommendations based on emerging trends to assist stakeholders in staying ahead of the competition and capitalizing on growth opportunities in the liqueur market. The report evaluates the potential impact of the COVID-19 pandemic on the liqueur market. It provides insights on market recovery, future prospects and analyzes the disruptions, challenges and opportunities arising from the pandemic. This analysis helps stakeholders understand the changing landscape, adapt their strategies to the new normal and consider evolving consumer behaviour and market conditions in the liqueur industry.

Liqueur Market Dynamics

The liqueur market is influenced by multiple factors such as drivers, opportunities, trends, challenges and threats. Consumer preferences are a major factor driving change. Consumers prefer premium and craft liqueurs due to the rise of cocktail culture and the demand for distinctive, high-quality products. Growing disposable incomes, especially in developing economies, have resulted in higher expenditure on luxurious and indulgent items, such as high-end liqueurs. Favourable market conditions for growth. Distribution channel expansion drives the liqueur market. Liqueurs are now more accessible and convenient for consumers due to their availability in supermarkets, liquor stores, bars and restaurants, as well as the growth of online retail channels. The rise of mixology and cocktail experimentation has increased the need for liqueurs as crucial components in creating unique and refined beverages. Opportunities exist in the liqueur market. Demand for low-sugar, low-calorie and natural liqueurs is increasing among health-conscious consumers. Great market potential. Artisanal and craft liqueurs are gaining popularity, creating a market opportunity. Small producers can stand out by providing distinctive flavours, top-notch ingredients and captivating narratives. Emerging markets offer untapped opportunities for liqueur companies to expand and capture new market share due to increasing disposable incomes and evolving consumer tastes. Liqueur market trends are diverse. Consumers are currently showing a strong preference for premium and ultra-premium liqueurs that provide a unique taste, high quality and a luxurious experience. This trend is known as premiumization and is driving higher prices for these products. Consumers are increasingly interested in sustainable and ethical production practises, such as organic ingredients, fair trade sourcing and environmentally friendly packaging. RTD liqueur cocktails are gaining popularity, especially among younger consumers, because of their convenience and pre-mixed flavours. Flavour experimentation and limited editions drive innovation in the market. Liqueur market has positive dynamics but also challenges. Regulatory challenges are a major concern for liqueur producers due to varying tax structures and strict regulations across regions and countries. These challenges can impact production, distribution and compliance. Health and wellness trends may affect the demand for high-sugar and calorie-dense liqueurs. Intense competition from established and craft brands makes it challenging for new entrants to gain market share. Supply chain disruptions from climate change, crop availability and logistics can affect ingredient availability, production and pricing. Liqueur market encounters threats. Consumer behaviour changes pose a risk to liqueur demand due to rapid shifts in preferences and the emergence of alternative beverage options. Economic instability poses a threat as it can impact consumer spending habits, resulting in reduced spending on luxury goods like liqueurs. Alcohol's health and safety concerns can impact consumer choices and demand. Counterfeit liqueurs in the market can harm brand reputation and consumer trust, which can lead to lower sales and market share.Liqueur Market Regional Analysis

Regional analysis of the liqueur market offers valuable insights into market trends and dynamics in various geographical areas. The US is a major player in the liqueur market in North America. Diverse flavours and strong cocktail culture in the region drive demand for premium and craft liqueurs. Europe's liqueur market is mature due to its rich tradition and consumption habits. New and premium liqueur flavours, such as craft and natural/organic options, are gaining popularity alongside traditional flavours. The Asia-Pacific liqueur market is growing. China, Japan, South Korea and India are buying more premium and imported liqueurs due to rising affluence, urbanisation and changing tastes. Mexico, Brazil and Argentina have distinct markets for traditional liqueurs. Flavoured liqueurs and cocktail mixers are becoming more popular in the region due to the growth of cocktail culture and tourism.Liqueur Market Segment Analysis

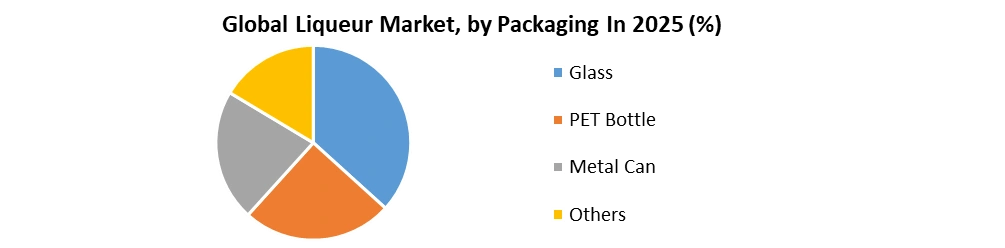

Based on Packaging: The market is segmented into Glass, PET Bottle, Metal Can and Others. The Glass segmented held the largest Liqueur Market share in 2025. Consumers' preference for reliable, healthy, sustainable, and premium liqueur beverages is anticipated to drive strong demand for glass bottle packaging. Glass offers durability, non-porosity, impermeability to oxygen, and heat tolerance, ensuring the preservation and presentation of flavors exactly as intended. Consequently, consumers prefer liqueurs packaged in glass bottles due to these inherent qualities.

Liqueur Market Competitive Landscape

The liqueur market is competitive with established and emerging players competing for market share. Leading companies in the liqueur market are Diageo, Pernod Ricard, Campari Group, Brown-Forman Corporation and Rémy Cointreau. Top liqueur companies have diverse product lines, extensive distribution channels and strong brand recognition, leading to their market leadership. Regional spirits markets are influenced by local players. Local consumer preferences and cultural nuances are well understood, giving an advantage in catering to specific regional tastes. Local players excel in creating niche markets by offering unique flavours, innovative packaging and localised marketing strategies. Consumers prefer specialised liqueur brands that offer unique formulations and cater to specific applications. Leading liqueur brands focus on producing premium products with unique taste profiles that can be used in a variety of ways. Bailey's, Grand Marnier and Kahlua have effectively positioned themselves in different segments of the liqueur market by targeting specific consumer groups and highlighting their unique brand propositions.Tailored liqueurs that cater to various consumer preferences and provide distinctive tastes or experiences can aid businesses in increasing their market presence. R&D investment is crucial for liqueur market competitiveness. R&D helps companies innovate, create new flavours or products and adjust to changing consumer preferences. Partnering with suppliers, distributors and strategic allies is crucial for broadening market reach and streamlining liqueur product distribution. Marketing is essential for brand recognition and customer engagement. Liqueur products are promoted through different channels like advertising, trade shows, publications, online platforms and social media to increase brand visibility and customer loyalty. Analysing the liqueur market's competition provides companies with valuable information on industry trends, achievements, advancements and consumer preferences. This data helps companies find market openings, create focused plans and stay ahead in the worldwide liqueur market.

Liqueur Market Scope: Inquire before buying

Liqueur Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 141.98 Bn. Forecast Period 2026 to 2032 CAGR: 4.9% Market Size in 2032: USD 198.45 Bn. Segments Covered: by Type Neutrals/Bitters Creams Fruit Flavored Others by Packaging Glass PET Bottle Metal Can Others by Distribution Channel Liquor Stores Supermarkets Bars and Restaurants Online Retail Duty-Free Shops Specialty Stores Liqueur Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Liqueur Key Players

The captured list of leading manufacturers of Liqueur industry has been compiled after an analysis of multiple factors. It is not an exhaustive list based only on market share ranking. After a regional analysis, competitive analysis and other such considerations, the company profiles were selected based on a variety of factors. The comprehensive report contains information on the position of each company in the market from a local and global perspective. North America: 1. Brown-Forman Corporation (United States) 2. Beam Suntory Inc. (United States) 3. Sazerac Company Inc. (United States) 4. Heaven Hill Brands (United States) Europe: 1. Diageo (United Kingdom) 2. Pernod Ricard (France) 3. Bacardi Limited (Bermuda) 4. Rémy Cointreau (France) 5. Campari Group (Italy) 6. Lucas Bols N.V. (Netherlands) Asia-Pacific: 1. Mast-Jägermeister SE (Germany) 2. William Grant & Sons Ltd. (United Kingdom) 3. Distell Group Limited (South Africa) South America: 1. Destilerias Unidas S.A. (Dominican Republic) FAQs 1: What are the factors driving the growth of the Liqueur market? Ans: Factors driving market growth in the liqueur industry include increased consumer demand for unique flavours, the popularity of mixology and craft cocktails and rising disposable incomes. 2: What was the Global Liqueur Market size in 2025? Ans: The Global Liqueur Market size was USD 141.98 Billion in 2025. 3: What are the commonly used applications of Liqueurs? Ans: Liqueurs are commonly used as cocktail ingredients, flavour enhancers in desserts and enjoyed as standalone drinks. They also find usage in creating signature dishes in high-end restaurants. 4: Are there any regulatory considerations for Liqueurs? Ans: Yes, the production and sale of liqueurs are subject to regulations governing alcohol production and distribution. Compliance with licensing, labelling and alcohol content restrictions is necessary. 5: What are the key challenges in the Liqueur market? Ans: Key challenges in the liqueur market include intense competition, the need for continuous product innovation, adapting to changing regulations, managing supply chain logistics and maintaining product quality and consistency.

1. Liqueur Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Liqueur Market: Dynamics 2.1. Liqueur Market Trends by Region 2.1.1. North America Liqueur Market Trends 2.1.2. Europe Liqueur Market Trends 2.1.3. Asia Pacific Liqueur Market Trends 2.1.4. Middle East and Africa Liqueur Market Trends 2.1.5. South America Liqueur Market Trends 2.2. Liqueur Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Liqueur Market Drivers 2.2.1.2. North America Liqueur Market Restraints 2.2.1.3. North America Liqueur Market Opportunities 2.2.1.4. North America Liqueur Market Challenges 2.2.2. Europe 2.2.2.1. Europe Liqueur Market Drivers 2.2.2.2. Europe Liqueur Market Restraints 2.2.2.3. Europe Liqueur Market Opportunities 2.2.2.4. Europe Liqueur Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Liqueur Market Drivers 2.2.3.2. Asia Pacific Liqueur Market Restraints 2.2.3.3. Asia Pacific Liqueur Market Opportunities 2.2.3.4. Asia Pacific Liqueur Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Liqueur Market Drivers 2.2.4.2. Middle East and Africa Liqueur Market Restraints 2.2.4.3. Middle East and Africa Liqueur Market Opportunities 2.2.4.4. Middle East and Africa Liqueur Market Challenges 2.2.5. South America 2.2.5.1. South America Liqueur Market Drivers 2.2.5.2. South America Liqueur Market Restraints 2.2.5.3. South America Liqueur Market Opportunities 2.2.5.4. South America Liqueur Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Liqueur Industry 2.8. Analysis of Government Schemes and Initiatives For Liqueur Industry 2.9. Liqueur Market Trade Analysis 2.10. The Global Pandemic Impact on Liqueur Market 3. Liqueur Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 3.1. Liqueur Market Size and Forecast, by Type (2025-2032) 3.1.1. Neutrals/Bitters 3.1.2. Creams 3.1.3. Fruit Flavored 3.1.4. Others 3.2. Liqueur Market Size and Forecast, by Packaging (2025-2032) 3.2.1. Glass 3.2.2. PET Bottle 3.2.3. Metal Can 3.2.4. Others 3.3. Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 3.3.1. Liquor Stores 3.3.2. Supermarkets 3.3.3. Bars and Restaurants 3.3.4. Online Retail 3.3.5. Duty-Free Shops 3.3.6. Specialty Stores 3.4. Liqueur Market Size and Forecast, by Region (2025-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Liqueur Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 4.1. North America Liqueur Market Size and Forecast, by Type (2025-2032) 4.1.1. Neutrals/Bitters 4.1.2. Creams 4.1.3. Fruit Flavored 4.1.4. Others 4.2. North America Liqueur Market Size and Forecast, by Packaging (2025-2032) 4.2.1. Glass 4.2.2. PET Bottle 4.2.3. Metal Can 4.2.4. Others 4.3. North America Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 4.3.1. Liquor Stores 4.3.2. Supermarkets 4.3.3. Bars and Restaurants 4.3.4. Online Retail 4.3.5. Duty-Free Shops 4.3.6. Specialty Stores 4.4. North America Liqueur Market Size and Forecast, by Country (2025-2032) 4.4.1. United States 4.4.1.1. United States Liqueur Market Size and Forecast, by Type (2025-2032) 4.4.1.1.1. Neutrals/Bitters 4.4.1.1.2. Creams 4.4.1.1.3. Fruit Flavored 4.4.1.1.4. Others 4.4.1.2. United States Liqueur Market Size and Forecast, by Packaging (2025-2032) 4.4.1.2.1. Glass 4.4.1.2.2. PET Bottle 4.4.1.2.3. Metal Can 4.4.1.2.4. Others 4.4.1.3. United States Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.1.3.1. Liquor Stores 4.4.1.3.2. Supermarkets 4.4.1.3.3. Bars and Restaurants 4.4.1.3.4. Online Retail 4.4.1.3.5. Duty-Free Shops 4.4.1.3.6. Specialty Stores 4.4.2. Canada 4.4.2.1. Canada Liqueur Market Size and Forecast, by Type (2025-2032) 4.4.2.1.1. Neutrals/Bitters 4.4.2.1.2. Creams 4.4.2.1.3. Fruit Flavored 4.4.2.1.4. Others 4.4.2.2. Canada Liqueur Market Size and Forecast, by Packaging (2025-2032) 4.4.2.2.1. Glass 4.4.2.2.2. PET Bottle 4.4.2.2.3. Metal Can 4.4.2.2.4. Others 4.4.2.3. Canada Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.2.3.1. Liquor Stores 4.4.2.3.2. Supermarkets 4.4.2.3.3. Bars and Restaurants 4.4.2.3.4. Online Retail 4.4.2.3.5. Duty-Free Shops 4.4.2.3.6. Specialty Stores 4.4.3. Mexico 4.4.3.1. Mexico Liqueur Market Size and Forecast, by Type (2025-2032) 4.4.3.1.1. Neutrals/Bitters 4.4.3.1.2. Creams 4.4.3.1.3. Fruit Flavored 4.4.3.1.4. Others 4.4.3.2. Mexico Liqueur Market Size and Forecast, by Packaging (2025-2032) 4.4.3.2.1. Glass 4.4.3.2.2. PET Bottle 4.4.3.2.3. Metal Can 4.4.3.2.4. Others 4.4.3.3. Mexico Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.3.3.1. Liquor Stores 4.4.3.3.2. Supermarkets 4.4.3.3.3. Bars and Restaurants 4.4.3.3.4. Online Retail 4.4.3.3.5. Duty-Free Shops 4.4.3.3.6. Specialty Stores 5. Europe Liqueur Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. Europe Liqueur Market Size and Forecast, by Type (2025-2032) 5.2. Europe Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.3. Europe Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4. Europe Liqueur Market Size and Forecast, by Country (2025-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.1.2. United Kingdom Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.1.3. United Kingdom Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.2. France 5.4.2.1. France Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.2.2. France Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.2.3. France Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.3. Germany 5.4.3.1. Germany Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.3.2. Germany Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.3.3. Germany Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.4. Italy 5.4.4.1. Italy Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.4.2. Italy Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.4.3. Italy Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.5. Spain 5.4.5.1. Spain Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.5.2. Spain Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.5.3. Spain Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.6. Sweden 5.4.6.1. Sweden Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.6.2. Sweden Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.6.3. Sweden Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.7. Austria 5.4.7.1. Austria Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.7.2. Austria Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.7.3. Austria Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Liqueur Market Size and Forecast, by Type (2025-2032) 5.4.8.2. Rest of Europe Liqueur Market Size and Forecast, by Packaging (2025-2032) 5.4.8.3. Rest of Europe Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6. Asia Pacific Liqueur Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Asia Pacific Liqueur Market Size and Forecast, by Type (2025-2032) 6.2. Asia Pacific Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.3. Asia Pacific Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4. Asia Pacific Liqueur Market Size and Forecast, by Country (2025-2032) 6.4.1. China 6.4.1.1. China Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.1.2. China Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.1.3. China Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.2. S Korea 6.4.2.1. S Korea Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.2.2. S Korea Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.2.3. S Korea Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.3. Japan 6.4.3.1. Japan Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.3.2. Japan Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.3.3. Japan Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.4. India 6.4.4.1. India Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.4.2. India Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.4.3. India Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.5. Australia 6.4.5.1. Australia Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.5.2. Australia Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.5.3. Australia Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.6.2. Indonesia Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.6.3. Indonesia Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.7.2. Malaysia Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.7.3. Malaysia Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.8.2. Vietnam Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.8.3. Vietnam Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.9.2. Taiwan Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.9.3. Taiwan Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Liqueur Market Size and Forecast, by Type (2025-2032) 6.4.10.2. Rest of Asia Pacific Liqueur Market Size and Forecast, by Packaging (2025-2032) 6.4.10.3. Rest of Asia Pacific Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 7. Middle East and Africa Liqueur Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Middle East and Africa Liqueur Market Size and Forecast, by Type (2025-2032) 7.2. Middle East and Africa Liqueur Market Size and Forecast, by Packaging (2025-2032) 7.3. Middle East and Africa Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 7.4. Middle East and Africa Liqueur Market Size and Forecast, by Country (2025-2032) 7.4.1. South Africa 7.4.1.1. South Africa Liqueur Market Size and Forecast, by Type (2025-2032) 7.4.1.2. South Africa Liqueur Market Size and Forecast, by Packaging (2025-2032) 7.4.1.3. South Africa Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.2. GCC 7.4.2.1. GCC Liqueur Market Size and Forecast, by Type (2025-2032) 7.4.2.2. GCC Liqueur Market Size and Forecast, by Packaging (2025-2032) 7.4.2.3. GCC Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Liqueur Market Size and Forecast, by Type (2025-2032) 7.4.3.2. Nigeria Liqueur Market Size and Forecast, by Packaging (2025-2032) 7.4.3.3. Nigeria Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Liqueur Market Size and Forecast, by Type (2025-2032) 7.4.4.2. Rest of ME&A Liqueur Market Size and Forecast, by Packaging (2025-2032) 7.4.4.3. Rest of ME&A Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 8. South America Liqueur Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. South America Liqueur Market Size and Forecast, by Type (2025-2032) 8.2. South America Liqueur Market Size and Forecast, by Packaging (2025-2032) 8.3. South America Liqueur Market Size and Forecast, by Distribution Channel(2025-2032) 8.4. South America Liqueur Market Size and Forecast, by Country (2025-2032) 8.4.1. Brazil 8.4.1.1. Brazil Liqueur Market Size and Forecast, by Type (2025-2032) 8.4.1.2. Brazil Liqueur Market Size and Forecast, by Packaging (2025-2032) 8.4.1.3. Brazil Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.2. Argentina 8.4.2.1. Argentina Liqueur Market Size and Forecast, by Type (2025-2032) 8.4.2.2. Argentina Liqueur Market Size and Forecast, by Packaging (2025-2032) 8.4.2.3. Argentina Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Liqueur Market Size and Forecast, by Type (2025-2032) 8.4.3.2. Rest Of South America Liqueur Market Size and Forecast, by Packaging (2025-2032) 8.4.3.3. Rest Of South America Liqueur Market Size and Forecast, by Distribution Channel (2025-2032) 9. Global Liqueur Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2025) 9.3.5. Company Locations 9.4. Leading Liqueur Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Brown-Forman Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Beam Suntory Inc. (United States) 10.3. Sazerac Company Inc. (United States) 10.4. Heaven Hill Brands (United States) 10.5. Diageo (United Kingdom) 10.6. Pernod Ricard (France) 10.7. Bacardi Limited (Bermuda) 10.8. Rémy Cointreau (France) 10.9. Campari Group (Italy) 10.10. Lucas Bols N.V. (Netherlands) 10.11. Mast-Jägermeister SE (Germany) 10.12. William Grant & Sons Ltd. (United Kingdom) 10.13. Distell Group Limited (South Africa) 10.14. Destilerias Unidas S.A. (Dominican Republic) 11. Key Findings 12. Industry Recommendations 13. Liqueur Market: Research Methodology 14. Terms and Glossary