Light Field Market size was valued at USD 81.53 Million in 2023 and Light Field Revenue is expected to grow at a CAGR of 15.04% from 2024 to 2030, reaching nearly USD 217.40 Million in 2030.Light Field Market Overview:

Growth in the Light Field Market is driven by the increasing demand for visual effects technology across a variety of industries. The use of light field technology that can record both direction and strength of light rays, especially in areas such as marketing, movies and new 5D & 4D technologies contributes to Light Field Market growth. The integration of virtual reality (VR), augmented reality (AR) and light field technology also boosts market growth due to increased need for immersive experiences particularly seen in healthcare sector plus automotive as well as entertainment applications. The Light Field Market is influenced by several key trends, including progress in imaging solutions especially within medical uses, as well as the combination of private 5G networks for augmented reality and virtual reality experiences. Light field technology - which can also be called integral imaging - is changing fast with better imaging solutions available to many industries now. Furthermore, strategic moves like taking over businesses and putting money into new companies are boosting innovation and competition within this market. The Light Field Market is found in many different industries like healthcare, automotive, consumer electronics, aerospace and manufacturing. This technology changes how images are made which has big effects on things like complex diagnosis or product model creation to even creating vivid experiences for people involved in various fields. Industry efforts concentrate on research and improvement to boost the capabilities of light field technology, along with planned purchases that fortify market standing and enlarge what is available in products. Observance of rules and norms guarantees that products are of good quality, safe to use, and compatible with one another which helps build trust among consumers while promoting market expansion. In the Light Field Market, companies are competing against each other with a focus on innovation. They spend money to improve technology and form important partnerships. Companies like Light Field Lab Inc., Avegant Corporation and NVIDIA Corporation are leading the way because of their creative solutions as well as buying other businesses. The market is changing so these companies work hard to keep up with demand changes and stay ahead in this fast-moving business environment.To know about the Research Methodology :- Request Free Sample Report The overall report focuses on primary sections such as – market segments, market outlook, competitive landscape, and company profiles. The segments provide details in terms of various perspectives such as end-use industry, and any other relevant segmentation as per the market’s current scenario which includes various aspects to perform additional marketing activity. The market outlook section gives a detailed analysis of market evolution, growth drivers, restraints opportunities, and challenges, Porter’s 5 Forces Framework, macroeconomic analysis, and pricing analysis that directly shape the market at present and over the forecasted period. We have collected key data related to the Global Light Field Market using multiple approaches. Various secondary sources were referred to for the identification and collection of information for the study. Secondary sources include annual reports, press releases, and investor presentations of companies, white papers, medical journals, certified publications, articles from recognized authors, gold standard and silver standard websites, directories, and databases. The research gives a thorough description of each regional market's size, and growth rate and offers a complete view. It provides comprehensive information on major industry participants, explaining their approaches to maintaining and increasing their market share. This thorough analysis helps clients gain a better grasp of the global Light Field market, enabling them to make informed investment decisions based on trustworthy data.

Light Field Market Dynamics:

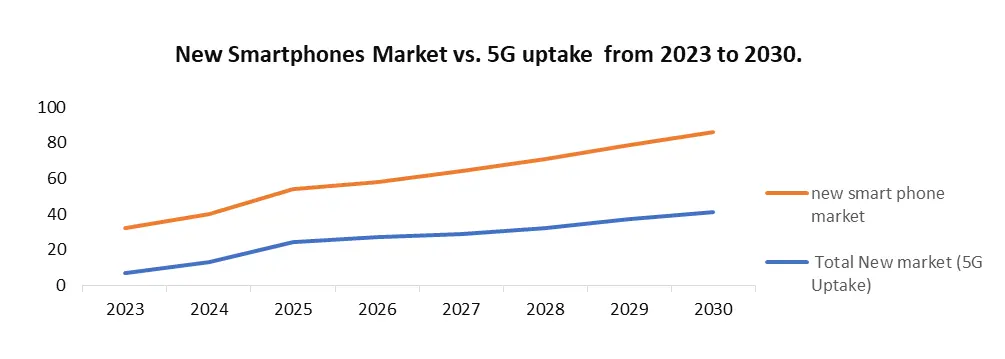

The Intersection of Virtual Reality, Augmented Reality, and Light Field Technology to drive the Light Field market The growing demand for virtual reality and augmented reality devices, and the increasing use of light field imaging technology in healthcare, automotive, and entertainment applications has driven the market growth of the Light Field Market. Rising demand for virtual and augmented reality solutions also drives the Light Field Industry. Unlike AR, Virtual Reality (VR) is a computer-generated three-dimensional environment where users interact and become immersed by using devices that send and receive information, such as goggles, headsets, gloves, bodysuits, etc. In a typical VR format, the person wearing the headset with a stereoscopic screen views animated images of the simulated environment. Impact on Healthcare and Manufacturing with Private 5G Integration The computer-based technology has been greatly improved, developing reconstructed images with high revolution. In the pharmaceutical industry, it has been used to study and improve the medicine manufacturing process to generate good quality products. CT is an effective technique for monitoring various types of cancers such as cancer of the bladder, kidneys, skeleton, neck, and head, and for diagnosing infection. 3D USCT is a promising technology for imaging breast cancer. Simultaneous recording of reproducible reflection, speed of sound volume, fast data collection, attenuation, and high image quality production are all the main advantages of the USCT system. The 3D USCT system is a full-potential device used for clinical purposes Private 5G technology provides several benefits that make it well-suited for supporting augmented reality and virtual reality (AR/VR) applications. Private 5G networks offer high bandwidth and low latency, which are essential for enabling AR/VR experiences that require real-time interaction and response. In manufacturing, private 5G networks support AR/VR applications for remote equipment maintenance, troubleshooting, and repair. With AR/VR headsets, technicians receive real-time visual guidance from experts located elsewhere, without the need for on-site visits. It saves time and reduces costs, while also minimizing downtime. Private 5G technology is revolutionizing the way that autonomous guided vehicles (AGVs) operate in large manufacturing environments by enabling real-time connectivity and control. For example, in a large manufacturing plant, AGVs are used to transport raw materials or finished products between different areas of the plant. With Private 5G, the AGVs communicate with the central control system in real-time, allowing for dynamic route planning and adjustments.

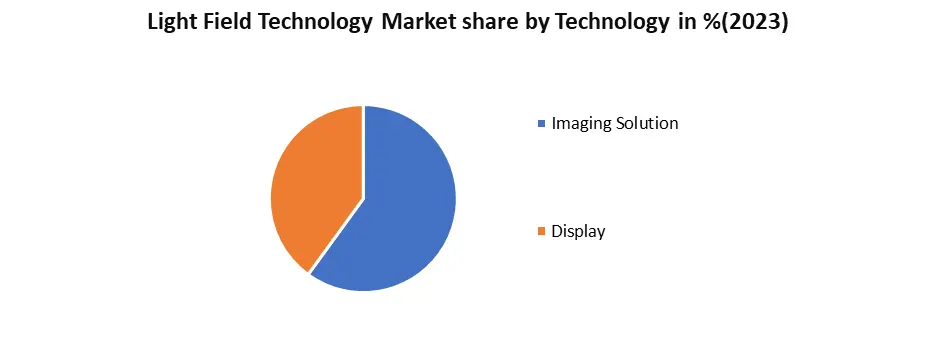

Light Field Market Segment Analysis:

By technology, Imaging solution Light field technology, also called integral imaging, is an emerging concept for imaging, the advantages of which are not widely understood, even among imaging industry professionals. As there are several ways to capture light field imaging, industry professionals have not quite agreed on which light field capturing technique is the best. and there is ongoing discussion on how to best capture images. Light field capturing has been performed passively by using camera arrays where each camera acquires the scene at a different angle and a different point of view. Some of the challenges related to using a camera array are the need to synchronize the camera shutter and to avoid big differences in illumination between the different camera viewpoints, in addition to the heavy computing required to generate the light field video. light field imaging development that solved the portability challenge was the invention of the plenoptic camera. The introduction of large digital imaging sensors that place a microlens array in between the lens and the image sensor allows a single camera to capture an array of images from different angles and with different viewpoints In the United States, approximately 50% of total ionizing radiation exposure is composed of radiation exposure from medical imaging. Medical imaging technologies are used to measure illnesses and manage, treat, and prevent them. Imaging techniques have become a necessary tool to diagnose almost all major types of medical abnormalities and illnesses, such as trauma disease, many types of cancer diseases, cardiovascular diseases, neurological disorders, and many other medical conditions. Medical imaging techniques are used by highly trained technicians like medical specialists, from oncologists to internists.

Light Field Market Regional Insight:

North America has dominated the region in the Light Field Market. The growth is majorly attributed to the presence of leading light field companies that are headquartered in the U.S. With the rising cybersecurity challenges faced while using wi-fi over radio frequencies, the demand for high-speed, reliable, and safe li-fi networks has been witnessing a remarkable uptick in demand. One of the major industry trends that have been vitalizing the North American li-fi market outlook is the increasing demand for li-fi for location-based applications such as retail and commercial sectors. Li-fi technology also leverages light spectrums instead of radio waves for transferring data, ensuring their suitability for intrinsically safe environments. As a result, li-fi can be used in settings where communication via radio waves can be dangerous or where RF signals cannot penetrate. For instance, underground mines can deploy this technology for the reinforced security of the laborers. Overall, the Li-Fi Technology market is poised for continued growth in the forecast period thanks to the increasing demand for sustainable and innovative products, as well as the widespread adoption of technology 1. Cooper Lighting, a subsidiary of Signify, acquired ILC in March 2023, strengthening its business in the smart internet field to better meet the demand for smart lighting in North AmericaAsia Pacific is the fastest-growing region in the Light field market through the forecast period. The government and other regulatory bodies in China highly encourage the development and adoption of VR technology in the country around 20 provinces and local municipal governments in China have begun to develop and manufacture local AR/VR devices. The surging adoption of the light field in various industries like aerospace, healthcare, consumer electronics, defines, and automotive is boosting the demand for these solutions in the region. In addition, the surge in agricultural activities in different countries of this region is pushing market players to increase their manufacturing capability. Indian 105mm Light Field Gun is the primary artillery piece used in mass over Indian terrain by the Indian Army, considered one of the best in the world in terms of weight and its range which surpasses the Russian equivalent 122-mm D-30 field gun. The Indian army is looking to replace its old 105mm light field guns with a mix of towed, mounted, and wheeled artillery. Light Field Market Competitive Landscape: 1. In February 2023, Light Field Lab announced a new technological startup that raised 50 USD Million to develop and commercialize its Solid Light holographic display platform. By investing in these startups Light Field Lab wants to expand its market position by integrating this amount into its products. 2. In October 2023, signify completed the asset acquisition of DLC, a lighting component manufacturer originally owned by Panasonic. DLC specializes in producing control systems and digital lighting solutions, which complement and align with Signify’s existing smart internet lighting technology and control systems, enhancing its competitiveness in the smart lighting market. 3. In November 2023, Acuity Brands announced the acquisition of Current’s Arize product series, which is expected to accelerate the growth of the group’s horticulture lighting business.

Global Light Field Market Scope: Inquire before buying

Global Light Field Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 81.53 Mn. Forecast Period 2024 to 2030 CAGR: 15.04% Market Size in 2030: US $ 217.40 Mn. Segments Covered: by Technology Product Imaging Solutions Light Field Display by Vertical Defence and Security Media and Entertainment Healthcare and Medical Architecture and Engineering Industrial Light Field Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Light Field Market Key Players:

1. Avegant Corporation - Belmont, California, United States 2. Magic Leap - Plantation, Florida, United States 3. OTOY Inc. - Los Angeles, California, United States 4. Light Field Lab Inc. - San Jose, California, United States 5. NVIDIA Corporation - Santa Clara, California, United States 6. Sony Corporation - Tokyo, Japan 7. Canon Inc. - Tokyo, Japan 8. Raytrix GmbH - Kiel, Germany 9. Leia Inc. - Menlo Park, California, United States 10. HoloLens (Microsoft) - Redmond, Washington, United States 11. Samsung Electronics Co., Ltd. - Suwon, South Korea 12. FoVI 3D - Cambridge, Massachusetts, United States 13. Toshiba Corporation - Tokyo, Japan 14. Qualcomm Incorporated - San Diego, California, United States 15. Google LLC - Mountain View, California, United States 16. AYE3D - San Jose, California, United States 17. MOPIC - Seoul, South Korea 18. NanoAR - San Francisco, California, United States 19. Foundry - London, United Kingdom Frequently Asked Questions: 1] What segments are covered in the Light Field Market report? Ans. The segments covered in the Light Field Market report is by Technology product and Vertical. 2] Which region is expected to hold the highest share in the Light Field Market? Ans. The North American region is expected to hold the highest share of the Light Field Market. 3] What is the market size of the Light Field Market by 2030? Ans. The market size of the Light Field Market by 2030 will be $ 217.40 Million. 4] What is the forecast period for the Light Field Market? Ans. The Forecast period for the Light Field Market is 2024- 2030.

1. Light Field Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Light Field Market: Dynamics 2.1. Light Field Market Trends by Region 2.1.1. North America Light Field Market Trends 2.1.2. Europe Light Field Market Trends 2.1.3. Asia Pacific Light Field Market Trends 2.1.4. Middle East and Africa Light Field Market Trends 2.1.5. South America Light Field Market Trends 2.2. Light Field Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Light Field Market Drivers 2.2.1.2. North America Light Field Market Restraints 2.2.1.3. North America Light Field Market Opportunities 2.2.1.4. North America Light Field Market Challenges 2.2.2. Europe 2.2.2.1. Europe Light Field Market Drivers 2.2.2.2. Europe Light Field Market Restraints 2.2.2.3. Europe Light Field Market Opportunities 2.2.2.4. Europe Light Field Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Light Field Market Drivers 2.2.3.2. Asia Pacific Light Field Market Restraints 2.2.3.3. Asia Pacific Light Field Market Opportunities 2.2.3.4. Asia Pacific Light Field Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Light Field Market Drivers 2.2.4.2. Middle East and Africa Light Field Market Restraints 2.2.4.3. Middle East and Africa Light Field Market Opportunities 2.2.4.4. Middle East and Africa Light Field Market Challenges 2.2.5. South America 2.2.5.1. South America Light Field Market Drivers 2.2.5.2. South America Light Field Market Restraints 2.2.5.3. South America Light Field Market Opportunities 2.2.5.4. South America Light Field Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Light Field Industry 2.8. Analysis of Government Schemes and Initiatives For Light Field Industry 2.9. Light Field Market Trade Analysis 2.10. The Global Pandemic Impact on Light Field Market 3. Light Field Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Light Field Market Size and Forecast, by Technology Product (2023-2030) 3.1.1. Imaging Solutions 3.1.2. Light Field Display 3.2. Light Field Market Size and Forecast, by Vertical (2023-2030) 3.2.1. Defence and Security 3.2.2. Media and Entertainment 3.2.3. Healthcare and Medical 3.2.4. Architecture and Engineering 3.2.5. Industrial 3.3. Light Field Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Light Field Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Light Field Market Size and Forecast, by Technology Product (2023-2030) 4.1.1. Imaging Solutions 4.1.2. Light Field Display 4.2. North America Light Field Market Size and Forecast, by Vertical (2023-2030) 4.2.1. Defence and Security 4.2.2. Media and Entertainment 4.2.3. Healthcare and Medical 4.2.4. Architecture and Engineering 4.2.5. Industrial 4.3. North America Light Field Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Light Field Market Size and Forecast, by Technology Product (2023-2030) 4.3.1.1.1. Imaging Solutions 4.3.1.1.2. Light Field Display 4.3.1.2. United States Light Field Market Size and Forecast, by Vertical (2023-2030) 4.3.1.2.1. Defence and Security 4.3.1.2.2. Media and Entertainment 4.3.1.2.3. Healthcare and Medical 4.3.1.2.4. Architecture and Engineering 4.3.1.2.5. Industrial 4.3.2. Canada 4.3.2.1. Canada Light Field Market Size and Forecast, by Technology Product (2023-2030) 4.3.2.1.1. Imaging Solutions 4.3.2.1.2. Light Field Display 4.3.2.2. Canada Light Field Market Size and Forecast, by Vertical (2023-2030) 4.3.2.2.1. Defence and Security 4.3.2.2.2. Media and Entertainment 4.3.2.2.3. Healthcare and Medical 4.3.2.2.4. Architecture and Engineering 4.3.2.2.5. Industrial 4.3.3. Mexico 4.3.3.1. Mexico Light Field Market Size and Forecast, by Technology Product (2023-2030) 4.3.3.1.1. Imaging Solutions 4.3.3.1.2. Light Field Display 4.3.3.2. Mexico Light Field Market Size and Forecast, by Vertical (2023-2030) 4.3.3.2.1. Defence and Security 4.3.3.2.2. Media and Entertainment 4.3.3.2.3. Healthcare and Medical 4.3.3.2.4. Architecture and Engineering 4.3.3.2.5. Industrial 5. Europe Light Field Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.2. Europe Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3. Europe Light Field Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.1.2. United Kingdom Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.2. France 5.3.2.1. France Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.2.2. France Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.3.2. Germany Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.4.2. Italy Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.5.2. Spain Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.6.2. Sweden Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.7.2. Austria Light Field Market Size and Forecast, by Vertical (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Light Field Market Size and Forecast, by Technology Product (2023-2030) 5.3.8.2. Rest of Europe Light Field Market Size and Forecast, by Vertical (2023-2030) 6. Asia Pacific Light Field Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.2. Asia Pacific Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3. Asia Pacific Light Field Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.1.2. China Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.2.2. S Korea Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.3.2. Japan Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.4. India 6.3.4.1. India Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.4.2. India Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.5.2. Australia Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.6.2. Indonesia Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.7.2. Malaysia Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.8.2. Vietnam Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.9.2. Taiwan Light Field Market Size and Forecast, by Vertical (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Light Field Market Size and Forecast, by Technology Product (2023-2030) 6.3.10.2. Rest of Asia Pacific Light Field Market Size and Forecast, by Vertical (2023-2030) 7. Middle East and Africa Light Field Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Light Field Market Size and Forecast, by Technology Product (2023-2030) 7.2. Middle East and Africa Light Field Market Size and Forecast, by Vertical (2023-2030) 7.3. Middle East and Africa Light Field Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Light Field Market Size and Forecast, by Technology Product (2023-2030) 7.3.1.2. South Africa Light Field Market Size and Forecast, by Vertical (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Light Field Market Size and Forecast, by Technology Product (2023-2030) 7.3.2.2. GCC Light Field Market Size and Forecast, by Vertical (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Light Field Market Size and Forecast, by Technology Product (2023-2030) 7.3.3.2. Nigeria Light Field Market Size and Forecast, by Vertical (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Light Field Market Size and Forecast, by Technology Product (2023-2030) 7.3.4.2. Rest of ME&A Light Field Market Size and Forecast, by Vertical (2023-2030) 8. South America Light Field Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Light Field Market Size and Forecast, by Technology Product (2023-2030) 8.2. South America Light Field Market Size and Forecast, by Vertical (2023-2030) 8.3. South America Light Field Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Light Field Market Size and Forecast, by Technology Product (2023-2030) 8.3.1.2. Brazil Light Field Market Size and Forecast, by Vertical (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Light Field Market Size and Forecast, by Technology Product (2023-2030) 8.3.2.2. Argentina Light Field Market Size and Forecast, by Vertical (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Light Field Market Size and Forecast, by Technology Product (2023-2030) 8.3.3.2. Rest Of South America Light Field Market Size and Forecast, by Vertical (2023-2030) 9. Global Light Field Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Light Field Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Avegant Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Magic Leap 10.3. OTOY Inc. 10.4. Light Field Lab Inc. 10.5. NVIDIA Corporation 10.6. Sony Corporation 10.7. Canon Inc. 10.8. Raytrix GmbH 10.9. Leia Inc. 10.10. HoloLens (Microsoft) 10.11. Samsung Electronics Co., Ltd. 10.12. FoVI 3D 10.13. Toshiba Corporation 10.14. Qualcomm Incorporated 10.15. Google LLC 10.16. AYE3D 10.17. MOPIC 10.18. NanoAR 10.19. Foundry 11. Key Findings 12. Industry Recommendations 13. Light Field Market: Research Methodology 14. Terms and Glossary