The LED Light Engine Market size was valued at USD 41.38 Billion in 2023 and the total LED Light Engine revenue is expected to grow at a CAGR of 11.82% from 2024 to 2030, reaching nearly USD 90.45 Billion by 2030.LED Light Engine Market Overview:

LED light engines, serving as the core components of LED lighting systems, were gaining traction across various industries due to their energy efficiency, longevity, and versatility. The market had witnessed a surge in demand primarily driven by the increasing adoption of LED technology in indoor and outdoor lighting applications. Factors such as the push for energy-efficient lighting solutions, stringent government regulations favoring LED technology, and the rising awareness of sustainability contributed to the LED Light Engine Market size. Industries like residential, commercial, automotive, and industrial sectors were embracing LED light engines for their cost-effectiveness, reduced environmental impact, and improved performance compared to traditional lighting sources. The continuous advancements in LED technology, including improvements in efficiency, brightness, color rendering, and smart features, further propelled the LED Light Engine industry growth and innovation. Additionally, the LED Light Engine Market was characterized by intense competition among key players and an emphasis on research and development to introduce more efficient and feature-rich LED light engine solutions. The integration of smart controls, connectivity options, and IoT capabilities into LED lighting systems was also becoming a prominent trend, catering to the growing demand for intelligent and adaptable lighting solutions.To know about the Research Methodology :- Request Free Sample Report

LED Light Engine Market Competitive Landscape:

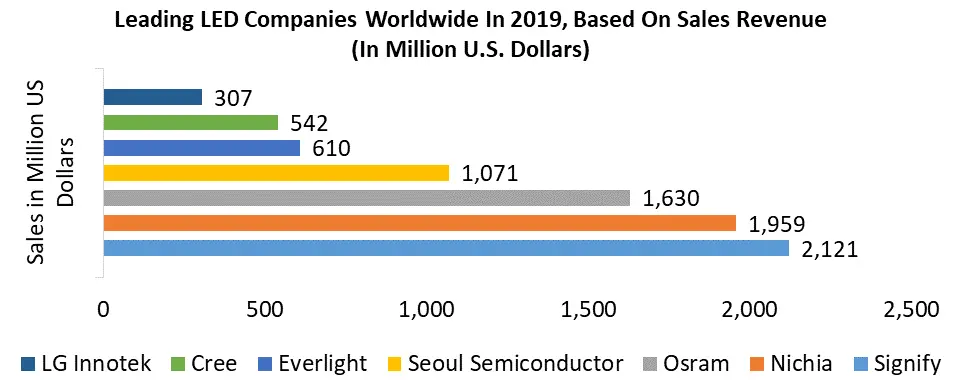

The MMR’s LED Light Engine Market report provides a detailed overview of the competitive environment in the LED Light Engine industry, highlighting the major companies, emerging startups, and established players in the industry. In addition, it further provides key players' strategic intent, their market positions, and market share. Statistical data and market insights shed light on the market's competitive dynamics. According to the MMR analysis, the LED Light Engine Market is dominated by prominent players such as Philips Lighting, OSRAM GmbH, Cree, Inc., General Electric Company, and Seoul Semiconductor Co., Ltd. These companies have established strong market positions and possess extensive product portfolios. They focus on continuous product innovation and strategic partnerships to strengthen their market presence. In terms of market share, Philips Lighting held a significant position in the LED Light Engine Market, accounting for approximately 18.5% of the global market in 2023. The company's extensive product range, global distribution network, and strong brand recognition have contributed to its market leadership. OSRAM GmbH is another major player in the LED Light Engine Market, holding a substantial market share in 2023. The company offers a wide range of LED light engines, catering to diverse applications and end-use industries. OSRAM GmbH focuses on technological advancements and collaborations to expand its market reach. Cree, Inc., a leading player in the LED industry, has a strong presence in the LED Light Engine Market. The company is known for its high-performance LED products, emphasizing energy efficiency and durability. Cree, Inc. invests heavily in research and development to enhance its product offerings and stay at the forefront of LED technology. In 2022, Cree, Inc. announced the launch of its new LED light engine, which is designed to deliver superior performance and energy efficiency. General Electric Company (GE) is also a key player in the LED Light Engine Market, leveraging its expertise in lighting and technology. GE offers a comprehensive range of LED light engines for various applications. The company's focus on sustainability and energy efficiency aligns with the market's growing demand for environmentally friendly lighting solutions. Seoul Semiconductor Co., Ltd. is a prominent player in the LED Light Engine Market, known for its innovative LED technologies. The company emphasizes research and development to introduce cutting-edge products with enhanced performance and energy efficiency. Seoul Semiconductor Co., Ltd. also collaborates with industry partners to drive market growth. In 2023, Seoul Semiconductor Co., Ltd. announced the acquisition of a leading LED light engine manufacturer, which is expected to help the company expand its product portfolio and strengthen its position in the market. In addition to these major players, the LED Light Engine Market includes several other regional and local manufacturers competing based on price, product quality, and technological advancements. These players often specialize in niche segments and cater to specific customer requirements. These companies are focusing on developing innovative LED light engines with enhanced features and benefits to meet the growing demand from end-users. They are also expanding their product portfolio to cater to the growing demand for LED light engines in a wide range of applications. The LED light engine market is expected to witness significant market growth during the forecast period. The market is driven by a number of factors, including increasing demand for energy-efficient lighting solutions, rising urbanization, and government initiatives to promote the adoption of LED lighting. The key players in the market are focusing on developing innovative LED light engines with enhanced features and benefits to meet the growing demand from end-users.

LED Light Engine Market Dynamics:

LED Light Engine Market Drivers: LED light engines are more energy-efficient than traditional lighting sources, such as incandescent and fluorescent bulbs. This is because LEDs consume less power and last longer. As a result, there is a growing demand for LED light engines from businesses and consumers who are looking for ways to save energy and reduce their carbon footprint. Thus, this acts as a major driver for the LED Light Engine Market. Urbanization is a global trend that is leading to the growth of cities and urban areas. This is leading to an increased demand for lighting solutions in these areas. LED light engines are well-suited for use in urban areas due to their energy efficiency and long lifespan. Governments around the world are promoting the adoption of LED lighting through various initiatives, such as subsidies, tax breaks, and regulations. These initiatives are helping to drive the growth of the LED light engine market. LED technology is constantly evolving, leading to the development of more efficient and cost-effective LED light engines. These advancements are helping to drive the growth of the LED light engine market. Also, LED lighting is becoming increasingly popular in the automotive sector due to its energy efficiency, long lifespan, and ability to produce a wide range of colors. This is helping to drive the growth of the LED light engine market.Businesses and consumers are increasingly focused on sustainability and environmental protection. LED light engines are a more sustainable option than traditional lighting sources, as they consume less energy and produce less waste. Thus, this acts as a driver for the growth of the LED light engine market. Growing demand for smart lighting: Smart lighting is a rapidly growing trend, and LED light engines are well-suited for use in smart lighting systems. LED light engines can be easily connected to smart home and building automation systems, which allows users to control and automate their lighting. This is contributing to the growth of the LED light engine market Expanding application base: LED light engines are being used in a wide range of applications, including residential, commercial, industrial, and automotive. The expanding application base of LED light engines is a driving force behind the growth of the LED light engine market. The prices of LED light engines have been falling steadily in recent years. This is making LED light engines more affordable and accessible to businesses and consumers. The falling prices of LED light engines are helping to drive the growth of the market. LED light engines are more energy-efficient than traditional lighting sources, such as incandescent and fluorescent bulbs. This is due to the fact that LEDs consume less power and last longer. As a result, there is a growth in the LED Light Engine Market from businesses and consumers who are looking for ways to save energy and reduce their carbon footprint. For example, a recent study by the U.S. Department of Energy found that LED light engines can save businesses and consumers up to 75% on their lighting costs. This is a major driver of the growth of the LED light engine market. Urbanization is a global trend that is leading to the growth of cities and urban areas. This is leading to an increased demand for lighting solutions in these areas. LED light engines are well-suited for use in urban areas due to their energy efficiency and long lifespan. For example, a recent study by the World Bank found that urbanization is expected to increase by 2.5 billion people by 2050. This will lead to an increased demand for lighting solutions in urban areas, which will drive the growth of the market. Government initiatives to promote the adoption of LED lighting: Governments around the world are promoting the adoption of LED lighting through various initiatives, such as subsidies, tax breaks, and regulations. These initiatives are helping to drive the growth of the LED light engine market. For example, the U.S. government has offered a number of incentives to businesses and consumers who adopt LED lighting. These incentives include tax breaks, rebates, and grants. These incentives have helped to drive the growth of the LED light engine market in the United States. LED Light Engine Market Restraints LED light engines are more expensive than traditional lighting sources, such as incandescent and fluorescent bulbs. This high initial cost can be a barrier to adoption for some businesses and consumers. LED light engines have a shorter lifespan than traditional lighting sources. This can lead to increased maintenance and replacement costs. There is a growing availability of counterfeit LED light engines on the market. These counterfeit products are often of poor quality and can fail prematurely. Thus, this acts as a hindrance to the Market. The LED light engine market is facing increasing competition from other lighting technologies, such as OLED and laser lighting. These technologies offer some advantages over LED light engines, such as improved efficiency and longer lifespan. The LED light engine market is facing regulatory challenges in some countries. For example, the European Union has implemented a number of regulations on LED light engines, such as the Energy Labelling Directive and the Eco-design Directive. These regulations are designed to improve the energy efficiency of LED light engines, but they can also make it more difficult for manufacturers to bring new products to market. The LED light engine market is also facing trade tensions between the United States and China. The Trump administration has imposed tariffs on a number of Chinese products, including LED light engines. These tariffs have made it more expensive for businesses in the United States to buy LED light engines from China. LED Light Engine Market Trend The LED light engine market is witnessing a rising demand for smart lighting solutions that offer advanced control features, including dimming, color changing, and integration with smart home systems. The global smart lighting market is expected to grow at a significant CAGR, indicating a lucrative growth opportunity for LED light engine manufacturers. There is an increasing emphasis on human-centric lighting solutions that mimic natural light patterns to enhance well-being, productivity, and comfort. LED light engines with tuneable white technology, allowing for adjustable color temperature and intensity, are gaining traction in commercial and residential applications. These factors are expected to drive the Market. The horticultural sector is witnessing a rapid adoption of LED light engines for indoor farming and vertical gardening. LED-based horticultural lighting systems offer precise control over light spectra, enabling optimal plant growth and yield. The global push towards energy efficiency and sustainability is driving the demand for LED light engines and the LED light engine market. With governments all across the world implementing stringent regulations and energy efficiency standards, LED light engines are being widely adopted as a replacement for traditional lighting technologies, resulting in reduced energy consumption and lower carbon emissions. The LED Light Engine Market is witnessing advancements in miniaturization, enabling their integration into compact lighting fixtures and appliances. Additionally, manufacturers are focusing on customization options to cater to specific requirements of end-users, such as unique form factors, color rendering capabilities, and compatibility with intelligent control systems. The integration of LED light engines with Li-Fi (Light Fidelity) technology is gaining attention. Li-Fi utilizes LED light signals to transmit data, offering high-speed wireless communication and complementing existing Wi-Fi networks. This factor is further expected to propel the growth of the Market. The COVID-19 pandemic has heightened the demand for UV-C LED light engines for air and surface disinfection purposes. UV-C LED technology offers a chemical-free and energy-efficient alternative to traditional disinfection methods. The market for UV LED disinfection is expected to grow significantly in the coming years, driven by the need for improved hygiene and sanitization practices. Companies operating in the LED light engine market are investing heavily in research and development activities to enhance product efficiency, durability, and performance. Advancements in LED chip technology, thermal management, and optics are expected to drive innovation and provide manufacturers with a competitive edge.

LED Light Engine Market Segment Analysis:

By Application, the Indoor Lighting segment dominated the global LED light engine market with the highest market share in 2023. This growth is attributed to the increasing adoption of LED lights due to LED lights are highly energy-efficient, consuming significantly less power compared to traditional lighting sources like incandescent or fluorescent bulbs. This efficiency results in reduced electricity bills for homes and businesses, making them a cost-effective choice. In addition, LED lights have a longer lifespan, lasting tens of thousands of hours compared to traditional bulbs, which translates to fewer replacements and reduced maintenance costs. This longevity appeals to consumers looking for durable, long-term lighting solutions. Additionally, LED lights offer better control over brightness and color temperature, allowing for customizable and adaptable lighting in indoor spaces. They also emit less heat, making them safer for enclosed areas. The environmental advantages of LED lights, such as their low carbon footprint and absence of hazardous materials like mercury, align with the growing emphasis on sustainability. Government regulations favoring energy-efficient lighting solutions also drive the shift towards LED lights in indoor environments. As more homes, offices, retail spaces, and various indoor settings opt for LED lighting for its cost-effectiveness, durability, versatility, and eco-friendliness, the market for LED lights experiences substantial growth. The increasing demand across diverse indoor applications fuels innovation and competition among manufacturers, contributing further to the market growth. Based on the distribution channel, the indirect sales segment held the largest market share of about 78.23% and dominated the global LED light engine market in 2023. Indirect sales channels, such as distributors, retailers, and online marketplaces, offer a wider distribution network, making these advanced lighting solutions more readily available to consumers. This is expected to be the primary factor driving the segment growth. By leveraging these channels, LED light engine manufacturers tap into diverse markets and cater to a broader customer base, including businesses and end-users seeking innovative lighting solutions. Additionally, indirect sales options often provide better customer support, education, and technical assistance, aiding in the adoption of LED light engines among consumers less familiar with the technology. This factor is further expected to boost the market revenue growth during the forecast period. The shift towards indirect sales channels is poised to have a substantial impact on the market. Increased accessibility and availability through various retail outlets and online platforms mean greater exposure and awareness among potential customers. It also facilitates easier procurement for businesses looking to integrate LED lighting solutions into their operations. The expanded market reach offered by indirect sales channels is expected to spur higher demand for LED light engines, potentially accelerating light engines market growth. Moreover, these channels is expected to drive competition among manufacturers, fostering innovation and competitive pricing strategies to capture a larger market share.LED Light Engine Market Regional Insights:

The report provides an in-depth analysis of the growth potential of the LED Light Engine Market. According to the report the Asia-Pacific region is expected to be the fastest-growing region for the market during the forecast period. This is due to the rapid industrialization and urbanization in the region, as well as the increasing government support for the adoption of LED lighting. China is the largest Market in the Asia-Pacific region, followed by India and Japan. China is the largest market for LED light engines, accounting for a share of over 30% in 2023. The growth of the market in China is driven by the increasing demand for energy-efficient lighting solutions in the residential and commercial sectors. North America is expected to hold the second-largest position in the Market revenue share by 2030. The growth of the market in North America is expected to be driven by the increasing demand for energy-efficient lighting solutions in the commercial and industrial sectors. The United States is the largest market for LED light engines in North America, followed by Canada and Mexico. Europe is expected to grow at a significant CAGR during the forecast period. The growth of the Market in Europe is further expected to be driven by the increasing demand for energy-efficient lighting solutions in the commercial and residential sectors. Germany, France, and the United Kingdom are the largest countries in the market in Europe. The Latin America and Middle East & and Africa (LAMEA) region is expected to be the slowest-growing Market for LED light engines during the forecast period. This is due to the low penetration of LED lighting in the region. However, the increasing government initiatives to promote the adoption of LED lighting in the region are expected to drive the market during the forecast period. LED Light Engine Market Research Methodology MMR's analysis of the Market used a meticulous combination of qualitative and quantitative methodologies to provide a thorough perspective. To estimate the market size, the bottom-up method was used, collating data from diverse segments like product types, applications, and geographic regions. This detailed segmentation allowed a holistic comprehension of the LED light engine market landscape. Data collection heavily relied on robust secondary research including paid databases, government websites, the company’s annual reports, etc. These outlets provided rich data on market trends, strategies, and financial performance of major players like Philips Lighting, OSRAM GmbH, Cree, Inc., General Electric Company, and Seoul Semiconductor Co., Ltd. Additionally, industry-specific publications and trade journals offered in-depth analyses shaping the market. While secondary research formed the study's foundation, primary research played a pivotal role in validating and enhancing collected data. This phase involved interviews, surveys, and discussions with industry experts, key opinion leaders, and stakeholders. Their qualitative inputs added depth, validating and refining information sourced through secondary research. This comprehensive blend of bottom-up estimation for market size, complemented by extensive secondary research and validated by primary insights, fortified MMR's methodology. It ensured an accurate grasp of the dynamics within the Market, offering a nuanced and thorough understanding.LED Light Engine Market Scope: Inquire before buying

LED Light Engine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 41.38 Bn. Forecast Period 2024 to 2030 CAGR: 11.82% Market Size in 2029: US $ 90.45 Bn. Segments Covered: by Product Type Lamp A-Shape Reflector Decorative Specialty Luminaire Ceiling Fan Chandelier Highbay Lighting Recessed Luminaire Others by Installation Type New installation Consulting Installation and Deployment Maintenance Retrofit installation Consulting Installation and Deployment Maintenance by End-Use Industry Residential Commercial Industrial Others by Application Indoor Lighting Outdoor Lighting by Distribution Channel Direct Sales Indirect Sales LED Light Engine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)LED Light Engine Market Key Players

The report has in detail information about the Strategies adopted by the following key companies to sustain and grow in the market. These LED Light Engine Manufacturers covered in the report are selected on the basis of certain criteria. 1. Cree, Inc (Durham, North Carolina, United States) 2. Acuity Brands, Inc. (Atlanta, Georgia, United States) 3. Eaton Corporation plc (Dublin, Ireland) - While headquartered in Ireland, it has a significant presence in North America. 4. GE Lighting (Fairfield, Connecticut, United States) Major LED Light Engine Market players in Europe: 1. Osram Licht AG (Munich, Germany) 2. Zumtobel Group AG (Lustenau, Austria) 3. Philips Lighting (Amsterdam, Netherlands) Major LED Light Engine manufacturers in Asia - East: 1. Seoul Semiconductor Co., Ltd. (Gyeonggi-do, South Korea) 2. Nichia Corporation (Tokushima, Japan) 3. Samsung Electronics Co., Ltd. (Suwon, South Korea) 4. Panasonic Corporation (Osaka, Japan) 5. Seoul Viosys Co., Ltd. (Gyeonggi-do, South Korea) 6. USHIO Corporation (Tokyo, Japan) Leading LED Light Engine Manufacturers in Asia - Southeast: 1. AEON Lighting (Shanghai, China) 2. FSL Corporation (Taipei, Taiwan) 3. Lextar Electronics Corporation (New Taipei City, Taiwan) 4. Lite-On Opto Technology Corporation (Taipei, Taiwan) 5. Opple Lighting Co., Ltd. (Guangzhou, China) 6. Yangzhou Everlight Electronics Co., Ltd. (Yangzhou, China) 7. Megaman (Thailand) Co., Ltd. (Bangkok, Thailand) 8. Osram Opto Semiconductors (India) Private Limited (Gurgaon, India) 9. Philips Lighting (India) Private Limited (Gurgaon, India) 10. Zumtobel Group (India) Private Limited (Gurgaon, India) Leading LED Light Engine Market Players in South America: 1. Feller (Brazil) Ind. e Com. Ltda. (São Paulo, Brazil) 2. ITL Lighting (São Paulo, Brazil) 3. Lamda Electric (Argentina) S.A.I.C.I.F. y A. (Buenos Aires, Argentina) FAQs: 1. What are the growth drivers for the LED Light Engine Market? Ans: Businesses and consumers are increasingly focused on sustainability and environmental protection which acts as a driver for the Market 2. What is the major restraint for the LED Light Engine Market growth? Ans: The availability of counterfeit products is one of the major restraints for the Industry. 3. Which region is expected to lead the global Market during the forecast period? Ans: Asia-Pacific region is expected to be the fastest-growing market for during the forecast period. 4. What is the projected market size & and growth rate of the Market? Ans: The Market size was valued at USD 41.38 Billion in 2023 and the total revenue is expected to grow at a CAGR of 11.82% from 2024 to 2030, reaching nearly USD 90.45 Billion by 2030. 5. What segments are covered in the Market report? Ans: The segments that are covered in the Market reports are Product Type, Installation Type, End-Use Industry, Application, Distribution Channel, and Region.

1. LED Light Engine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. LED Light Engine Market: Dynamics 2.1. LED Light Engine Market Trends by Region 2.1.1. North America LED Light Engine Market Trends 2.1.2. Europe LED Light Engine Market Trends 2.1.3. Asia Pacific LED Light Engine Market Trends 2.1.4. Middle East and Africa LED Light Engine Market Trends 2.1.5. South America LED Light Engine Market Trends 2.2. LED Light Engine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America LED Light Engine Market Drivers 2.2.1.2. North America LED Light Engine Market Restraints 2.2.1.3. North America LED Light Engine Market Opportunities 2.2.1.4. North America LED Light Engine Market Challenges 2.2.2. Europe 2.2.2.1. Europe LED Light Engine Market Drivers 2.2.2.2. Europe LED Light Engine Market Restraints 2.2.2.3. Europe LED Light Engine Market Opportunities 2.2.2.4. Europe LED Light Engine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific LED Light Engine Market Drivers 2.2.3.2. Asia Pacific LED Light Engine Market Restraints 2.2.3.3. Asia Pacific LED Light Engine Market Opportunities 2.2.3.4. Asia Pacific LED Light Engine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa LED Light Engine Market Drivers 2.2.4.2. Middle East and Africa LED Light Engine Market Restraints 2.2.4.3. Middle East and Africa LED Light Engine Market Opportunities 2.2.4.4. Middle East and Africa LED Light Engine Market Challenges 2.2.5. South America 2.2.5.1. South America LED Light Engine Market Drivers 2.2.5.2. South America LED Light Engine Market Restraints 2.2.5.3. South America LED Light Engine Market Opportunities 2.2.5.4. South America LED Light Engine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For LED Light Engine Industry 2.8. Analysis of Government Schemes and Initiatives For LED Light Engine Industry 2.9. LED Light Engine Market Trade Analysis 2.10. The Global Pandemic Impact on LED Light Engine Market 3. LED Light Engine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Lamp 3.1.2. Luminaire 3.2. LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 3.2.1. New installation 3.2.2. Retrofit installation 3.3. LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 3.3.1. Industry Residential 3.3.2. Commercial 3.3.3. Industrial 3.3.4. Others 3.4. LED Light Engine Market Size and Forecast, by Application (2023-2030) 3.4.1. Indoor Lighting 3.4.2. Outdoor Lighting 3.5. LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 3.5.1. Direct Sales 3.5.2. Indirect Sales 3.6. LED Light Engine Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America LED Light Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Lamp 4.1.2. Luminaire 4.2. North America LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 4.2.1. New installation 4.2.2. Retrofit installation 4.3. North America LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 4.3.1. Industry Residential 4.3.2. Commercial 4.3.3. Industrial 4.3.4. Others 4.4. North America LED Light Engine Market Size and Forecast, by Application (2023-2030) 4.4.1. Indoor Lighting 4.4.2. Outdoor Lighting 4.5. North America LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.1. Direct Sales 4.5.2. Indirect Sales 4.6. North America LED Light Engine Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 4.6.1.1.1. Lamp 4.6.1.1.2. Luminaire 4.6.1.2. United States LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 4.6.1.2.1. New installation 4.6.1.2.2. Retrofit installation 4.6.1.3. United States LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 4.6.1.3.1. Industry Residential 4.6.1.3.2. Commercial 4.6.1.3.3. Industrial 4.6.1.3.4. Others 4.6.1.4. United States LED Light Engine Market Size and Forecast, by Application (2023-2030) 4.6.1.4.1. Indoor Lighting 4.6.1.4.2. Outdoor Lighting 4.6.1.5. United States LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.1.5.1. Direct Sales 4.6.1.5.2. Indirect Sales 4.6.2. Canada 4.6.2.1. Canada LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 4.6.2.1.1. Lamp 4.6.2.1.2. Luminaire 4.6.2.2. Canada LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 4.6.2.2.1. New installation 4.6.2.2.2. Retrofit installation 4.6.2.3. Canada LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 4.6.2.3.1. Industry Residential 4.6.2.3.2. Commercial 4.6.2.3.3. Industrial 4.6.2.3.4. Others 4.6.2.4. Canada LED Light Engine Market Size and Forecast, by Application (2023-2030) 4.6.2.4.1. Indoor Lighting 4.6.2.4.2. Outdoor Lighting 4.6.2.5. Canada LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.2.5.1. Direct Sales 4.6.2.5.2. Indirect Sales 4.6.3. Mexico 4.6.3.1. Mexico LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 4.6.3.1.1. Lamp 4.6.3.1.2. Luminaire 4.6.3.2. Mexico LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 4.6.3.2.1. New installation 4.6.3.2.2. Retrofit installation 4.6.3.3. Mexico LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 4.6.3.3.1. Industry Residential 4.6.3.3.2. Commercial 4.6.3.3.3. Industrial 4.6.3.3.4. Others 4.6.3.4. Mexico LED Light Engine Market Size and Forecast, by Application (2023-2030) 4.6.3.4.1. Indoor Lighting 4.6.3.4.2. Outdoor Lighting 4.6.3.5. Mexico LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.3.5.1. Direct Sales 4.6.3.5.2. Indirect Sales 5. Europe LED Light Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.3. Europe LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.4. Europe LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.5. Europe LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6. Europe LED Light Engine Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.1.2. United Kingdom LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.1.3. United Kingdom LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.1.4. United Kingdom LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.1.5. United Kingdom LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.2. France 5.6.2.1. France LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.2.2. France LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.2.3. France LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.2.4. France LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.2.5. France LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.3. Germany 5.6.3.1. Germany LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.3.2. Germany LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.3.3. Germany LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.3.4. Germany LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.3.5. Germany LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.4. Italy 5.6.4.1. Italy LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.4.2. Italy LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.4.3. Italy LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.4.4. Italy LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.4.5. Italy LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.5. Spain 5.6.5.1. Spain LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.5.2. Spain LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.5.3. Spain LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.5.4. Spain LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.5.5. Spain LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.6.2. Sweden LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.6.3. Sweden LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.6.4. Sweden LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.6.5. Sweden LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.7. Austria 5.6.7.1. Austria LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.7.2. Austria LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.7.3. Austria LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.7.4. Austria LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.7.5. Austria LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 5.6.8.2. Rest of Europe LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 5.6.8.3. Rest of Europe LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 5.6.8.4. Rest of Europe LED Light Engine Market Size and Forecast, by Application (2023-2030) 5.6.8.5. Rest of Europe LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific LED Light Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.3. Asia Pacific LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.4. Asia Pacific LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6. Asia Pacific LED Light Engine Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.1.2. China LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.1.3. China LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.1.4. China LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.1.5. China LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.2.2. S Korea LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.2.3. S Korea LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.2.4. S Korea LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.2.5. S Korea LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.3. Japan 6.6.3.1. Japan LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.3.2. Japan LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.3.3. Japan LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.3.4. Japan LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.3.5. Japan LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.4. India 6.6.4.1. India LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.4.2. India LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.4.3. India LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.4.4. India LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.4.5. India LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.5. Australia 6.6.5.1. Australia LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.5.2. Australia LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.5.3. Australia LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.5.4. Australia LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.5.5. Australia LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.6.2. Indonesia LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.6.3. Indonesia LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.6.4. Indonesia LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.6.5. Indonesia LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.7.2. Malaysia LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.7.3. Malaysia LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.7.4. Malaysia LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.7.5. Malaysia LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.8.2. Vietnam LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.8.3. Vietnam LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.8.4. Vietnam LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.8.5. Vietnam LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.9.2. Taiwan LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.9.3. Taiwan LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.9.4. Taiwan LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.9.5. Taiwan LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 6.6.10.2. Rest of Asia Pacific LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 6.6.10.3. Rest of Asia Pacific LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 6.6.10.4. Rest of Asia Pacific LED Light Engine Market Size and Forecast, by Application (2023-2030) 6.6.10.5. Rest of Asia Pacific LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa LED Light Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 7.3. Middle East and Africa LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 7.4. Middle East and Africa LED Light Engine Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 7.6. Middle East and Africa LED Light Engine Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 7.6.1.2. South Africa LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 7.6.1.3. South Africa LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 7.6.1.4. South Africa LED Light Engine Market Size and Forecast, by Application (2023-2030) 7.6.1.5. South Africa LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.2. GCC 7.6.2.1. GCC LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 7.6.2.2. GCC LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 7.6.2.3. GCC LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 7.6.2.4. GCC LED Light Engine Market Size and Forecast, by Application (2023-2030) 7.6.2.5. GCC LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 7.6.3.2. Nigeria LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 7.6.3.3. Nigeria LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 7.6.3.4. Nigeria LED Light Engine Market Size and Forecast, by Application (2023-2030) 7.6.3.5. Nigeria LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 7.6.4.2. Rest of ME&A LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 7.6.4.3. Rest of ME&A LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 7.6.4.4. Rest of ME&A LED Light Engine Market Size and Forecast, by Application (2023-2030) 7.6.4.5. Rest of ME&A LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America LED Light Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 8.2. South America LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 8.3. South America LED Light Engine Market Size and Forecast, by End-Use(2023-2030) 8.4. South America LED Light Engine Market Size and Forecast, by Application (2023-2030) 8.5. South America LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 8.6. South America LED Light Engine Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 8.6.1.2. Brazil LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 8.6.1.3. Brazil LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 8.6.1.4. Brazil LED Light Engine Market Size and Forecast, by Application (2023-2030) 8.6.1.5. Brazil LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 8.6.2.2. Argentina LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 8.6.2.3. Argentina LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 8.6.2.4. Argentina LED Light Engine Market Size and Forecast, by Application (2023-2030) 8.6.2.5. Argentina LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America LED Light Engine Market Size and Forecast, by Product Type (2023-2030) 8.6.3.2. Rest Of South America LED Light Engine Market Size and Forecast, by Installation Type (2023-2030) 8.6.3.3. Rest Of South America LED Light Engine Market Size and Forecast, by End-Use (2023-2030) 8.6.3.4. Rest Of South America LED Light Engine Market Size and Forecast, by Application (2023-2030) 8.6.3.5. Rest Of South America LED Light Engine Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global LED Light Engine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading LED Light Engine Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Acuity Brands, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Eaton Corporation plc 10.3. GE Lighting 10.4. Osram Licht AG 10.5. Zumtobel Group AG 10.6. Philips Lighting 10.7. Seoul Semiconductor Co., Ltd. 10.8. Nichia Corporation 10.9. Samsung Electronics Co., Ltd. 10.10. Panasonic Corporation 10.11. Seoul Viosys Co., Ltd. 10.12. USHIO Corporation 10.13. AEON Lighting 10.14. FSL Corporation 10.15. Lextar Electronics Corporation 10.16. Lite-On Opto Technology Corporation 10.17. Opple Lighting Co., Ltd. 10.18. Yangzhou Everlight Electronics Co., Ltd. 10.19. Megaman (Thailand) Co., Ltd. 10.20. Osram Opto Semiconductors (India) Private Limited 10.21. Philips Lighting (India) Private Limited 10.22. Zumtobel Group (India) Private Limited 11. Key Findings 12. Industry Recommendations 13. LED Light Engine Market: Research Methodology 14. Terms and Glossary