Land mobile wireless systems market was valued at US$ 19.88 billion in 2022 and the total market is forecasted to grow at a CAGR of 6.2% from 2023 to 2029, reaching nearly US$ 29.52 billion by 2029.Land Mobile Wireless Systems Market Overview

The Land Mobile Wireless Systems market encompasses the deployment of wireless communication technology in mobile applications such as emergency services, public safety, transportation, and commercial activities. Two-way radio systems, mobile data systems, and wireless broadband technologies are also part of the market. Because of the increasing demand for dependable and effective communication systems in many industries, the Land Mobile Wireless Systems market has been consistently growing over the years. The report contains a thorough analysis on how the adoption of new technologies such as 4G and 5G, as well as the integration of IoT and AI, facilitating real-time data collection and analysis, remote monitoring, and control of devices and equipment, is likely to boost the market's growth even further.Report Scope

The Land Mobile Wireless Systems market comprises of a vast array of wireless communication technologies and applications utilised for mobile communications in a variety of industries. Some major areas where it has a high potential to further expand include public safety (for emergency services such as police, fire and ambulance), transportation (such as railways, airports and seaports), commercial operations (such as mining and oil and gas industries), government, and military. The market is extremely competitive, with major players investing significantly in R&D to develop cutting-edge technologies and customer-centric solutions. The report has analysed the market and observed high potential growth in market share in the developed economies and great scope for penetration in the developing economies, especially with the technological advancements happening in the environmental landscape. Both tier 1 and tier 2 cities have a growing curve for the demand of Land Mobile Wireless Systems. It is forecasted that the market share of Land Mobile Wireless Systems is expected to be dominated by variants like DMR, Project 25 and TETRA.To know about the Research Methodology :- Request Free Sample Report

Research Methodology

Both primary and secondary data sources are utilized for studying the Land Mobile Wireless Systems Market. The research includes a thorough examination of all factors that may affect the market, validated through primary research and evaluated to provide valuable conclusions. Variables such as inflation, economic downturns, regulatory and policy changes, and others in our market forecasts for top-level markets and sub-segments have also been factored in. To estimate market size and forecasts, the bottom-up approach has been employed and multiple data triangulation methodologies have been utilized. Weights have been assigned to each segment based on their utilization rate and average sale price to derive percentage splits, market shares, and breakdowns. The country-wise analysis of the market and its sub-segments is based on the percentage adoption or utilization of the given market size in the respective region or country. To identify the major players in the market, secondary research was conducted based on indicators like market revenue, price, services offered, advancements, mergers and acquisitions, and joint ventures. Also, extensive primary research has been conducted to verify and confirm crucial numbers arrived at, after comprehensive market engineering and calculations for market statistics, market size estimations, market forecasts, market breakdown, and data triangulation. The analysis provided in the report about the external and internal factors that may affect the business positively or negatively, will provide decision-makers with a clear futuristic view of the industry. Furthermore, the report offers a clear representation of competitive analysis of key players by price, financial position, growth strategies, and regional presence in the market, making it an investor’s guide. The secondary research phase involved a thorough synthesis of existing publications across the web to gather meaningful insights on the current situation of the market, technology developments, and any other market-related information. Information has been gathered from various sources including industry and government websites, blogs, magazines, and other publications, scientific papers, journals, and publications, trade information, conference proceedings, and association publications, among others. Apart from that, industry experts across the value chain were pooled in to gather first-hand insights on the market studied, including consultants and freelancers to collaborate on assignments that requires real-time industry insights. In addition to primary and secondary research, market surveys have also been conducted to gather qualitative insights and opinion of individuals related to the industry. The primary research methods used to prepare this report include industry expert review, personal interview, telephonic interview, collecting responses to surveys and questionnaires through email, surveys through fieldwork, and social media monitoring. Primary research has been used to validate the data points obtained from secondary research and fill the data gaps. Critical insights obtained from primary research have been used to ascertain critical market dynamics, market distribution across various segments, market entry for new companies, and insights into the competitive landscape.Land Mobile Wireless Systems Market Dynamics

Market Drivers The Land Mobile Wireless Systems Market is driven by growing industry demand for reliable and secure communication systems. Real-time communication and data exchange are essential for public safety and transportation operations, driving this demand. Wireless communication technology advances also influence the Land Mobile Wireless Systems Market and the users are likely to upgrade their systems to take advantage of the current technology. Government policies also shape the Land Mobile Wireless Systems Market. Spectrum allocation and licencing rules can impact communication system frequencies, which affect service providers' competitiveness and profitability. Competition is also a significant factor in this market - as more providers compete for customers, costs may fall and service quality may rise. Restraints There are a few factors such as high deployment and maintenance costs, security and privacy concerns, regulatory obstacles, emergence of alternative communication technologies, limited range and coverage, etc. that could affect the growth of this market and be a challenge for the key players in the industry. Since land mobile wireless systems are frequently used for crucial communication and data sharing, security and privacy are significant concerns, any perceived security flaw could discourage organisations from investing in new systems or utilising existing ones, thereby impeding market expansion. Government regulations pertaining to data privacy, cybersecurity, and interoperability may influence the adoption of land mobile wireless systems. Also, as newer and more advanced communication technologies, such as 5G and satellite-based systems are emerging, land mobile wireless systems may encounter increased competition. This could restrict market expansion and force service providers to innovate and differentiate themselves in order to remain competitive. Opportunities To withstand the challenges in the market environment, there are multiple opportunities that the players can leverage upon. Few of them are adoption of advanced technologies (like 5G, IoT, AI), integration with other systems (like video surveillance, GPS, vehicle tracking, smart watches and other wearables), catering to the increasing demand for public safety applications, growth in the emerging markets (like Asia-Pacific, Africa, and Latin America), catering to the increased demand in transportation and logistics with the expansion of e-commerce. Challenges There are some major challenges in the land mobile wireless systems market which might pose hindrance to the growth of the industry. Some of the most dominant concerns include safety and security, high costs (this includes cost of installation and maintenance), interoperability (because generally different organizations use different communication systems), limited battery life, environmental factors (such as weather conditions and physical obstructions which can impact the performance of the system), regulatory compliance and evolution of technology which offer cheaper alternatives of communication.Land mobile wireless systems Market Trends

The land mobile wireless systems market is dominated by some evolving trends like increasing demand for high-speed broadband communication, adoption of LTE (Long-Term Evolution) technology, growing demand for interoperability between different land mobile wireless systems, rising demand for wireless communication in the transportation sector, emergence of Internet of Things (IoT) and Machine-to-Machine (M2M) communication and the shift towards cloud-based solutions. Maximize has done a thorough analysis of the major as well as supporting factors which influence the global market and the full report contains detailed information on each of the factors. The information will help companies understand the trends and the scenario of the market, also whether it is fruitful to invest in such an industry and its potential future.Land Mobile Wireless Systems Market Segment Analysis

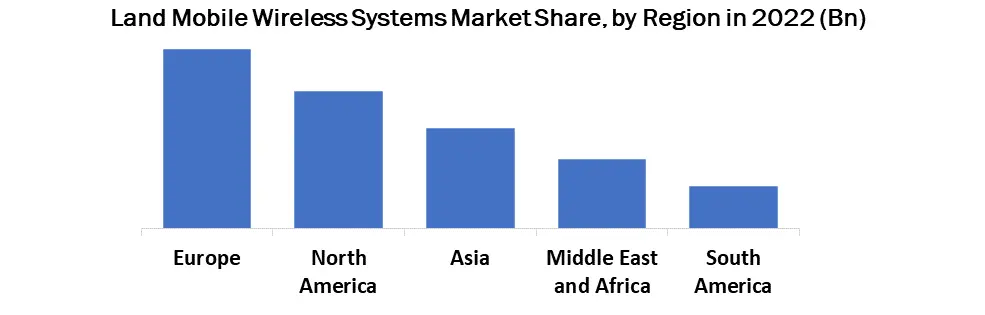

The market is divided into segments based on 4 categories - Technology, Type, Application and Geography. Based on technology, the market is segmented into analog systems (primarily used for voice communication) and digital systems (provide better voice quality, data transmission, and security features). The market is segmented based on type into portable and mobile systems. Portable systems are handheld devices that are easy to carry around, whereas mobile systems are installed in vehicles and provide a wider range of coverage. Based on application, the market is segmented into public safety (police, emergency medical services and fire departments), transportation (taxis, buses, and trains), utilities (power and gas utilities), and others (industrial, commercial, and construction sites). Additionally based on geography, the market is segmented into North America, Europe, Asia Pacific, Middle East and Africa and South America. North America and Europe are mature markets, whereas the Asia Pacific region is expected to grow at a higher rate due to the increasing adoption of advanced communication technologies in countries such as China, India, and Japan. Companies focus on targeting the most profitable segment which have the potential to give highest returns. For example, a company may choose to focus on the public safety segment by offering communication solutions to police departments and emergency services and create their niche in that area. It is also essential to position the company based on their target segment and creating an identity and image for company's products or services in the minds of customers. Companies position their wireless systems as reliable and secure communication solutions to meet the specific needs of their target segments. For example, a company targeting the transportation industry would position their systems as providing efficient and real-time communication between drivers, dispatchers, and customers.Land Mobile Wireless Systems Market Regional Analysis

The United States dominates the mature market for land mobile wireless systems in North America. Apart from the US, Canada also has a significant presence. On the other hand, Europe is a mature market for land mobile wireless systems, with countries such as the United Kingdom, Germany, France, and Italy having a significant presence. Asia, majorly being a developing economy is a rapidly expanding market for land mobile wireless systems, with China, India, Japan, and South Korea having a significant presence. Within Middle East and Africa (a growing market for land mobile wireless systems), countries such as Saudi Arabia, the United Arab Emirates, and South Africa have a significant presence. In South America, the market for land mobile wireless systems is also expanding; Brazil, Argentina, and Chile all have a significant presence in this industry. The largest market for the Land Mobile Wireless Systems is Europe, followed by North America and Asia-Pacific. The increasing demand for modern communication systems in the public safety and transportation sectors is driving growth in these regions.

Land Mobile Wireless Systems Market Competitive Analysis

The market structure of the land mobile wireless systems market can be defined as an oligopoly, with a few major players dominating the industry. JVCKENWOOD Corporation (Japan), Harris Corporation (US), Raytheon Company (US), Motorola Solutions (US), Thales Group (France), Nokia Networks (Finland) and Hytera Communications Corporation Limited (China) are among them. Due to the strong brand reputation and vast distribution networks of the existing players, new competitors find it hard to enter the market. The market leaders compete on technology, price, innovation, and product features.In recent years, the market for land mobile wireless systems has undergone significant consolidation, with a few key players dominating the industry. The consolidation has been driven by mergers and acquisitions, which have enabled companies to expand their product portfolios, enhance their technological capabilities, and enter new markets. The consolidations are making it even more difficult for new competitors to enter the market and compete with the established firms. For example, in 2014, Zebra Technologies acquired Motorola Solutions enterprise division in one of the largest industry mergers. Motorola Solutions was able to concentrate on its primary public safety and commercial businesses, whereas Zebra Technologies was able to expand its product offerings in the mobile computing and data capture market. Apart from this, Hytera Communications had acquired Sepura in 2016, which expanded Hytera's product line up and strengthened its position on the European market. In addition, Motorola Solutions acquired the video surveillance and analytics company Avigilon in 2018 to enhance its public safety solutions.

Land Mobile Wireless Systems Market Scope: Inquire before buying

Land Mobile Wireless Systems Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 19.88 Bn. Forecast Period 2023 to 2029 CAGR: 6.2% Market Size in 2029: US $ 29.52 Bn. Segments Covered: by Technology 1. Analog Systems 2. Digital Systems by Type 1. Portable Systems 2. Mobile Systems by Application 1. Public Safety 2. Transportation 3. Utilities Land Mobile Wireless Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Land Mobile Wireless Systems Market, Key Players are

1. Harris Corporation (US) 2. Raytheon Company (US) 3. Motorola Solutions (US) 4. BK Technologies (US) 5. Maxon America, Inc. (US) 6. Codex Radio Systems Inc. (Canada) 7. Technisonic Industries Ltd. (Canada) 8. NRC Radio Ltd. (UK) 9. Simoco Wireless Solutions (UK) 10. Entel UK Limited (UK) 11. Sepura plc (UK) 12. Rohde & Schwarz (Germany) 13. Thales Group (France) 14. Airbus Defence and Space (France) 15. Nokia Networks (Finland) 16. JVCKENWOOD Corporation (Japan) 17. Icom Inc. (Japan) 18. Hytera Communications Corporation Limited (China) 19. Huawei Technologies Co. Ltd (China) 20. Kirisun Communications Co. Ltd (China) 21. Codan Communications (Australia) 22. Tait Communications (New Zealand) 23. Ituran (Israel) 24. RAY Solutions (Dubai) 25. Al-Fattan Engineering (UAE) 26. Prointec (Colombia) FAQs 1. How big is the Land Mobile Wireless Systems Market? Ans: Land Mobile Wireless Systems Market was valued at US$ 19.88 billion in 2022. 2. What is the growth rate of the Land Mobile Wireless Systems Market? Ans: The CAGR of the Land Mobile Wireless Systems Market is forecasted at 6.2%. 3. What are the segments for the Land Mobile Wireless Systems Market? Ans: There are primarily 4 segments - Application, Geography, Technology and Type for the Land Mobile Wireless Systems Market. 4. Which industries use Land Mobile Wireless Systems? Ans: Some of the major areas where the Land Mobile Wireless System is used are public safety (for emergency services such as police, fire and ambulance), transportation (such as railways, airports and seaports), commercial operations (such as mining and oil and gas industries), government, military and much more. 5. Is it profitable to invest in the Land Mobile Wireless Systems Market? Ans: There is a fair growth rate in this market and there are various factors to be analysed like the driving forces and opportunities of the market which has been discussed extensively in Maximize’s full report. That would help in understanding the profitability in the market.

1. Land Mobile Wireless Systems Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Land Mobile Wireless Systems Market: Dynamics 2.1. Land Mobile Wireless Systems Market Trends by Region 2.1.1. North America Land Mobile Wireless Systems Market Trends 2.1.2. Europe Land Mobile Wireless Systems Market Trends 2.1.3. Asia Pacific Land Mobile Wireless Systems Market Trends 2.1.4. Middle East and Africa Land Mobile Wireless Systems Market Trends 2.1.5. South America Land Mobile Wireless Systems Market Trends 2.2. Land Mobile Wireless Systems Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Land Mobile Wireless Systems Market Drivers 2.2.1.2. North America Land Mobile Wireless Systems Market Restraints 2.2.1.3. North America Land Mobile Wireless Systems Market Opportunities 2.2.1.4. North America Land Mobile Wireless Systems Market Challenges 2.2.2. Europe 2.2.2.1. Europe Land Mobile Wireless Systems Market Drivers 2.2.2.2. Europe Land Mobile Wireless Systems Market Restraints 2.2.2.3. Europe Land Mobile Wireless Systems Market Opportunities 2.2.2.4. Europe Land Mobile Wireless Systems Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Land Mobile Wireless Systems Market Drivers 2.2.3.2. Asia Pacific Land Mobile Wireless Systems Market Restraints 2.2.3.3. Asia Pacific Land Mobile Wireless Systems Market Opportunities 2.2.3.4. Asia Pacific Land Mobile Wireless Systems Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Land Mobile Wireless Systems Market Drivers 2.2.4.2. Middle East and Africa Land Mobile Wireless Systems Market Restraints 2.2.4.3. Middle East and Africa Land Mobile Wireless Systems Market Opportunities 2.2.4.4. Middle East and Africa Land Mobile Wireless Systems Market Challenges 2.2.5. South America 2.2.5.1. South America Land Mobile Wireless Systems Market Drivers 2.2.5.2. South America Land Mobile Wireless Systems Market Restraints 2.2.5.3. South America Land Mobile Wireless Systems Market Opportunities 2.2.5.4. South America Land Mobile Wireless Systems Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Land Mobile Wireless Systems Industry 2.8. Analysis of Government Schemes and Initiatives For Land Mobile Wireless Systems Industry 2.9. Land Mobile Wireless Systems Market Trade Analysis 2.10. The Global Pandemic Impact on Land Mobile Wireless Systems Market 3. Land Mobile Wireless Systems Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 3.1.1. Analog Systems 3.1.2. Digital Systems 3.2. Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 3.2.1. Portable Systems 3.2.2. Mobile Systems 3.3. Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 3.3.1. Public Safety 3.3.2. Transportation 3.3.3. Utilities 3.4. Land Mobile Wireless Systems Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Land Mobile Wireless Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 4.1.1. Analog Systems 4.1.2. Digital Systems 4.2. North America Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 4.2.1. Portable Systems 4.2.2. Mobile Systems 4.3. North America Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 4.3.1. Public Safety 4.3.2. Transportation 4.3.3. Utilities 4.4. North America Land Mobile Wireless Systems Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 4.4.1.1.1. Analog Systems 4.4.1.1.2. Digital Systems 4.4.1.2. United States Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 4.4.1.2.1. Portable Systems 4.4.1.2.2. Mobile Systems 4.4.1.3. United States Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Public Safety 4.4.1.3.2. Transportation 4.4.1.3.3. Utilities 4.4.2. Canada 4.4.2.1. Canada Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 4.4.2.1.1. Analog Systems 4.4.2.1.2. Digital Systems 4.4.2.2. Canada Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 4.4.2.2.1. Portable Systems 4.4.2.2.2. Mobile Systems 4.4.2.3. Canada Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Public Safety 4.4.2.3.2. Transportation 4.4.2.3.3. Utilities 4.4.3. Mexico 4.4.3.1. Mexico Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 4.4.3.1.1. Analog Systems 4.4.3.1.2. Digital Systems 4.4.3.2. Mexico Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 4.4.3.2.1. Portable Systems 4.4.3.2.2. Mobile Systems 4.4.3.3. Mexico Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Public Safety 4.4.3.3.2. Transportation 4.4.3.3.3. Utilities 5. Europe Land Mobile Wireless Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.1. Europe Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.1. Europe Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4. Europe Land Mobile Wireless Systems Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.1.2. United Kingdom Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.1.3. United Kingdom Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.2. France 5.4.2.1. France Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.2.2. France Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.2.3. France Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.3.2. Germany Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.3.3. Germany Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.4.2. Italy Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.4.3. Italy Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.5.2. Spain Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.5.3. Spain Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.6.2. Sweden Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.6.3. Sweden Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.7.2. Austria Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.7.3. Austria Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 5.4.8.2. Rest of Europe Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 5.4.8.3. Rest of Europe Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Land Mobile Wireless Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.2. Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.3. Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.1.2. China Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.1.3. China Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.2.2. S Korea Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.2.3. S Korea Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.3.2. Japan Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.3.3. Japan Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.4.2. India Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.4.3. India Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.5.2. Australia Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.5.3. Australia Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.6.2. Indonesia Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.6.3. Indonesia Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.7.2. Malaysia Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.7.3. Malaysia Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.8.2. Vietnam Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.8.3. Vietnam Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.9.2. Taiwan Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.9.3. Taiwan Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 6.4.10.2. Rest of Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Land Mobile Wireless Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 7.2. Middle East and Africa Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 7.3. Middle East and Africa Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Land Mobile Wireless Systems Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 7.4.1.2. South Africa Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 7.4.1.3. South Africa Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 7.4.2.2. GCC Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 7.4.2.3. GCC Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 7.4.3.2. Nigeria Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 7.4.3.3. Nigeria Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 7.4.4.2. Rest of ME&A Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 7.4.4.3. Rest of ME&A Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 8. South America Land Mobile Wireless Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 8.2. South America Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 8.3. South America Land Mobile Wireless Systems Market Size and Forecast, by Application(2022-2029) 8.4. South America Land Mobile Wireless Systems Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 8.4.1.2. Brazil Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 8.4.1.3. Brazil Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 8.4.2.2. Argentina Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 8.4.2.3. Argentina Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Land Mobile Wireless Systems Market Size and Forecast, by Technology (2022-2029) 8.4.3.2. Rest Of South America Land Mobile Wireless Systems Market Size and Forecast, by Type (2022-2029) 8.4.3.3. Rest Of South America Land Mobile Wireless Systems Market Size and Forecast, by Application (2022-2029) 9. Global Land Mobile Wireless Systems Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Land Mobile Wireless Systems Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Harris Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Raytheon Company (US) 10.3. Motorola Solutions (US) 10.4. BK Technologies (US) 10.5. Maxon America, Inc. (US) 10.6. Codex Radio Systems Inc. (Canada) 10.7. Technisonic Industries Ltd. (Canada) 10.8. NRC Radio Ltd. (UK) 10.9. Simoco Wireless Solutions (UK) 10.10. Entel UK Limited (UK) 10.11. Sepura plc (UK) 10.12. Rohde & Schwarz (Germany) 10.13. Thales Group (France) 10.14. Airbus Defence and Space (France) 10.15. Nokia Networks (Finland) 10.16. JVCKENWOOD Corporation (Japan) 10.17. Icom Inc. (Japan) 10.18. Hytera Communications Corporation Limited (China) 10.19. Huawei Technologies Co. Ltd (China) 10.20. Kirisun Communications Co. Ltd (China) 10.21. Codan Communications (Australia) 10.22. Tait Communications (New Zealand) 10.23. Ituran (Israel) 10.24. RAY Solutions (Dubai) 10.25. Al-Fattan Engineering (UAE) 10.26. Prointec (Colombia) 11. Key Findings 12. Industry Recommendations 13. Land Mobile Wireless Systems Market: Research Methodology 14. Terms and Glossary