Global Big Data Security Market size was valued at USD 23.06 Bn in 2022 and is expected to reach USD 77.48 Bn by 2029, at a CAGR of 18.9% over the forecast period.Big Data Security Market Overview

Big Data Security technology and practice is implemented to protect big data security infrastructure, systems, and sensitive data from unauthorized access, data breaches, and cyber threats & security. Big data security consists of large volumes of structured semi-structured, and unstructured data generated from sources such as social media, sensors, devices, transactions, and other digital interactions. The data is characterized by high volume, velocity, and variety with specialized tools and technologies to store and derive insights from it. Organizations need security measures to safeguard big data assets and maintain trust and integrity, which is expected to boost the Big Data Security Market growth.To know about the Research Methodology :- Request Free Sample Report

Big Data Security Market Dynamics

Increasing Volume and Complexity of Big Data to Boost the Market Growth The exponential growth of data generated from various sources needs enhanced security measures. As organizations collect and analyze massive volumes of data, the need to protect sensitive information and prevent unauthorized access becomes critical and is expected to boost the Big Data Security Market growth. Rising cyber security threats with increased risks to big data environments increase the demand for Big Data security. Cyber-attacks, data breaches, and sophisticated hacking techniques are rising day by day. Organizations are adopting robust security solutions for the safety of big data assets, detect and respond to threats in real time monitoring systems, with minimizing the potential impact of security incidents. Data protection and privacy regulations, such as the General Data Protection Regulation and the California Consumer Privacy Act, implements stringent requirements on organizations regarding the handling and security of personal and sensitive data. Compliance with these regulations drives the adoption of Big Data Security solutions to ensure data privacy, consent management, and adherence to regulatory frameworks and is the reason for the growth of the Big Data Security Market. Big data analytics has become a strategic priority for organizations seeking to gain valuable insights and make data-driven decisions. The use of big data analytics introduces security challenges. Organizations require robust security measures to protect data integrity, prevent unauthorized access to analytical models, and ensure the confidentiality of valuable insights. The increased adoption of cloud computing and hybrid IT infrastructures has transformed the way for organizations to store and process big data. The cloud introduces new security trends. Organizations need solutions that provide secure data transfer, encryption, access controls, and monitoring capabilities to protect data in cloud-based environments. Industries, such as finance, healthcare, and government, have a demand for unique security requirements due to sensitive data and regulatory obligations. Industries dealing with highly regulated data or intellectual property invest in specialized Big Data Security companies due to their specific needs, which is expected to boost the Big Data Security industry growth. Increasing awareness about data privacy issues and high-profile data breaches has increased the need for data protection. Organizations are prioritizing Big Data Security to enhance customer trust, safeguard brand reputation, and maintain a competitive edge in the market. The Complexity of Big Data Environments to restraint Big Data Security market growth Big data environments are highly complex, with diverse data sources, distributed architectures, and varied data formats. Securing such complex environments requires specialized expertise and resources, making it challenging for organizations to implement and manage effective Big Data Security solutions and is the reason expected to restrain the Big Data Security Market growth. The demand for skilled security professionals who possess expertise in both big data technologies and security is high. Still there is a shortage of professionals with the necessary knowledge to design, implement, and manage Big Data Security technology. Implementing comprehensive Big Data Security solutions can involve significant investments in terms of technology, infrastructure, and skilled personnel. Organizations must carefully evaluate the cost-benefit ratio and assess the return on investment (ROI) of their security initiatives and is expected to restrain the Big Data Security market growth. Integrating Big Data Security solutions with existing IT infrastructure, legacy systems, and other security tools can be complex. Ensuring seamless integration, interoperability, and compatibility with various data platforms and security frameworks can pose challenges and require additional time and resources. Security measures, such as data encryption and access controls, can introduce overhead and impact the performance and speed of data processing and analysis in big data environments. It requires continuous updates, proactive monitoring, and threat intelligence integration to ensure the effectiveness of security measures. Compliance with data protection and privacy regulations adds complexity to Big Data Security initiatives. Navigating and adhering to various regional and industry-specific compliance requirements, such as GDPR, CCPA, HIPAA, or PCI-DSS, can be challenging and time-consuming for organizations, particularly when dealing with large volumes of diverse data.Big Data Security Market Trends

Adoption of Advanced Analytics and Machine Learning: Big Data Security solutions were leveraging advanced analytics techniques, machine learning, and artificial intelligence to detect patterns, anomalies, and potential security threats within large datasets. This trend aimed to enable proactive threat detection, real-time monitoring, and efficient incident response. Shift towards Cloud-Based Solutions: The adoption of cloud-based Big Data Security solutions was gaining momentum. Cloud deployment offered benefits such as scalability, agility, cost-effectiveness, and accessibility from anywhere. Integration of Big Data Security with Data Governance: Data governance frameworks were being enhanced to include security policies, access controls, and privacy regulations. This trend aimed to establish a holistic approach to data management that addressed both security and governance requirements. Focus on Insider Threat Detection: Insider threats, including accidental or intentional data breaches by employees or authorized personnel, were a growing concern. Big Data Security solutions were being deployed to detect and mitigate insider threats through user behavior analytics, access controls, and data monitoring techniques. Increasing Demand for Managed Security Services: MSSPs offered specialized expertise, 24/7 monitoring, and incident response capabilities, allowing organizations to focus on their core busi Energy and Utilitiesness while ensuring robust security measures.Regional Insight

North America region to boost the Big Data Security Market growth North America region dominated the market in 2022 and is expected to hold the largest Big Data Security market share over the forecast period. As the number of data being generated increases the risk of data breaches and cyber threats. Organizations are investing on big data security solutions to protect their information and to prevent from unauthorized access. Big Data security companies are adopting big data analytics to gain valuable insights and make data-driven decisions. This increased reliance on big data analytics need stronger security measures to protect the data being analyze, and is the reason the region is highly adopting Big Data Security solutions. The widespread adoption of cloud computing and the Internet of Things (IoT) has led to the generation and storage of vast amounts of data. Securing data and the associated infrastructure is mandatory. Big Data Security key players in the region include software vendors, IT security companies, and consulting firms that provide solutions such as data encryption, access control, threat detection, and data loss prevention. Asia Pacific region to dominate the market over the forecast period Asia pacific market provides solutions and services designed to secure and protect large volumes of data generated by organizations. China, Japan, India, Australia, and South Korea are countries significantly contributing for the growth of the market over the forecast period. Digital transformation across various industries has resulted in the generation of vast amounts of data, which requires robust security measures to protect against cyber threats and data breaches. With the increasing cyber-attacks and data breaches organizations in the region are becoming increasingly aware of the need for strong data security measures. This awareness regarding data security is expected to boost the Big Data security market growth with solutions to safeguard critical data assets. Countries in the region have implemented data protection and cyber security regulations. All these regulations require organizations to implement stringent security measures, including big data security solutions, to ensure compliance.Big Data Security Market Segment Analysis

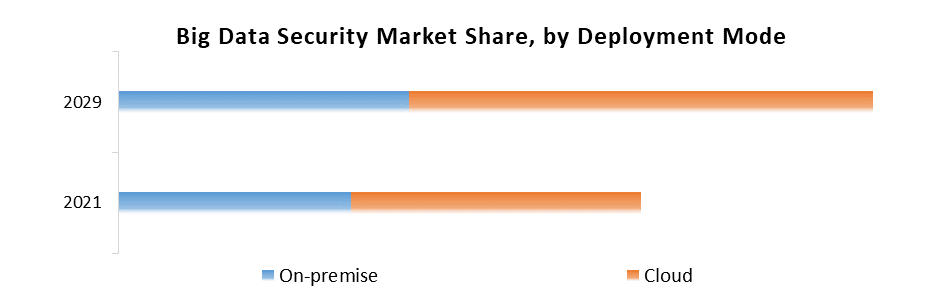

Based on Component, the market is segmented into Software, and Services. The software segment dominated the market in 2022 and is expected to hold the largest Big Data Security Market share over the forecast period. The software refers to the tools and applications the enable organizations to secure the big data environment. The software solutions provides features such as data encryption, access controls, and monitoring capabilities. The software helps to protect data from unauthorized access with certain regulations and provides insights into potential threats. Big Data Security software organizations deals with large volumes of data, and helps to establish a secure data infrastructure and maintain data integrity, which is expected to boost the segment growth in Big Data Security market. Based on Security Type, the market is segmented into Data Discovery and Classification, Data, Authorization and Access, Data Encryption, Tokenization and Masking, Data Auditing and Monitoring, Data Governance and Compliance, Data Security Analytics, and Data Backup and Recovery. Data Security Analytics segment held the largest Big Data Security market share in 2022 and is expected to dominate the market over the forecast period. Data security analytics leverages advanced analytics techniques, machine learning, and artificial intelligence to detect patterns, anomalies, and potential security threats within large datasets. This security type enables proactive threat detection and incident response.Based on Deployment mode, the market is segmented into On-premise and Cloud. Cloud segment held the largest market share in 2022 and is expected to hold the largest market share over the forecast period. Cloud deployment involves hosting Big Data Security solutions on cloud platforms provided by third-party service providers. Cloud deployment offers several advantages, including scalability, agility, reduced upfront costs, and easy accessibility from anywhere. Cloud-based solutions also benefit from the service provider's expertise in managing and securing infrastructure, which can offload some security responsibilities from the organization. Cloud deployment is particularly beneficial for organizations seeking rapid deployment, elastic scalability, and cost optimization, which is expected to boost the segment growth in the Big Data Security market.

Competitive Landscape

Big Data security companies are highly investing on Research and development activities with innovative advanced technology to minimize malicious attacks taken by key Big Data security market vendors to gain a competitive edge. The Big data security industry is highly competitive and consists of several key players by holding major Big Data Security market share with focused on increasing their customer base across different regions. The strategies adopted by the Big Data Security key player, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to enhance the Big Data Security Market penetration. The competitive environment in the market with technological innovation, product extensions, and different strategies are adopted by the Big Data Security key vendors. In November 2022, Kyndryl collaborated with AWS on different processes and technologies to support greater visibility, threat intelligence, and faster execution of threat intelligence to reduce time and investment to detect and resolve a major incident and downtime of a cyber-event.Big Data Security Market Scope: Inquire before buying

Big Data Security Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 23.06 Bn Forecast Period 2023 to 2029 CAGR: 18.9 % Market Size in 2029: USD 77.48 Bn Segments Covered: by Component Software Services by Security type Data Discovery and Classification Data Authorization and Access Data Encryption, Tokenization and Masking Data Auditing and Monitoring Data Governance and Compliance Data Security Analytics Data Backup and Recovery by Deployment Mode On-premise Cloud by Organization Size Large Enterprise Small and Medium Enterprise by Industry Vertical Banking, Financial Services, and Insurance (BFSI) Healthcare and Life Sciences Retail and E-commerce Government and Defense Manufacturing Telecom and IT Energy and Utilities Others Big Data Security Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Tracxn Technologies Limited 2. IBM 3. Oracle 4. Microsoft 5. Cloudera 6. Amazon Web Services (AWS) 7. HPE (Hewlett Packard Enterprise) 8. Symantec (now part of Broadcom) 9. McAfee (now part of TPG Capital) 10. Splunk 11. Dell EMC 12. Check Point Software Technologies 13. Cisco Systems 14. Palo Alto Networks 15. Fortinet 16. Imperva 17. Trend Micro 18. Informatica 19. Thales Group 20. Micro Focus 21. RSA Security (a division of Dell Technologies) 22. FireEye 23. Rapid7 24. Proofpoint 25. Varonis Systems 26. Bitdefender 27. Carbon Black (now part of VMware) 28. LogRhythm 29. Trustwave Holdings (a Singtel company) 30. F5 Networks 31. Digital Guardian Frequently Asked Questions: 1] What is the growth rate of the Global Big Data Security Market? Ans. The Global Big Data Security Market is growing at a significant rate of 18.9% over the forecast period. 2] Which region is expected to dominate the Global Big Data Security Market? Ans. North American region is expected to dominate the Big Data Security Market over the forecast period. 3] What is the expected Global Big Data Security Market size by 2029? Ans. The market size of the Big Data Security Market is expected to reach USD 77.48 Bn by 2029. 4] Who are the top players in the Global Big Data Security Industry? Ans. The major key players in the Global Big Data Security Market are PureLiving, Bayer AG, Imperial World Trade Pvt. Ltd., Jiwa, and RiceBran Technologies. 5] Which factors are expected to drive the Global Big Data Security Market growth by 2029? Ans. Increasing Volume and Complexity of Big Data are is expected to drive the Big Data Security Market growth over the forecast period (2023-2029).

1. Big Data Security Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Big Data Security Market: Dynamics 2.1. Big Data Security Market Trends by Region 2.1.1. North America Big Data Security Market Trends 2.1.2. Europe Big Data Security Market Trends 2.1.3. Asia Pacific Big Data Security Market Trends 2.1.4. Middle East and Africa Big Data Security Market Trends 2.1.5. South America Big Data Security Market Trends 2.2. Big Data Security Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Big Data Security Market Drivers 2.2.1.2. North America Big Data Security Market Restraints 2.2.1.3. North America Big Data Security Market Opportunities 2.2.1.4. North America Big Data Security Market Challenges 2.2.2. Europe 2.2.2.1. Europe Big Data Security Market Drivers 2.2.2.2. Europe Big Data Security Market Restraints 2.2.2.3. Europe Big Data Security Market Opportunities 2.2.2.4. Europe Big Data Security Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Big Data Security Market Drivers 2.2.3.2. Asia Pacific Big Data Security Market Restraints 2.2.3.3. Asia Pacific Big Data Security Market Opportunities 2.2.3.4. Asia Pacific Big Data Security Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Big Data Security Market Drivers 2.2.4.2. Middle East and Africa Big Data Security Market Restraints 2.2.4.3. Middle East and Africa Big Data Security Market Opportunities 2.2.4.4. Middle East and Africa Big Data Security Market Challenges 2.2.5. South America 2.2.5.1. South America Big Data Security Market Drivers 2.2.5.2. South America Big Data Security Market Restraints 2.2.5.3. South America Big Data Security Market Opportunities 2.2.5.4. South America Big Data Security Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Big Data Security Industry 2.8. Analysis of Government Schemes and Initiatives For Big Data Security Industry 2.9. Big Data Security Market Trade Analysis 2.10. The Global Pandemic Impact on Big Data Security Market 3. Big Data Security Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Big Data Security Market Size and Forecast, by Component (2022-2029) 3.1.1. Software 3.1.2. Services 3.2. Big Data Security Market Size and Forecast, by Security type (2022-2029) 3.2.1. Data Discovery and Classification 3.2.2. Data Authorization and Access 3.2.3. Data Encryption, Tokenization and Masking 3.2.4. Data Auditing and Monitoring 3.2.5. Data Governance and Compliance 3.2.6. Data Security Analytics 3.2.7. Data Backup and Recovery 3.3. Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 3.3.1. On-premise 3.3.2. Cloud 3.4. Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 3.4.1. Large Enterprise 3.4.2. Small and Medium Enterprise 3.5. Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 3.5.1. Banking, Financial Services, and Insurance (BFSI) 3.5.2. Healthcare and Life Sciences 3.5.3. Retail and E-commerce 3.5.4. Government and Defense 3.5.5. Manufacturing 3.5.6. Telecom and IT 3.5.7. Energy and Utilities 3.5.8. Others 3.6. Big Data Security Market Size and Forecast, by Region (2022-2029) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Big Data Security Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Big Data Security Market Size and Forecast, by Component (2022-2029) 4.1.1. Software 4.1.2. Services 4.2. North America Big Data Security Market Size and Forecast, by Security type (2022-2029) 4.2.1. Data Discovery and Classification 4.2.2. Data Authorization and Access 4.2.3. Data Encryption, Tokenization and Masking 4.2.4. Data Auditing and Monitoring 4.2.5. Data Governance and Compliance 4.2.6. Data Security Analytics 4.2.7. Data Backup and Recovery 4.3. North America Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 4.3.1. On-premise 4.3.2. Cloud 4.4. North America Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 4.4.1. Large Enterprise 4.4.2. Small and Medium Enterprise 4.5. North America Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 4.5.1. Banking, Financial Services, and Insurance (BFSI) 4.5.2. Healthcare and Life Sciences 4.5.3. Retail and E-commerce 4.5.4. Government and Defense 4.5.5. Manufacturing 4.5.6. Telecom and IT 4.5.7. Energy and Utilities 4.5.8. Others 4.6. North America Big Data Security Market Size and Forecast, by Country (2022-2029) 4.6.1. United States 4.6.1.1. United States Big Data Security Market Size and Forecast, by Component (2022-2029) 4.6.1.1.1. Software 4.6.1.1.2. Services 4.6.1.2. United States Big Data Security Market Size and Forecast, by Security type (2022-2029) 4.6.1.2.1. Data Discovery and Classification 4.6.1.2.2. Data Authorization and Access 4.6.1.2.3. Data Encryption, Tokenization and Masking 4.6.1.2.4. Data Auditing and Monitoring 4.6.1.2.5. Data Governance and Compliance 4.6.1.2.6. Data Security Analytics 4.6.1.2.7. Data Backup and Recovery 4.6.1.3. United States Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 4.6.1.3.1. On-premise 4.6.1.3.2. Cloud 4.6.1.4. United States Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 4.6.1.4.1. Large Enterprise 4.6.1.4.2. Small and Medium Enterprise 4.6.1.5. United States Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 4.6.1.5.1. Banking, Financial Services, and Insurance (BFSI) 4.6.1.5.2. Healthcare and Life Sciences 4.6.1.5.3. Retail and E-commerce 4.6.1.5.4. Government and Defense 4.6.1.5.5. Manufacturing 4.6.1.5.6. Telecom and IT 4.6.1.5.7. Energy and Utilities 4.6.1.5.8. Others 4.6.2. Canada 4.6.2.1. Canada Big Data Security Market Size and Forecast, by Component (2022-2029) 4.6.2.1.1. Software 4.6.2.1.2. Services 4.6.2.2. Canada Big Data Security Market Size and Forecast, by Security type (2022-2029) 4.6.2.2.1. Data Discovery and Classification 4.6.2.2.2. Data Authorization and Access 4.6.2.2.3. Data Encryption, Tokenization and Masking 4.6.2.2.4. Data Auditing and Monitoring 4.6.2.2.5. Data Governance and Compliance 4.6.2.2.6. Data Security Analytics 4.6.2.2.7. Data Backup and Recovery 4.6.2.3. Canada Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 4.6.2.3.1. On-premise 4.6.2.3.2. Cloud 4.6.2.4. Canada Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 4.6.2.4.1. Large Enterprise 4.6.2.4.2. Small and Medium Enterprise 4.6.2.5. Canada Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 4.6.2.5.1. Banking, Financial Services, and Insurance (BFSI) 4.6.2.5.2. Healthcare and Life Sciences 4.6.2.5.3. Retail and E-commerce 4.6.2.5.4. Government and Defense 4.6.2.5.5. Manufacturing 4.6.2.5.6. Telecom and IT 4.6.2.5.7. Energy and Utilities 4.6.2.5.8. Others 4.6.3. Mexico 4.6.3.1. Mexico Big Data Security Market Size and Forecast, by Component (2022-2029) 4.6.3.1.1. Software 4.6.3.1.2. Services 4.6.3.2. Mexico Big Data Security Market Size and Forecast, by Security type (2022-2029) 4.6.3.2.1. Data Discovery and Classification 4.6.3.2.2. Data Authorization and Access 4.6.3.2.3. Data Encryption, Tokenization and Masking 4.6.3.2.4. Data Auditing and Monitoring 4.6.3.2.5. Data Governance and Compliance 4.6.3.2.6. Data Security Analytics 4.6.3.2.7. Data Backup and Recovery 4.6.3.3. Mexico Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 4.6.3.3.1. On-premise 4.6.3.3.2. Cloud 4.6.3.4. Mexico Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 4.6.3.4.1. Large Enterprise 4.6.3.4.2. Small and Medium Enterprise 4.6.3.5. Mexico Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 4.6.3.5.1. Banking, Financial Services, and Insurance (BFSI) 4.6.3.5.2. Healthcare and Life Sciences 4.6.3.5.3. Retail and E-commerce 4.6.3.5.4. Government and Defense 4.6.3.5.5. Manufacturing 4.6.3.5.6. Telecom and IT 4.6.3.5.7. Energy and Utilities 4.6.3.5.8. Others 5. Europe Big Data Security Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Big Data Security Market Size and Forecast, by Component (2022-2029) 5.1. Europe Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.1. Europe Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.1. Europe Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.1. Europe Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6. Europe Big Data Security Market Size and Forecast, by Country (2022-2029) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.1.2. United Kingdom Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.1.3. United Kingdom Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.1.4. United Kingdom Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.1.5. United Kingdom Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.2. France 5.6.2.1. France Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.2.2. France Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.2.3. France Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.2.4. France Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.2.5. France Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.3. Germany 5.6.3.1. Germany Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.3.2. Germany Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.3.3. Germany Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.3.4. Germany Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.3.5. Germany Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.4. Italy 5.6.4.1. Italy Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.4.2. Italy Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.4.3. Italy Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.4.4. Italy Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.4.5. Italy Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.5. Spain 5.6.5.1. Spain Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.5.2. Spain Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.5.3. Spain Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.5.4. Spain Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.5.5. Spain Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.6. Sweden 5.6.6.1. Sweden Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.6.2. Sweden Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.6.3. Sweden Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.6.4. Sweden Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.6.5. Sweden Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.7. Austria 5.6.7.1. Austria Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.7.2. Austria Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.7.3. Austria Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.7.4. Austria Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.7.5. Austria Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Big Data Security Market Size and Forecast, by Component (2022-2029) 5.6.8.2. Rest of Europe Big Data Security Market Size and Forecast, by Security type (2022-2029) 5.6.8.3. Rest of Europe Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 5.6.8.4. Rest of Europe Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.6.8.5. Rest of Europe Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6. Asia Pacific Big Data Security Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Big Data Security Market Size and Forecast, by Component (2022-2029) 6.2. Asia Pacific Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.3. Asia Pacific Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.4. Asia Pacific Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.5. Asia Pacific Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6. Asia Pacific Big Data Security Market Size and Forecast, by Country (2022-2029) 6.6.1. China 6.6.1.1. China Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.1.2. China Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.1.3. China Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.1.4. China Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.1.5. China Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.2. S Korea 6.6.2.1. S Korea Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.2.2. S Korea Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.2.3. S Korea Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.2.4. S Korea Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.2.5. S Korea Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.3. Japan 6.6.3.1. Japan Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.3.2. Japan Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.3.3. Japan Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.3.4. Japan Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.3.5. Japan Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.4. India 6.6.4.1. India Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.4.2. India Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.4.3. India Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.4.4. India Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.4.5. India Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.5. Australia 6.6.5.1. Australia Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.5.2. Australia Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.5.3. Australia Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.5.4. Australia Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.5.5. Australia Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.6. Indonesia 6.6.6.1. Indonesia Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.6.2. Indonesia Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.6.3. Indonesia Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.6.4. Indonesia Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.6.5. Indonesia Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.7. Malaysia 6.6.7.1. Malaysia Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.7.2. Malaysia Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.7.3. Malaysia Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.7.4. Malaysia Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.7.5. Malaysia Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.8. Vietnam 6.6.8.1. Vietnam Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.8.2. Vietnam Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.8.3. Vietnam Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.8.4. Vietnam Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.8.5. Vietnam Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.9. Taiwan 6.6.9.1. Taiwan Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.9.2. Taiwan Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.9.3. Taiwan Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.9.4. Taiwan Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.9.5. Taiwan Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Big Data Security Market Size and Forecast, by Component (2022-2029) 6.6.10.2. Rest of Asia Pacific Big Data Security Market Size and Forecast, by Security type (2022-2029) 6.6.10.3. Rest of Asia Pacific Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 6.6.10.4. Rest of Asia Pacific Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.6.10.5. Rest of Asia Pacific Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 7. Middle East and Africa Big Data Security Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Big Data Security Market Size and Forecast, by Component (2022-2029) 7.2. Middle East and Africa Big Data Security Market Size and Forecast, by Security type (2022-2029) 7.3. Middle East and Africa Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 7.4. Middle East and Africa Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 7.5. Middle East and Africa Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 7.6. Middle East and Africa Big Data Security Market Size and Forecast, by Country (2022-2029) 7.6.1. South Africa 7.6.1.1. South Africa Big Data Security Market Size and Forecast, by Component (2022-2029) 7.6.1.2. South Africa Big Data Security Market Size and Forecast, by Security type (2022-2029) 7.6.1.3. South Africa Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 7.6.1.4. South Africa Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 7.6.1.5. South Africa Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.2. GCC 7.6.2.1. GCC Big Data Security Market Size and Forecast, by Component (2022-2029) 7.6.2.2. GCC Big Data Security Market Size and Forecast, by Security type (2022-2029) 7.6.2.3. GCC Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 7.6.2.4. GCC Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 7.6.2.5. GCC Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.3. Nigeria 7.6.3.1. Nigeria Big Data Security Market Size and Forecast, by Component (2022-2029) 7.6.3.2. Nigeria Big Data Security Market Size and Forecast, by Security type (2022-2029) 7.6.3.3. Nigeria Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 7.6.3.4. Nigeria Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 7.6.3.5. Nigeria Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Big Data Security Market Size and Forecast, by Component (2022-2029) 7.6.4.2. Rest of ME&A Big Data Security Market Size and Forecast, by Security type (2022-2029) 7.6.4.3. Rest of ME&A Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 7.6.4.4. Rest of ME&A Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 7.6.4.5. Rest of ME&A Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 8. South America Big Data Security Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Big Data Security Market Size and Forecast, by Component (2022-2029) 8.2. South America Big Data Security Market Size and Forecast, by Security type (2022-2029) 8.3. South America Big Data Security Market Size and Forecast, by Deployment Mode(2022-2029) 8.4. South America Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 8.5. South America Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 8.6. South America Big Data Security Market Size and Forecast, by Country (2022-2029) 8.6.1. Brazil 8.6.1.1. Brazil Big Data Security Market Size and Forecast, by Component (2022-2029) 8.6.1.2. Brazil Big Data Security Market Size and Forecast, by Security type (2022-2029) 8.6.1.3. Brazil Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 8.6.1.4. Brazil Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 8.6.1.5. Brazil Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 8.6.2. Argentina 8.6.2.1. Argentina Big Data Security Market Size and Forecast, by Component (2022-2029) 8.6.2.2. Argentina Big Data Security Market Size and Forecast, by Security type (2022-2029) 8.6.2.3. Argentina Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 8.6.2.4. Argentina Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 8.6.2.5. Argentina Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Big Data Security Market Size and Forecast, by Component (2022-2029) 8.6.3.2. Rest Of South America Big Data Security Market Size and Forecast, by Security type (2022-2029) 8.6.3.3. Rest Of South America Big Data Security Market Size and Forecast, by Deployment Mode (2022-2029) 8.6.3.4. Rest Of South America Big Data Security Market Size and Forecast, by Organization Size (2022-2029) 8.6.3.5. Rest Of South America Big Data Security Market Size and Forecast, by Industry Vertical (2022-2029) 9. Global Big Data Security Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Big Data Security Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Tracxn Technologies Limited 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. IBM 10.3. Oracle 10.4. Microsoft 10.5. Cloudera 10.6. Amazon Web Services (AWS) 10.7. HPE (Hewlett Packard Enterprise) 10.8. Symantec (now part of Broadcom) 10.9. McAfee (now part of TPG Capital) 10.10. Splunk 10.11. Dell EMC 10.12. Check Point Software Technologies 10.13. Cisco Systems 10.14. Palo Alto Networks 10.15. Fortinet 10.16. Imperva 10.17. Trend Micro 10.18. Informatica 10.19. Thales Group 10.20. Micro Focus 10.21. RSA Security (a division of Dell Technologies) 10.22. FireEye 10.23. Rapid7 10.24. Proofpoint 10.25. Varonis Systems 10.26. Bitdefender 10.27. Carbon Black (now part of VMware) 10.28. LogRhythm 10.29. Trustwave Holdings (a Singtel company) 10.30. F5 Networks 10.31. Digital Guardian 11. Key Findings 12. Industry Recommendations 13. Big Data Security Market: Research Methodology 14. Terms and Glossary