The Global Isostearic Acid Market size was valued at USD 272.44 Mn in 2023 and is expected to reach USD 440.35 Mn by 2030, at a CAGR of 7.1 %Overview of the Global Isostearic Acid Market

The branched-chain fatty acid isostearic acid, which is largely generated from oleic acid, has found use in a number of industries, including lubricants, personal care products, and chemical intermediates. Since isostearic acid can be made from renewable resources, the market was driven by the rising demand for environmentally friendly and biodegradable chemicals. Its qualities, such as strong oxidation stability, also made it a popular option in industrial applications. Market dynamics may have changed since then, though, as a result of things like regulatory adjustments, the emergence of new technology, and changing customer tastes. The graphical representation and structural exclusive information showed the dominating region of the Global Isostearic Acid Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Isostearic Acid Market.To know about the Research Methodology :- Request Free Sample Report

Isostearic Acid Market Dynamics

Increasing Awareness of Sustainability and Environmental Responsibility are the Growth Drivers for Isostearic Acid Market The growing demand for environmentally friendly compounds, such as isostearic acid, is driven by the increasing awareness of sustainability and environmental responsibility. Isostearic acid, sourced from natural oils, perfectly aligns with these objectives. Notably, the cosmetics and personal care sector has significantly fuelled market growth, as isostearic acid plays an essential role in formulating cosmetic products, including skin creams and lipsticks. Furthermore, the industrial sector has exhibited substantial demand for isostearic acid due to its remarkable oxidation stability, rendering it an ideal choice for lubricants and greases. Technological advancements in production processes have bolstered the cost-efficiency of isostearic acid, further enhancing its utilization across various applications. Together, these factors contribute to the global expansion of the isostearic acid market. However, it's imperative for industry stakeholders to remain informed about the latest trends and developments, as market conditions may evolve. Price Fluctuations and Supply Shortages are the Restraining Factors of The Isostearic Acid Market Historically, the isostearic acid market has encountered significant challenges. One major impediment lies in the reliance on feedstock availability. Castor oil, a common source of isostearic acid, can experience price fluctuations and supply shortages, potentially affecting production costs and pricing stability. Additionally, the industry faces regulatory pressures and environmental concerns, urging businesses to reduce their carbon footprint. This presents a challenge for isostearic acid producers. Despite its unique properties, the market penetration of isostearic acid may face limitations due to the availability of alternative substances for various applications. Regional disparities in awareness and market fragmentation can also impede growth. Overcoming these restraints necessitates strategic adjustments by industry players, collectively influencing the trajectory of the global isostearic acid market. Challenges have arisen, affecting manufacturing costs and the reliability of feedstock supply due to price fluctuations and supply shortages of raw materials, particularly castor oil, a primary source of isostearic acid. Stringent regulations related to sustainability and environmental issues have introduced additional complexities, urging the industry to adopt eco-friendly production methods, often at a considerable cost. The mounting competition from bio-based substitutes, such as synthetic fatty acids and other alternatives, necessitates that isostearic acid manufacturers adhere to stringent quality and environmental standards to align with consumer preferences for sustainable and renewable products. The market's complexity has intensified due to global economic uncertainties and trade disruptions, potentially impacting the industry. Surge in consumer awareness regarding eco-friendly products has amplified opportunities in the Isostearic Acid Market The global isostearic acid industry continues to be driven by pivotal factors that offer promising opportunities. The surge in consumer awareness regarding eco-friendly products has amplified the demand for bio-based compounds like isostearic acid, particularly due to its renewable sourcing from plant oils. The personal care and cosmetics sector, a major driver, relies on isostearic acid for creating lotions, lipsticks, and skincare products, and the demand for innovative, environmentally friendly cosmetics continues to rise. Isostearic acid's exceptional oxidative stability has unlocked opportunities in the lubricants and grease industry, especially in high-performance industrial applications. Anticipated cost reductions, resulting from advancements in production technology and expanded manufacturing capabilities, are poised to enhance market competitiveness. The emphasis on research and development to expand the applications of isostearic acid across various sectors, including pharmaceuticals and food additives, presents new prospects in the global isostearic acid market.Isostearic Acid Market Segment Analysis

Application: The Isostearic Acid market exhibits a versatile array of applications, spanning diverse sectors. Notably, its role within the personal care and cosmetics industry is paramount. Isostearic acid is prized for its exceptional moisturizing capabilities and its ability to enhance the texture of various cosmetic products. As an essential emollient and binder, it plays a pivotal role in the formulation of skincare products, lipsticks, and a variety of other cosmetics. Furthermore, its versatility extends to the realm of lubricants and greases. Within this sector, isostearic acid assumes a critical role in improving the performance and durability of both automotive and industrial lubricants. Beyond these applications, isostearic acid also contributes significantly to the production of esters used in aroma compounds and serves as an intermediary in the synthesis of specialty chemicals. The extensive and diverse range of applications underscores the exceptional versatility of isostearic acid, rendering it invaluable across a spectrum of global industries. This multifaceted utility not only contributes to the Isostearic Acid Market Growth but also aligns seamlessly with the ongoing Isostearic Acid Market Trends. End-User: The global Isostearic Acid market is intricately divided by end-users, each sector playing a vital role in its overall demand and utilization. Notably, the personal care and cosmetics industry stands as a cornerstone, owing to the emollient and binding properties of isostearic acid. In this sector, isostearic acid is widely embraced for its role in the formulation of lipsticks, lotions, and creams, where it enhances both texture and performance. Moving into the lubricant industry, isostearic acid assumes a foundational role, especially within high-performance applications. Its contributions are pivotal in the development of specialty lubricants, thus underpinning the sector's efficiency. Additionally, isostearic acid extends its influence to the manufacturing of various compounds, establishing itself as a vital component within the chemical intermediates market. Beyond these sectors, the food industry also finds utility in isostearic acid, employing it for a range of purposes, including its role as a food additive. The collective impact of these diverse end-user markets substantially influences the overall demand for isostearic acid, thus playing a pivotal role in propelling Isostearic Acid Market Growth. These dynamics closely align with the ongoing Isostearic Acid Market Trends, showcasing the adaptability and broad appeal of isostearic acid across various industries.Isostearic Acid Market Regional Analysis

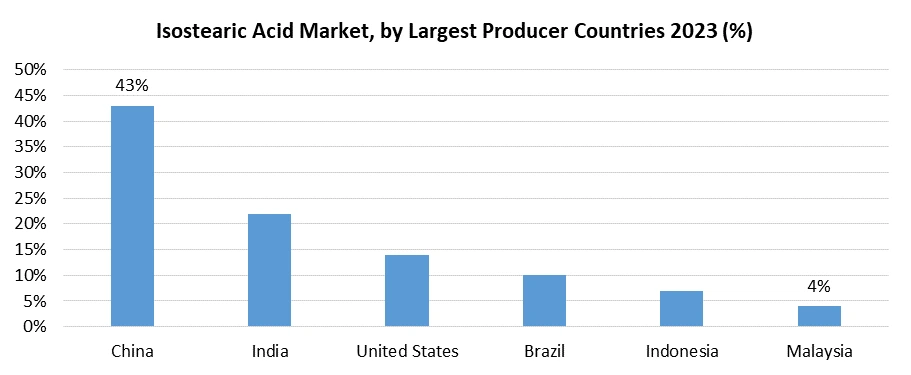

Europe asserts its dominance in the global Isostearic Acid Market, commanding a substantial market share. The driving force behind this strong presence is Europe's thriving cosmetics and personal care market, where isostearic acid plays a pivotal role. This versatile compound is an essential ingredient in a wide array of products, including creams, lotions, and lipsticks, within the flourishing European cosmetics and personal care industry. Furthermore, Europe's unwavering commitment to sustainability and strict adherence to environmental regulations have propelled the utilization of bio-based and eco-friendly chemicals, further enhancing the significance of isostearic acid in this region. This not only aligns with Isostearic Acid Market Growth but also resonates with the ongoing Isostearic Acid Market Trends. The influence of North America on the global Market is undeniable, with the United States at the forefront of this impact. The region boasts a well-established cosmetics and personal care industry, serving as a substantial driver of demand for isostearic acid. This demand is primarily underpinned by the emollient qualities of isostearic acid, rendering it a highly sought-after ingredient in skincare, lipsticks, and hair care formulations. North America's strong affinity for cosmetic applications of isostearic acid is a prominent factor contributing to its robust presence in the Isostearic Acid Market. These factors align with prevailing Market Trends, reinforcing the consistent bolstering of Isostearic Acid Production. The Asia-Pacific region emerges as a noteworthy contender in the global Isostearic Acid Market, showcasing significant demand for isostearic acid. This surge is powered by the region's rapidly expanding consumer base and burgeoning industrial sector. Isostearic acid has found versatile applications across diverse industries, including cosmetics, lubricants, and detergents, with countries like China and India actively incorporating it into their manufacturing processes. The dynamic growth of the industrial landscape in the Asia-Pacific region has further intensified the utilization of isostearic acid, establishing it as a vital component in various sectors and propelling Isostearic Acid Market Growth, in harmony with evolving Market Trends.

Isostearic Acid Market Competitive Landscape

Croda International Plc, a significant player in the Isostearic Acid Market, has demonstrated a strong commitment to research and development endeavors. Their goal has been to diversify their product range to meet the ever-evolving demands of various industries, making their mark on Isostearic Acid Production. To solidify their market presence, Croda International Plc has strategically formed alliances, participated in mergers, and engaged in acquisitions. Oleon NV, a prominent player in the Isostearic Acid Market, has placed a strong focus on research and development initiatives. Their aim has been to diversify their product offerings and adapt to the ever-changing needs of various industries, thereby contributing significantly to Isostearic Acid Production. The company has adeptly utilized strategic alliances, mergers, and acquisitions to enhance its market positioning. The market's increasing demand for environmentally friendly and sustainable products has been pivotal in shaping Oleon NV's strategy, propelling them to innovate with novel isostearic acid derivatives that resonate with the market's evolving trends in Applications of Isostearic Acid. Nissan Chemical Corporation has established itself as a substantial presence in the Market through its strong focus on research and development activities. Their efforts have been directed towards expanding their product range and adapting to the dynamic requirements of various industries, thus significantly contributing to Isostearic Acid Production. The company has strategically employed alliances, mergers, and acquisitions to consolidate its market presence. Nissan Chemical Corporation's dedication to creating environmentally friendly and sustainable products has led to the development of innovative isostearic acid derivatives that align with the market's increasing emphasis on sustainability in Applications of Isostearic Acid. Emery Oleochemicals is a notable participant in the Market, actively engaging in research and development activities. Their primary goal has been to diversify their product offerings to cater to the evolving needs of various industries, thus contributing to Isostearic Acid Production. Emery Oleochemicals has effectively harnessed strategic alliances, mergers, and acquisitions to fortify their market positions. In response to the surging market demand for environmentally friendly and sustainable products, the company has been committed to innovating with novel isostearic acid derivatives, solidifying their role in the transformation of Applications of Isostearic Acid in line with the growing emphasis on sustainability.Global Isostearic Acid Market Market Scope: Inquire before buying

Global Isostearic Acid Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 272.44 Mn. Forecast Period 2024 to 2030 CAGR: 7.1% Market Size in 2030: US $ 440.35 Mn. Segments Covered: by Application Chemical Esters Lubricants and Greases Food Additive Pigment Enhancer Detergents Others by End-User Personal Care Home Care Food & Beverages Pharmaceutical Automotive Textile Isostearic Acid Market , by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Croda International Plc 2. KOKYU ALCOHOL KOGYO CO., LTD. 3. Oleon NV 4. Nissan Chemical Corporation 5. Emery Oleochemicals 6. Jarchem Innovative Ingredients LLC 7. KLK EMMERICH GmbH 8. Santa Cruz Biotechnology, Inc. 9. Vantage Specialty Chemicals 10. Foreverest Resources Ltd. 11. SysKem Chemie GmbH 12. KRATON CORPORATION Frequently Asked Questions 1. What are the key drivers for the growth of the Isostearic Acid Market? Ans: The market is driven by the increasing demand for eco-friendly products and the versatility of isostearic acid in meeting sustainability goals. 2. Which regions have a significant presence in the Market? Ans: Europe, North America, and the Asia-Pacific region are noteworthy contributors to the global Market. 3. What are the major trends in the Market? Ans: Current trends include the rising demand for green chemicals, expanding applications in personal care products, and increasing industrial uses. 4. Who are some key players in the Market? Ans: Notable companies like Croda International Plc, KOKYU ALCOHOL KOGYO CO., LTD., Oleon NV, Nissan Chemical Corporation, and Emery Oleochemicals are significant players driving the market. 5. What are the distribution channels in the Market? Ans: Companies stay competitive by expanding product offerings, forming strategic alliances, mergers, acquisitions, and innovating with derivatives in response to market demands.

1. Isostearic Acid Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Isostearic Acid Market: Dynamics 2.1. Isostearic Acid Market Trends by Region 2.1.1. North America Isostearic Acid Market Trends 2.1.2. Europe Isostearic Acid Market Trends 2.1.3. Asia Pacific Isostearic Acid Market Trends 2.1.4. Middle East and Africa Isostearic Acid Market Trends 2.1.5. South America Isostearic Acid Market Trends 2.2. Isostearic Acid Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Isostearic Acid Market Drivers 2.2.1.2. North America Isostearic Acid Market Restraints 2.2.1.3. North America Isostearic Acid Market Opportunities 2.2.1.4. North America Isostearic Acid Market Challenges 2.2.2. Europe 2.2.2.1. Europe Isostearic Acid Market Drivers 2.2.2.2. Europe Isostearic Acid Market Restraints 2.2.2.3. Europe Isostearic Acid Market Opportunities 2.2.2.4. Europe Isostearic Acid Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Isostearic Acid Market Drivers 2.2.3.2. Asia Pacific Isostearic Acid Market Restraints 2.2.3.3. Asia Pacific Isostearic Acid Market Opportunities 2.2.3.4. Asia Pacific Isostearic Acid Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Isostearic Acid Market Drivers 2.2.4.2. Middle East and Africa Isostearic Acid Market Restraints 2.2.4.3. Middle East and Africa Isostearic Acid Market Opportunities 2.2.4.4. Middle East and Africa Isostearic Acid Market Challenges 2.2.5. South America 2.2.5.1. South America Isostearic Acid Market Drivers 2.2.5.2. South America Isostearic Acid Market Restraints 2.2.5.3. South America Isostearic Acid Market Opportunities 2.2.5.4. South America Isostearic Acid Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Isostearic Acid Industry 2.8. Analysis of Government Schemes and Initiatives For Isostearic Acid Industry 2.9. Isostearic Acid Market Trade Analysis 2.10. The Global Pandemic Impact on Isostearic Acid Market 3. Isostearic Acid Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Isostearic Acid Market Size and Forecast, by Application (2023-2030) 3.1.1. Chemical Esters 3.1.2. Lubricants and Greases 3.1.3. Food Additive 3.1.4. Pigment Enhancer 3.1.5. Detergents 3.1.6. Others 3.2. Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 3.2.1. Personal Care 3.2.2. Home Care 3.2.3. Food & Beverages 3.2.4. Pharmaceutical 3.2.5. Automotive 3.2.6. Textile 3.3. Isostearic Acid Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Isostearic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Isostearic Acid Market Size and Forecast, by Application (2023-2030) 4.1.1. Chemical Esters 4.1.2. Lubricants and Greases 4.1.3. Food Additive 4.1.4. Pigment Enhancer 4.1.5. Detergents 4.1.6. Others 4.2. North America Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 4.2.1. Personal Care 4.2.2. Home Care 4.2.3. Food & Beverages 4.2.4. Pharmaceutical 4.2.5. Automotive 4.2.6. Textile 4.3. North America Isostearic Acid Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Isostearic Acid Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Chemical Esters 4.3.1.1.2. Lubricants and Greases 4.3.1.1.3. Food Additive 4.3.1.1.4. Pigment Enhancer 4.3.1.1.5. Detergents 4.3.1.1.6. Others 4.3.1.2. United States Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 4.3.1.2.1. Personal Care 4.3.1.2.2. Home Care 4.3.1.2.3. Food & Beverages 4.3.1.2.4. Pharmaceutical 4.3.1.2.5. Automotive 4.3.1.2.6. Textile 4.3.2. Canada 4.3.2.1. Canada Isostearic Acid Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Chemical Esters 4.3.2.1.2. Lubricants and Greases 4.3.2.1.3. Food Additive 4.3.2.1.4. Pigment Enhancer 4.3.2.1.5. Detergents 4.3.2.1.6. Others 4.3.2.2. Canada Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 4.3.2.2.1. Personal Care 4.3.2.2.2. Home Care 4.3.2.2.3. Food & Beverages 4.3.2.2.4. Pharmaceutical 4.3.2.2.5. Automotive 4.3.2.2.6. Textile 4.3.3. Mexico 4.3.3.1. Mexico Isostearic Acid Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Chemical Esters 4.3.3.1.2. Lubricants and Greases 4.3.3.1.3. Food Additive 4.3.3.1.4. Pigment Enhancer 4.3.3.1.5. Detergents 4.3.3.1.6. Others 4.3.3.2. Mexico Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 4.3.3.2.1. Personal Care 4.3.3.2.2. Home Care 4.3.3.2.3. Food & Beverages 4.3.3.2.4. Pharmaceutical 4.3.3.2.5. Automotive 4.3.3.2.6. Textile 5. Europe Isostearic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.2. Europe Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3. Europe Isostearic Acid Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.2. France 5.3.2.1. France Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Isostearic Acid Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Isostearic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3. Asia Pacific Isostearic Acid Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.4. India 6.3.4.1. India Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Isostearic Acid Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Isostearic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Isostearic Acid Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 7.3. Middle East and Africa Isostearic Acid Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Isostearic Acid Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Isostearic Acid Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Isostearic Acid Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Isostearic Acid Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 8. South America Isostearic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Isostearic Acid Market Size and Forecast, by Application (2023-2030) 8.2. South America Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 8.3. South America Isostearic Acid Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Isostearic Acid Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Isostearic Acid Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Isostearic Acid Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Isostearic Acid Market Size and Forecast, by End-User (2023-2030) 9. Global Isostearic Acid Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Isostearic Acid Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Croda International Plc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. KOKYU ALCOHOL KOGYO CO., LTD. 10.3. Oleon NV 10.4. Nissan Chemical Corporation 10.5. Emery Oleochemicals 10.6. Jarchem Innovative Ingredients LLC 10.7. KLK EMMERICH GmbH 10.8. Santa Cruz Biotechnology, Inc. 10.9. Vantage Specialty Chemicals 10.10. Foreverest Resources Ltd. 10.11. SysKem Chemie GmbH 10.12. KRATON CORPORATION 11. Key Findings 12. Industry Recommendations 13. Isostearic Acid Market: Research Methodology 14. Terms and Glossary