The Integrated Microwave Assembly Market size was valued at USD 1.9 Billion in 2023 and the total Integrated Microwave Assembly revenue is expected to grow at a CAGR of 6.9% from 2024 to 2030, reaching nearly USD 3.03 Billion in 2030.Integrated Microwave Assembly Market Overview

The MMR Inclusive Report on the Integrated Microwave Assembly Market covers the analysis of the market, defining its scope and objectives to furnish stakeholders with actionable insights. The report aims to find insights from the IMA market analysis and provides a brief review of current market trends, drivers, challenges, and opportunities to help in informed decision-making. The industry has various advantageous investment opportunities, particularly in the development of new and improved Integrated Microwave Assembly (IMA) designs that are distinguished by greater performance and smaller size. Also, investments in manufacturing facilities capable of handling complex and tiny assemblies are quite promising. Opportunities also exist for the development of test and measurement equipment specifically designed for IMAs to meet the market's changing needs. Additionally, services that include IMA design, prototyping, and testing offer profitable investment opportunities, which is indicative of the growing need for all-inclusive solutions and support within the IMA ecosystem. These investment opportunities illustrate the dynamic and developing nature of the IMA industry.To know about the Research Methodology :- Request Free Sample Report Technological advancement increases shrinking, new technology integration, and improved performance in the integrated microwave assembly sector. The growing number of 5G networks and the increase in data consumption are driving up demand for high-speed connectivity. Emerging economies are seeing growth driven by rising disposable income and rapid technological adoption. Also, a greater focus on defense and security encourages government investment in modern military equipment. These factors contribute to a dynamic market landscape, highlighting the importance of innovation, rising connectivity needs, growing economies in developing regions, and prioritizing defense capabilities in propelling the integrated microwave assembly sector ahead.

Integrated Microwave Assembly Market Dynamics

Increasing Demand for Compact and Lightweight Solutions The miniaturization of IMAs is a crucial response to the ever-growing demand for compact and lightweight electronic devices across various industries. Aerospace, defense, telecommunications, and automobile industries require electronics that are smaller, lighter, and more portable. In aerospace, downsized IMAs support smaller satellites and drones, while portable communication systems benefit defense. Telecommunications require tiny components for denser 5G networks, whereas automotive relies on downsized electronics for ADAS and self-driving automobiles. It miniaturization trend is enabled by technological advancements in material science, such as gallium nitride (GaN), fabrication techniques such as micromachining and 3D printing, and integration methods such as System-on-a-Package (SoP), which facilitate the development of lighter and more efficient electronic components for a variety of applications. With rising demand, manufacturers compete for market share by producing smaller, lighter, and more efficient IMAs. Miniaturization provides the path for novel applications such as wearable electronics and Internet of Things devices, increasing the reach of Integrated Microwave Assemblies into new sectors amidst increased competition. According to MMR estimation, In 2023 Researchers at MIT revealed an ultra-miniature GaN amplifier 10 times smaller than conventional models, showcasing continuous progress in miniaturization technology.Growing Demand for Wireless Communication Systems The Integrated Microwave Assembly (IMA) market is expected to grow thanks to rising demand for wireless communication systems. The need is being driven by the proliferation of connected devices, including smartphones, with global shipments expected to reach 1.4 billion units in 2024, and an IoT boom, with an estimated 27 billion connected devices by 2025. The introduction of 5G technology increases demand for advanced microwave components. IMAs provide a solution by combining many components into a compact unit, which improves performance, efficiency, and reliability over discrete components, addressing the needs of applications such as autonomous vehicles and linked factories. The Integrated Microwave Assembly (IMA) market forecasts rising demand for certain types such as as amplifiers and filters, which are required for signal amplification and filtering. IMAs designed for 5G frequencies are especially highly after. Emerging industries including driverless vehicles and smart cities are going to generate further potential for IMAs.

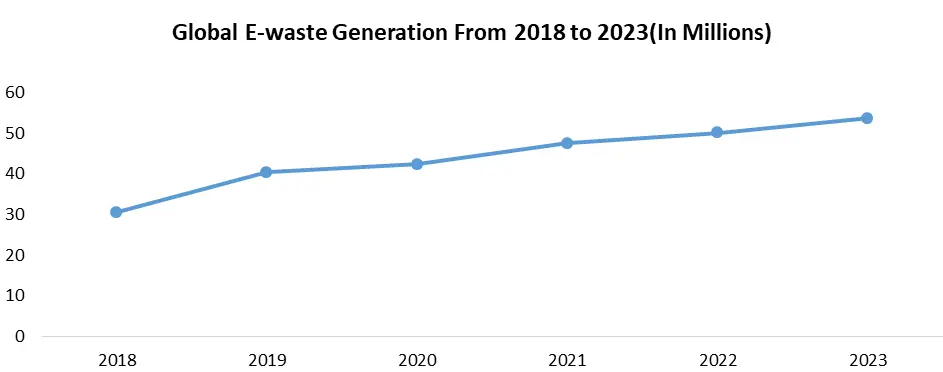

Balancing Sustainability and Performance in the IMA Market Environmental awareness and concerns about climate change and resource depletion are driving up demand for sustainable products. RoHS and WEEE rules prohibit the use of hazardous compounds and require electronic equipment to be managed responsibly at the end of its life. In addition, customer attitudes are evolving toward environmentally friendly solutions, with sustainability emerging as a key purchasing determinant. This trend underscores the importance for businesses to promote environmental sustainability in their product offerings to comply with regulatory obligations and meet changing consumer expectations. Replacing traditional materials with sustainable alternatives frequently raises production costs, causing financial hurdles for enterprises. Also, the transition to sustainable materials demands design changes to overcome potential performance differences with conventional choices. It demonstrates the significance of ongoing innovation and investment in research and development (R&D) to create Integrated Microwave Assemblies (IMAs) that combine sustainability, performance, and regulatory compliance. Despite these hurdles, prioritizing sustainability is going to be a unique selling factor, appealing to environmentally concerned consumers while also delivering a competitive advantage in the market.

The Integrated Microwave Assembly Market Regional Insights

North America maintains its dominance in the Integrated Microwave Assembly (IMA) market, accounting for over 45% of the worldwide share as of 2023. The dominance is driven by a variety of variables. To begin with, the region is home to key industry firms such as TE Connectivity, Qorvo, and Northrop Grumman, all of which contribute to its strong presence. Second, important industries such as aerospace and defense, telecommunications, and automotive have a strong demand for high-performance IMAs, which is driving market growth. Ultimately, government assistance through financing and activities targeted at encouraging microwave technologies strengthens the North American IMA market, reinforcing its dominant position in the industry. The increase in 5G network implementation drives up demand for small, high-frequency Integrated Microwave Assemblies (IMAs) in base stations and mobile devices. In addition, rising geopolitical tensions and military modernization projects are driving the demand for sophisticated IMAs in military electronics. Moreover, there is an increasing focus on sustainability in the business, with producers shifting to eco-friendly materials and procedures to comply with legislation and fulfill changing consumer expectations. The complicated market landscape highlights the essential function of IMAs in enabling technical developments while also addressing environmental and geopolitical issues. In 2023, the U.S. Department of Defense allocated USD XX billion for microwave technology research. Government initiatives such as the National Institute of Standards and Technology (NIST) and the Air Force Research Laboratory (AFRL) bolster research and development in advanced microwave technologies, including Integrated Microwave Assemblies (IMAs). Additionally, Canada's Strategic Innovation Fund (SIF) offers financial support for projects focusing on innovative technologies, including those about IMAs, reflecting a concerted effort to increase technological advancement and innovation in the region. The United States dominates the North American Integrated Microwave Assembly (IMA) market, owing to its strong industrial base, the presence of key industry players, and significant government investment for R&D. Initiatives including the National Institute of Standards and Technology (NIST) and the Air Force Research Laboratory (AFRL) demonstrate the government's commitment to advanced microwave technology, including IMAs. Meanwhile, Canada's Strategic Innovation Fund (SIF) funds programs that create breakthrough technologies, including those applicable to IMAs. The United States retains its supremacy in the region thanks to its strong industrial base, large R&D investments, and broad demand across numerous industries.The Integrated Microwave Assembly Market Segment Analysis

By Product, the Amplifiers segment accounts for an estimated 35% of the overall Integrated Microwave Assembly. The growing demand for high data rates and long transmission distances drives demand for amplifiers, which are crucial in satisfying these requirements by amplifying weak signals from antennas to assure long-term data transfer with minimal deterioration. Additionally, amplifiers improve signal intensity before transmission, allowing for faster data speeds in communication systems, as well as increasing radar signals for longer detection ranges and improved target identification. Manufacturers are responding to the trend of miniaturization by designing compact, lightweight amplifiers for portable and space-constrained electronic gadgets. Also, technical advancements including Gallium Nitride (GaN) transistors drive market growth by offering more efficient and strong amplification options. The amplifier segment of the IMA market is positioned for long-term growth, driven by continuing demand for higher data rates and longer communication ranges in a variety of applications. Simultaneously, the tendency toward shrinking drives the development of compact and effective amplifiers to fulfill changing needs. Advancements in amplifier technology, exploiting materials such as GaN, improve performance and efficiency, moving the market forward. Also, there is a growing focus on sustainability, spurring the creation of eco-friendly amplifier designs to address environmental issues. These converging elements help to drive the amplifier segment's progress and growth in the IMA market.The Integrated Microwave Assembly Market Competitive landscape The US-based company Analog Devices Inc. provides a wide range of IMAs to the automotive, telecommunications, aerospace, and defense industries. Recent products include the Hittite HMC9192 GaN amplifier for 5G base stations and the Hittite HMC9128 mixer for millimeter-wave applications. Qorvo Inc. (US) is a leader in RF solutions, including IMAs for radar, communication systems, and test equipment. Their most recent releases include the QTM78001 GaN on GaN power amplifier for satellite communications and the QTM369 surface-mount mixer for 5G applications. Teledyne Technologies Inc. (US) provides a comprehensive IMA portfolio for aerospace, defense, and commercial applications, including the Microwave Solutions 95A700000000 GaAs MMIC amplifier for SATCOM and the Microwave Solutions 91A541000000 GaAs MMIC mixer for defense applications. The competitive landscape, driven by ongoing creativity and significant investments from key players, supports market growth in the Integrated Microwave Assembly (IMA) industry. Competition drives advances in technology, leading to more efficient and compact IMAs. It also encourages the diversification of product offerings to satisfy the needs of emergent applications. Cost reduction attempts and increased price competitiveness exacerbate market dynamics. The constantly changing atmosphere not only offers opportunities to established players but also encourages newcomers. Ultimately, this competition benefits both the market and users by driving growth while promoting the widespread adoption of advanced technologies.

The Integrated Microwave Assembly Market Scope : Inquire Before Buying

Global Integrated Microwave Assembly Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.9 Bn. Forecast Period 2024 to 2030 CAGR: 6.9% Market Size in 2030: US $ 3.03 Bn. Segments Covered: by Product Amplifiers Filters Mixers Oscillators Switches by Frequency Ku-Band X-Band Ka-Band S-Band C-Band by Vertical Military & Defense Communication Avionics The Integrated Microwave Assembly Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Integrated Microwave Assembly Market

1. Integrated Microwave Corporation 2. Analog Devices 3. Qorvo 4. CAES 5. APITech 6. Narda-MITEQ 7. Teledyne Technologies 8. MACOM 9. CPI International 10. National Instruments 11. NXP Semiconductors 12. Thales Group (France) 13. Rohde & Schwarz 14. Teledyne Microwave Solutions 15. Hitachi Metals 16. Sumitomo Electric Industries 17. Skyworks Solutions 18. Cdiweb 19. Erzia 20. Anritsu 21. Livemint 22. Micros FAQs: 1. How does miniaturization impact the IMA market? Ans. Miniaturization enables the development of smaller, lighter, and more efficient IMAs, which are increasingly in demand for portable electronic devices, space-constrained applications, and applications requiring high-density integration. 2. What are the challenges faced by the IMA market? Ans. Challenges include cost pressures associated with developing compact and efficient IMAs, performance trade-offs when using new materials or miniaturized designs, regulatory compliance requirements such as RoHS and WEEE, and the need for continuous innovation to stay competitive. 3. What is the projected market size & and growth rate of the Integrated Microwave Assembly Market? Ans. The Integrated Microwave Assembly Market size was valued at USD 1.9 Billion in 2023 and the total Integrated Microwave Assembly revenue is expected to grow at a CAGR of 6.9% from 2023 to 2030, reaching nearly USD 3.03 Billion in 2030. 4. What segments are covered in the Integrated Microwave Assembly Market report? Ans. The segments covered in the Integrated Microwave Assembly market report are Product, Frequency, and Vertical.

1. Integrated Microwave Assembly Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Integrated Microwave Assembly Market: Dynamics 2.1. Integrated Microwave Assembly Market Trends by Region 2.1.1. North America Integrated Microwave Assembly Market Trends 2.1.2. Europe Integrated Microwave Assembly Market Trends 2.1.3. Asia Pacific Integrated Microwave Assembly Market Trends 2.1.4. Middle East and Africa Integrated Microwave Assembly Market Trends 2.1.5. South America Integrated Microwave Assembly Market Trends 2.2. Integrated Microwave Assembly Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Integrated Microwave Assembly Market Drivers 2.2.1.2. North America Integrated Microwave Assembly Market Restraints 2.2.1.3. North America Integrated Microwave Assembly Market Opportunities 2.2.1.4. North America Integrated Microwave Assembly Market Challenges 2.2.2. Europe 2.2.2.1. Europe Integrated Microwave Assembly Market Drivers 2.2.2.2. Europe Integrated Microwave Assembly Market Restraints 2.2.2.3. Europe Integrated Microwave Assembly Market Opportunities 2.2.2.4. Europe Integrated Microwave Assembly Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Integrated Microwave Assembly Market Drivers 2.2.3.2. Asia Pacific Integrated Microwave Assembly Market Restraints 2.2.3.3. Asia Pacific Integrated Microwave Assembly Market Opportunities 2.2.3.4. Asia Pacific Integrated Microwave Assembly Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Integrated Microwave Assembly Market Drivers 2.2.4.2. Middle East and Africa Integrated Microwave Assembly Market Restraints 2.2.4.3. Middle East and Africa Integrated Microwave Assembly Market Opportunities 2.2.4.4. Middle East and Africa Integrated Microwave Assembly Market Challenges 2.2.5. South America 2.2.5.1. South America Integrated Microwave Assembly Market Drivers 2.2.5.2. South America Integrated Microwave Assembly Market Restraints 2.2.5.3. South America Integrated Microwave Assembly Market Opportunities 2.2.5.4. South America Integrated Microwave Assembly Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Integrated Microwave Assembly Industry 2.8. Analysis of Government Schemes and Initiatives For Integrated Microwave Assembly Industry 2.9. Integrated Microwave Assembly Market Trade Analysis 2.10. The Global Pandemic Impact on Integrated Microwave Assembly Market 3. Integrated Microwave Assembly Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 3.1.1. Amplifiers 3.1.2. Filters 3.1.3. Mixers 3.1.4. Oscillators 3.1.5. Switches 3.2. Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 3.2.1. Ku-Band 3.2.2. X-Band 3.2.3. Ka-Band 3.2.4. S-Band 3.2.5. C-Band 3.3. Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 3.3.1. Military & Defense 3.3.2. Communication 3.3.3. Avionics 3.4. Integrated Microwave Assembly Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Integrated Microwave Assembly Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 4.1.1. Amplifiers 4.1.2. Filters 4.1.3. Mixers 4.1.4. Oscillators 4.1.5. Switches 4.2. North America Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 4.2.1. Ku-Band 4.2.2. X-Band 4.2.3. Ka-Band 4.2.4. S-Band 4.2.5. C-Band 4.3. North America Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 4.3.1. Military & Defense 4.3.2. Communication 4.3.3. Avionics 4.4. North America Integrated Microwave Assembly Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Amplifiers 4.4.1.1.2. Filters 4.4.1.1.3. Mixers 4.4.1.1.4. Oscillators 4.4.1.1.5. Switches 4.4.1.2. United States Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 4.4.1.2.1. Ku-Band 4.4.1.2.2. X-Band 4.4.1.2.3. Ka-Band 4.4.1.2.4. S-Band 4.4.1.2.5. C-Band 4.4.1.3. United States Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 4.4.1.3.1. Military & Defense 4.4.1.3.2. Communication 4.4.1.3.3. Avionics 4.4.2. Canada 4.4.2.1. Canada Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Amplifiers 4.4.2.1.2. Filters 4.4.2.1.3. Mixers 4.4.2.1.4. Oscillators 4.4.2.1.5. Switches 4.4.2.2. Canada Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 4.4.2.2.1. Ku-Band 4.4.2.2.2. X-Band 4.4.2.2.3. Ka-Band 4.4.2.2.4. S-Band 4.4.2.2.5. C-Band 4.4.2.3. Canada Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 4.4.2.3.1. Military & Defense 4.4.2.3.2. Communication 4.4.2.3.3. Avionics 4.4.3. Mexico 4.4.3.1. Mexico Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Amplifiers 4.4.3.1.2. Filters 4.4.3.1.3. Mixers 4.4.3.1.4. Oscillators 4.4.3.1.5. Switches 4.4.3.2. Mexico Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 4.4.3.2.1. Ku-Band 4.4.3.2.2. X-Band 4.4.3.2.3. Ka-Band 4.4.3.2.4. S-Band 4.4.3.2.5. C-Band 4.4.3.3. Mexico Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 4.4.3.3.1. Military & Defense 4.4.3.3.2. Communication 4.4.3.3.3. Avionics 5. Europe Integrated Microwave Assembly Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.2. Europe Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.3. Europe Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4. Europe Integrated Microwave Assembly Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.1.3. United Kingdom Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.2. France 5.4.2.1. France Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.2.3. France Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.3.3. Germany Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.4.3. Italy Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.5.3. Spain Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.6.3. Sweden Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.7.3. Austria Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 5.4.8.3. Rest of Europe Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6. Asia Pacific Integrated Microwave Assembly Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.3. Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4. Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.1.3. China Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.2.3. S Korea Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.3.3. Japan Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.4. India 6.4.4.1. India Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.4.3. India Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.5.3. Australia Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.6.3. Indonesia Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.7.3. Malaysia Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.8.3. Vietnam Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.9.3. Taiwan Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 6.4.10.3. Rest of Asia Pacific Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 7. Middle East and Africa Integrated Microwave Assembly Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 7.3. Middle East and Africa Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 7.4. Middle East and Africa Integrated Microwave Assembly Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 7.4.1.3. South Africa Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 7.4.2.3. GCC Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 7.4.3.3. Nigeria Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 7.4.4.3. Rest of ME&A Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 8. South America Integrated Microwave Assembly Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 8.2. South America Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 8.3. South America Integrated Microwave Assembly Market Size and Forecast, by Vertical(2023-2030) 8.4. South America Integrated Microwave Assembly Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 8.4.1.3. Brazil Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 8.4.2.3. Argentina Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Integrated Microwave Assembly Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Integrated Microwave Assembly Market Size and Forecast, by Frequency (2023-2030) 8.4.3.3. Rest Of South America Integrated Microwave Assembly Market Size and Forecast, by Vertical (2023-2030) 9. Global Integrated Microwave Assembly Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Integrated Microwave Assembly Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Integrated Microwave Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Analog Devices 10.3. Qorvo 10.4. CAES 10.5. APITech 10.6. Narda-MITEQ 10.7. Teledyne Technologies 10.8. MACOM 10.9. CPI International 10.10. National Instruments 10.11. NXP Semiconductors 10.12. Thales Group (France) 10.13. Rohde & Schwarz 10.14. Teledyne Microwave Solutions 10.15. Hitachi Metals 10.16. Sumitomo Electric Industries 10.17. Skyworks Solutions 10.18. Cdiweb 10.19. Erzia 10.20. Anritsu 10.21. Livemint 10.22. Micros 11. Key Findings 12. Industry Recommendations 13. Integrated Microwave Assembly Market: Research Methodology 14. Terms and Glossary