The Global Insurance Brokerage Market was valued at USD 75.24 billion in 2022 & is expected to grow to USD 104.22 billion by 2029, representing a compound annual growth rate (CAGR) of 5.2% during the forecast period.Insurance Brokerage Market Overview

The insurance brokerage market is a large and expanding sector of the insurance industry. This company serves as a mediator between insurance companies and clients, simplifying the intricate insurance industry for both individuals and businesses. The insurance brokerage market is growing due to factors like increased awareness of insurance products, regulatory changes and the need for risk management. Insurance brokers provide various services to clients. Services offered: risk assessment, policy selection, policy administration, claims assistance and risk management consulting. Insurance brokers provide customised insurance solutions from multiple providers by closely collaborating with their clients to comprehend their specific insurance requirements. Brokers differentiate themselves by offering personalised coverage that meets customer needs. The insurance brokerage market has different segments based on various factors. Geographically, the market is segmented into North America, Europe, Asia Pacific and Rest of the World. Insurance brokers have specialisations in property and casualty, life and health, or reinsurance. Insurance brokers cater to both personal and commercial customers. The insurance brokerage market is highly competitive, with many players competing for market share at the local, regional and global levels. Top brokerage firms are Marsh & McLennan, Aon, Willis Towers Watson, Arthur J. Gallagher and Brown & Brown Insurance. The market is changing due to the rise of online insurance marketplaces and insurtech firms. Digital platforms offer customers easy access to compare and buy insurance policies, creating new competition for traditional brokers. Insurance brokers follow specific regulations in each country or region. Meeting licencing and compliance requirements is necessary to ensure consumer protection, transparency and ethical conduct in the industry. Regulations maintain insurance brokerage market integrity and safeguard customer interests. Tech and digitalization are changing insurance brokerage. Brokers are using technology to improve their operations and customer experience. Online and mobile platforms allow customers to easily access insurance quotes, policy details and claims processing. Brokers are utilising data analytics, artificial intelligence and automation to enhance efficiency and offer customised insurance solutions based on individual risk profiles. Emerging trends are shaping the insurance brokerage market. Insurtech startups are disrupting traditional brokerage practises with innovative technologies and business models. Startups use digital platforms and advanced analytics to offer efficient and user-friendly insurance solutions. ESG considerations are increasingly important. Brokers aid clients in evaluating and handling ESG risks, ensuring that their insurance coverage is in line with sustainable and responsible business practises.To know about the Research Methodology :- Request Free Sample Report

Insurance Brokerage Market Report Scope

The report assesses the current state and historical growth of the insurance brokerage market in terms of market size and growth. This analyses market trends, data and forecasts to determine growth trajectory over the forecast period. The analysis helps stakeholders grasp the market's size and potential for growth. The report analyses market segmentation of the insurance brokerage industry, considering factors like geography, insurance type and target customers. The report analyses each segment in detail, covering market share, growth rate and key drivers and challenges unique to each segment. Segmentation analysis aids stakeholders in identifying opportunities and customizing strategies to target specific market segments. The report provides a detailed summary of key players in the insurance brokerage market, focusing on the competitive landscape. The report analyses major players in the market, including their market share, business strategies, product offerings and recent updates. The analysis helps stakeholders understand market competition and find opportunities for collaboration or acquisition. The report includes information on the regulatory environment for insurance brokers. This report analyses the licensing and compliance requirements for insurance brokers and discusses the effects of regulatory changes on the industry. Market participants need this data to comply with regulations and keep up with changes. The report analyses the market dynamics of the insurance brokerage industry, including factors that drive growth, limit growth, present opportunities and pose challenges. This research examines market trends, customer preferences, technology advancements and macroeconomic factors to comprehend market dynamics and their influence on the industry. The report offers market insights and future trends for the insurance brokerage industry. Identifying emerging trends, technological advancements and market disruptions that will shape the market in the future. The analysis informs stakeholders for future growth opportunities. The report assesses the insurance brokerage market in key regions including North America, Europe, Asia Pacific and Rest of the World. Evaluates market size, growth potential and major players in every region. Regional analysis aids stakeholders in comprehending regional dynamics and recognizing growth prospects in particular markets. The report assesses the COVID-19 impact on the insurance brokerage market. This study examines the pandemic's impact on market growth, customer behaviour and industry trends in both the short and long term. The analysis helps stakeholders create strategies to deal with challenges and take advantage of opportunities caused by the pandemic.Insurance Brokerage Market Dynamics

Market dynamics significantly impact the insurance brokerage industry, shaping its direction and influencing the behaviour of market participants. Several key elements drive, define and challenge the market dynamics in the insurance brokerage sector. These include market drivers, trends, opportunities, threats and challenges. One of the primary market drivers is the increasing awareness and demand for insurance coverage and risk management. As individuals and businesses become more conscious of the potential risks they face, there is a growing recognition of the value that insurance brokers bring in providing expert advice and tailored insurance solutions. Regulatory changes also play a vital role in driving the need for insurance brokers. Evolving regulations in the insurance industry create compliance requirements and consumer protection measures. This creates opportunities for brokers to navigate the complex regulatory landscape on behalf of their clients and provide the necessary expertise in ensuring compliance and appropriate coverage. The complexity of insurance products is another driver for the insurance brokerage market. Insurance policies often have intricate terms, coverage options and exclusions that require expert guidance. Insurance brokers help clients understand these complexities, enabling them to make informed decisions about their insurance coverage. The increasing emphasis on effective risk management strategies by businesses contributes to the demand for insurance brokerage services. Insurance brokers play a crucial role in assessing risks, identifying suitable coverage options and providing risk management consulting services to their clients. Several trends are shaping the insurance brokerage market. The digital transformation is revolutionizing the industry, with online platforms, mobile apps and insurtech solutions streamlining processes and enhancing customer experience. Brokers are leveraging data analytics and artificial intelligence to analyse customer data, assess risks and personalize insurance solutions, leading to more accurate underwriting, pricing models and claims management.

Insurance Brokerage Market Regional Analysis

North America has a highly competitive insurance brokerage market with major firms dominating the industry. The insurance industry is well-established in the region, with high awareness of insurance products and strong regulatory frameworks. North American insurance brokers provide diverse services to meet various customer needs. The insurance brokerage market in Europe is mature and values professionalism and regulatory compliance. UK, Germany and France are key drivers of market growth. The European market is defined by strict regulations, diverse insurance options and knowledgeable customers. Regional insurance brokers offer specialised expertise and customised solutions. Asia Pacific's insurance brokerage market is growing rapidly due to higher disposable income, urbanisation and greater awareness of insurance. The region's key markets include China, Japan, India and Australia. Asia-Pacific offers opportunities and challenges due to varying customer preferences and regulations. Regional insurance brokers customise services to meet the unique needs of various customer segments. Emerging market for insurance brokerage services in South America. Insurance penetration in the region is on the rise due to economic growth, expanding middle-class populations and increased awareness of insurance. Brazil has a notable number of insurance brokers. Latin American market encounters regulatory complexities and economic volatility. Insurance brokers face challenges while meeting the increasing demand for insurance products. Middle East & Africa insurance brokerage market shows stable growth. Factors like insurance awareness, regulatory reforms and infrastructure development drive market growth. UAE, South Africa and Kenya are important players in the regional market. Market conditions in the Middle East and Africa differ by country due to varying regulations and market development. Insurance brokers in this area should adjust their strategies to the market conditions and take advantage of opportunities.Insurance Brokerage Market Segment Analysis

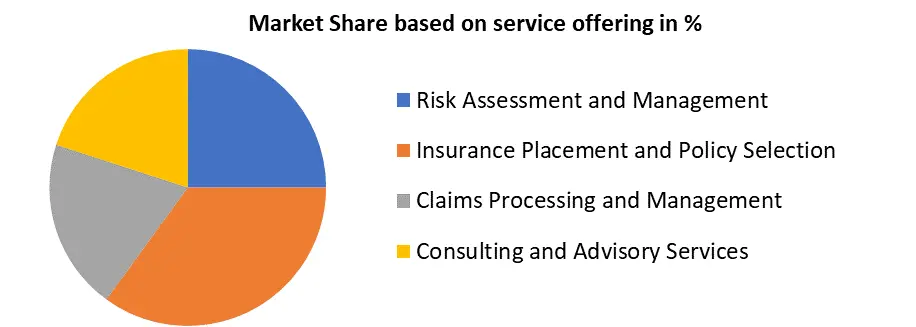

In terms of product type, the insurance brokerage market encompasses property and casualty insurance, life and health insurance and specialty insurance. Property and Casualty insurance covers property damage and liability risks, like commercial property and general liability insurance. Life and health insurance products cover life, health and medical needs, such as life, health and disability insurance. Specialty insurance caters to niche markets and specific risks, such as cyber insurance and professional indemnity insurance. Insurance brokers specializing in these segments offer tailored solutions and industry-specific expertise to their clients. The distribution channel is another important segment of the insurance brokerage market. Retail brokerage focuses on serving individual consumers and small businesses directly. Retail insurance brokers provide personalized advice, compare policies from multiple insurers and assist clients with policy selection and claims processing. On the other hand, wholesale and reinsurance brokerage acts as intermediaries between insurance carriers and retail brokers. Wholesale brokers facilitate the placement of complex or high-value risks with insurance carriers, while reinsurance brokers help insurance companies transfer a portion of their risk to other insurers through reinsurance arrangements. When considering the customer segment, insurance brokers cater to individuals and families, small and medium-sized enterprises (SMEs) and large corporations and institutions. Insurance brokers serving individuals and families help clients secure coverage for personal assets, life, health and other personal risks. For SMEs, insurance brokers play a crucial role in providing comprehensive coverage for businesses, including property, liability and specialized insurance needs. Insurance brokers serving large corporations and institutions offer risk management consulting, customized insurance programs and assistance in managing complex insurance portfolios. Segmenting the insurance brokerage market based on product type, distribution channel and customer segment allows insurance brokers to specialize their services and cater to specific needs. By focusing on specific product types, brokers can develop expertise and provide tailored solutions to their clients. Understanding the different distribution channels helps brokers optimize their operations and reach their target customers effectively. Moreover, identifying specific customer segments allows brokers to provide personalized services, industry-specific knowledge and efficient insurance solutions.Insurance Brokerage Market Competitive Landscape

The insurance brokerage market features a competitive landscape characterized by the presence of various players, including global insurance brokerage firms, regional and national brokers, niche specialists and insurtech companies. These companies compete to gain market share, attract clients and offer specialized industry expertise. At the global level, major insurance brokerage firms like Aon, Marsh & McLennan Companies and Willis Towers Watson dominate the market. These multinational companies have a significant presence across multiple regions and countries. Leveraging their global reach, extensive resources and diverse expertise, they offer comprehensive insurance and risk management services to clients worldwide. In addition to global players, regional and national brokerage firms play a crucial role in the competitive landscape. These companies operate within specific geographic regions or countries, enabling them to possess in-depth knowledge of local insurance markets, regulations and customer preferences. With strong relationships with regional insurers and a deep understanding of the local business landscape, regional brokers like Hub International, Brown & Brown and Gallagher provide personalized services and establish strong connections within their respective regions. Niche specialists are another important component of the competitive landscape. These insurance brokerage firms specialize in specific industry sectors or types of insurance. By focusing on niche markets, such as specialty risks, employee benefits, or reinsurance, firms like JLT Specialty, Lockton and Ed Broking offer highly specialized services and industry-specific expertise to their clients. Their deep understanding of the unique risks and requirements within their niches allows them to provide tailored advice and insurance solutions.The advent of technology in the insurance industry has led to the emergence of insurtech companies in the brokerage space. These companies leverage innovative technologies, such as artificial intelligence, data analytics and digital platforms, to disrupt traditional insurance brokerage models. Insurtech firms like Policygenius, Oscar Insurance and Lemonade focus on enhancing the customer experience, streamlining insurance processes and providing digital tools for insurance purchasing and management. The competitive landscape in the insurance brokerage market is shaped by factors such as the breadth and depth of insurance offerings, industry expertise, customer relationships, global reach, technological capabilities and the ability to provide tailored solutions. To remain competitive, insurance brokerage firms continuously adapt to changing market dynamics and customer demands. They invest in tech, talent and partnerships to improve services and stand out from rivals. Mergers and acquisitions are important for companies to expand their market presence, gain synergies and access new markets and capabilities.

Insurance Brokerage Market Scope: Inquire before buying

Insurance Brokerage Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 75.24 Bn. Forecast Period 2023 to 2029 CAGR: 5.2% Market Size in 2029: US $ 104.22 Bn. Segments Covered: by Product Type Property and Casualty Insurance Life and Health Insurance Specialty Insurance by Distribution Channel Retail Brokerage Wholesale and Reinsurance Brokerage by Customer Segment Individuals and Families Small and Medium-sized Enterprises (SMEs) Large Corporations and Institutions by Industry Vertical Healthcare Manufacturing Construction Financial Services Retail by Service Offering Risk Assessment and Management Insurance Placement and Policy Selection Claims Processing and Management Consulting and Advisory Services by Insurance Coverage Property Insurance Liability Insurance Workers' Compensation Insurance Professional Liability Insurance Employee Benefits Insurance Insurance Brokerage Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argetina and Rest of South America)Company Profile: Insurance Brokerage Key players

The captured list of leading manufacturers of Insurance Brokerage industry has been compiled after an analysis of multiple factors. It is not an exhaustive list based only on market share ranking. After a regional analysis, a competitive analysis and other such considerations, the company profiles were selected based on a variety of factors. The comprehensive report contains information on the position of each company in the market from a local and global perspective. North America: Aon plc (United States) Marsh & McLennan Companies, Inc. (United States) Willis Towers Watson (United States) Arthur J. Gallagher & Co. (United States) Hub International Ltd. (United States) Brown & Brown, Inc. (United States) Lockton Companies, LLC (United States) Gallagher Bassett Services, Inc. (United States) Integro Insurance Brokers (United States) USI Insurance Services LLC (United States) The Hylant Group (United States) AssuredPartners, Inc. (United States) Oswald Companies (United States) Europe: Jardine Lloyd Thompson Group Ltd. (United Kingdom) Ed Broking Group Ltd. (United Kingdom) BMS Group Ltd. (United Kingdom) JLT Specialty Limited (United Kingdom) Bluefin Insurance Services Limited (United Kingdom) Middle East and Africa: Al Futtaim Willis (UAE) Howden Insurance Brokers (South Africa) Alexander Forbes Group Holdings Limited (South Africa) AJG International B.V. (South Africa) Griffiths & Armour (South Africa)FAQs

Q: What is driving the growth of the insurance brokerage market? A: Factors such as increasing awareness about the importance of insurance, evolving regulatory frameworks, complex risk landscapes and the need for specialized insurance expertise are driving the growth of the insurance brokerage market. Q: What are the key services provided by insurance brokers? A: Insurance brokers provide a range of services including risk assessment, policy placement, claims assistance, policy management, risk consulting and advisory services. Q: How do insurance brokers generate revenue? A: Insurance brokers typically earn commissions from insurance providers for placing policies on behalf of clients. They may also charge service fees or receive contingent commissions based on the performance of the placed policies. Q: What are the advantages of using insurance brokers? A: Insurance brokers offer several advantages, including access to a wide range of insurance products from multiple providers, unbiased advice, personalized service, claims assistance and expertise in navigating complex insurance markets. Q: What are the main challenges faced by insurance brokers? A: Insurance brokers face challenges such as increasing competition, regulatory compliance, technology disruption, cybersecurity risks, client retention and the need to stay updated with evolving insurance products and market trends. Q: How is technology impacting the insurance brokerage market? A: Technology is playing a transformative role in the insurance brokerage market. Insurtech innovations are streamlining processes, enhancing customer experiences, enabling digital interactions and providing data analytics tools for risk assessment and management. Q: What are the trends shaping the insurance brokerage market? A: Key trends include the rise of insurtech startups, the increasing demand for specialized insurance solutions, the adoption of digital platforms for insurance purchasing and management, the emphasis on personalized customer experiences and the integration of data analytics for risk assessment.

1. Insurance Brokerage Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Insurance Brokerage Market: Dynamics 2.1. Insurance Brokerage Market Trends by Region 2.1.1. North America Insurance Brokerage Market Trends 2.1.2. Europe Insurance Brokerage Market Trends 2.1.3. Asia Pacific Insurance Brokerage Market Trends 2.1.4. Middle East and Africa Insurance Brokerage Market Trends 2.1.5. South America Insurance Brokerage Market Trends 2.2. Insurance Brokerage Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Insurance Brokerage Market Drivers 2.2.1.2. North America Insurance Brokerage Market Restraints 2.2.1.3. North America Insurance Brokerage Market Opportunities 2.2.1.4. North America Insurance Brokerage Market Challenges 2.2.2. Europe 2.2.2.1. Europe Insurance Brokerage Market Drivers 2.2.2.2. Europe Insurance Brokerage Market Restraints 2.2.2.3. Europe Insurance Brokerage Market Opportunities 2.2.2.4. Europe Insurance Brokerage Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Insurance Brokerage Market Drivers 2.2.3.2. Asia Pacific Insurance Brokerage Market Restraints 2.2.3.3. Asia Pacific Insurance Brokerage Market Opportunities 2.2.3.4. Asia Pacific Insurance Brokerage Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Insurance Brokerage Market Drivers 2.2.4.2. Middle East and Africa Insurance Brokerage Market Restraints 2.2.4.3. Middle East and Africa Insurance Brokerage Market Opportunities 2.2.4.4. Middle East and Africa Insurance Brokerage Market Challenges 2.2.5. South America 2.2.5.1. South America Insurance Brokerage Market Drivers 2.2.5.2. South America Insurance Brokerage Market Restraints 2.2.5.3. South America Insurance Brokerage Market Opportunities 2.2.5.4. South America Insurance Brokerage Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Insurance Brokerage Industry 2.8. Analysis of Government Schemes and Initiatives For Insurance Brokerage Industry 2.9. Insurance Brokerage Market Trade Analysis 2.10. The Global Pandemic Impact on Insurance Brokerage Market 3. Insurance Brokerage Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 3.1.1. Property and Casualty Insurance 3.1.2. Life and Health Insurance 3.1.3. Specialty Insurance 3.2. Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 3.2.1. Retail Brokerage 3.2.2. Wholesale and Reinsurance Brokerage 3.3. Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 3.3.1. Individuals and Families 3.3.2. Small and Medium-sized Enterprises (SMEs) 3.3.3. Large Corporations and Institutions 3.4. Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 3.4.1. Healthcare 3.4.2. Manufacturing 3.4.3. Construction 3.4.4. Financial Services 3.4.5. Retail 3.5. Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 3.5.1. Risk Assessment and Management 3.5.2. Insurance Placement and Policy Selection 3.5.3. Claims Processing and Management 3.5.4. Consulting and Advisory Services 3.6. Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 3.6.1. Property Insurance 3.6.2. Liability Insurance 3.6.3. Workers' Compensation Insurance 3.6.4. Professional Liability Insurance 3.6.5. Employee Benefits Insurance 3.7. Insurance Brokerage Market Size and Forecast, by Region (2022-2029) 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 4. North America Insurance Brokerage Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Property and Casualty Insurance 4.1.2. Life and Health Insurance 4.1.3. Specialty Insurance 4.2. North America Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 4.2.1. Retail Brokerage 4.2.2. Wholesale and Reinsurance Brokerage 4.3. North America Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 4.3.1. Individuals and Families 4.3.2. Small and Medium-sized Enterprises (SMEs) 4.3.3. Large Corporations and Institutions 4.4. North America Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 4.4.1. Healthcare 4.4.2. Manufacturing 4.4.3. Construction 4.4.4. Financial Services 4.4.5. Retail 4.5. North America Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 4.5.1. Risk Assessment and Management 4.5.2. Insurance Placement and Policy Selection 4.5.3. Claims Processing and Management 4.5.4. Consulting and Advisory Services 4.6. North America Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 4.6.1. Property Insurance 4.6.2. Liability Insurance 4.6.3. Workers' Compensation Insurance 4.6.4. Professional Liability Insurance 4.6.5. Employee Benefits Insurance 4.7. North America Insurance Brokerage Market Size and Forecast, by Country (2022-2029) 4.7.1. United States 4.7.1.1. United States Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 4.7.1.1.1. Property and Casualty Insurance 4.7.1.1.2. Life and Health Insurance 4.7.1.1.3. Specialty Insurance 4.7.1.2. United States Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 4.7.1.2.1. Retail Brokerage 4.7.1.2.2. Wholesale and Reinsurance Brokerage 4.7.1.3. United States Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 4.7.1.3.1. Individuals and Families 4.7.1.3.2. Small and Medium-sized Enterprises (SMEs) 4.7.1.3.3. Large Corporations and Institutions 4.7.1.4. United States Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 4.7.1.4.1. Healthcare 4.7.1.4.2. Manufacturing 4.7.1.4.3. Construction 4.7.1.4.4. Financial Services 4.7.1.4.5. Retail 4.7.1.5. United States Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 4.7.1.5.1. Risk Assessment and Management 4.7.1.5.2. Insurance Placement and Policy Selection 4.7.1.5.3. Claims Processing and Management 4.7.1.5.4. Consulting and Advisory Services 4.7.1.6. United States Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 4.7.1.6.1. Property Insurance 4.7.1.6.2. Liability Insurance 4.7.1.6.3. Workers' Compensation Insurance 4.7.1.6.4. Professional Liability Insurance 4.7.1.6.5. Employee Benefits Insurance 4.7.2. Canada 4.7.2.1. Canada Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 4.7.2.1.1. Property and Casualty Insurance 4.7.2.1.2. Life and Health Insurance 4.7.2.1.3. Specialty Insurance 4.7.2.2. Canada Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 4.7.2.2.1. Retail Brokerage 4.7.2.2.2. Wholesale and Reinsurance Brokerage 4.7.2.3. Canada Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 4.7.2.3.1. Individuals and Families 4.7.2.3.2. Small and Medium-sized Enterprises (SMEs) 4.7.2.3.3. Large Corporations and Institutions 4.7.2.4. Canada Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 4.7.2.4.1. Healthcare 4.7.2.4.2. Manufacturing 4.7.2.4.3. Construction 4.7.2.4.4. Financial Services 4.7.2.4.5. Retail 4.7.2.5. Canada Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 4.7.2.5.1. Risk Assessment and Management 4.7.2.5.2. Insurance Placement and Policy Selection 4.7.2.5.3. Claims Processing and Management 4.7.2.5.4. Consulting and Advisory Services 4.7.2.6. Canada Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 4.7.2.6.1. Property Insurance 4.7.2.6.2. Liability Insurance 4.7.2.6.3. Workers' Compensation Insurance 4.7.2.6.4. Professional Liability Insurance 4.7.2.6.5. Employee Benefits Insurance 4.7.3. Mexico 4.7.3.1. Mexico Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 4.7.3.1.1. Property and Casualty Insurance 4.7.3.1.2. Life and Health Insurance 4.7.3.1.3. Specialty Insurance 4.7.3.2. Mexico Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 4.7.3.2.1. Retail Brokerage 4.7.3.2.2. Wholesale and Reinsurance Brokerage 4.7.3.3. Mexico Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 4.7.3.3.1. Individuals and Families 4.7.3.3.2. Small and Medium-sized Enterprises (SMEs) 4.7.3.3.3. Large Corporations and Institutions 4.7.3.4. Mexico Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 4.7.3.4.1. Healthcare 4.7.3.4.2. Manufacturing 4.7.3.4.3. Construction 4.7.3.4.4. Financial Services 4.7.3.4.5. Retail 4.7.3.5. Mexico Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 4.7.3.5.1. Risk Assessment and Management 4.7.3.5.2. Insurance Placement and Policy Selection 4.7.3.5.3. Claims Processing and Management 4.7.3.5.4. Consulting and Advisory Services 4.7.3.6. Mexico Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 4.7.3.6.1. Property Insurance 4.7.3.6.2. Liability Insurance 4.7.3.6.3. Workers' Compensation Insurance 4.7.3.6.4. Professional Liability Insurance 4.7.3.6.5. Employee Benefits Insurance 5. Europe Insurance Brokerage Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.2. Europe Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.3. Europe Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 5.4. Europe Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.5. Europe Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.6. Europe Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7. Europe Insurance Brokerage Market Size and Forecast, by Country (2022-2029) 5.7.1. United Kingdom 5.7.1.1. United Kingdom Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.1.2. United Kingdom Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.1.3. United Kingdom Insurance Brokerage Market Size and Forecast, by Customer Segment(2022-2029) 5.7.1.4. United Kingdom Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.1.5. United Kingdom Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.1.6. United Kingdom Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.2. France 5.7.2.1. France Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.2.2. France Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.2.3. France Insurance Brokerage Market Size and Forecast, by Customer Segment(2022-2029) 5.7.2.4. France Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.2.5. France Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.2.6. France Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.3. Germany 5.7.3.1. Germany Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.3.2. Germany Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.3.3. Germany Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 5.7.3.4. Germany Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.3.5. Germany Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.3.6. Germany Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.4. Italy 5.7.4.1. Italy Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.4.2. Italy Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.4.3. Italy Insurance Brokerage Market Size and Forecast, by Customer Segment(2022-2029) 5.7.4.4. Italy Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.4.5. Italy Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.4.6. Italy Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.5. Spain 5.7.5.1. Spain Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.5.2. Spain Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.5.3. Spain Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 5.7.5.4. Spain Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.5.5. Spain Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.5.6. Spain Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.6. Sweden 5.7.6.1. Sweden Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.6.2. Sweden Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.6.3. Sweden Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 5.7.6.4. Sweden Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.6.5. Sweden Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.6.6. Sweden Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.7. Austria 5.7.7.1. Austria Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.7.2. Austria Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.7.3. Austria Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 5.7.7.4. Austria Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.7.5. Austria Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.7.6. Austria Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 5.7.8. Rest of Europe 5.7.8.1. Rest of Europe Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 5.7.8.2. Rest of Europe Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 5.7.8.3. Rest of Europe Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 5.7.8.4. Rest of Europe Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 5.7.8.5. Rest of Europe Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 5.7.8.6. Rest of Europe Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6. Asia Pacific Insurance Brokerage Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.2. Asia Pacific Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.3. Asia Pacific Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.4. Asia Pacific Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.5. Asia Pacific Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.6. Asia Pacific Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7. Asia Pacific Insurance Brokerage Market Size and Forecast, by Country (2022-2029) 6.7.1. China 6.7.1.1. China Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.1.2. China Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.1.3. China Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.1.4. China Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.1.5. China Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.1.6. China Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.2. S Korea 6.7.2.1. S Korea Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.2.2. S Korea Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.2.3. S Korea Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.2.4. S Korea Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.2.5. S Korea Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.2.6. S Korea Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.3. Japan 6.7.3.1. Japan Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.3.2. Japan Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.3.3. Japan Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.3.4. Japan Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.3.5. Japan Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.3.6. Japan Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.4. India 6.7.4.1. India Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.4.2. India Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.4.3. India Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.4.4. India Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.4.5. India Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.4.6. India Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.5. Australia 6.7.5.1. Australia Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.5.2. Australia Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.5.3. Australia Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.5.4. Australia Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.5.5. Australia Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.5.6. Australia Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.6. Indonesia 6.7.6.1. Indonesia Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.6.2. Indonesia Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.6.3. Indonesia Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.6.4. Indonesia Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.6.5. Indonesia Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.6.6. Indonesia Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.7. Malaysia 6.7.7.1. Malaysia Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.7.2. Malaysia Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.7.3. Malaysia Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.7.4. Malaysia Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.7.5. Malaysia Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.7.6. Malaysia Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.8. Vietnam 6.7.8.1. Vietnam Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.8.2. Vietnam Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.8.3. Vietnam Insurance Brokerage Market Size and Forecast, by Customer Segment(2022-2029) 6.7.8.4. Vietnam Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.8.5. Vietnam Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.8.6. Vietnam Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.9. Taiwan 6.7.9.1. Taiwan Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.9.2. Taiwan Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.9.3. Taiwan Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.9.4. Taiwan Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.9.5. Taiwan Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.9.6. Taiwan Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 6.7.10. Rest of Asia Pacific 6.7.10.1. Rest of Asia Pacific Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 6.7.10.2. Rest of Asia Pacific Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 6.7.10.3. Rest of Asia Pacific Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 6.7.10.4. Rest of Asia Pacific Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 6.7.10.5. Rest of Asia Pacific Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 6.7.10.6. Rest of Asia Pacific Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 7. Middle East and Africa Insurance Brokerage Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 7.2. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 7.3. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 7.4. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 7.5. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 7.6. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 7.7. Middle East and Africa Insurance Brokerage Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.7.1.1. South Africa Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 7.7.1.2. South Africa Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 7.7.1.3. South Africa Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 7.7.1.4. South Africa Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 7.7.1.5. South Africa Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 7.7.1.6. South Africa Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 7.7.2. GCC 7.7.2.1. GCC Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 7.7.2.2. GCC Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 7.7.2.3. GCC Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 7.7.2.4. GCC Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 7.7.2.5. GCC Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 7.7.2.6. GCC Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 7.7.3. Nigeria 7.7.3.1. Nigeria Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 7.7.3.2. Nigeria Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 7.7.3.3. Nigeria Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 7.7.3.4. Nigeria Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 7.7.3.5. Nigeria Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 7.7.3.6. Nigeria Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 7.7.4. Rest of ME&A 7.7.4.1. Rest of ME&A Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 7.7.4.2. Rest of ME&A Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 7.7.4.3. Rest of ME&A Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 7.7.4.4. Rest of ME&A Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 7.7.4.5. Rest of ME&A Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 7.7.4.6. Rest of ME&A Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 8. South America Insurance Brokerage Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 8.2. South America Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 8.3. South America Insurance Brokerage Market Size and Forecast, by Customer Segment(2022-2029) 8.4. South America Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 8.5. South America Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 8.6. South America Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 8.7. South America Insurance Brokerage Market Size and Forecast, by Country (2022-2029) 8.7.1. Brazil 8.7.1.1. Brazil Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 8.7.1.2. Brazil Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 8.7.1.3. Brazil Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 8.7.1.4. Brazil Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 8.7.1.5. Brazil Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 8.7.1.6. Brazil Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 8.7.2. Argentina 8.7.2.1. Argentina Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 8.7.2.2. Argentina Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 8.7.2.3. Argentina Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 8.7.2.4. Argentina Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 8.7.2.5. Argentina Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 8.7.2.6. Argentina Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 8.7.3. Rest Of South America 8.7.3.1. Rest Of South America Insurance Brokerage Market Size and Forecast, by Product Type (2022-2029) 8.7.3.2. Rest Of South America Insurance Brokerage Market Size and Forecast, by Distribution Channel (2022-2029) 8.7.3.3. Rest Of South America Insurance Brokerage Market Size and Forecast, by Customer Segment (2022-2029) 8.7.3.4. Rest Of South America Insurance Brokerage Market Size and Forecast, by Industry Vertical (2022-2029) 8.7.3.5. Rest Of South America Insurance Brokerage Market Size and Forecast, by Service Offering (2022-2029) 8.7.3.6. Rest Of South America Insurance Brokerage Market Size and Forecast, by Insurance Coverage (2022-2029) 9. Global Insurance Brokerage Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Insurance Brokerage Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Aon plc (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Marsh & McLennan Companies, Inc. (United States) 10.3. Willis Towers Watson (United States) 10.4. Arthur J. Gallagher & Co. (United States) 10.5. Hub International Ltd. (United States) 10.6. Brown & Brown, Inc. (United States) 10.7. Lockton Companies, LLC (United States) 10.8. Gallagher Bassett Services, Inc. (United States) 10.9. Integro Insurance Brokers (United States) 10.10. USI Insurance Services LLC (United States) 10.11. The Hylant Group (United States) 10.12. AssuredPartners, Inc. (United States) 10.13. Oswald Companies (United States) 10.14. Jardine Lloyd Thompson Group Ltd. (United Kingdom) 10.15. Ed Broking Group Ltd. (United Kingdom) 10.16. BMS Group Ltd. (United Kingdom) 10.17. JLT Specialty Limited (United Kingdom) 10.18. Bluefin Insurance Services Limited (United Kingdom) 10.19. Al Futtaim Willis (UAE) 10.20. Howden Insurance Brokers (South Africa) 10.21. Alexander Forbes Group Holdings Limited (South Africa) 10.22. AJG International B.V. (South Africa) 10.23. Griffiths & Armour (South Africa) 11. Key Findings 12. Industry Recommendations 13. Insurance Brokerage Market: Research Methodology 14. Terms and Glossary