The Influenza Diagnostics Market size was valued at USD 1.1 Billion in 2023 and the total Influenza Diagnostics revenue is expected to grow at a CAGR of 8 % from 2024 to 2030, reaching nearly USD 1.89 Billion in 2030.Influenza Diagnostics Market Overview

The Report of MMR covers the in-depth analysis of market dynamics, trends, challenges, opportunities, and key players. Market dynamics explore drivers, challenges, and opportunities, alongside regulatory and technological influences. The market segmentation covers test types, end users, and technologies. Regional analysis examines growth trends and influencing factors across key regions. The competitive landscape profiles major players, their strategies, and SWOT analyses. Innovative technologies are evolving with faster, more accurate, and multiplex testing that targets various influenza strains. Home-based testing solutions prioritize usability for easy self-testing. The integration of diagnostics with telehealth improves accessibility through online consultations. Broad-spectrum assays are being developed, with a focus on conserved viral sections to detect a greater range of strains. Emerging markets, particularly in poor nations with high influenza burdens, are experiencing increased access to diagnostics, indicating a global commitment to solving influenza detection and management difficulties. Innovative technologies are evolving with faster, more accurate, and multiplex testing that targets various influenza strains. Home-based testing solutions prioritize usability for easy self-testing. The integration of diagnostics with telehealth improves accessibility through online consultations. Broad-spectrum assays are being developed, with a focus on conserved viral sections to detect a greater range of strains. Emerging markets, particularly in poor nations with high influenza burdens, are experiencing increased access to diagnostics, indicating a global commitment to solving influenza detection and management difficulties. Molecular tests, particularly PCR, are highly accurate and specific, commanding a premium in the market. Emerging technologies offer innovative diagnostic approaches with distinctive features or larger applications, which have a significant profit potential. Specialty market niches, such as tests designed for certain populations, such as quick tests for youngsters, offer chances with little competition. These factors contribute to the influenza diagnostics market's dynamic landscape, which drives competitive innovation and differentiation. Rising awareness and healthcare access in developing regions are driving the influenza diagnostics market, as are continuous technological advancements and test diversification, increased adoption of home-based testing and telehealth integration, and the potential emergence of new influenza strains necessitating diagnostic updates.To know about the Research Methodology :- Request Free Sample Report Increasing Awareness and Screening Programs Public awareness programs focus on the importance of early identification and treatment for influenza, encouraging people to get tested when they become ill. As a result, the demand for diagnostic tests rises in a variety of settings, including hospitals, clinics, and home-based kits. Screening programs are regularly implemented by healthcare institutions and governments during peak seasons or for high-risk demographics. These programs provide a steady demand for diagnostic testing, which plays an important role in market growth. Market growth drives demand for various influenza diagnostic methods, including fast antigen tests, PCR tests, and serological assays. Manufacturers are innovating to accommodate this demand by developing new, faster, and more user-friendly diagnostic instruments. Market segmentation, which targets certain populations such as youngsters and the elderly, encourages the development of personalized diagnostic solutions. The ever-evolving environment promotes continual breakthroughs in influenza diagnostics, meeting the changing needs of healthcare practitioners and promoting better patient care.

Prevalence of Influenza The seasonal nature of influenza, combined with its widespread reach, presents a significant opportunity for the influenza diagnostics market. Every year, millions of people throughout the world capture influenza, showing the ongoing need for precise and early diagnostics. During peak flu seasons, demand rises, highlighting the importance of effective testing methods to handle additional cases. Early detection of influenza is critical for timely treatment, which reduces sickness severity and consequences. It also helps to adopt appropriate isolation measures to prevent transmission and informs public health activities during epidemics. Rapid and accurate diagnostic tests, therefore, play an important role in meeting these vital needs. The potential of the influenza diagnostics industry drives innovation, resulting in faster, more accurate, and user-friendly test methods such as rapid antigen tests and point-of-care molecular assays. There is a greater focus on increasing test accessibility and affordability, as well as the growth of market segments catering to certain demographics, such as home-based testing kits for children and the elderly.

1. According to MMR Studies, An estimated 290,000 to 650,000 respiratory deaths occur annually because of influenza worldwide.

2. The COVID-19 pandemic increased awareness of respiratory infections and the importance of diagnostics, potentially impacting the influenza diagnostics market as well.

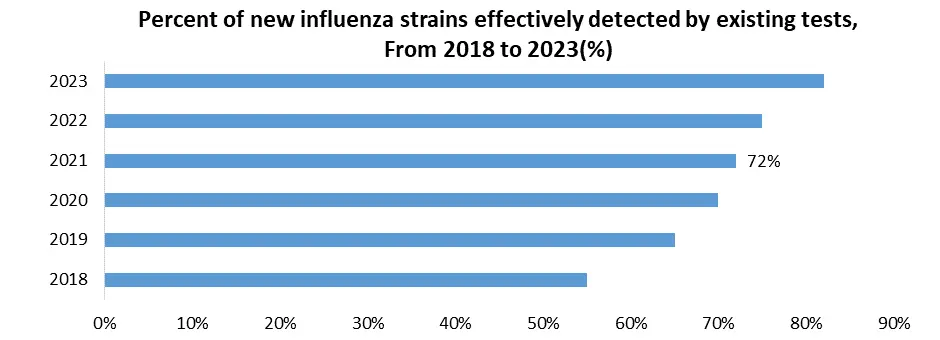

Antigenic Drift and Shift Existing diagnostic techniques fail to detect new influenza strains due to antigenic drift and shift, resulting in false negatives that cause patient diagnosis and treatment delays, as well as inaccurate data that leads to ineffective public health measures. Misdiagnosis may lead to needless antibiotic use. Continuous updates are required, which necessitates continuing monitoring of circulating strains and the invention or adjustment of tests regularly. To sustain test efficacy, manufacturers must make large R&D investments. The influenza diagnostics market confronts challenges such as market unpredictable nature due to viral mutations, increasing development costs, and regulatory barriers to new assays. Tests that fail to adjust may lose market share. However, this opens the door to new methods for detecting different strains and broad-spectrum assays that target conserved viral areas. The development of adaptive platforms enables faster reactions to new strains, increasing demand for rapid diagnostic solutions.1. From 2018 to 2023, Vaccine effectiveness was low due to a dominant strain not included in the vaccine, highlighting the challenge of antigenic drift.

2. Several companies are developing universal influenza vaccines and diagnostics targeting conserved viral regions, indicating an industry response to the challenge.

The Influenza Diagnostics Market Regional Insights

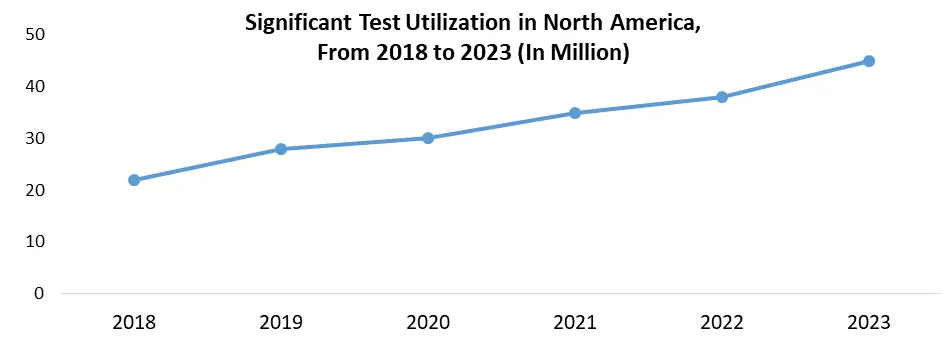

North America accounts for the largest share of the global influenza diagnostics market, estimated at 40% in 2023. The high prevalence of influenza, which affects 15% of Americans each year (CDC), drives the growth of influenza diagnostics. Increased awareness and screening programs encourage early detection. Technological advancements, such as rapid antigen tests (RATs) and point-of-care assays, provide quick and easy testing solutions. In addition, a strong healthcare infrastructure promotes the widespread use of diagnostic tools. Recent advances in influenza diagnostics include a focus on rapid and multiplex assays, which enable faster results and simultaneous identification of numerous influenza strains. Also, there is a growing tendency in home-based testing thanks to the increased availability of over-the-counter rapid antigen tests (RATs) allowing simple testing at home. Integrating diagnostic testing with telehealth platforms improves accessibility through remote consultations. In addition, there is a shift toward broad-spectrum tests that target conserved sections of the virus to detect a wider range of strains. Government initiatives play an important role in enhancing influenza diagnosis. The CDC's Influenza Division conducts surveillance, research, and public health guidelines, while the National Institutes of Health (NIH) funds influenza diagnostics and vaccine development. The Food and Drug Administration (FDA) oversees the approval and marketing of influenza diagnostic tests to ensure their safety and effectiveness. State and municipal public health agencies carry out influenza vaccine and screening programs, which help to prevent and control illness spread. The United States leads the influenza diagnostics market in North America because of its huge population, high healthcare spending, strong research and development infrastructure, and established public health programs. These characteristics contribute to the country's large market share and leadership in developing influenza diagnostic technology and efforts.• The NIH invested USD 148.8 million in influenza research in 2022.

The Influenza Diagnostics Market Segment Analysis

By Test, The Molecular Diagnostics segment accounts for an estimated 25% of the overall Influenza Diagnostics Market. PCR provides unprecedented precision in detecting influenza viruses, even new strains, hence improving patient management and public health surveillance through more trustworthy data. A timely and correct diagnosis allows for early therapeutic efforts, potentially lowering disease severity and spread. Accurate identification also minimizes the need for antiviral medications by separating influenza from other respiratory infections, reducing unnecessary antibiotic prescriptions, and reducing antibiotic resistance. The demand for faster, more accessible PCR tests fuels research and development, resulting in developments such as point-of-care PCR for rapid testing in clinics and pharmacies, which improves accessibility and turnaround times. Multiplex tests detect many respiratory viruses, including influenza, in a single test, which simplifies diagnosis and saves money. Home-based molecular tests are more convenient and may stimulate earlier testing, leading to better disease control efforts. These developments demonstrate the importance of PCR in driving innovation and improving influenza diagnosis.The Influenza Diagnostics Market Competitive Landscape

Abbott Laboratories is a key participant in influenza diagnostics, with a comprehensive range that includes fast antigen, PCR, and serological assays. Becton Dickinson and Company (BD) provides point-of-care solutions such as the BD Veritor™ fast antigen test. Roche offers molecular solutions, including the Cobas influenza A/B test. QuidelOrtho Corporation provides fast antigen and PCR tests. Siemens Healthineers offers the Atellica® IM Influenza A/B Rapid Antigen Test. Leading influenza diagnostics companies make major R&D efforts to adapt to emerging strains and develop innovative solutions, with a focus on fast and multiplex tests for complete respiratory virus identification. There is an increasing trend toward home-based testing, with investments in user-friendly, over-the-counter exams to improve accessibility. Integration with digital platforms and artificial intelligence (AI) are examples of technological breakthroughs that improve data analysis. Recently launched products include Roche's Elecsys® Xpert Flu/RSV test, BD's Veritor™ Plus System, and Quidel's QuickVue Influenza A+B by PCR RSV/Flu Combo Kit. The increase in invention increases competition, promotes product diversification, and is expected to lower prices. New technologies that are appealing to a diverse range of customer segments stimulate market growth. Companies attempt to provide tests with increased specificity, comfort, and ease of use, in response to changing consumer demands in the influenza diagnostics industry.Influenza Diagnostics Market Scope: Inquiry Before Buying

Influenza Diagnostics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.1 Bn. Forecast Period 2024 to 2030 CAGR: 8% Market Size in 2030: US $ 1.89 Bn. Segments Covered: by Test Rapid Antigen Tests Molecular Assays (PCR) Viral Culture Next-Generation Sequencing (NGS) Biosensors and Microarrays Immunofluorescence Assays by Technology Molecular Diagnostics Immunodiagnostics Next-Generation Sequencing Traditional Methods by End User Hospitals Diagnostic Laboratories Research Institutes Homecare Settings Influenza Diagnostics Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Players in the Influenza Diagnostics Market

1. Becton 2. Abbott Laboratories 3. F. Hoffmann-La Roche AG 4. Quidel Corporation 5. Hologic 6. Thermo Fisher Scientific 7. Altona Diagnostics GmbH 8. Danaher Corporation (US) 9. DiaSorin SpA (Italy) 10. Hologic Inc. (US) 11. Luminex Corporation (US) 12. Meridian Bioscience Inc. (US) 13. Sekisui Diagnostics (US) 14. bioMérieux 15. Siemens Healthineers 16. QuidelOrtho 17. Integralmolecular 18. trupcr 19. emedicine.medscape 20. Jstor 21. degruyter 22. woah.orgFAQs:

1. What are rapid antigen tests, and how do they work? Ans. Rapid antigen tests detect viral proteins in respiratory specimens, providing quick results within minutes. They are less sensitive than molecular assays but offer rapid point-of-care testing. 2. What role does viral culture play in influenza diagnostics? Ans. Viral culture involves inoculating respiratory specimens onto cell cultures to isolate and identify influenza viruses. It allows for strain characterization and antiviral susceptibility testing. 3. What is the projected market size & and growth rate of the Influenza Diagnostics Market? Ans. The Influenza Diagnostics Market size was valued at USD 1.1 Billion in 2023 and the total Influenza Diagnostics revenue is expected to grow at a CAGR of 8% from 2023 to 2030, reaching nearly USD 1.89 Billion in 2030. 4. What segments are covered in the Influenza Diagnostics Market report? Ans. The segments covered in the Influenza Diagnostics market report are Test, Technology, and End User.

1. Influenza Diagnostics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Influenza Diagnostics Market: Dynamics 2.1. Influenza Diagnostics Market Trends by Region 2.1.1. North America Influenza Diagnostics Market Trends 2.1.2. Europe Influenza Diagnostics Market Trends 2.1.3. Asia Pacific Influenza Diagnostics Market Trends 2.1.4. Middle East and Africa Influenza Diagnostics Market Trends 2.1.5. South America Influenza Diagnostics Market Trends 2.2. Influenza Diagnostics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Influenza Diagnostics Market Drivers 2.2.1.2. North America Influenza Diagnostics Market Restraints 2.2.1.3. North America Influenza Diagnostics Market Opportunities 2.2.1.4. North America Influenza Diagnostics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Influenza Diagnostics Market Drivers 2.2.2.2. Europe Influenza Diagnostics Market Restraints 2.2.2.3. Europe Influenza Diagnostics Market Opportunities 2.2.2.4. Europe Influenza Diagnostics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Influenza Diagnostics Market Drivers 2.2.3.2. Asia Pacific Influenza Diagnostics Market Restraints 2.2.3.3. Asia Pacific Influenza Diagnostics Market Opportunities 2.2.3.4. Asia Pacific Influenza Diagnostics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Influenza Diagnostics Market Drivers 2.2.4.2. Middle East and Africa Influenza Diagnostics Market Restraints 2.2.4.3. Middle East and Africa Influenza Diagnostics Market Opportunities 2.2.4.4. Middle East and Africa Influenza Diagnostics Market Challenges 2.2.5. South America 2.2.5.1. South America Influenza Diagnostics Market Drivers 2.2.5.2. South America Influenza Diagnostics Market Restraints 2.2.5.3. South America Influenza Diagnostics Market Opportunities 2.2.5.4. South America Influenza Diagnostics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Clinical Trial Analysis for Influenza Diagnostics 2.8. Key Opinion Leader Analysis For the Influenza Diagnostics Industry 2.9. Analysis of Government Schemes and Initiatives For the Influenza Diagnostics Industry 3. Influenza Diagnostics Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Billion ) (2023-2030) 3.1. Global Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 3.1.1. Rapid Antigen Tests 3.1.2. Molecular Assays (PCR) 3.1.3. Viral Culture 3.1.4. Next-Generation Sequencing (NGS) 3.1.5. Biosensors and Microarrays 3.1.6. Immunofluorescence Assays 3.2. Global Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 3.2.1. Molecular Diagnostics 3.2.2. Immunodiagnostics 3.2.3. Next-Generation Sequencing 3.2.4. Traditional Methods 3.3. Global Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospitals 3.3.2. Diagnostic Laboratories 3.3.3. Research Institutes 3.3.4. Homecare Settings 3.4. Global Influenza Diagnostics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Influenza Diagnostics Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Billion ) (2023-2030) 4.1. North America Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 4.1.1. Rapid Antigen Tests 4.1.2. Molecular Assays (PCR) 4.1.3. Viral Culture 4.1.4. Next-Generation Sequencing (NGS) 4.1.5. Biosensors and Microarrays 4.1.6. Immunofluorescence Assays 4.2. North America Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.2.1. Molecular Diagnostics 4.2.2. Immunodiagnostics 4.2.3. Next-Generation Sequencing 4.2.4. Traditional Methods 4.3. North America Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Diagnostic Laboratories 4.3.3. Research Institutes 4.3.4. Homecare Settings 4.4. United States 4.5. United States Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 4.5.1. Rapid Antigen Tests 4.5.2. Molecular Assays (PCR) 4.5.3. Viral Culture 4.5.4. Next-Generation Sequencing (NGS) 4.5.5. Biosensors and Microarrays 4.5.6. Immunofluorescence Assays 4.6. United States Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.6.1. Molecular Diagnostics 4.6.2. Immunodiagnostics 4.6.3. Next-Generation Sequencing 4.6.4. Traditional Methods 4.7. United States Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 4.7.1. Hospitals 4.7.2. Diagnostic Laboratories 4.7.3. Research Institutes 4.7.4. Homecare Settings 4.8. Canada 4.9. Canada Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 4.9.1. Rapid Antigen Tests 4.9.2. Molecular Assays (PCR) 4.9.3. Viral Culture 4.9.4. Next-Generation Sequencing (NGS) 4.9.5. Biosensors and Microarrays 4.9.6. Immunofluorescence Assays 4.10. Canada Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.10.1. Molecular Diagnostics 4.10.2. Immunodiagnostics 4.10.3. Next-Generation Sequencing 4.10.4. Traditional Methods 4.11. Canada Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 4.11.1. Hospitals 4.11.2. Diagnostic Laboratories 4.11.3. Research Institutes 4.11.4. Homecare Settings 4.12. Mexico 4.13. Mexico Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 4.13.1. Rapid Antigen Tests 4.13.2. Molecular Assays (PCR) 4.13.3. Viral Culture 4.13.4. Next-Generation Sequencing (NGS) 4.13.5. Biosensors and Microarrays 4.13.6. Immunofluorescence Assays 4.14. Mexico Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 4.14.1. Molecular Diagnostics 4.14.2. Immunodiagnostics 4.14.3. Next-Generation Sequencing 4.14.4. Traditional Methods 4.15. Mexico Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 4.15.1. Hospitals 4.15.2. Diagnostic Laboratories 4.15.3. Research Institutes 4.15.4. Homecare Settings 5. Europe Influenza Diagnostics Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Billion ) (2022-2029) 5.1. Europe Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.2. Europe Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4. Europe Influenza Diagnostics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.1.2. United Kingdom Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.1.3. United Kingdom Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.2.2. France Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.2.3. France Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.3.2. Germany Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.3.3. Germany Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.4.2. Italy Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.4.3. Italy Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.5.2. Spain Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.5.3. Spain Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.6.2. Sweden Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.6.3. Sweden Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.7.2. Austria Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.7.3. Austria Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 5.4.8.2. Rest of Europe Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 5.4.8.3. Rest of Europe Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Influenza Diagnostics Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Billion ) (2023-2030) 6.1. Asia Pacific Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.2. Asia Pacific Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Influenza Diagnostics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.1.2. China Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. China Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.2.2. S Korea Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. S Korea Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.3.2. Japan Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Japan Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.4.2. India Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. India Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.5.2. Australia Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Australia Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.6.2. Indonesia Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Indonesia Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.7.2. Malaysia Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Malaysia Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.8.2. Vietnam Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Vietnam Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.9.2. Taiwan Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.9.3. Taiwan Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 6.4.10.2. Rest of Asia Pacific Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Influenza Diagnostics Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Billion ) (2023-2030) 7.1. Middle East and Africa Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 7.2. Middle East and Africa Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 7.3.1.2. South Africa Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.3.1.3. South Africa Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 7.3.2.2. GCC Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.3.2.3. GCC Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 7.3.3. Rest of ME&A 7.3.3.1. Rest of ME&A Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 7.3.3.2. Rest of ME&A Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 7.3.3.3. Rest of ME&A Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 8. South America Influenza Diagnostics Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Billion ) (2023-2030) 8.1. South America Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 8.2. South America Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.3. South America Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 8.3.1.2. Brazil Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.3.1.3. Brazil Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 8.3.2.2. Argentina Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.3.2.3. Argentina Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest of South America Influenza Diagnostics Market Size and Forecast, by Test (2023-2030) 8.3.3.2. Rest of South America Influenza Diagnostics Market Size and Forecast, by Technology (2023-2030) 8.3.3.3. Rest of South America Influenza Diagnostics Market Size and Forecast, by End User (2023-2030) 9. Global Influenza Diagnostics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Influenza Diagnostics Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Becton 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Abbott Laboratories 10.3. F. Hoffmann-La Roche AG 10.4. Quidel Corporation 10.5. Hologic 10.6. Thermo Fisher Scientific 10.7. Altona Diagnostics GmbH 10.8. Danaher Corporation (US) 10.9. DiaSorin SpA (Italy) 10.10. Hologic Inc. (US) 10.11. Luminex Corporation (US) 10.12. Meridian Bioscience Inc. (US) 10.13. Sekisui Diagnostics (US) 10.14. bioMérieux 10.15. Siemens Healthineers 10.16. QuidelOrtho 10.17. Integralmolecular 10.18. trupcr 10.19. emedicine.medscape 10.20. Jstor 10.21. degruyter 10.22. woah.org 11. Key Findings 12. Industry Recommendations 13. Influenza Diagnostics Market: Research Methodology