Global Industrial Machinery Market size was valued at USD 621.8 Billion in 2022, and is expected to reach USD 959.94 Billion by 2029, exhibiting a CAGR of 6.4% during the forecast period (2023-2029)Industrial Machinery Market Overview

The Industrial Machinery market plays a crucial role in supporting industrial activities across the world. The industrial machinery industry is majorly undergoing a transformation with the integration of Industry 4.0 technologies. Automation, IoT, artificial intelligence, and data analytics are increasingly being embedding in machinery to enhance efficiency, productivity, and predictive maintenance capabilities. Ongoing research and development efforts are increasingly fuelling the innovation in the industrial machinery sector. A notable trend in the industry is the shift from traditional product-centric models to service-oriented models. Industrial Machinery Manufacturers are increasingly offering maintenance, repair, and upgrade services, emphasizing the importance of the entire product lifecycle.To know about the Research Methodology :- Request Free Sample Report

Industrial Machinery Market Dynamics

Growing Construction Equipment Industry driving the Industrial Machinery Market The urbanization and population growth are mainly rising the need for infrastructure development, which is fuelling the demand for construction equipment. This demand, in turn, is necessitating the production and innovation of industrial machinery to support the construction industry. The urbanization across the world is highly taking off, investments into infrastructure projects, such as the Belt and Road Initiative, from both public and private sectors. This is expected to drive push the growth of construction equipment market in the future. The construction equipment industry is highly witnessing rapid advancements in technologies, which includes the integration of telematics, IoT (Internet of Things) and automation. These innovations are mainly increasing the demand for advanced industrial machinery that keep pace with the evolving needs of construction projects.Growth Opportunity in Battery Manufacturing Equipment to drive the Industrial Machinery Market As the world is undergoing a transformative shift towards sustainable energy solutions and electric mobility, the demand for advanced and efficient battery technologies is increasing. This increase in demand is leading to an increase in need for cutting-edge battery manufacturing equipment, which is expected to drive the industrial machinery market into a new era of expansion and innovation. The increase in the production of EVs has a direct impacted on the need for high-performance batteries, which is driving the demand for sophisticated battery manufacturing equipment. Industrial machinery key players are highly capitalizing on this trend by developing advanced production lines capable of meeting the stringent quality and efficiency requirements of modern technologies of battery. Battery technologies are a key component in energy storage systems that provides grid stability and enabling the effective utilization of renewable energy. This burgeoning energy storage systems market is resulting in a parallel demand for state-of-the-art battery manufacturing equipment within the industrial machinery sector. The localization of supply chains, especially in critical sectors such as battery manufacturing, is gaining prominence. This shift is leading to an increase in demand for industrial machinery that facilitates decentralized and agile production processes, which ensure a steady and reliable supply of batteries.

High Initial Costs being a major Restraint for the Industrial Machinery Market The financial barrier poses challenges for Industrial Machinery manufacturers, businesses, and investors, impacting adoption rates, innovation, and market accessibility in several ways. The high initial costs are creating barrier to entry, especially for small and medium-sized enterprises (SMEs). These businesses, which possess innovative solutions or niche applications for industrial machinery, lack the financial capacity to compete with larger counterparts. This limits the industrial machinery market diversity and competition. The substantial upfront investment impacting profitability as some industrial machinery companies are facing extended payback periods. This delayed return on investment affecting financial metrics and limiting the ability of businesses to reinvest profits into research and development, hindering innovation.

Industrial Machinery Market Regional Insights

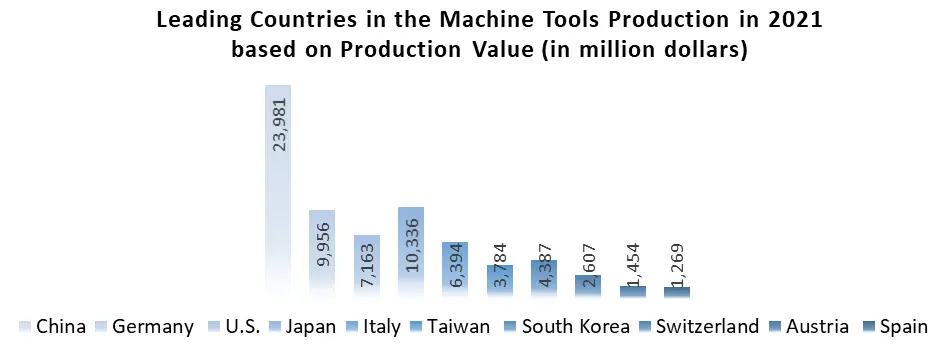

North American Industrial Machinery Market dominated the global market with the share of around 31% in 2022. The region market is a robust and diverse sector that plays a crucial role in supporting the continent's industrial activities. It encompasses a diverse portfolio of equipment, which includes machine tools, robotics, material handling equipment, packaging machinery and more. These machines mainly cater to industries such as automotive, aerospace, manufacturing and food processing in the region. Environmental consciousness is influencing technological advancements, which leads to the development of eco-friendly and energy-efficient machinery that aligns with sustainability goals. Asia Pacific Industrial Machinery Market is expected to grow rapidly during the forecast period due to the growing industries. The regional market held the share of around 24.1% in 2022. In the region, majority of the companies that specialize in battery cell manufacturing equipment are in China, Japan, and South Korea. The region is a key player in global supply chains, with industrial machinery being a main export. Trade dynamics and international collaborations mainly shape the competitiveness of the region in the global market. The growing e-commerce and logistics is contributing to the demand for material handling and automation equipment, including robotics and conveyor systems. China is emerging as a global powerhouse in manufacturing and is a key player in the machine tools production. The impact of China machine tools industry on the Asia Pacific industrial machinery market is multifaceted and significant. The country is not only the largest machine tools consumer but also a main exporter, which supplies machinery to countries across the Asia Pacific region and beyond.

Industrial Machinery Market Segment Analysis

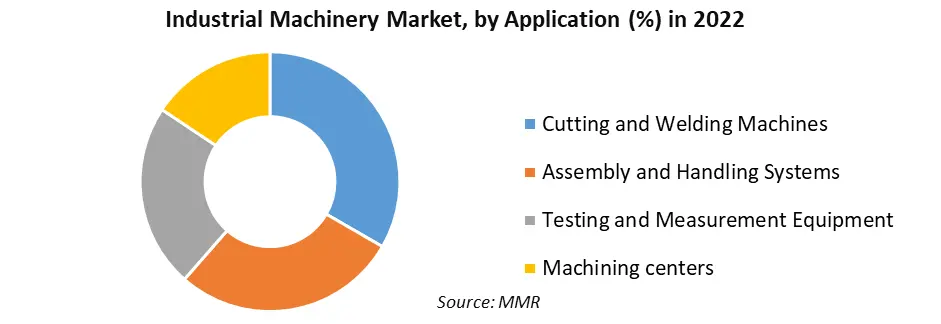

Based on Type: The market is segmented into Material Handling Equipment, Machine Tools, Packaging Machinery, Industrial Robotics, Construction Machinery and Textile Machinery. The Material Handling Equipment segment held the largest Industrial Machinery Market share of around 26% in 2022. This is because the Material handling equipment streamlines supply chain processes that enhances warehouse efficiency and reduces manual labor. With the growth of e-commerce and modern logistics, these machine. The Machine Tools segment was the second largest segment in 2022. This is because the machine tools are the backbone of manufacturing, which enables the production of intricate parts with high precision. The evolution of CNC technology has revolutionized machining processes that allows for increased efficiency and accuracy.Based on Application: The market is segmented into Cutting and Welding Machines, Assembly and Handling Systems, Testing and Measurement Equipment and Machining Centers. The Cutting and Welding Machines segment held largest Industrial Machinery Market share of around 32% in 2022. This segment is driven by the increasing demand for precision cutting and welding in industries such as aerospace, automotive, and shipbuilding. The Assembly and Handling Systems segment held the second largest market share in 2022 due to the increasing demand for automation and efficiency in manufacturing and logistics operations.

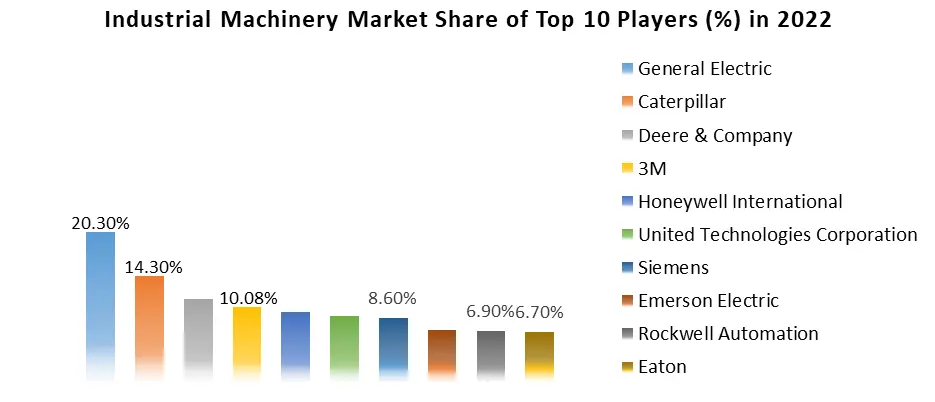

Industrial Machinery Market Competitive Landscape

As per the study, the market is highly competitive with large number of players. For companies it is challenging to establish and maintain a strong market position. Many players in the market are focusing on specialized or niche segments, becoming experts in specific types of machinery. These companies are expected to excel in areas such as CNC machines, robotics or material handling equipment. Komatsu’s Industrial Machinery division offers various industrial products such as Stamping presses, Mechanical presses, Servo presses, Forging presses and Large press system. It also offers KOMTRAX monitoring services as standard for all industrial machineries.

Industrial Machinery Market Scope: Inquiry Before Buying

Industrial Machinery Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 621.8 Bn. Forecast Period 2023 to 2029 CAGR: 6.4% Market Size in 2029: US $ 959.94 Bn. Segments Covered: by Type Material Handling Equipment Machine Tools Packaging Machinery Industrial Robotics Construction Machinery Textile Machinery by Operation Autonomous Semi- Autonomous Manual by Application Cutting and Welding Machines Assembly and Handling Systems Testing and Measurement Equipment Machining Centers by End-Use Industry Energy Construction Packaging Textiles Manufacturing Mining by Distribution Channel Offline Online Industrial Machinery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South AmericaIndustrial Machinery Key Players

1. Siemens AG (Munich, Germany) 2. General Electric (GE) (Boston, Massachusetts, USA) 3. ABB Group (Zurich, Switzerland) 4. Caterpillar Inc. (Deerfield, Illinois, USA) 5. Schneider Electric (Rueil-Malmaison, France) 6. Komatsu Ltd. (Tokyo, Japan) 7. Emerson Electric Co. (St. Louis, Missouri, USA) 8. Fanuc Corporation (Yamanashi, Japan) 9. Deere & Company (Moline, Illinois, USA) 10. Rockwell Automation (Milwaukee, Wisconsin, USA) 11. Mitsubishi Heavy Industries, Ltd (Tokyo, Japan) 12. Atlas Copco AB (Stockholm, Sweden) 13. Hitachi, Ltd. (Tokyo, Japan) 14. Honeywell International Inc (Charlotte, North Carolina, USA) 15. The Timken Company (North Canton, Ohio, USA) 16. Parker Hannifin Corporation (Cleveland, Ohio, USA) 17. Sandvik AB (Stockholm, Sweden) 18. Wärtsilä Corporation (Helsinki, Finland) 19. Yaskawa Electric Corporation (Kitakyushu, Japan) 20. JCB (J.C. Bamford Excavators Ltd.) (Rocester, Staffordshire, United Kingdom) 21. Ingersoll Rand (Davidson, North Carolina, USA) 22. ITT Inc (White Plains, New York, USA) 23. Kubota Corporation (Osaka, Japan) 24. Regal Beloit Corporation (Beloit, Wisconsin, USA) 25. 3M (St. Paul, Minnesota, USA) 26. United Technologies Corporation (Farmington, Connecticut, USA) 27. Eaton (Dublin, Ireland)Frequently Asked Questions

1] What is the expected CAGR of the Global Industrial Machinery Market during the forecast period? Ans. During the forecast period, the Global Industrial Machinery Market is expected to grow at a CAGR of 6.4 percent. 2] What was the Industrial Machinery Market size in 2022? Ans. USD 621.8 Bn was the Industrial Machinery Market size in 2022. 3] What is the expected Industrial Machinery Market size by 2029? Ans. USD 959.94 Bn is the expected Industrial Machinery Market size by 2029. 4] What are the Industrial Machinery Market segments? Ans. The market is divided by Type, Operation, Application, End-User and Distribution Channel. 5] Which region’s Industrial Machinery Market share is expected to grow at a high rate during the forecast period? Ans. Asia-Pacific region is expected grow at a rapid growth rate over the forecast period.

1. Industrial Machinery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Industrial Machinery Market: Dynamics 2.1. Industrial Machinery Market Trends by Region 2.1.1. Global Industrial Machinery Market Trends 2.1.2. North America Industrial Machinery Market Trends 2.1.3. Europe Industrial Machinery Market Trends 2.1.4. Asia Pacific Industrial Machinery Market Trends 2.1.5. Middle East and Africa Industrial Machinery Market Trends 2.1.6. South America Industrial Machinery Market Trends 2.2. Industrial Machinery Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Industrial Machinery Market Drivers 2.2.1.2. North America Industrial Machinery Market Restraints 2.2.1.3. North America Industrial Machinery Market Opportunities 2.2.1.4. North America Industrial Machinery Market Challenges 2.2.2. Europe 2.2.2.1. Europe Industrial Machinery Market Drivers 2.2.2.2. Europe Industrial Machinery Market Restraints 2.2.2.3. Europe Industrial Machinery Market Opportunities 2.2.2.4. Europe Industrial Machinery Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Industrial Machinery Market Drivers 2.2.3.2. Asia Pacific Industrial Machinery Market Restraints 2.2.3.3. Asia Pacific Industrial Machinery Market Opportunities 2.2.3.4. Asia Pacific Industrial Machinery Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Industrial Machinery Market Drivers 2.2.4.2. Middle East and Africa Industrial Machinery Market Restraints 2.2.4.3. Middle East and Africa Industrial Machinery Market Opportunities 2.2.4.4. Middle East and Africa Industrial Machinery Market Challenges 2.2.5. South America 2.2.5.1. South America Industrial Machinery Market Drivers 2.2.5.2. South America Industrial Machinery Market Restraints 2.2.5.3. South America Industrial Machinery Market Opportunities 2.2.5.4. South America Industrial Machinery Market Challenges 2.3. PORTER’s Five Price Ranges Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Import and Export Analysis 2.8. Regulatory Landscape by Region 2.8.1. Global 2.8.2. North America 2.8.3. Europe 2.8.4. Asia Pacific 2.8.5. Middle East and Africa 2.8.6. South America 2.9. Key Opinion Leader Analysis For the Industrial Machinery Industry 2.10. Analysis of Government Schemes and Initiatives For the Industrial Machinery Industry 2.11. The Global Pandemic Impact on the Industrial Machinery Market 3. Industrial Machinery Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Industrial Machinery Market Size and Forecast, by Type (2022-2029) 3.1.1. Material Handling Equipment 3.1.2. Machine Tools 3.1.3. Packaging Machinery 3.1.4. Industrial Robotics 3.1.5. Construction Machinery 3.1.6. Textile Machinery 3.2. Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 3.2.1. Autonomous 3.2.2. Semi- Autonomous 3.2.3. Manual 3.3. Industrial Machinery Market Size and Forecast, by Application (2022-2029) 3.3.1. Cutting and Welding Machines 3.3.2. Assembly and Handling Systems 3.3.3. Testing and Measurement Equipment 3.3.4. Machining Centers 3.4. Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 3.4.1. Energy 3.4.2. Construction 3.4.3. Packaging 3.4.4. Textiles 3.4.5. Manufacturing 3.4.6. Mining 3.5. Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 3.5.1. Online 3.5.2. Offline 3.6. Industrial Machinery Market Size and Forecast, by Region (2022-2029) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Industrial Machinery Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 4.1. North America Industrial Machinery Market Size and Forecast, by Type (2022-2029) 4.1.1. Material Handling Equipment 4.1.2. Machine Tools 4.1.3. Packaging Machinery 4.1.4. Industrial Robotics 4.1.5. Construction Machinery 4.1.6. Textile Machinery 4.2. North America Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 4.2.1. Autonomous 4.2.2. Semi- Autonomous 4.2.3. Manual 4.3. North America Industrial Machinery Market Size and Forecast, by Application (2022-2029) 4.3.1. Cutting and Welding Machines 4.3.2. Assembly and Handling Systems 4.3.3. Testing and Measurement Equipment 4.3.4. Machining Centers 4.4. North America Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 4.4.1. Energy 4.4.2. Construction 4.4.3. Packaging 4.4.4. Textiles 4.4.5. Manufacturing 4.4.6. Mining 4.5. North America Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1. Online 4.5.2. Offline 4.6. North America Industrial Machinery Market Size and Forecast, by Country (2022-2029) 4.6.1. United States 4.6.1.1. United States Industrial Machinery Market Size and Forecast, by Type (2022-2029) 4.6.1.1.1. Material Handling Equipment 4.6.1.1.2. Machine Tools 4.6.1.1.3. Packaging Machinery 4.6.1.1.4. Industrial Robotics 4.6.1.1.5. Construction Machinery 4.6.1.1.6. Textile Machinery 4.6.1.2. United States Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 4.6.1.2.1. Autonomous 4.6.1.2.2. Semi- Autonomous 4.6.1.2.3. Manual 4.6.1.3. United States Industrial Machinery Market Size and Forecast, by Application (2022-2029) 4.6.1.3.1. Cutting and Welding Machines 4.6.1.3.2. Assembly and Handling Systems 4.6.1.3.3. Testing and Measurement Equipment 4.6.1.3.4. Machining Centers 4.6.1.4. United States Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 4.6.1.4.1. Energy 4.6.1.4.2. Construction 4.6.1.4.3. Packaging 4.6.1.4.4. Textiles 4.6.1.4.5. Manufacturing 4.6.1.4.6. Mining 4.6.1.5. United States Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.1.5.1. Online 4.6.1.5.2. Offline 4.6.2. Canada 4.6.2.1. Canada Industrial Machinery Market Size and Forecast, by Type (2022-2029) 4.6.2.1.1. Material Handling Equipment 4.6.2.1.2. Machine Tools 4.6.2.1.3. Packaging Machinery 4.6.2.1.4. Industrial Robotics 4.6.2.1.5. Construction Machinery 4.6.2.1.6. Textile Machinery 4.6.2.2. Canada Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 4.6.2.2.1. Autonomous 4.6.2.2.2. Semi- Autonomous 4.6.2.2.3. Manual 4.6.2.3. Canada Industrial Machinery Market Size and Forecast, by Application (2022-2029) 4.6.2.3.1. Cutting and Welding Machines 4.6.2.3.2. Assembly and Handling Systems 4.6.2.3.3. Testing and Measurement Equipment 4.6.2.3.4. Machining Centers 4.6.2.4. Canada Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 4.6.2.4.1. Energy 4.6.2.4.2. Construction 4.6.2.4.3. Packaging 4.6.2.4.4. Textiles 4.6.2.4.5. Manufacturing 4.6.2.4.6. Mining 4.6.2.5. Canada Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.2.5.1. Online 4.6.2.5.2. Offline 4.6.2.6. Mexico 4.6.2.7. Mexico Industrial Machinery Market Size and Forecast, by Type (2022-2029) 4.6.2.7.1. Material Handling Equipment 4.6.2.7.2. Machine Tools 4.6.2.7.3. Packaging Machinery 4.6.2.7.4. Industrial Robotics 4.6.2.7.5. Construction Machinery 4.6.2.7.6. Textile Machinery 4.6.2.8. Mexico Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 4.6.2.8.1. Autonomous 4.6.2.8.2. Semi- Autonomous 4.6.2.8.3. Manual 4.6.2.9. Mexico Industrial Machinery Market Size and Forecast, by Application (2022-2029) 4.6.2.9.1. Cutting and Welding Machines 4.6.2.9.2. Assembly and Handling Systems 4.6.2.9.3. Testing and Measurement Equipment 4.6.2.9.4. Machining Centers 4.6.2.10. Mexico Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 4.6.2.10.1. Energy 4.6.2.10.2. Construction 4.6.2.10.3. Packaging 4.6.2.10.4. Textiles 4.6.2.10.5. Manufacturing 4.6.2.10.6. Mining 4.6.2.11. Mexico Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.2.11.1. Online 4.6.2.11.2. Offline 5. Europe Industrial Machinery Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 5.1. Europe Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.2. Europe Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.3. Europe Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.4. Europe Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.5. Europe Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6. Europe Industrial Machinery Market Size and Forecast, by Country (2022-2029) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.1.2. United Kingdom Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.1.3. United Kingdom Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.1.4. United Kingdom Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.1.5. United Kingdom Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.2. France 5.6.2.1. France Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.2.2. France Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.2.3. France Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.2.4. France Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.2.5. France Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.3. Germany 5.6.3.1. Germany Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.3.2. Germany Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.3.3. Germany Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.3.4. Germany Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.3.5. Germany Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.4. Italy 5.6.4.1. Italy Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.4.2. Italy Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.4.3. Italy Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.4.4. Italy Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.4.5. Italy Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.5. Spain 5.6.5.1. Spain Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.5.2. Spain Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.5.3. Spain Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.5.4. Spain Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.5.5. Spain Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.6. Sweden 5.6.6.1. Sweden Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.6.2. Sweden Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.6.3. Sweden Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.6.4. Sweden Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.6.5. Sweden Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.7. Austria 5.6.7.1. Austria Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.7.2. Austria Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.7.3. Austria Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.7.4. Austria Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.7.5. Austria Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Industrial Machinery Market Size and Forecast, by Type (2022-2029) 5.6.8.2. Rest of Europe Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 5.6.8.3. Rest of Europe Industrial Machinery Market Size and Forecast, by Application (2022-2029) 5.6.8.4. Rest of Europe Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.8.5. Rest of Europe Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Industrial Machinery Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 6.1. Asia Pacific Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.3. Asia Pacific Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.5. Asia Pacific Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6. Asia Pacific Industrial Machinery Market Size and Forecast, by Country (2022-2029) 6.6.1. China 6.6.1.1. China Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.1.2. China Industrial Machinery Market Size and Forecast, by Price Range (2022-2029) 6.6.1.3. China Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.1.4. China Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.1.5. China Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.1.6. China Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.2. S Korea 6.6.2.1. S Korea Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.2.2. S Korea Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.2.3. S Korea Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.2.4. S Korea Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.2.5. S Korea Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.3. Japan 6.6.3.1. Japan Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.3.2. Japan Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.3.3. Japan Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.3.4. Japan Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.3.5. Japan Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.4. India 6.6.4.1. India Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.4.2. India Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.4.3. India Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.4.4. India Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.4.5. India Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.5. Australia 6.6.5.1. Australia Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.5.2. Australia Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.5.3. Australia Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.5.4. Australia Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.5.5. Australia Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.6. Indonesia 6.6.6.1. Indonesia Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.6.2. Indonesia Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.6.3. Indonesia Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.6.4. Indonesia Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.6.5. Indonesia Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.7. Malaysia 6.6.7.1. Malaysia Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.7.2. Malaysia Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.7.3. Malaysia Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.7.4. Malaysia Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.7.5. Malaysia Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.8. Vietnam 6.6.8.1. Vietnam Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.8.2. Vietnam Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.8.3. Vietnam Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.8.4. Vietnam Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.8.5. Vietnam Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.9. Taiwan 6.6.9.1. Taiwan Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.9.2. Taiwan Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.9.3. Taiwan Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.9.4. Taiwan Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.9.5. Taiwan Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Industrial Machinery Market Size and Forecast, by Type (2022-2029) 6.6.10.2. Rest of Asia Pacific Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 6.6.10.3. Rest of Asia Pacific Industrial Machinery Market Size and Forecast, by Application (2022-2029) 6.6.10.4. Rest of Asia Pacific Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.10.5. Rest of Asia Pacific Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Industrial Machinery Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 7.1. Middle East and Africa Industrial Machinery Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 7.3. Middle East and Africa Industrial Machinery Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 7.5. Middle East and Africa Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 7.6. Middle East and Africa Industrial Machinery Market Size and Forecast, by Country (2022-2029) 7.6.1. South Africa 7.6.1.1. South Africa Industrial Machinery Market Size and Forecast, by Type (2022-2029) 7.6.1.2. South Africa Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 7.6.1.3. South Africa Industrial Machinery Market Size and Forecast, by Application (2022-2029) 7.6.1.4. South Africa Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.1.5. South Africa Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.2. GCC 7.6.2.1. GCC Industrial Machinery Market Size and Forecast, by Type (2022-2029) 7.6.2.2. GCC Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 7.6.2.3. GCC Industrial Machinery Market Size and Forecast, by Application (2022-2029) 7.6.2.4. GCC Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.2.5. GCC Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.3. Nigeria 7.6.3.1. Nigeria Industrial Machinery Market Size and Forecast, by Type (2022-2029) 7.6.3.2. Nigeria Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 7.6.3.3. Nigeria Industrial Machinery Market Size and Forecast, by Application (2022-2029) 7.6.3.4. Nigeria Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.3.5. Nigeria Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Industrial Machinery Market Size and Forecast, by Type (2022-2029) 7.6.4.2. Rest of ME&A Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 7.6.4.3. Rest of ME&A Industrial Machinery Market Size and Forecast, by Application (2022-2029) 7.6.4.4. Rest of ME&A Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.4.5. Rest of ME&A Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Industrial Machinery Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 8.1. South America Industrial Machinery Market Size and Forecast, by Type (2022-2029) 8.2. South America Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 8.3. South America Industrial Machinery Market Size and Forecast, by Application (2022-2029) 8.4. South America Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 8.5. South America Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 8.6. South America Industrial Machinery Market Size and Forecast, by Country (2022-2029) 8.6.1. Brazil 8.6.1.1. Brazil Industrial Machinery Market Size and Forecast, by Type (2022-2029) 8.6.1.2. Brazil Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 8.6.1.3. Brazil Industrial Machinery Market Size and Forecast, by Application (2022-2029) 8.6.1.4. Brazil Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 8.6.1.5. Brazil Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.2. Argentina 8.6.2.1. Argentina Industrial Machinery Market Size and Forecast, by Type (2022-2029) 8.6.2.2. Argentina Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 8.6.2.3. Argentina Industrial Machinery Market Size and Forecast, by Application (2022-2029) 8.6.2.4. Argentina Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 8.6.2.5. Argentina Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Industrial Machinery Market Size and Forecast, by Type (2022-2029) 8.6.3.2. Rest Of South America Industrial Machinery Market Size and Forecast, by Operation (2022-2029) 8.6.3.3. Rest Of South America Industrial Machinery Market Size and Forecast, by Application (2022-2029) 8.6.3.4. Rest Of South America Industrial Machinery Market Size and Forecast, by End-Use Industry (2022-2029) 8.6.3.5. Rest Of South America Industrial Machinery Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Industrial Machinery Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Industrial Machinery Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Siemens AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. General Electric (GE) 10.3. ABB Group 10.4. Caterpillar Inc. 10.5. Schneider Electric 10.6. Komatsu Ltd. 10.7. Emerson Electric Co. 10.8. Fanuc Corporation 10.9. Deere & Company 10.10. Rockwell Automation 10.11. Mitsubishi Heavy Industries, Ltd 10.12. Atlas Copco AB 10.13. Hitachi, Ltd. 10.14. Honeywell International Inc 10.15. The Timken Company 10.16. Parker Hannifin Corporation 10.17. Sandvik AB 10.18. Wärtsilä Corporation 10.19. Yaskawa Electric Corporation 10.20. JCB (J.C. Bamford Excavators Ltd.) 10.21. Ingersoll Rand 10.22. ITT Inc 10.23. Kubota Corporation 10.24. Regal Beloit Corporation 10.25. 3M 10.26. United Technologies Corporation 10.27. Eaton 11. Key Findings 12. Industry Recommendations 13. Industrial Machinery Market: Research Methodology 14. Terms and Glossary