India Agrochemical Market size was valued at USD 30.28 Mn. in 2022 and the Potable Water Tank Coating total revenue is expected to grow by 4.00 % from 2023 to 2029, reaching nearly USD 36.84 Mn.India Agrochemical Market Overview: -

Agrochemicals are pesticides, herbicides, or fertilizers used for the management of ecosystems in agricultural sectors. The rising population in India, accompanied by rising affluence, is creating a shift in consumption patterns. There is a need to not just increase production to meet demand but also to ensure that the nutritional needs of an increasingly affluent population are met. Shrinking arable land and loss of crops due to pest attacks lead to wastage, posing a critical challenge to ensuring food and nutritional security. The agrochemical market is an important agriculture support industry, which boosts the agriculture output. These factors support the growth of the market. In India, about 15-25% of potential crop production is lost due to pests, weeds, and diseases. The need for improving crop productivity with a focus on the effective use of pest control measures and the adoption of weed management practices has been recognized as an important factor in increasing agricultural output. These factors are aiding the use of agrochemicals in agriculture to increase output.India Agrochemical Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Pesticide usage is high among other chemicals. Price premiums and innovative eco-friendly production methods are emerging steadily in the agrochemical market. There is an increasing need to balance the judicious use of the best chemicals and minimize the impact of that use. As the Central Government focuses on promoting sustainable agriculture practices, there is an increase in the use of biopesticides which now accounts for 15% of the market. According to the Federation of Indian Chambers of Commerce and Industry, the Indian government recognizes the agrochemical industry as one of its top 12 industries to achieve global leadership, growing at 8-10% through 2025. Thus, the agrochemical sector in India is projected to witness growth during the forecast period.

India Agrochemical Market Drivers:-

industry. Fruits and vegetables account for nearly 90% of total horticulture production in India, making it the 2nd largest producer of fruits and vegetables in the world. India is also the leader in several horticultural crops, including mango, banana, papaya, areca nut, potato, and okra. As the horticulture and floriculture industries continue to grow, there will be an increase in demand for agrochemicals, especially fungicides. With India's diverse climate ensuring the production of all varieties of fresh fruits and vegetables, the trend has slowly shifted from the production of food grains to horticulture, with horticulture production consistently exceeding the production of food grains. These factors contribute to the growth of the Indian agrochemical industry in the coming years.India Agrochemical Market restraints: -

Environmental and health concerns associated with agrochemicals is driving down the growth of the agrochemical industry in India. The use of agrochemicals to increase crop yields and mitigate pest problems in India has been a topic of debate due to the potential environmental and health concerns associated with their usage. While agrochemicals have been shown to increase crop yields by 25%-50%, their overuse can lead to soil degradation, water pollution, and the development of resistance in pests. Pesticide residues in food can also have adverse effects on human health, including developmental and neurological problems, cancer, and endocrine disruption. The use of agrochemicals has also been linked to the decline in pollinators, such as bees and butterflies, which play a crucial role in crop production. The indiscriminate use of agrochemicals can also lead to the destruction of natural habitats and biodiversity loss. Additionally, the high cost of agrochemicals can be a significant restraint on their usage, particularly for small-scale farmers who may not have the financial resources to invest in these inputs. The need to balance the benefits of agrochemical usage with its potential risks is a significant restraint on the growth of the agrochemical industry in India. The industry must focus on developing safer and more sustainable agrochemicals, promoting responsible usage, and educating farmers on their safe usage to mitigate the potential risks and ensure sustainable agriculture.India Agrochemical Market Opportunities: -

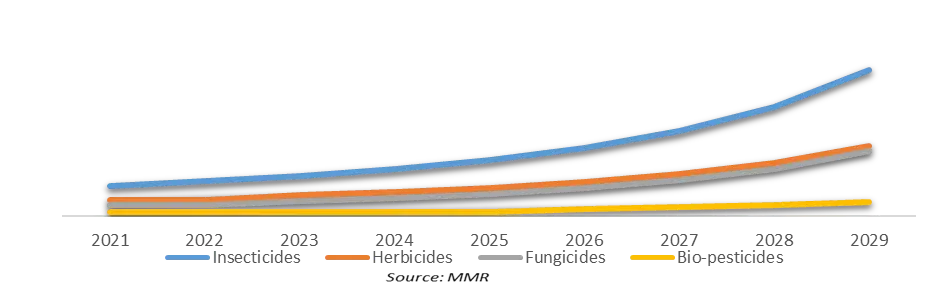

Rising Demand for Herbicides and Fungicides Set to Drive Growth in Indian Agrochemicals Market The Indian agrochemicals market is poised for growth in the next few years, with a particular focus on herbicides and fungicides. In contrast to global trends, insecticides have traditionally been the largest share of the Indian agrochemicals industry due to the country's tropical climate and prevalence of insect and fungi attacks. However, the use of herbicides is on the rise due to shortages of farm labor and concerns about the affordability of labor costs. This shift towards herbicides is expected to emerge as a key growth segment in the agrochemicals industry in India.India Agrochemical Market Segment Analysis:-

Based on Product, Insecticides dominated the India Agrochemical Market in 2022 and are expected to continue their dominance during the forecast period. Based on type product is classified into insecticides, Herbicides, Fungicides, Bio-pesticide. Antioxidants, Catalysts, Emulsifiers, Stabilizers, Fillers, Flame Retardants, and Others. The effectiveness of flame-retardant chemicals in reducing the flammability of consumer products in house fires is disputed. Used in various industries, including Construction, Automotive and Transportation, And Electronics. As a result, it is expected that the market for polyurethane additives grow during the forecast period due to the increased use of flame retardants in the production of polyurethanes.India Agrochemical Market,by Product 2022 (%)

India Agrochemical Market Scope: Inquire Before Buying

India Agrochemical Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 30.28 Mn. Forecast Period 2023 to 2029 CAGR: 4.2% Market Size in 2029: US $ 36.84 Mn. Segments Covered: by Product Insecticides Herbicides Fungicides Bio-pesticides by Application Cereals & Grains Vegetables & Fruits Oilseed & Pulses Other India Agrochemical Market, Key Players are

1. Bayer Crop Science 2. BASF 3. Potash Corporation of Saskatchewan 4. Yara International 5. Indian Farmers Fertilizer Cooperative 6. E.I. Du Pont De Nemours & Company 7. Adama Industries. 8. Excel Crop Care Limited (Sumitomo Chemical) 9. Syngenta AG. 10. National Fertilizers Limited 11. Coromandel International Limited 12. Rastriya Chemicals and Fertilizers Ltd. 13. Zari Agrochemical Limited 14. Nagarjuna Fertilizers and Chemicals Limited 15. Deepak Fertilizers 16. Tata Chemicals 17. Chambal Fertilizers 18. Dow Agrosciences 19. Makhteshim Gan Industries LtdFrequently Asked Questions:

1] What segments are covered in the India Agrochemical Market report? Ans. The segments covered in the India Agrochemical Market report are based on product, application, and Disease. 2] What is the expected size of the India Agrochemical Market by 2029? Ans. The market size of the India Agrochemical Market by 2029 is expected to reach US$ 36.84 Mn. 3] What is the forecast period for the India Agrochemical Market report? Ans. The forecast period for the India Agrochemical Market report is 2023-2029. 4] What was the market size of the India Agrochemical Market in 2022? Ans. The market size of the India Agrochemical Market in 2022 was valued at US$ 30.28 Mn

1. India Agrochemical Market: Research Methodology 2. India Agrochemical Market: Executive Summary 3. India Agrochemical Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. India Agrochemical Market: Dynamics 4.1. Market Drivers 4.2. Market Restraints 4.3. Market Opportunities 4.4. Market Challenges 4.5. PORTER’s Five Forces Analysis 4.6. PESTLE Analysis 4.7. Value Chain Analysis 4.8. Regulatory Landscape 4.9. COVID-19 Impact on the India Agrochemical Market 5. India Agrochemical Market (by Value USD) 5.1. India Agrochemical Market, by Product (2022-2029) 5.2. India Agrochemical Market, by Application (2022-2029) 6. Company Profile: Key players 6.1. Bayer Crop Science 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. GSK BASF 6.3. Potash Corporation of Saskatchewan 6.4. Yara International 6.5. Indian Farmers Fertiliser Cooperative 6.6. E.I. Du Pont De Nemours & Company 6.7. Adama Industries. 6.8. Excel Crop Care Limited (Sumitomo Chemical) 6.9. Syngenta AG. 6.10. National Fertilizers Limited 7. Key Findings 8. Industry Recommendation