The Global Bisphenol A Market size was valued at USD 23.61 Bn in 2023 and is expected to reach USD 34.25 Bn by 2030, at a CAGR of 5.46 %Overview of the Global Bisphenol A Market

Polycarbonate plastics is an essential intermediate for high-performance polymer plastics are often used to store food and beverages containers like water bottles and other consumer goods. Epoxy resins are used for the coating of metal products, such as water supply lines, food and beverages cans and bottle tops and some Bisphenol A may also be found in composites and dental sealants. The graphical representation and structural exclusive information showed the dominating region of the Global Bisphenol A Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Bisphenol A Market.To know about the Research Methodology :- Request Free Sample Report

Bisphenol A Market Dynamics

Increasing Industrial Applications and Consumer Based Products with Endocrine Disruption Properties are the Growth Factors in Bisphenol A Market Bisphenol A (BPA) holds a pivotal role in the manufacturing of polycarbonate plastics and epoxy resins, which are indispensable materials across diverse industries, including manufacturing, automotive, electronics, and construction. These materials are highly sought after due to their remarkable durability and versatility, thus propelling the consistent demand for BPA. Consequently, BPA remains integral to the Bisphenol A Market growth and advancement of these sectors, significantly contributing to market growth, market potential, and robust market share. BPA is a ubiquitous component found in a wide array of everyday consumer goods, encompassing items like food and beverage containers, eyeglass lenses, and electronic equipment. These consumer products are consistently in high demand and make a substantial contribution to the requirement for BPA within the market. The incorporation of BPA in the manufacturing process of these items exemplifies the broad spectrum of applications and the pertinence of BPA across diverse consumer sectors. This consistent demand bolsters Bisphenol A Market share and fuels market growth. Despite associated health concerns, BPA's unique capability to mimic the hormone estrogen renders it indispensable for applications necessitating such characteristics. These applications extend to specific medical equipment and products where the endocrine-disruption properties of BPA are tactically harnessed. As a result, the BPA market benefits significantly from these unique chemical attributes, fostering both market penetration and a promising market potential. Alternatives and Substitutes and Rising Demand for BPA-Free Products are creating more opportunities in the Bisphenol A Market Heightened apprehensions regarding the health implications of BPA have ignited fervent research and development efforts to explore and create BPA-free alternatives. This proactive endeavor offers a compelling opportunity for manufacturers and suppliers alike. It opens the door to produce and market safer substitutes while aligning with the market's growing appetite for healthier alternatives. BPA Recycling is another way to improve opportunities in the market. This endeavor signifies the potential for significant Bisphenol A Market growth and increased market capitalization. With escalating consumer awareness concerning the potential health risks linked to BPA exposure, there is an observable surge in the demand for BPA-free products. This heightened consumer preference presents a valuable opportunity for businesses to innovate and introduce safer, healthier alternatives into the market. BPA-Free Packaging Options are another opportunity to improve market share. Companies that can adeptly address and satisfy this growing demand are strategically positioned to capitalize on the shifting consumer sentiment, thereby augmenting their market capitalization. Regulatory Constraints and Gaining Health Concerns are restraining the Bisphenol A Market Stringent regulations and outright bans on BPA across various regions, propelled by substantial concerns about its health impacts, especially its role as an endocrine-disrupting chemical, have considerably restricted its usage in numerous products. These stringent regulatory constraints pose a formidable obstacle to the widespread application of BPA, cultivating a challenging operating environment for businesses situated in regions with stringent BPA regulations. This restraint undeniably impedes market penetration and expansion. The health apprehensions linked to BPA exposure, notably its potential to disrupt the endocrine system, have spurred consumers to actively seek and favor products that are entirely free from BPA. This discernible shift in consumer preferences translates into reduced demand for BPA-containing products, exerting a tangible influence on its market share and overall profitability. Consequently, the discerning and health-conscious consumer base has metamorphosed into a potent restraint for the BPA market, prompting the need for adaptability and change to sustain Bisphenol A Market share and promote continued growth.Bisphenol A Market, by Impact of Bisphenol A in Bottles on Children’s Health (%) 2023

Bisphenol A Market Segment Analysis

Application: In Bisphenol A Uses, Epoxy resins play a vital role in a variety of industrial applications, notably as protective liners within cans utilized for food and beverage packaging. Their significance lies in preserving product quality and integrity, attributed to their remarkable qualities encompassing corrosion resistance, thermal stability, and mechanical strength. Epoxy resins are a driving force in the Bisphenol A (BPA) market, ensuring the quality maintenance of food and beverages. Polycarbonate resins hold a dominant position within the BPA market, constituting an impressive 75% of consumption in 2023. Flame retardants are indispensable components known for their fire-suppressing properties, playing a pivotal role across various industries. They find applications in products where fire safety is paramount, such as construction materials, electronics, and automotive components. As safety regulations become increasingly stringent, the demand for flame retardants is anticipated to surge, thereby contributing to market growth and cementing their role in fire safety applications. Also, some industries use BPA in Food Packaging and there are BPA-Free Alternatives in the industry. Polyetherimide, renowned for its high-temperature resistance and robust mechanical properties, finds applications where these attributes are critical. Industries such as aerospace, automotive, and electronics harness the unique characteristics of polyetherimide to meet specific performance requirements, thereby establishing its role in Bisphenol A Market growth and its market potential. Polysulfone resins, characterized by their excellent chemical resistance and heat resistance, are pivotal in various industries. These resins serve in sectors such as electronics, automotive, and healthcare, where the demand for robust materials prevails. Their chemical and heat-resistant properties solidify their status as indispensable components in these industries, ensuring their presence and Bisphenol A Market share. Unsaturated polyester resins play a pivotal role in the production of composites, particularly fiberglass-reinforced plastics. These resins are widely employed in industries such as construction, marine, and automotive due to their lightweight and durable characteristics. Their contribution to the production of durable and efficient products within these sectors fuels market growth and market penetration. Beyond the mentioned applications, Bisphenol A finds utility in various other industries, encompassing adhesives and coatings. This reflects its adaptability and versatility in catering to diverse industry needs, underscoring its market growth potential. End Use: BPA plays a pivotal role in enhancing the durability and safety of appliances, with common usage in products such as kitchen appliances. Its presence in these applications ensures a consistent demand for BPA, contributing to its market share within the appliance sector. Eyeglass lenses represent a notable application within the consumer industry. BPA's properties are harnessed to create lenses with optical clarity, impact resistance, and lightweight characteristics, meeting the demands of consumers and reinforcing its market presence. The automotive industry significantly benefits from BPA, primarily in the form of polycarbonates used for various purposes, including weight reduction, energy absorption, and shock absorption. These applications propel market growth within the automotive sector, emphasizing its market potential. BPA finds extensive use in various consumer goods, particularly in food and beverage containers, contributing significantly to market growth and market penetration within the consumer sector. The construction industry leverages BPA in diverse applications, including sealants and coatings, where durability and performance are critical for withstanding environmental factors. Its role in construction contributes to market growth and Bisphenol A Market penetration within the construction sector. BPA's properties are utilized in the electrical and electronic equipment sector, where it serves as an insulating material, safeguarding components and ensuring their efficient operation. This application secures its market presence and potential within the electrical and electronics industry. In the renewable energy sector, BPA plays a pivotal role in composite materials designed for wind energy applications. Its presence within the renewable energy industry underscores its contribution to market growth and its Bisphenol A Market share. Some industries use Bisphenol A in Epoxy Resins. BPA, with its adhesive and protective properties, is a valuable component within the paint and coating industry. Its presence contributes to market growth and underscores its solid market potential within this sector. In agriculture, BPA finds application in greenhouses, where it is utilized for protective coverings and other.Bisphenol A Market Regional Analysis

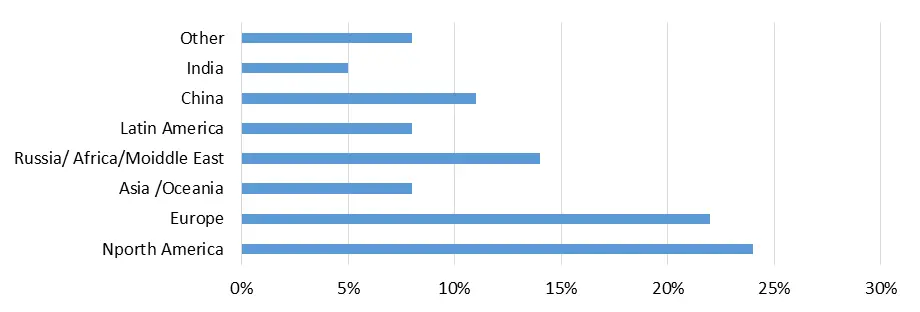

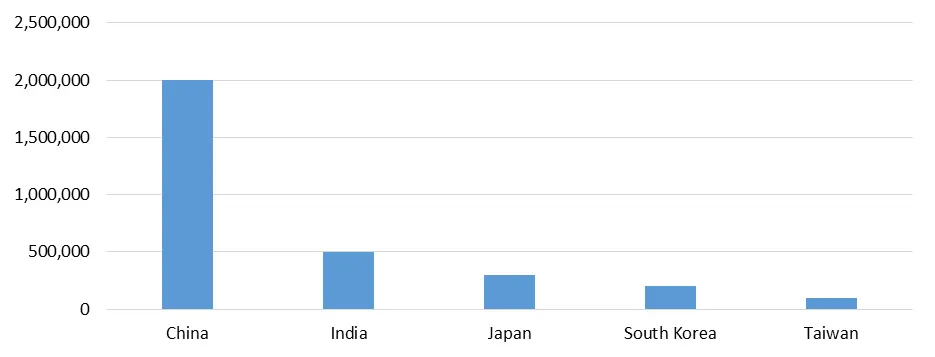

The Asia-Pacific region emerges as the dominant market for Bisphenol A (BPA), and leading region in the Bisphenol A Suppliers. Securing the largest market share of xx% in 2023. Projections indicate that this share is set for substantial expansion, with a projected market value of US$ xx.x million by 2030, boasting a notable compound annual growth rate (CAGR) of xx%. A key contributing factor to the resounding presence of BPA in Asia-Pacific is the significant 54% share it commands within the global BPA market. This market flourishes, primarily driven by emerging economies, with China, Brazil, and India playing pivotal roles. Notably, China's strategic plans include the initiation of new plant installations coupled with capacity expansions for BPA, feedstock phenol, and acetone in the near future. For instance, in 2018, the US-based company KBR secured licensing, engineering (LBED), and an equipment supply agreement to collaborate with Cangzhou Dahua New Materials (CDNM), a chemical producer, in establishing a state-of-the-art polycarbonate plant in Cangzhou City, China. This initiative underlines China's proactive approach to bolstering BPA production capacity. Furthermore, the region enjoys the advantages of government initiatives and substantial investments by major companies in research and development, as well as global-level technological advancements, all contributing to the burgeoning growth of the BPA market in the Asia-Pacific region. North America and Europe surface as the swiftest growing markets for BPA, with estimated CAGR figures of 4.5% and 4.3%, respectively, foreseen between 2023 and 2030. These regions are characterized by the presence of major industry players and a well-established infrastructure, both of which significantly bolster the flourishing BPA market. However, it is worth noting that, within the European Union and Canada, regulatory measures have led to the prohibition of polycarbonate products, subsequently affecting the demand for BPA. This regulatory stance has resulted in a decline in demand for BPA-based products within these regions.Bisphenol A Market, by Production Volume in Asia-Pacific (tonnes) 2023

Bisphenol A Market Competitive Landscape

In June 2017, Teijin proclaimed its plan to launch the first-ever polycarbonate-resin pillar-less automotive front window, marking a significant innovation in the industry. While the use of polycarbonate resins in front windows of automobiles has traditionally been restricted due to safety standards, these new advancements in resin technology are expected to address these concerns. The newly developed polycarbonate resin offers high resistance to weather and abrasion, aligning with the novel Japanese standards and creating an exciting prospect for its application in automotive front windows. Such pioneering product launches not only demonstrate the evolution of Bisphenol A (BPA) technology but also serve to elevate its demand globally. In 2018, KBR, a US-based company, achieved a milestone by securing a license and engineering (LBED) as well as an equipment supply agreement in collaboration with chemicals producer Cangzhou Dahua New Materials (CDNM). This partnership was aimed at establishing a new polycarbonate plant in Cangzhou City, China. The introduction of such state-of-the-art facilities is indicative of the continuous advancements in BPA production and technology, particularly in the domain of polycarbonate production. It underscores the commitment of major industry players to expand the capabilities of BPA production, thereby fulfilling the rising demand for various applications. The report aims to provide a comprehensive analysis of the Global Bisphenol A Market, encompassing all relevant stakeholders within the industry. It endeavors to present the historical and current status of the industry, offering insights into market size and prevailing trends while simplifying complex data for a wider audience. The report encompasses all facets of the industry and includes a dedicated examination of key players, encompassing market leaders, followers, and new entrants. By incorporating methodologies such as PORTER, SVOR, and PESTEL analysis, the report assesses the potential impact of micro-economic factors on the market. It scrutinizes both external and internal elements that may have positive or negative effects on the industry, thereby providing valuable insights for decision-makers. Furthermore, the report aids in understanding the dynamics of the Global Bisphenol A Market by analysing market segments and forecasting the market's size. It offers a lucid portrayal of the competitive landscape, analysing key players based on various factors such as pathogen type, price, financial position, product portfolio, growth strategies, and regional presence. This information equips investors with the guidance needed to make informed decisions within the Global Bisphenol A Market, underscoring the significance of these developments in the industry.Bisphenol A Market Scope: Inquire before buying

Bisphenol A Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 23.61 Bn. Forecast Period 2024 to 2030 CAGR: 5.46% Market Size in 2030: US $ 34.25 Bn. Segments Covered: by Application Epoxy resins Polycarbonates Resins Flame retardants Polyacrylat Polyetherimide Polysulfone resins Unsaturated polyester resins Other Applications by End Use Appliances Eye wear Automotives component Consumer Construction Electrical and Electronics Wind Energy Composites Paint and Coating Green House Others Bisphenol A Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Bisphenol A Market

1. Covestro AG 2. DowDuPont Inc. 3. Mitsui Chemical Inc. 4. SABIC Innovative Plastics 5. Bayer Material Science 6. Vinmar International 7. Dow Chemical 8. LG Chemical 9. Kumho 10. P&B Chemicals 11. Formosa Plastics 12. Samyang Innochem 13. Teijin 14. Chang Chun Plastics Co Ltd 15. Hexion Inc. 16. Mitsubishi Chemical Corporation 17. Nan Ya Plastics Corporation 18. Nippon Steel & Sumikin Chemical Co Ltd 19. Olin Corporation 20. Kingboard Holdings 21. Rhodia Brasil 22. Sunoco Chemicals Frequently Asked Questions and Answers about Bisphenol A Market 1. What are the key drivers of market growth for Bisphenol A Market? Ans: Market growth is primarily driven by increasing BPA usage in diverse industries, particularly automotive, electronics, and construction. 2. Are there alternatives to Bisphenol A Market? Ans: Yes, there are BPA-free alternatives being explored due to health and regulatory concerns, presenting opportunities for market diversification. 3. Which regions exhibit the most significant market potential for Bisphenol A Market? Ans: Asia-Pacific leads the market, with North America and Europe also showing substantial growth potential. 4. What are the emerging trends in the Bisphenol A Market? Ans: Emerging trends include a shift towards BPA-free packaging options and a focus on sustainable practices in BPA production. 5. How do regulatory constraints impact the Bisphenol A Market? Ans: Stringent regulations in certain regions have led to a reduced demand for BPA in certain products, affecting market penetration.

1. Bisphenol A Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Bisphenol A Market: Dynamics 2.1. Bisphenol A Market Trends by Region 2.1.1. North America Bisphenol A Market Trends 2.1.2. Europe Bisphenol A Market Trends 2.1.3. Asia Pacific Bisphenol A Market Trends 2.1.4. Middle East and Africa Bisphenol A Market Trends 2.1.5. South America Bisphenol A Market Trends 2.2. Bisphenol A Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Bisphenol A Market Drivers 2.2.1.2. North America Bisphenol A Market Restraints 2.2.1.3. North America Bisphenol A Market Opportunities 2.2.1.4. North America Bisphenol A Market Challenges 2.2.2. Europe 2.2.2.1. Europe Bisphenol A Market Drivers 2.2.2.2. Europe Bisphenol A Market Restraints 2.2.2.3. Europe Bisphenol A Market Opportunities 2.2.2.4. Europe Bisphenol A Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Bisphenol A Market Drivers 2.2.3.2. Asia Pacific Bisphenol A Market Restraints 2.2.3.3. Asia Pacific Bisphenol A Market Opportunities 2.2.3.4. Asia Pacific Bisphenol A Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Bisphenol A Market Drivers 2.2.4.2. Middle East and Africa Bisphenol A Market Restraints 2.2.4.3. Middle East and Africa Bisphenol A Market Opportunities 2.2.4.4. Middle East and Africa Bisphenol A Market Challenges 2.2.5. South America 2.2.5.1. South America Bisphenol A Market Drivers 2.2.5.2. South America Bisphenol A Market Restraints 2.2.5.3. South America Bisphenol A Market Opportunities 2.2.5.4. South America Bisphenol A Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Bisphenol A Industry 2.8. Analysis of Government Schemes and Initiatives For Bisphenol A Industry 2.9. Bisphenol A Market Trade Analysis 2.10. The Global Pandemic Impact on Bisphenol A Market 3. Bisphenol A Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Bisphenol A Market Size and Forecast, by Application (2023-2030) 3.1.1. Epoxy resins 3.1.2. Polycarbonates Resins 3.1.3. Flame retardants 3.1.4. Polyacrylat 3.1.5. Polyetherimide 3.1.6. Polysulfone resins 3.1.7. Unsaturated polyester resins 3.1.8. Other Applications 3.2. Bisphenol A Market Size and Forecast, by End Use (2023-2030) 3.2.1. Appliances 3.2.2. Eye wear 3.2.3. Automotives component 3.2.4. Consumer 3.2.5. Construction 3.2.6. Electrical and Electronics 3.2.7. Wind Energy Composites 3.2.8. Paint and Coating 3.2.9. Others 3.3. Bisphenol A Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Bisphenol A Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Bisphenol A Market Size and Forecast, by Application (2023-2030) 4.1.1. Epoxy resins 4.1.2. Polycarbonates Resins 4.1.3. Flame retardants 4.1.4. Polyacrylat 4.1.5. Polyetherimide 4.1.6. Polysulfone resins 4.1.7. Unsaturated polyester resins 4.1.8. Other Applications 4.2. North America Bisphenol A Market Size and Forecast, by End Use (2023-2030) 4.2.1. Appliances 4.2.2. Eye wear 4.2.3. Automotives component 4.2.4. Consumer 4.2.5. Construction 4.2.6. Electrical and Electronics 4.2.7. Wind Energy Composites 4.2.8. Paint and Coating 4.2.9. Others 4.3. North America Bisphenol A Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Bisphenol A Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Epoxy resins 4.3.1.1.2. Polycarbonates Resins 4.3.1.1.3. Flame retardants 4.3.1.1.4. Polyacrylat 4.3.1.1.5. Polyetherimide 4.3.1.1.6. Polysulfone resins 4.3.1.1.7. Unsaturated polyester resins 4.3.1.1.8. Other Applications 4.3.1.2. United States Bisphenol A Market Size and Forecast, by End Use (2023-2030) 4.3.1.2.1. Appliances 4.3.1.2.2. Eye wear 4.3.1.2.3. Automotives component 4.3.1.2.4. Consumer 4.3.1.2.5. Construction 4.3.1.2.6. Electrical and Electronics 4.3.1.2.7. Wind Energy Composites 4.3.1.2.8. Paint and Coating 4.3.1.2.9. Others 4.7.2. Canada 4.3.2.1. Canada Bisphenol A Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Epoxy resins 4.3.2.1.2. Polycarbonates Resins 4.3.2.1.3. Flame retardants 4.3.2.1.4. Polyacrylat 4.3.2.1.5. Polyetherimide 4.3.2.1.6. Polysulfone resins 4.3.2.1.7. Unsaturated polyester resins 4.3.2.1.8. Other Applications 4.3.2.2. Canada Bisphenol A Market Size and Forecast, by End Use (2023-2030) 4.3.2.2.1. Appliances 4.3.2.2.2. Eye wear 4.3.2.2.3. Automotives component 4.3.2.2.4. Consumer 4.3.2.2.5. Construction 4.3.2.2.6. Electrical and Electronics 4.3.2.2.7. Wind Energy Composites 4.3.2.2.8. Paint and Coating 4.3.2.2.9. Others 4.7.3. Mexico 4.3.3.1. Mexico Bisphenol A Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Epoxy resins 4.3.3.1.2. Polycarbonates Resins 4.3.3.1.3. Flame retardants 4.3.3.1.4. Polyacrylat 4.3.3.1.5. Polyetherimide 4.3.3.1.6. Polysulfone resins 4.3.3.1.7. Unsaturated polyester resins 4.3.3.1.8. Other Applications 4.3.3.2. Mexico Bisphenol A Market Size and Forecast, by End Use (2023-2030) 4.3.3.2.1. Appliances 4.3.3.2.2. Eye wear 4.3.3.2.3. Automotives component 4.3.3.2.4. Consumer 4.3.3.2.5. Construction 4.3.3.2.6. Electrical and Electronics 4.3.3.2.7. Wind Energy Composites 4.3.3.2.8. Paint and Coating 4.3.3.2.9. Others 5. Europe Bisphenol A Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.2. Europe Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3. Europe Bisphenol A Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.2. France 5.3.2.1. France Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Bisphenol A Market Size and Forecast, by End Use (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Bisphenol A Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Bisphenol A Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.7. Asia Pacific Bisphenol A Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.4. India 6.3.4.1. India Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Bisphenol A Market Size and Forecast, by End Use (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Bisphenol A Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Bisphenol A Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Bisphenol A Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Bisphenol A Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Bisphenol A Market Size and Forecast, by End Use (2023-2030) 7.7. Middle East and Africa Bisphenol A Market Size and Forecast, by Country (2023-2030) 7.7.1. South Africa 7.3.1.1. South Africa Bisphenol A Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Bisphenol A Market Size and Forecast, by End Use (2023-2030) 7.7.2. GCC 7.3.2.1. GCC Bisphenol A Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Bisphenol A Market Size and Forecast, by End Use (2023-2030) 7.7.3. Nigeria 7.3.3.1. Nigeria Bisphenol A Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Bisphenol A Market Size and Forecast, by End Use (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Bisphenol A Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Bisphenol A Market Size and Forecast, by End Use (2023-2030) 8. South America Bisphenol A Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Bisphenol A Market Size and Forecast, by Application (2023-2030) 8.2. South America Bisphenol A Market Size and Forecast, by End Use (2023-2030) 8.7. South America Bisphenol A Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Bisphenol A Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Bisphenol A Market Size and Forecast, by End Use (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Bisphenol A Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Bisphenol A Market Size and Forecast, by End Use (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Bisphenol A Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Bisphenol A Market Size and Forecast, by End Use (2023-2030) 9. Global Bisphenol A Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Bisphenol A Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Covestro AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. DowDuPont Inc. 10.3. Mitsui Chemical Inc. 10.4. SABIC Innovative Plastics 10.5. Bayer Material Science 10.6. Vinmar International 10.7. Dow Chemical 10.8. LG Chemical 10.9. Kumho 10.10. P&B Chemicals 10.11. Formosa Plastics 10.12. Samyang Innochem 10.13. Teijin 10.14. Chang Chun Plastics Co Ltd 10.15. Hexion Inc. 10.16. Mitsubishi Chemical Corporation 10.17. Nan Ya Plastics Corporation 10.18. Nippon Steel & Sumikin Chemical Co Ltd 10.19. Olin Corporation 10.20. Kingboard Holdings 10.21. Rhodia Brasil 10.22. Sunoco Chemicals 11. Key Findings 12. Industry Recommendations 13. Bisphenol A Market: Research Methodology 14. Terms and Glossary