In-Mold Labels Market size was valued at USD 2.68 Billion in 2024 and the total In Mold Labels revenue is expected to grow at a CAGR of 4.7% from 2025 to 2032, reaching nearly USD 3.87 Billion.In-Mold Labels Market Overview

In-Mold Labeling is a cutting-edge packaging technology that allows labels and produced together and provides great design flexibility, enabling brands to create colorful and complex graphics with the performance advantages of being moisture, scratch, and fade resistant. The In-Mold Labels Market is rapidly growing because of the value it brings to brands with high-quality, durable, and attractive packaging. In-Mold Labels Market, technology is highly desirable for consumer packaging across food, personal care, household, and cosmetic products due to its durability, premium appearance, and production efficiency. Allowing brands to put the label in the molds and reduce the number of material handling steps while increasing production efficiency and durability, along with assured label accuracy and permanency, all make it an appealing option for brands designed operationally and aesthetically. IML quickly transformed into a viable new technology with a broad range of Applications including Food and Beverages, Personal Care, Pharmaceuticals, and Household Materials. The IML industry is expanding rapidly due to consumer demand for sustainable packaging, cost-effective technological advancements, etc. Growing utilization of smart labeling technology is enhancing the IML scene. IML is expanding to include elements such as RFID tags, QR codes, and interactive design capabilities, which help foster brand experience, Material traceability, and supply chain transparency. In the Mold Labels Market, these new forms of branding unlock advanced capabilities while increasing the volume of branded, visually distinctive materials. From possibilities introduced by technological advancements in UV/EB coatings to specialized films and adhesives, the list and number of capabilities available to consumer brands are flexible and fascinating. Cork has led the way with Materials such as CORKOTE 615 INL and CORKURE 1036HG-18 that boast outstanding durability, spirited graphics, and high-gloss finishes while meeting the demands of current packaging trends.To know about the Research Methodology :- Request Free Sample Report

Trend: Advanced Digital Printing & Customization

In Mold Labels is a process that integrates the label into the plastic container while it is being injection molded or blow molded, producing a finished product that is seamless, durable, and more visually appealing than labels stuck on the container. The global market value of digital printing is expected to grow to USD 32.40 billion by 2024, which has triggered the growth of In-Mold Labels by making it easy and cost-effective to produce and apply quickly high-resolution labeling options while avoiding the costly use of screens or plates. IML positions itself well in digital print technology to take advantage of quick changeovers, supported low runs, brand customization, produce less waste, and reduced set-up times. This capability makes it easier for brands to respond to trends, seasonal promotions, and unique consumer requests or promotions. The environmental benefits of the In-Mold Labels Market make it an increasingly attractive option, as labels made from the same substrate as the container simplify recycling and eliminate the need for label removal by brands. The mechanical bond of IML creates a barrier against moisture, chemicals, abrasion, and extreme temperatures, far superior to pressure-sensitive films, which peel, wrinkle, and break down over time. Digital printing enables complex or intricate designs, vibrant color reproduction, and variable data, offering freedom of design like never before. This combination of customization, sustainability, durability, and productivity will drive the In-Mold Labels Market for all global consumer and industrial application segments. Advanced Digital Printing & Customization Technologies Revolutionizing the In-Mold Labels Industry

Technology Description UV Inkjet Digital Printing Uses UV-curable inks instantly cured by UV light. Electrophotographic (Dry Toner) Printing Electrostatic transfer of dry toner fused by heat or pressure. Laser Die-Cutting Technology Precision laser cutting instead of mechanical dies. High-Speed Direct-to-Object (DTO) Printing Prints directly onto molded objects or substrates. Digital Embellishment & Special Effects Adds decorative effects such as foil, texture, or 3D finishes digitally. In-Mold Labels Market Dynamics

Increasing Demand for Sustainable and Fully Recyclable Packaging to Drive in In-Mold Labels Market The use of mono-material polypropylene (PP) for both label and container, along with 100% recyclability, offers good compatibility with APR, WPO, and RecyClass recycling requirements. The broad design possibilities offered in IML allow for the provision of vibrant and durable graphics that can be resistant to moisture/mild water products, heat, and chemicals. The durability offered by the In Mold Labels (IML) Market makes it particularly well-suited for packaging in the food, beverage, healthcare, cosmetics, and household industries. Mold Labels Companies, such as CMG Plastics and Millennium World, have greatly expanded their IML service capabilities, including state-of-the-art molding machinery, to meet the growing global demand for sustainable and high-performance packaging that is in alignment with consumer expectations and company sustainability goals. IML packaging is also engaging with the larger design-for-recycling (DfR) and promoting circularity efforts by being embraced by brands to minimize the overall carbon footprint and result in better material presentation and shelf presence. IML provides the advantage such as integrating a label during the molding process, less materials, less energy, lower operational costs, and fewer total steps in the bottling or packaging process. As product innovations such as NextCycle IML and SealPPeel die-cut lidding are providing alternatives to non-recyclable materials such as aluminum, these innovations strengthen the sustainability credentials of IML applications. • SABIC, Taghleef, Karydakis, and Kotronis Packaging developed recyclable IML solutions using renewable polypropylene. The mono-material, thin-wall containers offer vibrant, durable finishes, integrate BOPP labels, support HolyGrail 2.0 recycling, ensure tamper-proof Materialion, and reduce CO₂ emissions for sustainable packaging. • Checkpoint’s IML RFID labels enable reusable packaging for fast food chains, offering durability, heat resistance, and 99% accurate real-time tracking. This supports circular economy goals by reducing waste, lowering costs, enhancing transparency, ensuring regulatory compliance, and enhancing the customer experience. High Initial Equipment and Tooling Costs to Hamper In-Mold Labels Market Growth There is a notable restraint for the In-mold labeling (IML) process that is the high initial costs of IML equipment and tool setups, which is a serious barrier to entry for many custom molders and original equipment manufacturers (OEMs). Executing an IML project requires specialized IML-compatible molds, robotic automation (for the insertion of the label), precise temperature and pressure control systems, along with injection molding machines with a high-speed design. In-Mold Labels Market involves significant acquisition and integration costs, as IML equipment requires a substantial initial capital investment. The costs imposed by these high initial costs compared to that of already established traditional labeling procedures such as pad printing, painting, or pressure-sensitive labels pose a challenge to In-Mold Label companies transitioning to the IML process, as it appears there are loose efficiency and added labour related to these traditional processes to begin the project, and certainly the immediate costs tend to be lower. The associated costs of designing, prototyping, and ramping up, paying for calibrating IML tool setups which meet exacting specifications, is a daunting task, particularly for those manufacturers with multiple, frequent, or short-run projects that require Material changeover.In-Mold Labels Market Segment Analysis

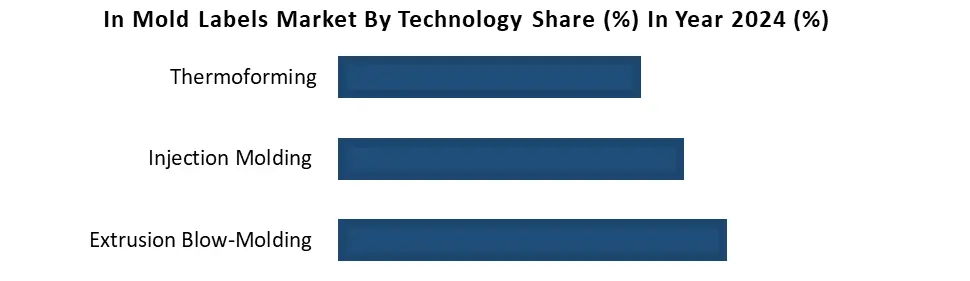

Based on Material, the In-Mold Labels Market is segmented into Polypropylene, Polyethylene, Polyvinyl Chloride, ABS Resins, and Others. In 2024, polypropylene represented the majority of the share in the In-Mold Labels Market. In mold labeling is a complex packaging decoration process that involves pre-printed PP labels being inserted into a mold to make the end product, such as tubs, containers, and even appliance panels, throughout an injection or blow molding process. The polypropylene is injected into the mold, and the resultant material fuses with the pre-printed label, becoming a unified whole. This process does not require adhesive to unite both components, and the resulting product becomes more durable, more attractive, and has material integrity to support the graphics and product information printed on it. RecyClass, a reference of recyclability related to plastic, has validated that IML technology printed on PP is highly compatible with the recycling stream for rigid-colored polypropylene containers, provided that the weight of the ink is no more than 1% of the packaging weight. Taghleef produces BOPP label films, using bio-based resins from SABIC, with decorative finishes such as gloss or matte, tactile features (e.g., velvet or orange peel), or other textures that provide brands and brand owners with options that stand out in the market. Karydakis creates customized print processes to optimize ink usage and recyclability and, add traceability capabilities powered by digital watermarking in compliance with GS1.Based on Technology, the market is segmented into Extrusion Blow-Molding, Injection Molding and Thermoforming. Injection molding achieves perfect label placement (eliminating issues of labels peeling or misaligning), the use of complex, multi-color, high-definition graphics to leave a lasting impression, and packaging can be produced, labeled and shipped in record time. The use of injection molding dramatically reduces production time, labor and material waste, which allows manufacturers to maximize production efficiency while maintaining consistent output. Sustainability is achieved by using the same polypropylene (PP) material for both packaging and labels, enabling full recyclability and aligning with circular economy principles, boosting In-Mold Labels Market growth. This demonstrates consideration of a circular economy. Injection molding IML has proven resilient to moisture and extreme temperatures, as well as being resistant to mechanical wear. Therefore, it can be used for refrigerated products, hot-fill products, and outdoor applications.

In-Mold Labels Market Regional Insights

North America dominated In-Mold Labels Market and is expected to continue its dominance over the forecast period. The increasing popularity of In-Mold Labeling (IML) in North America is primarily due to delivering 360-degree decoration with high-resolution graphics, which improves shelf appeal and brand recognition. In-Mold Labeling accommodates a wide range of container shapes typical to North America, including round, oval, and square shapes, and lids, allowing for great flexibility of shapes and ways of packaging. Manufacturers are recognizing the ability of In-Mold Labeling to produce impactful finishes like metallic effects, clear labels, and textured finishes, all of which provide a premium look and feel. In-Mold Labels usage is moving quickly forward, with early advocates leading the way, such as IML Labels located in Montreal, Quebec, Canada. The organization has worked hard to push IML as a niche labeling product with high value in the territory. As the only IML producer in Canada, IML Labels has shown steady double-digit growth year over year and is expanding into Chicago, demonstrating an increase in the United States In Mold Market demand. The dairy segment remains the largest area of growth, particularly for butter, yogurt and ice cream containers. However, including for sauces, dips, household goods, and pet goods, IML labeling has more recently started to take hold. Asia-Pacific is the fastest-growing region in the In-Mold Labels Market. This growth is attributed to the explosion in the manufacturing sectors, the increasing consumer demand for packaged goods, and increased demand for more sustainable solutions that can be developed using advanced packaging technologies. China, India, Japan, and South Korea are rapidly adopting IML because of its lower cost, high-quality branded products, and sustainability factors. The European In-Mold Labels Market is driven by strong sustainability requirements, advanced packaging solutions and strong uptake in food and consumer goods. Europe is positioned as the innovator in IML because we have established major players, with technological expertise to develop the marketplace and growing demand for recyclable, mono-material packaging solutions. Labeling Revolutionized: The Power of Polypropylene in IML

In-Mold Labels Competitive Landscape

The competitive landscape of the In-Mold Labels Market includes intense innovation, strategic collaborations, and a growing focus on sustainability. Global giants like CCL Industries, Avery Dennison, Multi-Color Corporation, and Huhtamaki dominate with expansive product portfolios and robust manufacturing capabilities. These players are leveraging automation, digital printing integration, and smart labeling technologies to cater to evolving consumer demands. Regional specialists such as Inland Packaging, Taghleef Industries, and Coveris are carving niches through customization, eco-friendly substrates, and agile production models. Mergers, acquisitions, and strategic partnerships are common as companies aim to expand geographic presence and technology footprints. The In Mold Labels Market witnesses a rising influx of Asian players offering cost-effective yet high-quality solutions, adding competitive pressure. • On March 31, 2021, Multi-Color Corporation (MCC) announced the acquisition of Herrods, a leading Australian in-mold label (IML) manufacturer based in Melbourne. The merger strengthens MCC’s presence in the Asia-Pacific region and expands its IML capabilities. Herrods, known for its innovation and quality in IML since 1963, will continue operating under its existing brand and leadership. The move enables both companies to better serve customers in Australia and New Zealand while leveraging MCC’s global reach to explore growth in Asia. The acquisition aligns with MCC Verstraete’s commitment to premium, sustainable, and brand-building label solutions.In-Mold Labels Market Scope: Inquire before buying

In-Mold Labels Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.68 Bn. Forecast Period 2025 to 2032 CAGR: 4.7% Market Size in 2032: USD 3.87 Bn. Segments Covered: by Material Polypropylene Polyethylene Polyvinyl Chloride ABS Resins Others by Technology Extrusion Blow-Molding Injection Molding Thermoforming by Printing Technology Flexographic Printing Offset Printing Gravure Printing Digital Printing Others by Printing Inks UV Curable Inks Thermal Cured Inks Water-Soluble Inks Others by End Use Food & Beverage Cosmetics & Personal Care Pharmaceuticals Automotive Consumer Durables Others In-Mold Labels Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Thailand, Philippines, and Rest of APAC) South America (Brazil, Argentina, Rest of South America) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)In Mold Labels key Players

1. Avery Dennison 2. CCL Industries 3. Constantia Flexibles 4. Multi Color Corporation 5. Huhtamaki Group 6. Coveris Holdings 7. EVCO Plastics 8. Inland Packaging 9. Innovia Films 10. Cenveo Inc. 11. Fuji Seal International 12. Fort Dearborn Company 13. Yupo Corporation 14. Serigraph Inc. 15. Smyth Companies 16. Taghleef Industries 17. Admark Visual Imaging 18. Aspasie Inc. 19. General Press Corporation 20. Mitsubishi Chemical Holdings 21. Jindal Films 22. Century Label Inc. 23. Allen Plastic 24. Mepco Label Systems 25. Berry Global 26. WS Packaging Group 27. Vibrant Graphics 28. Xiang In Enterprise 29. Shenzhen Kunbei 30. Shanghai HyprintFrequently Asked Questions:

1. Which region has the largest share in the Global In-Mold Labels Market? Ans: The North America region held the largest market share in 2024. 2. What is the growth rate of the Global In-Mold Labels Market? Ans: The Global Market is expected to grow at a CAGR of 4.7% during the forecast period 2025-2032. 3. What is the scope of the Global In-Mold Labels Market report? Ans: Global In-Mold Labels Market report helps with the PESTEL, PORTER, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global In-Mold Labels Market? Ans: The important key players in the Global In-Mold Labels Market are Avery Dennison, CCL Industries, Constantia Flexibles, and Multi Color Corporation. 5. What is the study period of this market? Ans: The Global In-Mold Labels Market is studied from 2024 to 2032.

1. In-Mold Labels Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global In-Mold Labels Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2024 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. In-Mold Labels Market: Dynamics 3.1. In-Mold Labels Market Trends 3.2. In-Mold Labels Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Innovation & Sustainability Trends 4.1. Eco-friendly In-Mold Films 4.2. Digital Printing Integration 4.3. Smart Labels (NFC, QR) 4.4. Bio-Based & Compostable IML Substrates 4.5. Laser-Codable IML Surfaces 5. Regulatory Compliance, By Region 5.1. Plastic Packaging Regulations 5.2. REACH & RoHS Relevance 5.3. Labeling Compliance 5.4. Plastic Packaging & Extended Producer Responsibility (EPR) 6. In-Mold Labels Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. In-Mold Labels Market Size and Forecast, By Material (2024-2032) 6.1.1. Polypropylene 6.1.2. Polyethylene 6.1.3. Polyvinyl Chloride 6.1.4. ABS Resins 6.1.5. Others 6.2. In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 6.2.1. Extrusion Blow-Molding 6.2.2. Injection Molding 6.2.3. Thermoforming 6.3. In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.3.1. Flexographic Printing 6.3.2. Offset Printing 6.3.3. Gravure Printing 6.3.4. Digital Printing 6.3.5. Others 6.4. In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 6.4.1. UV Curable Inks 6.4.2. Thermal Cured Inks 6.4.3. Water-Soluble Inks 6.4.4. Others 6.5. In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 6.5.1. Food & Beverage 6.5.2. Cosmetics & Personal Care 6.5.3. Pharmaceuticals 6.5.4. Automotive 6.5.5. Consumer Durables 6.5.6. Others 6.6. In-Mold Labels Market Size and Forecast, By Region (2024-2032) 6.6.1. North America 6.6.2. Europe 6.6.3. Asia Pacific 6.6.4. Middle East and Africa 6.6.5. South America 7. North America In-Mold Labels Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. North America In-Mold Labels Market Size and Forecast, By Material (2024-2032) 7.1.1. Polypropylene 7.1.2. Polyethylene 7.1.3. Polyvinyl Chloride 7.1.4. ABS Resins 7.1.5. Others 7.2. North America In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 7.2.1. Extrusion Blow-Molding 7.2.2. Injection Molding 7.2.3. Thermoforming 7.3. North America In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.3.1. Flexographic Printing 7.3.2. Offset Printing 7.3.3. Gravure Printing 7.3.4. Digital Printing 7.3.5. Others 7.4. North America In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 7.4.1. UV Curable Inks 7.4.2. Thermal Cured Inks 7.4.3. Water-Soluble Inks 7.4.4. Others 7.5. North America In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 7.5.1. Food & Beverage 7.5.2. Cosmetics & Personal Care 7.5.3. Pharmaceuticals 7.5.4. Automotive 7.5.5. Consumer Durables 7.5.6. Others 7.6. North America In-Mold Labels Market Size and Forecast, by Country (2024-2032) 7.6.1. United States 7.6.1.1. United States In-Mold Labels Market Size and Forecast, By Material (2024-2032) 7.6.1.1.1. Polypropylene 7.6.1.1.2. Polyethylene 7.6.1.1.3. Polyvinyl Chloride 7.6.1.1.4. ABS Resins 7.6.1.1.5. Others 7.6.1.2. United States In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 7.6.1.2.1. Extrusion Blow-Molding 7.6.1.2.2. Injection Molding 7.6.1.2.3. Thermoforming 7.6.1.3. United States In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.6.1.3.1. Flexographic Printing 7.6.1.3.2. Offset Printing 7.6.1.3.3. Gravure Printing 7.6.1.3.4. Digital Printing 7.6.1.3.5. Others 7.6.1.4. United States In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 7.6.1.4.1. UV Curable Inks 7.6.1.4.2. Thermal Cured Inks 7.6.1.4.3. Water-Soluble Inks 7.6.1.4.4. Others 7.6.1.5. United States In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 7.6.1.5.1. Food & Beverage 7.6.1.5.2. Cosmetics & Personal Care 7.6.1.5.3. Pharmaceuticals 7.6.1.5.4. Automotive 7.6.1.5.5. Consumer Durables 7.6.1.5.6. Others 7.6.2. Canada 7.6.2.1. United States In-Mold Labels Market Size and Forecast, By Material (2024-2032) 7.6.2.1.1. Polypropylene 7.6.2.1.2. Polyethylene 7.6.2.1.3. Polyvinyl Chloride 7.6.2.1.4. ABS Resins 7.6.2.1.5. Others 7.6.2.2. United States In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 7.6.2.2.1. Extrusion Blow-Molding 7.6.2.2.2. Injection Molding 7.6.2.2.3. Thermoforming 7.6.2.3. United States In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.6.2.3.1. Flexographic Printing 7.6.2.3.2. Offset Printing 7.6.2.3.3. Gravure Printing 7.6.2.3.4. Digital Printing 7.6.2.3.5. Others 7.6.2.4. United States In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 7.6.2.4.1. UV Curable Inks 7.6.2.4.2. Thermal Cured Inks 7.6.2.4.3. Water-Soluble Inks 7.6.2.4.4. Others 7.6.2.5. United States In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 7.6.2.5.1. Food & Beverage 7.6.2.5.2. Cosmetics & Personal Care 7.6.2.5.3. Pharmaceuticals 7.6.2.5.4. Automotive 7.6.2.5.5. Consumer Durables 7.6.2.5.6. Others 7.6.3. Mexico 7.6.3.1. United States In-Mold Labels Market Size and Forecast, By Material (2024-2032) 7.6.3.1.1. Polypropylene 7.6.3.1.2. Polyethylene 7.6.3.1.3. Polyvinyl Chloride 7.6.3.1.4. ABS Resins 7.6.3.1.5. Others 7.6.3.2. United States In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 7.6.3.2.1. Extrusion Blow-Molding 7.6.3.2.2. Injection Molding 7.6.3.2.3. Thermoforming 7.6.3.3. United States In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.6.3.3.1. Flexographic Printing 7.6.3.3.2. Offset Printing 7.6.3.3.3. Gravure Printing 7.6.3.3.4. Digital Printing 7.6.3.3.5. Others 7.6.3.4. United States In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 7.6.3.4.1. UV Curable Inks 7.6.3.4.2. Thermal Cured Inks 7.6.3.4.3. Water-Soluble Inks 7.6.3.4.4. Others 7.6.3.5. United States In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 7.6.3.5.1. Food & Beverage 7.6.3.5.2. Cosmetics & Personal Care 7.6.3.5.3. Pharmaceuticals 7.6.3.5.4. Automotive 7.6.3.5.5. Consumer Durables 7.6.3.5.6. Others 8. Europe In-Mold Labels Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Europe In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.2. Europe In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.3. Europe In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.4. Europe In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.5. Europe In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6. Europe In-Mold Labels Market Size and Forecast, by Country (2024-2032) 8.6.1. United Kingdom 8.6.1.1. United Kingdom In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.1.2. United Kingdom In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.1.3. United Kingdom In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.1.4. United Kingdom In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.1.5. United Kingdom In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.2. France 8.6.2.1. France In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.2.2. France In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.2.3. France In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.2.4. France In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.2.5. France In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.3. Germany 8.6.3.1. Germany In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.3.2. Germany In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.3.3. Germany In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.3.4. Germany In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.3.5. Germany In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.4. Italy 8.6.4.1. Italy In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.4.2. Italy In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.4.3. Italy In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.4.4. Italy In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.4.5. Italy In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.5. Spain 8.6.5.1. Spain In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.5.2. Spain In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.5.3. Spain In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.5.4. Spain In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.5.5. Spain In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.6. Sweden 8.6.6.1. Sweden In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.6.2. Sweden In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.6.3. Sweden In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.6.4. Sweden In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.6.5. Sweden In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.7. Russia 8.6.7.1. Russia In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.7.2. Russia In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.7.3. Russia In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.7.4. Russia In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.7.5. Russia In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 8.6.8. Rest of Europe 8.6.8.1. Rest of Europe In-Mold Labels Market Size and Forecast, By Material (2024-2032) 8.6.8.2. Rest of Europe In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 8.6.8.3. Rest of Europe In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.6.8.4. Rest of Europe In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 8.6.8.5. Rest of Europe In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9. Asia Pacific In-Mold Labels Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Asia Pacific In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.2. Asia Pacific In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.3. Asia Pacific In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.4. Asia Pacific In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.5. Asia Pacific In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6. Asia Pacific In-Mold Labels Market Size and Forecast, by Country (2024-2032) 9.6.1. China 9.6.1.1. China In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.1.2. China In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.1.3. China In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.1.4. China In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.1.5. China In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.2. S Korea 9.6.2.1. S Korea In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.2.2. S Korea In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.2.3. S Korea In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.2.4. S Korea In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.2.5. S Korea In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.3. Japan 9.6.3.1. Japan In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.3.2. Japan In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.3.3. Japan In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.3.4. Japan In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.3.5. Japan In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.4. India 9.6.4.1. India In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.4.2. India In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.4.3. India In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.4.4. India In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.4.5. India In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.5. Australia 9.6.5.1. Australia In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.5.2. Australia In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.5.3. Australia In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.5.4. Australia In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.5.5. Australia In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.6. Indonesia 9.6.6.1. Indonesia In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.6.2. Indonesia In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.6.3. Indonesia In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.6.4. Indonesia In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.6.5. Indonesia In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.7. Malaysia 9.6.7.1. Malaysia In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.7.2. Malaysia In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.7.3. Malaysia In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.7.4. Malaysia In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.7.5. Malaysia In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.8. Philippines 9.6.8.1. Philippines In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.8.2. Philippines In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.8.3. Philippines In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.8.4. Philippines In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.8.5. Philippines In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.8.6. 9.6.9. Thailand 9.6.9.1. Thailand In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.9.2. Thailand In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.9.3. Thailand In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.9.4. Thailand In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.9.5. Thailand In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.10. Vietnam 9.6.10.1. Vietnam In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.10.2. Vietnam In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.10.3. Vietnam In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.10.4. Vietnam In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.10.5. Vietnam In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 9.6.11. Rest of Asia Pacific 9.6.11.1. Rest of Asia Pacific In-Mold Labels Market Size and Forecast, By Material (2024-2032) 9.6.11.2. Rest of Asia Pacific In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 9.6.11.3. Rest of Asia Pacific In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.6.11.4. Rest of Asia Pacific In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 9.6.11.5. Rest of Asia Pacific In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 10. Middle East and Africa In-Mold Labels Market Size and Forecast (by Value in USD Million) (2024-2032 10.1. Middle East and Africa In-Mold Labels Market Size and Forecast, By Material (2024-2032) 10.2. Middle East and Africa In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 10.3. Middle East and Africa In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 10.4. Middle East and Africa In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 10.5. Middle East and Africa In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 10.6. Middle East and Africa In-Mold Labels Market Size and Forecast, by Country (2024-2032) 10.6.1. South Africa 10.6.1.1. South Africa In-Mold Labels Market Size and Forecast, By Material (2024-2032) 10.6.1.2. South Africa In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 10.6.1.3. South Africa In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 10.6.1.4. South Africa In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 10.6.1.5. South Africa In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 10.6.2. GCC 10.6.2.1. GCC In-Mold Labels Market Size and Forecast, By Material (2024-2032) 10.6.2.2. GCC In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 10.6.2.3. GCC In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 10.6.2.4. GCC In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 10.6.2.5. GCC In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 10.6.3. Egypt 10.6.3.1. Egypt In-Mold Labels Market Size and Forecast, By Material (2024-2032) 10.6.3.2. Egypt In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 10.6.3.3. Egypt In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 10.6.3.4. Egypt In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 10.6.3.5. Egypt In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 10.6.4. Nigeria 10.6.4.1. Nigeria In-Mold Labels Market Size and Forecast, By Material (2024-2032) 10.6.4.2. Nigeria In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 10.6.4.3. Nigeria In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 10.6.4.4. Nigeria In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 10.6.4.5. Nigeria In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 10.6.5. Rest of ME&A 10.6.5.1. Rest of ME&A In-Mold Labels Market Size and Forecast, By Material (2024-2032) 10.6.5.2. Rest of ME&A In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 10.6.5.3. Rest of ME&A In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 10.6.5.4. Rest of ME&A In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 10.6.5.5. Rest of ME&A In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 11. South America In-Mold Labels Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 11.1. South America In-Mold Labels Market Size and Forecast, By Material (2024-2032) 11.2. South America In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 11.3. South America In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 11.4. South America In-Mold Labels Market Size and Forecast, By End User (2024-2032) 11.5. South America In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 11.6. South America In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 11.7. South America In-Mold Labels Market Size and Forecast, by Country (2024-2032) 11.7.1. Brazil 11.7.1.1. Brazil In-Mold Labels Market Size and Forecast, By Material (2024-2032) 11.7.1.2. Brazil In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 11.7.1.3. Brazil In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 11.7.1.4. Brazil In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 11.7.1.5. Brazil In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 11.7.2. Argentina 11.7.2.1. Argentina In-Mold Labels Market Size and Forecast, By Material (2024-2032) 11.7.2.2. Argentina In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 11.7.2.3. Argentina In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 11.7.2.4. Argentina In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 11.7.2.5. Argentina In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 11.7.3. Colombia 11.7.3.1. Colombia In-Mold Labels Market Size and Forecast, By Material (2024-2032) 11.7.3.2. Colombia In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 11.7.3.3. Colombia In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 11.7.3.4. Colombia In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 11.7.3.5. Colombia In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 11.7.4. Chile 11.7.4.1. Chile In-Mold Labels Market Size and Forecast, By Material (2024-2032) 11.7.4.2. Chile In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 11.7.4.3. Chile In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 11.7.4.4. Chile In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 11.7.4.5. Chile In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 11.7.5. Rest Of South America 11.7.5.1. Rest Of South America In-Mold Labels Market Size and Forecast, By Material (2024-2032) 11.7.5.2. Rest Of South America In-Mold Labels Market Size and Forecast, By Technology (2024-2032) 11.7.5.3. Rest Of South America In-Mold Labels Market Size and Forecast, By Printing Technology (2024-2032) 11.7.5.4. Rest Of South America In-Mold Labels Market Size and Forecast, By Printing Inks (2024-2032) 11.7.5.5. Rest Of South America In-Mold Labels Market Size and Forecast, By End Use (2024-2032) 12. Company Profile: Key Players 12.1. CCL Industries 12.1.1. Company Overview 12.1.2. Business Portfolio 12.1.3. Financial Overview 12.1.4. SWOT Analysis 12.1.5. Strategic Analysis 12.1.6. Recent Developments 12.2. Avery Dennison 12.3. Constantia Flexibles 12.4. Multi Color Corporation 12.5. Huhtamaki Group 12.6. Coveris Holdings 12.7. EVCO Plastics 12.8. Inland Packaging 12.9. Innovia Films 12.10. Cenveo Inc. 12.11. Fuji Seal International 12.12. Fort Dearborn Company 12.13. Yupo Corporation 12.14. Serigraph Inc. 12.15. Smyth Companies 12.16. Taghleef Industries 12.17. Admark Visual Imaging 12.18. Aspasie Inc. 12.19. General Press Corporation 12.20. Mitsubishi Chemical Holdings 12.21. Jindal Films 12.22. Century Label Inc. 12.23. Allen Plastic 12.24. Mepco Label Systems 12.25. Berry Global 12.26. WS Packaging Group 12.27. Vibrant Graphics 12.28. Xiang In Enterprise 12.29. Shenzhen Kunbei 12.30. Shanghai Hyprint 12.31. 13. Key Findings 14. Analyst Recommendations 15. In-Mold Labels Market: Research Methodology