Global Household Appliances Market size was valued at USD 670.3 Bn. in 2022 and the total Household Appliances industry revenue is expected to grow by 5.52 % from 2023 to 2029, reaching nearly USD 976.3 Bn.Household Appliances Market Overview

Household appliances are equipment that is used in assisting various household functions such as cooking and cleaning. Increasing product awareness, affordable pricing, innovative products, and high disposable incomes have aided in the strong growth of the consumer electronics market globally. The global household appliances market is witnessing growth due to the major trend of smart homes. Smart and connected appliances are growing in the household appliances market so this factor is expected to further fuel the growth of the market. Increase demand for products such as LED TVs, laptops, split ACs, and, beauty and wellness products in urban areas. In rural markets, durables like refrigerators, as well as other home appliances, are likely to witness growing demand. Technological advancement, innovative products, and Lifestyle products significantly create lucrative growth opportunities for the market.To know about the Research Methodology :- Request Free Sample Report

Household Appliances Market Trends:

Urbanization and digitization are the key macro trends influencing the Household Appliances market. Technological advancement in smart appliances has emerged in the last few years. Instead of manually operated remote controls, smart appliances can communicate through voice assistants such as Google Home, Alexa, and Siri The smart appliances market in smart homes is estimated to witness a high growth rate. The trend of smart and connected appliances is growing in the household appliances market. The increasing adoption of automatic appliances such as adopting artificial intelligence, AR and VR the IoT, and Robotics significantly boosts the market growth. These changes are placing demands on investments and economies of scale, but also open up major opportunities for market growth. Moreover, improving the standard of living has resulted in an increase in spending on smart IoT products. This factor expects a healthy rise in the demand for IoT Enabled household appliances.Household Appliances Market Dynamics

Changing consumer lifestyles and preferences boost the market growth The Evolving consumer lifestyles and increased disposable income have significantly driven the growth of the household appliances market. Nowadays consumers are seeking easy-to-use, comfortable, and time-saving household appliances which enhanced the living standard of the consumer. Growing adoption of smart home systems the demand for advanced and smart appliances increased. With the increasing disposable income particularly in emerging economies the purchasing power of income is increasing so this led to a rise in the demand for smart household appliances such as refrigerators, air conditioners, washing machines, and smart kitchen equipment which will enhance the work quality in the minimum time period. Therefore, more and more consumers choose smart appliances. This factor significantly propels market growth. Rising urbanization and housing developments drive the market growth To fulfil everyday needs such as cooking and cleaning there is a greater need for household appliances. Rapid urbanization and the expansion of housing developments create excellent demand for household appliances. The maximum number of people move to urban areas regarding their jobs they set up a new household this factor boosts the household appliances market demand. Additionally, the rising population and urbanization rates significantly impact the household appliances Market. Increasing demand for smaller and larger appliances is expected to drive the market growth. The continuous advancement in technology plays a significant role in shaping the household appliances market. Innovations such as smart home integration, internet of Things (IoT) connectivity, energy-efficient designs, and improved functionalities have driven the demand for modern appliances in urban areas.

Market Restrains

High cost of smart appliances restrains market growth. Smart Appliances are priced too high therefore they become unaffordable for a large portion of the population. Globally, many consumers find a difficult to invest in smart household appliances due to limited financial resources and unaffordability. This factor hampers the growth of the market. Due to the High prices of appliances, consumers seek alternatives or postponed their purchases. They choose cheaper and lower-quality options. Which creates obstacles to new demand. Household appliances are expensive so the consumer opts for second-hand household appliances. This factor creates concerns for manufacturers. Also, the availability of second-hand appliances limits the growth of the potential of the household market. Therefore, Due to the consumer’s budget constraint and high prices of smart household appliances hampers the market growth.Market Growth Opportunities

Emerging advanced technology creates lucrative growth opportunities. Emerging technology such as smart appliances that are connected to the internet as well Bluetooth allows them to be controlled and monitored using devices like smartphones. So, the adoption of modern lifestyles and technological advancement is expected to drive the demand for smart appliances. The smart appliances provided by smart home appliances are added safety and health support. For instance, water purifiers can monitor Total Dissolved Solids (TDS) levels in real-time and display the status of filters. Additionally, IoT-enabled air coolers and air purifiers come with pollutant tracking features to ensure cleaner indoor air and promote healthier breathing. With the increasing penetration of smartphones for various activities, people are now seeking to control all their appliances and devices through a single device this factor boosts the market growth. There are multiple smart household appliances available in the market such as water purifiers, air purifiers, water heaters, and ceiling fans. These products have advanced features and internet connectivity to enhance their functionality. Therefore the emerging advanced technology in household appliances propels market growth.Competitive landscape:

The global Household Appliances market is highly competitive. The numerous key players drive the market growth are Whirlpool, SAMSUNG, Miele, Nespresso, Robert Bosch GmbH, Beko, Haier, Bajaj Electronics, Kent, Orient Electric, LG Corporation, IFB Appliances, Eureka Forbes and Panasonic Holdings Corporation Samsung Corporation: The Samsung Corporation is one of the biggest and major appliance manufacturers in the world. The company offers a wide range of smart household appliances such as washing machines, refrigerators, and others. In September 2022 the company launches a new semi-automatic washing machine with advanced technological immersion. Also, the company launches the dishwasher in Singapore with smart features in July 2022. The key players of the global Household Appliances Market majorly focus on mergers and Acquisitions to consolidate the market growth. Also, the key players primarily expand the product portfolio with technological inventions. The increasing demand for smart and advanced household appliances helps manufacturers invent new technology.Household Appliances Market Segment Analysis:

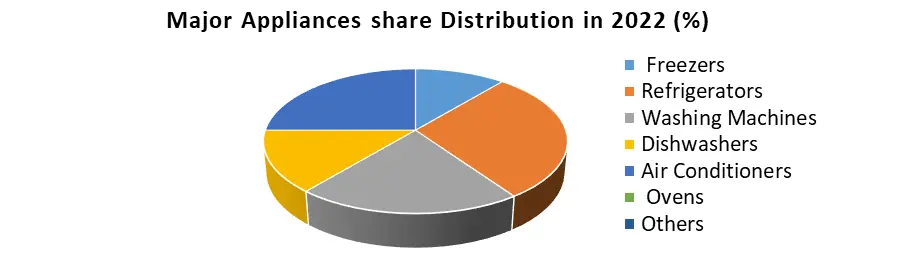

Based on Type, The major appliances dominate the market in the year 2022. The major appliances include the appliances such as Freezers, Refrigerators, Washing Machines, Dishwashers, Air Conditioners, Ovens, and others. The major appliances provide functionality in the home. This appliance makes everyday tasks easy and maintains a comfortable and convenient lifestyle. The consumer’s preference for major appliances is due to the high quality and extended durability of the product. So, increasing preference for durability and quality accelerates the demand for major appliances. The manufacturers introduce new advanced technologies in major appliances such as smart connectivity, and advanced control. This advancement in major appliances boosts market growth. Moreover, the longer replacement cycle, advanced technology, and increasing trend of smart homes drive the market growth.

Household Appliances Market Regional Insights:

Asia Pacific dominates the global Household Appliances Market in the year 2022.The region experiencing rapid growth due to the rising purchasing power of the people and urbanization. The countries like India, china witnessing significant demand for smart household appliances. The population growth and improving standard of living boost the demand for household appliances. The consumers rising preference for smart technology integration and premium features in household appliances propels the demand. The increasing demand for major appliances this because of the easy loan facility available on major appliances in a country like India. Low-cost EMI, and zero-cost EMI these facilities make major appliances affordable to the consumer. The presence of local brands such as LG, and Haier has a strong presence with a wide range of product portfolio this factor drives the growth of the household appliances market growth.Household Appliances Market Scope: Inquire before buying

Household Appliances Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 670.3 Bn. Forecast Period 2023 to 2029 CAGR: 5.52% Market Size in 2029: US $ 976.3 Bn. Segments Covered: by Type 1. Major Appliances 1.1. Freezers 1.2. Refrigerators 1.3. Washing Machines 1.4. Dishwashers 1.5. Air Conditioners 1.6. Ovens 1.7. Others 2. Small Appliances 2.1. Food Processors 2.2. Grills & Roasters 2.3. Tea/Coffee Makers 2.4. Vacuum Cleaners 2.5. Others by Distribution Channel 1. Supermarkets and Hypermarkets 2. Specialty Stores 3. E-Commerce 4. Others Household Appliances Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Household Appliances Market Key Players

1. Whirlpool Corporation 2. Samsung Corporation 3. Miele 4. Nespresso 5. Robert Bosch GmbH 6. Beko 7. Haier 8. Bajaj Electronics 9. Kent Corporation 10. Orient Electric 11. LG Corporation 12. IFB Appliances 13. Eureka Forbes 14. Panasonic Holdings CorporationFrequently Asked Questions:

1] What segments are covered in the Global Household Appliances Market report? Ans. The segments covered in the Household Appliances Market report are based on Type, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Household Appliances Market? Ans. The Asia Pacific region is expected to hold the highest share of the Household Appliances Market. 3] What is the market size of the Global Household Appliances Market by 2029? Ans. The market size of the Household Appliances Market by 2029 is expected to reach US$ 976.37 Bn. 4] What is the forecast period for the Global Household Appliances Market? Ans. The forecast period for the Household Appliances Market is 2023-2029. 5] What was the market size of the Global Household Appliances Market in 2022? Ans. The market size of the Household Appliances Market in 2022 was valued at US$ 670.3 Bn.

1. Household Appliances Market: Research Methodology 2. Household Appliances Market: Executive Summary 3. Household Appliances Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Household Appliances Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Household Appliances Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Household Appliances Market Size and Forecast, by Type (2022-2029) 5.1.1. Major Appliances 5.1.2. Small Appliances 5.2. Household Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 5.2.1. Supermarkets and Hypermarkets 5.2.2. Specialty Stores 5.2.3. E-Commerce 5.2.4. Others 5.3. Household Appliances Market Size and Forecast, by Region (2022-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Household Appliances Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Household Appliances Market Size and Forecast, by Type (2022-2029) 6.1.1. Major Appliances 6.1.2. Small Appliances 6.2. North America Household Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.2.1. Supermarkets and Hypermarkets 6.2.2. Specialty Stores 6.2.3. E-Commerce 6.2.4. Others 6.3. North America Household Appliances Market Size and Forecast, by Country (2022-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Household Appliances Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Household Appliances Market Size and Forecast, by Type (2022-2029) 7.1.1. Major Appliances 7.1.2. Small Appliances 7.2. Europe Household Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 7.2.1. Supermarkets and Hypermarkets 7.2.2. Specialty Stores 7.2.3. E-Commerce 7.2.4. Others 7.3. Europe Household Appliances Market Size and Forecast, by Country (2022-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Household Appliances Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Household Appliances Market Size and Forecast, by Type (2022-2029) 8.1.1. Major Appliances 8.1.2. Small Appliances 8.2. Asia Pacific Household Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 8.2.1. Supermarkets and Hypermarkets 8.2.2. Specialty Stores 8.2.3. E-Commerce 8.2.4. Others 8.3. Asia Pacific Household Appliances Market Size and Forecast, by Country (2022-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Household Appliances Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Household Appliances Market Size and Forecast, by Type (2022-2029) 9.1.1. Major Appliances 9.1.2. Small Appliances 9.2. Middle East and Africa Household Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 9.2.1. Supermarkets and Hypermarkets 9.2.2. Specialty Stores 9.2.3. E-Commerce 9.2.4. Others 9.3. Middle East and Africa Household Appliances Market Size and Forecast, by Country (2022-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Household Appliances Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Household Appliances Market Size and Forecast, by Type (2022-2029) 10.1.1. Major Appliances 10.1.2. Small Appliances 10.2. South America Household Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 10.2.1. Supermarkets and Hypermarkets 10.2.2. Specialty Stores 10.2.3. E-Commerce 10.2.4. Others 10.3. South America Household Appliances Market Size and Forecast, by Country (2022-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Whirlpool Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Samsung Corporation 11.3. Miele 11.4. Nespresso 11.5. Robert Bosch GmbH 11.6. Beko 11.7. Haier 11.8. Bajaj Electronics 11.9. Kent 11.10. Orient Electric 11.11. LG Corporation 11.12. IFB Appliances 11.13. Eureka Forbes 11.14. Panasonic Holdings Corporation 12. Key Findings 13. Industry Recommendation