The Home Medical Equipment market size reached USD 2.32 Bn in 2022 and is expected to reach USD 5.16 Bn by 2029, growing at a CAGR of 10.5 % during the forecast period. The home medical equipment market refers to the devices that are used by patients in their homes to manage their medical conditions. This can include a wide range of products such as digital blood-glucose meters, blood pressure monitors, pulse oximeters, and peak flow meters. The shift of many healthcare services from traditional clinical settings to the home is expected to spur significant growth in the Home Medical Equipment market in the coming years. The market for home medical equipment has been growing in recent years driven by an aging population, an increase in chronic diseases, and a greater focus on patient-centered care. Technological advances have also contributed to the growth of the market with new devices and products being developed to improve patient outcomes and quality of life. Some of the key players operating in the Home Medical Equipment market are Medtronic plc, Abbott Laboratories, Hill-Rom Holdings, Inc., Invacare Corporation, and Drive DeVilbiss Healthcare. They are increasingly investing in the development of technologically advanced medical equipment to meet the growing demand for more sophisticated and effective healthcare solutions. Medtronic is a global leader in medical technology, offering a wide range of products and services. Their home medical equipment portfolio includes respiratory devices, insulin pumps, and other products. In North America, the United States is the largest market for home medical equipment, with a market share of around 80%. The demand for the home medical equipment market in the US is being driven by an aging population, increasing healthcare costs, and a shift towards patient-centered care. Home Medical Equipment Market offers a comprehensive overview of the current market situation and provides a forecast until 2029. This report provides qualitative and quantitative information that highlights important market developments, trends, challenges, competition, and new opportunities within Home Medical Equipment Market. The report aims to provide a comprehensive presentation of the global market for Home Medical equipment, with both quantitative and qualitative analysis to help readers develop business/growth strategies, assess the market competitive situation, and analyze their position in the current marketplace. The report also discusses technological trends and new product developments. The report includes Porter’s Five Forces analysis which explains the five forces: namely buyers' bargaining power, supplier's bargaining power, the threat of new entrants, and the degree of competition in the Home Medical Equipment Market. The report also focuses on the competitive landscape of the Market. The analysis will help the Home Medical Equipment market players to understand the present situation of the market.To know about the Research Methodology :- Request Free Sample Report

Home Medical Equipment Market Dynamics:

Rapid growth in the elderly population and rising incidence of chronic diseases drive the Home Medical Equipment market Patients are increasingly seeking to take control of their own healthcare, and are looking for ways to manage their conditions in the comfort and privacy of their own homes. The global home medical equipment market is being driven by several factors such as the rapid growth in the elderly population and the rising incidence of chronic diseases. As the aging population grows, the demand for home medical equipment is expected to increase because people require medical devices and equipment to manage their health conditions. Chronic diseases, such as diabetes, heart disease, and respiratory illnesses are also on the rise, creating a greater need for home medical equipment all over the world. Many patients with chronic diseases require ongoing medical care and monitoring, and home medical equipment can help to provide this care more conveniently and cost-effectively. Many leading Home Medical Equipment companies are developing new and innovative products to meet the needs of patients with chronic diseases. Overall, the combination of an aging population, rising incidence of chronic diseases, advancements in technology, and a growing trend towards patient-centered care is expected to drive continued growth in the home medical equipment market during the forecast period. Increasing focus on telehealth services in the Home Medical Equipment market Telehealth services in the market refer to the use of technology to deliver healthcare services remotely. This can include video consultations, remote monitoring of vital signs, and online health education and support. Telehealth services have become increasingly popular in the home medical equipment market due to their convenience and ability to improve access to care for patients who may have difficulty traveling to medical facilities. Additionally, telehealth services can help reduce healthcare costs and increase efficiency by allowing providers to see more patients in less time. Telehealth services are on a rise driven by the increasing prevalence of chronic diseases, rising healthcare costs, and advancements in technology. The COVID-19 pandemic has also accelerated the adoption of telehealth services, as healthcare providers and patients seek to minimize in-person contact. Some home medical equipment used in telehealth services includes remote patient monitoring devices, wearable sensors, and home testing kits. These devices can transmit data to healthcare providers in real time, allowing for timely interventions and adjustments to treatment plans. Overall, the use of telehealth services in the home medical equipment market has the potential to improve patient outcomes, increase access to care, and reduce healthcare costs. Opportunities for eCommerce in the market The Home Medical Equipment (HME) market is a rapidly growing industry with a high potential for eCommerce. With the rise of technology and online shopping, more and more consumers are turning to eCommerce for their healthcare needs. eCommerce provides a convenient way for consumers to purchase HME products from the comfort of their own homes. They can browse and order products online, without having to visit physical stores or clinics. Furthermore, eCommerce is helping HME providers to save on costs associated with maintaining physical stores such as rent, utilities, and staffing. This allows them to offer competitive prices to customers. Thus, eCommerce offers a great opportunity for Home Medical Equipment market providers to expand their reach and increase sales while providing consumers with a convenient and personalized shopping experience. Government initiatives to promote home healthcare and expanding insurance coverage for home medical equipment Governments around the world have taken various initiatives to promote home healthcare and expand insurance coverage for home medical equipment. This has led to an increase in demand for home medical equipment, as patients are able to receive necessary medical care from the comfort of their own homes. In the United States, Medicare provides coverage for a range of market, including oxygen equipment, hospital beds, and walkers. This coverage has helped to make home healthcare more accessible and affordable for seniors and individuals with disabilities. Regulatory agencies such as the US Food and Drug Administration (FDA) and the European Medicines Agency have approved a range of home medical equipment devices like insulin pumps and continuous glucose monitors. These approvals ensure safety and efficacy standards, which gives patients and healthcare providers confidence in their use. Therefore, the home medical equipment market is expected to grow during the forecast period. Complexities and difficulties involved in using home medical equipment hamper the growth of the market Some home medical equipment such as dialysis machines or ventilators are technically complex and require extensive training to operate properly. Patients and caregivers may need to undergo specialized training before they can use this equipment at home. Patients who use home medical equipment need to be able to communicate with their healthcare providers, including physicians, nurses, and other specialists. This can be challenging if the equipment is not integrated with the healthcare provider's electronic health records system. These reasons are expected to hinder the growth of the home medical equipment market.Home Medical Equipment Market Segment Analysis:

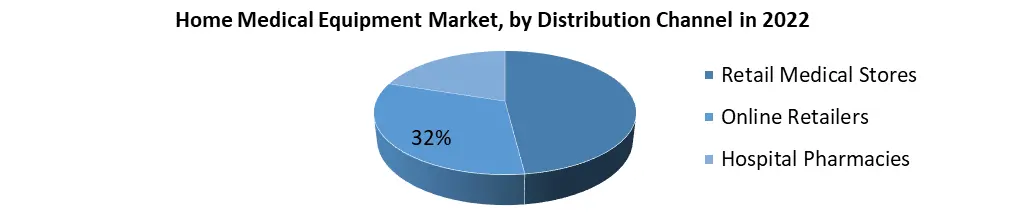

Based on the Equipment Type, the therapeutic home medical equipment segment held the largest revenue share of 26.2 % in 2022. The therapeutic home medical equipment segment has been growing steadily in recent years because of the increasing demand for home-based healthcare solutions. The aging population is a major driver of the therapeutic home medical equipment market, as older adults often have chronic health conditions that require ongoing care and treatment. Technological advancements have made it possible for therapeutic home medical equipment to be more effective and easier to use. This has increased the demand for these products among patients and healthcare providers. The Telemedicine Patient Monitoring Equipment segment is expected to grow at a CAGR of 11.2% during the forecast period. New Technological advancements in wireless sensors, remote monitoring systems, and cloud computing have made telemedicine patient monitoring equipment more effective and easier to use. This has increased the demand for these products among patients and healthcare providers. Based on the Distribution Channel, the demand for the Retail medical stores segment in Home Medical Equipment is growing rapidly at a CAGR of 12.3% during the forecast period. Retail medical stores are a common distribution channel for home medical equipment. These stores offer a range of medical supplies and equipment, including mobility aids, respiratory equipment, wound care supplies, and more. Retail medical stores often have knowledgeable staff who can provide guidance and support to customers in selecting the right equipment for their needs. They can also provide advice on how to use and maintain the equipment properly.

Home Medical Equipment Market Regional Insights

North America is expected to emerge as the major contributor in terms of revenue in the Home Medical Equipment market during the forecast period. The North American home medical equipment market is driven by factors such as the growing aging population, increasing prevalence of chronic diseases, rising healthcare costs, and a shift towards home-based healthcare. Additionally, technological advancements and government initiatives aimed at promoting home healthcare and expanding insurance coverage for home medical equipment are also contributing to the growth of the market. There are many home medical equipment companies operating in North America catering to the needs of individuals who require medical equipment for home use. Some of the key players in the North American market include Philips Healthcare, Invacare Corporation, Medline Industries Inc., Drive DeVilbiss Healthcare, ResMed, and Hill-Rom Holdings, Inc. These companies offer a wide range of home medical equipment products and services, including equipment rental, sales, and maintenance. Apria Healthcare is a leading provider of home medical equipment in North America. Apria Healthcare offers a wide range of equipment and supplies, including oxygen therapy, sleep apnea therapy, and mobility aids. Therefore, the North American home medical equipment market is expected to grow during the forecast period. Asia-Pacific is the second largest growing region across the globe in the Home Medical Equipment market. The home medical equipment market in the Asia Pacific region is segmented into various categories such as patient monitoring equipment, mobility aids and transportation equipment, respiratory therapy equipment, sleep apnea devices, and others. Patient monitoring equipment is the largest segment, accounting for the majority of the market share because of the rising prevalence of chronic diseases and the need for continuous monitoring of vital signs. In terms of geography, Japan is the largest market for home medical equipment in the Asia Pacific region, followed by China, South Korea, and India. The market is highly competitive with several big key players such as Omron Healthcare, ResMed, Philips Healthcare, Becton Dickinson, and Nihon Kohden dominating the industry. Nihon Kohden is a manufacturer and distributor of Market. They offer a range of products, including patient monitors, electrocardiography (ECG) machines, and defibrillators.Home Medical Equipment Market Scope: Inquire before buying

Home Medical Equipment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.32 Bn. Forecast Period 2023 to 2029 CAGR: 10.5% Market Size in 2029: US $ 5.16 Bn. Segments Covered: by Equipment Type 1. Therapeutic Equipment 1. Respiratory Therapy Equipment 2. Dialysis Equipment 3. Intravenous Equipment 4. Other Therapeutic Equipment

2. Patient Monitoring Equipment1. Conventional Monitors 2. Telemedicine Patient Monitoring Equipment

3. Mobility Assist and Patient Support Equipment1. Mobility Assist Equipment 2. Medical Furniture 3. Bathroom Safety Equipment

by Distribution Channel 1. Retail Medical Stores 2. Online Retailers 3. Hospital Pharmacies Home Medical Equipment, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Home Medical Equipment Market, Key Players

1. B. Braun Melsungen AG 2. Cesco Bio Products 3. Fresenius Medical Care AG & Co. Kgaa 4. Gf Health Products, Inc. 5. Hill-Rom Holdings, Inc. 6. Koninklijke Philips N.V. 7. Mckesson Corp. 8. Medtronic plc 9. Omron Healthcare, Inc. 10. Rotech Healthcare Inc. 11. Siemens Healthcare GmbH 12. Stryker Corp. 13. Sunrise Medical (US) LLC 14. 3M Co. 15. Abbott Laboratories 16. ARKRAY Inc. 17. Baxter International Inc. 18. Becton Dickinson and Co. 19. Boston Scientific Corp. 20. Cardinal Health Inc. 21. General Electric Co. 22. Home Medical Products Inc. 23. Invacare Corp. 24. Johnson and Johnson 25. Medline Industries Inc. 26. Medtronic Plc 27. ResMed Inc. 28. Smiths Group Plc 29. Thermo Fisher Scientific Inc. FAQs: 1. Who are the key players in the market? Ans. Abbott Laboratories, Baxter International Inc, B. Braun Melsungen Ag, and Becton are the major companies operating in the Home Medical Equipment market. 2. Which Equipment Type segment dominates the market? Ans. The Therapeutic Equipment segment accounted for the largest share of the global market in 2021. 3. How big is the Market? Ans. The Global market size reached USD 2.32 Bn in 2022 and is expected to reach USD 5.16 Bn by 2029, growing at a CAGR of 10.5 % during the forecast period. 4. What are the key regions in the global market? Ans. Based On the region, the Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. North America dominates the global Home Medical Equipment market. 5. What is the study period of this market? Ans. The Global Market is studied from 2021 to 2029.

1. Home Medical Equipment Market: Research Methodology 2. Home Medical Equipment Market: Executive Summary 3. Home Medical Equipment Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Home Medical Equipment Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Home Medical Equipment Market: Segmentation (by Value USD) 5.1. Home Medical Equipment Market, by Equipment Type (2022-2029) 5.1.1. Therapeutic Equipment o Respiratory Therapy Equipment o Dialysis Equipment o Intravenous Equipment o Other Therapeutic Equipment 5.1.2. Patient Monitoring Equipment o Conventional Monitors o Telemedicine Patient Monitoring Equipment 5.1.3. Mobility Assist and Patient Support Equipment o Mobility Assist Equipment o Medical Furniture o Bathroom Safety Equipment 5.2. Home Medical Equipment Market, by Distribution Channel (2022-2029) 5.2.1. Retail Medical Stores 5.2.2. Online Retailers 5.2.3. Hospital Pharmacies 5.3. Home Medical Equipment Market, by Region (2022-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Home Medical Equipment Market (by Value USD) 6.1. North America Home Medical Equipment Market, by Equipment Type (2022-2029) 6.1.1. Therapeutic Equipment o Respiratory Therapy Equipment o Dialysis Equipment o Intravenous Equipment o Other Therapeutic Equipment 6.1.2. Patient Monitoring Equipment o Conventional Monitors o Telemedicine Patient Monitoring Equipment 6.1.3. Mobility Assist and Patient Support Equipment o Mobility Assist Equipment o Medical Furniture o Bathroom Safety Equipment 6.2. North America Home Medical Equipment Market, by Distribution Channel (2022-2029) 6.2.1. Retail Medical Stores 6.2.2. Online Retailers 6.2.3. Hospital Pharmacies 6.3. North America Home Medical Equipment Market, by Country (2022-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Home Medical Equipment Market (by Value USD) 7.1. Europe Home Medical Equipment Market, by Equipment Type (2022-2029) 7.2. Europe Home Medical Equipment Market, by Distribution Channel (2022-2029) 7.3. Europe Home Medical Equipment Market, by Country (2022-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Home Medical Equipment Market (by Value USD) 8.1. Asia Pacific Home Medical Equipment Market, by Equipment Type (2022-2029) 8.2. Asia Pacific Home Medical Equipment Market, by Distribution Channel (2022-2029) 8.3. Asia Pacific Home Medical Equipment Market, by Country (2022-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Home Medical Equipment Market (by Value USD) 9.1. Middle East and Africa Home Medical Equipment Market, by Equipment Type (2022-2029) 9.2. Middle East and Africa Home Medical Equipment Market, by Distribution Channel (2022-2029) 9.3. Middle East and Africa Home Medical Equipment Market, by Country (2022-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Home Medical Equipment Market (by Value USD) 10.1. South America Home Medical Equipment Market, by Equipment Type (2022-2029) 10.2. South America Home Medical Equipment Market, by Distribution Channel (2022-2029) 10.3. South America Home Medical Equipment Market, by Country (2022-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. B. Braun Melsungen AG 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Cesco Bio Products 11.3. Fresenius Medical Care AG & Co. Kgaa 11.4. Gf Health Products, Inc. 11.5. Hill-Rom Holdings, Inc. 11.6. Koninklijke Philips N.V. 11.7. Mckesson Corp. 11.8. Medtronic plc 11.9. Omron Healthcare, Inc. 11.10. Rotech Healthcare Inc. 11.11. Siemens Healthcare GmbH 11.12. Stryker Corp. 11.13. Sunrise Medical (US) LLC 11.14. 3M Co. 11.15. Abbott Laboratories 11.16. ARKRAY Inc. 11.17. Baxter International Inc. 11.18. Becton Dickinson and Co. 11.19. Boston Scientific Corp. 11.20. Cardinal Health Inc. 11.21. General Electric Co. 11.22. Home Medical Products Inc. 11.23. Invacare Corp. 11.24. Johnson and Johnson 11.25. Medline Industries Inc. 11.26. Medtronic Plc 11.27. ResMed Inc. 11.28. Smiths Group Plc 11.29. Thermo Fisher Scientific Inc. 12. Key Findings 13. Industry Recommendation