The Heavy Construction Vehicles Market size was valued at USD 82.26 Billion in 2025 and the total Heavy Construction Vehicles revenue is expected to grow at a CAGR of 4.03% from 2026 to 2032, reaching nearly USD 108.47 Billion by 2032.Heavy Construction Vehicles Market Overview

Heavy construction vehicles form the operational backbone of global infrastructure development, enabling large-scale earthmoving, material handling, mining, and road construction activities. In 2015, global demand for heavy construction vehicles was largely concentrated in developed economies and commodity-driven markets. By 2024, demand shifted decisively toward Asia-Pacific, driven by national highway programs, smart city development, renewable energy infrastructure, and mining investments.To know about the Research Methodology :- Request Free Sample Report Globally, over 1.95 billion heavy construction vehicles were sold in 2025, with Asia-Pacific accounted for nearly xx % of total unit demand, followed by North America (nearly 25%) and Europe (xx%). China remains the largest manufacturing and consumption hub, while India has emerged as the fastest-growing large market due to aggressive public infrastructure spending.

Market Key Highlights:

• Global heavy construction vehicle demand grew at a CAGR of nearly xx% between 2020 and 2024 • Asia-Pacific accounted for xx% of the global market value in 2025 • Construction applications represented 62.9% of total vehicle utilisation, in 2025. • Diesel-powered vehicles dominated with xx% share in 2025, though electric variants are growing at 14%+ CAGR • In 2025, Autonomous and telematics-enabled equipment reduced operating costs by 15–20% for fleet owners.Heavy Construction Vehicles Market Dynamics

Penetration, Adoption, and Utilization Trends and Drivers

Between 2020 and 2024, the penetration rate of heavy construction vehicles increased steadily in emerging economies due to infrastructure expansion and contractor fleet formalisation. Adoption of rental and leasing models increased sharply, especially among mid-sized contractors. Rental penetration rose from 32% in 2020 to nearly 44% in 2025, improving equipment utilisation and lowering capex barriers. Global infrastructure spending is a key driver propelling the heavy construction vehicles market. For instance, the U.S. government allocated over USD 350 billion in 2024 to enhance highways, transportation, and energy infrastructure, directly stimulating demand for advanced construction equipment. Similarly, the UK and other developed economies are channelling substantial investments toward energy and transportation projects, highlighting a clear governmental push that fosters market growth.The graph displays the brand-wise heavy construction vehicles sales by country in 2025 (measured in thousands of units). It highlights the sales distribution of leading brands like Caterpillar, Komatsu, XCMG, and others across various regions, with China showing the highest sales volume.

Market Challenges and Opportunities

• Challenges: Sales decline in certain months due to project delays, funding issues, and urban-rural demand divides impact short-term growth. • Opportunities: Growing focus on semi-urban and tier-2 cities, rising government infrastructure projects post-elections, and competitive pricing with stable inventory create favorable conditions for sales growth. • Unorganized Sector: Small and mid-sized contractors contribute to demand fluctuations, indicating potential market formalization and digital adoption opportunities.

Heavy Construction Vehicles Market: Segment Analysis

The Construction & Infrastructure sector dominated the Heavy Construction Vehicles market with a commanding xx% global market share in 2025, followed by significant demand from Mining and Material Handling industries, driving growth. Loaders dominated the global Heavy Construction Vehicles Market, accounting for a market value of USD xx billion in 2025, supported by their high utilization rate in material handling, mining operations, and urban infrastructure projects. The segment is projected to grow at a CAGR of xx% (2026–2032), with Asia-Pacific holding nearly xxx % market share, driven by China, India, and Southeast Asia.Heavy Construction Vehicles Market: Regional Analysis

• Asia-Pacific: Dominated the largest market share in 2025 and fastest-growing market with 520,000 units sold in 2025; China (xx%), India (22%), Japan, Indonesia, and Vietnam are key contributors • North America: Mature yet technology-driven market; xx units sold, with high rental penetration (48%) • Europe: Strong regulatory-driven demand; electric and hybrid penetration already >9% • Middle East & Africa: Infrastructure-led growth; adoption rate growing at >7% CAGR (2025-2032) • South America: Mining and energy projects driving demand in Brazil, Chile, and Peru

Competitive Landscape Analysis

The market is highly competitive with several key global and regional players shaping the industry landscape:Between 2020 and 2024, leading players achieved 4–7% average annual revenue growth, driven by aftermarket services, digital platforms, and geographic expansion. Organised OEMs are steadily gaining share from the unorganized and regional manufacturers due to financing access, emission compliance, and technology differentiation. Recent Developments by Major Players

Company 5-Year Growth Rate (%) 2025 Market Share Key Strategic Moves & Market Impact JCB India Ltd -xx.x % AA Market leader; expanding telematics and aftersales services. Action Construction Equipment (ACE) -0.5% xx% Scaling production; innovation in crane and loader segments. Ajax Engineering Ltd +0.43% 7.22% Niche player focusing on concrete and metro projects. Escorts Kubota Ltd -xx.x % xx% Focused on backhoe loaders; poised for demand recovery. Caterpillar India Pvt Ltd -0.31% xx% Leader in autonomous haul trucks; expanding digital solutions.

Development Area Key Highlights Impact / Data Electrification & Sustainability Komatsu electric excavators & Zoomlion hybrid trucks Up to 30% energy savings, emissions cut; Govt incentives boost 20% YoY adoption Automation & AI Autonomous haul trucks (Caterpillar), CASE telematics Productivity ↑ by 15-20%, safety incidents ↓ by 10% Product Innovation Caterpillar 330 UHD demolition excavator launch Precision & safety improved; 10% faster operation Strategic Impact and Future Opportunities

OEM strategies increasingly focus on: • Electrification and automation to meet regulatory and ESG mandates • Localized manufacturing to reduce cost and improve delivery timelines • Digital fleet management platforms for contractors and rental operators The organized sector controls 72% of global sales, while unorganized and regional manufacturers remain influential in price-sensitive markets such as South Asia, Africa, and parts of South America.Heavy Construction Vehicles Market Scope: Inquire before buying

Global Heavy Construction Vehicles Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 82.26 Bn. Forecast Period 2026 to 2032 CAGR: 4.5% Market Size in 2032: USD 108.47 Bn. Segments Covered: by Type Dump Trucks Bulldozers Loaders Graders Dozers Cranes Graders Others byPower source Diesel Electric Hybrid by Application Excavation & Mining Lifting & Material Handling Earthmoving Tunneling Transportation Others by Sales Channel OEM Direct Sales Dealerships & Distributors Aftermarket Sales by Industry Oil & Gas Construction & Infrastructure Manufacturing Mining Agriculture Transportation & Logistic Others Heavy Construction Vehicles Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Heavy Construction Vehicles Key Players

1. Caterpillar Inc. 2. Komatsu Ltd. 3. XCMG Group 4. SANY Group 5. Deere & Company (John Deere) 6. Volvo Construction Equipment 7. Hitachi Construction Machinery 8. Liebherr Group 9. Sandvik AB 10. JCB 11. Doosan Bobcat / Develon 12. CNH Industrial (CASE Construction) 13. Kobelco Construction Machinery 14. Hyundai Construction Equipment 15. Zoomlion Heavy Industry 16. Astec Industries, Inc. 17. Bauer Group 18. Bell Equipment Ltd. 19. Hidromek Co. Ltd. 20. Tata Hitachi Construction Machinery 21. BEML Ltd. 22. Action Construction Equipment (ACE) 23. LiuGong 24. Schwing Stetter 25. Putzmeister 26. Coninfra Machinery Pvt. Ltd. 27. Bobcat Company 28. CNH Industrial (New Holland) 29. Taiyuan Heavy Industry 30. Atlas Copco 31. Others FAQ 1. What is the size of the global heavy construction vehicles market in 2025? Ans: The global heavy construction vehicles market was valued at USD 82.26 billion in 2025 and is projected to grow steadily with a CAGR of 4.03% through 2032. 2. Which region holds the largest share in the heavy construction vehicles market? Ans: Asia-Pacific is the largest market region, led by China and India, driven by rapid infrastructure development and rising demand. 3. What are the main types of heavy construction vehicles? Ans: The primary types include loaders, dump trucks, bulldozers, graders, and cranes, with loaders having the highest market utilization. 4. What technological trends are shaping the heavy construction vehicles market? Ans: Key trends include automation, autonomous vehicles, telematics, and electrification, enhancing efficiency and sustainability. 5. Who are the leading companies in the heavy construction vehicles market? Ans: Top players are Caterpillar Inc., Komatsu Ltd., JCB, Volvo Construction Equipment, and Hitachi Construction Machinery, focusing on innovation and market growth.

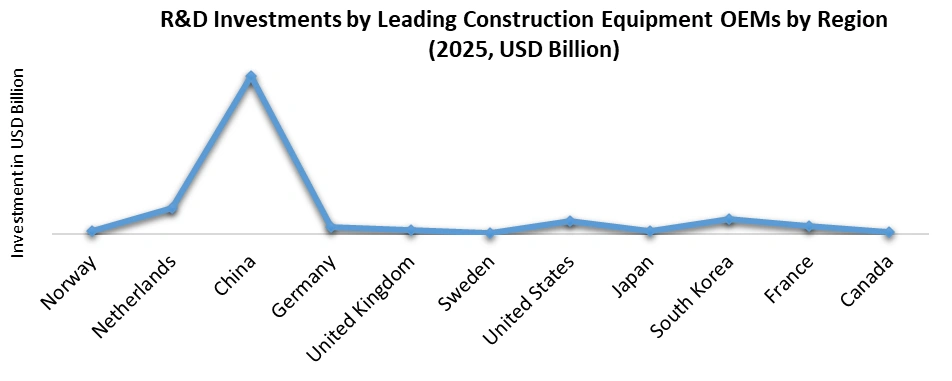

1. Heavy Construction Vehicles Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Heavy Construction Vehicles Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. OEM Consumption Analysis (2025) – Heavy Construction Vehicles 2.3.1. Global OEM-Wise Consumption – Excavators, Bulldozers, Loaders, Dump Trucks, and Cranes 2.3.2. Estimated Volume and Value by Leading OEMs (e.g., Caterpillar, Komatsu, Volvo, JCB, Liebherr, Hitachi) 2.3.3. OEM Market Share (%) – Comparative View by Vehicle Type and Region 2.3.4. Vehicle Program-Level Breakdown (e.g., Caterpillar 336 Excavator, Komatsu D65 Bulldozer, Volvo L350 Loader) 2.3.5. OEM Procurement Trends and Sourcing Strategies (In-house Manufacturing vs. Outsourced Components) 2.3.6. Implications for Tier 1 and Tier 2 Suppliers (Engine Manufacturers, Hydraulic Systems, Transmission, Electronics) 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Heavy Construction Vehicles Market: Dynamics 3.1. Heavy Construction Vehicles Market Trends 3.2. Heavy Construction Vehicles Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Heavy Construction Vehicles Market: Import-Export Analysis by Country (2020-2025) 4.1 Top 10 Importing Countries of Heavy Construction Vehicles 4.2 Top 10 Exporting Countries of Heavy Construction Vehicle Components (Engines, Hydraulic Parts, Chassis) 4.3 Trade Flow and Regional Dependencies 4.4 Impact of Trade Agreements and Tariffs (USMCA, EU Trade Policies, China-ASEAN Trade, etc.) 5. Heavy Construction Vehicles Price Trend Analysis by Region (2020–2025) 5.1 Historical and Current Pricing Trends (2020–2025) by Vehicle Type (Excavators, Loaders, Dump Trucks) 5.2 Regional Price Comparison of Major Components and Complete Vehicles 5.3 Cost Trends in OEM vs. Aftermarket Parts and Services 5.4 Key Factors Impacting Price Fluctuations (Raw Materials, Steel, Engine Emission Norms, Currency Fluctuations) 6. Heavy Construction Vehicles Market: Buyer & End-User Analysis 6.1 End-User Segmentation: Construction Companies, Mining, Infrastructure, Agriculture 6.2 Preferences: OEM Vehicles vs. Used/Refurbished Vehicles 6.3 Replacement Cycles and Maintenance Frequency of Heavy Construction Vehicles 6.4 Brand Preferences and Regional Awareness Trends 6.5 Digital and E-commerce Growth in Heavy Equipment Sales and Rental Platforms 7. Funding, Investment & Innovation Infrastructure 7.1 R&D Investments by Leading OEMs (Caterpillar, Komatsu, Volvo, JCB) 7.2 Venture Funding and Strategic Partnerships for Construction Tech Startups 7.3 Innovation Clusters: North America (US, Canada), Europe (Germany, Sweden), Asia-Pacific (China, India) 7.4 Government-Led Incentives and Pilot Programs Promoting Green Construction Equipment (Electric/Hybrid Vehicles) 8. Supply-Chain Analysis of Heavy Construction Vehicles 8.1 Raw Materials and Critical Components (Steel, Hydraulic Fluids, Engines, Electronics) 8.2 Major Component Manufacturers & Tier-1 OEMs 8.3 Assembly Plants and Manufacturing Hubs by Region 8.4 Distribution Channels: OEM Dealerships, Rental Services, Online Marketplaces 8.5 Service Providers: Maintenance, Spare Parts, Retrofitting Services 9. Regulatory, Policy & Certification Landscape 9.1 Global & Regional Regulations: EPA (US), EU Stage V Emission Norms, Bharat Stage VI (India), China Non-Road Emission Standards 9.2 Safety and Operational Compliance (ISO, ANSI, OSHA Standards) 9.3 Environmental Mandates: Emission Reduction, Noise Control, Recycling of Equipment 9.4 Incentives & Trade Barriers: Tax Benefits, Import/Export Duties, Subsidies for Electric/Hybrid Equipment 9.5 Certification & Testing Infrastructure: Equipment Testing Labs, Emission Certification Bodies 10. Strategic Analysis of Branding, Awareness & Market Engagement 10.1 Government and Industry Initiatives Promoting Sustainable Construction Equipment 10.2 Digital Marketing and Brand Awareness Campaigns by OEMs 10.3 CSR & Sustainability Engagements (Green Equipment Adoption, Carbon Neutrality) 10.4 OEM & Startup Branding Strategies (Caterpillar vs. New Entrants like Epiroc, XCMG) 10.5 Partnerships with Infrastructure Projects, Rental Fleets, and Contractors 11. Heavy Construction Vehicles Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 11.1. Heavy Construction Vehicles Market Size and Forecast, By Type (2025-2032) 11.1.1. Dump Trucks 11.1.2. Bulldozers 11.1.3. Loaders 11.1.4. Graders 11.1.5. Dozers 11.1.6. Cranes 11.1.7. Graders 11.1.8. Others 11.2. Heavy Construction Vehicles Market Size and Forecast, By Power Source (2025-2032) 11.2.1. Diesel 11.2.2. Electric 11.2.3. Hybrid 11.3. Heavy Construction Vehicles Market Size and Forecast, By Application (2025-2032) 11.3.1. Excavation & Mining 11.3.2. Lifting & Material Handling 11.3.3. Earthmoving 11.3.4. Tunneling 11.3.5. Transportation 11.3.6. Others 11.4. Heavy Construction Vehicles Market Size and Forecast, By Sales Channel (2025-2032) 11.4.1. OEM Direct Sales 11.4.2. Dealerships & Distributors 11.4.3. Aftermarket Sales 11.5. Heavy Construction Vehicles Market Size and Forecast, By Industry (2025-2032) 11.5.1. Oil & Gas 11.5.2. Construction & Infrastructure 11.5.3. Manufacturing 11.5.4. Mining 11.5.5. Agriculture 11.5.6. Transportation & Logistic 11.5.7. Others 11.6. Heavy Construction Vehicles Market Size and Forecast, By Region (2025-2032) 11.6.1. North America 11.6.2. Europe 11.6.3. Asia Pacific 11.6.4. Middle East and Africa 11.6.5. South America 12. North America Heavy Construction Vehicles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 12.1. North America Heavy Construction Vehicles Market Size and Forecast, By Type (2025-2032) 12.2. North America Heavy Construction Vehicles Market Size and Forecast, By Power Source (2025-2032) 12.3. North America Heavy Construction Vehicles Market Size and Forecast, By Application (2025-2032) 12.4. North America Heavy Construction Vehicles Market Size and Forecast, By Sales Channel (2025-2032) 12.5. North America Heavy Construction Vehicles Market Size and Forecast, By Industry (2025-2032) 12.6. North America Heavy Construction Vehicles Market Size and Forecast, by Country (2025-2032) 12.6.1. United States 12.6.2. Canada 12.6.3. Mexico 13. Europe Heavy Construction Vehicles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 13.1. Europe Heavy Construction Vehicles Market Size and Forecast, By Type (2025-2032) 13.2. Europe Heavy Construction Vehicles Market Size and Forecast, By Power Source (2025-2032) 13.3. Europe Heavy Construction Vehicles Market Size and Forecast, By Application (2025-2032) 13.4. Europe Heavy Construction Vehicles Market Size and Forecast, By Sales Channel (2025-2032) 13.5. Europe Heavy Construction Vehicles Market Size and Forecast, By Industry (2025-2032) 13.6. Europe Heavy Construction Vehicles Market Size and Forecast, by Country (2025-2032) 13.6.1. United Kingdom 13.6.2. France 13.6.3. Germany 13.6.4. Italy 13.6.5. Spain 13.6.6. Sweden 13.6.7. Russia 13.6.8. Rest of Europe 14. Asia Pacific Heavy Construction Vehicles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 14.1. Asia Pacific Heavy Construction Vehicles Market Size and Forecast, By Type (2025-2032) 14.2. Asia Pacific Heavy Construction Vehicles Market Size and Forecast, By Power Source (2025-2032) 14.3. Asia Pacific Heavy Construction Vehicles Market Size and Forecast, By Application (2025-2032) 14.4. Asia Pacific Heavy Construction Vehicles Market Size and Forecast, By Sales Channel (2025-2032) 14.5. Asia Pacific Heavy Construction Vehicles Market Size and Forecast, By Industry (2025-2032) 14.6. Asia Pacific Heavy Construction Vehicles Market Size and Forecast, by Country (2025-2032) 14.6.1. China 14.6.2. S Korea 14.6.3. Japan 14.6.4. India 14.6.5. Australia 14.6.6. Indonesia 14.6.7. Malaysia 14.6.8. Philippines 14.6.9. Thailand 14.6.10. Vietnam 14.6.11. Rest of Asia Pacific 15. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 15.1. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast, By Type (2025-2032) 15.2. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast, By Power Source (2025-2032) 15.3. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast, By Application (2025-2032) 15.4. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast, By Sales Channel (2025-2032) 15.5. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast, By Industry (2025-2032) 15.6. Middle East and Africa Heavy Construction Vehicles Market Size and Forecast, by Country (2025-2032) 15.6.1. South Africa 15.6.2. GCC 15.6.3. Egypt 15.6.4. Nigeria 15.6.5. Rest of ME&A 16. South America Heavy Construction Vehicles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 16.1. South America Heavy Construction Vehicles Market Size and Forecast, By Type (2025-2032) 16.2. South America Heavy Construction Vehicles Market Size and Forecast, By Power Source (2025-2032) 16.3. South America Heavy Construction Vehicles Market Size and Forecast, By Application (2025-2032) 16.4. South America Heavy Construction Vehicles Market Size and Forecast, By Sales Channel (2025-2032) 16.5. South America Heavy Construction Vehicles Market Size and Forecast, By Industry (2025-2032) 16.6. South America Heavy Construction Vehicles Market Size and Forecast, by Country (2025-2032) 16.6.1. Brazil 16.6.2. Argentina 16.6.3. Colombia 16.6.4. Chile 16.6.5. Rest Of South America 17. Company Profile: Key Players 17.1. Caterpillar Inc. 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. Komatsu Ltd. 17.3. XCMG Group 17.4. SANY Group 17.5. Deere & Company (John Deere) 17.6. Volvo Construction Equipment 17.7. Hitachi Construction Machinery 17.8. Liebherr Group 17.9. Sandvik AB 17.10. JCB 17.11. Doosan Bobcat / Develon 17.12. CNH Industrial (CASE Construction) 17.13. Kobelco Construction Machinery 17.14. Hyundai Construction Equipment 17.15. Zoomlion Heavy Industry 17.16. Astec Industries, Inc. 17.17. Bauer Group 17.18. Bell Equipment Ltd. 17.19. Hidromek Co. Ltd. 17.20. Tata Hitachi Construction Machinery 17.21. BEML Ltd. 17.22. Action Construction Equipment (ACE) 17.23. LiuGong 17.24. Schwing Stetter 17.25. Putzmeister 17.26. Coninfra Machinery Pvt. Ltd. 17.27. Bobcat Company 17.28. CNH Industrial (New Holland) 17.29. Taiyuan Heavy Industry 17.30. Atlas Copco 18. Key Findings 19. Analyst Recommendations 20. Heavy Construction Vehicles Market: Research Methodology