The Haemodialysis and Peritoneal Dialysis Market size was valued at USD 104.08 Billion in 2023 and the total Haemodialysis and Peritoneal Dialysis revenue is expected to grow at a CAGR of 9.3 % from 2024 to 2030, reaching nearly USD 193.96 Billion in 2030.Haemodialysis and Peritoneal Dialysis Market Overview

The report offers a comprehensive analysis covering market dynamics, key players, regulatory landscape, and future trends. Haemodialysis dominates the market with established infrastructure, while peritoneal dialysis gains traction for its portability. Driving factors include ESRD prevalence, innovation, personalized medicine, and government support for home-based dialysis. Leading players of the market such as Fresenius Medical Care and Baxter International invest in home dialysis growth, wearable technology, and AI for personalized care. The increasing prevalence of End-Stage Renal Disease (ESRD) worldwide, attributed to reasons such as ageing populations, diabetes, and hypertension, necessitates a growing number of dialysis services. Wearable artificial kidneys, biocompatible solutions, telehealth, and AI-powered systems all promise better patient outcomes and more treatment alternatives, drawing investment and establishing new markets. Regulatory measures and evolving reimbursement methods promote higher-quality care, increasing demand for specialized equipment, training programs, and data-driven solutions. Also, the shift to home-based therapies such as peritoneal dialysis, driven by patient preferences for enhanced quality of life and potential cost savings, creates an opportunity for companies that provide home dialysis equipment and remote monitoring systems.To know about the Research Methodology :- Request Free Sample Report Expanding home dialysis infrastructure, which includes equipment manufacture, remote monitoring technology, and patient training programs, presents attractive business prospects. Telehealth and data analytics start-ups focused on dialysis management are seeing increased demand and garnering investment. Emerging markets with rising ESRD prevalence and restricted dialysis access give prospects for companies that provide affordable and accessible treatment solutions, attracting additional investor interest. Market estimations show a shift in dialysis modalities, with hemodialysis remaining dominant but declining to 60% by 2030, while peritoneal dialysis climbs to 40% because of higher home therapy usage. Developed regions such as North America and Europe are going to dominate, whereas Asia and South America are expected to experience a quicker increase as ESRD prevalence rises and healthcare infrastructure improves. The Rising Prevalence of ESRD (End-Stage Renal Disease) The increasing prevalence of chronic kidney diseases, including diabetes and hypertension, contributes significantly to the demand for dialysis treatments. As the population ages and lifestyles change, the incidence of ESRD continues to rise globally. Chronic kidney disease (CKD) is on the rise worldwide, approaching 10% prevalence in many areas, with diabetes, hypertension, and glomerular disorders being the leading causes. Aging populations, combined with lifestyle changes such as poor diets and obesity, increase the chance of developing CKD. Limited access to preventive healthcare exacerbates the problem, and despite early CKD management choices, severe stages necessitate dialysis for survival, hence increasing market demand. Rising patient numbers and technical developments are driving dialysis growth. Despite hemodialysis supremacy because of its established infrastructure and extensive availability, peritoneal dialysis is gaining popularity thanks to its adaptability and suitability for home-based therapy. The modification in market share distribution is influenced by regional preferences and differences in healthcare accessibility.

Technological Advancements Wearable gadgets that provide patients more flexibility, biocompatible solutions that reduce complications, and remote monitoring that improves patient care are all examples of significant innovations in dialysis. Miniaturized artificial kidneys promise a higher quality of life, while advanced dialysate fluids and membrane technologies increase toxin clearance and patient health. Remote monitoring, made possible by wearable sensors and telehealth technologies, enables customized care management and timely interventions, potentially lowering hospital visits. Also, artificial intelligence is changing dialysis by optimizing treatment settings, personalizing programs, and predicting complications, resulting in improved patient care effectiveness and efficiency. Technological developments drive the dialysis industry forward by increasing demand for innovative equipment and solutions. Early-stage technologies, such as wearable devices, have the potential to establish new market segments. As these technologies advance, patient preferences are expected to shift toward home-based and flexible treatment alternatives, affecting market dynamics. On the other hand, the adoption of innovative technologies frequently results in premium pricing, creating worries about healthcare expenses and affordability. Despite this, the appeal of improved technologies continues to influence the changing landscape of dialysis care.

Quality of Care Challenges in Dialysis Markets Complications in dialysis include infection risks from vascular access, which raises mortality rates, as well as vascular difficulties that impede therapy and necessitate complex procedures. Cardiovascular comorbidities such as hypertension and heart failure require intensive care. Variability in care, driven by staffing and resources, causes differences in outcomes. Balancing quality and affordability remains a challenge, especially given the influence of modern technology on budget. Social variables and restricted educational access impede patient involvement, which is critical for adherence and self-management. These difficulties demand targeted measures for improving treatment quality, reducing inequities, managing costs, and encouraging patient participation. Quality improvement initiatives are driving dialysis growth, resulting in an increased need for specialist equipment, training, and data analytics technologies. Stricter quality standards from regulatory agencies encourage facilities to invest in compliance and quality development. Evolving reimbursement structures that prioritize quality outcomes impact market rivalry and treatment options. Informed patients drive competition by seeking facilities that provide greater care quality. To fulfill regulatory obligations, capitalize on growing reimbursement patterns, and respond to patient preferences in this ever-changing market, smart investments in technology, training, and compliance are required.

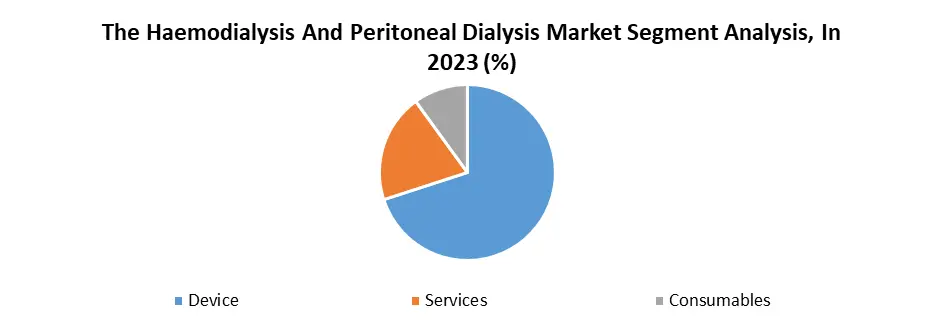

According to MMR Analysis, 30% of hemodialysis patients experience vascular access complications annually Over 80% of ESRD patients have at least one cardiovascular comorbidity Dialysis is a significant cost driver in healthcare systems, with global spending exceeding USD 110 billion in 2023. The Haemodialysis and Peritoneal Dialysis Market Segment Analysis

By Product, The Devices segment accounts for an estimated 70% of the overall Haemodialysis and Peritoneal Dialysis Market. The current infrastructure, which includes in-centre services and trained healthcare personnel, ensures universal access to therapy. Hemodialysis, which is considered cost-effective in certain situations, particularly in complex cases, is a potential alternative to peritoneal dialysis. Continuous technological developments in dialysis machines, dialyzers, and vascular access technologies improve treatment efficiency and patient outcomes. Also, the big and established hemodialysis category contributes significantly to total market stability and growth, demonstrating its long-term relevance in the healthcare industry. While hemodialysis is necessary, it has limits because of the frequent centre visits, which reduces patient autonomy. It increases the risk of vascular problems and infections compared to peritoneal dialysis. Shifting patient preferences toward home-based therapies such as peritoneal dialysis could undermine its supremacy over time. Regulatory measures to promote home dialysis choices and quality care requirements may put additional strain on traditional in-centre hemodialysis models, indicating a rising focus on patient-centred healthcare solutions.

The Haemodialysis and Peritoneal Dialysis Market Regional Insights

The North American hemodialysis and peritoneal dialysis industry continues to grow as the prevalence of end-stage renal disease (ESRD) rises, encouraged by an ageing population and an increase in diabetes and hypertension patients. Technological innovations, such as wearable dialysis equipment and biocompatible solutions, improve patient outcomes while driving market growth. Regulatory actions and shifting reimbursement structures that prioritize quality care encourage investment in specialized equipment and services, hence expanding the industry. The ever-evolving ecosystem provides chances for innovation and expansion as stakeholders work to meet North America's growing demand for high-quality dialysis services. Hemodialysis continues to dominate the market because of its established infrastructure and widespread availability, but its share is expected to shrink as developments in home-based therapies such as peritoneal dialysis emerge. Peritoneal dialysis has a high growth potential as a result of its portability and flexibility, which demands of patients who are seeking a better quality of life. Wearable artificial kidneys are currently in the early stages of development, with the possibility to enter the market. Telehealth use is increasing for remote monitoring and cost-effective patient management, while AI integration in dialysis is gaining popularity for treatment optimization and individualized care plans. Medicare reimbursement reforms incentivize home-based dialysis and remote patient monitoring, increasing accessibility and lowering costs. Quality improvement programs, such as the ESRD Quality Incentive Program, aim to raise care standards and patient outcomes. The United States dominates the market thanks to its greater population and higher incidence of end-stage renal disease (ESRD). However, Canada has significant development potential, showing a shifting picture in North America's dialysis business. The Haemodialysis and Peritoneal Dialysis Market Competitive Landscape Fresenius Medical Care, a global leader, provides a comprehensive line of hemodialysis and peritoneal dialysis products and services. Recent investments include increasing home dialysis services and developing wearable dialysis technology. In 2023, DaVita Healthcare Partners, a prominent hemodialysis rival, made significant investments in home dialysis options and digital health solutions. Baxter International is a leader in peritoneal dialysis solutions and equipment, with recent developments in 2022 including the debut of biocompatible solutions and collaboration on wearable dialysis devices. In 2023, Nxstage Medical specializes in portable and home-based peritoneal dialysis solutions, and recent improvements aim to widen product lines and increase home dialysis usage through collaborations with healthcare providers. Major businesses are making significant investments from 2018 to 2023 to extend their home dialysis solutions in response to patient demands, cost benefits, and government backing. Wearable artificial kidneys are in the early stages of development and show potential for improving patient mobility and quality of life. Telehealth use is increasing for patient monitoring, medication management, and remote consultations. Personalized treatment planning, dialysis parameter optimization, and complication prediction are all examples of artificial intelligence research in the dialysis business, indicating a shift toward enhanced care delivery. These developments highlight stakeholders' coordinated efforts to improve patient outcomes, increase accessibility, and embrace advances in technology in dialysis therapy. Rising competition drives innovation, potentially lowering patient expenses. Home-based therapies are gaining traction, posing a challenge to inpatient facilities. Personalized medicine advances with AI, improving treatment strategies for better results. Evolving legislation and reimbursement mechanisms influence market dynamics and treatment strategies.Haemodialysis and Peritoneal Dialysis Market Scope: Inquire before buying

Global Haemodialysis and Peritoneal Dialysis Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 104.08 Bn. Forecast Period 2024 to 2030 CAGR: 9.3% Market Size in 2030: US $ 193.96 Bn. Segments Covered: by Test Haemodialysis Peritoneal dialysis by Product Device Services Consumables by End User Hospitals Home-Based Haemodialysis and Peritoneal Dialysis Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Haemodialysis and Peritoneal Dialysis Market

1. Baxter. 2. B. Braun SE. 3. Fresenius Medical Care AG. 4. Medtronic. 5. Asahi Kasei Medical Co., Ltd. 6. Nipro Corp. 7. DaVita. 8. BD. 9. Braun Melsungen AG 10. NxStage Medical, Inc. 11. Medtronic 12. Allmed Medical Care 13. DaVita Healthcare Partners 14. JMS Co. Ltd 15. Mar Cor Purification 16. Nikkiso Co., Ltd. (Japan) 17. Diaverum 18. Freseniusmedicalcare 19. Hemantsurgical 20. pharm.ucsf.edu 21. mayoclinic FAQs: 1. What factors are driving the growth of the Haemodialysis and Peritoneal Dialysis Market? Ans. Factors driving market growth include the increasing prevalence of ESRD, technological advancements, rising patient preference for home-based therapies, and government initiatives promoting dialysis access. 2. Who are the key players in the Haemodialysis and Peritoneal Dialysis Market? Ans. Major Players in the market include Fresenius Medical Care, DaVita Healthcare Partners, Baxter International, Nipro Corporation, and Nxstage Medical. These companies offer a range of dialysis products, services, and solutions. 3. What is the projected market size & and growth rate of the Haemodialysis and Peritoneal Dialysis Market? Ans. The Haemodialysis and Peritoneal Dialysis Market size was valued at USD104.08 Billion in 2023 and the total Haemodialysis and Peritoneal Dialysis revenue is expected to grow at a CAGR of 9.3 % from 2023 to 2030, reaching nearly USD 193.96 Billion in 2030. 4. What segments are covered in the Haemodialysis and Peritoneal Dialysis Market report? Ans. The segments covered in the Haemodialysis and Peritoneal Dialysis market report are Test, Product, and End User.

1. Haemodialysis and Peritoneal Dialysis Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Haemodialysis and Peritoneal Dialysis Market: Dynamics 2.1. Haemodialysis and Peritoneal Dialysis Market Trends by Region 2.1.1. North America Haemodialysis and Peritoneal Dialysis Market Trends 2.1.2. Europe Haemodialysis and Peritoneal Dialysis Market Trends 2.1.3. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Trends 2.1.4. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Trends 2.1.5. South America Haemodialysis and Peritoneal Dialysis Market Trends 2.2. Haemodialysis and Peritoneal Dialysis Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Haemodialysis and Peritoneal Dialysis Market Drivers 2.2.1.2. North America Haemodialysis and Peritoneal Dialysis Market Restraints 2.2.1.3. North America Haemodialysis and Peritoneal Dialysis Market Opportunities 2.2.1.4. North America Haemodialysis and Peritoneal Dialysis Market Challenges 2.2.2. Europe 2.2.2.1. Europe Haemodialysis and Peritoneal Dialysis Market Drivers 2.2.2.2. Europe Haemodialysis and Peritoneal Dialysis Market Restraints 2.2.2.3. Europe Haemodialysis and Peritoneal Dialysis Market Opportunities 2.2.2.4. Europe Haemodialysis and Peritoneal Dialysis Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Drivers 2.2.3.2. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Restraints 2.2.3.3. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Opportunities 2.2.3.4. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Drivers 2.2.4.2. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Restraints 2.2.4.3. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Opportunities 2.2.4.4. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Challenges 2.2.5. South America 2.2.5.1. South America Haemodialysis and Peritoneal Dialysis Market Drivers 2.2.5.2. South America Haemodialysis and Peritoneal Dialysis Market Restraints 2.2.5.3. South America Haemodialysis and Peritoneal Dialysis Market Opportunities 2.2.5.4. South America Haemodialysis and Peritoneal Dialysis Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Haemodialysis and Peritoneal Dialysis Industry 2.8. Analysis of Government Schemes and Initiatives For Haemodialysis and Peritoneal Dialysis Industry 2.9. Haemodialysis and Peritoneal Dialysis Market Trade Analysis 2.10. The Global Pandemic Impact on Haemodialysis and Peritoneal Dialysis Market 3. Haemodialysis and Peritoneal Dialysis Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 3.1.1. Haemodialysis 3.1.2. Peritoneal dialysis 3.2. Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 3.2.1. Device 3.2.2. Services 3.2.3. Consumables 3.3. Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospitals 3.3.2. Home-Based 3.4. Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Haemodialysis and Peritoneal Dialysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 4.1.1. Haemodialysis 4.1.2. Peritoneal dialysis 4.2. North America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 4.2.1. Device 4.2.2. Services 4.2.3. Consumables 4.3. North America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Home-Based 4.4. North America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 4.4.1.1.1. Haemodialysis 4.4.1.1.2. Peritoneal dialysis 4.4.1.2. United States Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 4.4.1.2.1. Device 4.4.1.2.2. Services 4.4.1.2.3. Consumables 4.4.1.3. United States Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospitals 4.4.1.3.2. Home-Based 4.4.2. Canada 4.4.2.1. Canada Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 4.4.2.1.1. Haemodialysis 4.4.2.1.2. Peritoneal dialysis 4.4.2.2. Canada Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 4.4.2.2.1. Device 4.4.2.2.2. Services 4.4.2.2.3. Consumables 4.4.2.3. Canada Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospitals 4.4.2.3.2. Home-Based 4.4.3. Mexico 4.4.3.1. Mexico Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 4.4.3.1.1. Haemodialysis 4.4.3.1.2. Peritoneal dialysis 4.4.3.2. Mexico Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 4.4.3.2.1. Device 4.4.3.2.2. Services 4.4.3.2.3. Consumables 4.4.3.3. Mexico Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospitals 4.4.3.3.2. Home-Based 5. Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.2. Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.3. Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4. Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.1.2. United Kingdom Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.1.3. United Kingdom Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.2.2. France Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.2.3. France Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.3.2. Germany Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.3.3. Germany Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.4.2. Italy Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.4.3. Italy Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.5.2. Spain Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.5.3. Spain Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.6.2. Sweden Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.6.3. Sweden Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.7.2. Austria Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.7.3. Austria Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 5.4.8.2. Rest of Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 5.4.8.3. Rest of Europe Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.2. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.3. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.1.2. China Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.1.3. China Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.2.2. S Korea Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.2.3. S Korea Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.3.2. Japan Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.3.3. Japan Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.4.2. India Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.4.3. India Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.5.2. Australia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.5.3. Australia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.6.2. Indonesia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.6.3. Indonesia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.7.2. Malaysia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.7.3. Malaysia Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.8.2. Vietnam Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.8.3. Vietnam Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.9.2. Taiwan Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.9.3. Taiwan Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 6.4.10.2. Rest of Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 6.4.10.3. Rest of Asia Pacific Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 7.2. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 7.3. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 7.4.1.2. South Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 7.4.1.3. South Africa Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 7.4.2.2. GCC Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 7.4.2.3. GCC Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 7.4.3.2. Nigeria Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 7.4.3.3. Nigeria Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 7.4.4.2. Rest of ME&A Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 7.4.4.3. Rest of ME&A Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 8. South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 8.2. South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 8.3. South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User(2023-2030) 8.4. South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 8.4.1.2. Brazil Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 8.4.1.3. Brazil Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 8.4.2.2. Argentina Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 8.4.2.3. Argentina Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Test (2023-2030) 8.4.3.2. Rest Of South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by Product (2023-2030) 8.4.3.3. Rest Of South America Haemodialysis and Peritoneal Dialysis Market Size and Forecast, by End User (2023-2030) 9. Global Haemodialysis and Peritoneal Dialysis Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Haemodialysis and Peritoneal Dialysis Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Baxter. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. B. Braun SE. 10.3. Fresenius Medical Care AG. 10.4. Medtronic. 10.5. Asahi Kasei Medical Co., Ltd. 10.6. Nipro Corp. 10.7. DaVita. 10.8. BD. 10.9. Braun Melsungen AG 10.10. NxStage Medical, Inc. 10.11. Medtronic 10.12. Allmed Medical Care 10.13. DaVita Healthcare Partners 10.14. JMS Co. Ltd 10.15. Mar Cor Purification 10.16. Nikkiso Co., Ltd. (Japan) 10.17. Diaverum 10.18. Freseniusmedicalcare 10.19. Hemantsurgical 10.20. pharm.ucsf.edu 10.21. mayoclinic 11. Key Findings 12. Industry Recommendations 13. Haemodialysis and Peritoneal Dialysis Market: Research Methodology 14. Terms and Glossary