Green Packaging Market was valued at USD 325.83 Bn in 2023 and is expected to reach US 506.34 Bn by 2030, at a CAGR of 6.5 percent during the forecast period.Global Green Packaging Market Overview

Green packaging is known as eco-friendly packaging, with the use of materials and manufacturing methods that have a reduced impact on the environment compared to traditional packaging. The adoption of green packaging varies across regions, with some areas showing stronger commitments to sustainability than others. Europe and North America, for example, have been early adopters of green packaging practices. Changing consumer preferences in the green packaging market, particularly among younger demographics, are shifting toward environmentally friendly products and packaging, which boosts the Green Packaging Market growth. With the rise of e-commerce, there is a growing need for sustainable packaging solutions tailored to the unique requirements of online retail. This includes packaging that minimizes waste and optimizes shipping efficiency. Green packaging companies not only contribute to environmental conservation but also position themselves favorably in the eyes of increasingly eco-conscious consumers.To know about the Research Methodology :- Request Free Sample Report

Green Packaging Market Dynamics

Growing awareness among consumers to boost the Green Packaging Market growth Growing awareness among consumers about the environmental impact of packaging materials led to increased demand for sustainable and eco-friendly alternatives. Many Green Packaging companies are integrating environmental sustainability into their corporate social responsibility (CSR) strategies. Adopting green packaging is a way for businesses to demonstrate their commitment to environmental stewardship. Stringent regulations and policies at national and international levels are pushing companies to adopt sustainable packaging practices. These regulations include restrictions on single-use plastics, mandates for recycled content, and requirements for eco-friendly packaging, which significantly boosts the Green Packaging industry. Green packaging, particularly when designed for efficiency, can lead to cost savings in the long term. For example, lightweight packaging can reduce transportation costs, and the use of recycled materials may lower raw material expenses. Ongoing research and technological advancements have led to the development of new, innovative green packaging materials. This includes biodegradable plastics, compostable materials, and improved recycling processes. Companies are recognizing the need to minimize their environmental footprint, and adopting green packaging is a way to address concerns related to waste generation and pollution. The concept of a circular economy, where materials are reused, recycled, or composted, is influencing packaging strategies and helps to boost the Green Packaging market growth. Green packaging aligns with this approach by promoting a more sustainable use of resources. Availability of Suitable Alternatives to limit the Green Packaging Market growth As there are innovative green packaging materials, the range of available options is limited compared to conventional materials, restricting the choices for certain applications. Green packaging materials and technologies are more expensive than traditional alternatives, posing a challenge for businesses, especially smaller ones or those operating on tight budgets. In some regions, the lack of adequate infrastructure for collecting, sorting, and recycling green packaging materials hinder their widespread adoption and limits the Green Packaging Market growth. Insufficient recycling facilities limit the effectiveness of recycling initiatives. Despite growing environmental awareness, some consumers don’t understand the benefits of green packaging or are resistant to change. Education and communication efforts are crucial to overcoming this barrier. Adopting green packaging require changes throughout the supply chain, from sourcing raw materials to manufacturing processes. Some Green packaging companies find it challenging to navigate this complexity and limits the Green Packaging Market growth. Resistance to change within industries that are accustomed to traditional packaging methods is a significant barrier. Established practices and infrastructure make it challenging for some businesses to transition to green packaging. Some biodegradable materials have limitations in terms of shelf life and performance in certain conditions, which impact their suitability for specific applications.Trends in the Green Packaging Market

1. Minimalist and Sustainable Design: Adoption of minimalist packaging designs that use fewer materials, reducing waste and environmental impact. 2. Plant-Based and Renewable Materials: Increased use of plant-based and renewable materials, such as bamboo, hemp, and mushroom-based packaging. 3. E-commerce-Focused Solutions: Development of packaging solutions tailored for the unique challenges of e-commerce, such as optimizing size, reducing excess materials, and improving recyclability. 4. Smart Packaging for Sustainability: Integration of smart packaging technologies to enhance supply chain efficiency, reduce waste, and provide consumers with information on product sustainability.Green Packaging Market Segment Analysis

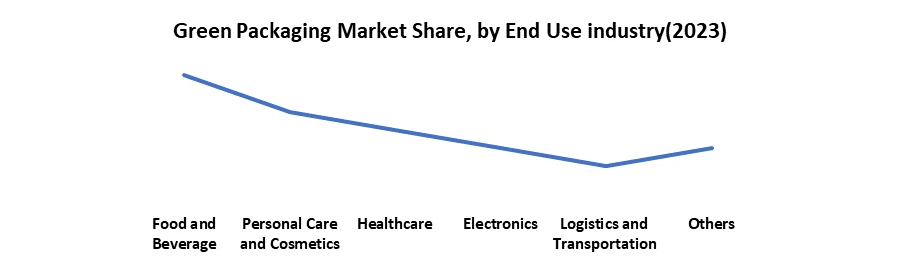

Based on Packaging Type, the market is segmented into Recycled Content Packaging, Reusable Packaging, Degradable Packaging, and others. Recycled Content Packaging segment dominated the market in 2023 and is expected to hold the largest market share over the forecast period. Packaging made from recycled paper and cardboard is a common and widely accepted practice. It involves using post-consumer or post-industrial recycled fibers to produce boxes, cartons, and other packaging materials. The recycling process for paper and cardboard helps conserve forests, reduce energy consumption, and decrease water usage compared to manufacturing with virgin materials. The Recycled Content Packaging segment aligns with the principles of the circular economy, where materials are reused, recycled, and reintegrated into the production cycle. This approach aims to minimize waste and reduce the environmental impact of packaging, which significantly boosts the Green Packaging Market growth.Based on the End User industry, the market is segmented into Food and Beverage, Personal Care and Cosmetics, Healthcare, Electronics, Logistics and Transportation and others. Food and beverage segment dominated the market in 2023 and is expected to hold the largest Green Packaging Market share over the forecast period. The Food and beverage companies emphasize their commitment to sustainability through eco-friendly labels and branding on packaging. Food and beverage companies operating in different regions need to comply with various environmental regulations related to packaging materials. Understanding and adhering to these regulations influence the choice of green packaging solutions and significantly boosts the Green Packaging Market growth. Because of the growing popularity of green packaging, many restaurants, fast food chains, packaged food companies, and casual dining facilities are embracing moulded pulp packaging and biodegradable packaging, which is expected to boost the food and beverage industry. Many personal care product makers are moving toward greener solutions by lowering the amount of material used in packaging.

Green Packaging Market Regional Insight

Rising Consumer Demand for Eco-Friendly Products to boost the Europe Green Packaging Market growth Consumer preferences are shifting toward products that have minimal environmental impact. Brands that embrace green packaging appeal to environmentally conscious consumers and gain a competitive advantage in the market. Governments in Europe provide support and incentives for businesses adopting sustainable practices, including green packaging. Financial incentives, tax breaks, and grants are often available to companies implementing environmentally friendly packaging solutions. European countries set ambitious targets for waste reduction, recycling rates, and landfill diversion, which increases the Green Packaging Market share in Europe. To meet these targets, companies are motivated to invest in green packaging technologies and materials that contribute to waste reduction and recycling goals. Sustainability considerations extend throughout the supply chain. European companies are increasingly evaluating and improving the sustainability of their entire supply chain, including packaging materials, transportation, and distribution. Education campaigns and clear labeling on products help consumers make informed choices. Labels indicating recyclability, use of recycled materials, or biodegradability play a crucial role in communicating the eco-friendly attributes of packaging. In Europe, the plastic-packaging recycling rate reported was somewhat higher at approximately 40 percent, compared to 80 percent for paperboard, and 75–80 percent for metal and glass. Many U.S. companies are incorporating sustainability into their core values and business strategies. Adopting green packaging aligns with corporate sustainability goals and helps enhance brand reputation. Major retailers and e-commerce platforms are emphasizing sustainable packaging practices. Many retailers in the U.S. are encouraging or requiring their suppliers to adopt green packaging solutions. Ongoing research and development lead to the introduction of innovative materials with lower environmental footprints. Companies are investing in the development of biodegradable, compostable, and recycled-content packaging materials. 3 to 5 % consumers in US are willing to pay more for sustainable Packaging, which will significantly help to boost the Green Packaging Industry growth.APAC is the second dominant region and is expected to hold the largest Green Packaging market share over the forecast period. Factors such as the growth of recyclable and reusable materials, new eco-friendly technologies, and government backing are influencing the region's packaging future. Additionally, major investments in product development and packaging technology updates increase the size of the region’s packaging market. Moreover, the region's growing e-commerce businesses drive long-term packaging market growth.

Green Packaging Market Competitive Landscape

Major multinational corporations and established players dominate the green packaging market. Competition exists among companies offering a wide array of green packaging materials and technologies. Companies focus on continuous innovation and invest in research and development to introduce new and improved green packaging solutions. Technological advancements and novel materials are key factors influencing competitiveness. Mergers and acquisitions are observed as companies seek to expand their product portfolios, geographic reach, and capabilities. Green Packaging companies often differentiate themselves based on their commitment to meeting or exceeding sustainability standards. Companies develop marketing strategies that highlight their commitment to sustainability and cater to the growing demand for eco-friendly products. The Green Packaging market is characterized by both global players and regional manufacturers offering localized green packaging solutions.Green Packaging Market Scope: Inquiry Before Buying

Global Green Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 325.83 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: US $ 506.34 Bn. Segments Covered: By Packaging Type Recycled Content Packaging Reusable Packaging Degradable Packaging Others By End User industry Food and Beverage Personal Care and Cosmetics Healthcare Electronics Logistics and Transportation Others Global Green Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Green Packaging Market Key Players:

Global: 1. Ball Corporation (United States) 2. Tetra Pak International S.A. (Switzerland) 3. Sealed Air Corporation (United States) 4. Smurfit Kappa Group (Ireland) 5. Bemis Company, Inc. (United States) 6. WestRock Company (United States) North America: 1. International Paper Company (United States) 2. WestRock Company (United States) 3. Sonoco Products Company (United States) Europe: 1. DS Smith Plc (United Kingdom) 2. Smurfit Kappa Group (Ireland) 3. Mondi Group (Austria) Asia-Pacific: 1. Amcor Limited (Australia) 2. Huhtamäki Oyj (Finland) 3. Tetra Pak International S.A. (Switzerland) Latin America: 1. Klabin S.A. (Brazil) 2. Grupo Gondi (Mexico) Middle East & Africa: 3. Nampak Ltd (South Africa)Frequently Asked Questions:

1. How is consumer demand influencing the green packaging market in Europe? Ans: Consumer preferences in Europe are shifting toward products with minimal environmental impact. Brands that adopt green packaging appeal to environmentally conscious consumers, and government support, including financial incentives, further boosts the adoption of sustainable practices. 2. How are U.S. companies incorporating sustainability into their business strategies? Ans: Many U.S. companies are integrating sustainability into their core values and business strategies. Adopting green packaging aligns with corporate sustainability goals, enhances brand reputation, and is encouraged or required by major retailers and e-commerce platforms in the country. 3. What are the challenges faced by the green packaging industry? Ans: Challenges include limited options compared to conventional materials, higher costs of green packaging materials, inadequate infrastructure for collecting and recycling, and resistance to change within industries accustomed to traditional packaging methods. 4. Why is there a growing demand for green packaging in the market? Ans: The growing demand for green packaging is driven by changing consumer preferences, particularly among younger demographics, who prioritize environmentally friendly products. Additionally, stringent regulations, increased awareness about the environmental impact of packaging, and the rise of e-commerce contribute to the rising demand for sustainable packaging solutions.

1. Green Packaging Market: Research Methodology 2. Green Packaging Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Green Packaging Market: Dynamics 3.1. Green Packaging Market Trends by Region 3.1.1. North America Green Packaging Market Trends 3.1.2. Europe Green Packaging Market Trends 3.1.3. Asia Pacific Green Packaging Market Trends 3.1.4. Middle East and Africa Green Packaging Market Trends 3.1.5. South America Green Packaging Market Trends 3.2. Green Packaging Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Green Packaging Market Drivers 3.2.1.2. North America Green Packaging Market Restraints 3.2.1.3. North America Green Packaging Market Opportunities 3.2.1.4. North America Green Packaging Market Challenges 3.2.2. Europe 3.2.2.1. Europe Green Packaging Market Drivers 3.2.2.2. Europe Green Packaging Market Restraints 3.2.2.3. Europe Green Packaging Market Opportunities 3.2.2.4. Europe Green Packaging Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Green Packaging Market Drivers 3.2.3.2. Asia Pacific Green Packaging Market Restraints 3.2.3.3. Asia Pacific Green Packaging Market Opportunities 3.2.3.4. Asia Pacific Green Packaging Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Green Packaging Market Drivers 3.2.4.2. Middle East and Africa Green Packaging Market Restraints 3.2.4.3. Middle East and Africa Green Packaging Market Opportunities 3.2.4.4. Middle East and Africa Green Packaging Market Challenges 3.2.5. South America 3.2.5.1. South America Green Packaging Market Drivers 3.2.5.2. South America Green Packaging Market Restraints 3.2.5.3. South America Green Packaging Market Opportunities 3.2.5.4. South America Green Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis For Green Packaging Market 3.7. Analysis of Government Schemes and Initiatives For the Green Packaging Market 3.8. The Global Pandemic Impact on the Green Packaging Market 4. Green Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 4.1.1. Recycled Content Packaging 4.1.2. Reusable Packaging 4.1.3. Degradable Packaging 4.1.4. Others 4.2. Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 4.2.1. Food and Beverage 4.2.2. Personal Care and Cosmetics 4.2.3. Healthcare 4.2.4. Electronics 4.2.5. Logistics and Transportation 4.2.6. Others 4.3. Green Packaging Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Green Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 5.1.1. Recycled Content Packaging 5.1.2. Reusable Packaging 5.1.3. Degradable Packaging 5.1.4. Others 5.2. North America Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 5.2.1. Food and Beverage 5.2.2. Personal Care and Cosmetics 5.2.3. Healthcare 5.2.4. Electronics 5.2.5. Logistics and Transportation 5.2.6. Others 5.3. North America Green Packaging Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 5.3.1.1.1. Recycled Content Packaging 5.3.1.1.2. Reusable Packaging 5.3.1.1.3. Degradable Packaging 5.3.1.1.4. Others 5.3.1.2. United States Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 5.3.1.2.1. Food and Beverage 5.3.1.2.2. Personal Care and Cosmetics 5.3.1.2.3. Healthcare 5.3.1.2.4. Electronics 5.3.1.2.5. Logistics and Transportation 5.3.1.2.6. Others 5.3.2. Canada 5.3.2.1. Canada Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 5.3.2.1.1. Recycled Content Packaging 5.3.2.1.2. Reusable Packaging 5.3.2.1.3. Degradable Packaging 5.3.2.1.4. Others 5.3.2.2. Canada Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 5.3.2.2.1. Food and Beverage 5.3.2.2.2. Personal Care and Cosmetics 5.3.2.2.3. Healthcare 5.3.2.2.4. Electronics 5.3.2.2.5. Logistics and Transportation 5.3.2.2.6. Others 5.3.3. Mexico 5.3.3.1. Mexico Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 5.3.3.1.1. Recycled Content Packaging 5.3.3.1.2. Reusable Packaging 5.3.3.1.3. Degradable Packaging 5.3.3.1.4. Others 5.3.3.2. Mexico Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 5.3.3.2.1. Food and Beverage 5.3.3.2.2. Personal Care and Cosmetics 5.3.3.2.3. Healthcare 5.3.3.2.4. Electronics 5.3.3.2.5. Logistics and Transportation 5.3.3.2.6. Others 6. Europe Green Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.2. Europe Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3. Europe Green Packaging Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.1.2. United Kingdom Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.2. France 6.3.2.1. France Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.2.2. France Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.3.2. Germany Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.4.2. Italy Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.5.2. Spain Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.6.2. Sweden Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.7.2. Austria Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 6.3.8.2. Rest of Europe Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7. Asia Pacific Green Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.2. Asia Pacific Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3. Asia Pacific Green Packaging Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.1.2. China Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.2.2. S Korea Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.3.2. Japan Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.4. India 7.3.4.1. India Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.4.2. India Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.5.2. Australia Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.6.2. Indonesia Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.7.2. Malaysia Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.8.2. Vietnam Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.9.2. Taiwan Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 8. Middle East and Africa Green Packaging Market Size and Forecast (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 8.2. Middle East and Africa Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 8.3. Middle East and Africa Green Packaging Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 8.3.1.2. South Africa Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 8.3.2.2. GCC Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 8.3.3.2. Nigeria Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 8.3.4.2. Rest of ME&A Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 9. South America Green Packaging Market Size and Forecast by (by Value in USD Million) (2023-2030 9.1. South America Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 9.2. South America Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 9.3. South America Green Packaging Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 9.3.1.2. Brazil Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 9.3.2.2. Argentina Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Green Packaging Market Size and Forecast, By Packaging Type (2023-2030) 9.3.3.2. Rest Of South America Green Packaging Market Size and Forecast, By End User Industry (2023-2030) 10. Global Green Packaging Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Green Packaging Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Amcor Limited (Australia) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Ball Corporation (United States) 11.3. Tetra Pak International S.A. (Switzerland) 11.4. Sonoco Products Company (United States) 11.5. Sealed Air Corporation (United States) 11.6. Bemis Company, Inc. (United States) 11.7. Huhtamäki Oyj (Finland) 11.8. WestRock Company (United States) 11.9. International Paper Company (United States) 11.10. WestRock Company (United States) 11.11. DS Smith Plc (United Kingdom) 11.12. Smurfit Kappa Group (Ireland) 11.13. Mondi Group (Austria) 11.14. Tetra Pak International S.A. (Switzerland) 11.15. Klabin S.A. (Brazil) 11.16. Grupo Gondi (Mexico) 11.17. Nampak Ltd (South Africa) 11.18. Mondi Group (Austria) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary