The Global Green Building Solutions Market size was valued at USD 702.82 Bn in 2023 and is expected to reach USD 1343.67 Bn by 2030, at a CAGR of 9.70 %Overview of the Green Building Solutions Market

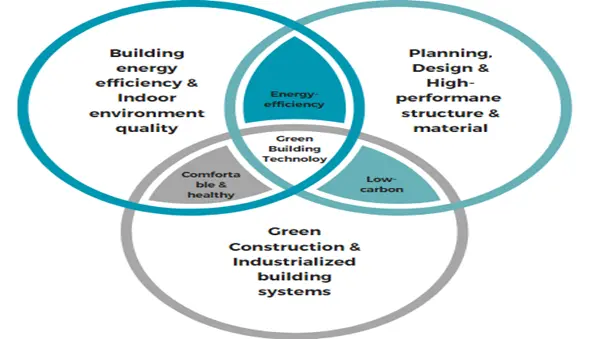

Green building solutions comprise an array of environmentally conscious practices, advanced technologies, and strategies used in the designing, construction, and manufacturing procedure of buildings. Their prioritized objective is to produce less negative environmental impacts and offer sustainability. These solutions strive to create structures that are energy-efficient, resource-efficient, and leave a reduced ecological footprint. The graphical representation and structural exclusive information showed dominating region of the Green Building Solutions Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Green Building Solutions Market.To know about the Research Methodology :- Request Free Sample Report

Green Building Solutions Market Dynamics

Environmental Awareness and contribution towards creating green buildings and offering benefits and solution drives the Green Building Solutions Market Green buildings contribute to mitigating negative impacts on the natural environment through various sustainable practices. They achieve this by employing resource-efficient measures, such as minimizing water and energy consumption, utilizing renewable energy sources, and adopting eco-friendly materials. Additionally such green buildings focus on reducing emissions and waste, further enhancing their environmental benefits in the green building solutions market. Some green buildings even go beyond being carbon-neutral and generate their own energy or contribute positively to biodiversity conservation. Remarkably, within the industries responsible for significant greenhouse gas emissions, the building sector possesses the greatest potential to drive substantial reductions in emissions and make a significant difference in combatting climate change in the green building solutions industry. Evolving building structures and demand for greener housing societies are creating major opportunities for upcoming generations The adoption of green building measures, which result in improved performance, also yields economic advantages for various stakeholders. Developers experience higher property values due to efficient resource utilization and the construction of durable, high-performing buildings. These enhanced structures are appealing to both business owners and occupants due to their environmental benefits, increased comfort, higher efficiency, reduced waste, and lower operating costs, all of which positively impact occupancy rates. Also, the green building industry fosters significant job creation, contributing to its substantial growth in the green building solution market. Studies also reveal that individuals working in the improved environment of green buildings experience benefits in areas such as work performance and sleep quality. The ongoing expansion of this sector highlights its potential to generate positive outcomes not only for the environment but also for the economy and the well-being of building occupants. The cost factor and environmental changes are becoming the prime challenge to limiting the green building solutions market The primary limitation faced by green buildings is their higher upfront cost compared to conventional buildings in the green building solutions market. While green buildings offer substantial long-term financial benefits, their initial investment is typically more significant due to the expense of materials and technologies employed. Also these eco-friendly materials are less readily available in the market and construction timelines get extended due to the specialized nature of green building practices. Specifically obtaining bank funding for green building projects proves to be more challenging.Common Obstacles for the construction of Green Buildings in 2023 (%)

Technology Smart building technologies: These smart buildings play a crucial role in the green building solutions market, as they provide smart solutions to enhanced energy efficiency, residents’ comfort, and whole sustainability. These technologies support advanced sensors, controls, and automation systems to enhance building operations and reduce energy consumption. Building Automation System (BAS): A building automation system (BAS) is a network designed to connect and automate certain functions inside a building. Building automation systems do have a significant role to play in ensuring energy efficiency in facilities. By optimizing building systems and equipment, BAS reduces energy consumption and costs, improves building performance, and contributes to a sustainable future. Energy-efficient lighting: It is a key component of green building solutions market strategies, and LED (Light Emitting Diode) lighting stands out as an important technology in this field. LED lighting has transformed the lighting industry with its excellent energy efficiency, environmental welfare, and enduring performance. One of the main reasons for LED's popularity in green buildings is its significant levels of energy consumption compared to traditional lighting options in the green building solutions market. LEDs are applied for semiconductors to convert electricity into light, which makes them extremely efficient in converting energy to visible brightness. As they use up to 80% less energy than traditional incandescent bulbs and are visibly more efficient than fluorescent lighting options. Advanced insulation materials: These materials play an important role in improving the energy efficiency of green buildings, as they offer greater thermal performance compared to traditional insulation options in the green building solutions market. These innovative materials, such as spray foam insulation and aerogel, donates significantly to lowering the heating and cooling energy requirements, resulting in reduced energy consumption and lower utility costs. Building-Integrated Photovoltaics (BIPV): The BIVP is a leading-edge technology that combines solar energy generation with the architecture of the building itself in the green building solutions market. Unlike old-fashioned solar panels placed on top of roofs or on adjacent structures, BIPV systems are integrated directly into various building elements, such as rooftops, facades, windows, and canopies. This alignment not only produces renewable energy but also enhances the aesthetics and functionality of the building.

Green Building Solutions Market Segment Analysis

Green Building Solutions Market Regional Analysis

China is capturing important steps in contributing green buildings to succeed in its goal of high carbon emissions from urban and rural construction by 2030. The Ministry of Housing and Urban-Rural Development (MHURD) and the National Development and Reform Commission (NDRC) have issued an action plan to drive this initiative in the green building solutions market. The action plan outlines several key objectives. By 2024, all new urban buildings in China are constructed in adherence to green building standards. Also around 60% of urban communities are targeted to transform into green communities with convenient access to various services by 2030. Substantially in 2020, a significant 77% of China's new urban construction was already classified as green buildings, signaling substantial progress in sustainable construction practices. The Canada Green Buildings Strategy sets an ambitious target of achieving net-zero emissions and climate-resilient buildings sector by 2050, with an interim goal of reducing emissions by 37% from 2005 levels by 2030. In 2023, Canada demonstrated its commitment to sustainability by certifying 205 projects, encompassing over 3.2 million gross square meters (GSM) of LEED space. The U.S. Green Building Council (USGBC) releases the global LEED ranking annually. One noteworthy achievement in Northern Canada was the Greenstone Building in Yellowknife, which became the region's first building to attain LEED Gold status in the green building solutions market. The building's central atrium features a curtain wall embedded with photovoltaic cells, constituting one of the largest installations of its kind worldwide. These cells harness solar energy to heat water collected from the green roof and groundwater, showcasing cutting-edge sustainable design. The Canadian Green Building Council's (CAGBC) Zero Carbon Building (ZCB) standards exemplify a domestically developed framework that prioritizes carbon reduction as the new measure of building innovation. Being among the world's pioneering zero-carbon building standards, they underscore the significance of building emissions in achieving national climate commitments in the green building solutions industry. Canada's commitment to green spaces is also evident in Montreal, boasting an impressive array of 65 parks scattered throughout the city. As well as the city takes pride in its fourth-best cycling infrastructure globally, making it an attractive choice for residents seeking environmentally friendly commuting options, reducing reliance on cars.Green Building Solutions Market Competitive Landscape Johnson Controls to expand Open Blue digital buildings capabilities through the acquisition of workplace management software leader. The global leader for smart, healthy, and sustainable buildings, has acquired FM: Systems, a leading digital workplace management and Internet of Things (IoT) solutions provider for facilities and real estate professionals. Workplace management technology is a key enabler in terms of improving operational efficiency, creating safer, healthier, and smarter buildings, and supporting sustainability goals. Gensler Partners with UN-Habitat on the Cities Investment Advisory Platform. In April 2022, UN-Habitat and the United Nations Capital Development Fund (UNCDF) joined hands to strengthen The Cities Investment Facility (CIF), which aims to unlock institutional and commercial capital to finance sustainable and masterplan-integrated municipal development projects. Gensler Partners with the City of Bogotá on Community Center Initiative. M/C Partners engaged Gensler to design a workplace that reflects its brand and enhances its organizational culture. An in-depth visioning process and close collaboration with the client team were essential to identifying the project objectives and defining a workplace vision to ensure all stakeholders were aligned on its success.

Rank 2021 Firm Green Building Design Revenue (Mn USD) 1 Gensler, Los Angeles, Calif. 924.14 2 AECOM, Los Angeles, Calif. 730 3 Arup, New York, N.Y. 379.45 4 HOK, St. Louis, Mo. 336.6 5 HDR, Omaha, Neb. 237.21 6 Stantec Inc., Irvine, Calif. 227.58 7 HKS, Dallas, Texas 205.01 8 Stanley Consultants, Muscatine, Iowa 201.29 9 Skidmore Owings & Merrill, New York, N.Y. 190.1 10 DLR Group, Minneapolis, Minn 184.6 11 ZGF Architects LLP, Portland, Ore. 174.14 12 WSP USA, New York, N.Y. 150 13 CannonDesign, New York City, N.Y. 150 14 Kimley-Horn, Raleigh, N.C. 147.47 15 Burns & McDonnell, Kansas City, Mo. 128.09 16 NBBJ, Seattle, Wash. 112.1 17 SmithGroup, Detroit, Mich. 101.6 18 EYP Architecture & Engineering, Albany, N.Y. 101.04 19 BR+A Consulting Engineers, Boston, Mass. 99.62 20 Perkins&Will, Chicago, Ill. 85.5 Green Building Solutions Market Scope: Inquire Before Buying

Global Green Building Solutions Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 702.82 Bn. Forecast Period 2024 to 2030 CAGR: 9.70% Market Size in 2030: US $ 1343.67 Bn. Segments Covered: by Product Energy-efficient Materials Renewable Energy Technology Water-saving Solutions Sustainable Constructions Materials Green Roof & Green Wall Solutions by Service Green Certifications & Consulting Services Energy Management & Automation Services Indoor Environmental Quality Services Waste Management & Recycling Services by Application Residential Buildings Commercial Buildings Industrial Buildings Institutional Buildings by Technology Smart Building Technologies Energy-Efficient Lighting Advanced Insulation Technology Building- Integrated Photovoltaics (BIPV) Building Energy Modeling (BEM) Building Automation System (BAS) Green Building Solutions Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Green Building Solutions Market

1. AECOM, Los Angeles, Calif. 2. Arup, New York, N.Y. 3. HOK, St. Louis, Mo. 4. HDR, Omaha, Neb. 5. Stantec Inc., Irvine, Calif. 6. HKS, Dallas, Texas 7. Stanley Consultants, Muscatine, Iowa 8. Skidmore Owings & Merrill, New York, N.Y. 9. DLR Group, Minneapolis, Minn. 10. ZGF Architects LLP, Portland, Ore. 11. WSP USA, New York, N.Y. 12. CannonDesign, New York City, N.Y. 13. Kimley-Horn, Raleigh, N.C. 14. Burns & McDonnell, Kansas City, Mo. 15. NBBJ, Seattle, Wash. 16. SmithGroup, Detroit, Mich. 17. EYP Architecture & Engineering, Albany, N.Y. 18. BR+A Consulting Engineers, Boston, Mass. 19. Perkins&Will, Chicago, Ill.Frequently Asked Questions and Answers

1. What are green building solutions? Ans: Green building solutions refer to environmentally conscious practices, technologies, and strategies used in construction to minimize environmental impact and promote sustainability. 2. How is the green building solutions market growing? Ans: The green building solutions market is growing due to increased environmental awareness, government incentives, and corporate sustainability initiatives. 3. What is the green building solutions market size? Ans: The green building solutions market size was USD 702.82 Bn in 2023 and is expected to reach USD 1343.67 Bn by 2030. 4. Are green building solutions cost-effective? Ans: Yes, the green building solutions market often leads to long-term cost savings through energy efficiency and reduced maintenance expenses. 5. How does the green building solutions market contribute to global sustainability efforts? Ans: Green buildings reduce carbon emissions, conserve resources, and support global efforts to combat climate change.

1. Green Building Solutions Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Green Building Solutions Market: Dynamics 2.1. Green Building Solutions Market Trends by Region 2.1.1. North America Green Building Solutions Market Trends 2.1.2. Europe Green Building Solutions Market Trends 2.1.3. Asia Pacific Green Building Solutions Market Trends 2.1.4. Middle East and Africa Green Building Solutions Market Trends 2.1.5. South America Green Building Solutions Market Trends 2.2. Green Building Solutions Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Green Building Solutions Market Drivers 2.2.1.2. North America Green Building Solutions Market Restraints 2.2.1.3. North America Green Building Solutions Market Opportunities 2.2.1.4. North America Green Building Solutions Market Challenges 2.2.2. Europe 2.2.2.1. Europe Green Building Solutions Market Drivers 2.2.2.2. Europe Green Building Solutions Market Restraints 2.2.2.3. Europe Green Building Solutions Market Opportunities 2.2.2.4. Europe Green Building Solutions Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Green Building Solutions Market Drivers 2.2.3.2. Asia Pacific Green Building Solutions Market Restraints 2.2.3.3. Asia Pacific Green Building Solutions Market Opportunities 2.2.3.4. Asia Pacific Green Building Solutions Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Green Building Solutions Market Drivers 2.2.4.2. Middle East and Africa Green Building Solutions Market Restraints 2.2.4.3. Middle East and Africa Green Building Solutions Market Opportunities 2.2.4.4. Middle East and Africa Green Building Solutions Market Challenges 2.2.5. South America 2.2.5.1. South America Green Building Solutions Market Drivers 2.2.5.2. South America Green Building Solutions Market Restraints 2.2.5.3. South America Green Building Solutions Market Opportunities 2.2.5.4. South America Green Building Solutions Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Green Building Solutions Industry 2.8. Analysis of Government Schemes and Initiatives For Green Building Solutions Industry 2.9. Green Building Solutions Market Trade Analysis 2.10. The Global Pandemic Impact on Green Building Solutions Market 3. Green Building Solutions Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Green Building Solutions Market Size and Forecast, by Product (2023-2030) 3.1.1. Energy-efficient Materials 3.1.2. Renewable Energy Technology 3.1.3. Water-saving Solutions 3.1.4. Sustainable Constructions Materials 3.1.5. Green Roof & Green Wall Solutions 3.2. Green Building Solutions Market Size and Forecast, by Service (2023-2030) 3.2.1. Green Certifications & Consulting Services 3.2.2. Energy Management & Automation Services 3.2.3. Indoor Environmental Quality Services 3.2.4. Waste Management & Recycling Services 3.3. Green Building Solutions Market Size and Forecast, by Application (2023-2030) 3.3.1. Residential Buildings 3.3.2. Commercial Buildings 3.3.3. Industrial Buildings 3.3.4. Institutional Buildings 3.4. Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 3.4.1. Smart Building Technologies 3.4.2. Energy-Efficient Lighting 3.4.3. Advanced Insulation Technology 3.4.4. Building- Integrated Photovoltaics (BIPV) 3.4.5. Building Energy Modeling (BEM) 3.4.6. Building Automation System (BAS) 3.5. Green Building Solutions Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Green Building Solutions Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Green Building Solutions Market Size and Forecast, by Product (2023-2030) 4.1.1. Energy-efficient Materials 4.1.2. Renewable Energy Technology 4.1.3. Water-saving Solutions 4.1.4. Sustainable Constructions Materials 4.1.5. Green Roof & Green Wall Solutions 4.2. North America Green Building Solutions Market Size and Forecast, by Service (2023-2030) 4.2.1. Green Certifications & Consulting Services 4.2.2. Energy Management & Automation Services 4.2.3. Indoor Environmental Quality Services 4.2.4. Waste Management & Recycling Services 4.3. North America Green Building Solutions Market Size and Forecast, by Application (2023-2030) 4.3.1. Residential Buildings 4.3.2. Commercial Buildings 4.3.3. Industrial Buildings 4.3.4. Institutional Buildings 4.4. North America Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 4.4.1. Smart Building Technologies 4.4.2. Energy-Efficient Lighting 4.4.3. Advanced Insulation Technology 4.4.4. Building- Integrated Photovoltaics (BIPV) 4.4.5. Building Energy Modeling (BEM) 4.4.6. Building Automation System (BAS) 4.5. North America Green Building Solutions Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Green Building Solutions Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Energy-efficient Materials 4.5.1.1.2. Renewable Energy Technology 4.5.1.1.3. Water-saving Solutions 4.5.1.1.4. Sustainable Constructions Materials 4.5.1.1.5. Green Roof & Green Wall Solutions 4.5.1.2. United States Green Building Solutions Market Size and Forecast, by Service (2023-2030) 4.5.1.2.1. Green Certifications & Consulting Services 4.5.1.2.2. Energy Management & Automation Services 4.5.1.2.3. Indoor Environmental Quality Services 4.5.1.2.4. Waste Management & Recycling Services 4.5.1.3. United States Green Building Solutions Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Residential Buildings 4.5.1.3.2. Commercial Buildings 4.5.1.3.3. Industrial Buildings 4.5.1.3.4. Institutional Buildings 4.5.1.4. United States Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 4.5.1.4.1. Smart Building Technologies 4.5.1.4.2. Energy-Efficient Lighting 4.5.1.4.3. Advanced Insulation Technology 4.5.1.4.4. Building- Integrated Photovoltaics (BIPV) 4.5.1.4.5. Building Energy Modeling (BEM) 4.5.1.4.6. Building Automation System (BAS) 4.5.2. Canada 4.5.2.1. Canada Green Building Solutions Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Energy-efficient Materials 4.5.2.1.2. Renewable Energy Technology 4.5.2.1.3. Water-saving Solutions 4.5.2.1.4. Sustainable Constructions Materials 4.5.2.1.5. Green Roof & Green Wall Solutions 4.5.2.2. Canada Green Building Solutions Market Size and Forecast, by Service (2023-2030) 4.5.2.2.1. Green Certifications & Consulting Services 4.5.2.2.2. Energy Management & Automation Services 4.5.2.2.3. Indoor Environmental Quality Services 4.5.2.2.4. Waste Management & Recycling Services 4.5.2.3. Canada Green Building Solutions Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Residential Buildings 4.5.2.3.2. Commercial Buildings 4.5.2.3.3. Industrial Buildings 4.5.2.3.4. Institutional Buildings 4.5.2.4. Canada Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 4.5.2.4.1. Smart Building Technologies 4.5.2.4.2. Energy-Efficient Lighting 4.5.2.4.3. Advanced Insulation Technology 4.5.2.4.4. Building- Integrated Photovoltaics (BIPV) 4.5.2.4.5. Building Energy Modeling (BEM) 4.5.2.4.6. Building Automation System (BAS) 4.5.3. Mexico 4.5.3.1. Mexico Green Building Solutions Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Energy-efficient Materials 4.5.3.1.2. Renewable Energy Technology 4.5.3.1.3. Water-saving Solutions 4.5.3.1.4. Sustainable Constructions Materials 4.5.3.1.5. Green Roof & Green Wall Solutions 4.5.3.2. Mexico Green Building Solutions Market Size and Forecast, by Service (2023-2030) 4.5.3.2.1. Green Certifications & Consulting Services 4.5.3.2.2. Energy Management & Automation Services 4.5.3.2.3. Indoor Environmental Quality Services 4.5.3.2.4. Waste Management & Recycling Services 4.5.3.3. Mexico Green Building Solutions Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Residential Buildings 4.5.3.3.2. Commercial Buildings 4.5.3.3.3. Industrial Buildings 4.5.3.3.4. Institutional Buildings 4.5.3.4. Mexico Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 4.5.3.4.1. Smart Building Technologies 4.5.3.4.2. Energy-Efficient Lighting 4.5.3.4.3. Advanced Insulation Technology 4.5.3.4.4. Building- Integrated Photovoltaics (BIPV) 4.5.3.4.5. Building Energy Modeling (BEM) 4.5.3.4.6. Building Automation System (BAS) 5. Europe Green Building Solutions Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.1. Europe Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.1. Europe Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.1. Europe Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5. Europe Green Building Solutions Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.1.3. United Kingdom Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.2. France 5.5.2.1. France Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.2.3. France Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.3.3. Germany Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.4.3. Italy Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.5.3. Spain Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.6.3. Sweden Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.7.3. Austria Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Green Building Solutions Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Green Building Solutions Market Size and Forecast, by Service (2023-2030) 5.5.8.3. Rest of Europe Green Building Solutions Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6. Asia Pacific Green Building Solutions Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.3. Asia Pacific Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5. Asia Pacific Green Building Solutions Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.1.3. China Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.2.3. S Korea Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.3.3. Japan Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.4. India 6.5.4.1. India Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.4.3. India Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.5.3. Australia Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.6.3. Indonesia Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.7.3. Malaysia Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.8.3. Vietnam Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.9.3. Taiwan Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Green Building Solutions Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Green Building Solutions Market Size and Forecast, by Service (2023-2030) 6.5.10.3. Rest of Asia Pacific Green Building Solutions Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 7. Middle East and Africa Green Building Solutions Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Green Building Solutions Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Green Building Solutions Market Size and Forecast, by Service (2023-2030) 7.3. Middle East and Africa Green Building Solutions Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 7.5. Middle East and Africa Green Building Solutions Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Green Building Solutions Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Green Building Solutions Market Size and Forecast, by Service (2023-2030) 7.5.1.3. South Africa Green Building Solutions Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Green Building Solutions Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Green Building Solutions Market Size and Forecast, by Service (2023-2030) 7.5.2.3. GCC Green Building Solutions Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Green Building Solutions Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Green Building Solutions Market Size and Forecast, by Service (2023-2030) 7.5.3.3. Nigeria Green Building Solutions Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Green Building Solutions Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Green Building Solutions Market Size and Forecast, by Service (2023-2030) 7.5.4.3. Rest of ME&A Green Building Solutions Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 8. South America Green Building Solutions Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Green Building Solutions Market Size and Forecast, by Product (2023-2030) 8.2. South America Green Building Solutions Market Size and Forecast, by Service (2023-2030) 8.3. South America Green Building Solutions Market Size and Forecast, by Application(2023-2030) 8.4. South America Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 8.5. South America Green Building Solutions Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Green Building Solutions Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Green Building Solutions Market Size and Forecast, by Service (2023-2030) 8.5.1.3. Brazil Green Building Solutions Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Green Building Solutions Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Green Building Solutions Market Size and Forecast, by Service (2023-2030) 8.5.2.3. Argentina Green Building Solutions Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Green Building Solutions Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Green Building Solutions Market Size and Forecast, by Service (2023-2030) 8.5.3.3. Rest Of South America Green Building Solutions Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Green Building Solutions Market Size and Forecast, by Technology (2023-2030) 9. Global Green Building Solutions Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Green Building Solutions Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. AECOM, Los Angeles, Calif. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Arup, New York, N.Y. 10.3. HOK, St. Louis, Mo. 10.4. HDR, Omaha, Neb. 10.5. Stantec Inc., Irvine, Calif. 10.6. HKS, Dallas, Texas 10.7. Stanley Consultants, Muscatine, Iowa 10.8. Skidmore Owings & Merrill, New York, N.Y. 10.9. DLR Group, Minneapolis, Minn. 10.10. ZGF Architects LLP, Portland, Ore. 10.11. WSP USA, New York, N.Y. 10.12. CannonDesign, New York City, N.Y. 10.13. Kimley-Horn, Raleigh, N.C. 10.14. Burns & McDonnell, Kansas City, Mo. 10.15. NBBJ, Seattle, Wash. 10.16. SmithGroup, Detroit, Mich. 10.17. EYP Architecture & Engineering, Albany, N.Y. 10.18. BR+A Consulting Engineers, Boston, Mass. 10.19. Perkins&Will, Chicago, Ill. 11. Key Findings 12. Industry Recommendations 13. Green Building Solutions Market: Research Methodology 14. Terms and Glossary