Global Graphic Designing Software Market size was valued at USD 8.41 Bn in 2023 and is expected to reach USD 13.98 Bn by 2030, at a CAGR of 9.8 %.Graphic Designing Software Market Overview

Graphic designing software is used for computer programs and applications particularly designed to assist the creation, editing, manipulation and production of visual content for several purposes. These software tools are used by graphic designers, artists, illustrators and other creative professionals to generate a wide range of visual materials, for print as well as digital Media. Graphic designing software offers users a collection of tools, features and functionalities that allow them to generate visual content edit and improve images and layout design. Evolution of digital trends, growth of E-commerce industry and technological advancements are the driving factors of the Graphic Designing Software Market growth. The report covers insights into the major drivers, challenges and major restraints of the Graphic Designing Software industry. Data is collected using primary and secondary databases with qualitative and quantitative analysis. SWOT analysis is used to help organizations to develop a complete awareness of all factors included to make a business decision in the Graphic Designing Software Market. The PESTLE provides information about growth targets and risks to the productivity of the market.To know about the Research Methodology :- Request Free Sample Report

Graphic Designing Software Market Dynamics

Increasing Demand for Visual Content to Boost Graphic Designing Software Market Growth Visual content including images, infographics, videos and animations, is highly effective in assigning messages, emotions, and information quickly and memorably. As businesses and individuals distinguish the power of visual communication, they search for tools that enable them to create convincing visuals. In the digital age, marketing and advertising heavily depend on eye-catching visuals to demand and engage audiences. Brands and marketers use graphic design software to create visually attractive ads, banners, social media posts and other promotional materials that resonate with consumers. The variety of visual content types allows businesses and creators to provide several preferences and platforms. Whether it's social media posts, blog graphics, product images, or video content, graphic design software offers the flexibility to generate a wide range of visuals which drives Graphic Designing Software Market growth. Visuals are powerful tools for storytelling. Through graphic design software, businesses have visually narrated their brand stories, products, and services, making it easier for consumers to connect with and understand their offerings. Visuals enrich user engagement on websites, apps and social media. Engaging visuals enhance the user experience, promote longer interactions, and have been resulting in increased conversions. Social media platforms prioritize visual content, and users are more likely to share and engage with posts that involve compelling visuals. Graphic design software allows individuals and businesses to create shareable content that resonates with their target audiences. In a crowded market, unique and visually distinctive branding is crucial for standing out. Graphic design software enables the creation of logos, visual identities, and brand assets that reflect a brand's personality and values. The graphic design market boosts demand for graphic design software which boost Graphic Designing Software Market growth. As businesses and individuals have been needing visual content for branding, marketing, advertising and other purposes, the requirement for erudite and versatile design tools rises. For Instance, Consider the Graphic design market in Vietnam.Rising Prominence of User Experience (UX) and User Interface (UI) Design to Fuel Graphic Designing Software Market With the prompt development in the digital world, user experience and interface design have a direct influence on how users interact with websites, applications and digital products. Businesses recognize that posing intuitive and enjoyable user experiences is vital for attracting and retaining customers. As user expectations increase, companies differentiate themselves by providing superior UX and UI design. Effective design has set a product or service apart from competitors, resulting in increased market share and customer loyalty. Well-designed interfaces and seamless interactions contribute to a positive brand image. User-friendly and visually attractive interfaces have been reinforcing brand credibility and trust. Intuitive UI and immersive UX boost users to stay longer, engage more deeply and complete desired actions including making purchases or signing up for services. This directly impacts conversion rates and business success. With the explosion of mobile devices, mobile apps have become essential to daily life. The demand for graphic designing software rises from the need to create visually appealing, responsive and user-centered mobile interfaces and drive Graphic Designing Software Market growth . UX/UI design ensures that products are usable and available to a diverse range of users such as those with disabilities. This inclusivity is not only ethical but also a legal need in many regions. Businesses are growingly adopting a customer-centric approach, aiming at the requirements, preferences and emotions of their users. Effective UX/UI design is central to providing this approach. Designing for optimal user experiences involves iterative processes and continuous enhancement based on user feedback. Graphic designing software enables designers to efficiently make changes and test several design iterations.

Graphic Designing Software Market Trend

Growing Shift to Cloud-Based Solutions Cloud-based graphic design software allows seamless collaboration among team members, regardless of their geographical location. Designers have been working together on the same project in real-time, sharing files and offering feedback, improving teamwork and efficiency, particularly in a remote or distributed work environment. Cloud-based solutions enable designers to access their projects and tools from any device with an internet connection. This flexibility is essential for those who need to work on their designs while on the go or switch between several workstations. Cloud-based software includes version control and automatic backup features, ensuring that designers have been easily revert to previous versions of their work if required and avoid the risk of data loss. Cloud-based solutions offload ample processing power and storage demands to remote servers. This means designers have been working with complex projects and large files without demanding high-end hardware on their local machines. Cloud-based software providers have been rolling out updates and new features seamlessly. Users don't need to concern about manual installations or compatibility issues, ensuring that they always have access to the latest tools and enhancements. Cloud-based solutions have been scaling up or down based on user requirements. Businesses have easily added or removed licenses as their design team grows or projects change, providing cost-efficiency and flexibility. Reputable cloud providers invest heavily in security measures to secure user data. Data encryption, protect authentication and regular audits maintain the integrity and confidentiality of sensitive design assets which boost Graphic Designing Software Market growth. Graphic Designing Software Market Restraint Cost and Pricing Models to hamper Graphic Designing Software Market growth High upfront costs or subscription fees associated with premium graphic designing software have been deterring potential users, particularly individual designers, freelancers, small businesses and start-ups with limited financial resources. The perceived values of the software have not aligned with the cost, resulting in hesitation or reluctance to invest. Many individuals and businesses have allocated budgets for software and tools. If the cost of graphic designing software exceeds these budgets, users have to opt for more affordable or free alternatives, limiting the potential customer base for premium software providers. With the propagation of subscription-based services across several industries, users have experience subscription fatigue. The cumulative cost of multiple software subscriptions has been adding up, leading users to prioritize which subscriptions to maintain and potentially cancel graphic design software subscriptions. Complex or tiered pricing structures have been confusing potential users, making it challenging for them to determine the most suitable option for their requirements. Unclear pricing has led to frustration and deterred the decision-making process. As a result, Cost and Pricing Models impede Graphic Designing Software Market growthGraphic Designing Software Market Regional Insights

North America dominated Graphic Designing Software Market and is expected to continue its dominance during the forecast period. North America is a global hub for technology innovation, with key software companies and start-ups constantly pushing the boundaries of graphic design software abilities. This environment adopts the development of cutting-edge tools and features that appeal to users and boost Graphic Designing Software Market growth. The region's creative industries such as advertising, marketing, entertainment and digital media, have an increasing demand for graphic design software. As these industries continue to advance and expand, the requirement for advanced design tools grows. North American businesses are growingly embracing digital transformation, resulting in a greater demand for graphic design software to create fascinating digital content, user interfaces, and interactive experiences. The growth of e-commerce in the region boosts the demand for visually appealing product images, packaging designs, and web graphics, all of which need vigorous graphic design software. The region's vibrant start-up ecosystem embraces numerous tech and creative start-ups that rely on graphic design software for branding, marketing and user interface design. North America is home to many admired universities and design schools that provide graphic design programs. These institutions contribute to the demand for graphic design software as students learn and develop their skills. The various cultural landscapes in the region lead to varied design preferences and requirements. Graphic design software has been provided to a wide range of design styles and cultural sensitivities, boosting innovation and customization. The region's prominent media and entertainment industry relies comprehensively on graphic design software for creating visual effects, animations and multimedia content. The increase in freelancing and the gig economy in North America create an essential for available and efficient graphic design software that individual designers have been using to offer their services which drive Graphic Designing Software Market growth.Graphic Designing Software Market Segment Analysis

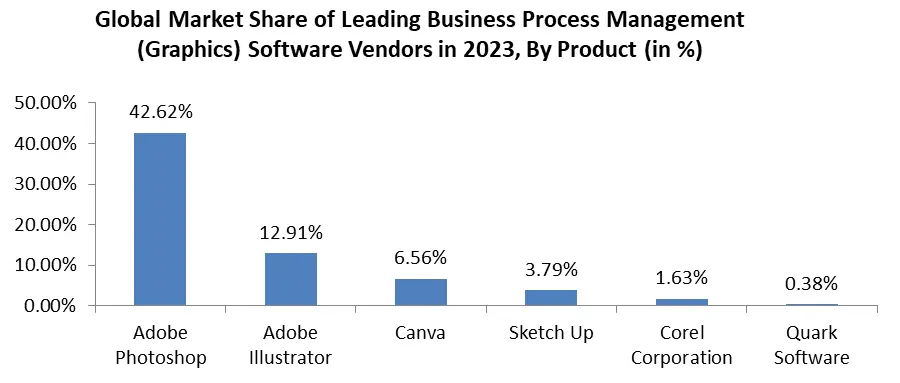

Based on End User, the market is segmented into Marketing and Advertising, Media and Entertainment, E-commerce, Education, Web Design and Development and Print and Publishing. Marketing and Advertising dominated the largest Graphic Designing Software Market share in 2023. Marketing and advertising heavily rely on visual content to apprehend the attention of target audiences. Graphic designing software is crucial for creating eye-catching visuals including advertisements, banners, social media graphics and promotional materials. Graphic design software is used to advance and maintain brand identities. This involves designing logos, typography, color schemes and other visual elements that support creating a consistent and perceptible brand image. Graphic design software is used to create designs for print as well as digital campaigns, ensuring consistency across several marketing channels. This includes designing materials for print ads, billboards, online banners, email marketing and others. Graphic design software is vigorous for creating product packaging designs that appeal to consumers and communicate the value of a product. Packaging plays a critical role in prompting purchasing decisions. Effective marketing involves visual storytelling. Graphic design software enables marketers to deliver messages and narratives through compelling visuals that resonate with the target audience. Content marketing strategies rely on visually attractive content including infographics, presentations, and videos. Graphic design software is used to create engaging content that communicates information efficiently which drives Graphic Designing Software Market growth. Graphic design software is used to create promotional materials for events, trade shows, and conferences, assisting to generate interest and attract attendees.Graphic Designing Software Market Competitive Analysis The report offers Competitive benchmarking of the Graphic Designing Software industry Market revenue, share and size of the key players. The report provides such type of competitive landscape of all Key Players to assist new market entrants. It also gives information about the analysis of the Competitive Landscape in the Graphic Designing Software Market structure, highlighting the key players and their strategies. Some of the key companies are Adobe Inc.(US), Corel Corporation ( Canada), Autodesk, Inc. ( US), Canva (Australia), Serif (Affinity) ( United Kingdom), InVisionApp, Inc. ( US), Sketch (United Kingdom), Quark Software Inc. ( US),Gravit Designer (Austria)Figma ( US), Crello ( Israel), Vectr ( US), Xara Group Ltd. ( Germany), PaintShop Pro ( Canada), Blender Foundation ( Netherlands) and Others. Many companies conducted mergers and acquisition to increase their product portfolio. For instance, In 2023, Adobe announced that it have been agreed to purchase the software design start-up Figma for USD 20 billion. Figma is cloud-based design software that competes with Adobe XD. The acquisition is predictable to support Adobe strengthen its position in the design software market.

Graphic Designing Software Market Scope: Inquire before buying

Global Graphic Designing Software Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.41 Bn. Forecast Period 2024 to 2030 CAGR: 9.8% Market Size in 2030: US $ 13.98 Bn. Segments Covered: by Software Type Vector Graphics Editing Software Raster Image Editing Software by Deployment Type On-Premises Cloud-Based by End User Marketing and Advertising Web Design and Development Others Graphic Designing Software Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Graphic Designing Software Key Player

1. Adobe Inc.(US) 2. Corel Corporation ( Canada) 3. Autodesk, Inc. ( US) 4. Canva (Australia) 5. Serif (Affinity) ( United Kingdom) 6. InVisionApp, Inc. ( US) 7. Sketch (United Kingdom) 8. Quark Software Inc. ( US) 9. Gravit Designer (Austria) 10. Figma ( US) 11. Crello ( Israel) 12. Vectr ( US) 13. Xara Group Ltd. ( Germany) 14. PaintShop Pro ( Canada) 15. Blender Foundation ( Netherlands) 16. Pixelmator ( Lithuania) 17. Pixlr ( US) 18. Adobe Spark (US) 19. Adobe Illustrator ( US) 20. Adobe Photoshop ( US) 21. Affinity Designer ( United Kingdom) 22. Procreate (Australia) 23. Wacom ( Japan) 24. DesignCrowd ( Australia) Frequently Asked Questions: 1] What is the growth rate of the Global Graphic Designing Software Market? Ans. The Global Graphic Designing Software Market is growing at a significant rate of 9.8 % during the forecast period. 2] Which region is expected to dominate the Global Graphic Designing Software Market? Ans. North America is expected to dominate the Graphic Designing Software Market during the forecast period. 3] What is the expected Global Graphic Designing Software Market size by 2030? Ans. The Graphic Designing Software Market size is expected to reach USD 13.98 Bn by 2030. 4] Which are the top players in the Global Graphic Designing Software Market? Ans. The top players in the Global Graphic Designing Software Market are Adobe Inc.(US), Corel Corporation ( Canada), Autodesk, Inc. ( US), Canva (Australia), Serif (Affinity) ( United Kingdom), InVisionApp, Inc. ( US), Sketch (United Kingdom), Quark Software Inc. (US),Gravit Designer (Austria)Figma ( US), Crello ( Israel), Vectr ( US), Xara Group Ltd. ( Germany), PaintShop Pro ( Canada), Blender Foundation ( Netherlands) and others. 5] What are the factors driving the Global Graphic Designing Software Market growth? Ans. Increasing demand for visual content and technological advancements are expected to drive market growth during the forecast period.

1. Graphic Designing Software Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Graphic Designing Software Market: Dynamics 2.1. Graphic Designing Software Market Trends by Region 2.1.1. North America Graphic Designing Software Market Trends 2.1.2. Europe Graphic Designing Software Market Trends 2.1.3. Asia Pacific Graphic Designing Software Market Trends 2.1.4. Middle East and Africa Graphic Designing Software Market Trends 2.1.5. South America Graphic Designing Software Market Trends 2.2. Graphic Designing Software Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Graphic Designing Software Market Drivers 2.2.1.2. North America Graphic Designing Software Market Restraints 2.2.1.3. North America Graphic Designing Software Market Opportunities 2.2.1.4. North America Graphic Designing Software Market Challenges 2.2.2. Europe 2.2.2.1. Europe Graphic Designing Software Market Drivers 2.2.2.2. Europe Graphic Designing Software Market Restraints 2.2.2.3. Europe Graphic Designing Software Market Opportunities 2.2.2.4. Europe Graphic Designing Software Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Graphic Designing Software Market Drivers 2.2.3.2. Asia Pacific Graphic Designing Software Market Restraints 2.2.3.3. Asia Pacific Graphic Designing Software Market Opportunities 2.2.3.4. Asia Pacific Graphic Designing Software Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Graphic Designing Software Market Drivers 2.2.4.2. Middle East and Africa Graphic Designing Software Market Restraints 2.2.4.3. Middle East and Africa Graphic Designing Software Market Opportunities 2.2.4.4. Middle East and Africa Graphic Designing Software Market Challenges 2.2.5. South America 2.2.5.1. South America Graphic Designing Software Market Drivers 2.2.5.2. South America Graphic Designing Software Market Restraints 2.2.5.3. South America Graphic Designing Software Market Opportunities 2.2.5.4. South America Graphic Designing Software Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Graphic Designing Software Industry 2.8. Analysis of Government Schemes and Initiatives For Graphic Designing Software Industry 2.9. Graphic Designing Software Market Trade Analysis 2.10. The Global Pandemic Impact on Graphic Designing Software Market 3. Graphic Designing Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 3.1.1. Vector Graphics Editing Software 3.1.2. Raster Image Editing Software 3.2. Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 3.2.1. On-Premises 3.2.2. Cloud-Based 3.3. Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 3.3.1. Marketing and Advertising 3.3.2. Web Design and Development 3.3.3. Others 3.4. Graphic Designing Software Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Graphic Designing Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 4.1.1. Vector Graphics Editing Software 4.1.2. Raster Image Editing Software 4.2. North America Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 4.2.1. On-Premises 4.2.2. Cloud-Based 4.3. North America Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 4.3.1. Marketing and Advertising 4.3.2. Web Design and Development 4.3.3. Others 4.4. North America Graphic Designing Software Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 4.4.1.1.1. Vector Graphics Editing Software 4.4.1.1.2. Raster Image Editing Software 4.4.1.2. United States Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 4.4.1.2.1. On-Premises 4.4.1.2.2. Cloud-Based 4.4.1.3. United States Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Marketing and Advertising 4.4.1.3.2. Web Design and Development 4.4.1.3.3. Others 4.4.2. Canada 4.4.2.1. Canada Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 4.4.2.1.1. Vector Graphics Editing Software 4.4.2.1.2. Raster Image Editing Software 4.4.2.2. Canada Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 4.4.2.2.1. On-Premises 4.4.2.2.2. Cloud-Based 4.4.2.3. Canada Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Marketing and Advertising 4.4.2.3.2. Web Design and Development 4.4.2.3.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 4.4.3.1.1. Vector Graphics Editing Software 4.4.3.1.2. Raster Image Editing Software 4.4.3.2. Mexico Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 4.4.3.2.1. On-Premises 4.4.3.2.2. Cloud-Based 4.4.3.3. Mexico Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Marketing and Advertising 4.4.3.3.2. Web Design and Development 4.4.3.3.3. Others 5. Europe Graphic Designing Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.2. Europe Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.3. Europe Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4. Europe Graphic Designing Software Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.1.2. United Kingdom Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.1.3. United Kingdom Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.2.2. France Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.2.3. France Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.3.2. Germany Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.3.3. Germany Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.4.2. Italy Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.4.3. Italy Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.5.2. Spain Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.5.3. Spain Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.6.2. Sweden Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.6.3. Sweden Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.7.2. Austria Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.7.3. Austria Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 5.4.8.2. Rest of Europe Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 5.4.8.3. Rest of Europe Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Graphic Designing Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.2. Asia Pacific Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.3. Asia Pacific Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Graphic Designing Software Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.1.2. China Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.1.3. China Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.2.2. S Korea Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.2.3. S Korea Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.3.2. Japan Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.3.3. Japan Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.4.2. India Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.4.3. India Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.5.2. Australia Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.5.3. Australia Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.6.2. Indonesia Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.6.3. Indonesia Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.7.2. Malaysia Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.7.3. Malaysia Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.8.2. Vietnam Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.8.3. Vietnam Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.9.2. Taiwan Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.9.3. Taiwan Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Graphic Designing Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 7.2. Middle East and Africa Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 7.3. Middle East and Africa Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Graphic Designing Software Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 7.4.1.2. South Africa Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 7.4.1.3. South Africa Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 7.4.2.2. GCC Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 7.4.2.3. GCC Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 7.4.3.2. Nigeria Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 7.4.3.3. Nigeria Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 7.4.4.2. Rest of ME&A Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 7.4.4.3. Rest of ME&A Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 8. South America Graphic Designing Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 8.2. South America Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 8.3. South America Graphic Designing Software Market Size and Forecast, by End User(2023-2030) 8.4. South America Graphic Designing Software Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 8.4.1.2. Brazil Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 8.4.1.3. Brazil Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 8.4.2.2. Argentina Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 8.4.2.3. Argentina Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Graphic Designing Software Market Size and Forecast, by Software Type (2023-2030) 8.4.3.2. Rest Of South America Graphic Designing Software Market Size and Forecast, by Deployment Type (2023-2030) 8.4.3.3. Rest Of South America Graphic Designing Software Market Size and Forecast, by End User (2023-2030) 9. Global Graphic Designing Software Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Graphic Designing Software Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Adobe Inc.(US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Corel Corporation ( Canada) 10.3. Autodesk, Inc. ( US) 10.4. Canva (Australia) 10.5. Serif (Affinity) ( United Kingdom) 10.6. InVisionApp, Inc. ( US) 10.7. Sketch (United Kingdom) 10.8. Quark Software Inc. ( US) 10.9. Gravit Designer (Austria) 10.10. Figma ( US) 10.11. Crello ( Israel) 10.12. Vectr ( US) 10.13. Xara Group Ltd. ( Germany) 10.14. PaintShop Pro ( Canada) 10.15. Blender Foundation ( Netherlands) 10.16. Pixelmator ( Lithuania) 10.17. Pixlr ( US) 10.18. Adobe Spark (US) 10.19. Adobe Illustrator ( US) 10.20. Adobe Photoshop ( US) 10.21. Affinity Designer ( United Kingdom) 10.22. Procreate (Australia) 10.23. Wacom ( Japan) 10.24. DesignCrowd ( Australia) 11. Key Findings 12. Industry Recommendations 13. Graphic Designing Software Market: Research Methodology 14. Terms and Glossary