Global Graphic Card Market size was valued at USD 35.12 Bn in 2023 and is expected to reach USD 269.62 Bn by 2030, at a CAGR of 33.8%.Graphic Card Market Overview

A graphics processing unit or GPU is also known as a graphics card. It's an electronics circuit that accelerates the processing required for creating and rendering images, animations and video. The Market is thoroughly elaborated by offering several pieces of information such as Graphic Card Market size, key players and their market value, their recent developments as well as their partnerships, mergers, and acquisitions. The graphical representation and structural exclusive information showed dominating region of the Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Graphic Card Market.To Know About The Research Methodology :- Request Free Sample Report

Graphic Card Market Dynamics

Technological Advancements and Growing Demand for Virtual Reality (VR) are the major drivers of the graphic card market The market is significantly driven by the gaming industry. As gaming technology upgrading, there is an increasing demand for good quality graphics and realistic visuals. Gamers need powerful graphic cards to embrace their gaming experience, enabling smooth battle play, high frame rates, and lifelike graphics. Ongoing advancements in graphics technologies fuel the demand for newer and more powerful graphic cards. The market is influenced by developments in GPU architecture, manufacturing processes, memory technology, and software optimization. These advancements aim to enhance graphics performance, power efficiency, and support for new features and technologies. Graphic cards play a crucial role in presenting immersive, prominent, and realistic experiences in virtual reality and greater reality applications. As VR and AR have grown in popularity across various industries and the graphic card market, including gaming, entertainment, education, healthcare, and engineering, there is an increased need for powerful graphic cards capable of rendering complex virtual environments. Artificial Intelligence (AI) and Competitive Gaming Cryptocurrency Mining are the supporting factors in the graphic card market The processing capacity provided by graphic cards is required for AI and ML applications. Graphic cards with parallel processing capabilities excel in accelerating AI and ML workloads. As AI and ML continue to advance and find applications in data analysis, image recognition, autonomous vehicles, and other fields, the demand for graphic cards optimized for these workloads rises. Graphic cards play an important role in content and video creation and multimedia editing programs. Professional players, video makers, and content creators mostly prefer these graphic cards in industries such as video editing, animation, graphic design, and architecture require graphic cards which are enough capable of handling difficult tasks, processing big data sets, and presenting in real-time rendering capabilities. The rise of eSports, virtual games tournaments, and competitive gaming programs have boosted the demand for high-performance graphic cards. Professional gamers and eSports players require graphic cards that give smooth gameplay, high refresh rates, and low latency to gain a competitive edge in the graphic card market. Graphic cards are instrumental in cryptocurrency mining, such as Bitcoin mining, as they provide the necessary computational power. During periods of increased cryptocurrency value, there is heightened demand for graphic cards from miners looking to capitalize on mining opportunities in the market. Restraints, Challenges, Opportunities, and Trends of the Graphic Card Market High Cost and Technological Obsolescence are the biggest restraints of graphic card market Graphic cards, especially those designed for high-end gaming or professional applications, can be expensive. This high cost can limit market penetration and affordability for some consumers. The rapid pace of technological advancements in the graphic card industry can quickly render older models obsolete. Consumers may hesitate to invest in graphic cards if they fear their purchase will become outdated soon. Power Consumption and Heat Dissipation and Compatibility and Driver Support are the main challenges of the graphic card market High-performance graphic cards often consume significant power and generate substantial heat. Efficient power management and effective cooling solutions are crucial to address these challenges and prevent overheating issues. Ensuring compatibility with various operating systems, software applications, and game titles can be challenging for graphic card manufacturers. Providing timely driver updates and support is essential to maintain optimal performance and compatibility. Increasing Demand for Gaming and eSports Advancements in Virtual Reality are the prominent opportunities in the graphic card market The increasing popularity of gaming and eSports offers exponential opportunities for the market. As more people are investing in gaming activities, there is a heightened demand for more effective and powerful graphic cards to offer immersive and high-performance gaming experiences in the market. The emerging applications of virtual reality (VR) and augmented reality (AR) in industries such as gaming, entertainment, healthcare, video graphing, and education build up various opportunities for graphic card manufacturers in the graphic card market. The demand for graphic cards enough capable of handling the rendering requirements of VR and AR experiences are expected to rise. Graphic cards optimized for AI and ML workloads can drive demand from industries such as data analysis, autonomous vehicles, and image recognition. Ray Tracing Technology and Compact and Miniature Form Factors Ray tracing are the current trends in the graphic card market Ray tracing, a rendering technique that simulates realistic lighting and reflections, has gained prominence in the market. Manufacturers are incorporating hardware acceleration for ray tracing to enhance visual realism in games and other applications. Energy efficiency has become a significant trend in the graphic card market. Manufacturers are developing graphic cards with improved power efficiency, enabling better performance while reducing power consumption and heat generation. Customizable graphic cards with RGB lighting features have gained popularity among gamers and PC enthusiasts. Manufacturers are incorporating customizable lighting options to enhance aesthetics and offer personalized visual experiences. There is a growing trend towards compact and miniature graphic cards. These smaller form factors cater to the needs of small form factor PC builds, such as Mini-ITX systems, where space is limited.Graphic Card Market Segment Analysis

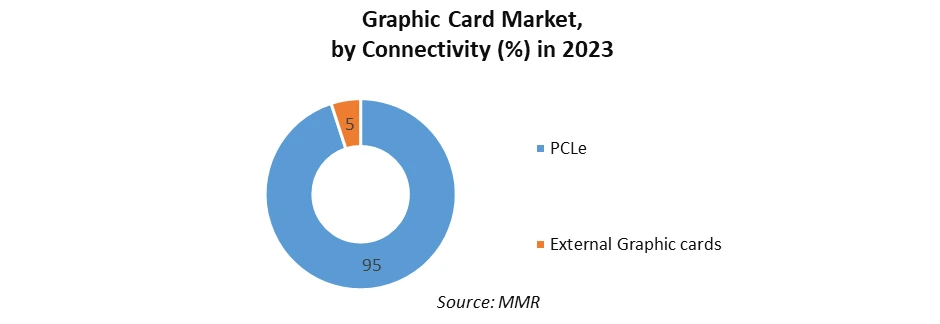

Type-based Segmentation Dedicated Graphic Cards: This segment comprises standalone graphic cards dedicated solely to graphics processing. These cards offer high-performance capabilities and are commonly used in gaming and professional applications. Integrated Graphic Cards: Graphic cards in this segment are integrated into the CPU or motherboard, typically found in entry-level systems. They provide basic graphics capabilities and are suitable for general computing tasks. Connectivity-based Segmentation: PCIe (Peripheral Component Interconnect Express): This segment covers graphic cards utilizing the PCIe interface for high-speed data transfer and compatibility with most desktop systems. PCIe cards offer reliable connectivity and a wide range of options. External Graphics Cards: Graphic cards in this segment are designed to be used externally with laptops or systems lacking internal expansion slots. These cards offer an option for game players and customers who want to embrace graphics performance on their portable devices for better performance.

Application-based Segmentation

Gaming: Graphic cards optimized for gaming applications, delivering high-performance graphics and immersive gaming experiences. These graphic cards offer high-performance graphics, upgraded visual effects, and immersive gaming experiences these benefits of graphic card boosts the graphic card market. Content Creation and Multimedia Editing: Graphic cards customized for professional customers in video editing, animation programs, graphic designing, and multimedia industries like NVidia. These cards comprise advanced rendering capabilities, real-time editing, and efficient processing of big data sets. Virtual Reality (VR) and Augmented Reality (AR): Graphic cards designed for rendering realistic and immersive VR and AR experiences. These graphic cards present high graphical frame rates, low latency, and exponential image quality to make better virtual environments. Artificial Intelligence (AI) and Machine Learning (ML): Graphic cards in this segment are optimized to accelerate AI and ML workloads. They offer parallel processing capabilities and support complex calculations, enabling faster data analysis, pattern recognition, and deep learning tasks.End User-based Segmentation Gaming Enthusiasts: This segment targets avid gamers and gaming enthusiasts who demand high-performance graphic cards to achieve smooth gameplay, high frame rates, and advanced gaming features. Professionals: Graphic cards in this segment cater to professionals in industries such as content creation, multimedia editing, engineering, and architecture. These cards provide efficient rendering, real-time editing, and enhanced productivity for demanding professional applications. Casual Users: This segment includes graphic cards suitable for casual gamers and general computing needs. These cards offer decent graphics performance at an affordable price point in the graphic card market.

Graphic Card Market Regional Analysis

Asia Pacific held the largest share in the global Graphic Cards Market. The regional market is driven by the gaining popularity of gaming, rising disposable incomes, and technological advancements in new graphic cards in countries like China, Japan, and South Korea. China, specifically, has emerged as a major player in the market, with a recognizable consumer base and a thriving gaming industry. The region also witnesses a high demand for graphic cards in content creation, virtual reality, and machine learning applications, reflecting the evolving digital landscape. Latin America offers a developing market for graphic cards, with countries like Brazil, Mexico, and Argentina showcasing a gaining interest in gaming and content creation. The region benefits from a growing middle class, rising disposable incomes, and improving technological infrastructure, all contributing to graphic card market growth. The presence of gaming events and eSports tournaments further fuels the demand for high-performance graphic cards in Latin America. North America is expected to grow at a high rate during the forecast period due to the presence of larger technology companies and industries, to growth vigorously the gaming industry, and the high adoption and upgradation rate of advanced technologies. The United States, in specific places, plays an important role in driving the market, with a large demand for graphic cards in gaming, videos, content creation, and AI applications programs. The region showcases benefits from consistent product innovation and upgradation, well-known distribution channels, and a mature user base, all contributing to graphic card market growth. Europe showcases important graphic card market players for graphic cards, with countries like Germany, the United Kingdom, and France the emerging leading in terms of adoption, upgradation, and technological improvement. The region provides a robust gaming culture, resulting in high demand for high-performance graphic cards for gamers, players, and eSports enthusiasts. Furthermore, Europe's emphasis on content creation, animation, and multimedia industries fuels the need for graphic cards optimized for these specific applications. Competitive Landscape Analysis of the Graphic Card Market NVIDIA Corporation is a leading player renowned for its GeForce series of graphic cards. NVIDIA has focused on developing its RTX series, incorporating ray tracing technology for realistic graphics rendering. Additionally, they introduced DLSS (Deep Learning Super Sampling) technology to enhance performance. In 2020, NVIDIA acquired ARM Limited, a prominent semiconductor and software design company, enabling expansion into the AI and data center markets. Advanced Micro Devices, Inc. AMD is a major player offering Radeon series graphic cards. AMD launched its RDNA 2 architecture, featured in the Radeon RX 6000 series, providing competitive performance and ray tracing capabilities. AMD partnered with Samsung to bring RDNA 2 graphics technology to mobile devices and collaborated with various game developers for optimized graphics performance. Intel Corporation, renowned in the semiconductor industry, has expanded its presence in the g market with the Intel Xe series. Intel released the Xe-HPG (High-Performance Gaming) microarchitecture for dedicated gaming graphic cards, targeting the enthusiast graphic card market. Intel collaborated with several laptop manufacturers to integrate their Xe graphics technology into their devices. ASUS developed its first extendable router and AiMesh technology. Since then, most ASUS routers have been extendable and AiMesh-compatible. ASUS extendable routers ensure that users can enjoy robust WiFi connections with easy scalability, hassle-free management tools, comprehensive security and a rich feature set. ASUS graphics cards are engineered in the pursuit of maximizing performance. These innovative features have made ASUS graphics cards the world's most awarded graphics card brand in the world. The ASUS AIoT Alliance Program is an ecosystem of industry partners that extends to independent software vendors (ISVs), distributors, value-added resellers (VARs), cloud-solution providers and system integrators (SIs) that work harmoniously to create end-to-end AIoT solutions across diverse vertical graphic card market.Graphic Card Market Scope : Inquire Before Buying

Global Graphic Card Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 35.12 Bn. Forecast Period 2024 to 2030 CAGR: 33.8% Market Size in 2030: US $ 269.12 Bn. Segments Covered: by Type Dedicated Graphic Cards Integrated Graphic Cards by Connectivity PCLe External Graphic cards by Application Gaming Content Creation & Multimedia Reality Virtual Reality(VR) & Augmented Reality (AR) AI & ML by End-User Desktops Laptops Workstations Others Graphic Card Market,by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Graphic Card Key Players

1. NVIDIA Corporation 2. Advanced Micro Devices, Inc. (AMD) 3. Intel Corporation 4. ASUSTeK Computer Inc. (ASUS) 5. Gigabyte Technology Co., Ltd. 6. MSI (Micro-Star International Co., Ltd.) 7. EVGA Corporation 8. Zotac International 9. Palit Microsystems Ltd. 10. SAPPHIRE Technology Ltd. 11. XFX Technology 12. PNY Technologies, Inc. 13. GALAX (formerly Galaxy Microsystems Ltd.) 14. Inno3D 15. HIS (Hightech Information System Limited) Frequently Asked Questions and Answers for Graphic Card Market 1. What are the key factors affecting the performance of a graphic card? Ans: Several factors influence the performance of a graphic card, including the GPU architecture, clock speed, memory capacity, and bandwidth, number of CUDA cores (in the case of NVIDIA GPUs), and cooling system efficiency. Additionally, the driver software and optimizations for specific applications can impact performance. It's important to consider these factors and choose a graphic card that aligns with your performance requirements. 2. What is the future outlook for the graphic card market? Ans: The graphic card market is expected to continue growing due to the increasing demand for high-quality graphics and immersive experiences in gaming, virtual reality, augmented reality, and professional applications. Technological advancements such as ray tracing, AI acceleration, and improved power efficiency are driving innovation in the industry. Additionally, the rising popularity of eSports and the development of graphics-intensive industries like animation, film production, and data analysis contribute to the market's positive outlook. 3. What are the different types of graphic cards? Ans: There are two main types of graphic cards: integrated and dedicated. Integrated graphic cards are built into the computer's motherboard and share system resources, suitable for basic graphical tasks and everyday computing. Dedicated graphic cards, on the other hand, are separate components that have their own dedicated memory and processing power. They offer higher performance and are specifically designed for demanding graphical tasks. 4. Are there any alternatives to traditional graphic cards? Ans: Yes, there are alternative solutions to traditional graphic cards. Integrated graphics, built into the computer's CPU, provide basic graphical capabilities and are suitable for everyday computing tasks. Additionally, external graphics processing units (eGPUs) are available, which are separate units that connect to a computer via Thunderbolt or USB ports, providing additional graphical power. eGPUs are often used with laptops or computers that have limited upgradability. However, it's important to note that external solutions may have limitations compared to dedicated graphic cards in terms of performance and compatibility. 5. Are graphic cards compatible with all operating systems? Ans: Graphic cards are generally compatible with popular operating systems such as Windows, macOS, and Linux. However, it's important to check the system requirements and driver compatibility before purchasing a graphic card. Some graphic cards may have better driver support or optimizations for specific operating systems. It's recommended to visit the manufacturer's website or consult the product specifications to ensure compatibility with your desired operating system.

1. Graphic Card Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Graphic Card Market: Dynamics 2.1. Graphic Card Market Trends by Region 2.1.1. North America Graphic Card Market Trends 2.1.2. Europe Graphic Card Market Trends 2.1.3. Asia Pacific Graphic Card Market Trends 2.1.4. Middle East and Africa Graphic Card Market Trends 2.1.5. South America Graphic Card Market Trends 2.2. Graphic Card Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Graphic Card Market Drivers 2.2.1.2. North America Graphic Card Market Restraints 2.2.1.3. North America Graphic Card Market Opportunities 2.2.1.4. North America Graphic Card Market Challenges 2.2.2. Europe 2.2.2.1. Europe Graphic Card Market Drivers 2.2.2.2. Europe Graphic Card Market Restraints 2.2.2.3. Europe Graphic Card Market Opportunities 2.2.2.4. Europe Graphic Card Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Graphic Card Market Drivers 2.2.3.2. Asia Pacific Graphic Card Market Restraints 2.2.3.3. Asia Pacific Graphic Card Market Opportunities 2.2.3.4. Asia Pacific Graphic Card Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Graphic Card Market Drivers 2.2.4.2. Middle East and Africa Graphic Card Market Restraints 2.2.4.3. Middle East and Africa Graphic Card Market Opportunities 2.2.4.4. Middle East and Africa Graphic Card Market Challenges 2.2.5. South America 2.2.5.1. South America Graphic Card Market Drivers 2.2.5.2. South America Graphic Card Market Restraints 2.2.5.3. South America Graphic Card Market Opportunities 2.2.5.4. South America Graphic Card Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Graphic Card Industry 2.8. Analysis of Government Schemes and Initiatives For Graphic Card Industry 2.9. Graphic Card Market Trade Analysis 2.10. The Global Pandemic Impact on Graphic Card Market 3. Graphic Card Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Graphic Card Market Size and Forecast, by Type (2023-2030) 3.1.1. Dedicated Graphic Cards 3.1.2. Integrated Graphic Cards 3.2. Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 3.2.1. PCLe 3.2.2. External Graphic cards 3.3. Graphic Card Market Size and Forecast, by Application (2023-2030) 3.3.1. Gaming 3.3.2. Content Creation & Multimedia Reality 3.3.3. Virtual Reality(VR) & Augmented Reality (AR) 3.3.4. AI & ML 3.4. Graphic Card Market Size and Forecast, by End User (2023-2030) 3.4.1. Desktops 3.4.2. Laptops 3.4.3. Workstations 3.4.4. Others 3.5. Graphic Card Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Graphic Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Graphic Card Market Size and Forecast, by Type (2023-2030) 4.1.1. Dedicated Graphic Cards 4.1.2. Integrated Graphic Cards 4.2. North America Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 4.2.1. PCLe 4.2.2. External Graphic cards 4.3. North America Graphic Card Market Size and Forecast, by Application (2023-2030) 4.3.1. Gaming 4.3.2. Content Creation & Multimedia Reality 4.3.3. Virtual Reality(VR) & Augmented Reality (AR) 4.3.4. AI & ML 4.4. North America Graphic Card Market Size and Forecast, by End User (2023-2030) 4.4.1. Desktops 4.4.2. Laptops 4.4.3. Workstations 4.4.4. Others 4.5. North America Graphic Card Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Graphic Card Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Dedicated Graphic Cards 4.5.1.1.2. Integrated Graphic Cards 4.5.1.2. United States Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 4.5.1.2.1. PCLe 4.5.1.2.2. External Graphic cards 4.5.1.3. United States Graphic Card Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Gaming 4.5.1.3.2. Content Creation & Multimedia Reality 4.5.1.3.3. Virtual Reality(VR) & Augmented Reality (AR) 4.5.1.3.4. AI & ML 4.5.1.4. United States Graphic Card Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Desktops 4.5.1.4.2. Laptops 4.5.1.4.3. Workstations 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Graphic Card Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Dedicated Graphic Cards 4.5.2.1.2. Integrated Graphic Cards 4.5.2.2. Canada Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 4.5.2.2.1. PCLe 4.5.2.2.2. External Graphic cards 4.5.2.3. Canada Graphic Card Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Gaming 4.5.2.3.2. Content Creation & Multimedia Reality 4.5.2.3.3. Virtual Reality(VR) & Augmented Reality (AR) 4.5.2.3.4. AI & ML 4.5.2.4. Canada Graphic Card Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Desktops 4.5.2.4.2. Laptops 4.5.2.4.3. Workstations 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Graphic Card Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Dedicated Graphic Cards 4.5.3.1.2. Integrated Graphic Cards 4.5.3.2. Mexico Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 4.5.3.2.1. PCLe 4.5.3.2.2. External Graphic cards 4.5.3.3. Mexico Graphic Card Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Gaming 4.5.3.3.2. Content Creation & Multimedia Reality 4.5.3.3.3. Virtual Reality(VR) & Augmented Reality (AR) 4.5.3.3.4. AI & ML 4.5.3.4. Mexico Graphic Card Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Desktops 4.5.3.4.2. Laptops 4.5.3.4.3. Workstations 4.5.3.4.4. Others 5. Europe Graphic Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Graphic Card Market Size and Forecast, by Type (2023-2030) 5.2. Europe Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.3. Europe Graphic Card Market Size and Forecast, by Application (2023-2030) 5.4. Europe Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5. Europe Graphic Card Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.1.3. United Kingdom Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.2.3. France Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.3.3. Germany Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.4.3. Italy Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.5.3. Spain Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.6.3. Sweden Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.7.3. Austria Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Graphic Card Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Graphic Card Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 5.5.8.3. Rest of Europe Graphic Card Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Graphic Card Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Graphic Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Graphic Card Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.3. Asia Pacific Graphic Card Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Graphic Card Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.1.3. China Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.2.3. S Korea Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.3.3. Japan Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.4.3. India Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.5.3. Australia Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.6.3. Indonesia Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.7.3. Malaysia Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.8.3. Vietnam Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.9.3. Taiwan Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Graphic Card Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Graphic Card Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 6.5.10.3. Rest of Asia Pacific Graphic Card Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Graphic Card Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Graphic Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Graphic Card Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 7.3. Middle East and Africa Graphic Card Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Graphic Card Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Graphic Card Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Graphic Card Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 7.5.1.3. South Africa Graphic Card Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Graphic Card Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Graphic Card Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 7.5.2.3. GCC Graphic Card Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Graphic Card Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Graphic Card Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 7.5.3.3. Nigeria Graphic Card Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Graphic Card Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Graphic Card Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 7.5.4.3. Rest of ME&A Graphic Card Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Graphic Card Market Size and Forecast, by End User (2023-2030) 8. South America Graphic Card Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Graphic Card Market Size and Forecast, by Type (2023-2030) 8.2. South America Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 8.3. South America Graphic Card Market Size and Forecast, by Application(2023-2030) 8.4. South America Graphic Card Market Size and Forecast, by End User (2023-2030) 8.5. South America Graphic Card Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Graphic Card Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 8.5.1.3. Brazil Graphic Card Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Graphic Card Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Graphic Card Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 8.5.2.3. Argentina Graphic Card Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Graphic Card Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Graphic Card Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Graphic Card Market Size and Forecast, by Connectivity (2023-2030) 8.5.3.3. Rest Of South America Graphic Card Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Graphic Card Market Size and Forecast, by End User (2023-2030) 9. Global Graphic Card Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Graphic Card Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. NVIDIA Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Advanced Micro Devices, Inc. (AMD) 10.3. Intel Corporation 10.4. ASUSTeK Computer Inc. (ASUS) 10.5. Gigabyte Technology Co., Ltd. 10.6. MSI (Micro-Star International Co., Ltd.) 10.7. EVGA Corporation 10.8. Zotac International 10.9. Palit Microsystems Ltd. 10.10. SAPPHIRE Technology Ltd. 10.11. XFX Technology 10.12. PNY Technologies, Inc. 10.13. GALAX (formerly Galaxy Microsystems Ltd.) 10.14. Inno3D 10.15. HIS (Hightech Information System Limited) 11. Key Findings 12. Industry Recommendations 13. Graphic Card Market: Research Methodology 14. Terms and Glossary