Graphene Battery Market size was valued at USD 167.15 Mn. in 2023 and the total Graphene Battery revenue is expected to grow by 23% from 2024 to 2030, reaching nearly USD 711.96 Mn.Graphene Battery Market Overview:

The Graphene is an efficient conductor that is extremely lightweight and flexible, with a large surface area, making it an excellent material for high-capacity energy storage. Continuous research and development activities are underway to create more innovative and improved products such as Lithium Sulphur Batteries and Graphene-based Supercapacitors. The adoption of graphene-based batteries is expected to increase during the forecasted period due to features such as quick charging capacity, high-temperature effectiveness, increased charge cycles, and extended duration to hold the charge. Because of its high investment return, the graphene battery market is expected to see high financial investments. The increased sales of electric vehicles, which have a longer range for long-distance travel and require less charging time, are driving graphene battery market growth. The thriving portable electronics market is expected to drive market growth. Moreover, increased government R&D investments are expected to provide lucrative growth opportunities. However, the lack of awareness of graphene technology and the market's inability to commercialise graphene batteries are expected to stymie the graphene battery market's growth. Graphene, on the other hand, has been recognised for its potential to be widely used in physics, chemistry, information, energy, and device manufacturing. Chemical doping or an electric field can change its conductivity over a wide range. Automotive, aerospace and defence, healthcare, energy storage, electronics, and industrial robotics are all covered in this report. The automotive, electronics, aerospace and defence industries are expected to dominate the global graphene battery market.To know about the Research Methodology :- Request Free Sample Report

Report Scope:

The report on Graphene Battery provides a quantitative analysis of market size, price, M&A, demand, supply chain, investment and growth plans by key competitors, and predictions. Porter's five forces study explains how buyers and suppliers build supplier-buyer networks and make profit-driven decisions. The present Graphene Battery Market potential is assessed through detailed analysis and segmentation. The analysis will provide investors with a full insight into the industry's future, as well as the elements likely to affect the firm favorably or adversely. The research offers a complete understanding of the market for those investors wishing to invest. This study contains scenarios for the Graphene Battery Market from the past and present, along with projected market numbers. The report's thorough analysis of important competitors, including market leaders, followers, and new entrants, covers every aspect of the market. The research contains strategic profiles of the top market participants, a full examination of their key competencies, and their company-specific plans for the introduction of new products, growth, partnerships, joint ventures, and acquisitions. With its clear portrayal of competitive analysis of significant companies by product, pricing, financial condition, product portfolio, growth strategies, and regional presence in the domestic as well as the local market, the research acts as an investor's guide.Graphene Battery Market Dynamics:

Graphene Battery Market Drivers Bolstering demand for graphene batteries in the electric vehicle sector The graphene battery market growth is fueled by demand for graphene batteries in sectors such as electronics, biomedical technologies, energy storage, composites and coatings, and water and wastewater treatment. Modern rechargeable batteries may be able to charge more quickly and hold more energy thanks to graphene. Graphene also decreases the overall weight of the battery assembly and lengthens the life of lithium-ion batteries. As a result, market growth is expected to be fueled by graphene batteries growing used in the electric vehicle (EV) sector. The market in the United States is expected to grow significantly, and the country is one of the primary exporters of graphene-based products to countries that lack graphene production capabilities. Additionally, the rising popularity of graphene due to its superior properties is expected to drive graphene battery market growth over the forecast period. Because of the presence of a number of manufacturers in the country, the aircraft parts manufacturing industry is expected to grow in the United States. Additionally, it is expected that increasing demand for materials with low density, low electrical conductivity, durability, and high strength will drive the market for composites based on graphene. Batteries can be replaced with supercapacitors because of their higher power densities. They can also function at very low temperatures. The development of electric supercars may benefit from the superior short-burst energy delivery capabilities displayed by graphene-based supercapacitors. As a result, it is expected that product demand will increase exponentially. R&D efforts for continuously developing new and better products Growing research activities in graphene-based energy storage technologies, as well as the increasing use of graphene in membrane separation, are expected to benefit graphene battery market growth. Graphene's primary applications include electronics, biomedical technologies, energy storage, composites and coatings, and water and wastewater treatment. One of the primary factors driving graphene research around the world is a growing emphasis on miniaturisation. Because of its conductivity and extremely thin nature, graphene has the potential to revolutionise the semiconductor industry. The main impediment to full-scale graphene adoption is a lack of viable, cost-effective mass-production technology. Continuous research and development efforts have been made to improve the quality of the materials produced and to create superior graphene nanoplatelets and graphene oxide films. Because the majority of key players are concentrated in developed regions, regional partnerships and distribution agreements are the primary strategic initiatives adopted by market participants. In 2020, Applied Graphene Materials was one of the major manufacturers that signed several distribution agreements with various other regional players in order to establish its market presence. Graphene is a fantastic material for high-capacity energy storage because it is an efficient conductor that is incredibly light, highly flexible, and has a sizable surface area. To develop novel and improved products like lithium sulphide batteries and supercapacitors based on graphene, ongoing research and development (R&D) is being done. Due to characteristics like quick charging capacity, increased charge cycles, high-temperature effectiveness, and extended hold charge duration, the graphene battery market is expected to see high financial investments during the forecast period.Graphene Battery Market Restraints Inability to understand graphene technology and incompetence in business Consumers are unaware of the benefits of graphene-enhanced batteries due to a lack of proper publicity and representation. Another impediment is the proper use of graphene. Despite the availability of theoretical knowledge about graphene and its properties, the application is slow, limiting the graphene market's growth. These factors could cause the graphene battery market to stagnate. Graphene Battery Market Opportunity Recent advancements in technology are increasing the demand for graphene batteries Researchers at the University of Queensland in Australia have created a graphene-based hybrid battery prototype in collaboration with the Graphene Manufacturing Group. This battery is known as a graphene aluminium battery because it uses graphene and aluminium as electrode materials. The battery has an energy density of 150-160 Wh/kg and can be charged in as little as 1-5 minutes. Furthermore, graphene aluminium-ion batteries have significant advantages in terms of battery safety, recyclability, and longer battery life (over 2000 cycles) with almost no performance degradation. According to the most recent information, the Graphene Manufacturing Group (GMG) has manufactured its graphene aluminium-ion batteries in pouch cell format for use in smartphones, tablets, laptops, and other devices. These batteries' theoretical energy limit is around 1050 Wh/Kg. As a result, with further development, consumers can soon expect the graphene battery market to have more energy than commercial batteries. At the end of 2021, the California-based company Lyten developed a graphene battery for electric vehicles with an energy density three times that of traditional lithium-ion batteries. These are lithium-sulfur (Li-S) batteries, which have been heralded as the next generation of rechargeable batteries. The formation of soluble polysulfide species during discharge cycles is a problem in real-world Li-S battery applications. These intermediate species cause internal short circuits by diffusing between the anode and cathode. This phenomenon, known as the shuttling effect, is responsible for the poor efficiency and rapid capacity fading of Li-S cells. To address this issue, Lyten incorporated a 3D graphene membrane into the sulphur cathode, which acted as an effective separator and slowed the cyclic capacity decay rate. The product is called LytCell EV, and it is said to have an energy density of 900 Wh/kg. According to tests, a LytCell prototype can withstand more than 1,400 charge-discharge cycles. These recent advances in the graphene battery market are expected to boost. Increased patent activity Companies from the end-use industries, such as Samsung SDI (South Korea) and LG Chem, are the leaders in graphene battery patent applications (South Korea) LG Chem has filed approximately 19 patents, as has IBM (US). Graphene patenting activity for battery applications has been rapidly increasing year after year. The increased number of patent filings creates an enormous opportunity for graphene batteries in a variety of end-use industries.

Graphene Battery Market Segment Analysis:

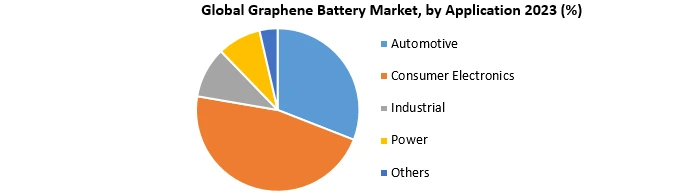

Based on Type, In 2023, the lithium-ion battery segment held approximately 89% of the market share. The graphene battery market is divided into four categories: lithium-ion, lithium sulphur, graphene supercapacitor, and others like metal-air, lithium-titanate, and lead-acid. All graphene-enhanced batteries have good properties, such as being lightweight and durable, but lithium-ion batteries are in high demand due to rising consumer confidence. That is why it is the market leader in the segment. Additionally, the use of lithium-ion batteries is growing globally. It is used in automotive, consumer electronics, and industrial applications. The graphene battery market will be boosted by the electric vehicle business. Based on the Application, In 2023, the automotive segment is expected to hold the largest share of the graphene battery market. The need for high power and energy density has created a demand for reliable and safe batteries for sectors such as automotive and consumer electronics, ultimately driving the graphene battery market's growth. In the automotive industry, graphene batteries are used in electric vehicles. The automotive segment is expected to grow at the fastest rate due to increased demand for electric vehicles as a result of environmental concerns and increased awareness about clean and sustainable fuel. The consumer electronics sector is another area where the graphene battery market is expected to thrive. Governments are increasing R&D funding in the graphene battery market globally, resulting in a positive market boost.

Regional Insights:

The Asia-Pacific region dominates the majority of the graphene battery market. Graphene oxide is expected to grow rapidly due to rapid industrialization and an increase in graphene-based application patents in the region. China has one of the largest electronics production bases and competes fiercely with existing upstream producers such as South Korea, Singapore, and Taiwan. In terms of demand, electronic products such as smartphones, OLED TVs, and tablets have the highest growth rates in the consumer electronics segment of the market. The International Air Transport Association (IATA) predicts that India will become the world's third-largest aviation market by the end of the forecast period. Over the next two decades, the country is expected to have a demand for 2,100 aircraft, amounting to more than USD 295 billion in sales. As a result of these factors, the aerospace sector's demand for graphene is expected to rise.According to the Stockholm International Peace Research Institute (SIPRI), China will spend an estimated USD 298 billion on its military in 2021, a 4.9% increase over 2020. The Photovolt Ukushima Solar PV Park is a 480 MW solar PV power project under construction in Nagasaki, Japan. The project is currently undergoing permitting. It could be created in a single phase. The project is expected to be commissioned in July 2023 after construction is completed. As a result of the aforementioned trends, Asia-Pacific is expected to dominate the graphene battery market studied during the forecast period.

Graphene Battery Market Scope: Inquire before buying

Graphene Battery Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 167.15 Mn. Forecast Period 2024 to 2030 CAGR: 23% Market Size in 2030: US $ 711.96 Mn. Segments Covered: by Type Lithium-ion Battery Lithium- Sulphur battery Graphene Supercapacitor Others by Application Automotive Consumer Electronics Industrial Power Others by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Graphene Battery Manufacturers are:

1. Samsung SDI Co., Ltd., (South Korea) 2. Huawei Technologies Co., Ltd. (China) 3. Hybrid Kinetic Group Ltd. (Hong Kong) 4. Hybrid Kinetic Group (Hong Kong) 5. Log 9 Materials (India) 6. Metalgrass Ltd (Malaysia) 7. Cabot Corporation (US) 8. Nanotech Energy (US) 9. Nanotek Instruments, Inc. (US) 10.XG Sciences, Inc. (US) 11.Global Graphene Group (US) 12.Vorbeck Materials Corp. (US) 13.Zentek Ltd. (Canada) 14.Targray Group (Canada) 15.Zen Graphene Solutions Ltd (Canada) 16.Earthdas (Spain) 17.Grupo Graphenano (Spain) 18.Graphenea Group (Spain) 19.Grabat Energy (Spain) Frequently Asked Questions: 1] Is graphene battery the future? Ans. The theoretical energy limit of these batteries, according to GMG, is around 1050 Wh/Kg. As a result, with further development, we can soon expect graphene batteries to have more energy than commercial batteries. 2] Are graphene batteries available? Ans. Although the use of graphene batteries in EVs is currently possible, they are not yet commercially available due to the need for additional research to develop mass production techniques and further determine the material's practical abilities. Several companies have expressed interest in using graphene batteries to power electric vehicles. 3] What is the cost of 1 kg graphene? Ans. 1kg Graphene Nanoplatelets Powder | Graphene Oxide in Mumbai | ID: 23566486412. 4] Is graphene better than lithium? Ans. Graphene batteries have been shown to have significantly higher average capacity than lithium-ion batteries, even in smaller sizes. Lithium-ion batteries have a capacity of 180 Wh per kilogram, whereas graphene has a capacity of 1,000Wh per kilogram, making it a much more space-efficient energy storage medium. 5] Are graphene batteries expensive? Ans. In layman's terms, a graphene battery can have a higher capacity than a lithium-ion battery of the same physical size. It is worth noting that, while graphene appears to be ready for market, there is more to it than meets the eye. Graphene is not cheap; one sheet can cost up to $25.

1. Graphene Battery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Graphene Battery Market: Dynamics 2.1. Graphene Battery Market Trends by Region 2.1.1. North America Graphene Battery Market Trends 2.1.2. Europe Graphene Battery Market Trends 2.1.3. Asia Pacific Graphene Battery Market Trends 2.1.4. Middle East and Africa Graphene Battery Market Trends 2.1.5. South America Graphene Battery Market Trends 2.2. Graphene Battery Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Graphene Battery Market Drivers 2.2.1.2. North America Graphene Battery Market Restraints 2.2.1.3. North America Graphene Battery Market Opportunities 2.2.1.4. North America Graphene Battery Market Challenges 2.2.2. Europe 2.2.2.1. Europe Graphene Battery Market Drivers 2.2.2.2. Europe Graphene Battery Market Restraints 2.2.2.3. Europe Graphene Battery Market Opportunities 2.2.2.4. Europe Graphene Battery Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Graphene Battery Market Drivers 2.2.3.2. Asia Pacific Graphene Battery Market Restraints 2.2.3.3. Asia Pacific Graphene Battery Market Opportunities 2.2.3.4. Asia Pacific Graphene Battery Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Graphene Battery Market Drivers 2.2.4.2. Middle East and Africa Graphene Battery Market Restraints 2.2.4.3. Middle East and Africa Graphene Battery Market Opportunities 2.2.4.4. Middle East and Africa Graphene Battery Market Challenges 2.2.5. South America 2.2.5.1. South America Graphene Battery Market Drivers 2.2.5.2. South America Graphene Battery Market Restraints 2.2.5.3. South America Graphene Battery Market Opportunities 2.2.5.4. South America Graphene Battery Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Graphene Battery Industry 2.8. Analysis of Government Schemes and Initiatives For Graphene Battery Industry 2.9. Graphene Battery Market Trade Analysis 2.10. The Global Pandemic Impact on Graphene Battery Market 3. Graphene Battery Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Graphene Battery Market Size and Forecast, by Type (2023-2030) 3.1.1. Lithium-ion Battery 3.1.2. Lithium- Sulphur battery 3.1.3. Graphene Supercapacitor 3.1.4. Others 3.2. Graphene Battery Market Size and Forecast, by Application (2023-2030) 3.2.1. Automotive 3.2.2. Consumer Electronics 3.2.3. Industrial 3.2.4. Power 3.2.5. Others 3.3. Graphene Battery Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Graphene Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Graphene Battery Market Size and Forecast, by Type (2023-2030) 4.1.1. Lithium-ion Battery 4.1.2. Lithium- Sulphur battery 4.1.3. Graphene Supercapacitor 4.1.4. Others 4.2. North America Graphene Battery Market Size and Forecast, by Application (2023-2030) 4.2.1. Automotive 4.2.2. Consumer Electronics 4.2.3. Industrial 4.2.4. Power 4.2.5. Others 4.3. North America Graphene Battery Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Graphene Battery Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Lithium-ion Battery 4.3.1.1.2. Lithium- Sulphur battery 4.3.1.1.3. Graphene Supercapacitor 4.3.1.1.4. Others 4.3.1.2. United States Graphene Battery Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Automotive 4.3.1.2.2. Consumer Electronics 4.3.1.2.3. Industrial 4.3.1.2.4. Power 4.3.1.2.5. Others 4.3.2. Canada 4.3.2.1. Canada Graphene Battery Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Lithium-ion Battery 4.3.2.1.2. Lithium- Sulphur battery 4.3.2.1.3. Graphene Supercapacitor 4.3.2.1.4. Others 4.3.2.2. Canada Graphene Battery Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Automotive 4.3.2.2.2. Consumer Electronics 4.3.2.2.3. Industrial 4.3.2.2.4. Power 4.3.2.2.5. Others 4.3.3. Mexico 4.3.3.1. Mexico Graphene Battery Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Lithium-ion Battery 4.3.3.1.2. Lithium- Sulphur battery 4.3.3.1.3. Graphene Supercapacitor 4.3.3.1.4. Others 4.3.3.2. Mexico Graphene Battery Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Automotive 4.3.3.2.2. Consumer Electronics 4.3.3.2.3. Industrial 4.3.3.2.4. Power 4.3.3.2.5. Others 5. Europe Graphene Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.2. Europe Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3. Europe Graphene Battery Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Graphene Battery Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Graphene Battery Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Graphene Battery Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Graphene Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Graphene Battery Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Graphene Battery Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Graphene Battery Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Graphene Battery Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Graphene Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Graphene Battery Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Graphene Battery Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Graphene Battery Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Graphene Battery Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Graphene Battery Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Graphene Battery Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Graphene Battery Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Graphene Battery Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Graphene Battery Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Graphene Battery Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Graphene Battery Market Size and Forecast, by Application (2023-2030) 8. South America Graphene Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Graphene Battery Market Size and Forecast, by Type (2023-2030) 8.2. South America Graphene Battery Market Size and Forecast, by Application (2023-2030) 8.3. South America Graphene Battery Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Graphene Battery Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Graphene Battery Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Graphene Battery Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Graphene Battery Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Graphene Battery Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Graphene Battery Market Size and Forecast, by Application (2023-2030) 9. Global Graphene Battery Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Graphene Battery Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Samsung SDI Co., Ltd., (South Korea) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Huawei Technologies Co., Ltd. (China) 10.3. Hybrid Kinetic Group Ltd. (Hong Kong) 10.4. Hybrid Kinetic Group (Hong Kong) 10.5. Log 9 Materials (India) 10.6. Metalgrass Ltd (Malaysia) 10.7. Cabot Corporation (US) 10.8. Nanotech Energy (US) 10.9. Nanotek Instruments, Inc. (US) 10.10. XG Sciences, Inc. (US) 10.11. Global Graphene Group (US) 10.12. Vorbeck Materials Corp. (US) 10.13. Zentek Ltd. (Canada) 10.14. Targray Group (Canada) 10.15. Zen Graphene Solutions Ltd (Canada) 10.16. Earthdas (Spain) 10.17. Grupo Graphenano (Spain) 10.18. Graphenea Group (Spain) 10.19. Grabat Energy (Spain) 11. Key Findings 12. Industry Recommendations 13. Graphene Battery Market: Research Methodology 14. Terms and Glossary