The Gourmet Salt Market size was valued at USD 2.92 Billion in 2025 and the total Gourmet Salt revenue is expected to grow at a CAGR of 6.4% from 2025 to 2032, reaching nearly USD 4.50 Billion by 2032. Gourmet salt is a naturally harvested sea salt with low levels of sodium. Gourmet salt is a special salt that is collected naturally without being refined. Gourmet salt is raw sea salt that is harvested naturally and adds extra flavor and seasoning to food. Gourmet salt is more soluble and has a higher mineral concentration. It can be applied to herbs and other spices to bring out their color and flavor. Gourmet salt is utilized in chicken, savory dishes, baked goods, confections, and many more. It helps to preserve food products to enhance their shelf life. The best-known gourmet salts include Himalayan pink salt, Peruvian pink salt, Hawaiian red and black salt, and Australian salt. Several factors including the growth in the number of fine dining establishments, the increased demand for gourmet flavors in the food service industry, increasing demand for premium food products, rising disposable incomes, growing awareness of health-consciousness as well as rising investments in the manufacturing of gourmet salts, are driving the market. Major key players in the gourmet salt market are Murray River Salt, Infosa, Cargill Inc., Alaska Pure Sea Salt, Pyramid Salt Pty Ltd., Maldon Crystal Salt Co, Amagansett Sea Salt Co, The Sea Salt Co, Morton Salt Inc., Saltworks Inc., Kalahari Pristine Salt Worx, San Francisco Salt Company, Salty Wahine Gourmet Hawaiian Sea Salts, Sea Salt Superstore, and HEPP'S Salt. Asia-Pacific is the fastest-growing region with a market share of over 33.5% in 2025. The region is expected to grow at a CAGR of 6.4% during the forecast period and maintain its dominance by 2032. Gourmet salt products are made available through a variety of channels including specialty food stores, gourmet retailers, E-commerce online platforms, and even mainstream supermarkets. The market is becoming more accessible and the consumer has diversified to easier access. The increasing availability of flavors salts, organic varieties of crystals, and high-quality premium food products, also the rising demand for processed food, and the growing health awareness in food and beverage industries. China is producing salt around 22.48% and India’s rate of production of salt is 8.96%.To know about the Research Methodology :- Request Free Sample Report

Gourmet Salt Market Dynamics:

Rising Demand for Natural & Premium Gourmet Salt The growing consumer preference for natural and premium gourmet salt reflects broader shifts towards healthier, more authentic, and sustainable food choices. The demand for food-grade salts has been growing as a result of globalization driving the growth and popularity of foreign cuisines such as Italian and French food, which calls for specific flavors and seasonings. The healthier diet and consumers are becoming more aware of the potential harmful effects of fast food diets with their high salt content. So consumers prefer Gourmet salt. The rising application of gourmet salt in meat, poultry, seafood, and sauces, as well as the growing demand for high-quality, premium food products these factors are driving the Gourmet Salt Market. Gourmet salts have been identified to contain less sodium and trace minerals than ordinary table salt. Gourmet salt demands increased knowledge of the possible health benefits, including improved electrolyte balance and a lower risk of high blood pressure. Because gourmet sea salts have less sodium and contain vital minerals, consumers are choosing them over regular table salt as a healthier option, which is driving the rise of the gourmet salt market. Indian production and exports are expected to grow strong. The high salinity of Indian salt means that a pinch or small quantities are enough for flavoring, making the product largely popular in the international market. Restraints : Lack of Consumer Awareness and Rising Prices in the Gourmet Salt Market Lack of consumer awareness and rising prices for gourmet salty products are hampering the gourmet salt market during the forecast period. The low adoption of natural salts, high cost, and limited product availability are expected to slow market growth. Gourmet salt is expensive because of its mineral content, color, unique and attractive taste that adds value to the dish. Gourmet salt is limited owing to its small-scale production. So, the costs of collection, processing, labeling, marketing, and transportation are higher, and the prices of the products are much higher than those of conventional salt. The production cost is greater than that of traditional salt mainly gourmet salt requires proper care during transport. The price also depends on the typical sauces and whether they are hand-picked in exotic locations. Hamper the growth outlook of the gourmet salt market.Gourmet Salt Market Segment Analysis :

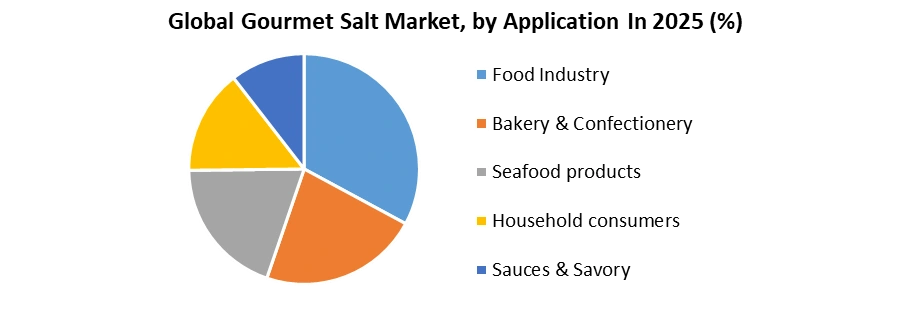

Based on Type, the Sea Salt segment held the largest market share of about 51.7% in the Gourmet Salt Market in 2025. According to the MMR analysis, the segment is expected to grow at a CAGR of 7.3% during the forecast period and maintain its dominance till 2032. Sea Salt is produced by an evaporation method with its natural and unrefined qualities, Sea Salt Consumer the preferred option for customers looking for high-quality, natural items. It includes fleur de sel, Maldon salt, and Himalayan pink salt. The unique pink color of Himalayan salt is a result of its high concentration of trace minerals, such as iron, potassium, and magnesium. The highly rich nutrients present in Sea Salts as compared to table salt have contributed to its growing demand in food and cosmetic use.Based on Applications, the Seafood products segment held the largest market share of about 36.4% in the Gourmet Salt Market in 2025 and is expected to maintain its dominance till 2032 The North American Gourmet Salt Market can be divided into bakery and confectionery, meats, and food preservation, sauces, and flavors. The rise in Seafood product processing and the preservation of canned meats is set to propel the growth of the North American gourmet salt market. Baking and confectionery is projected to be the fastest-growing segment during the forecast period thanks to the increasing use of Gourmet Salt in diverse food industries.

Regional Analysis of Gourmet Salt Market:

North America region dominates the Gourmet Salt Market with the largest market share accounting for 39.4% in 2025, the region is expected to grow during the forecast period and maintain its dominance by 2032. The Asia Pacific region is often a significant market because of the health-conscious population, increasing intake of healthy and natural food products, and growing popularity of flavored gourmet cooking food. In luxurious restaurants, spreading Westernization about natural and organic cuisine is becoming more popular, and gourmet salts are used to elevate the flavor profiles of their dishes, catering to the demand for unique culinary experiences. The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the market. Europe, the fast-growing region in the Gourmet Salt Market held a market share of 27.5% and is significantly growing during the forecast period. Consumers in Europe are upgrading from table salt to gourmet salt due to growing awareness of health benefits. An increase in the demand for nutritious food as the increased lifespans of the population age should contribute to a rise in demand for products. Currently, the region represents more than 26% of the population over 60 years of age.Competitive Landscape for Gourmet Salt Market

The leading players in the gourmet salt market include Morton Salt Inc., Salt walk Inc., and Murray River Gourmet Salt. The companies are adopting development strategies such as new product launches and developing their product portfolio and productivity. In December 2022, Norwest Equity Partners (NEP), a US-based leading venture and growth equity firm focusing on consumer, enterprise, and healthcare sectors, acquired Red Monkey Foods for an undisclosed amount. This acquisition will help to capitalize on the compelling trends with the new partner's resources and further build the business into an even stronger and more diversified, industry-leading company. Red Monkey Foods is a US-based company that provides private-label organic spices, seasonings, and gourmet salt. Himshakti Global Foods and Hindustan Salts Ltd. collaborated to introduce six distinct gourmet salts, each tailored to meet distinct requirements. Himshakti is the product developer, and Hindustan Salts Ltd. is the manufacturer. About 14% of all salt produced in India is produced by Hindustan Salt. Himshakti, a proud start-up from Uttarakhand, received praise from their honorable governor for their efforts to work with Sambhar Lake to promote "Made in India" goods globally. Alaska Pure Sea Salt Co. - It produces hand crafted, flake-style sea salt straight from the pristine waters of Sitka, Alaska. Morton Salt Inc. - It is an American food company producing salt for food, water conditioning, industrial, agricultural, and road/highway use. Based in Chicago, the business is North America's leading producer and marketer of salt. It is a subsidiary of holding company Stone Canyon Industries Holdings Inc. In January 2021: A newly released purified sea salt flour is from Cargill Salt. The component is a special kind of ultra-finely ground, powdered sodium chloride. It works well for topping snack foods and for applications like dry soup, cereal, flour, and spice mixes that call for incredibly small sizes for mixing. In April 2021, JK Masale unveiled a new gourmet range for its customers in India. With this new launch, the company forays into the seasoning segment. This product range has been developed for food lovers who want to enjoy tasty and healthy food at the sameGourmet Salt Market Scope: Inquire before buying

Gourmet Salt Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 2.92 Bn. Forecast Period 2026 to 2032 CAGR: 6.4 % Market Size in 2032: USD 4.50 Bn. Segments Covered: by Type Sea Salt Rock Salt Specialty Salt Fleur de sel Himalayan salt Sel Gris / Grey Salt Flake Salts by Application Food Industry Bakery & Confectionery Seafood products Household consumers Sauces & Savory by Distribution Channel Offline Distribution Online Distribution Gourmet Salt Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gourmet Salt Market, Key Players:

1. Cargill Inc 2. Alaska Pure Sea Salt Co. 3. Amagansett Sea Salt Co. 4. Kalahari Pristine Salt Worx 5. Morton Salt Inc. 6. Cheetham Salt 7. Pyramid Salt 8. Saltworks Inc. 9. Maldon Crystal Salt Co. 10. Himalayan Salt Company 11. Infosa 12. Salt of Earth Ltd. 13. Le Saunier de Camargue 14. Naturex S.A. 15. Sensient Technology Corporation 16. D.D. Willamson &Co. Inc 17. MC Corporation 18. Dohler Group 19. Koninklijke DSM N.V 20. Kalsec Inc. 21. Chr. Hansen S/A 22. Fiorio ColoriFrequently Asked Questions:

1] What segments are covered in the Global Gourmet Salt Market report? Ans. The segments covered in the Market report are based on Type, Application, Distribution Channel, and Region. 2] Which region is expected to hold the highest share of the Global Gourmet Salt Market? Ans. The North American region is expected to hold the highest share of the Market. 3] What is the growth rate of the Gourmet Salt Market? Ans. The Gourmet Salt Market is expected to grow at a CAGR of 6.4% during the forecast period of 2026 to 2032. 4] What is the significant driving factor for the Gourmet Salt market? Ans. The increasing consumer interest in gourmet and specialty food will influence the market growth. 5] What is the market size of the Gourmet Salt Market? Ans. The Gourmet Salt Market size was valued at USD 2.92 Billion in 2025 reaching nearly USD 4.50 Billion in 2032.

1. Gourmet Salt Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Gourmet Salt Market: Dynamics 2.1. Global Gourmet Salt Market Trends by Region 2.1.1. North America Gourmet Salt Market Trends 2.1.2. Europe Gourmet Salt Market Trends 2.1.3. Asia Pacific Gourmet Salt Market Trends 2.1.4. Middle East and Africa Gourmet Salt Market Trends 2.1.5. South America Gourmet Salt Market Trends 2.2. Global Gourmet Salt Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Gourmet Salt Market Drivers 2.2.1.2. North America Gourmet Salt Market Restraints 2.2.1.3. North America Gourmet Salt Market Opportunities 2.2.1.4. North America Gourmet Salt Market Challenges 2.2.2. Europe 2.2.2.1. Europe Gourmet Salt Market Drivers 2.2.2.2. Europe Gourmet Salt Market Restraints 2.2.2.3. Europe Gourmet Salt Market Opportunities 2.2.2.4. Europe Gourmet Salt Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Gourmet Salt Market Drivers 2.2.3.2. Asia Pacific Gourmet Salt Market Restraints 2.2.3.3. Asia Pacific Gourmet Salt Market Opportunities 2.2.3.4. Asia Pacific Gourmet Salt Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Gourmet Salt Market Drivers 2.2.4.2. Middle East and Africa Gourmet Salt Market Restraints 2.2.4.3. Middle East and Africa Gourmet Salt Market Opportunities 2.2.4.4. Middle East and Africa Gourmet Salt Market Challenges 2.2.5. South America 2.2.5.1. South America Gourmet Salt Market Drivers 2.2.5.2. South America Gourmet Salt Market Restraints 2.2.5.3. South America Gourmet Salt Market Opportunities 2.2.5.4. South America Gourmet Salt Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Analysis of Government Schemes and Initiatives For the Gourmet Salt Industry 3. Gourmet Salt Market: Global Market Size and Forecast by Segmentation (by Value) (2025-2032) 3.1. Gourmet Salt Market Size and Forecast, by Type (2025-2032) 3.1.1. Sea Salt 3.1.2. Rock Salt 3.1.3. Specialty Salt 3.1.4. Fleur de sel 3.1.5. Himalayan Salt 3.1.6. Sel Gris / Grey Salt 3.1.7. Flake Salts 3.2. Gourmet Salt Market Size and Forecast, by Application (2025-2032) 3.2.1. Food Industry 3.2.2. Bakery & Confectionery 3.2.3. Seafood products 3.2.4. Household Consumers 3.2.5. Sauces & Savory 3.3. Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 3.3.1. Offline 3.3.2. Online 3.4. Gourmet Salt Market Size and Forecast, by Region (2025-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Gourmet Salt Market Size and Forecast (by Value in USD Billion) (2025-2032) 4.1. North America Gourmet Salt Market Size and Forecast, by Type (2025-2032) 4.1.1. Sea Salt 4.1.2. Rock Salt 4.1.3. Specialty Salt 4.1.4. Fleur de sel 4.1.5. Himalayan Salt 4.1.6. Sel Gris / Grey Salt 4.1.7. Flake Salts 4.2. North America Gourmet Salt Market Size and Forecast, by Application (2025-2032) 4.2.1. Food Industry 4.2.2. Bakery & Confectionery 4.2.3. Seafood products 4.2.4. Household Consumers 4.2.5. Sauces & Savory 4.3. North America Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 4.3.1. Offline 4.3.2. Online 4.4. North America Gourmet Salt Market Size and Forecast, by Country (2025-2032) 4.4.1. United States 4.4.1.1. United States Gourmet Salt Market Size and Forecast, by Type (2025-2032) 4.4.1.1.1. Sea Salt 4.4.1.1.2. Rock Salt 4.4.1.1.3. Specialty Salt 4.4.1.1.4. Fleur de sel 4.4.1.1.5. Himalayan Salt 4.4.1.1.6. Sel Gris / Grey Salt 4.4.1.1.7. Flake Salts 4.4.1.2. United States Gourmet Salt Market Size and Forecast by Application (2025-2032) 4.4.1.2.1. Food Industry 4.4.1.2.2. Bakery & Confectionery 4.4.1.2.3. Seafood products 4.4.1.2.4. Household Consumers 4.4.1.2.5. Sauces & Savory 4.4.1.3. United States Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.1.3.1. Offline 4.4.1.3.2. Online 4.4.2. Canada 4.4.2.1. Canada Gourmet Salt Market Size and Forecast, by Type (2025-2032) 4.4.2.1.1. Sea Salt 4.4.2.1.2. Rock Salt 4.4.2.1.3. Specialty Salt 4.4.2.1.4. Fleur de sel 4.4.2.1.5. Himalayan Salt 4.4.2.1.6. Sel Gris / Grey Salt 4.4.2.1.7. Flake Salts 4.4.2.2. Canada Gourmet Salt Market Size and Forecast, by Application (2025-2032) 4.4.2.2.1. Food Industry 4.4.2.2.2. Bakery & Confectionery 4.4.2.2.3. Seafood products 4.4.2.2.4. Household Consumers 4.4.2.2.5. Sauces & Savory 4.4.2.3. Canada Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.2.3.1. Offline 4.4.2.3.2. Online 4.4.3. Mexico 4.4.3.1. Mexico Gourmet Salt Market Size and Forecast, by Type (2025-2032) 4.4.3.1.1. Sea Salt 4.4.3.1.2. Rock Salt 4.4.3.1.3. Specialty Salt 4.4.3.1.4. Fleur de sel 4.4.3.1.5. Himalayan Salt 4.4.3.1.6. Sel Gris / Grey Salt 4.4.3.1.7. Flake Salts 4.4.3.2. Mexico Gourmet Salt Market Size and Forecast, by Application (2025-2032) 4.4.3.2.1. Food Industry 4.4.3.2.2. Bakery & Confectionery 4.4.3.2.3. Seafood products 4.4.3.2.4. Household Consumers 4.4.3.2.5. Sauces & Savory 4.4.3.3. Mexico Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.3.3.1. Offline 4.4.3.3.2. Online 5. Europe Gourmet Salt Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 5.1. Europe Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.2. Europe Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.3. Europe Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4. Europe Gourmet Salt Market Size and Forecast, by Country (2025-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.1.2. United Kingdom Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.4.1.3. United Kingdom Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.2. France 5.4.2.1. France Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.2.2. France Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.4.2.3. France Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.3. Germany 5.4.3.1. Germany Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.3.2. Germany Gourmet Salt Market Size and Forecast by Application (2025-2032) 5.4.3.3. Germany Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.4. Italy 5.4.4.1. Italy Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.4.2. Italy Gourmet Salt Market Size and Forecast by Application (2025-2032) 5.4.4.3. Italy Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.5. Spain 5.4.5.1. Spain Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.5.2. Spain Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.4.5.3. Spain Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.6. Sweden 5.4.6.1. Sweden Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.6.2. Sweden Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.4.6.3. Sweden Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.7. Austria 5.4.7.1. Austria Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.7.2. Austria Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.4.7.3. Austria Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Gourmet Salt Market Size and Forecast, by Type (2025-2032) 5.4.8.2. Rest of Europe Gourmet Salt Market Size and Forecast, by Application (2025-2032) 5.4.8.3. Rest of Europe Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6. Asia Pacific Gourmet Salt Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 6.1. Asia Pacific Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.2. Asia Pacific Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.3. Asia Pacific Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4. Asia Pacific Gourmet Salt Market Size and Forecast, by Country (2025-2032) 6.4.1. China 6.4.1.1. China Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.1.2. China Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.1.3. China Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.2. S Korea 6.4.2.1. S Korea Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.2.2. S Korea Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.2.3. S Korea Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.3. Japan 6.4.3.1. Japan Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.3.2. Japan Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.3.3. Japan Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.4. India 6.4.4.1. India Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.4.2. India Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.4.3. India Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.5. Australia 6.4.5.1. Australia Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.5.2. Australia Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.5.3. Australia Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.6.2. Indonesia Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.6.3. Indonesia Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.7.2. Malaysia Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.7.3. Malaysia Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.8.2. Vietnam Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.8.3. Vietnam Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.9.2. Taiwan Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.9.3. Taiwan Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Gourmet Salt Market Size and Forecast, by Type (2025-2032) 6.4.10.2. Rest of Asia Pacific Gourmet Salt Market Size and Forecast, by Application (2025-2032) 6.4.10.3. Rest of Asia Pacific Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 7. Middle East and Africa Gourmet Salt Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 7.1. Middle East and Africa Gourmet Salt Market Size and Forecast, by Type (2025-2032) 7.2. Middle East and Africa Gourmet Salt Market Size and Forecast, by Application (2025-2032) 7.3. Middle East and Africa Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4. Middle East and Africa Gourmet Salt Market Size and Forecast, by Country (2025-2032) 7.4.1. South Africa 7.4.1.1. South Africa Gourmet Salt Market Size and Forecast, by Type (2025-2032) 7.4.1.2. South Africa Gourmet Salt Market Size and Forecast, by Application (2025-2032) 7.4.1.3. South Africa Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.2. GCC 7.4.2.1. GCC Gourmet Salt Market Size and Forecast, by Type (2025-2032) 7.4.2.2. GCC Gourmet Salt Market Size and Forecast by Application (2025-2032) 7.4.2.3. GCC Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Gourmet Salt Market Size and Forecast, by Type (2025-2032) 7.4.3.2. Nigeria Gourmet Salt Market Size and Forecast, by Application (2025-2032) 7.4.3.3. Nigeria Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Gourmet Salt Market Size and Forecast, by Type (2025-2032) 7.4.4.2. Rest of ME&A Gourmet Salt Market Size and Forecast, by Application (2025-2032) 7.4.4.3. Rest of ME&A Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 8.1. South America Gourmet Salt Market Size and Forecast, by Type (2025-2032) 8.2. Sout8. South America Gourmet Salt Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) h America Gourmet Salt Market Size and Forecast, by Application (2025-2032) 8.3. South America Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 8.4. South America Gourmet Salt Market Size and Forecast, by Country (2025-2032) 8.4.1. Brazil 8.4.1.1. Brazil Gourmet Salt Market Size and Forecast, by Type (2025-2032) 8.4.1.2. Brazil Gourmet Salt Market Size and Forecast, by Application (2025-2032) 8.4.1.3. Brazil Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.2. Argentina 8.4.2.1. Argentina Gourmet Salt Market Size and Forecast, by Type (2025-2032) 8.4.2.2. Argentina Gourmet Salt Market Size and Forecast, by Application (2025-2032) 8.4.2.3. Argentina Gourmet Salt Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Gourmet Salt Market Size and Forecast, by Type (2025-2032) 8.4.3.2. Rest Of South America Gourmet Salt Market Size and Forecast, by Application (2025-2032) 8.4.3.3. Rest Of South America Gourmet Salt Market Size and Forecast, by Distribution Channel 2025-2032) 9. Gourmet Salt Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Gourmet Salt Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Alaska Pure Sea Salt Co. (Sitka) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on partnership 10.1.8. Regulatory Accreditations and certifications Received by Them 10.1.9. Awards Received by the firm 10.1.10. Recent Developments 10.2. Cargill Inc. 10.3. Amagansett Sea Salt Co. 10.4. Kalahari Pristine Salt Worx 10.5. Morton Salt Inc. 10.6. Cheetham Salt 10.7. Pyramid Salt 10.8. Saltworks Inc. 10.9. Maldon Crystal Salt Co. 10.10. Himalayan Salt Company 10.11. Infosa 10.12. Salt of Earth Ltd. 10.13. Le Saunier de Camargue 11. Key Findings 12. Industry Recommendations 13. Gourmet Salt Market: Research Methodology