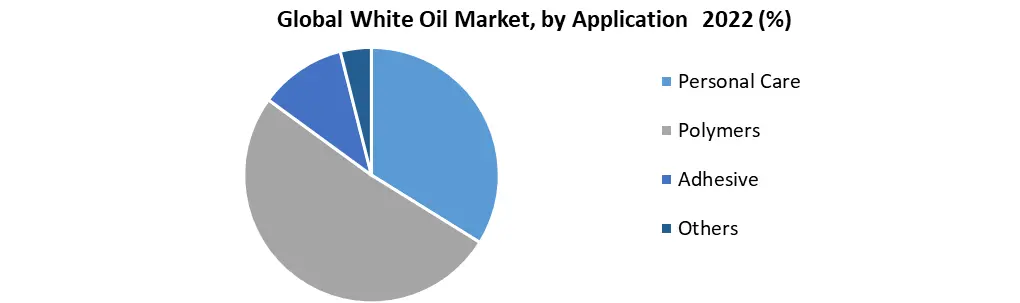

White Oil Market size was valued at US$ 2.04 Bn. in 2022. Personal Care, one of the segments reviewed in MMR report is dominating the Global White Oil Market.White Oil Market Overview:

White oil also known as white mineral oil is a highly stable, refined, pure mineral oil. It is a mineral lubricant used as a mixed base for pharmaceuticals and cosmetics. It is widely recognized as a highly refined and versatile class of mineral oils and is commonly made by refineries from paraffinic or naphthenic bases. Due to its non-toxic and chemically inert nature, widely used as an insecticide to control various insect pastes in the garden.To know about the Research Methodology :- Request Free Sample Report

White Oil Market Dynamics:

White oil is generally refined, pure, stable, colorless, odorless, and non-toxic mineral oil. These attributes make the product ideal for use in the chemical, cosmetic and pharmaceutical manufacturing industries. It is recognized as an important ingredient in the cosmetic industry, being incorporated in the formulations of topical skincare lotions, mineral oils, moisturizers, cosmetics, cold creams, and care products. Hair care and baby oil, among others. This factor is driving the demand for the white oil market. The growing demand for personal care products in countries such as China, Indonesia, India, Japan, and Korea have facilitated cosmetic manufacturers towards innovation and new product development. The properties of white oil, such as oiliness, resistance to moisture, and chemical inertness, facilitate its use in cosmetics and beauty products. These factors are driving the market growth of white oil. Increasing demand for skin care and hair care products is anticipated to have a positive impact on product demand. In the pharmaceutical sector, the product is utilized in the formulation of multiple lotions, ointments, laxatives, complexion creams, and is also used as a carrier for curative drug formulations. White oil also plays an essential role in producing plastics and elastomers, polystyrene internal lubricants, PVC external lubricants, plastic annealing, and catalyst carriers. Besides this, manufacturers are extensively investing in research and development activities to introduce cost-efficient products. Market trends and challenges are analyzed and compiled in the report. The data of 2022 is considered for a better understanding of the client. Moreover, Analytics of the market is based on real numbers of past years from 2017 to 2022 with market forecast until 2029.White Oil Market Segment Analysis:

Based on Application, Personal care dominated the market with a 30% share by 2022. The wide application of products in the formulation of baby oil and hair and skin care products, such as serums, creams and lotions, and makeup products are driving the demand for the product. Personal care product manufacturers are focusing on launching new products to meet growing demand. It has the ability to create a barrier on the skin against the external environment, thus helping to protect the skin from harmful agents. It is also widely used in the formulation of anti-aging products, which is in high demand, especially in different countries in East and North Asia. These factors are driving the market growth of the market segment. Polymer’s segment is expected to grow at a CAGR of 5.5% through the forecast period. Polymer manufacturers because it is extremely important as a fluidity regulator as well as providing polymer release properties. This improves the physical condition of the polymers. Numerous companies are focusing on improving their product lines to consume white oil in various elastomers and adhesives, which are widely used for the production of adhesives for diapers, toys, brushes. toothbrush and common household items. These factors are expected to grow the market through the forecast period.

White Oil Market Regional Insights:

Asia-Pacific dominated the market with a 52% market share in 2022. Consumption of adhesives in the construction and automotive sectors is driving the growth of the white oil market. It is also used in polymer products because it is widely used in the manufacture of household products. These factors are driving the growth of the white oil market in this region. North America is expected to grow at a CAGR of 3.8 % through the forecast period. An increase in the construction industry and strong demand for products from polymer and adhesive applications is expected to drive the market demand for this product. High purchasing power and large consumer investment in the region in household products are expected to drive the market throughout the forecast period. The objective of the report is to present a comprehensive analysis of the White Oil market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the White Oil market dynamics, structure by analyzing the market segments and projecting the White Oil market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the White Oil market make the report investor’s guide.White Oil Market Scope: Inquire before buying

Global White Oil Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.04 Bn. Forecast Period 2023 to 2029 CAGR: 4% Market Size in 2029: US $ 2.69 Bn. Segments Covered: by Application 1. Personal Care 2. Polymers 3. Adhesive 4. Others by Grade 1. Technical 2. Pharmaceutical White Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)White Oil Market, Key Players are

1. ExxonMobil Corp. 2. Total SA 3. Honeywell, Inc. 4. Eni Energy 5. Repsol SA 6. Sonneborn, LLC 7. British Petroleum 8. Seo-jin Chemical Co. Ltd. 9. Renkert Oil Inc. 10. Sasol 11. Nynas AB 12. Sonneborn Inc. 13. Royal Dutch Shell N.V. 14. JX Nippon Oil & Energy Corporation 15. Petro-CanadaFAQ:

1] What segments are covered in the White Oil Market report? Ans. The segments covered in the White Oil Market report are based on Application 2] Which region is expected to hold the highest share in the White Oil Market? Ans. North America region is expected to hold the highest share in the White Oil Market. 3] What is the market size of the White Oil Market by 2029? Ans. The market size of the White Oil Market by 2029 is US $ 2.69 Bn. 4] Who are the top key players in the Market? Ans. ExxonMobil Corp., Total SA, Honeywell, Inc., Eni Energy, Repsol SA, Sonneborn, LLC, British Petroleum, Seo-jin Chemical Co. Ltd., Renkert Oil Inc., Sasol, Nynas AB, Sonneborn Inc., Royal Dutch Shell N.V., JX Nippon Oil & Energy Corporation, Petro-Canada. 5] What was the market size of the White Oil Market in 2022? Ans. The market size of the White Oil Market in 2022 was US $ 2.04 Bn.

1. Global White Oil Market: Research Methodology 2. Global White Oil Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global White Oil Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global White Oil Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global White Oil Market Segmentation 4.1. Global White Oil Market, by Application (2022-2029) • Personal Care • Polymers • Adhesive • Others 4.2. Global White Oil Market, by Grade (2022-2029) • Technical • Pharmaceutical 5. North America White Oil Market(2022-2029) 5.1 North American White Oil Market, By Application (2022-2029) • Personal Care • Polymers • Adhesive • Others 5.2 North America White Oil Market, By Grade (2022-2029) • Technical • Pharmaceutical 5.3 North America White Oil Market, by Country (2022-2029) • United States • Canada • Mexico 6. European White Oil Market (2022-2029) 6.1. European White Oil Market, By Application (2022-2029) 6.2. European White Oil Market, By Grade (2022-2029) 6.3 European White Oil Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific White Oil Market (2022-2029) 7.1. Asia Pacific White Oil Market, By Application (2022-2029) 7.2. Asia Pacific White Oil Market, By Grade (2022-2029) 7.3. Asia Pacific White Oil Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa White Oil Market (2022-2029) 8.1. Middle East and Africa White Oil Market, By Application (2022-2029) 8.2. Middle East and Africa White Oil Market, By Grade (2022-2029) 8.3. Middle East and Africa White Oil Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America White Oil Market (2022-2029) 9.1. South America White Oil Market, By Application (2022-2029) 9.2. South America White Oil Market, By Grade (2022-2029) 9.3 South America White Oil Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 ExxonMobil Corp. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Total SA 10.3 Honeywell, Inc. 10.4 Eni Energy 10.5 Repsol SA 10.6 Sonneborn, LLC 10.7 British Petroleum 10.8 Seo-jin Chemical Co. Ltd. 10.9 Renkert Oil Inc. 10.10 Sasol 10.11 Nynas AB 10.12 Sonneborn Inc. 10.13 Royal Dutch Shell N.V. 10.14 JX Nippon Oil & Energy Corporation 10.15 Petro-Canada