Global Waterproofing Membranes Market size was valued at USD 35.01 Bn in 2023 and is expected to reach USD 55.44 Bn by 2030, at a CAGR of 6.3 %.Overview

A waterproofing membrane is a thin, continuous layer of water-tight material laid over a surface, preventing water seepage. Two main types exist sheet-based and liquid-applied membranes, each about 2 to 4mm thick. An ideal membrane is strong, flexible, tear-resistant, and elastic, capable of covering cracks and accommodating building movement. UV stability is crucial for sun-exposed applications, and flexibility allows it to conform to various shapes and construction features. Proper installation, with a sloped filler material beneath, ensures effective water drainage, avoiding puddles that may lead to seepage into the underlying structure over time.To know about the Research Methodology :- Request Free Sample Report JOBS Group, a leader in waterproofing services, highlights the critical role of waterproofing membranes in protecting buildings from water damage. The comprehensive article discusses membrane types, applications, and the importance of expert selection and application processes. Emphasizing safety, durability, and environmental considerations, the piece underscores the significance of preventative waterproofing to ensure structural integrity and occupant health. The Waterproofing Membranes Market growth drivers are the surge in global infrastructure development. With escalating urbanization and the need for durable, long-lasting structures, waterproofing membranes are becoming indispensable in construction projects. The demand is particularly high in emerging economies where infrastructure investments are robust. Governments and private investors are allocating substantial budgets for projects such as roads, bridges, and commercial complexes, driving the adoption of waterproofing membranes to enhance the longevity and performance of these structures. As a result, the market is witnessing a significant uptick in demand, providing lucrative growth opportunities for manufacturers and suppliers.

Waterproofing Membranes Market Dynamics

Increasing Construction Activities Globally to Drive the Market Growth As urbanization accelerates and infrastructure development expands, there is a growing demand for effective waterproofing solutions. Waterproofing membranes play a pivotal role in safeguarding structures from water damage, ensuring durability and longevity. The escalating need for reliable waterproofing in residential, commercial, and industrial construction projects is a key driver of the Waterproofing Membrane Market growth. With the construction industry showing no signs of slowing down, the Waterproofing Membranes Market is positioned to capitalize on this trend, offering innovative and efficient solutions to address the evolving challenges of modern construction.Rising Awareness of Environmental Sustainability to Boost the Market Growth Another crucial growth driver for the Waterproofing Membranes Market is the increasing awareness and emphasis on environmental sustainability. As regulatory bodies implement stringent environmental standards, there is a growing preference for eco-friendly and sustainable construction materials. Waterproofing membranes that are designed to be environmentally responsible, with minimal ecological impact, is gaining traction. The market is witnessing a shift towards products that not only provide superior waterproofing performance but also align with sustainable building practices. This shift in consumer preferences and industry trends towards green building solutions is expected to propel the growth of environmentally conscious waterproofing membrane options. The demand for eco-friendly waterproofing membranes is evident in the architectural and construction industry. Seven reputable manufacturers, including Carlisle Construction Materials, Holcim Elevate, and DRACO, offer innovative solutions. Effisus presents ProFlex FR, a multi-layered membrane with high elongation capacity. Holcim Elevate's RubberGard™ stands out for its insulating properties. DRACO introduces BENT 300, a single-layer bentonite membrane for various applications. Tejas Borja's ECO 135 provides UV protection. The market reflects a growing emphasis on sustainability, with membranes offering superior performance while meeting ecological standards. This curated selection caters to diverse needs, emphasizing quality, durability, and environmental consciousness. Advancements in Material Technology of Waterproofing Membranes to Create Lucrative Opportunity for Market Technological advancements in material science are playing a pivotal role in shaping the Waterproofing Membranes Market. Ongoing research and development efforts are leading to the creation of innovative materials with enhanced waterproofing properties, improved durability, and ease of application. The introduction of high-performance polymer-based membranes, reinforced with advanced fibers, is revolutionizing the market by offering superior resistance to water ingress and increased flexibility. These advancements not only enhance the overall performance of waterproofing membranes but also contribute to cost-effectiveness and ease of installation. As manufacturers continue to invest in cutting-edge technologies, the market is poised for sustained growth, driven by the constant evolution of materials and their application in waterproofing solutions. Waterproofing is vital in construction, safeguarding buildings from water damage and enhancing longevity. Traditional methods require specialists, but advancements like Elephant Shield allow even painters to perform waterproofing without technical expertise. These advanced products, cost-effective and easy to apply, eliminate the need for specialized labor. Elephant Shield, suitable for various surfaces, offers standing water resistance and long-lasting protection against harsh conditions. It improves structural integrity, making it a versatile solution for roofs, walls, basements, and foundations. For cost-effective waterproofing, one can now rely on painters equipped with user-friendly advanced products. Such cost-efficient and advanced products are expected to drive the Waterproofing Membranes Market growth. Textile Glossary provides insights into the term "Membrane" in the textile industry. A membrane refers to a thin, flexible material acting as a barrier while permitting specific elements like air or moisture to pass through. This innovation has transformed industries, offering properties such as waterproofing and breathability. Originating from the study of biological membranes, synthetic materials mimicked these functionalities, leading to the commercial success of waterproof and breathable fabrics in the mid-20th century. Membranes come in various types, including micro-porous, reverse osmosis, nano-filtration, gas separation, and hydrophilic/hydrophobic. Major waterproofing membrane manufacturers include Gore-Tex, W. L. Gore & Associates, Siemens Water Solutions, Evonik Industries, and GE Water & Process Technologies. Membranes find applications in outdoor apparel, water filtration, medical, industrial filtration, and energy storage, revolutionizing various sectors. Their continuous evolution promises innovative solutions for diverse needs. Regulatory Compliance Challenges and Fluctuating Raw Material Costs to Restrain the Market Growth One significant growth restraint for the Waterproofing membrane market is the stringent regulatory landscape. As governments worldwide intensify environmental and safety regulations, manufacturers face increased pressure to comply with evolving standards. Adherence to these regulations necessitates substantial investments in research, development, and product modification. Meeting diverse regional and international requirements adds complexity, impacting time-to-market and operational efficiency. Companies must navigate a maze of compliance hurdles, leading to delays and increased costs. This regulatory burden, encompassing environmental, health, and safety mandates, constrains market growth by diverting resources from innovation and expansion efforts. The Waterproofing Membranes Market's trajectory is consequently influenced by the ability of companies to adapt swiftly to regulatory changes while maintaining profitability.

Projex Group specializes in providing waterproofing solutions for architects, engineers, and builders in Australia and New Zealand. They offer Wolfin and Cosmofin waterproofing membranes, both compliant with Australian Standards 4654.1 and 4858. Wolfin, is a flexible polyester PVC sheet membrane known for its mechanical, chemical, and elongation properties. Cosmofin, a UV-stable PVC waterproof membrane, offers reliable, long-term performance. Projex Group ensures the design and installation meet Australian standards and provides comprehensive support for Wolfin and Cosmofin installations. With a commitment to excellence, Projex Group delivers technically superior products for effective waterproofing in diverse construction projects to boost the Waterproofing membrane industry's growth.

Waterproofing Membranes Market Segment Analysis

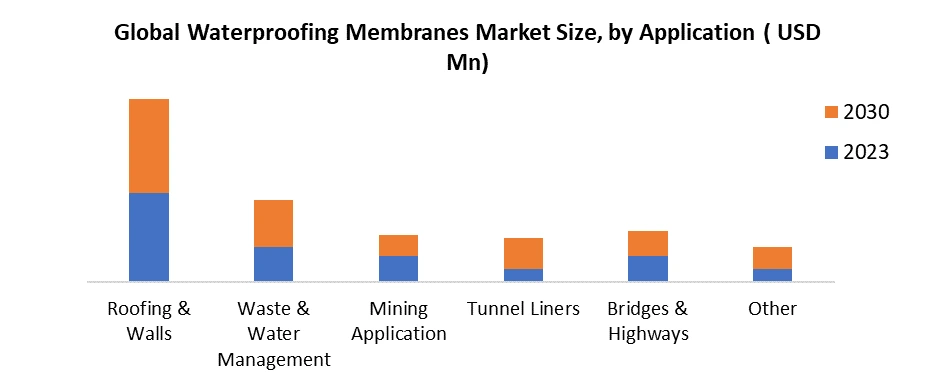

By Type: Based on the type, the liquid-applied membrane segment dominated the largest Waterproofing Membranes Market share in 2023. This growth is fueled by increasing awareness of its cost-effectiveness and easy installation. The surge in global infrastructure projects focusing on water conservation is a key factor driving demand. This growth is propelled by increasing awareness of its cost-effectiveness and easy installation. The demand for liquid-applied membranes is expected to surge globally due to rising infrastructural developments focused on water conservation and treatment. While Asia Pacific, North America, and Europe have been major markets, Asia Pacific is anticipated to lead as the fastest-growing region, followed by Europe. For instance, Polyurethane liquid applied membrane is poised for significant revenue growth at a rate of 9.1% during the forecast period. Known for its uniform thickness, it finds versatile applications in waterproofing for roofs, wet rooms, water & and sewage treatment plants, and stadium stands. Bituminous liquid membrane is projected to experience a CAGR of 7.3% in volume over the forecast period, driven by its exceptional properties such as high weathering and aging resistance. Its flexibility at low temperatures, high UV resistance, and improved flow resistance at high temperatures enhance its viability. By Application Based on the application, the Roofing & Walls segment held the largest Waterproofing Membranes Market share in 2023. In construction, shield roofs, foundations, and structures such as bridges and tunnels, ensure durability and water resistance. Water and waste management benefit from membranes in reservoirs and wastewater treatment plants, adhering to stringent quality standards. Transportation infrastructure, including roads, railways, and airports, utilizes waterproofing solutions for safety and longevity. In commercial and residential buildings, these membranes protect flat roofs, basements, and exterior walls from water-related damage. The energy sector employs them in oil and gas facilities and renewable energy projects for resilience against environmental factors. Overall, tailored solutions meet sector-specific demands, contributing to market growth.

Waterproofing Membranes Market Regional Insight

In 2023, Asia Pacific accounted for the largest Waterproofing Membranes Market share, propelled by robust infrastructural developments and rapid industrialization, particularly in China and India. Urban congestion arising from this trend is driving the demand for domestic utilities, including water requirements, contributing to market growth. India and China, as rising superpowers, navigate challenges posed by the Fourth Industrial Revolution. India's youthful population, skilled workforce, and favorable policies like 'Make in India' position it for growth. China, known for agility and favorable renewables policies, leads in solar energy. Collaborative efforts, especially in digital payments, can benefit both nations. Education and mutual learning initiatives can drive innovation. Their success is crucial for global stability, with India's growth potential attracting investments. Collaborating on environmental issues, like combating air pollution, showcases the potential for positive diplomatic ties. Building bridges for mutual markets, ideas, and services is key. Additionally, the ascending roofing and waste management industries are pivotal in boosting regional growth. The utilization of waterproofing membranes in mining applications is anticipated to further stimulate market expansion. In North America, the Waterproofing Membranes Market growth is increased by increased construction activities in Mexico and Canada. Also, rising investments in warehouse construction for the healthcare, retail, and automotive sectors, which necessitate effective waterproofing solutions, are positively influencing the industry's trajectory. The top construction projects in the USA for 2022 showcase groundbreaking developments across various sectors. Notable projects include the completion of Amazon HQ2 in Arlington, Virginia, a $2.5 billion venture featuring LEED-certified office buildings and retail spaces. Samsung's $17 billion semiconductor facility in Austin, Texas, addressing the global chip shortage, and California's $13.1 billion High-Speed Rail project stand out. Additionally, the $20 billion Texas Bullet Rail connecting Dallas/Fort Worth and Houston, the NFL's $1.4 billion Buffalo Bills Stadium, and the $20 billion Blue Castle Nuclear Plant in Utah demonstrate the nation's commitment to infrastructure advancements. Other projects include the USA/Mexico Border Wall, Hyperloop development, Venture Global Plaquemines LNG export facility, and the Edwards & Sanborn Solar facility with a $1.15 billion investment, making it the largest solar and storage project in development. Competitive Landscape Analysis The competitive landscape in the Waterproofing Membranes Market features key players at the forefront of innovation and quality. Leading manufacturers include Carlisle Construction Materials GmbH, Domissima S.A., DRACO, Effisus, Flexirub, Holcim Elevate, and Tejas Borja S.A.U. Each company brings unique strengths to the market, offering a diverse range of eco-friendly, UV-resistant, and high-performance waterproofing solutions. The products include Effisus' ProFlex FR, Holcim Elevate's RUBBERGARD™, and DRACO's BENT 300. The industry's focus on advancements, sustainable practices, and adapting to supply chain disruptions underscores the dynamic nature of the competitive landscape, with companies striving to meet the evolving demands of construction and infrastructure projects.Waterproofing Membranes Market Scope: Inquire before buying

Global Waterproofing Membranes Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 35.01 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 55.44 Bn. Segments Covered: by Raw Material Modified Bitumen PVC EPDM TPO HDPE LDPE Others by Type Liquid Applied Membranes Sheet Based Membranes by Application Roofing & Walls Building Structures Waste & Water Management Mining Application Tunnel Liners Bridges & Highways Others by End User Residential Commercial Industrial Waterproofing Membranes Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Waterproofing Membranes Key Players by Region

North America 1. Carlisle Companies Inc. - USA 2. Firestone Building Products Company LLC. – USA 3. The Dow Chemical Company - USA 4. GAF Materials Corporation - USA 5. Johns Manville – USA 6. Solmax International Inc. - Canada 7. Flex Roofing Systems - USA 8. GCP Applied Technologies Inc. - USA 9. GSE Environmental - Texas, USA 10. IKO Industries Ltd - Canada 11. Laticrete International, Inc. - USA 12. Noble Company - USA 13. Schluter System Ltd - USA Germany 14. Soprema Group - Strasbourg, France 15. Sika AG- Baar, Switzerland 16. Renolit SE - Worms, Germany 17. Chryso S.A.S - France 18. Copernit S.P.A. - Italy 19. Derbigum – Belgium 20. Isomat S.A - Greece 21. Mapei International - Italy 22. Paul Bauder GmbH & Co. Kg - Germany 23. Porcelanosa Group – Spain 24. Other MEA 25. Fosroc International Limited - United Arab Emirates 26. Juta A.S - Dolní Benešov, Czech Republic 27. Other Frequently Asked Questions: 1] What is the growth rate of the Global Waterproofing Membranes Market? Ans. The Global Waterproofing Membranes Market is growing at a significant rate of 6.3 % during the forecast period. 2] Which region is expected to dominate the Global Waterproofing Membranes Market? Ans. APAC is expected to dominate the Waterproofing Membranes Market during the forecast period. 3] What is the expected Global Waterproofing Membranes Market size by 2030? Ans. The Waterproofing Membranes Market size is expected to reach USD 55.44 Bn by 2030. 4] Which are the top players in the Global Waterproofing Membranes Market? Ans. The major top players in the Global Waterproofing Membranes Market are Carlisle Companies Inc., Firestone Building Products Company LLC. and others. 5] What are the factors driving the Global Waterproofing Membranes Market growth? Ans. The growth of huge construction activities and industrialization is expected to drive the Waterproofing membrane market growth. 6] Which country held the largest Global Waterproofing Membranes Market share in 2023? Ans. The India held the largest Waterproofing Membranes Market share in 2023.

1. Waterproofing Membranes Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Waterproofing Membranes Market: Dynamics 2.1. Waterproofing Membranes Market Trends by Region 2.1.1. North America Waterproofing Membranes Market Trends 2.1.2. Europe Waterproofing Membranes Market Trends 2.1.3. Asia Pacific Waterproofing Membranes Market Trends 2.1.4. Middle East and Africa Waterproofing Membranes Market Trends 2.1.5. South America Waterproofing Membranes Market Trends 2.2. Waterproofing Membranes Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Waterproofing Membranes Market Drivers 2.2.1.2. North America Waterproofing Membranes Market Restraints 2.2.1.3. North America Waterproofing Membranes Market Opportunities 2.2.1.4. North America Waterproofing Membranes Market Challenges 2.2.2. Europe 2.2.2.1. Europe Waterproofing Membranes Market Drivers 2.2.2.2. Europe Waterproofing Membranes Market Restraints 2.2.2.3. Europe Waterproofing Membranes Market Opportunities 2.2.2.4. Europe Waterproofing Membranes Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Waterproofing Membranes Market Drivers 2.2.3.2. Asia Pacific Waterproofing Membranes Market Restraints 2.2.3.3. Asia Pacific Waterproofing Membranes Market Opportunities 2.2.3.4. Asia Pacific Waterproofing Membranes Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Waterproofing Membranes Market Drivers 2.2.4.2. Middle East and Africa Waterproofing Membranes Market Restraints 2.2.4.3. Middle East and Africa Waterproofing Membranes Market Opportunities 2.2.4.4. Middle East and Africa Waterproofing Membranes Market Challenges 2.2.5. South America 2.2.5.1. South America Waterproofing Membranes Market Drivers 2.2.5.2. South America Waterproofing Membranes Market Restraints 2.2.5.3. South America Waterproofing Membranes Market Opportunities 2.2.5.4. South America Waterproofing Membranes Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Analysis of Government Schemes and Initiatives For the Waterproofing Membranes Industry 2.8. The Covid-19 Pandemic's Impact on the Waterproofing Membranes Market 3. Waterproofing Membranes Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 3.1. Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 3.1.1. Modified Bitumen 3.1.2. PVC 3.1.3. EPDM 3.1.4. TPO 3.1.5. HDPE 3.1.6. LDPE 3.1.7. Others 3.2. Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 3.2.1. Liquid Applied Membranes 3.2.2. Sheet Based Membranes 3.3. Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 3.3.1. Roofing & Walls 3.3.2. Building Structures 3.3.3. Waste & Water Management 3.3.4. Mining Application 3.3.5. Tunnel Liners 3.3.6. Bridges & Highways 3.3.7. Others 3.4. Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 3.4.1. Residential 3.4.2. Commercial 3.4.3. Industrial 3.5. Waterproofing Membranes Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Waterproofing Membranes Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 4.1. North America Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 4.1.1. Modified Bitumen 4.1.2. PVC 4.1.3. EPDM 4.1.4. TPO 4.1.5. HDPE 4.1.6. LDPE 4.1.7. Others 4.2. North America Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 4.2.1. Liquid Applied Membranes 4.2.2. Sheet Based Membranes 4.3. North America Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 4.3.1. Roofing & Walls 4.3.2. Building Structures 4.3.3. Waste & Water Management 4.3.4. Mining Application 4.3.5. Tunnel Liners 4.3.6. Bridges & Highways 4.3.7. Others 4.4. North America Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 4.4.1. Residential 4.4.2. Commercial 4.4.3. Industrial 4.5. North America Waterproofing Membranes Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 4.5.1.1.1. Modified Bitumen 4.5.1.1.2. PVC 4.5.1.1.3. EPDM 4.5.1.1.4. TPO 4.5.1.1.5. HDPE 4.5.1.1.6. LDPE 4.5.1.1.7. Others 4.5.1.2. United States Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 4.5.1.2.1. Liquid Applied Membranes 4.5.1.2.2. Sheet Based Membranes 4.5.1.3. United States Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Roofing & Walls 4.5.1.3.2. Building Structures 4.5.1.3.3. Waste & Water Management 4.5.1.3.4. Mining Application 4.5.1.3.5. Tunnel Liners 4.5.1.3.6. Bridges & Highways 4.5.1.3.7. Others 4.5.1.4. United States Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Residential 4.5.1.4.2. Commercial 4.5.1.4.3. Industrial 4.5.2. Canada 4.5.2.1. Canada Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 4.5.2.1.1. Modified Bitumen 4.5.2.1.2. PVC 4.5.2.1.3. EPDM 4.5.2.1.4. TPO 4.5.2.1.5. HDPE 4.5.2.1.6. LDPE 4.5.2.1.7. Others 4.5.2.2. Canada Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 4.5.2.2.1. Liquid Applied Membranes 4.5.2.2.2. Sheet Based Membranes 4.5.2.3. Canada Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Roofing & Walls 4.5.2.3.2. Building Structures 4.5.2.3.3. Waste & Water Management 4.5.2.3.4. Mining Application 4.5.2.3.5. Tunnel Liners 4.5.2.3.6. Bridges & Highways 4.5.2.3.7. Others 4.5.2.4. Canada Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Residential 4.5.2.4.2. Commercial 4.5.2.4.3. Industrial 4.5.3. Mexico 4.5.3.1. Mexico Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 4.5.3.1.1. Modified Bitumen 4.5.3.1.2. PVC 4.5.3.1.3. EPDM 4.5.3.1.4. TPO 4.5.3.1.5. HDPE 4.5.3.1.6. LDPE 4.5.3.1.7. Others 4.5.3.2. Mexico Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 4.5.3.2.1. Liquid Applied Membranes 4.5.3.2.2. Sheet Based Membranes 4.5.3.3. Mexico Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Roofing & Walls 4.5.3.3.2. Building Structures 4.5.3.3.3. Waste & Water Management 4.5.3.3.4. Mining Application 4.5.3.3.5. Tunnel Liners 4.5.3.3.6. Bridges & Highways 4.5.3.3.7. Others 4.5.3.4. Mexico Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Residential 4.5.3.4.2. Commercial 4.5.3.4.3. Industrial 5. Europe Waterproofing Membranes Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn)(2023-2030) 5.1. Europe Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.2. Europe Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.3. Europe Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.4. Europe Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5. Europe Waterproofing Membranes Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.1.2. United Kingdom Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.1.3. United Kingdom Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.2.2. France Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.2.3. France Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.3.2. Germany Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.3.3. Germany Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.4.2. Italy Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.4.3. Italy Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.5.2. Spain Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.5.3. Spain Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.6.2. Sweden Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.6.3. Sweden Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.7.2. Austria Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.7.3. Austria Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 5.5.8.2. Rest of Europe Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 5.5.8.3. Rest of Europe Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Waterproofing Membranes Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn)(2023-2030) 6.1. Asia Pacific Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.2. Asia Pacific Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Waterproofing Membranes Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.1.2. China Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.1.3. China Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.2.2. S Korea Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.2.3. S Korea Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.3.2. Japan Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.3.3. Japan Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.4.2. India Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.4.3. India Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.5.2. Australia Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.5.3. Australia Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.6.2. Indonesia Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.6.3. Indonesia Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.7.2. Malaysia Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.7.3. Malaysia Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.8.2. Vietnam Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.8.3. Vietnam Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.9.2. Taiwan Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.9.3. Taiwan Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 6.5.10.2. Rest of Asia Pacific Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Waterproofing Membranes Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 7.1. Middle East and Africa Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 7.2. Middle East and Africa Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Waterproofing Membranes Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 7.5.1.2. South Africa Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 7.5.1.3. South Africa Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 7.5.2.2. GCC Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 7.5.2.3. GCC Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 7.5.3.2. Nigeria Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 7.5.3.3. Nigeria Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 7.5.4.2. Rest of ME&A Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 7.5.4.3. Rest of ME&A Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 8. South America Waterproofing Membranes Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 8.1. South America Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 8.2. South America Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 8.3. South America Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 8.4. South America Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 8.5. South America Waterproofing Membranes Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 8.5.1.2. Brazil Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 8.5.1.3. Brazil Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 8.5.2.2. Argentina Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 8.5.2.3. Argentina Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Waterproofing Membranes Market Size and Forecast, by Raw Material (2023-2030) 8.5.3.2. Rest Of South America Waterproofing Membranes Market Size and Forecast, by Type (2023-2030) 8.5.3.3. Rest Of South America Waterproofing Membranes Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Waterproofing Membranes Market Size and Forecast, by End User (2023-2030) 9. Global Waterproofing Membranes Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.4. Leading Waterproofing Membranes Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carlisle Companies Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Firestone Building Products Company LLC. 10.3. Soprema Group 10.4. Sika AG 10.5. The DOW Chemical Company 10.6. GAF Materials Corporation 10.7. Johns Manville 10.8. Renolit SE 10.9. Fosroc International Limited 10.10. Solmax International Inc. 10.11. Chryso S.A.S 10.12. Copernit S.P.A. 10.13. Derbigum 10.14. Flex Roofing Systems 10.15. GCP Applied Technologies Inc. 10.16. GSE Environmental 10.17. IKO Industries Ltd 10.18. Isomat S.A 10.19. Juta A.S 10.20. Laticrete International, Inc. 10.21. Mapei International 10.22. Noble Company 10.23. Paul Bauder GmbH & Co. Kg 10.24. Paul Porcelanosa Group 10.25. Schluter System Ltd 11. Key Findings 12. Industry Recommendations 13. Waterproofing Membranes Market: Research Methodology