Global Video Conferencing Market size was valued at USD 5.47 Bn in 2023 and is expected to reach USD 10.06 Bn by 2030, at a CAGR of 9.1%.Video Conferencing Market

Video conferencing facilitates live, visual connections between remote parties, replicating face-to-face meetings over the Internet. It ranges from basic transmission of static images and text to sophisticated platforms enabling full-motion video and high-quality audio exchange among multiple locations. Essential in the Video Conferencing Market, providing integrated desktop and room solutions, vital for Telehealth, customer service, and unified communications in business. With cloud-based services, organizations adopt video conferencing affordably and access AI-powered features for enhanced audio and video performance. Its versatility and accessibility make it a vital tool for bridging geographical barriers and fostering collaboration across diverse settings.To know about the Research Methodology :- Request Free Sample Report The Video Conferencing market is experiencing significant growth driven by factors such as increasing globalization, the rise of remote work, and technological advancements. With the COVID-19 pandemic accelerating the adoption of digital collaboration tools, video conferencing has become essential for businesses across the globe. Technological innovations, including high-speed internet, cloud-based platforms, and AI-powered features, have enhanced accessibility, scalability, and user experience, driving widespread adoption across diverse industries and applications. From healthcare to education, customer service, and entertainment, video conferencing is being utilized for remote consultations, virtual classrooms, customer support interactions, and live events. The integration of video conferencing into several sectors underscores its versatility and value in facilitating virtual connections and enabling seamless communication across geographical barriers. As organizations prioritize flexibility, collaboration, and productivity in their operations, the demand for innovative video conferencing solutions is expected to persist, driving sustained growth in the industry. The continued evolution of technology, coupled with changing work dynamics and increasing demand for hybrid work environments, is likely to propel the Video Conferencing Market growth, positioning it as a critical component of modern communication and collaboration strategies for businesses of all sizes.

Video Conferencing Market Trend

Integration Of Artificial Intelligence (AI) And Machine Learning (ML) technologies As businesses worldwide increasingly rely on video conferencing tools to facilitate communication during the ongoing global health crisis, AI and ML have emerged as essential innovations enhancing the efficacy and user experience of virtual meetings. These technologies revolutionize traditional video conferencing by offering innumerable intelligent features and functionalities that boost Video Conferencing Market growth. AI-powered Natural Language Processing (NLP) tools optimize communication by providing voice-to-text transcription for seamless note-taking, language translation for multilingual conversations, and automated report generation for task assignment and action point sharing. AI-driven scheduling assistants streamline meeting management by leveraging online calendars to schedule, reschedule, and send reminders to participants, ensuring efficient coordination across different time zones. Computer vision capabilities enhance visual experiences by automatically adjusting camera angles, optimizing lighting conditions, and tagging participants individually for focused engagement. AI-driven analytics provide valuable insights into meeting dynamics, duration, and participant behavior, enabling organizations to drive productivity and make informed decisions. Which drives Video Conferencing Market growth. ML-based anomaly detection ensures the privacy and security of sensitive information shared during video conferences, enhancing trust among participants. The integration of AI and ML technologies empowers organizations to transform traditional video conferencing into intelligent, personalized, and secure communication platforms, catering to the evolving needs of remote collaboration and communication.Benefits Of AI in Video Conferencing

Benefit Description Efficient and effective meeting summaries AI automatically generates summaries of key meeting information, including a written recap, keywords, video highlights, and AI-generated topics. Advanced presentation delivery and engagement AI enhances presentations with features such as virtual whiteboards, noise cancellation, and background removal. Catch up on meetings quickly AI-powered live transcription allows latecomers, non-native speakers, and people with hearing difficulties to stay caught up. Distraction-free meetings AI automatically tracks your movements and keeps you centered in the video frame, reducing distractions. Better presentations AI moves presenters alongside their screen shares and presentations and even places them in virtual backgrounds. Automatic scheduling AI automates scheduling by analyzing online calendars and suggesting ideal meeting times. Analytics and continuous meeting improvement AI provides analytics on meeting productivity, including time spent on agenda items, identification of bottlenecks, and recognition of needed documents. Video Conferencing Market Dynamics

Increasing Demand for Remote Work Solutions to Boost Market Growth As organizations worldwide transition towards remote work setups, spurred by the COVID-19 pandemic and a broader shift towards flexible work arrangements, the need for efficient virtual collaboration tools has soared. Video conferencing platforms have emerged as indispensable tools for facilitating seamless communication and collaboration among remote teams, enabling live, visual connections that simulate face-to-face interaction which boost Video Conferencing Market growth. From small businesses to large enterprises, the ability to conduct virtual meetings, presentations, and discussions in real time has become essential for maintaining productivity and fostering team cohesion across geographically dispersed workforces. The Video Conferencing Market has witnessed unprecedented growth as businesses seek comprehensive solutions to bridge the physical divide between remote employees. These platforms range from simple transmission of static images and text to sophisticated systems offering full-motion video and high-quality audio transmission between multiple locations. With the rise of hybrid work models blending remote and in-office arrangements, desktop video conferencing has become a core component of unified communications platforms. These platforms, along with standalone cloud-based and on-premises video conferencing solutions, provide to diverse business needs, including telehealth, customer service, and distance learning. The widespread availability of cloud-based services has lowered barriers to entry, allowing organizations to implement video conferencing with minimal upfront investment and leverage emerging AI-powered features to enhance audio and video performance. As the demand for remote work solutions continues to grow, driven by evolving workplace dynamics and the pursuit of enhanced collaboration and flexibility, the Video Conferencing Market is poised for sustained growth, driving innovation and transforming the way teams connect and collaborate in the digital industry. Incorporating augmented reality (AR) and virtual reality (VR) technologies into a video conferencing platform is a lucrative Opportunity for the Market Incorporating augmented reality (AR) and virtual reality (VR) technologies into a video conferencing platform revolutionizes digital communication, offering immersive alternatives that enhance engagement and collaboration. AR overlays digital elements onto the real world, while VR creates entirely virtual environments, both providing unique benefits for business communication. Teleconferences rely solely on audio, video conferences incorporate both audio and visual elements, and VR conferences take immersion to the next level by placing users in 3D meeting environments, closely resembling in-person interactions which boost Video Conferencing Market growth. In VR meetings, participants use specialized hardware such as VR headsets to enter a 3D environment, enabling remote teams to engage in collective thinking and strategizing with minimal communication barriers. AR and VR technology also facilitates seamless team collaboration, allowing dispersed teams to work together in a sensory-rich virtual space, streamlining product development processes and strengthening client relationships. By offering immersive, engaging, and interactive experiences, AR and VR enable businesses to conduct more effective virtual meetings, collaborate seamlessly across distances, and deliver unparalleled client experiences that drive Video Conferencing Market growth. As these technologies continue to evolve, they have been shaping the future of digital communication and remote collaboration. Incorporating augmented reality (AR) and virtual reality (VR) into video conferencing platforms enhances user engagement and immersion. In the United States, the number of VR and AR users is growing steadily, driven by technological advancements and increased adoption of immersive experiences, with millions engaging in these technologies.Challenge Of Ensuring Data Security and Privacy to hamper Market Growth The challenge of ensuring data security and privacy in the video conferencing market is further compounded by the rapid expansion of remote work trends, accelerated by the global pandemic. As organizations transition to hybrid or fully remote work models, the reliance on video conferencing solutions has surged, amplifying the exposure of sensitive information across diverse networks and devices. The proliferation of endpoints accessing video conferencing platforms, ranging from laptops and desktops to smartphones and tablets, increases the attack surface for potential security breaches. The emergence of new threat vectors, such as phishing scams targeting video conferencing users, underscores the need for strong cybersecurity measures. In response, video conferencing providers are under pressure to enhance encryption protocols, implement stringent access controls, and fortify their infrastructure against evolving cyber threats. Failure to address these security and privacy concerns not only jeopardizes organizational data integrity but also erodes customer trust and regulatory compliance, posing a challenging restraint to the sustained Video Conferencing Market growth.

Video Conferencing Market Segment Analysis

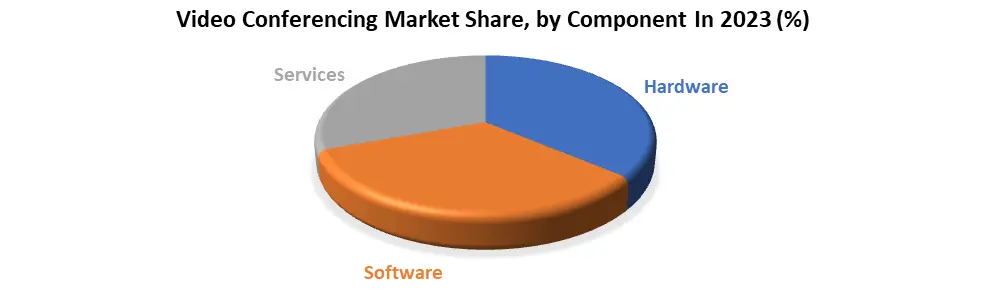

Based on Component, the market is segmented into Hardware, Software and Services. Software dominated the Video Conferencing Market in 2023 and is expected to continue its dominance over the forecast period. Software dominates the video conferencing market primarily due to its versatility, accessibility, and scalability. The software-based platforms offer a wide range of features including screen sharing, virtual backgrounds, and chat functionalities, enhancing user experience and collaboration. The software solutions are more adaptable to evolving technological trends and user needs, allowing for rapid updates and improvements without the need for physical hardware upgrades. The software-centric nature of video conferencing also raises integration with other applications and services, facilitating seamless workflows and enhancing productivity for businesses and individuals alike. Software exemplified by heavy hitters like Zoom, Microsoft Teams, GoToMeeting, Google Meet, ezTalks Meetings, StarLeaf, and Cisco Webex. These platforms offer a plethora of features aimed at simplifying remote communication and collaboration. From flawless video and crystal-clear audio to instant sharing capabilities, these software solutions provide seamless connectivity for users across various industries. Whether it's enterprises seeking effective client communication, educators facilitating virtual classrooms, or healthcare professionals conducting remote consultations, video conferencing software provides diverse needs. With functionalities such as screen sharing, whiteboarding, HD video and voice, chat, and scheduling, these platforms ensure efficient virtual interactions. Security features such as SSL encryption guarantee secure communications, vital for protecting sensitive information shared during meetings. The flexibility, scalability, and feature-rich nature of software solutions have made them indispensable tools for remote collaboration, leading to their prominent component in the Video Conferencing Market.

Video Conferencing Market Regional Insights

North America dominated the Video Conferencing Market in 2023 and is expected to continue its dominance over the forecast period. The region boasts a highly developed and mature telecommunications infrastructure, characterized by extensive broadband connectivity and advanced networking capabilities. This strong infrastructure provides the foundation for seamless and high-quality video conferencing experiences, facilitating smooth communication and collaboration among businesses, government agencies, educational institutions, and individuals across North America. The region is home to a large concentration of leading technology companies, including pioneers in the field of video conferencing such as Zoom, Cisco Systems, and Microsoft, among others. These companies have played a pivotal role in driving innovation and shaping the landscape of video conferencing solutions, leveraging their expertise and resources to develop cutting-edge technologies that meet the evolving needs of users.North America benefits from a strong culture of entrepreneurship and innovation, fostering a conducive environment for the adoption and integration of emerging technologies such as video conferencing into various sectors and industries. This culture of innovation, coupled with a highly educated workforce and a vibrant ecosystem of startups and research institutions, positions North America at the forefront of technological advancements that boost Video Conferencing Market Growth. The region's diverse and dynamic business landscape, spanning sectors such as finance, healthcare, information technology, entertainment, and more, presents ample opportunities for the deployment and utilization of video conferencing solutions to drive productivity, efficiency, and collaboration. North America leadership in the video conferencing market is driven by its proactive regulatory environment and strong commitment to data privacy and security. Regulatory frameworks such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada impose stringent requirements for the protection of sensitive information, including data transmitted through video conferencing platforms. Compliance with these regulations is paramount for businesses and organizations operating in North America, driving demand for video conferencing solutions that offer robust encryption, authentication, and access control features to safeguard user data and privacy.

Video Conferencing Market Scope: Inquire before buying

Global Video Conferencing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.47 Bn. Forecast Period 2024 to 2030 CAGR: 9.1% Market Size in 2030: US $ 10.06 Bn. Segments Covered: by Component Hardware Software Services by Deployment Mode Cloud-Based On-premises Others by Enterprise Size Small and Medium-sized Enterprises (SMEs) Large Enterprises by Vertical Education Healthcare Government and Public Sector Finance and Banking Others Video Conferencing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Video Conferencing Key players

Global 1. Zoom Video Communications (San Jose, California, USA) 2. Cisco Systems (San Jose, California, USA) 3. Microsoft Corporation (Redmond, Washington, USA) 4. Google (Mountain View, California, USA) 5. Adobe Inc. (San Jose, California, USA) North America 1. LogMeIn (Boston, Massachusetts, USA) 2. Lifesize (Austin, Texas, USA) 3. Avaya Inc. (Durham, North Carolina, USA) 4. Blackboard Inc. (Washington, D.C., USA) 5. BlueStar Inc. (Florence, Kentucky, USA) 6. Fuze Inc. (Boston, Massachusetts, USA) 7. Poly (Santa Cruz, California, USA) 8. Vonage (Holmdel Township, New Jersey, USA) Europe 1. StarLeaf (Watford, Hertfordshire, England) 2. Pexip (Oslo, Norway) Asia Pacific 1. Huawei Technologies Co., Ltd. (Shenzhen, China) 2. Tencent (Shenzhen, China) 3. Zoho Corporation (Chennai, Tamil Nadu, India) Frequently Asked Questions: 1] What is the growth rate of the Global Video Conferencing Market? Ans. The Global Video Conferencing Market is growing at a significant rate of 9.1% during the forecast period. 2] Which region is expected to dominate the Global Video Conferencing Market? Ans. North America is expected to dominate the Video Conferencing Market during the forecast period. 3] What is the expected Global Video Conferencing Market size by 2030? Ans. The Video Conferencing Market size is expected to reach USD 10.06 Billion by 2030. 4] Which are the top players in the Global Video Conferencing Market? Ans. The major top players in the Global Video Conferencing Market are Zoom Video Communications (San Jose, California, USA), Cisco Systems (San Jose, California, USA), Microsoft Corporation (Redmond, Washington, USA), Google (Mountain View, California, USA), Adobe Inc. (San Jose, California, USA), LogMeIn (Boston, Massachusetts, USA)and Others. 5] What are the factors driving the Global Video Conferencing Market growth? Ans. Globalization and Business expansion and technological advances are expected to drive market growth during the forecast period.

1. Video Conferencing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Video Conferencing Market: Dynamics 2.1. Video Conferencing Market Trends by Region 2.1.1. North America Video Conferencing Market Trends 2.1.2. Europe Video Conferencing Market Trends 2.1.3. Asia Pacific Video Conferencing Market Trends 2.1.4. Middle East and Africa Video Conferencing Market Trends 2.1.5. South America Video Conferencing Market Trends 2.2. Video Conferencing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Video Conferencing Market Drivers 2.2.1.2. North America Video Conferencing Market Restraints 2.2.1.3. North America Video Conferencing Market Opportunities 2.2.1.4. North America Video Conferencing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Video Conferencing Market Drivers 2.2.2.2. Europe Video Conferencing Market Restraints 2.2.2.3. Europe Video Conferencing Market Opportunities 2.2.2.4. Europe Video Conferencing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Video Conferencing Market Drivers 2.2.3.2. Asia Pacific Video Conferencing Market Restraints 2.2.3.3. Asia Pacific Video Conferencing Market Opportunities 2.2.3.4. Asia Pacific Video Conferencing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Video Conferencing Market Drivers 2.2.4.2. Middle East and Africa Video Conferencing Market Restraints 2.2.4.3. Middle East and Africa Video Conferencing Market Opportunities 2.2.4.4. Middle East and Africa Video Conferencing Market Challenges 2.2.5. South America 2.2.5.1. South America Video Conferencing Market Drivers 2.2.5.2. South America Video Conferencing Market Restraints 2.2.5.3. South America Video Conferencing Market Opportunities 2.2.5.4. South America Video Conferencing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Video Conferencing Industry 2.8. Analysis of Government Schemes and Initiatives For Video Conferencing Industry 2.9. Video Conferencing Market Trade Analysis 2.10. The Global Pandemic Impact on Video Conferencing Market 3. Video Conferencing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Video Conferencing Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 3.2.1. Cloud-Based 3.2.2. On-premises 3.2.3. Others 3.3. Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 3.3.1. Small and Medium-sized Enterprises (SMEs) 3.3.2. Large Enterprises 3.4. Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 3.4.1. Education 3.4.2. Healthcare 3.4.3. Government and Public Sector 3.4.4. Finance and Banking 3.4.5. Others 3.5. Video Conferencing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Video Conferencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Video Conferencing Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 4.2.1. Cloud-Based 4.2.2. On-premises 4.2.3. Others 4.3. North America Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 4.3.1. Small and Medium-sized Enterprises (SMEs) 4.3.2. Large Enterprises 4.4. North America Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 4.4.1. Education 4.4.2. Healthcare 4.4.3. Government and Public Sector 4.4.4. Finance and Banking 4.4.5. Others 4.5. North America Video Conferencing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Video Conferencing Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.1.3. Services 4.5.1.2. United States Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1.2.1. Cloud-Based 4.5.1.2.2. On-premises 4.5.1.2.3. Others 4.5.1.3. United States Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 4.5.1.3.1. Small and Medium-sized Enterprises (SMEs) 4.5.1.3.2. Large Enterprises 4.5.1.4. United States Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 4.5.1.4.1. Education 4.5.1.4.2. Healthcare 4.5.1.4.3. Government and Public Sector 4.5.1.4.4. Finance and Banking 4.5.1.4.5. Others 4.5.2. Canada 4.5.2.1. Canada Video Conferencing Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.1.3. Services 4.5.2.2. Canada Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.2.2.1. Cloud-Based 4.5.2.2.2. On-premises 4.5.2.2.3. Others 4.5.2.3. Canada Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 4.5.2.3.1. Small and Medium-sized Enterprises (SMEs) 4.5.2.3.2. Large Enterprises 4.5.2.4. Canada Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 4.5.2.4.1. Education 4.5.2.4.2. Healthcare 4.5.2.4.3. Government and Public Sector 4.5.2.4.4. Finance and Banking 4.5.2.4.5. Others 4.5.3. Mexico 4.5.3.1. Mexico Video Conferencing Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.1.3. Services 4.5.3.2. Mexico Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.3.2.1. Cloud-Based 4.5.3.2.2. On-premises 4.5.3.2.3. Others 4.5.3.3. Mexico Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 4.5.3.3.1. Small and Medium-sized Enterprises (SMEs) 4.5.3.3.2. Large Enterprises 4.5.3.4. Mexico Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 4.5.3.4.1. Education 4.5.3.4.2. Healthcare 4.5.3.4.3. Government and Public Sector 4.5.3.4.4. Finance and Banking 4.5.3.4.5. Others 5. Europe Video Conferencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.2. Europe Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.3. Europe Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.4. Europe Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5. Europe Video Conferencing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.1.3. United Kingdom Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.1.4. United Kingdom Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.2.3. France Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.2.4. France Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.3.3. Germany Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.3.4. Germany Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.4.3. Italy Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.4.4. Italy Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.5.3. Spain Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.5.4. Spain Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.6.3. Sweden Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.6.4. Sweden Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.7.3. Austria Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.7.4. Austria Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Video Conferencing Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.8.3. Rest of Europe Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.8.4. Rest of Europe Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6. Asia Pacific Video Conferencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.3. Asia Pacific Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.4. Asia Pacific Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5. Asia Pacific Video Conferencing Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.1.3. China Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.1.4. China Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.2.3. S Korea Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.2.4. S Korea Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.3.3. Japan Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.3.4. Japan Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.4.3. India Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.4.4. India Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.5.3. Australia Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.5.4. Australia Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.6.3. Indonesia Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.6.4. Indonesia Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.7.3. Malaysia Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.7.4. Malaysia Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.8.3. Vietnam Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.8.4. Vietnam Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.9.3. Taiwan Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.9.4. Taiwan Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Video Conferencing Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.10.3. Rest of Asia Pacific Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.10.4. Rest of Asia Pacific Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 7. Middle East and Africa Video Conferencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Video Conferencing Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 7.3. Middle East and Africa Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 7.4. Middle East and Africa Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 7.5. Middle East and Africa Video Conferencing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Video Conferencing Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.1.3. South Africa Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.1.4. South Africa Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Video Conferencing Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.2.3. GCC Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.2.4. GCC Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Video Conferencing Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.3.3. Nigeria Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.3.4. Nigeria Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Video Conferencing Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.4.3. Rest of ME&A Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.4.4. Rest of ME&A Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 8. South America Video Conferencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Video Conferencing Market Size and Forecast, by Component (2023-2030) 8.2. South America Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 8.3. South America Video Conferencing Market Size and Forecast, by Enterprise Size(2023-2030) 8.4. South America Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 8.5. South America Video Conferencing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Video Conferencing Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.1.3. Brazil Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 8.5.1.4. Brazil Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Video Conferencing Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.2.3. Argentina Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 8.5.2.4. Argentina Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Video Conferencing Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Video Conferencing Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.3.3. Rest Of South America Video Conferencing Market Size and Forecast, by Enterprise Size (2023-2030) 8.5.3.4. Rest Of South America Video Conferencing Market Size and Forecast, by Vertical (2023-2030) 9. Global Video Conferencing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Video Conferencing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Zoom Video Communications (San Jose, California, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cisco Systems (San Jose, California, USA) 10.3. Microsoft Corporation (Redmond, Washington, USA) 10.4. Google (Mountain View, California, USA) 10.5. Adobe Inc. (San Jose, California, USA) 10.6. LogMeIn (Boston, Massachusetts, USA) 10.7. Lifesize (Austin, Texas, USA) 10.8. Avaya Inc. (Durham, North Carolina, USA) 10.9. Blackboard Inc. (Washington, D.C., USA) 10.10. BlueStar Inc. (Florence, Kentucky, USA) 10.11. Fuze Inc. (Boston, Massachusetts, USA) 10.12. Poly (Santa Cruz, California, USA) 10.13. Vonage (Holmdel Township, New Jersey, USA) 10.14. StarLeaf (Watford, Hertfordshire, England) 10.15. Pexip (Oslo, Norway) 10.16. Huawei Technologies Co., Ltd. (Shenzhen, China) 10.17. Tencent (Shenzhen, China) 10.18. Zoho Corporation (Chennai, Tamil Nadu, India) 11. Key Findings 12. Industry Recommendations 13. Video Conferencing Market: Research Methodology 14. Terms and Glossary