Video Analytics Market was valued at US$ 7.79 Bn. in 2022 and is expected to reach US$ 32.62 Bn. by 2029, at a CAGR of 22.7% during a forecast period.Video Analytics Market Overview:

Video analytics technology software is used in computers to analyses video footage from cameras, most notably security cameras. Video surveillance analytics are often simple to set up and provide real-time monitoring of activity. The use of video analytics aids in making surveillance systems more efficient by reducing the amount of work required of safety personnel. Video analytics software, in particular, enables services that employees cannot perform as efficiently, such as odd visual perception with high accuracy, car location recognition, and auto-tracking.To know about the Research Methodology :- Request Free Sample Report

Video Analytics Market Dynamics:

The demand for real-time event detection continues to grow to drive the market. Video analysis software helps provide instant alerts that occur in various business areas to enhance situational awareness. Creating real-time data through video requires professional processing. Video analysis software can help analyze recorded video streams to classify and track behavior patterns and pre-defined objects, thus becoming a key market driver. In addition, the increasing deployment of AI-enabled video analytics solutions contributes to market growth. The deployment of AI-enabled video content analysis solutions is rapidly increasing globally. Government agencies are actively selecting AI-based video systems to monitor track congestion and using the AI Global Surveillance (AIGS) index to monitor smart energy metering to improve video clarity. AI and deep learning are crucial technologies for video content analysis and translating live or recorded films into structured information that can be used to provide measurable insights. Furthermore, increased investments and focus of governing institutions on public safety enabled them to use and analyses unstructured video surveillance data in real-time, resulting in a significant drop in rate due to surveillance cameras, which is expected to positively propel the growth of the global video analytics market. Certain obstacles and restrictions faced will hinder the growth of the overall market. Factors such as increased cyber-attacks and data theft activities are limiting the market growth. In addition, it is expected that the investment in the existing legacy monitoring system to prevent the implantation of new advanced solutions will grow slowly during the forecast period. In addition, the lack of necessary database infrastructure and potential security threats inhibited market growth. Nonetheless, technological advancements such as the integration of artificial intelligence and cloud technology with video analytics, the increasing use of facial recognition across applications, and the surge in demand for video analytics solutions from the non-governmental sector provide favorable growth opportunities.Video Analytics Market Segment Analysis:

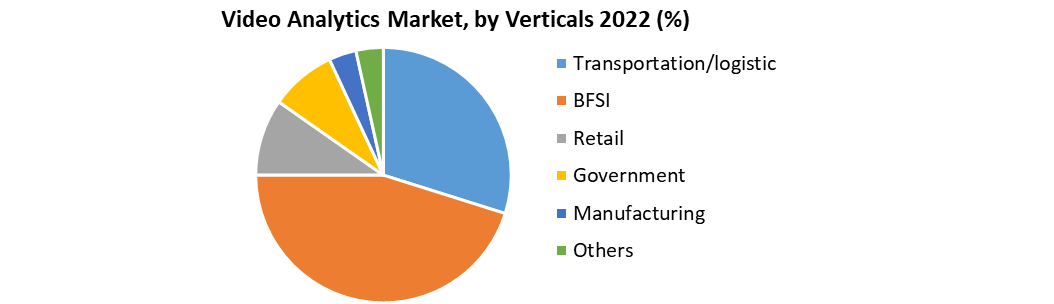

Based on deployment type, the on-premise segment held the largest market share of xx% in 2022. This approach is commonly used in applications involving the processing of sensitive and confidential data volumes. Internal and external surveillance footage, as well as video feeds of corporate processes including proprietary information and critical insights, are included in these data volumes. Companies must install the necessary hardware components, including the operating system, storage devices, servers, cameras, and routers, as well as video analytics software, for on-premises deployment. Due to privacy and security concerns over personal data, several large enterprises are using on-premises video analytics. Based on verticals, the transport and logistic segment held the largest market share of xx% in 2022. The number of benefits of video analytics to the transportation and logistics vertical is the removal of overcrowding, enhanced security measures, event recording, behavior analysis, and blind-spot detection. Video analysis helps to strengthen and improve this vertical area for commuters while providing higher security benefits. Various functions provided by video analytics, such as facial recognition, object tracking, unknown object detection, cargo and train car recognition, and intelligent traffic monitoring, can help transportation and logistics companies prevent disasters and detect new threats or vehicle collisions that may cause infrastructure damage, Resulting in the loss of life.

Regional Insight:

North America held the largest market share of xx% in 2022. The United States is the world's largest consumer of video analytics at the moment. The country's rapid technological advancement is backed up by significant economic growth. Furthermore, by adopting analytics, firms have refocused operations on security and safety. Due to changing client needs, there has been a movement from traditional on-premise video analytics implementation to cloud deployment. The Asia Pacific emerged as the second-largest market in terms of revenue share, owing to significant economic growth in countries such as India, China, and Indonesia. To safeguard the safety of their inhabitants, these economies have invested in advanced security surveillance systems. The market is likely to be driven by increased deployment of industry solutions, particularly in China, Japan, and India, as well as increased acceptance of cloud-based technologies.Recent Developments:

• Cisco announced the acquisition of Kenna Security in June 2021 to address security posture concerns such as automating cybersecurity threat prediction, identification, prioritisation, and remediation. • Avigilon announced the release of an artificial intelligence network video recorder in February 2021, combining traditional Avigilon NVR capabilities with the capabilities of the Avigilon AI appliance to provide organisations with a solution to meet analytics, storage, and cybersecurity requirements. The solution is linked to Avigilon cloud services, allowing for simple software upgrades and application downloads. The objective of the report is to present a comprehensive analysis of the Video Analytics market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Video Analytics market dynamics, structure by analyzing the market segments and projects the Video Analytics market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Video Analytics market make the report investor’s guide.Video Analytics Market Scope: Inquire before buying

Video Analytics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 7.79 Bn. Forecast Period 2023 to 2029 CAGR: 22.7 % Market Size in 2029: US $ 32.62 Bn. Segments Covered: by Deployment Cloud On-Premise by Component Software Services by Application Facial Recognition & Detection Incident Detection Perimeter Intrusion Detection Crowd Detection & Management Traffic & Parking Management Others by Verticals Transportation/logistic BFSI Retail Government Manufacturing Others Video Analytics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Key Players

1. Avigilon 2. Axis Communications 3. Cisco 4. Honeywell 5. Agent Vi 6. Allgovision 7. Aventura Systems 8. Genetec 9. Intellivision 10. Intuvision 11. Puretech Systems 12. Hikvision 13. Dahua 14. Iomniscient 15. Huawei 16. Gorilla Technology 17. Intelligent Security Systems 18. Verint 19. Viseum 20. NEC 21. Briefcam 22. Bosch Security 23. i2V 24. Digital BarrierFrequently Asked Questions:

1. Which region has the largest share in Global Video Analytics Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Video Analytics Market? Ans: The Global Video Analytics Market is growing at a CAGR of 22.7% during forecasting period 2023-2029. 3. What is scope of the Global Video Analytics Market report? Ans: Global Video Analytics Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Video Analytics Market? Ans: The important key players in the Global Video Analytics Market are – Avigilon, Axis Communications, Cisco, Honeywell, Agent Vi, Allgovision, Aventura Systems, Genetec, Intellivision, Intuvision, and Puretech Systems 5. What is the study period of this Market? Ans: The Global Video Analytics Market is studied from 2022 to 2029.

1. Video Analytics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Video Analytics Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Video Analytics Industry 2.9. Key Opinion Leader Analysis 2.10. The Global Pandemic Impact on Video Analytics Market 2.11. Tech Watch: Innovations in Video Analytics Technologies 2.11.1. Deep Learning and Neural Networks 2.11.2. Edge Computing for Real-time Analysis 3. Video Analytics Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Video Analytics Market Size and Forecast, By Deployment (2023-2030) 3.1.1. Cloud 3.1.2. On-Premise 3.2. Video Analytics Market Size and Forecast, By Component (2023-2030) 3.2.1. Software 3.2.2. Services 3.3. Video Analytics Market Size and Forecast, By Application (2023-2030) 3.3.1. Facial Recognition & Detection 3.3.2. Incident Detection 3.3.3. Perimeter Intrusion Detection 3.3.4. Crowd Detection & Management 3.3.5. Traffic & Parking Management 3.3.6. Others 3.4. Video Analytics Market Size and Forecast, By Vertical (2023-2030) 3.4.1. Transportation/logistic 3.4.2. BFSI 3.4.3. Retail 3.4.4. Government 3.4.5. Manufacturing 3.4.6. Others 3.5. Video Analytics Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Video Analytics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Video Analytics Market Size and Forecast, By Deployment (2023-2030) 4.1.1. Cloud 4.1.2. On-Premise 4.2. North America Video Analytics Market Size and Forecast, By Component (2023-2030) 4.2.1. Software 4.2.2. Services 4.3. North America Video Analytics Market Size and Forecast, By Application (2023-2030) 4.3.1. Facial Recognition & Detection 4.3.2. Incident Detection 4.3.3. Perimeter Intrusion Detection 4.3.4. Crowd Detection & Management 4.3.5. Traffic & Parking Management 4.3.6. Others 4.4. North America Video Analytics Market Size and Forecast, By Vertical (2023-2030) 4.4.1. Transportation/logistic 4.4.2. BFSI 4.4.3. Retail 4.4.4. Government 4.4.5. Manufacturing 4.4.6. Others 4.5. North America Video Analytics Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Video Analytics Market Size and Forecast, By Deployment (2023-2030) 4.5.1.1.1. Cloud 4.5.1.1.2. On-Premise 4.5.1.2. United States Video Analytics Market Size and Forecast, By Component (2023-2030) 4.5.1.2.1. Software 4.5.1.2.2. Services 4.5.1.3. United States Video Analytics Market Size and Forecast, By Application (2023-2030) 4.5.1.3.1. Facial Recognition & Detection 4.5.1.3.2. Incident Detection 4.5.1.3.3. Perimeter Intrusion Detection 4.5.1.3.4. Crowd Detection & Management 4.5.1.3.5. Traffic & Parking Management 4.5.1.3.6. Others 4.5.1.4. United States Video Analytics Market Size and Forecast, By Vertical (2023-2030) 4.5.1.4.1. Transportation/logistic 4.5.1.4.2. BFSI 4.5.1.4.3. Retail 4.5.1.4.4. Government 4.5.1.4.5. Manufacturing 4.5.1.4.6. Others 4.5.2. Canada 4.5.2.1. Canada Video Analytics Market Size and Forecast, By Deployment (2023-2030) 4.5.2.1.1. Cloud 4.5.2.1.2. On-Premise 4.5.2.2. Canada Video Analytics Market Size and Forecast, By Component (2023-2030) 4.5.2.2.1. Software 4.5.2.2.2. Services 4.5.2.3. Canada Video Analytics Market Size and Forecast, By Application (2023-2030) 4.5.2.3.1. Facial Recognition & Detection 4.5.2.3.2. Incident Detection 4.5.2.3.3. Perimeter Intrusion Detection 4.5.2.3.4. Crowd Detection & Management 4.5.2.3.5. Traffic & Parking Management 4.5.2.3.6. Others 4.5.2.4. Canada Video Analytics Market Size and Forecast, By Vertical (2023-2030) 4.5.2.4.1. Transportation/logistic 4.5.2.4.2. BFSI 4.5.2.4.3. Retail 4.5.2.4.4. Government 4.5.2.4.5. Manufacturing 4.5.2.4.6. Others 4.5.3. Mexico 4.5.3.1. Mexico Video Analytics Market Size and Forecast, By Deployment (2023-2030) 4.5.3.1.1. Cloud 4.5.3.1.2. On-Premise 4.5.3.2. Mexico Video Analytics Market Size and Forecast, By Component (2023-2030) 4.5.3.2.1. Software 4.5.3.2.2. Services 4.5.3.3. Mexico Video Analytics Market Size and Forecast, By Application (2023-2030) 4.5.3.3.1. Facial Recognition & Detection 4.5.3.3.2. Incident Detection 4.5.3.3.3. Perimeter Intrusion Detection 4.5.3.3.4. Crowd Detection & Management 4.5.3.3.5. Traffic & Parking Management 4.5.3.3.6. Others 4.5.3.4. Mexico Video Analytics Market Size and Forecast, By Vertical (2023-2030) 4.5.3.4.1. Transportation/logistic 4.5.3.4.2. BFSI 4.5.3.4.3. Retail 4.5.3.4.4. Government 4.5.3.4.5. Manufacturing 4.5.3.4.6. Others 5. Europe Video Analytics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.2. Europe Video Analytics Market Size and Forecast, By Component (2023-2030) 5.3. Europe Video Analytics Market Size and Forecast, By Application (2023-2030) 5.4. Europe Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5. Europe Video Analytics Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.1.2. United Kingdom Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.1.3. United Kingdom Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.1.4. United Kingdom Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.2.2. France Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.2.3. France Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.2.4. France Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.3.2. Germany Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.3.3. Germany Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.3.4. Germany Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.4.2. Italy Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.4.3. Italy Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.4.4. Italy Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.5.2. Spain Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.5.3. Spain Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.5.4. Spain Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.6.2. Sweden Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.6.3. Sweden Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.6.4. Sweden Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.7.2. Austria Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.7.3. Austria Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.7.4. Austria Video Analytics Market Size and Forecast, By Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Video Analytics Market Size and Forecast, By Deployment (2023-2030) 5.5.8.2. Rest of Europe Video Analytics Market Size and Forecast, By Component (2023-2030) 5.5.8.3. Rest of Europe Video Analytics Market Size and Forecast, By Application (2023-2030) 5.5.8.4. Rest of Europe Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6. Asia Pacific Video Analytics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.2. Asia Pacific Video Analytics Market Size and Forecast, By Component (2023-2030) 6.3. Asia Pacific Video Analytics Market Size and Forecast, By Application (2023-2030) 6.4. Asia Pacific Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5. Asia Pacific Video Analytics Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.1.2. China Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.1.3. China Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.1.4. China Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.2.2. S Korea Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.2.3. S Korea Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.2.4. S Korea Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.3.2. Japan Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.3.3. Japan Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.3.4. Japan Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.4.2. India Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.4.3. India Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.4.4. India Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.5.2. Australia Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.5.3. Australia Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.5.4. Australia Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.6.2. Indonesia Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.6.3. Indonesia Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.6.4. Indonesia Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.7.2. Malaysia Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.7.3. Malaysia Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.7.4. Malaysia Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.8.2. Vietnam Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.8.3. Vietnam Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.8.4. Vietnam Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.9.2. Taiwan Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.9.3. Taiwan Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.9.4. Taiwan Video Analytics Market Size and Forecast, By Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Video Analytics Market Size and Forecast, By Deployment (2023-2030) 6.5.10.2. Rest of Asia Pacific Video Analytics Market Size and Forecast, By Component (2023-2030) 6.5.10.3. Rest of Asia Pacific Video Analytics Market Size and Forecast, By Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Video Analytics Market Size and Forecast, By Vertical (2023-2030) 7. Middle East and Africa Video Analytics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Video Analytics Market Size and Forecast, By Deployment (2023-2030) 7.2. Middle East and Africa Video Analytics Market Size and Forecast, By Component (2023-2030) 7.3. Middle East and Africa Video Analytics Market Size and Forecast, By Application (2023-2030) 7.4. Middle East and Africa Video Analytics Market Size and Forecast, By Vertical (2023-2030) 7.5. Middle East and Africa Video Analytics Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Video Analytics Market Size and Forecast, By Deployment (2023-2030) 7.5.1.2. South Africa Video Analytics Market Size and Forecast, By Component (2023-2030) 7.5.1.3. South Africa Video Analytics Market Size and Forecast, By Application (2023-2030) 7.5.1.4. South Africa Video Analytics Market Size and Forecast, By Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Video Analytics Market Size and Forecast, By Deployment (2023-2030) 7.5.2.2. GCC Video Analytics Market Size and Forecast, By Component (2023-2030) 7.5.2.3. GCC Video Analytics Market Size and Forecast, By Application (2023-2030) 7.5.2.4. GCC Video Analytics Market Size and Forecast, By Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Video Analytics Market Size and Forecast, By Deployment (2023-2030) 7.5.3.2. Nigeria Video Analytics Market Size and Forecast, By Component (2023-2030) 7.5.3.3. Nigeria Video Analytics Market Size and Forecast, By Application (2023-2030) 7.5.3.4. Nigeria Video Analytics Market Size and Forecast, By Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Video Analytics Market Size and Forecast, By Deployment (2023-2030) 7.5.4.2. Rest of ME&A Video Analytics Market Size and Forecast, By Component (2023-2030) 7.5.4.3. Rest of ME&A Video Analytics Market Size and Forecast, By Application (2023-2030) 7.5.4.4. Rest of ME&A Video Analytics Market Size and Forecast, By Vertical (2023-2030) 8. South America Video Analytics Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. South America Video Analytics Market Size and Forecast, By Deployment (2023-2030) 8.2. South America Video Analytics Market Size and Forecast, By Component (2023-2030) 8.3. South America Video Analytics Market Size and Forecast, By Application (2023-2030) 8.4. South America Video Analytics Market Size and Forecast, By Vertical (2023-2030) 8.5. South America Video Analytics Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Video Analytics Market Size and Forecast, By Deployment (2023-2030) 8.5.1.2. Brazil Video Analytics Market Size and Forecast, By Component (2023-2030) 8.5.1.3. Brazil Video Analytics Market Size and Forecast, By Application (2023-2030) 8.5.1.4. Brazil Video Analytics Market Size and Forecast, By Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Video Analytics Market Size and Forecast, By Deployment (2023-2030) 8.5.2.2. Argentina Video Analytics Market Size and Forecast, By Component (2023-2030) 8.5.2.3. Argentina Video Analytics Market Size and Forecast, By Application (2023-2030) 8.5.2.4. Argentina Video Analytics Market Size and Forecast, By Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Video Analytics Market Size and Forecast, By Deployment (2023-2030) 8.5.3.2. Rest Of South America Video Analytics Market Size and Forecast, By Component (2023-2030) 8.5.3.3. Rest Of South America Video Analytics Market Size and Forecast, By Application (2023-2030) 8.5.3.4. Rest Of South America Video Analytics Market Size and Forecast, By Vertical (2023-2030) 9. Global Video Analytics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Manufacturing Locations 9.4. Leading Video Analytics Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Avigilon 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Axis Communications 10.3. Cisco 10.4. Honeywell 10.5. Agent Vi 10.6. Allgovision 10.7. Aventura Systems 10.8. Genetec 10.9. Intellivision 10.10. Intuvision 10.11. Puretech Systems 10.12. Hikvision 10.13. Dahua 10.14. Iomniscient 10.15. Huawei 10.16. Gorilla Technology 10.17. Intelligent Security Systems 10.18. Verint 10.19. Viseum 10.20. NEC 10.21. Briefcam 10.22. Bosch Security 10.23. i2V 10.24. Digital Barrier 11. Key Findings 12. Industry Recommendations 13. Video Analytics Market: Research Methodology.