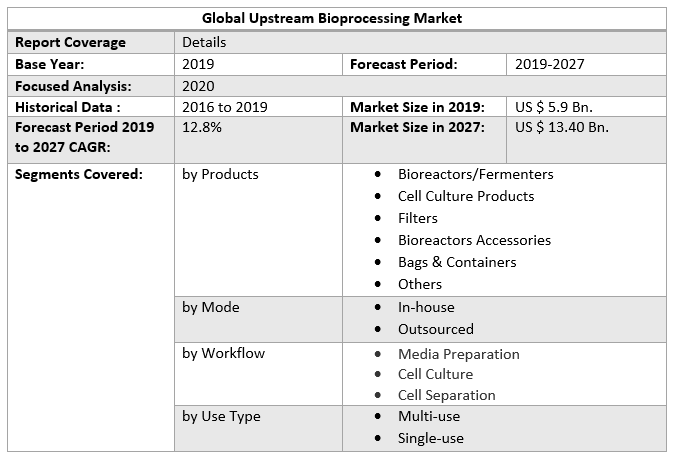

Global Upstream Bioprocessing Market size was valued at US$ 5.9 Bn. in 2019 and is expected to reach US$ 13.40 Bn. by 2027 at a CAGR of 12.8% during the forecast period.Global Upstream Bioprocessing Market Overview:

Upstream bioprocessing is the primary phase of the bioprocess in cell line development and cultivation to culture enlargement of the cells through the harvesting process. Modern cell culture systems are now constructing remarkably higher titers together with reducing the time limitation with higher accuracy in production bioreactors.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2019 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report

Global Upstream Bioprocessing Market Dynamics:

The key factors driving the growth of the market are the increasing implementation of Process Analytical Technology (PAT) tactic as a mechanism of design, analysis, and optimization process through the timely dimension of critical process limitations. The increasing investment in Process analytical technology to perform cell culture production on the basis of various parameters like real-time nutrient analysis and inline monitoring of cell density. These parameters are estimated to propel the productivity of the process. The standard shift from easy stainless-steel bioreactors to single used products has motivated manufacturing advantages for upstream applications. Moreover, with increasing adoptions of single-use technology, market players are focusing on cumulative production of single-use technology. For instance, Abzena Company, a biopharmaceutical manufactures designated Sartoius Sedium Biotech to manufacture their Bristol-based production facility for single-use format. Hence, this factor is estimated to boost the application of the upstream bioprocessing market in near future. Further, the rising productivity of cell lines has knowingly enhanced the performance of upstream processing with low cost and high process reproducibility. Also, this process involves high productive culture with low operational cost and rarer application of small bioreactors. Besides, market players are focusing on the development of innovative products to reduce the risk of contamination and to lessen the hazard of final product breakdown.Global Upstream Bioprocessing Market Segment Analysis:

The Bioreactors and fermenters segment is gaining more attention in the Upstream Bioprocessing Market:

The abundance of bioreactors and fermenters due to wider application in small-scale bioproduction is estimated to drive the growth of the market in the forecast period. Alongside, technological innovation in bioreactor and fermenters such as low-cost consumption, safe application, regulatory-biddable manufacturing of cell-based products for clinical application is projected to drive the growth of bioreactors and fermenters in the global upstream bioprocessing market. In addition, the rising demand for increased production of cell culture is estimated to fuel the growth of the market. Besides, the adoption of a patented cell line is likely to offer high achievement in the cell culture process as the original cell line has recorded minimal regulatory risk and well-organized industrial manufacturing.The Cell Culture Step Segment is dominating the Upstream Bioprocessing Market:

Cell Culture Step is estimated to gain a larger market share of xx% by 2027. Owing to the factors like technological advancement in the cell culture field, for example, the development of micro-bioreactors to simplify small-scale production of bioreactors. Further, expansion in the biological data analysis and data organization sector to bid a critical quality contribution in terms of cell cultivation is likely to stimulate the market. Moreover, continuous upgrading in increasing the high productivity throughout the analytical process and development of the multi-bioreactor system is estimated to motivate the market growth in a positive direction in the forecast period. The cell separation workflow segment is likely to grow at a low pace during the forecast period. due to low penetration, and less acceptance in the market. Moreover, factors like the execution of flocculants to improve high throughput in the centrifugation process and single-use tubular bowl centrifugation process are likely to adhere to the growth of the market.The Multi-Use Products segment is considered to supplement the growth of the Upstream Bioprocessing Market:

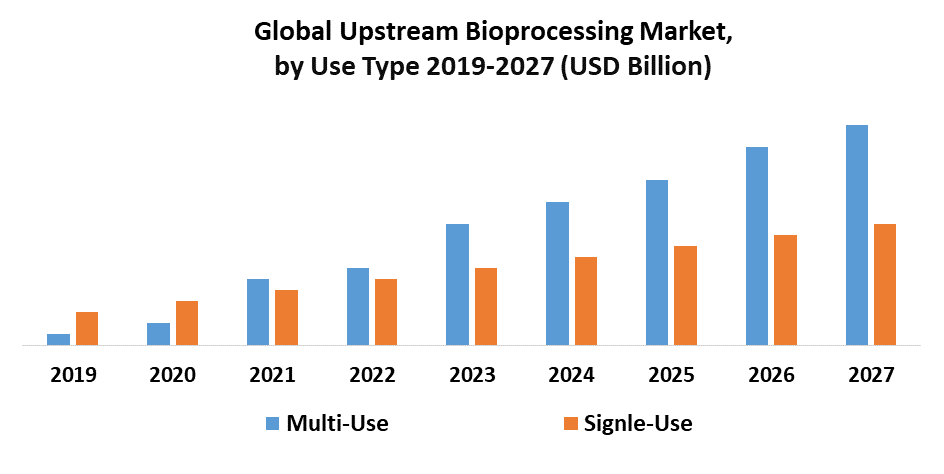

The multi-use product segment accounted for the largest market share of xx% in 2019 of the use-type segment of the global upstream bioprocessing market. The factors attributing to the growth of the market are the growing application of conventional stainless-steel bioreactors for large-scale industry biomanufacturing processes. Moreover, conventional stainless-steel bioreactors are responsible to lower environmental exposure as compared to the single-use system and are allied with a lower risk of leakage during the cell culture process. Further, advantages like the low-cost benefits of single-use products are likely to boost the acceptance and adoption in the market and are estimated to mark significant growth in the forecast period. Moreover, single-use bioreactors dismiss the need for sterilization, cleaning, additional expenses, process validation, installation, and assembly maintenance process, which are mandatory multi-use processes and this process is estimated to drive the market.

Global Upstream Bioprocessing Market Regional Insights:

North America dominates the Upstream Bioprocessing Market with a revenue share of 41.5% in 2020. Owing to increasing development strategies made by various industry verticals in the region and rising awareness among individuals. Further, the growing no. of pharmaceutical industries such as GE Healthcare; Merck KGaA; Corning, Inc.; Sartorius AG; Eppendorf AG; Applikon Biotechnology is likely to boost the market expansion in the region. The Mergers and acquisitions by pharmaceutical industries and expansion of manufacturing facilities are estimated to boost the growth of the market. For example, in 2019, Jefferson announced the formation of the Jefferson Institute for bioprocessing to educate and train students with professional biological manufacturing to generate awareness is likely to fuel the growth of the market. Further, Jefferson announced the partnership with National Institute for Bioprocessing Research and Training to generate initiatives among young individuals. Hence this factor is estimated to fuel the growth of the market and expansion in the future. The objective of the report is to present a comprehensive analysis of the Global Upstream Bioprocessing Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Upstream Bioprocessing Market dynamics, structure by analyzing the market segments and project the Global Upstream Bioprocessing Market size. Clear representation of competitive analysis of key players by Products, price, financial position, Products portfolio, growth strategies, and regional presence in the Global Upstream Bioprocessing Market make the report investor’s guideGlobal Upstream Bioprocessing Market Scope: Inquire before buying

Global Upstream Bioprocessing Market, by Region

• North America o US o Canada o Mexico • Europe o U.K o France o Germany o Italy o Spain o Sweden o CIS Countries o Rest of Europe • Asia Pacific o China o India o Japan o South Korea o Australia o ASEAN o Rest of Asia Pacific • Middle East and Africa o South Africa o GCC Countries o Egypt o Nigeria o Rest of ME&A • South America o Brazil o Argentina o Rest of South AmericaGlobal Upstream Bioprocessing Market Key Players

• GE Healthcare • Merck KGaA • Corning, Inc. • Sartorius AG • Eppendorf AG • Applikon Biotechnology • Lonza • PBS Biotech, Inc. • CellGenix GmbH • Boehringer Ingelheim • Samsung BioLogics • Patheon • CMC Biologics • JM BIOCONNECT • Danaher Corporation • Thermo Fisher Scientific, Inc.FAQs:

1. What is the global Upstream Bioprocessing Market value in 2019? Ans: The global Upstream Bioprocessing Market was valued USD 5.9 Billion in 2019, 2. What is the Upstream Bioprocessing Market growth rate? Ans: The global Upstream Bioprocessing Market is expected to grow at a compound annual growth rate of 12.8 % from 2020 to 2027 to reach USD 13.40 Billion by 2027. 3. Which segment is expected to dominate the market during the forecast period? Ans: The cell culture step is expected to maintain its dominance in terms of revenue share throughout the forecast period, due to the ongoing technological advancements in cell culture systems, such as, development of micro-bioreactors to facilitate small scale bioproduction. 4. What are the factors driving the Upstream Bioprocessing Market? Ans: Key factors that are driving the market growth include the implementation of the Process Analytical Technology (PAT) strategy as a mechanism to design, analyze, and optimize processes through timely measurements of critical process parameters. 5. What are the key players of the Prokaryotic Expression System market? Ans: Some key players operating in the Upstream Bioprocessing Market include Thermo Fisher Scientific, Inc; GE Healthcare; Merck KGaA; Corning, Inc.; Sartorius AG; Eppendorf AG; Applikon Biotechnology; Lonza; PBS Biotech, Inc.; CellGenix GmbH; Boehringer Ingelheim; Samsung BioLogics; Patheon; CMC Biologics; JM BIO CONNECT; Danaher Corporation

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Upstream Bioprocessing Market Size, by Market Value (US$ Bn.) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Upstream Bioprocessing Market 3.4. Geographical Snapshot of the Upstream Bioprocessing Market, By Manufacturer share 4. Global Upstream Bioprocessing Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The Threat of Substitute Products 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Upstream Bioprocessing Market 5. Supply Side and Demand Side Indicators 6. Global Upstream Bioprocessing Market Analysis and Forecast, 2019-2027 6.1. Global Upstream Bioprocessing Market Size & Y-o-Y Growth Analysis. 7. Global Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 7.1.1. Bioreactors/Fermenters 7.1.2. Cell Culture Products 7.1.3. Filters 7.1.4. Bioreactors Accessories 7.1.5. Bags & Containers 7.1.6. Others 7.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 7.2.1. In-house 7.2.2. Outsourced 7.3. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 7.3.1. Multi-use 7.3.2. Single-use 7.4. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 7.4.1. Media Preparation 7.4.2. Cell Culture 7.4.3. Cell Separation 8. Global Upstream Bioprocessing Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2027 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 9.1.1. Bioreactors/Fermenters 9.1.2. Cell Culture Products 9.1.3. Filters 9.1.4. Bioreactors Accessories 9.1.5. Bags & Containers 9.1.6. Others 9.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 9.2.1. In-house 9.2.2. Outsourced 9.3. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 9.3.1. Multi-use 9.3.2. Single-use 9.4. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 9.4.1. Media Preparation 9.4.2. Cell Culture 9.4.3. Cell Separation 10. North America Upstream Bioprocessing Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 11.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 11.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 12. Canada Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 12.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 12.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 12.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 13. Mexico Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 13.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 13.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 13.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 13.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 14. Europe Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 14.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 14.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 14.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 14.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 15. Europe Upstream Bioprocessing Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 16.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 16.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 16.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 16.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 17. France Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 17.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 17.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 17.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 17.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 18. Germany Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 18.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 18.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 18.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 18.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 19. Italy Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 19.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 19.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 19.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 19.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 20. Spain Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 20.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 20.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 20.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 20.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 21. Sweden Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 21.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 21.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 21.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 21.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 22. CIS Countries Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 22.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 22.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 22.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 22.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 23. Rest of Europe Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 23.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 23.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 23.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 23.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 24. Asia Pacific Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 24.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 24.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 24.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 24.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 25. Asia Pacific Upstream Bioprocessing Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 26.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 26.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 26.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 26.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 27. India Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 27.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 27.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 27.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 27.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 28. Japan Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 28.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 28.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 28.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 28.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 29. South Korea Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 29.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 29.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 29.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 29.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 30. Australia Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 30.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 30.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 30.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 30.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 31. ASEAN Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 31.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 31.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 31.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 31.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 32. Rest of Asia Pacific Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 32.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 32.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 32.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 32.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 33. Middle East Africa Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 33.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 33.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 33.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 33.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 34. Middle East Africa Upstream Bioprocessing Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 35.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 35.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 35.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 35.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 36. GCC Countries Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 36.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 36.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 36.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 36.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 37. Egypt Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 37.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 37.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 37.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 37.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 38. Nigeria Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 38.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 38.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 38.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 38.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 39. Rest of ME&A Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 39.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 39.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 39.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 39.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 40. South America Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 40.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 40.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 40.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 40.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 41. South America Upstream Bioprocessing Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 42.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 42.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 42.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 42.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 43. Argentina Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 43.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 43.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 43.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 43.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 44. Rest of South America Upstream Bioprocessing Market Analysis and Forecasts, 2019-2027 44.1. Market Size (Value) Estimates & Forecast By Products, 2019-2027 44.2. Market Size (Value) Estimates & Forecast By Mode, 2019-2027 44.3. Market Size (Value) Estimates & Forecast By Workflow, 2019-2027 44.4. Market Size (Value) Estimates & Forecast By Use Type, 2019-2027 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Upstream Bioprocessing Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Workflows and R&D Investment 45.2.2. New Products Launches and Products Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Merck KGaA. 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Products Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Merck KGaA 45.3.3. Charles River 45.3.4. Bio-Rad Laboratories, Inc. 45.3.5. Abbott 45.3.6. Thermo Fisher Scientific Inc. 45.3.7. Catalent, Inc. 45.3.8. GE Healthcare 45.3.9. Quest Diagnostics Incorporated 45.3.10. Eurofins Scientific 45.3.11. Laboratory Corporation of America Holdings 45.3.12. Evotec 45.3.13. Creative Bioarray 45.3.14. Gentronix 45.3.15. BioIVT 45.3.16. SGS SA 45.3.17. Agilent Technologies 46. Primary Key Insights