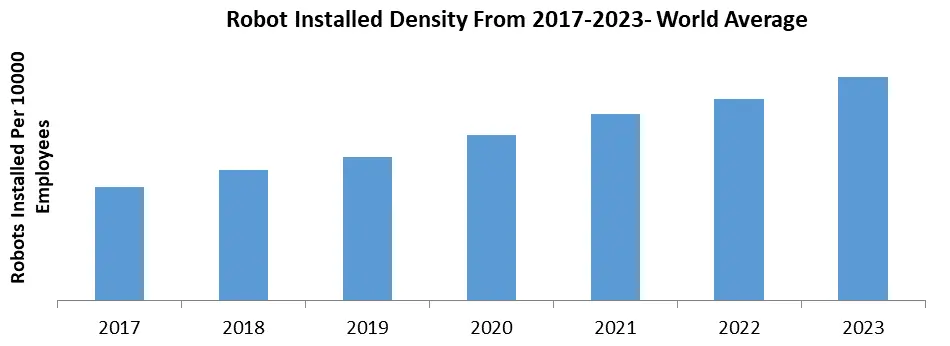

The Top Robotics Market size was valued at USD 124.89 billion in 2023 and the total Top Robotics Market revenue is expected to grow at a CAGR of 17.4 % from 2023 to 2030, reaching nearly USD 383.89 billion. Robotics is a multidisciplinary field that involves the design, construction, operation, and use of robots. A robot is a programmable machine capable of carrying out tasks autonomously or with human guidance. These tasks can range from simple, repetitive actions to complex activities requiring advanced capabilities. The Top Robotics Market is a dynamic industry characterized by the continuous evolution of technology and the increasing integration of robotics across various sectors. The key players in the market include globally recognized companies such as Mitsubishi Electric, Kawasaki, Epson, Universal Robots, UiPath, and others. These companies operate on a global scale and contribute significantly to the growth and development of the robotics sector. The current scenario of the Top Robotics Market is marked by robust growth, with the Republic of Korea leading as the world's number one adopter of industrial robots, showcasing a 6% annual increase in robot density. The Asia-Pacific region, notably China, maintains a strong position, ranking fifth globally with a high robot density of 392 robots per 10,000 employees. Driving factors for the growth of the top robotics market include global labor shortages, the demand for automation in various industries beyond manufacturing, and advancements in Artificial Intelligence (AI) and autonomous technologies. Collaborative robots, such as ABB's GoFa™ and SWIFTI™, are designed to work alongside human workers, addressing labor and skills shortages. Autonomous Mobile Robots (AMRs) equipped with advanced navigation technology are enhancing productivity across diverse sectors, including electronics, healthcare, e-commerce, pharmaceuticals, and food service. The market's resilience and adaptability are evident in its response to global events in 2023, where businesses invested significantly in robotic automation to increase flexibility and build operational resilience. Companies are reshoring operations, seeking to improve supply chain resilience and meet the growing demand for robots in non-traditional sectors. Despite the expansion of robotics beyond traditional manufacturing, there is a growing need for skilled workers. To bridge this gap, companies are forming partnerships with educators globally, exemplified by over 200 instances of ABB partnering with educational institutions for robotics education. The focus on user-friendly interfaces and the continued simplification of robot programming software is crucial for broader integration across industries. The creation of connected digital networks using open platforms facilitates the quick integration of robots, controllers, and software from different vendors. ABB's OmniCore controllers are designed to make robots more open and connected, enabling smaller companies and startups to embrace automation. These innovations, coupled with a surge in investments, showcase the Top Robotics industry's commitment to pushing the boundaries of robotics technology.To know about the Research Methodology :- Request Free Sample Report

Top Robotics Market Dynamics:

Increased demand in transportation and logistics fuels market growth: Rising consumer interest in domestic robots, particularly for floor cleaning applications, is a significant driver. In 2023, approximately 2.8 million robot vacuums were sold, showcasing sustained demand for household automation. Familiarity with gardening robots, exemplified by the sale of 1.1 million lawn mowing robots in 2023, indicates a growing trend towards robotic solutions to outdoor tasks, contributing to overall Top Robotics Market growth. The consumer market is witnessing an upsurge in social interaction and education robots. In 2023, 157,000 units were sold, with education robots reaching almost 104,000 units. This signals a shift toward robots assisting in educational and social scenarios. The professional service top robotics market benefits from increased demand in transportation and logistics, with sales growing by 44%. In 2023, more than 86,000 mobile robot solutions were deployed for the transportation of goods, emphasizing the pivotal role of robots in these sectors. Hospitality robots, including those for guidance, information, and telepresence, experienced a substantial sales increase of 125%, with over 24,500 units sold in 2023. This demonstrates the growing acceptance of robots in the hospitality industry. The use of robots in medical procedures remains a significant driver. In 2023, approximately 4,900 surgery robots were sold, showcasing the continued integration of robotics into medical applications. The agricultural sector's adoption of service robots for tasks like milking and barn cleaning has grown by 18%, with almost 8,000 units shipped in 2023. This reflects a drive towards sustainable and efficient agricultural practices. While sales in this area experienced a decline, the use of robots for rehabilitation and noninvasive therapy, with less than 3,200 robots sold, still contributes to the diversification of service robot applications in healthcare. The professional cleaning robot market witnessed 8% growth, with almost 6,900 units sold in 2023. The main application, floor cleaning, saw a 10% increase, representing more than 70% of shipments in this application group. Continuous advancements in robotic technologies, including AI and machine learning, contribute to top robotics market growth. Innovations enhance robot capabilities, making them more adaptable and intelligent, further fueling Top Robotics Market demand across various sectors.AI and Autonomous Technology Propel Robots Beyond Manufacturing: As global labor shortages persist, the demand for robots is on the rise. In response to aging populations and a reluctance to take up low-paying jobs, companies are turning to robots. A survey by ABB Robotics in 2023 indicates that 74% of European and 70% of U.S. businesses plan to re or nearshore operations, with significant investments in robotic automation expected. Robots are increasingly performing dull, dirty, and dangerous tasks, addressing global labor and skills shortages. Collaborative robots like ABB's GoFa™ and SWIFTI™ are designed to work safely alongside human workers. Examples include automation in the Haidilao restaurant chain for meal preparation and at the University of Texas Medical Branch for antibody research, increasing daily tests from 15 to 1000. Artificial intelligence (AI) and autonomous technology are making robots more accessible. ABB predicts increased investments in robots, particularly in industries beyond manufacturing. Autonomous Mobile Robots (AMRs) with advanced navigation technology enhance productivity, with applications in electronics, healthcare, e-commerce, pharmaceuticals, and food service. AI developments enable robots to perform more tasks. AI-powered robots at ABB's Robotics Mega Factory in Shanghai handle tasks like screw driving. This expansion of capabilities reduces barriers to adoption. As AI in robotics develops further, robots are expected to be deployed in various non-traditional sectors, contributing to top robotics market growth. Continued simplification of the software and controllers used to program robots enhances usability. This reduces the need for specialist expertise, making it easier for companies to adopt robotic automation. The focus on user-friendly interfaces is crucial for broader robot integration across industries. The near future will witness the creation of connected digital networks using open platforms. This facilitates the quick integration of robots, controllers, and software from different vendors. ABB’s OmniCore controllers are designed to make robots more open and connected, enabling smaller companies and start-ups to embrace automation. Companies seek to improve supply chain resilience through reshoring operations, driving demand for top robotics market. In response to global events in 2023, businesses are investing in robotic automation to increase flexibility and build operational resilience. Robots are expanding beyond traditional manufacturing and distribution environments. The trend involves their deployment in the electronics, healthcare, e-commerce, pharmaceuticals, and food service sectors. This diversification showcases the adaptability of robots to various industries. With the growing adoption of robots, there is an increasing need for skilled workers. Companies are forming partnerships with educators worldwide to equip current and future workers with the necessary skills. Over 200 examples exist of ABB partnering with educators globally for robotics education. Autonomous technologies, especially Autonomous Mobile Robots (AMRs), are contributing to a shift away from traditional production lines. Companies are adopting integrated scalable, modular production cells for enhanced flexibility and faster operations.

Market Segment Units Sold (2023) Growth Rate Consumer Robotics 2.8 million - Gardening Robots 1.1 million 18% Social Interaction and Education 1,57,000 - Professional Service (Logistics 86,000 44% Hospitality Robots 24,500 125% Medical Robotics 4,900 - Agriculture Robotics 8,000 18% Rehabilitation and Therapy 3,200 - Professional Cleaning 6,900 8%

Top Robotics Market Segment Analysis:

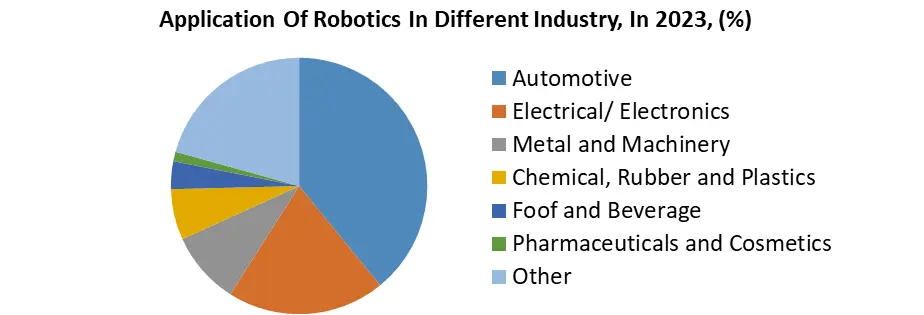

Based on End Use Industries, The automotive sector emerges as a dominant segment in the top robotics market, with a significant share of installations globally. The sector's pivotal role is evident in regions like the Americas, where automotive industry growth, particularly in the United States, fuels a 10% increase in robot installations, reaching 39,576 units in 2023. The Electrical and Electronics segment follows closely, driven by technological advancements in Asia, particularly in China, Japan, and South Korea. With the increasing automation needs of the electronics industry, these countries contribute significantly to the surge in robot installations. Metal and machinery also play a substantial role, showcasing resilience and adaptability, especially in Europe, where Germany remains a powerhouse. As industries diversify, the role of robots in Chemicals, Rubber, and Plastics, along with Food & Beverages, is on the rise. The Pharmaceuticals and Cosmetics segment is witnessing steady growth globally, emphasizing the importance of precision and automation in these critical sectors. Automotive and Electrical and Electronics dominate, with continued growth expected, while other sectors exhibit dynamic adoption patterns reflecting the evolving landscape of top robotics market applications in diverse industries.

Top Robotics Regional Insights:

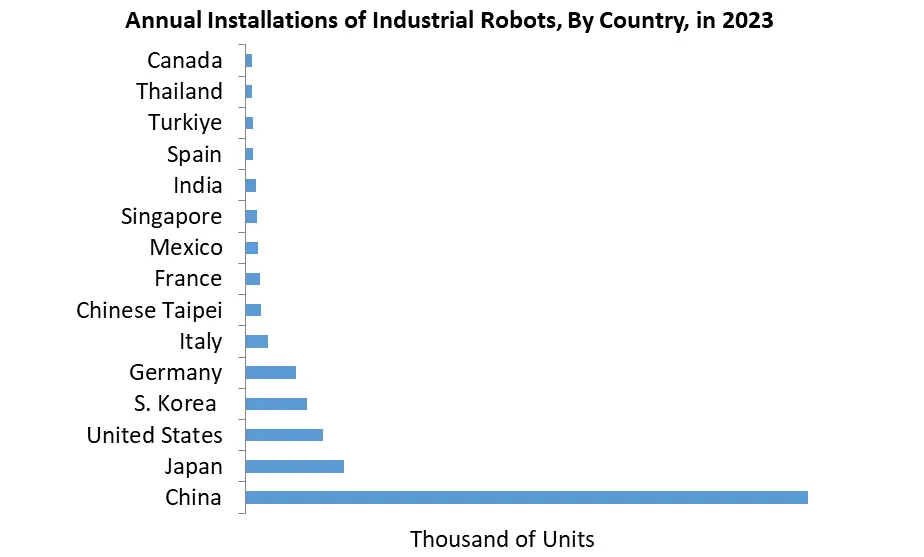

Asia emerges as a powerhouse, with China leading the way as the largest top robotics market. In 2023, China set a new record with 290,258 annual robot installations, showing 5% growth and maintaining an impressive 13% average annual growth since 2017. The country's massive investment in automation technology is reflected in its robot density of 168 units per 10,000 employees in the manufacturing industry. Japan follows closely, with 50,413 annual robot installations in 2023 and a 2% average annual growth since 2020, securing its position as the world's predominant robot manufacturing country. The Republic of Korea, despite experiencing marginal growth in the past two years, maintains its status as the world's number one adopter of industrial robots, with a consistent 6% increase in robot density since 2020. In Europe, Germany, with a robot density of 415 units per 10,000 employees, stands out as the dominant region, experiencing a 5% Compound Annual Growth Rate (CAGR). The European Union as a whole remains the world's second-largest top robotics market, recording 70,781 units in 2023 with 5% growth. Meanwhile, in the Americas, the United States takes the lead, accounting for 71% of the 56,053 robot installations in the region in 2023. With a 10% growth in installations, particularly driven by a surge in the automotive industry, the U.S. stands out as a major player. China's continuous growth in robot installations and its strategic investments in automation technology position it as the region expected to dominate the top robotics market further. The Americas, led by the United States, demonstrate strong growth potential, especially in the automotive sector. Europe, with Germany as a key player, maintains a stable position and Asia, fueled by technological advancements and industrial needs, is anticipated to experience sustained growth, with countries like Japan and the Republic of Korea at the forefront of innovation and adoption. The collaboration between Skyline Robotics and Principle Cleaning Services in London exemplifies the integration of robotic solutions beyond manufacturing, showing the broader applications and potential growth in the top robotics industry.

Competitive Landscape

Recent growth in strategic partnerships, acquisitions, and technological advancements in the robotics and AI sector is poised to propel significant top robotics market growth. Companies like ABB, NVIDIA, SoftBank Robotics, and Brain Corp are driving innovations, offering enhanced capabilities in AI-enabled mobile robotics, CAD/CAM software, and autonomous systems. These developments address industry challenges, such as labor shortages and operational inefficiencies, fostering a climate of increased automation adoption. Collaborations like SoftBank Robotics and Formant aim to revolutionize work solutions, while acquisitions like ABB's integration of Sevensense's technology into its AMR portfolio contribute to unprecedented speed, accuracy, and payload capabilities. These collective efforts are shaping a dynamic landscape, driving the market toward robust growth. On January 11, 2024, ABB strengthened its position in AI-enabled mobile robotics by acquiring Swiss start-up Sevensense, known for its 3D vision and navigation tech for autonomous robots. ABB plans to integrate Sevensense's technology into its portfolio, enhancing robot autonomy with speed and accuracy for industries facing skilled labor shortages. On January 9, 2024, SprutCAM Tech unveiled the 17.0.11 update for SprutCAM X and SprutCAM X Robot. This release from the Cyprus-based CAD/CAM/OLP software company introduces improved .dxf format support, enabling seamless sketch import and conversion to 3D models. Smart hints and enhancements in various operations contribute to an enhanced user-friendly experience. On January 8, 2024, NVIDIA and key collaborators such as Boston Dynamics, Covariant, Sanctuary AI, and Unitree Robotics joined forces to integrate generative AI and robotics. In a CES address, NVIDIA's VP of Robotics, Deepu Talla, outlined a strategic plan, highlighting the role of GPU-accelerated large language models in enhancing adaptability and intelligence across diverse machines. On January 3, 2024, Administrative Resource Options Inc. (ARO) unveiled its new subsidiary, Roboworx, emphasizing robotic service and support. With the rising integration of robots in various sectors, ARO established Roboworx to cater to the evolving needs of the robotics industry. The subsidiary focuses on delivering specialized maintenance and support services to organizations utilizing robotic technologies. On December 28, 2023, SoftBank Robotics America entered into a strategic partnership with Formant, a prominent robot management system, to enhance work transformation solutions. This collaboration aims to deepen integration within SoftBank Robotics' solution portfolio, incorporating advanced business intelligence, additional software services, and artificial intelligence. The partnership reflects SoftBank's dedication to assisting businesses in optimizing their investments in robotics amidst evolving labor challenges. On November 2, 2023, Brain Corp and Dane Technologies expanded their collaboration to create robotic inventory-scanning systems for retailers, leveraging Brain Corp's AI and autonomous systems expertise along with Dane's proficiency in retail technology deployment. The partnership aims to provide a new era of autonomous inventory-scanning solutions, promising significant cost reduction and notable return on investment for global retailers.Top Robotics Market Scope: Inquiry Before Buying

Top Robotics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 124.89 Bn. Forecast Period 2024 to 2030 CAGR: 17.4% Market Size in 2030: US $ 383.89 Bn. Segments Covered: by Type Articulated Robots SCARA Robots Cartesian Robots Parallel Robots Collaborative Robots by End Use Industries Automotive Electrical and Electronics Metal and Machinery Chemicals, Rubber, and Plastics Food & Beverages Precision Engineering and Optics Pharmaceuticals and Cosmetics Others by Application Handling Welding & Soldering Assembling & Disassembling Dispensing Processing Others (Inspections & Quality Testing and Die Casting & Molding) Top Robotics Market Key Players:

North America: 1. iRobot Corporation (Massachusetts, USA) 2. Universal Robots (USA) 3. Rethink Robotics (Massachusetts, USA) 4. Northrop Grumman (Virginia, USA) 5. DJI (North America) Europe: 1. ABB Robotics (Zurich, Switzerland) 2. KUKA Robotics Corporation (Acquired by Midea Group) (Augsburg, Germany) 3. Robert Bosch GmbH (Germany) 4. F&P Robotics AG (Switzerland) 5. Comau (Italy) Asia Pacific: 1. FANUC Corporation (Yamanashi, Japan) 2. Yaskawa Electric Corporation (Fukuoka, Japan) 3. Kawasaki Heavy Industries, Ltd. (Hyogo, Japan) 4. Techman Robot Inc.(Taipei, Taiwan) 5. Denso Corporation (Aichi, Japan) 6. Mitsubishi (Tokyo, Japan) 7. Anhui Efort Intelligent Equipment (Anhui, China) 8. Delta Electronics (Taipei, Taiwan)FAQs:

1. What are the growth drivers for the Top Robotics Market? Ans. Increased demand in transportation and logistics fuels market growth and is expected to be the major driver for the Top Robotics Market. 2. What is the major Opportunity for the Top Robotics Market growth? Ans. AI and Autonomous Technology Propel Robots beyond Manufacturing is expected to be the major Opportunity in the Top Robotics Market. 3. Which country is expected to lead the global Top Robotics Market during the forecast period? Ans. Asia Pacific is expected to lead the Top Robotics Market during the forecast period. 4. What is the projected market size and growth rate of the Top Robotics Market? Ans. The Top Robotics Market size was valued at USD 124.89 billion in 2023 and the total Top Robotics Market revenue is expected to grow at a CAGR of 17.4% from 2023 to 2030, reaching nearly USD 383.89 billion. 5. What segments are covered in the Top Robotics Market report? Ans. The segments covered in the Top Robotics Market report are by Type, End Use Industries, Application, and Region.

1. Top Robotics Market: Research Methodology 2. Top Robotics Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Top Robotics Market: Dynamics 3.1 Top Robotics Market Trends by Region 3.1.1 North America Top Robotics Market Trends 3.1.2 Europe Top Robotics Market Trends 3.1.3 Asia Pacific Top Robotics Market Trends 3.1.4 Middle East and Africa Top Robotics Market Trends 3.1.5 South America Top Robotics Market Trends 3.2 Top Robotics Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Top Robotics Market Drivers 3.2.1.2 North America Top Robotics Market Restraints 3.2.1.3 North America Top Robotics Market Opportunities 3.2.1.4 North America Top Robotics Market Challenges 3.2.2 Europe 3.2.2.1 Europe Top Robotics Market Drivers 3.2.2.2 Europe Top Robotics Market Restraints 3.2.2.3 Europe Top Robotics Market Opportunities 3.2.2.4 Europe Top Robotics Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Top Robotics Market Drivers 3.2.3.2 Asia Pacific Top Robotics Market Restraints 3.2.3.3 Asia Pacific Top Robotics Market Opportunities 3.2.3.4 Asia Pacific Top Robotics Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Top Robotics Market Drivers 3.2.4.2 Middle East and Africa Top Robotics Market Restraints 3.2.4.3 Middle East and Africa Top Robotics Market Opportunities 3.2.4.4 Middle East and Africa Top Robotics Market Challenges 3.2.5 South America 3.2.5.1 South America Top Robotics Market Drivers 3.2.5.2 South America Top Robotics Market Restraints 3.2.5.3 South America Top Robotics Market Opportunities 3.2.5.4 South America Top Robotics Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Top Robotics Industry 3.8 The Global Pandemic and Redefining of The Top Robotics Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Top Robotics Market: Global Market Size and Forecast by Segmentation(Value) (2023-2030) 4.1 Global Top Robotics Market Size and Forecast, By Type (2023-2030) 4.1.1 Articulated Robots 4.1.2 SCARA Robots 4.1.3 Cartesian Robots 4.1.4 Parallel Robots 4.1.5 Collaborative Robots 4.2 Global Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 4.2.1 Automotive 4.2.2 Electrical and Electronics 4.2.3 Metal and Machinery 4.2.4 Chemicals, Rubber, and Plastics 4.2.5 Food & Beverages 4.2.6 Precision Engineering and Optics 4.2.7 Pharmaceuticals and Cosmetics 4.2.8 Others 4.3 Global Top Robotics Market Size and Forecast, By Application (2023-2030) 4.3.1 Handling 4.3.2 Welding & Soldering 4.3.3 Assembling & Disassembling 4.3.4 Dispensing 4.3.5 Processing 4.3.6 Others (Inspections & Quality Testing and Die Casting & Molding) 4.4 Global Top Robotics Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Top Robotics Market Size and Forecast by Segmentation(Value) (2023-2030) 5.1 North America Top Robotics Market Size and Forecast, By Type (2023-2030) 5.1.1 Articulated Robots 5.1.2 SCARA Robots 5.1.3 Cartesian Robots 5.1.4 Parallel Robots 5.1.5 Collaborative Robots 5.2 North America Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 5.2.1 Automotive 5.2.2 Electrical and Electronics 5.2.3 Metal and Machinery 5.2.4 Chemicals, Rubber, and Plastics 5.2.5 Food & Beverages 5.2.6 Precision Engineering and Optics 5.2.7 Pharmaceuticals and Cosmetics 5.2.8 Others 5.3 North America Top Robotics Market Size and Forecast, By Application (2023-2030) 5.3.1 Handling 5.3.2 Welding & Soldering 5.3.3 Assembling & Disassembling 5.3.4 Dispensing 5.3.5 Processing 5.3.6 Others (Inspections & Quality Testing and Die Casting & Molding) 5.4 North America Top Robotics Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Top Robotics Market Size and Forecast, By Type (2023-2030) 5.4.1.1.1 Articulated Robots 5.4.1.1.2 SCARA Robots 5.4.1.1.3 Cartesian Robots 5.4.1.1.4 Parallel Robots 5.4.1.1.5 Collaborative Robots 5.4.1.2 United States Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 5.4.1.2.1 Automotive 5.4.1.2.2 Electrical and Electronics 5.4.1.2.3 Metal and Machinery 5.4.1.2.4 Chemicals, Rubber, and Plastics 5.4.1.2.5 Food & Beverages 5.4.1.2.6 Precision Engineering and Optics 5.4.1.2.7 Pharmaceuticals and Cosmetics 5.4.1.2.8 Others 5.4.1.3 United States Top Robotics Market Size and Forecast, By Application (2023-2030) 5.4.1.3.1 Handling 5.4.1.3.2 Welding & Soldering 5.4.1.3.3 Assembling & Disassembling 5.4.1.3.4 Dispensing 5.4.1.3.5 Processing 5.4.1.3.6 Others (Inspections & Quality Testing and Die Casting & Molding) 5.4.2 Canada 5.4.2.1 Canada Top Robotics Market Size and Forecast, By Type (2023-2030) 5.4.2.1.1 Articulated Robots 5.4.2.1.2 SCARA Robots 5.4.2.1.3 Cartesian Robots 5.4.2.1.4 Parallel Robots 5.4.2.1.5 Collaborative Robots 5.4.2.2 Canada Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 5.4.2.2.1 Automotive 5.4.2.2.2 Electrical and Electronics 5.4.2.2.3 Metal and Machinery 5.4.2.2.4 Chemicals, Rubber, and Plastics 5.4.2.2.5 Food & Beverages 5.4.2.2.6 Precision Engineering and Optics 5.4.2.2.7 Pharmaceuticals and Cosmetics 5.4.2.2.8 Others 5.4.2.3 Canada Top Robotics Market Size and Forecast, By Application (2023-2030) 5.4.2.3.1 Handling 5.4.2.3.2 Welding & Soldering 5.4.2.3.3 Assembling & Disassembling 5.4.2.3.4 Dispensing 5.4.2.3.5 Processing 5.4.2.3.6 Others (Inspections & Quality Testing and Die Casting & Molding) 5.4.3 Mexico 5.4.3.1 Mexico Top Robotics Market Size and Forecast, By Type (2023-2030) 5.4.3.1.1 Articulated Robots 5.4.3.1.2 SCARA Robots 5.4.3.1.3 Cartesian Robots 5.4.3.1.4 Parallel Robots 5.4.3.1.5 Collaborative Robots 5.4.3.2 Mexico Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 5.4.3.2.1 Automotive 5.4.3.2.2 Electrical and Electronics 5.4.3.2.3 Metal and Machinery 5.4.3.2.4 Chemicals, Rubber, and Plastics 5.4.3.2.5 Food & Beverages 5.4.3.2.6 Precision Engineering and Optics 5.4.3.2.7 Pharmaceuticals and Cosmetics 5.4.3.2.8 Others 5.4.3.3 Mexico Top Robotics Market Size and Forecast, By Application (2023-2030) 5.4.3.3.1 Handling 5.4.3.3.2 Welding & Soldering 5.4.3.3.3 Assembling & Disassembling 5.4.3.3.4 Dispensing 5.4.3.3.5 Processing 5.4.3.3.6 Others (Inspections & Quality Testing and Die Casting & Molding) 6. Europe Top Robotics Market Size and Forecast by Segmentation(Value) (2023-2030) 6.1 Europe Top Robotics Market Size and Forecast, By Type (2023-2030) 6.2 Europe Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.3 Europe Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4 Europe Top Robotics Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.1.2 United Kingdom Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.1.3 United Kingdom Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.2 France 6.4.2.1 France Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.2.2 France Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.2.3 France Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.3.2 Germany Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.3.3 Germany Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.4.2 Italy Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.4.3 Italy Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.5.2 Spain Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.5.3 Spain Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.6.2 Sweden Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.6.3 Sweden Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.7.2 Austria Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 6.4.7.3 Austria Top Robotics Market Size and Forecast, By Application (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Top Robotics Market Size and Forecast, By Type (2023-2030) 6.4.8.2 Rest of Europe Top Robotics Market Size and Forecast, By End Use Industries (2023-2030). 6.4.8.3 Rest of Europe Top Robotics Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Top Robotics Market Size and Forecast by Segmentation(Value) (2023-2030) 7.1 Asia Pacific Top Robotics Market Size and Forecast, By Type (2023-2030) 7.2 Asia Pacific Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.3 Asia Pacific Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4 Asia Pacific Top Robotics Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.1.2 China Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.1.3 China Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.2.2 S Korea Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.2.3 S Korea Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.3.2 Japan Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.3.3 Japan Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.4 India 7.4.4.1 India Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.4.2 India Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.4.3 India Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.5.2 Australia Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.5.3 Australia Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.6.2 Indonesia Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.6.3 Indonesia Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.7.2 Malaysia Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.7.3 Malaysia Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.8.2 Vietnam Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.8.3 Vietnam Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.9.2 Taiwan Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.9.3 Taiwan Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.10.2 Bangladesh Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.10.3 Bangladesh Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.11.2 Pakistan Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.11.3 Pakistan Top Robotics Market Size and Forecast, By Application (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Top Robotics Market Size and Forecast, By Type (2023-2030) 7.4.12.2 Rest of Asia Pacific Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 7.4.12.3 Rest of Asia Pacific Top Robotics Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Top Robotics Market Size and Forecast by Segmentation(Value) (2023-2030) 8.1 Middle East and Africa Top Robotics Market Size and Forecast, By Type (2023-2030) 8.2 Middle East and Africa Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 8.3 Middle East and Africa Top Robotics Market Size and Forecast, By Application (2023-2030) 8.4 Middle East and Africa Top Robotics Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Top Robotics Market Size and Forecast, By Type (2023-2030) 8.4.1.2 South Africa Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 8.4.1.3 South Africa Top Robotics Market Size and Forecast, By Application (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Top Robotics Market Size and Forecast, By Type (2023-2030) 8.4.2.2 GCC Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 8.4.2.3 GCC Top Robotics Market Size and Forecast, By Application (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Top Robotics Market Size and Forecast, By Type (2023-2030) 8.4.3.2 Egypt Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 8.4.3.3 Egypt Top Robotics Market Size and Forecast, By Application (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Top Robotics Market Size and Forecast, By Type (2023-2030) 8.4.4.2 Nigeria Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 8.4.4.3 Nigeria Top Robotics Market Size and Forecast, By Application (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Top Robotics Market Size and Forecast, By Type (2023-2030) 8.4.5.2 Rest of ME&A Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 8.4.5.3 Rest of ME&A Top Robotics Market Size and Forecast, By Application (2023-2030) 9. South America Top Robotics Market Size and Forecast by Segmentation(Value) (2023-2030) 9.1 South America Top Robotics Market Size and Forecast, By Type (2023-2030) 9.2 South America Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 9.3 South America Top Robotics Market Size and Forecast, By Application (2023-2030) 9.4 South America Top Robotics Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Top Robotics Market Size and Forecast, By Type (2023-2030) 9.4.1.2 Brazil Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 9.4.1.3 Brazil Top Robotics Market Size and Forecast, By Application (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Top Robotics Market Size and Forecast, By Type (2023-2030) 9.4.2.2 Argentina Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 9.4.2.3 Argentina Top Robotics Market Size and Forecast, By Application (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Top Robotics Market Size and Forecast, By Type (2023-2030) 9.4.3.2 Rest Of South America Top Robotics Market Size and Forecast, By End Use Industries (2023-2030) 9.4.3.3 Rest Of South America Top Robotics Market Size and Forecast, By Application (2023-2030) 10. Global Top Robotics Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Top Robotics Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 iRobot Corporation 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Adept Technology, Inc. (Acquired by OMRON Corporation) 11.3 FANUC Corporation 11.4 KUKA Robotics Corporation (Acquired by Midea Group) 11.5 Universal Robots 11.6 ABB Robotics 11.7 Robot System Products (RSP) 11.8 Yaskawa Electric Corporation 11.9 Kawasaki Heavy Industries, Ltd. 11.10 Techman Robot Inc. 11.11 Denso Corporation 11.12 Mitsubishi 11.13 CMA Robotics S.p.A. 11.14 Robert Bosch GmbH 11.15 Anhui Efort Intelligent Equipment 11.16 Precise Automation, Inc. 11.17 Rethink Robotics 11.18 F&P Robotics AG 11.19 Northrop Grumman 11.20 DJI 11.21 Intuitive Surgical 11.22 Honda Motor 11.23 Samsung Electronics 11.24 GeckoSystems 11.25 DeLaval 11.26 Kongsberg Maritime 11.27 Comau 11.28 b+m Surface Systems 11.29 Delta Electronics 12. Key Findings and Analyst Recommendations 13. Terms and Glossary