The Tire Pressure Monitoring System Market size was valued at USD 7.8 Billion in 2023 and the total Tire Pressure Monitoring System revenue is expected to grow at a CAGR of 10.4% from 2024 to 2030, reaching nearly USD 20.5 Billion by 2030.Tire Pressure Monitoring System Market Overview:

It stands for Tire Pressure Monitoring System, and it uses tire pressure sensors to track the air pressure of your tire. This system will turn the light on, or the TPMS lights flash, when it senses that one or more tires isn’t at the recommended pressure. While the TPMS probably isn’t your first thought when it comes to safety, it makes it easy to prevent tire failure no matter which Richlands roads you take. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Tire Pressure Monitoring System Market.To know about the Research Methodology :- Request Free Sample Report Tire Pressure Monitoring System Market Competitive Landscapes:

Tire Pressure Monitoring System Market Dynamics:

Safety Regulations and Market Growth and Fuel Efficiency and Environmental Concerns are driving the Tire Pressure Monitoring System Market Stringent safety regulations play a pivotal role in propelling the tire pressure monitoring system market forward. Numerous countries have either implemented or are contemplating regulations mandating the installation of tire pressure monitoring system in vehicles to enhance road safety. Compliance with these regulations significantly contributes to the market's growth, emphasizing the potential for tire pressure monitoring system to establish a prominent market share in the automotive safety segment. The increasing awareness of vehicle safety underscores the importance of tire pressure monitoring system adoption. Recognizing the crucial role proper tire pressure plays in preventing accidents and enhancing overall vehicle stability, consumers and manufacturers alike are embracing tire pressure monitoring system technology as a fundamental aspect of modern vehicle safety. This heightened awareness facilitates the penetration of tire pressure monitoring system into the market, positioning it as a key contributor to the automotive safety landscape. Tire pressure monitoring system positively impacts fuel efficiency, aligning with the growing emphasis on environmental sustainability and fuel economy. Maintaining proper tire pressure is acknowledged as a key factor in optimizing fuel efficiency, driving the adoption of tire pressure monitoring system as an eco-friendly technology. This eco-conscious approach enhances the potential of tire pressure monitoring system to capture a substantial TPMS market share among environmentally conscious consumers. The tire pressure monitoring system market is bolstered by continuous technological advancements. Innovations such as more accurate and reliable sensors, wireless communication capabilities, and seamless integration with other vehicle systems contribute to overall growth. These technological advancements enhance the effectiveness and efficiency of tire pressure monitoring system, allowing it to gain a larger market share by providing advanced features and functionalities. The global expansion of the automotive industry, marked by an increase in the production of both passenger and commercial vehicles, serves as a significant driver for the tire pressure monitoring system market. The rising demand for vehicles creates a parallel demand for safety features, including tire pressure monitoring system, driving market growth and expanding the potential market share for tire pressure monitoring system providers. Sensor Reliability and Maintenance Impact on Market Share with Aftermarket Challenges and Market Reach are restraining the market TPMS sensors, crucial components of the system, are susceptible to damage or malfunction. The need for maintenance or replacement of these sensors can add to the overall cost of ownership, potentially discouraging some consumers from fully embracing TPMS technology. Ensuring sensor reliability and minimizing maintenance costs is essential for TPMS providers to maintain and grow their TPMS market share. Retrofitting older vehicles with TPMS faces challenges in the aftermarket. Issues such as compatibility and installation complexities hinder the seamless integration of TPMS in existing vehicles. Overcoming these hurdles is essential to broaden the market reach and cater to a wider range of vehicles, thereby improving TPMS market penetration. The initial cost associated with installing TPMS in vehicles presents a substantial restraint, particularly in cost-sensitive markets. However, economies of scale and ongoing technological advancements are expected to gradually mitigate this barrier, making TPMS more accessible over time. Overcoming cost concerns is crucial for TPMS to penetrate diverse market segments and increase its market share. The adoption of TPMS in two-wheelers is constrained by cost considerations and a perceived lower safety impact compared to larger vehicles. Consumers may prioritize other features over TPMS due to budget constraints, limiting its penetration in the two-wheeler segment. Addressing these concerns is vital for TPMS market providers to explore untapped market segments and diversify their market share. As vehicles become increasingly connected, concerns about the security and privacy of data transmitted by TPMS systems emerge as a significant restraint. Consumer confidence and adoption rates may be affected by apprehensions related to data security, necessitating robust measures to address these concerns. Building trust in data security is crucial for TPMS providers to retain and expand their TPMS market share.

Tire Pressure Monitoring System Market Segment Analysis

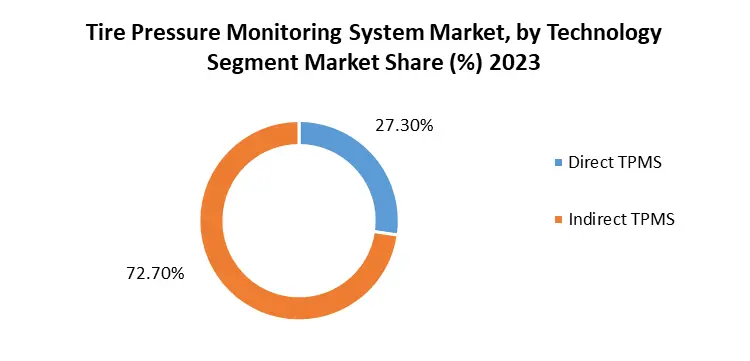

Vehicle: The LCV segment comprises a spectrum of vehicles, including vans and small trucks. Within this segment, TPMS plays a critical role in ensuring the safe transportation of goods and passengers. Regulatory standards emphasizing safety and operational efficiency drive the adoption of TPMS in LCVs, positioning it as an integral component of the overall vehicle safety system. The LCV segment share within the TPMS market reflects the emphasis on safety and regulatory compliance. HCVs, including trucks and buses, traverse significant distances, making tire pressure maintenance pivotal for fuel efficiency and safety. The HCV segment represents a substantial opportunity for TPMS adoption, particularly as fleet operators seek technologies to optimize performance, reduce fuel consumption, and enhance overall safety in their extensive operations. The TPMS market's regional segment growth in HCVs aligns with the increasing demand for safety solutions in the commercial transportation sector. TPMS integration in passenger vehicles is propelled by both safety regulations and heightened consumer awareness. Focused on enhancing road safety and reducing accidents, TPMS in passenger vehicles provides real-time tire pressure information to drivers, ensuring optimal driving conditions and contributing to overall safety standards. The passenger vehicle segment analysis highlights the integral role of TPMS in enhancing safety across a broad spectrum of private and commercial vehicles.Technology: Direct TPMS is expected to hold the largest share in the market during the forecast period. Direct TPMS have reducing tremendously the handling of multiple components via different size of the printed circuit board and removed the cost adding to external components. Small size gives suppliers the opportunity to use one solution in a wide variety of models. Direct TPMS in heavy-duty tractor/trailer trucks can have 18 or more tires, maintaining properly inflated tires saving thousands of dollars in fuel and tire servicing costs per vehicle over the course of its several hundred-thousand-mile lifetimes. Direct TPMS units do not require specialized tools to program or reset, making them much simpler to use. In Sales Channel, OEM is also expected to lead the market growth. Indirect TPMS, in contrast, utilizes existing vehicle systems such as the anti-lock braking system (ABS) to infer tire pressure based on wheel speed and other parameters. While often more cost-effective, indirect TPMS may sacrifice a slight degree of accuracy compared to direct systems. Commonly found in aftermarket solutions and specific OEM implementations, it addresses the need for efficient and budget-friendly TPMS alternatives. The regional segment growth of indirect TPMS reflects its role in providing cost-effective solutions, particularly in specific market regions.

Tire Pressure Monitoring System Market Regional Analysis

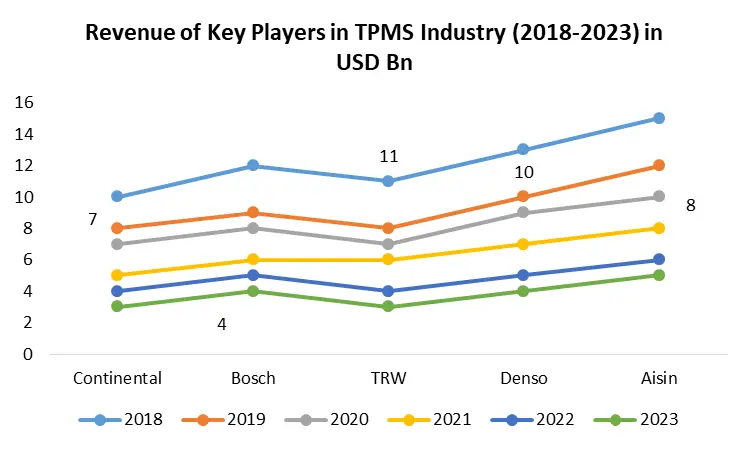

In North America, the TPMS market experiences robust TPMS Market growth propelled by stringent safety regulations and a pronounced emphasis on vehicle safety. The United States, in particular, stands out with mandated TPMS installation, significantly contributing to market penetration. The regional analysis underscores a mature TPMS market growth characterized by a high adoption rate, particularly evident in passenger vehicles and light trucks. • Regulatory Compliance: Stringent safety regulations in the U.S., mandating TPMS installation, act as a driving force behind market growth, positioning the region as a key player in TPMS adoption and fostering a culture of safety among vehicle owners. The regional growth in the US is evident in the widespread implementation of TPMS across various vehicle types. • Consumer Awareness: Heightened consumer awareness regarding the crucial role of tire pressure in ensuring vehicle safety further solidifies the market's stronghold, emphasizing the importance of TPMS technology. The TPMS market share in the US reflects the success of awareness campaigns in promoting TPMS adoption. • Advanced Automotive Industry: The presence of a technologically advanced automotive industry in North America encourages the integration of innovative TPMS market solutions. This synergy contributes significantly to the regional segment's growth, reflecting the industry's commitment to cutting-edge safety features and the vast potential for TPMS in the region. Europe showcases a robust presence in the TPMS market, with regulatory initiatives and heightened consumer awareness playing pivotal roles in shaping the industry. The European Union's regulations mandating TPMS installation contribute significantly to market growth. The regional analysis reveals a diverse market landscape with a dual focus on both passenger and commercial vehicles. • Regulatory Mandates: Regulatory mandates within the European Union requiring TPMS installation foster market growth. This ensures widespread adoption across the European automotive landscape, reinforcing the region's commitment to vehicle safety. The market potential in Europe is substantial, driven by regulatory compliance and safety-focused initiatives. • Growing Electric Vehicle Market: The increasing adoption of electric vehicles (EVs) in Europe serves as an additional impetus to the TPMS market. As EVs often incorporate advanced safety features, TPMS technologies find expanded relevance within this growing segment of the automotive market. The evolving electric vehicle market contributes to the overall potential of TPMS in Europe. The Asia Pacific region emerges as a significant player in the TPMS market, driven by the expanding automotive industry, safety concerns, and technological advancements. Countries such as China, Japan, and South Korea contribute substantially to the regional segment's growth, emphasizing a diverse array of vehicle types. • Rising Automotive Production: The Asia Pacific region, particularly China, serves as a manufacturing hub for the automotive industry. This positioning leads to increased TPMS integration in new vehicles, aligning with the region's commitment to advancing automotive safety. The regional growth in Asia Pacific is driven by the booming automotive production, creating ample opportunities for TPMS market expansion. • Government Initiatives: Supportive government initiatives promoting road safety and vehicle efficiency further contribute to the wider adoption of TPMS technologies in the Asia Pacific region. This reflects a concerted effort to enhance overall safety standards and reinforces the market's potential in the region. • Technological Advancements: Embracing technological advancements, the Asia Pacific region witnesses the seamless incorporation of advanced TPMS solutions in vehicles. This technological integration contributes significantly to the overall growth of the TPMS market in the region, highlighting its potential in addressing evolving automotive safety needs. Tire Pressure Monitoring System Market Competitive Landscape In a strategic move to reinforce its global market position, WEGMANN automotive, the parent company of ALLIGATOR Ventilfabrik GmbH, has recently completed a partial takeover, further solidifying its presence in the tire valves and TPMS (Tire Pressure Monitoring System) sector. The partial takeover involved the acquisition of key segments of ALLIGATOR Ventilfabrik GmbH in 2019. As part of this acquisition, WEGMANN automotive gained control of the ALLIGATOR brand name, along with the sales and distribution operations in both Europe and North America for car and commercial vehicle tire valves, TPMS sensors, and associated tools. This strategic move has significantly expanded WEGMANN automotive's portfolio, allowing it to cater to a broader customer base and offer a comprehensive range of products. Under the umbrella brand of WEGMANN automotive GmbH, the ALLIGATOR division has experienced notable growth and optimization. Currently, more than a million ALLIGATOR products are manufactured daily in Europe, showcasing the division's commitment to meeting the increasing demands of end customers and workshops globally. The products are distributed to customers in over 60 countries, highlighting the division's extensive reach and market presence. DENSO Corporation, a prominent mobility supplier, and United Semiconductor Japan Co., Ltd. (USJC), a subsidiary of global semiconductor foundry United Microelectronics Corporation, have announced a strategic collaboration to address the escalating demand in the automotive market for power semiconductors. The collaboration aims to leverage the strengths of both companies to enhance the production of insulated gate bipolar transistors (IGBTs), crucial components in the electrification of vehicles. DENSO and USJC will collaborate on the installation of an IGBT line at USJC's 300mm fab, marking a significant milestone as the first facility in Japan to produce IGBTs on 300mm wafers. This initiative aligns with the increasing global efforts to reduce carbon emissions and the growing demand for semiconductors to support the development of electric vehicles. DENSO will contribute its expertise in system-oriented IGBT device and process technologies to the collaboration. The combination of DENSO's technological capabilities with USJC's advanced 300mm wafer manufacturing capabilities is expected to enable the mass production of 300mm IGBTs, scheduled to commence in the first half of 2023. The collaboration is facilitated by the renovation and decarbonization program for indispensable semiconductors, receiving support from Japan’s Ministry of Economy, Trade, and Industry. This underscores the significance of the initiative in strengthening Japan's position in semiconductor production, a critical aspect of the automotive industry's evolution. With the acceleration of electric vehicle development and adoption worldwide, the demand for semiconductors essential for vehicle electrification is surging. IGBTs play a pivotal role as efficient power switches in inverters, converting DC and AC currents to drive and control electric vehicle motors. The collaboration positions DENSO and USJC to play a crucial role in meeting this growing demand.

Global Tire Pressure Monitoring System Market Scope: Inquire before buying

Global Tire Pressure Monitoring System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.8 Bn. Forecast Period 2024 to 2030 CAGR: 10.4% Market Size in 2030: US $ 20.5 Bn. Segments Covered: by Vehicle Light Commercial Vehicle (LCV) Heavy Commercial Vehicle (HCV) Passenger Vehicle by Technology Direct TPMS Indirect TPMS by Sales Channel OEMs Aftermarket Tire Pressure Monitoring System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tire Pressure Monitoring System Market Key Players:

North America: 1. Bartec USA LLC 2. Bendix Commercial Vehicles Systems LLC 3. Delphi Automotive LLP 4. General Electric Europe: 1. Alligator Gmbh 2. Continental AG 3. DUNLOP TECH GmbH 4. Huf Hulsbeck & Furst GmbH & Co. KG 5. NIRA Dynamics AB 6. Pacific Industrial 7. Schrader Electronics 8. Sensata Technologies Inc. 9. TRW Automotive 10. ZF Friedrichshafen Asia Pacific: 1. Denso Corporation 2. HAMATON AUTOMOTIVE TECHNOLOGY CO., LTD. 3. NXP Semiconductors 4. WABCO Global: Delphi Automotive LLP (Note: Listed in both North America and Global due to its global presence) FAQs: 1. What is a Tire Pressure Monitoring System (TPMS)? Ans: A TPMS is an electronic system designed to monitor and alert drivers about the tire pressure of their vehicles in real-time. 2. What are the types of TPMS? Ans: Key global market players include Pfizer Inc., AbbVie, Regeneron Pharmaceuticals, and F. Hoffmann La Roche Ltd. 3. Are TPMS systems mandatory? Ans: Many countries, including the U.S. and EU members, have mandated TPMS installation in new vehicles to enhance road safety. 4. What factors are driving the growth of the TPMS market? Ans: Understanding the key drivers helps stakeholders identify opportunities and market trends. 5. What technological advancements are shaping the TPMS market? Ans: Identifying technological trends helps stakeholders stay ahead in innovation and product development.

1. Tire Pressure Monitoring System Market: Research Methodology 2. Tire Pressure Monitoring System Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Tire Pressure Monitoring System Market: Dynamics 3.1. Tire Pressure Monitoring System Market Trends by Region 3.1.1. North America Tire Pressure Monitoring System Market Trends 3.1.2. Europe Tire Pressure Monitoring System Market Trends 3.1.3. Asia Pacific Tire Pressure Monitoring System Market Trends 3.1.4. Middle East and Africa Tire Pressure Monitoring System Market Trends 3.1.5. South America Tire Pressure Monitoring System Market Trends 3.2. Tire Pressure Monitoring System Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Tire Pressure Monitoring System Market Drivers 3.2.1.2. North America Tire Pressure Monitoring System Market Restraints 3.2.1.3. North America Tire Pressure Monitoring System Market Opportunities 3.2.1.4. North America Tire Pressure Monitoring System Market Challenges 3.2.2. Europe 3.2.2.1. Europe Tire Pressure Monitoring System Market Drivers 3.2.2.2. Europe Tire Pressure Monitoring System Market Restraints 3.2.2.3. Europe Tire Pressure Monitoring System Market Opportunities 3.2.2.4. Europe Tire Pressure Monitoring System Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Tire Pressure Monitoring System Market Drivers 3.2.3.2. Asia Pacific Tire Pressure Monitoring System Market Restraints 3.2.3.3. Asia Pacific Tire Pressure Monitoring System Market Opportunities 3.2.3.4. Asia Pacific Tire Pressure Monitoring System Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Tire Pressure Monitoring System Market Drivers 3.2.4.2. Middle East and Africa Tire Pressure Monitoring System Market Restraints 3.2.4.3. Middle East and Africa Tire Pressure Monitoring System Market Opportunities 3.2.4.4. Middle East and Africa Tire Pressure Monitoring System Market Challenges 3.2.5. South America 3.2.5.1. South America Tire Pressure Monitoring System Market Drivers 3.2.5.2. South America Tire Pressure Monitoring System Market Restraints 3.2.5.3. South America Tire Pressure Monitoring System Market Opportunities 3.2.5.4. South America Tire Pressure Monitoring System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Tire Pressure Monitoring System Market 3.8. Analysis of Government Schemes and Initiatives For Tire Pressure Monitoring System Market 3.9. The Global Pandemic Impact on Tire Pressure Monitoring System Market 4. Tire Pressure Monitoring System Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 4.1.1. Light Commercial Vehicle (LCV) 4.1.2. Heavy Commercial Vehicle (HCV) 4.1.3. Passenger Vehicle 4.2. Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 4.2.1. Direct TPMS 4.2.2. Indirect TPMS 4.3. Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 4.3.1. OEMs 4.3.2. Aftermarket 4.4. Tire Pressure Monitoring System Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Tire Pressure Monitoring System Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. North America Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 5.1.1. Light Commercial Vehicle (LCV) 5.1.2. Heavy Commercial Vehicle (HCV) 5.1.3. Passenger Vehicle 5.2. North America Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 5.2.1. Direct TPMS 5.2.2. Indirect TPMS 5.3. North America Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 5.3.1. OEMs 5.3.2. Aftermarket 5.4. North America Tire Pressure Monitoring System Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 5.4.1.1.1. Light Commercial Vehicle (LCV) 5.4.1.1.2. Heavy Commercial Vehicle (HCV) 5.4.1.1.3. Passenger Vehicle 5.4.1.2. United States Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 5.4.1.2.1. Direct TPMS 5.4.1.2.2. Indirect TPMS 5.4.1.3. United States Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 5.4.1.3.1. OEMs 5.4.1.3.2. Aftermarket 5.4.2. Canada 5.4.2.1. Canada Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 5.4.2.1.1. Light Commercial Vehicle (LCV) 5.4.2.1.2. Heavy Commercial Vehicle (HCV) 5.4.2.1.3. Passenger Vehicle 5.4.2.2. Canada Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 5.4.2.2.1. Direct TPMS 5.4.2.2.2. Indirect TPMS 5.4.2.3. Canada Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 5.4.2.3.1. OEMs 5.4.2.3.2. Aftermarket 5.4.3. Mexico 5.4.3.1. Mexico Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 5.4.3.1.1. Light Commercial Vehicle (LCV) 5.4.3.1.2. Heavy Commercial Vehicle (HCV) 5.4.3.1.3. Passenger Vehicle 5.4.3.2. Mexico Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 5.4.3.2.1. Direct TPMS 5.4.3.2.2. Indirect TPMS 5.4.3.3. Mexico Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 5.4.3.3.1. OEMs 5.4.3.3.2. Aftermarket 6. Europe Tire Pressure Monitoring System Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Europe Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.2. Europe Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.3. Europe Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4. Europe Tire Pressure Monitoring System Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.1.2. United Kingdom Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.1.3. United Kingdom Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.2. France 6.4.2.1. France Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.2.2. France Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.2.3. France Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.3.2. Germany Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.3.3. Germany Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.4.2. Italy Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.4.3. Italy Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.5.2. Spain Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.5.3. Spain Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.6.2. Sweden Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.6.3. Sweden Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.7.2. Austria Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.7.3. Austria Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 6.4.8.2. Rest of Europe Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 6.4.8.3. Rest of Europe Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7. Asia Pacific Tire Pressure Monitoring System Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.2. Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.3. Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4. Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.1.2. China Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.1.3. China Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.2.2. S Korea Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.2.3. S Korea Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.3.2. Japan Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.3.3. Japan Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.4. India 7.4.4.1. India Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.4.2. India Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.4.3. India Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.5.2. Australia Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.5.3. Australia Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.6.2. Indonesia Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.6.3. Indonesia Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.7.2. Malaysia Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.7.3. Malaysia Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.8.2. Vietnam Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.8.3. Vietnam Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.9.2. Taiwan Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.9.3. Taiwan Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 7.4.10.2. Rest of Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 7.4.10.3. Rest of Asia Pacific Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 8. Middle East and Africa Tire Pressure Monitoring System Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 8.2. Middle East and Africa Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 8.3. Middle East and Africa Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 8.4. Middle East and Africa Tire Pressure Monitoring System Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 8.4.1.2. South Africa Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 8.4.1.3. South Africa Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 8.4.2.2. GCC Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 8.4.2.3. GCC Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 8.4.3.2. Nigeria Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 8.4.3.3. Nigeria Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 8.4.4.2. Rest of ME&A Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 8.4.4.3. Rest of ME&A Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 9. South America Tire Pressure Monitoring System Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. South America Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 9.2. South America Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 9.3. South America Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 9.4. South America Tire Pressure Monitoring System Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 9.4.1.2. Brazil Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 9.4.1.3. Brazil Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 9.4.2.2. Argentina Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 9.4.2.3. Argentina Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Tire Pressure Monitoring System Market Size and Forecast, by Vehicle (2022-2029) 9.4.3.2. Rest Of South America Tire Pressure Monitoring System Market Size and Forecast, by Technology (2022-2029) 9.4.3.3. Rest Of South America Tire Pressure Monitoring System Market Size and Forecast, by Sales Channel (2022-2029) 10. Global Tire Pressure Monitoring System Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Tire Pressure Monitoring System Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Alligator Gmbh. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Denso 11.3. Pacific Industrial 11.4. Schrader Electronics 11.5. Delphi Automotive LLP 11.6. Huf Hulsbeck & Furst GmbH & Co. KG 11.7. ZF Friedrichshafen 11.8. Sensata Technologies Inc. 11.9. Bartec USA LLC 11.10. Delphi Automotive LLP. 11.11. General Electric 11.12. TRW Automotive 11.13. NIRA Dynamics AB 11.14. Continental AG 11.15. Denso Corporation 11.16. NXP Semiconductors 11.17. WABCO 11.18. Bendix Commercial Vehicles Systems LLC 11.19. DUNLOP TECH GmbH 11.20. HAMATON AUTOMOTIVE TECHNOLOGY CO., LTD. 12. Key Findings 13. Industry Recommendations