Brake Lines Market was valued at US $ 28.88 Bn. in 2022. Brake Lines Market size is estimated to grow at a CAGR of 3.97%. The market is expected to reach a value of US $ 37.93 Bn. by 2029.Brake Lines Market Overview:

From the driver's foot in the vehicle to the wheels of the vehicle, the braking system is made up of various components. Brake lines are mechanical components that transport brake fluid from the hydraulic master cylinder to the rear calipers or wheel cylinders in the braking system. When you apply the brakes, the braking fluid in the brake lines pushes the brake pad against the rotor, ensuring a safe and comfortable deceleration. Brake lines deliver the force applied by the driver. Most modern vehicles have a vacuum-assisted brake system, often known as brake boosters, and a brake force distribution system that considerably boosts the force provided by the driver to the vehicle's brakes.To know about the Research Methodology:- Request Free Sample Report

Brake Lines Market Dynamics:

The brake lines market for automotive is expected to benefit from increased vehicle production and increased demand for lightweight automobiles. During the forecast period, the rise in demand for automobiles with improved braking systems is likely to be a major factor driving the brake lines market for automotive. Global regulatory agencies are expected to impose strict regulations on the automotive industry to address safety concerns, which is expected to drive the brake lines market for automobiles. Brake lines are in charge of a variety of brake functions, including improved braking reaction, longer life, durability, and flexibility. This may very certainly present profitable chances for the brake lines sector. The brake lines market for automobiles is expected to be limited by frequent replacement due to fluid leakage. In terms of vehicle, passenger, and pedestrian safety, the braking system is a critical component. The braking line transports mechanical force from the master cylinder to the braking piston-cylinder assembly, which is an important part of the braking system. When the braking fluid is applied, the brake pad is forced against the rotor, reducing the vehicle's speed. Brake lines are readily available on the market and have a low cost of replacement. The cost of OEM brake lines is significantly less than the cost of aftermarket brake lines. The market is primarily focused on cheap buying costs, and new developments in braking technology are affecting brake line growth in the forecast period The surge in demand for brake lines is mostly due to advancements in vehicle preventive maintenance technology. Diagnostic technology advancements, such as remote diagnostics, make the process easier and simpler. The need for brake lines will continue to rise as old brake lines are replaced with new ones regularly to maintain their efficiency and safety. Technology such as continuous monitoring is also driving demand by alerting customers when brake lines need to be replaced. The global brake lines market is seeing some design and construction changes. Technology advancements and continued study in the vehicle braking system are assisting important stakeholders in improving braking performance and braking line lifespan. For the fabrication of brake lines, producers are concentrating on developing materials that are efficient, lightweight, and rigid. Weight reduction is being used by OEMs as a strategy to compete in the global market against aftermarket companies. The Brake Lines Market is expected to be driven by such factors.Competitive Landscape:

The companies are primarily concerned with producing environmentally safe, dependable, and durable braking systems. To enhance their market shares and assure healthy growth, the major players have made significant investments in research and development. Continental North America, for example, a United States-based subsidiary of Continental AG, committed over USD 40 million to expand the Morganton auto plant. The state of North Carolina has also given the corporation a USD 1.6 million training and employment incentive grant. The additional production capacity would be used to produce MK C1 braking systems. In India, the increased frequency of accidents has resulted in a rise in safety features, particularly in mid-level automobiles. The Indian government has made it necessary for all automobile firms to put anti-lock braking systems in their vehicles by April 2019 to reduce such tragedies. Due to the lack of ABS and strict government emissions and safety regulations, 2-wheeler models such as the Hero Karizma and Bajaj V15, as well as automobile models such as the Hyundai Eon, Honda Brio, Fiat Punto, Tata Bolt, and others, have been discontinued.Brake Lines Market Segment Analysis:

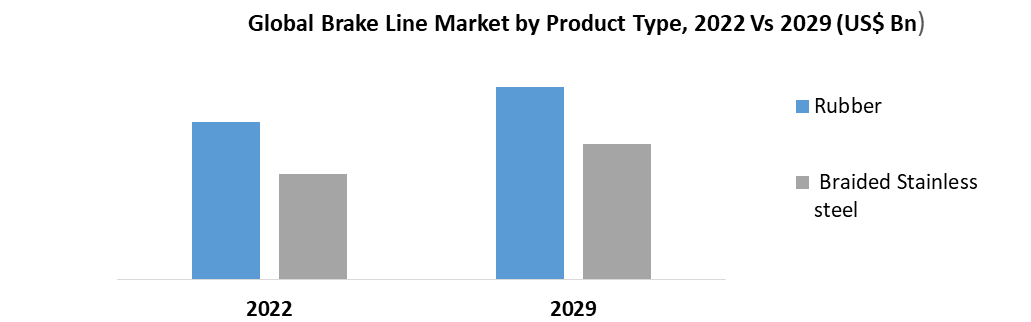

The global Brake Lines Market is sub-segmented into Product type and Vehicle type. Based on Product Type, the market is sub-segmented into Rubber and Braided Stainless steel. Rubber has a significant market share in 2022 and is expected to grow at a CAGR of xx% over the forecast period. The majority of rubber hose is made up of rubber and braiding. As rubber hose standards evolve, the use of appropriate rubber hoses is projected to rise. Brake fluid purity is one of the most critical criteria, and brake fluid contamination is caused by the rubber hose's incompatibility with brake fluid. The rubber hose market is expected to reach US$ xx Mn. by 2029. Other topics covered in the report include the application, drivers, regional market size, share, and condition.

Brake Lines Market Regional Insights:

High rate of adoption of automotive brake lines and the expansion of the automotive industry in the region, Asia Pacific accounts for a significant portion of the global brake lines market for automotive. As a result, vehicle production with automotive brake lines has increased, particularly in China, India, Japan, and South Korea. Due to the availability of low-cost labor and raw materials, the Asia-Pacific area continues to dominate the industry, and manufacturers in this region offer high-cost reductions. Also, the area includes countries like China and India, which together account for roughly 34% of overall automobile production. Active braking systems are becoming more popular, which improves sales of luxury and premium automobiles. Due to safety regulations set by regulatory organizations in these countries, the brake lines market for automobiles in Europe, particularly in Germany, France, Italy, and the United Kingdom, is likely to grow in the near future. During the forecast period, the automotive brake lines market in Latin America is expected to grow at a rapid rate.The objective of the report is to present a comprehensive analysis of the Brake Lines Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Brake Lines Market dynamic and structure by analyzing the market segments and projecting the Brake Lines Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Brake Lines Market make the report investor’s guide.

Brake Lines Market Scope: Inquire before buying

Global Brake Line Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 28.88 Bn. Forecast Period 2023 to 2029 CAGR: 3.97% Market Size in 2029: US $ 37.93 Bn. Segments Covered: by Product Type • Rubber • Braided Stainless steel by Vehicle Type • Passenger vehicle • Medium-Duty Commercial vehicle • Heavy Duty Commercial vehicle • Light Duty Commercial Vehicle Brake Lines Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Brake Lines Market Key Players are:

• Continental AG • Carlisle Brake & Friction • FTE Automotive • Sumitomo Riko Co. Ltd • BrakeQuip • Gates Corporation • Hutchinson SA • Yokohama Rubber Co., Ltd. • Bosch • Delphi • Hitachi • ValeoATE Brakes • Advice co. Ltd • Brembo SpA • Akebono Brake industryFrequently Asked Questions:

1] What segments are covered in the Brake Lines Market report? Ans. The segments covered in the Brake Lines Market report are based on Product type and vehicle type. 2] Which region is expected to hold the highest share in the Brake Lines Market? Ans. The Asia Pacific region is expected to hold the highest share in the Brake Lines Market. 3] What is the market size of the Brake Lines Market by 2029? Ans. The market size of the Brake Lines Market by 2029 is expected to be US $ 37.93 Bn. 4] What is the forecast period for the Brake Lines Market? Ans. The forecast period for the Brake Lines Market is 2023-2029. 5] What was the market size of the Brake Lines Market in 2022? Ans. The market size of the Brake Lines Market in 2022 was US $ 28.88 Bn

1. Global Brake Line Market Size: Research Methodology 2. Global Brake Line Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Brake Line Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Brake Line Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Brake Line Market Size Segmentation 4.1. Global Brake Line Market Size, by Product Type (2023-2029) • Rubber • Braided Stainless steel 4.2. Global Brake Line Market Size, by Vehicle Type (2023-2029) • Passenger vehicle • Medium-Duty Commercial vehicle • Heavy Duty Commercial vehicle • Light Duty Commercial Vehicle 5. North America Brake Line Market (2023-2029) 5.1. North America Brake Line Market Size, by Product Type (2023-2029) • Rubber • Braided Stainless steel 5.2. North America Brake Line Market Size, by Vehicle Type (2023-2029) • Passenger vehicle • Medium-Duty Commercial vehicle • Heavy Duty Commercial vehicle • Light Duty Commercial Vehicle 5.3. North America Brake Line Market, by Country (2023-2029) • United States • Canada • Mexico 6. European Brake Line Market (2023-2029) 6.1. European Brake Line Market, by Product Type (2023-2029) 6.2. European Brake Line Market Size, by Vehicle Type (2023-2029) 6.3. European Brake Line Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Brake Line Market (2023-2029) 7.1. Asia Pacific Brake Line Market, by Product Type (2023-2029) 7.2. Asia Pacific Brake Line Market Size, by Vehicle Type (2023-2029) 7.3. Asia Pacific Brake Line Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Brake Line Market (2023-2029) 8.1. The Middle East and Africa Brake Line Market, by Product type (2023-2029) 8.2. The Middle East and Africa America Brake Line Market Size, by Vehicle Type (2023-2029) 8.3. The Middle East and Africa Brake Line Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Brake Line Market (2023-2029) 9.1. Latin America Brake Line Market, by Product Type (2023-2029) 9.2. Latin America Brake Line Market Size, by Vehicle Type (2023-2029) 9.3. Latin America Brake Line Market, by Country (2023-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Continental AG 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Carlisle Brake & Friction 10.3. FTE Automotive 10.4. Sumitomo Riko Co. Ltd 10.5. BrakeQuip 10.6. Continental AG 10.7. Gates Corporation 10.8. Hutchinson SA 10.9. Yokohama Rubber Co., Ltd. 10.10. Bosch 10.11. Delphi 10.12. Hitachi 10.13. ValeoATE Brakes 10.14. Advice co. Ltd 10.15. Brembo SpA 10.16. Akebono Brake industry