The Bus Market size was valued at USD 20.15 Billion in 2025 and the total Bus revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 35.68 Billion by 2032.Bus Market Overview

The global market has been experiencing rapid growth over the years. The growing urbanization, growing population and the need for sustainable transportation solutions are majorly increasing the demand for buses. The Factors such as government initiatives, infrastructure development and economic conditions in different regions influence the market size. The bus market report includes a detailed analysis of the market size and share with segment-wise and region-wise market dynamics including growth drivers, major restraints, future opportunities and upcoming challenges.To know about the Research Methodology :- Request Free Sample Report

Bus Market Dynamics

Increasing investments in the bus market Compared to rail investment, the improvement of bus-based public transport has been considered a more cost-effective option. There have been many investment programs that targeted urban bus service development. The governments, public transportation agencies and private companies are highly investing in the development of electric buses and charging infrastructure. For example – Recently Proterra secured USD 200 million investment from Cowen Sustainable Advisors along with supporting investments from Soros Fund Management, Generation Investment Management, and Broadscale Group. The investments in the bus infrastructure such as bus depots, terminals and charging stations are increasing, which is driving the growth of the market. As the demand for buses is increasing, the need for adequate infrastructure to support their operations is also increasing. The ambitious plan aimed to introduce Sky Bus technology in India commenced with the picturesque state of Goa, allocating a projected budget of USD 11.99 Mn. The initial phase was designed to establish a 10.5 km inaugural route connecting Mapusa to Panaji. As of 2023, operational Sky Bus systems are operational in countries such as Japan, Germany, China, and the USA, where they are commonly referred to as suspended monorail systems. This kind of advancements to drive the market in the future. Rising trend of electric buses to drive the bus market growth As per the research, the Electric Bus Market is expected to grow rapidly during the forecast period. The increasing emphasis on reducing greenhouse gas emissions and improving air quality is resulting in an increase in demand for electric buses. Governments are also implementing favorable policies and regulations including financial incentives, subsidies, tax credits and grants to accelerate the adoption of electric buses. Compared to diesel or gasoline buses, electric buses offer lower operating costs. They require less maintenance and have fewer moving parts, which results in reduced servicing expenses. By eliminating tailpipe emissions, they reduce air pollution and contribute to improved public health and well-being. Electric Buses provide a more comfortable and pleasant commuting experience for passengers by operating quietly, which results in a reduction in noise pollution in urban environments. Hence all these benefits associated with the use of electric buses are increasing the demand for them across the world.Private demand for bus slowly increasing The private demand for buses is increasing slowly in various contexts. Many companies and organizations demand buses to provide transportation services to their employees. Buses are also often demanded for event transportation such as sports events, corporate events, weddings and concerts because they transport large groups of people comfortably by eliminating the need for multiple vehicles. The demand for luxury and specialty buses has also increased for private use. Buses are commonly used for airport transfer for majorly shuttling passengers between airports and hotels. These are the main factors contributing to the growth of the private bus market. An increase in orders for zero-emission vehicles, especially electric buses, contributes to the high demand for transit buses. At the end of April 2022, NFI Group Inc had a backlog of 8908 vehicles that had been ordered but not produced, valued at USD 4.9 billion. That includes zero-emission buses or 17% of the orders. The active bids are up 21% y-o-y while zero-emission buses represent 43% of total bids. Traffic congestion and fluctuating fuel prices restraining the global bus market growth Traffic congestion in urban areas is significantly affecting the efficiency and reliability of bus services. Delays caused due to heavy traffic is discouraging people from using buses, which is expected to lead to a decreased demand for buses in the future. Insufficient or poorly maintained bus terminals, stops and depots are affecting the attractiveness of bus services. This is expected to hamper the growth of the bus market. Fluctuations in fuel prices impact the operational expenses of bus operators. Higher fuel costs strain profit margins, making it difficult to maintain affordable fares and invest in technologies.

Bus Market Regional Insights

Asia Pacific Bus Market dominated the global market in 2025. The regional market is mainly driven by the growing population, rapid urbanization, increasing demand for public transportation and government initiatives to improve mobility and reduce emissions. In the region, China is the largest market majorly driven by its large population and big population. The presence of companies such as Yutong, BYD, and King Long in the country holds significant market shares. India is another country holding a major share of the market, which is dominated by domestic manufacturers such as Tata Motors, Ashok Leyland, and Mahindra & Mahindra. The market in the country is driven by public transportation, school buses and intercity travel. South Korean bus manufacturers are majorly focusing on developing advanced buses with improved fuel efficiency and reduced emissions. The European Bus Market also held the major share in 2025 and is expected to grow rapidly during the forecast period. The region has a well-developed public transportation infrastructure and buses play a major role in providing efficient and sustainable mobility solutions. The European Union has set stringent emission standards and regulations for buses, which aim to reduce greenhouse gas emissions and improve air quality. These regulations such as the Euro emission standards have pushed bus manufacturers to develop clean and fuel-efficient vehicles. The demand for electric and hybrid buses increasing in Europe due to environmental regulations and a major focus on sustainable transportation. Germany held the major share of the regional market and is well-known for its high-quality buses including city buses, intercity buses and coaches. The Bus Market in North America is also expected to grow rapidly because buses serve as the backbone of public transportation systems in many cities. Electric buses are gaining popularity in the region as cities and transit agencies aim to reduce carbon emissions. Greyhound, the largest provider of intercity bus transportation seamlessly links numerous communities throughout North America, offering a blend of convenience, comfort, and budget-friendly bus travel. Boasting an extensive network of nearly 2,300 destinations across the United States, Canada, and Mexico, Greyhound buses empowers their customers’ journey on their terms—from major metropolises like New York, Chicago, and Atlanta to smaller hubs such as Omaha, El Paso, and Albany. Regardless of size, we're here to cater to your travel needs. This kind of initiatives and advancements highly contributes to the regional market growth. The U.S. electric bus market highly contributes to the growth of total regional market. In the United States, school districts have started the transition to electric school buses (ESBs). In March 2022, 415 districts committed to the use of 12,275 ESBs across 38 states and a range of operating conditions. Electrification goals are being set by states and municipalities while manufacturers scale production. Compressed Natural Gas (CNG) and propane-powered buses are popular choices because they offer clean and quiet transportation options.Bus Market Segment Analysis

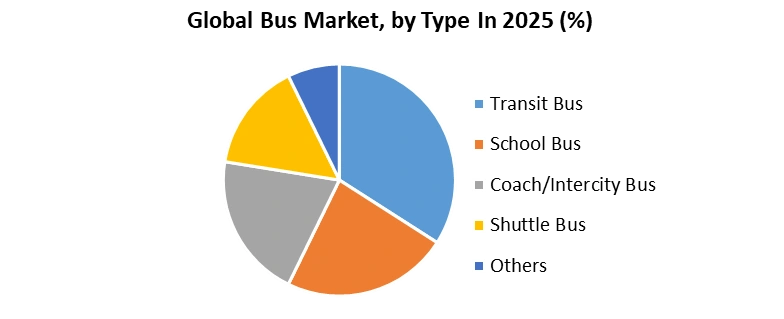

Based on Type, the transit bus segment dominated the bus market because of increasing urbanization, rising public transportation demand, and government initiatives promoting sustainable mobility in 2025. Cities global invested heavily in expanding and modernizing public transit fleets to reduce traffic congestion and lower carbon emissions. The growing shift towards electric and hybrid buses further boosted the transit bus segment, as governments implemented stricter emission regulations and provided subsidies for clean energy transportation. Additionally, advancements in smart transit systems, including real-time tracking and improved passenger comfort, increased ridership. Developing economies, especially in Asia-Pacific, played a key role in this growth, with countries like China and India expanding their public bus networks. As cities continue prioritizing efficient and eco-friendly transportation solutions, the transit bus segment remains the largest and fastest-growing in the market.

Bus Market Competitive Landscape

This section of the report includes strengths, weaknesses, opportunities and threats of the Bus key competitors with a detailed analysis of joint ventures, collaborations, mergers, acquisitions and new product launches.Mostly bus manufacturers collaborate with suppliers to ensure the availability of high-quality components. These collaborations involve supply chain partnerships, joint development efforts to optimize the manufacturing process and enhance product offerings. For example – In March 2021, Proterra who is an electric bus manufacturer collaborated with LG Energy Solutions, a major supplier of lithium-ion batteries. Manufacturers also collaborate with technology companies to integrate advanced technology into buses such as autonomous driving capabilities, electric propulsion bus systems and connectivity solutions. For example – To develop electric and autonomous buses, Volvo Buses collaborated with many technology partners. Public transportation agencies also collaborate with bus manufacturers frequently to improve transportation services. For example – In June 2021, Proterra collaborated with Miami-Dade County’s Department of Transportation and Public Works. In February 2023, FirstGroup showed its interest in purchasing both the bus services and bus dealer operations of Purfleet-based Ensignbus. On 29 May 2023, the BYD and Castrosua launched their first jointly manufactured eBus in an official ceremony held in Santiago de Compostela.Bus Market Scope: Inquire Before Buying

Global Bus Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 20.15 Bn Forecast Period 2026 to 2032 CAGR: 8.5% Market Size in 2032: USD 35.68 Bn Segments Covered: by Type Transit Bus School Bus Coach/Intercity Bus Shuttle Bus Others by Fuel Type Petrol Diesel Electric Others by Seat Capacity 15-30 Seats 31-50 Seats More than 50 Seats Bus Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Bus Market, Key Players are

1. Ashok Leyland 2. Tata Motors Limited 3. Anhui Ankai Automobile Co. Ltd 4. BYD Company Limited 5. Alexander Dennis 6. King Long United Automotive Industry Co. Ltd. 7. Yutong Bus Co., Ltd. 8. Zhongtong Bus Holding Co. Ltd 9. NFI Group Inc. 10. AB Volvo 11. Solaris Bus 12. Daimler Truck Holding AG 13. Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd 14. Mercedes-Benz Group AG 15. New Flyer Industries 16. Mahindra & Mahindra 17. Proterra 18. VDL Bus & Coach 19. JBM Group 20. Otokar 21. Temsa 22. Traton Group (Volkswagen AG) 23. SML ISUZU Ltd. 24. Ebusco 25. Irizar Group 26. Others Key Players Frequently Asked Questions 1] What is the expected CAGR of the Global Bus Market during the forecast period? Ans. During the forecast period, the Global Bus Market is expected to grow at a CAGR of 7.1 percent. 2] What was the Bus Market size in 2025? Ans. USD 20.15 Bn was the Bus Chassis Market size in 2025. 3] What is the expected Bus Market size by 2032? Ans. USD 35.68 Bn is the expected Bus Market size by 2032. 4] What are the Bus Market segments? Ans. The market is divided by Type, Seating Capacity, Fuel Type, Application, Distribution Channel and Sales Channel. 5] Which regional Bus Market is expected to grow at a high rate during the forecast period? Ans. The Bus Market of Asia Pacific is expected to grow at a high rate during the forecast period.

1. Bus Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2025-2032), 1.1.2. Market Size (Value and Volume) and Market Share (%) - By Segments, Regions and Country 2. Global Bus Market: Competitive Landscape 2.1. Industry Ecosystem 2.2. MMR Competition Matrix 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Market Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.6 Key Opinion Leader Analysis For the Global Bus Industry 3.7 Government schemes and initiatives for the Bus Market 3.8 Technological Roadmap 3.9 Supply Chain Analysis 4. Technology & Innovation 4.1 Evolution of Electric Bus Technologies 4.2 Technological Integration for Passenger Comfort and Safety 4.3 Role of Artificial Intelligence in Fleet Management 4.4 Innovations in Bus Design 4.5 Rise of Electric and Hybrid Buses 4.6 Smart Bus Infrastructure 5. Regulatory Environment & Policies 5.1 Global Regulatory Landscape for Bus Emissions 5.2 Government Policies Promoting Clean Transportation (Electric, Hybrid, Hydrogen) 5.3 Public Transit Subsidies and Funding Programs 5.4 Compliance with Safety and Accessibility Standards (ADA, ISO) 5.5 Local Regulations and Smart City Integration 5.6 Sustainability and Green Initiatives in the Bus Sector 5.7 Government Regulations Impacting the Bus Market 5.8 Emission Standards and Environmental Policies 6 Consumer Insights By Region 6.1 Changing Consumer Preferences Toward Eco-Friendly Buses 6.2 Impact of Urbanization and Population Growth on Bus Demand 6.3 Demand for High-Comfort, Low-Emission Public Transport Solutions 6.4 Analysis of Consumer Sentiment Toward Electric and Autonomous Buses 6.5 Public Perception of Bus Safety and Security 6.6 Role of Bus Services in Enhancing Urban Mobility 7 Bus Market: Global Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Units) (2025-2032) 7.1 Bus Market Size and Forecast, By Type (2025-2032) 7.1.1 Transit Bus 7.1.2 School Bus 7.1.3 Coach/Intercity Bus 7.1.4 Shuttle Bus 7.1.5 Others 7.2 Bus Market Size and Forecast, By Fuel Type (2025-2032) 7.2.1 Petrol 7.2.2 Diesel 7.2.3 Electric 7.2.4 Others 7.3 Bus Market Size and Forecast, By Seat Capacity (2025-2032) 7.3.1 15-30 Seats 7.3.2 31-50 Seats 7.3.3 More than 50 Seats 7.4 Bus Market Size and Forecast, By Region(2025-2032) 7.4.1 North America 7.4.2 Europe 7.4.3 Asia Pacific 7.4.4 South America 7.4.5 MEA 8 North America Bus Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Units) (2025-2032) 8.1 North America Bus Market Size and Forecast, By Type (2025-2032) 8.1.1 Transit Bus 8.1.2 School Bus 8.1.3 Coach/Intercity Bus 8.1.4 Shuttle Bus 8.1.5 Others 8.2 North America Bus Market Size and Forecast, By Fuel Type (2025-2032) 8.2.1 Petrol 8.2.2 Diesel 8.2.3 Electric 8.2.4 Others 8.3 North America Bus Market Size and Forecast, By Seat Capacity (2025-2032) 8.3.1 15-30 Seats 8.3.2 31-50 Seats 8.3.3 More than 50 Seats 8.4 North America Bus Market Size and Forecast, By Country (2025-2032) 8.4.1 United States 8.4.1.1 United States Bus Market Size and Forecast, By Type (2025-2032) 8.4.1.1.1 Transit Bus 8.4.1.1.2 School Bus 8.4.1.1.3 Coach/Intercity Bus 8.4.1.1.4 Shuttle Bus 8.4.1.1.5 Others 8.4.1.2 United States Bus Market Size and Forecast, By Fuel Type (2025-2032) 8.4.1.2.1 Petrol 8.4.1.2.2 Diesel 8.4.1.2.3 Electric 8.4.1.2.4 Others 8.4.1.3 United States Bus Market Size and Forecast, By Seat Capacity (2025-2032) 8.4.1.3.1 15-30 Seats 8.4.1.3.2 31-50 Seats 8.4.1.3.3 More than 50 Seats 8.4.2 Canada 8.4.2.1 Canada Bus Market Size and Forecast, By Type (2025-2032) 8.4.2.1.1 Transit Bus 8.4.2.1.2 School Bus 8.4.2.1.3 Coach/Intercity Bus 8.4.2.1.4 Shuttle Bus 8.4.2.1.5 Others 8.4.2.2 Canada Bus Market Size and Forecast, By Fuel Type (2025-2032) 8.4.2.2.1 Petrol 8.4.2.2.2 Diesel 8.4.2.2.3 Electric 8.4.2.2.4 Others 8.4.2.3 Canada Bus Market Size and Forecast, By Seat Capacity (2025-2032) 8.4.2.3.1 15-30 Seats 8.4.2.3.2 31-50 Seats 8.4.2.3.3 More than 50 Seats 8.4.3 Mexico 8.4.3.1 Mexico Bus Market Size and Forecast, By Type (2025-2032) 8.4.3.1.1 Transit Bus 8.4.3.1.2 School Bus 8.4.3.1.3 Coach/Intercity Bus 8.4.3.1.4 Shuttle Bus 8.4.3.1.5 Others 8.4.3.2 Mexico Bus Market Size and Forecast, By Fuel Type (2025-2032) 8.4.3.2.1 Petrol 8.4.3.2.2 Diesel 8.4.3.2.3 Electric 8.4.3.2.4 Others 8.4.3.3 Mexico Bus Market Size and Forecast, By Seat Capacity (2025-2032) 8.4.3.3.1 15-30 Seats 8.4.3.3.2 31-50 Seats 8.4.3.3.3 More than 50 Seats 9 Europe Bus Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Units) (2025-2032) 9.1 Europe Bus Market Size and Forecast, By Type (2025-2032) 9.2 Europe Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.3 Europe Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4 Europe Bus Market Size and Forecast, By Country (2025-2032) 9.4.1 United Kingdom 9.4.1.1 United Kingdom Bus Market Size and Forecast, By Type (2025-2032) 9.4.1.2 United Kingdom Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.1.3 United Kingdom Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.2 France 9.4.2.1 France Bus Market Size and Forecast, By Type (2025-2032) 9.4.2.2 France Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.2.3 France Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.3 Germany 9.4.3.1 Germany Bus Market Size and Forecast, By Type (2025-2032) 9.4.3.2 Germany Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.3.3 Germany Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.4 Italy 9.4.4.1 Italy Bus Market Size and Forecast, By Type (2025-2032) 9.4.4.2 Italy Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.4.3 Italy Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.5 Spain 9.4.5.1 Spain Bus Market Size and Forecast, By Type (2025-2032) 9.4.5.2 Spain Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.5.3 Spain Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.6 Sweden 9.4.6.1 Sweden Bus Market Size and Forecast, By Type (2025-2032) 9.4.6.2 Sweden Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.6.3 Sweden Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.7 Austria 9.4.7.1 Austria Bus Market Size and Forecast, By Type (2025-2032) 9.4.7.2 Austria Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.7.3 Austria Bus Market Size and Forecast, By Seat Capacity (2025-2032) 9.4.8 Rest of Europe 9.4.8.1 Rest of Europe Bus Market Size and Forecast, By Type (2025-2032) 9.4.8.2 Rest of Europe Bus Market Size and Forecast, By Fuel Type (2025-2032) 9.4.8.3 Rest of Europe Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10 Asia Pacific Bus Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Units) (2025-2032) 10.1 Asia Pacific Bus Market Size and Forecast, By Type (2025-2032) 10.2 Asia Pacific Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.3 Asia Pacific Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4 Asia Pacific Bus Market Size and Forecast, By Country (2025-2032) 10.4.1 China 10.4.1.1 China Bus Market Size and Forecast, By Type (2025-2032) 10.4.1.2 China Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.1.3 China Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.2 S Korea 10.4.2.1 S Korea Bus Market Size and Forecast, By Type (2025-2032) 10.4.2.2 S Korea Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.2.3 S Korea Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.3 Japan 10.4.3.1 Japan Bus Market Size and Forecast, By Type (2025-2032) 10.4.3.2 Japan Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.3.3 Japan Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.4 India 10.4.4.1 India Bus Market Size and Forecast, By Type (2025-2032) 10.4.4.2 India Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.4.3 India Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.5 Australia 10.4.5.1 Australia Bus Market Size and Forecast, By Type (2025-2032) 10.4.5.2 Australia Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.5.3 Australia Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.6 Malaysia 10.4.6.1 Malaysia Bus Market Size and Forecast, By Type (2025-2032) 10.4.6.2 Malaysia Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.6.3 Malaysia Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.7 Vietnam 10.4.7.1 Vietnam Bus Market Size and Forecast, By Type (2025-2032) 10.4.7.2 Vietnam Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.7.3 Vietnam Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.8 Thailand 10.4.8.1 Thailand Bus Market Size and Forecast, By Type (2025-2032) 10.4.8.2 Thailand Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.8.3 Thailand Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.9 Indonesia 10.4.9.1 Indonesia Bus Market Size and Forecast, By Type (2025-2032) 10.4.9.2 Indonesia Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.9.3 Indonesia Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.10 Philippines 10.4.10.1 Philippines Bus Market Size and Forecast, By Type (2025-2032) 10.4.10.2 Philippines Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.10.3 Philippines Bus Market Size and Forecast, By Seat Capacity (2025-2032) 10.4.11 Rest of Asia Pacific 10.4.11.1 Rest of Asia Pacific Bus Market Size and Forecast, By Type (2025-2032) 10.4.11.2 Rest of Asia Pacific Bus Market Size and Forecast, By Fuel Type (2025-2032) 10.4.11.3 Rest of Asia Pacific Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11 South America Bus Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Units) (2025-2032) 11.1 South America Bus Market Size and Forecast, By Type (2025-2032) 11.2 South America Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.3 South America Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11.4 South America Bus Market Size and Forecast, By Country (2025-2032) 11.4.1 Brazil 11.4.1.1 Brazil Bus Market Size and Forecast, By Type (2025-2032) 11.4.1.2 Brazil Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.4.1.3 Brazil Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11.4.2 Argentina 11.4.2.1 Argentina Bus Market Size and Forecast, By Type (2025-2032) 11.4.2.2 Argentina Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.4.2.3 Argentina Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11.4.3 Colombia 11.4.3.1 Colombia Bus Market Size and Forecast, By Type (2025-2032) 11.4.3.2 Colombia Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.4.3.3 Colombia Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11.4.4 Chile 11.4.4.1 Chile Bus Market Size and Forecast, By Type (2025-2032) 11.4.4.2 Chile Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.4.4.3 Chile Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11.4.5 Peru 11.4.5.1 Peru Bus Market Size and Forecast, By Type (2025-2032) 11.4.5.2 Peru Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.4.5.3 Peru Bus Market Size and Forecast, By Seat Capacity (2025-2032) 11.4.6 Rest Of South America 11.4.6.1 Rest Of South America Bus Market Size and Forecast, By Type (2025-2032) 11.4.6.2 Rest Of South America Bus Market Size and Forecast, By Fuel Type (2025-2032) 11.4.6.3 Rest Of South America Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12 Middle East and Africa Bus Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Units) (2025-2032) 12.1 Middle East and Africa Bus Market Size and Forecast, By Type (2025-2032) 12.2 Middle East and Africa Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.3 Middle East and Africa Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12.4 Middle East and Africa Bus Market Size and Forecast, By Country (2025-2032) 12.4.1 South Africa 12.4.1.1 South Africa Bus Market Size and Forecast, By Type (2025-2032) 12.4.1.2 South Africa Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.4.1.3 South Africa Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12.4.2 GCC 12.4.2.1 GCC Bus Market Size and Forecast, By Type (2025-2032) 12.4.2.2 GCC Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.4.2.3 GCC Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12.4.3 Nigeria 12.4.3.1 Nigeria Bus Market Size and Forecast, By Type (2025-2032) 12.4.3.2 Nigeria Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.4.3.3 Nigeria Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12.4.4 Egypt 12.4.4.1 Egypt Bus Market Size and Forecast, By Type (2025-2032) 12.4.4.2 Egypt Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.4.4.3 Egypt Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12.4.5 Turkey 12.4.5.1 Turkey Bus Market Size and Forecast, By Type (2025-2032) 12.4.5.2 Turkey Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.4.5.3 Turkey Bus Market Size and Forecast, By Seat Capacity (2025-2032) 12.4.6 Rest Of MEA 12.4.6.1 Rest Of MEA Bus Market Size and Forecast, By Type (2025-2032) 12.4.6.2 Rest Of MEA Bus Market Size and Forecast, By Fuel Type (2025-2032) 12.4.6.3 Rest Of MEA Bus Market Size and Forecast, By Seat Capacity (2025-2032) 13 Company Profile: Key Players 13.1 Ashok Leyland 13.1.1 Company Overview 13.1.2 Business Portfolio 13.1.3 Financial Overview 13.1.4 SWOT Analysis (Technological strengths and weaknesses) 13.1.5 Strategic Analysis (Recent strategic moves) 13.1.6 Recent Developments 13.2 Tata Motors Limited 13.3 Anhui Ankai Automobile Co. Ltd 13.4 BYD Company Limited 13.5 Alexander Dennis 13.6 King Long United Automotive Industry Co. Ltd. 13.7 Yutong Bus Co., Ltd. 13.8 Zhongtong Bus Holding Co. Ltd 13.9 NFI Group Inc. 13.10 AB Volvo 13.11 Solaris Bus 13.12 Daimler Truck Holding AG 13.13 Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd 13.14 Mercedes-Benz Group AG 13.15 New Flyer Industries 13.16 Mahindra & Mahindra 13.17 Proterra 13.18 VDL Bus & Coach 13.19 JBM Group 13.20 Otokar 13.21 Temsa 13.22 Traton Group (Volkswagen AG) 13.23 SML ISUZU Ltd. 13.24 Ebusco 13.25 Irizar Group 13.26 Others Key Players 14 Key Findings 15 Analyst Recommendations 16 Bus Market – Research Methodology