The Van Market size was valued at USD 164.70 Billion in 2024 and the total Van revenue is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 223.67 Billion.Van Market Overview:

A vehicle used to transport cargo. It is frequently bigger than a car but smaller than a truck, with an enclosed rear and no side windows. A van's interior space is optimized to be longer and taller than a car while remaining smaller than a truck. Vans often have a taller roof, reconfigurable seats, a flat floor, and sliding doors for the back entry. Furthermore, the driver's sitting arrangements maximize internal space, making it seem more comfortable and spacious. The majority of vans can comfortably accommodate 15 passengers without luggage. Vans can also be utilized to carry students to and from school. In India, for example, the van is one of the most prevalent vehicles for carrying schoolchildren, generally when the school buses are full. Therefore, it is expected that the need for vans to transport schoolchildren would rise in the near future, propelling the growth of the global van market. Regarding current automotive technology and driver assistance features, vans remain behind SUVs and utility vehicles. Due to the engine location, there is substantially less of a crush zone in front of the driver, making it more challenging for a van to receive a 5-star ANCAP crash test rating for driver and passenger safety, which is more challenging for van OMEs. The report covered detailed analyses of van oppurchinity and market strategies to drive the van market.To know about the Research Methodology :- Request Free Sample Report

Van Market Dynamics:

CO2 emission standards for new cars and vans The three main goals of the legislative proposal to amend Regulation 2019/631, which establishes CO2 emission performance criteria for automobiles and light commercial vehicles, are: 1. Reduce CO2 emissions from cars and vans in order to help the country meet its climate goals for the years 2030 and 2050, keeping in mind the need of taking action quickly due to the short lifespan of these vehicles, 2. assist residents through the widespread use of zero-emission cars by improving air quality, conserving energy, and lowering the overall cost of ownership of such vehicles, 3. promote employment, boost the technological leadership of all country manufacturers and suppliers, and encourage the development of zero-emission technology.By establishing more demanding rules for decreasing the CO2 emissions of new vehicles and vans, the proposal modifies Regulation 2019/631. The emissions of new passenger vehicles registered in the country would need to be 55% lower by 2030 compared to the CO2 emissions standards applicable in 2023, and the emissions of new vans registered in the countries would need to be 50% lower. New passenger cars and vans would have to cut their CO2 emissions by 100% by 2035 or have zero emissions altogether. Beginning in 2030, the incentive for zero- and low-emission cars would no longer be available. Only manufacturers with less than 1000 new vehicle registrations each year will be eligible to request a derogation from the specified emissions goal as of 2030. In 2029, the exemption for manufacturers producing between 1,000 and 10,000 automobiles or between 1,000 and 22,000 vans will come to an end. CO2 reduction targets in the current and proposed legislationCommercial van market growth creates new equipment opportunities to market players According to data on commercial van sales provided by the NTEA (National Truck Equipment Association), these sales are on the rise and are increasing year over year. Sales of commercial vans increased by 56.7% from 2013 to 2019. With such steady growth, also manufacturers have increased their product lines and now offer customers a variety of commercial and cargo van alternatives, including different van chassis, heights, engines, and drivetrains. Commercial cargo van-specific equipment has been added to the product ranges of manufacturers of commercial vehicle equipment, which drive the demand of van equipments in van market.

For example, Ford and GM remade themselves and emerged from the recession by changing their product lines to meet new market demands. The producers turned to Europe and identified an excellent chance to introduce commercial vehicles designed in Europe to North America. In North America, demand for commercial vehicles has grown. Their popularity peaked in 2012 and has continued to grow ever since. OEMs have been identified by the National Truck Equipment Association (NTEA) as producers of commercial vans: Ford, GM, Mercedes-Benz/Freightliner, Dodge Ram, and Nissan. With rising opportunity and demand for mobile air compressors for business vans, air compressor manufacturers have been slow to adapt their products for this popular kind of commercial vehicle, rapid adoption of this creat new opportunities for market players in the van market.

Van Market Segment Analysis:

Based on Type, the Van Market is segmented into Battery electric vehicles, Plug-in hybrid electric vehicles, hybrid electric vehicles, Internal combustion engine vehicles, and Gasoline vehicles. Battery-electric vehicles are expected to grow faster during the forecast period. All LCV categories had a decline in registrations in July, with 14,782 new vans weighing above 2.5 tonnes and up to 3.5 tonnes being registered in the month, a -11.2% decrease from 2022. The number of lighter vehicles weighing 2.0 tonnes or less fell by 20.3%, while the number of vans weighing between 2.0 tonnes and 2.5 tonnes fell by 49.8%. With continued industry investment in battery-electric vans (BEVs), demand is rising. In July, 765 BEVs were registered, an increase of 21.2%. This trend of increased uptake will continue in the first half of 2022 as van buyers take advantage of new electric models that offer longer ranges, efficiency savings, and quick charge times. As a result, 8,865 BEVs—a 55.7% increase—have been reported thus far this year. This is an increase from one in 37 a year earlier, but it still only accounts for one in 18 of all vans registered so far in 2023. The industry prognosis has been reduced from 328,000 to 307,000 new registrations for the year due to the continued weakness in overall registration volumes, a decrease of -6.5% from the previous outlook released in April. The market is now expected to end -13.7% lower than in 2022, when penetration nearly reached pre-pandemic levels. 4 Volumes are forecast to reach 357,000 units in 2023, a 16.4% increase, as the semiconductor scarcity is anticipated to start to improve during that year. BEVs are still expected to make up 6.4% of registrations this year, but the forecast for 2023 has been significantly revised lower, from 9.6% to 9.2%.Based on the Application, the Van Market is segmented into Up to 2 Tons, 2-3 Tons, 3-5.5 Tons. 2-3 Tons are expected to grow faster during the forecast period. Pick-up trucks, commercial 4x4s, and various sizes of vans are all included in the market for light commercial vehicles that weigh up to 3.5 tonnes. Despite sales falling by just under 10%, vans weighing between 2.5 and 3.5 tonnes continued to account for the majority of new registrations, making up just under two-thirds (65.8%) of the market overall. The second-most popular vehicles on the market were vans weighing between two and 2.5 tonnes, although they only made up around a fourth of all purchases (24.9 percent). That followed a sector increase of more than a third from the same month in 2022. Light commercial vehicle (LCV) vans with a tonnage of less than 2.5 tons is heavily used to transport goods across shorter or closer distances, driven by the growing demand for products from e-commerce. The expansion of the industrial sector in developing countries, rising demand from the logistics sector, and expanding demand from the global construction sector are all driving the market development in the 2.5 tons category.

Van Market Regional Insights:

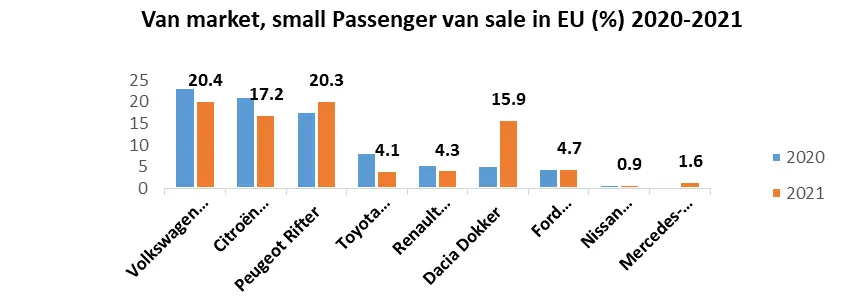

Europe dominated the market with a 56 % share in 2024. Europe is expected to witness significant growth during for the cast period. Van sales in Europe saw a marked decline, which may be mainly attributable to supply chain disruptions, a stop in manufacturing, and decreased customer demand as a result of falling purchasing power. The tendency of consumers toward online shopping and the availability of user-friendly mobile applications for the online purchase of a range of items, including industrial goods, have been the main drivers of the e-commerce industry's growth in Europe during the past few years. The need for vans for last-mile deliveries of products and commodities is probably going to rise as a result. In 2022 compared to 2020, the European e-commerce sector's revenue increased by roughly 10%. In the European transportation industry, road travel is essential. For example, road transportation, or around 1,750 billion metric ton-kilometers, accounts for almost 75% of inland freight movement inside the EU, according to Eurostat. In certain European countries, this ratio might be as high as 90%. The market is seeing significant growth as a result of the growing commercial relationships between regional parcel service providers and original equipment manufacturers. FedEx and BrightDrop, a division of General Motors, teamed together in January 2023 to provide the latter with vehicles for its home delivery service. The van market in Europe is quite competitive. Major OEMs' presence in the area is expected to drive the market's growth. Mercedes Benz, Volkswagen Group, Ford Motor Company, and Vauxhall are among the market's major competitors. New entrants like Arrival Electric Group Limited also serve the demands of the region's electric van market. The report covered detailed analyses of the current van market in Europe with key market players’ sales in 2023-2024.

Competitive Landscape

The van market is very competitive. Major OEMs' presence in the region is expected to drive the market's growth. Mercedes Benz, Volkswagen Group, Ford Motor Company, and Vauxhall are among the market's major competitors. New entrants like Arrival Electric Group Limited also service the demands of the region's van market. The adoption of electric cars is extremely obvious in many growing economies due to the significant growth among sectors, such as logistics and supply chain companies. Additionally, the strict pollution regulations that are forcing many companies to electrify their automobiles throughout the globe also play a significant part in the market's development. For example, the company introduced the new Renault Kangoo Van in 2022, effectively addressing the sizable European van market, and gaining an advantage over competitors. Renault began taking bookings for the new Traffic van in March 2022, and sales will begin at the end of the year. The van's entirely rebuilt interior and cabin are expected to provide the highest level of functionality and mobile connectivity. For long-haul travel reasons, the vehicle also has updated ADAS features. Volkswagen and Ford Motor Company announced their partnership in June 2020 as part of their present worldwide alliance for light commercial vans, electrification of vans, and autonomous driving. The van market report covered a detailed competitive landscape, which provides details by a competitor like a company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths, and weaknesses, product launch, product width, and breadth, application dominance.Van Market Scope: Inquiry Before Buying

Van Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 164.70 Bn. Forecast Period 2025 to 2032 CAGR: 3.9 % Market Size in 2032: USD 223.67 Bn. Segments Covered: by Tonnage Capacity Up to 2 Tons 2-3 Tons 3-5.5 Tons by Propulsion Type Battery electric vehicle Plug-in hybrid electric vehicle Hybride electric vehicle Internal combustion engine vehicle Gasoline Vehicle by End Use Commercial Personal Van Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Van Market, Key Players are:

1.Toyota 2. Volkswagen Group 3.Hyundai / Kia 4.General Motors 5.Ford 6.Nissan 7. Honda 8.FCA 9. Renault 10.Groupe PSA 11. Suzuki 12.SAIC 13.Daimler 14. BMW 15. Geely 16.Changan 17. Mazda 18. Dongfeng Motor 19. BAIC 20. Mitsubishi Frequently Asked Questions: 1] What segments are covered in the Global Van Market report? Ans. The segments covered in the Van Market report are based on Product Type and End User. 2] Which region is expected to hold the highest share in the Global Van Market? Ans. The Europe region is expected to hold the highest share in the Van Market. 3] What is the market size of the Global Van Market by 2032? Ans. The market size of the Van Market by 2032 is expected to reach USD 223.67 Bn. 4] What is the forecast period for the Global Van Market? Ans. The forecast period for the Van Market is 2025-2032. 5] What was the Global Van Market size in 2024? Ans: The Global Van Market size was USD 164.70 Billion in 2024.

1. Van Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Van Market: Dynamics 2.1. Van Market Trends by Region 2.1.1. North America Van Market Trends 2.1.2. Europe Van Market Trends 2.1.3. Asia Pacific Van Market Trends 2.1.4. Middle East and Africa Van Market Trends 2.1.5. South America Van Market Trends 2.2. Van Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Van Market Drivers 2.2.1.2. North America Van Market Restraints 2.2.1.3. North America Van Market Opportunities 2.2.1.4. North America Van Market Challenges 2.2.2. Europe 2.2.2.1. Europe Van Market Drivers 2.2.2.2. Europe Van Market Restraints 2.2.2.3. Europe Van Market Opportunities 2.2.2.4. Europe Van Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Van Market Drivers 2.2.3.2. Asia Pacific Van Market Restraints 2.2.3.3. Asia Pacific Van Market Opportunities 2.2.3.4. Asia Pacific Van Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Van Market Drivers 2.2.4.2. Middle East and Africa Van Market Restraints 2.2.4.3. Middle East and Africa Van Market Opportunities 2.2.4.4. Middle East and Africa Van Market Challenges 2.2.5. South America 2.2.5.1. South America Van Market Drivers 2.2.5.2. South America Van Market Restraints 2.2.5.3. South America Van Market Opportunities 2.2.5.4. South America Van Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Van Industry 2.8. Analysis of Government Schemes and Initiatives For Van Industry 2.9. Van Market Trade Analysis 2.10. The Global Pandemic Impact on Van Market 3. Van Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 3.1.1. Up to 2 Tons 3.1.2. 2-3 Tons 3.1.3. 3-5.5 Tons 3.2. Van Market Size and Forecast, by Propulsion Type (2024-2032) 3.2.1. Battery electric vehicle 3.2.2. Plug-in hybrid electric vehicle 3.2.3. Hybride electric vehicle 3.2.4. Internal combustion engine vehicle 3.2.5. Gasoline Vehicle 3.3. Van Market Size and Forecast, by End Use (2024-2032) 3.3.1. Commercial 3.3.2. Personal 3.4. Van Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Van Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 4.1.1. Up to 2 Tons 4.1.2. 2-3 Tons 4.1.3. 3-5.5 Tons 4.2. North America Van Market Size and Forecast, by Propulsion Type (2024-2032) 4.2.1. Battery electric vehicle 4.2.2. Plug-in hybrid electric vehicle 4.2.3. Hybride electric vehicle 4.2.4. Internal combustion engine vehicle 4.2.5. Gasoline Vehicle 4.3. North America Van Market Size and Forecast, by End Use (2024-2032) 4.3.1. Commercial 4.3.2. Personal 4.4. North America Van Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 4.4.1.1.1. Up to 2 Tons 4.4.1.1.2. 2-3 Tons 4.4.1.1.3. 3-5.5 Tons 4.4.1.2. United States Van Market Size and Forecast, by Propulsion Type (2024-2032) 4.4.1.2.1. Battery electric vehicle 4.4.1.2.2. Plug-in hybrid electric vehicle 4.4.1.2.3. Hybride electric vehicle 4.4.1.2.4. Internal combustion engine vehicle 4.4.1.2.5. Gasoline Vehicle 4.4.1.3. United States Van Market Size and Forecast, by End Use (2024-2032) 4.4.1.3.1. Commercial 4.4.1.3.2. Personal 4.4.2. Canada 4.4.2.1. Canada Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 4.4.2.1.1. Up to 2 Tons 4.4.2.1.2. 2-3 Tons 4.4.2.1.3. 3-5.5 Tons 4.4.2.2. Canada Van Market Size and Forecast, by Propulsion Type (2024-2032) 4.4.2.2.1. Battery electric vehicle 4.4.2.2.2. Plug-in hybrid electric vehicle 4.4.2.2.3. Hybride electric vehicle 4.4.2.2.4. Internal combustion engine vehicle 4.4.2.2.5. Gasoline Vehicle 4.4.2.3. Canada Van Market Size and Forecast, by End Use (2024-2032) 4.4.2.3.1. Commercial 4.4.2.3.2. Personal 4.4.3. Mexico 4.4.3.1. Mexico Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 4.4.3.1.1. Up to 2 Tons 4.4.3.1.2. 2-3 Tons 4.4.3.1.3. 3-5.5 Tons 4.4.3.2. Mexico Van Market Size and Forecast, by Propulsion Type (2024-2032) 4.4.3.2.1. Battery electric vehicle 4.4.3.2.2. Plug-in hybrid electric vehicle 4.4.3.2.3. Hybride electric vehicle 4.4.3.2.4. Internal combustion engine vehicle 4.4.3.2.5. Gasoline Vehicle 4.4.3.3. Mexico Van Market Size and Forecast, by End Use (2024-2032) 4.4.3.3.1. Commercial 4.4.3.3.2. Personal 5. Europe Van Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.2. Europe Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.3. Europe Van Market Size and Forecast, by End Use (2024-2032) 5.4. Europe Van Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.1.2. United Kingdom Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.1.3. United Kingdom Van Market Size and Forecast, by End Use (2024-2032) 5.4.2. France 5.4.2.1. France Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.2.2. France Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.2.3. France Van Market Size and Forecast, by End Use (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.3.2. Germany Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.3.3. Germany Van Market Size and Forecast, by End Use (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.4.2. Italy Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.4.3. Italy Van Market Size and Forecast, by End Use (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.5.2. Spain Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.5.3. Spain Van Market Size and Forecast, by End Use (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.6.2. Sweden Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.6.3. Sweden Van Market Size and Forecast, by End Use (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.7.2. Austria Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.7.3. Austria Van Market Size and Forecast, by End Use (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 5.4.8.2. Rest of Europe Van Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.8.3. Rest of Europe Van Market Size and Forecast, by End Use (2024-2032) 6. Asia Pacific Van Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.2. Asia Pacific Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.3. Asia Pacific Van Market Size and Forecast, by End Use (2024-2032) 6.4. Asia Pacific Van Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.1.2. China Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.1.3. China Van Market Size and Forecast, by End Use (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.2.2. S Korea Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.2.3. S Korea Van Market Size and Forecast, by End Use (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.3.2. Japan Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.3.3. Japan Van Market Size and Forecast, by End Use (2024-2032) 6.4.4. India 6.4.4.1. India Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.4.2. India Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.4.3. India Van Market Size and Forecast, by End Use (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.5.2. Australia Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.5.3. Australia Van Market Size and Forecast, by End Use (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.6.2. Indonesia Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.6.3. Indonesia Van Market Size and Forecast, by End Use (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.7.2. Malaysia Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.7.3. Malaysia Van Market Size and Forecast, by End Use (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.8.2. Vietnam Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.8.3. Vietnam Van Market Size and Forecast, by End Use (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.9.2. Taiwan Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.9.3. Taiwan Van Market Size and Forecast, by End Use (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 6.4.10.2. Rest of Asia Pacific Van Market Size and Forecast, by Propulsion Type (2024-2032) 6.4.10.3. Rest of Asia Pacific Van Market Size and Forecast, by End Use (2024-2032) 7. Middle East and Africa Van Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 7.2. Middle East and Africa Van Market Size and Forecast, by Propulsion Type (2024-2032) 7.3. Middle East and Africa Van Market Size and Forecast, by End Use (2024-2032) 7.4. Middle East and Africa Van Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 7.4.1.2. South Africa Van Market Size and Forecast, by Propulsion Type (2024-2032) 7.4.1.3. South Africa Van Market Size and Forecast, by End Use (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 7.4.2.2. GCC Van Market Size and Forecast, by Propulsion Type (2024-2032) 7.4.2.3. GCC Van Market Size and Forecast, by End Use (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 7.4.3.2. Nigeria Van Market Size and Forecast, by Propulsion Type (2024-2032) 7.4.3.3. Nigeria Van Market Size and Forecast, by End Use (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 7.4.4.2. Rest of ME&A Van Market Size and Forecast, by Propulsion Type (2024-2032) 7.4.4.3. Rest of ME&A Van Market Size and Forecast, by End Use (2024-2032) 8. South America Van Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 8.2. South America Van Market Size and Forecast, by Propulsion Type (2024-2032) 8.3. South America Van Market Size and Forecast, by End Use(2024-2032) 8.4. South America Van Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 8.4.1.2. Brazil Van Market Size and Forecast, by Propulsion Type (2024-2032) 8.4.1.3. Brazil Van Market Size and Forecast, by End Use (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 8.4.2.2. Argentina Van Market Size and Forecast, by Propulsion Type (2024-2032) 8.4.2.3. Argentina Van Market Size and Forecast, by End Use (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Van Market Size and Forecast, by Tonnage Capacity (2024-2032) 8.4.3.2. Rest Of South America Van Market Size and Forecast, by Propulsion Type (2024-2032) 8.4.3.3. Rest Of South America Van Market Size and Forecast, by End Use (2024-2032) 9. Global Van Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Van Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Toyota 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Volkswagen Group 10.3. Hyundai / Kia 10.4. General Motors 10.5. Ford 10.6. Nissan 10.7. Honda 10.8. FCA 10.9. Renault 10.10. Groupe PSA 10.11. Suzuki 10.12. SAIC 10.13. Daimler 10.14. BMW 10.15. Geely 10.16. Changan 10.17. Mazda 10.18. Dongfeng Motor 10.19. BAIC 10.20. Mitsubishi 11. Key Findings 12. Industry Recommendations 13. Van Market: Research Methodology 14. Terms and Glossary