Global Thermochromic Materials Market size was valued at USD 2.1 Bn in 2023 and is expected to reach USD 3.89 Bn by 2030, at a CAGR of 9.2 %. Thermochromic materials, prevalent in the Thermochromic Materials Market, possess a captivating quality they change color in response to temperature shifts. This incredible ability stems from two primary types: liquid crystals and leuco dyes. Liquid crystals rearrange their molecular structure with temperature changes, altering light interactions and resulting in color shifts. Leuco dyes, on the other hand, modify their chemical composition at varying temperatures, affecting their light absorption and perceived color. Their applications are diverse and practical. From temperature indicators in thermometers and smart clothing to security features in documents and packaging, these materials offer versatility. They also serve decorative purposes in items like mugs and clothing, and even find use in solar control, regulating heat and light transmittance in smart windows.To know about the Research Methodology:-Request Free Sample Report Ongoing research explores more advanced functionalities, hinting at a promising future for the Thermochromic Materials Market. This includes biocompatible materials for medical monitoring, energy harvesting from temperature fluctuations, and adaptive camouflage capabilities. The potential for innovative applications seems boundless, ensuring that thermochromic materials will continually dazzle us with their colorful transformations. The Thermochromic Materials market experiences robust growth propelled by a surging demand for smart packaging and textiles. These materials offer multifaceted benefits across various domains. They are highly instrumental in enhancing consumer safety and convenience, acting as indicators of food spoilage in packaging and regulating body temperature in textiles, thereby enhancing safety and comfort levels for end-users. the ability of thermochromic materials to offer customization and personalization in products is a key driver. These materials enable unique designs, satisfying consumer preferences for personalized items. Imagine a mug that displays a personalized design when hot or a t-shirt with a logo that changes color with mood these possibilities drive consumer interest and market growth. Sustainability is another critical aspect bolstering the market. Thermochromic materials are utilized in smart windows to save energy by regulating temperature and are being developed with biodegradable properties, contributing to eco-friendly production practices. This eco-conscious approach aligns with the growing emphasis on sustainability across various industries. Advancements in technology have significantly boosted the appeal of thermochromic materials. Newer materials exhibit improved features like faster response times, wider color ranges, and increased durability, making them more attractive for a wide array of applications. Increasing disposable incomes, particularly in the Asia-Pacific region, fuel the demand for smart products, driving market growth. The convergence of these factors, aligning with consumer preferences for convenience, personalization, and sustainability, is expected to sustain the Thermochromic Materials market's growth trajectory as technology evolves and demand intensifies for innovative solutions.

Thermochromic Materials Market Driver

Revolutionizing User Experience through Smart Packaging, Elevating Security with Advanced Authentication Features, Pioneering Sustainable Solutions In the expansive realm of the Thermochromic Materials Market, smart packaging is a transformative force. Utilizing thermochromic materials, companies like Nestle and NUK in Europe have innovated packaging solutions that offer indicators for food spoilage and temperature alerts, enhancing consumer safety and convenience. Pactiv Corporation's introduction of self-heating coffee cups in the US and Japanese researchers' color-changing materials for food safety further exemplify this revolution. Asia-Pacific, especially China and India, leads this domain, driven by their tech-forward populace, showcasing substantial adoption of smart packaging solutions. Thermochromic materials are rewriting security protocols, offering concealed information and tamper-evident indicators. Luxury brands such as Louis Vuitton rely on these materials to authenticate products, while Teva Pharmaceuticals ensures medication integrity through tamper-evident labels. In Europe, notably in Germany and Switzerland, stringent regulations drive the adoption of these advanced security features, positioning the region as a leader in deploying innovative authentication solutions within the Thermochromic Materials Market. The emergence of biodegradable thermochromic inks and pigments signifies a pivotal step towards sustainability in the Thermochromic Materials Market. These innovations cater to global sustainability objectives, providing eco-friendly alternatives that are expected to gain momentum across diverse industries, aligning with growing environmental consciousness Driving Forces Igniting Innovation: Surging Demand for Smart Packaging Solutions and Technological Advancements Propel Thermochromic Materials Market The evolution of more sophisticated and versatile thermochromic materials is steered by technological progressions. Noteworthy developments encompass improved response times, expanded color ranges, and heightened durability, rendering these materials suitable for diverse applications. In the United States, pioneers like Chromatic Technologies Inc. and Matsui International are trailblazing advancements in thermochromic inks and pigments. These innovations find application in smart packaging, where they serve as indicators for product freshness or temperature changes. Meanwhile, in Germany, entities such as the Fraunhofer Institute and IFF GmbH are pivotal in crafting advanced thermochromic materials integrated into textiles, specifically in sports apparel. These materials indicate body temperature changes and regulate ventilation, elevating their utility and practicality. The growing consumer preference for convenient and secure products is driving the surge in demand for smart packaging solutions. Thermochromic materials play a pivotal role in this domain by indicating temperature fluctuations, food spoilage, or safety alerts, ensuring the integrity and safety of products. In Japan, market leaders like LCR Hallcrest are at the forefront of smart packaging solutions, leveraging thermochromic materials to create temperature-sensitive labels on beverage containers. These labels indicate the ideal serving temperature, enhancing user experience. Similarly, in China, companies responding to the escalating demand for food safety solutions are utilizing thermochromic technologies in packaging. These materials are employed in labels indicating freshness or temperature variations in food items.The Thermochromic Materials Market, fueled by technological innovation and an escalating need for advanced packaging solutions, is being shaped globally. Notable advancements and applications in countries such as the United States, Germany, Japan, and China underscore the transformative impact of these drivers in the market's evolution. Thermochromic Materials Market Restraint The Thermochromic Materials Market, despite its promising prospects, grapples with notable obstacles impacting its broader acceptance and application. These constraints encompass multifaceted challenges that hinder the seamless integration and widespread use of thermochromic materials. Foremost among these hurdles is the High-Cost factor. The specialized techniques and materials required for manufacturing and implementing thermochromic materials significantly escalate production expenses compared to conventional alternatives, posing a considerable barrier, particularly for cost-sensitive industries and consumers. involves Durability and Stability concerns. Certain thermochromic materials may exhibit undesirable traits such as fading, color alterations, or susceptibility to external elements like UV light. This lack of long-term stability and the risk of color degradation dissuade manufacturers and users from embracing these materials confidently. The integration of thermochromic materials into existing manufacturing processes necessitates intricate adjustments and potentially specialized equipment. This technical complexity can impede adoption and delay the incorporation of these materials into various applications. Regulatory Concerns are a pertinent issue, especially in fields involving food or medical products. Safety and migration concerns regarding thermochromic materials necessitate lengthy and costly approval processes, impacting their utilization in critical sectors. Limited Awareness and Consumer Adoption hinder widespread Thermochromic Materials Market penetration. Compared to established technologies, thermochromic materials remain relatively novel, limiting public awareness and understanding of their benefits and applications. The impact of these restraints is evident across industries. In the pharmaceutical sector, the high cost and regulatory complexities limit the extensive use of thermochromic labels in packaging. Similarly, in textiles, concerns persist about the durability and washing resistance of thermochromic inks, deterring their incorporation into clothing. Despite these challenges, ongoing developments strive to address these issues. Research focuses on enhancing the cost-effectiveness, durability, and stability of thermochromic materials. Collaborations between research institutions and industry players aim to tackle technical challenges and expedite market commercialization. Simultaneously, educational initiatives aim to raise awareness and exhibit the potential applications of these materials, fostering greater consumer acceptance in the Thermochromic Materials Market.Thermochromic Materials Market Segment Analysis

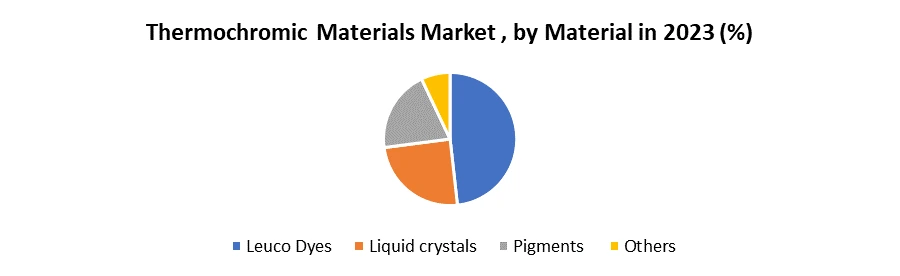

Based on Type In the Thermochromic Materials Market, an intriguing competition unfolds between two camps: reversible and irreversible variants. These two categories, each offering distinct advantages and limitations, shape the market's direction and future prospects. In 2023, within the Thermochromic Materials market, the reversible segment dominated, maintaining the largest market share, encompassing around 57.8%. Irreversible materials, while growing steadily at approximately 10%, held a smaller yet significant share. Reversible Thermochromic Materials, known for their capacity to revert to their original hue after returning to the initial temperature, present compelling benefits. They offer multiple cycles, enabling repeated color changes and prolonged application lifespan. Their swift response to temperature shifts allows precise adjustments, catering to specific needs. Moreover, these materials find versatile applications, proving valuable in dynamic sectors like smart packaging and dynamic textiles. However, they grapple with higher production costs and potential durability concerns over time, challenging their widespread adoption. On the other hand, Irreversible Thermochromic Materials undergo a one-time, permanent color change upon hitting a specific temperature. Their simplicity and cost-effectiveness in production drive their appeal. They are straightforward to implement across diverse applications. Yet, they are limited in their utility, unsuitable for scenarios requiring multiple color changes, and can exhibit less precision in transitions between colors. As of 2023, reversible materials maintain a dominant market share of about 55-60%, propelled by their adaptability. In contrast, irreversible materials steadily grow at around 10%, owing to their cost-effectiveness in specific applications. The ongoing rivalry between these segments will persist, influenced by technological advancements and market demands. Reversible materials may solidify their lead with cost reductions, while innovative uses for irreversible materials will drive their growth. Expect the market to progress with a balance, catering to diverse needs within the Thermochromic Materials landscape. Based on Material, In 2023, within the Thermochromic Materials market, the largest market share was held by Leuco Dyes, surpassing Liquid Crystals, Pigments, and other materials, asserting its dominance as the leading segment in this dynamic market. In the competitive realm of the Thermochromic Materials market, the struggle for supremacy extends beyond the reversible versus irreversible divide. Within these categories, a spirited contest ensues among the primary material segments leuco dyes, liquid crystals, and pigments. These contenders each bring their distinctive advantages and limitations to the forefront, significantly impacting their market presence and steering the evolution of this vibrant industry. Leuco Dyes constitute a significant player in this arena, undergoing chemical alterations at specific temperatures to produce color changes. Renowned for their vivid color range and swift response to temperature variations, they showcase durability despite their higher production costs and solubility constraints. Liquid Crystals, straddling the line between solid and liquid states, exhibit distinct optical changes influenced by temperature and orientation. Their adaptability across a broader temperature spectrum and tunable properties grant precision in color and light control. However, they also come with technical complexities and higher production costs, making them a premium choice. Pigments, insoluble solid particles imparting color based on temperature shifts, offer affordability and easy integration into manufacturing processes. Despite a more limited color range and slower response times compared to dyes or liquid crystals, their cost-effectiveness and versatility in various applications, especially in mass-market products, maintain their significance in the market. In 2023, Leuco Dyes currently reign supreme, securing a dominant market share of approximately 47.67 %. Despite this, Liquid Crystals are witnessing the most rapid growth, with an annual estimated increase of about 15.78%, owing to their advanced functionalities and appeal in high-tech applications. Pigments maintain a crucial role, holding around 38.98% of the market share, due to their accessibility and suitability for broad applications. The competition among these material segments is set to intensify further. Anticipated advancements in liquid crystal production costs and innovative pigment formulations may alter market dynamics, ensuring a diversified landscape catering to diverse needs within the Thermochromic Materials market. Continued research, innovation, and evolving market demands will undoubtedly shape the future trajectory of leuco dyes, liquid crystals, and pigments in this ever-evolving industry.

Thermochromic Materials Market Regional Analysis

North America, takes center stage, wielding a substantial Thermochromic Materials market share of about 37.1%. Its dominance is fueled by a fusion of technological prowess and a flourishing luxury goods sector. This region orchestrates a symphony of innovation, primarily manifested through its strides in advanced packaging solutions, intelligent textiles, and cutting-edge medical applications. Key players like Chromatic Technologies Inc. and LCR Hallcrest LLC emerge as virtuosos, setting the rhythm of this sector's advancement. They spearhead the melody of progress with their pioneering initiatives, heavily supported by robust research and development endeavors. Their contributions echo throughout the industry, shaping the landscape of thermochromic applications. This melodic blend of technological expertise and a penchant for luxury goods amplifies the region's resonance within the Thermochromic Materials Market. Its harmonious symphony encompasses an array of groundbreaking solutions that not only cater to current demands but also pioneer innovations, driving the crescendo of this dynamic market segment. Europe's dominance in the Thermochromic Materials Market stems from several compelling factors. Its stronghold lies in stringent regulatory standards that ensure the safety, security, and sustainability of materials, making thermochromic applications trustworthy and widely adopted. Additionally, the region's well-established luxury goods industry has embraced these materials, utilizing them for sophisticated security features, anti-counterfeiting measures, and specialized packaging. Europe's focus on technological innovation is evident through robust R&D endeavors, fostering advancements in thermochromic applications, particularly in security packaging and self-authenticating features. Moreover, the market's emphasis on sustainability aligns with the growing demand for eco-friendly solutions, amplifying the appeal of bio-based or environmentally conscious thermochromic materials. With a sophisticated market and a penchant for high-quality, innovative solutions, Europe stands at the forefront of the Thermochromic Materials Market, showcasing a commitment to innovation, quality, and stringent regulatory compliance. Asia-Pacific crescendos as the fastest-growing region, projected to reach a 30-35% market share by 2030. Fueled by rapid urbanization and rising disposable incomes, this ensemble resonates with innovations in food packaging, anti-counterfeiting solutions, and smart home applications. Leading names like Matsui International, New Prisematic Enterprise, and Smarol Industrial drive production and innovation. Rest of the World emerges with promising potential in markets like Latin America and the Middle East, particularly in sectors emphasizing food safety and security applications. Regional players and partnerships cultivate growth, adapting to specific needs and contributing unique accents to the symphony. The future harmony of the Thermochromic Materials Market lies in cross-regional collaboration, sustainability initiatives, and tailored solutions meeting distinct regional preferences. Understanding these regional dynamics is key to navigating this diverse and promising market, which promises a crescendo of exciting developments in this global symphony. Thermochromic Materials Market Competitive Analysis The competitive landscape within the Thermochromic Materials Market is a dynamic interplay of innovation, technology, and strategic positioning among key players globally. Industry leaders continually vie for dominance through product differentiation, technological advancements, and market expansion strategies. Established companies like Chromatic Technologies Inc., LCR Hallcrest LLC, OliKrom, and Matsui International Co. Ltd. maintain their prominence by investing significantly in R&D, developing cutting-edge thermochromic materials, and fostering partnerships to expand their market presence. Smaller, agile firms like Gem'Innov, New Prisematic Enterprise Co. Ltd., and Smarol Industrial Co. Ltd. often lead in niche applications or emerging markets. Their focus on innovation, agility, and flexibility allows them to explore unique applications, giving them a competitive edge. Research institutions and technology-focused entities collaborate closely with industry players, driving breakthroughs in thermochromic materials. Companies leveraging liquid crystals, leuco dyes, or novel pigment formulations capitalize on technological advancements to gain a competitive advantage. Regional dominance, such as North America's technological prowess and Europe's stringent regulatory environment, influences competition. Asia-Pacific's rapid growth and emerging markets bring fierce competition through cost-effective solutions and tailored applications. Competitive intensity will likely escalate as companies strive for sustainable, cost-effective, and versatile materials. Collaborations, innovations, and a deep understanding of market demands will define the competitive edge within the ever-evolving Thermochromic Materials Market.Scope of Global Thermochromic Materials Market : Inquire before buying

Global Thermochromic Materials Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.1 Bn. Forecast Period 2024 to 2030 CAGR: 9.2% Market Size in 2030: US $ 3.89 Bn. Segments Covered: by Type Reversible Irreversible by Material Leuco Dyes Liquid crystals Pigments Others by End User Packaging Printing & Coating Medical Textile Industrial Others Thermochromic Materials Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Thermochromic Materials Key players

North America: 1. Chromatic Technologies Inc. (US) 2. LCR Hallcrest LLC (US) 3. Radiant Color (US) 4. LumiInk (US) 5. Sensient Technologies Corporation (US) 6. Sun Chemical Corporation (US) Europe 1. OliKrom (France) 2. Gem'Innov (France) 3. BASF (Germany) 4. Merck KGaA (Germany) 5. Colortherm (UK) 6. Flint Group (Luxembourg) Asia-Pacific 1. Matsui International Co. Ltd. (Japan) 2. Toyo Seisakusho Co., Ltd. (Japan) 3. Teijin Limited (Japan) 4. DIC Corporation (Japan) 5. Dainippon Ink and Chemicals, Inc. (Japan) 6. New Prisematic Enterprise Co. Ltd. (Taiwan) 7. Smarol Industrial Co. Ltd. (China) 8. Kolortek Co. Ltd. (China) 9. Kolorjet Chemicals Pvt. Ltd. (India) 10. CTI (Chromatic Technologies India) (India) 11. Hali Pigment Co. Ltd. (China) 12. T&R Ink Manufacturing Co., Ltd. (South Korea) 13. Shanghai Weigao Packaging Materials Co., Ltd. (China) 14. Sakurai Chemical Industry Co., Ltd. (Japan) Frequently Asked Questions: 1] What is the growth rate of the Global Thermochromic Materials Market? Ans. The Global Thermochromic Materials Market is growing at a significant rate of 9.2 % during the forecast period. 2] Which region is expected to dominate the Global Thermochromic Materials Market? Ans. North America is expected to dominate the Thermochromic Materials Market during the forecast period. 3] What is the expected Global Thermochromic Materials Market size by 2030? Ans. The Thermochromic Materials Market size is expected to reach USD 76.8 Bn by 2030. 4] Which are the top players in the Global Thermochromic Materials Market? Ans. The major top players in the Global Thermochromic Materials Market are Chromatic Technologies Inc. (US), LCR Hallcrest LLC (US), Radiant Color (US), LumiInk (US), Sensient Technologies Corporation (US), Sun Chemical Corporation (US) and other 5] What are the factors driving the Global Thermochromic Materials Market growth? Ans. The increasing focus on determine the temperature variation and also used as temperature indicators in chemical reaction and apparatus is driving the market. 6] What are the emerging trends in the Thermochromic Materials Market share in 2023? Ans. The key trends for the market are advancement in medical and chemical technologies is the key trend for global thermochromic materials market.

1. Thermochromic Materials Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Thermochromic Materials Market: Dynamics 2.1. Thermochromic Materials Market Trends by Region 2.1.1. North America Thermochromic Materials Market Trends 2.1.2. Europe Thermochromic Materials Market Trends 2.1.3. Asia Pacific Thermochromic Materials Market Trends 2.1.4. Middle East and Africa Thermochromic Materials Market Trends 2.1.5. South America Thermochromic Materials Market Trends 2.2. Thermochromic Materials Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Thermochromic Materials Market Drivers 2.2.1.2. North America Thermochromic Materials Market Restraints 2.2.1.3. North America Thermochromic Materials Market Opportunities 2.2.1.4. North America Thermochromic Materials Market Challenges 2.2.2. Europe 2.2.2.1. Europe Thermochromic Materials Market Drivers 2.2.2.2. Europe Thermochromic Materials Market Restraints 2.2.2.3. Europe Thermochromic Materials Market Opportunities 2.2.2.4. Europe Thermochromic Materials Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Thermochromic Materials Market Drivers 2.2.3.2. Asia Pacific Thermochromic Materials Market Restraints 2.2.3.3. Asia Pacific Thermochromic Materials Market Opportunities 2.2.3.4. Asia Pacific Thermochromic Materials Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Thermochromic Materials Market Drivers 2.2.4.2. Middle East and Africa Thermochromic Materials Market Restraints 2.2.4.3. Middle East and Africa Thermochromic Materials Market Opportunities 2.2.4.4. Middle East and Africa Thermochromic Materials Market Challenges 2.2.5. South America 2.2.5.1. South America Thermochromic Materials Market Drivers 2.2.5.2. South America Thermochromic Materials Market Restraints 2.2.5.3. South America Thermochromic Materials Market Opportunities 2.2.5.4. South America Thermochromic Materials Market Challenges 2.3. PORTER’s Five Products Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For the Thermochromic Materials Industry 2.7. Analysis of Government Schemes and Initiatives For the Thermochromic Materials Industry 2.8. The Global Pandemic Impact on the Thermochromic Materials Market 3. Thermochromic Materials Market: Global Market Size and Forecast (by Value) (2023-2030) 3.1. Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 3.1.1. Reversible 3.1.2. Irreversible 3.2. Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 3.2.1. Leuco Dyes 3.2.2. Liquid crystals 3.2.3. Pigments 3.2.4. Others 3.3. Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 3.3.1. Packaging 3.3.2. Printing & Coating 3.3.3. Medical 3.3.4. Textile 3.3.5. Industrial 3.3.6. Others 3.4. Thermochromic Materials Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Thermochromic Materials Market Size and Forecast (by Value in USD Million) (2023-2030) 4.1. North America Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 4.1.1. Reversible 4.1.2. Irreversible 4.2. North America Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 4.2.1. Leuco Dyes 4.2.2. Liquid crystals 4.2.3. Pigments 4.2.4. Others 4.3. North America Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 4.3.1. Packaging 4.3.2. Printing & Coating 4.3.3. Medical 4.3.4. Textile 4.3.5. Industrial 4.3.6. Others 4.4. North America Thermochromic Materials Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Reversible 4.4.1.1.2. Irreversible 4.4.1.2. United States Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 4.4.1.2.1. Leuco Dyes 4.4.1.2.2. Liquid crystals 4.4.1.2.3. Pigments 4.4.1.2.4. Others 4.4.1.3. United States Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Packaging 4.4.1.3.2. Printing & Coating 4.4.1.3.3. Medical 4.4.1.3.4. Textile 4.4.1.3.5. Industrial 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Reversible 4.4.2.1.2. Irreversible 4.4.2.2. Canada Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 4.4.2.2.1. Leuco Dyes 4.4.2.2.2. Liquid crystals 4.4.2.2.3. Pigments 4.4.2.2.4. Others 4.4.2.3. Canada Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Packaging 4.4.2.3.2. Printing & Coating 4.4.2.3.3. Medical 4.4.2.3.4. Textile 4.4.2.3.5. Industrial 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Reversible 4.4.3.1.2. Irreversible 4.4.3.2. Mexico Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 4.4.3.2.1. Leuco Dyes 4.4.3.2.2. Liquid crystals 4.4.3.2.3. Pigments 4.4.3.2.4. Others 4.4.3.3. Mexico Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 4.4.3.3.1. Packaging 4.4.3.3.2. Printing & Coating 4.4.3.3.3. Medical 4.4.3.3.4. Textile 4.4.3.3.5. Industrial 4.4.3.3.6. Others 5. Europe Thermochromic Materials Market Size and Forecast (by Value in USD Million) (2023-2030) 5.1. Europe Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.2. Europe Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.3. Europe Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Thermochromic Materials Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.1.3. United Kingdom Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.2. France 5.4.2.1. France Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.2.3. France Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.3.3. Germany Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.4.3. Italy Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.5.3. Spain Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.6.3. Sweden Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.7.3. Austria Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 5.4.8.3. Rest of Europe Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Thermochromic Materials Market Size and Forecast (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.3. Asia Pacific Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Thermochromic Materials Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.1.3. China Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.2.3. S Korea Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.3.3. Japan Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.4.3. India Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.5.3. Australia Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.6.3. Indonesia Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.7.3. Malaysia Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.8.3. Vietnam Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.9.3. Taiwan Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 6.4.10.3. Rest of Asia Pacific Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Thermochromic Materials Market Size and Forecast (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 7.3. Middle East and Africa Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Thermochromic Materials Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 7.4.1.3. South Africa Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 7.4.2.3. GCC Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 7.4.3.3. Nigeria Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 7.4.4.3. Rest of ME&A Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 8. South America Thermochromic Materials Market Size and Forecast (by Value in USD Million) (2023-2030) 8.1. South America Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 8.2. South America Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 8.3. South America Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 8.4. South America Thermochromic Materials Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 8.4.1.3. Brazil Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 8.4.2.3. Argentina Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Thermochromic Materials Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Thermochromic Materials Market Size and Forecast, by Material (2023-2030) 8.4.3.3. Rest Of South America Thermochromic Materials Market Size and Forecast, by End-User (2023-2030) 9. Global Thermochromic Materials Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Thermochromic Materials Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Chromatic Technologies Inc. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Recent Developments 10.2. OliKrom (France) 10.3. Gem'Innov (France) 10.4. LCR Hallcrest LLC (US) 10.5. Matsui International Co. Ltd. (Japan) 10.6. New Prisematic Enterprise Co. Ltd. (Taiwan) 10.7. Smarol Industrial Co. Ltd. (China) 10.8. CTI (Chromatic Technologies India) (India) 10.9. Kolortek Co. Ltd. (China) 10.10. Kolorjet Chemicals Pvt. Ltd. (India) 10.11. BASF (Germany) 10.12. Merck KGaA (Germany) 10.13. Toyo Seisakusho Co., Ltd. (Japan) 10.14. Hali Pigment Co. Ltd. (China) 10.15. Colortherm (UK) 10.16. Radiant Color (US) 10.17. LumiInk (US) 10.18. Teijin Limited (Japan) 10.19. Sun Chemical Corporation (US) 10.20. T&R Ink Manufacturing Co., Ltd. (South Korea) 10.21. Sensient Technologies Corporation (US) 10.22. DIC Corporation (Japan) 10.23. Flint Group (Luxembourg) 10.24. Dainippon Ink and Chemicals, Inc. (Japan) 10.25. Sakurai Chemical Industry Co., Ltd. (Japan) 10.26. Shanghai Weigao Packaging Materials Co., Ltd. (China) 11. Key Findings 12. Industry Recommendations 13. Thermochromic Materials Market: Research Methodology 14. Terms and Glossary