Global Telecom Cloud Service Market size was valued at USD 33.76 Bn in 2023 and is expected to reach USD 107.67 Bn by 2030, at a CAGR of 15.6%.Telecom Cloud Market Overview

Telco Cloud is a revolutionary network architecture merging software-defined networking, virtualization and cloud-native technology. It creates a distributed computing network, enabling automation and orchestration across several sites and clouds. This evolution allows telecommunications service providers (telcos) to rapidly deploy services, adapt to changing network demands and efficiently manage resources, which boost Telecom Cloud Market growth. Initially inspired by data center virtualization, the advent of 5G spurred the integration of newer technologies such as containers and microservices, alongside hybrid cloud architectures. Telco Cloud fundamentally transforms network construction, operation, and management, leveraging NFV, SDN, AI, and distributed computing. Implementation of cloud business practices, telcos innovate to become more open, dynamic, agile and efficient, fostering successful digital transformations.To know about the Research Methodology :- Request Free Sample Report The Telecom Cloud market is growing, driven by the integration of software-defined networking, network functions virtualization and cloud-native technologies. This cutting-edge network architecture empowers telecom service providers to deploy virtualized and programmable infrastructure across distributed computing networks, streamlining automation and orchestration processes. With the emergence of 5G, Telecom Cloud has evolved to embrace innovative solutions including containers, microservices, and hybrid cloud setups, enhancing agility and efficiency. By leveraging Telecom Cloud solutions, providers expedite service delivery, effectively adapt to fluctuating network demands, and efficiently manage resources both centrally and across decentralized environments. This transformative paradigm shift not only optimizes operational efficiency but also stimulates innovation through the adoption of cloud-centric business practices.

Telecom Cloud Market Trend

Adoption Of Edge Computing Technology The adoption of edge computing technology has an important shift in modern computing paradigms, where processing power is decentralized and brought closer to the point of data generation. This transformative approach enables unparalleled speed and volume in data processing, unlocking real-time actionable insights and revolutionizing user experiences across diverse domains. Edge computing's deployment of computing resources at or near the user presents a myriad of advantages over traditional centralized models, particularly in optimizing the management of physical assets and fostering innovative, interactive human experiences that boost Telecom Cloud Market growth. Through a constellation of edge devices ranging from smart speakers, watches, and phones to IoT devices, point of sales systems, robots, vehicles, and sensors, data is collected and processed locally, diminishing reliance on distant cloud servers and facilitating swift, responsive operations. The convergence of edge computing with 5G technology at the network edge propels the realization of unprecedented capabilities, empowering applications such as autonomous drones, remote telesurgery and smart city initiatives with lightning-fast, low-latency connectivity. As a distributed IT architecture, edge computing strategically situates data processing at the periphery of the network, maximizing proximity to data sources including IoT devices and local edge servers. This closeness to the source engenders a host of business benefits, including expedited insights, enhanced response times, and optimized bandwidth utilization which boost the Telecom Cloud Market growth. Edge computing addresses critical network challenges by eliminating latency, conserving bandwidth and mitigating congestion.Telecom Cloud Market Dynamics

Increasing Demand for Agile and Flexible Network Infrastructure to Boost Market Growth As digital transformation sweeps across sectors, particularly in telecommunications, the need for adaptable infrastructure becomes critical. Whether spurred by the arrival of 5G, the shift toward hybrid cloud setups, or the embrace of edge computing, technology leaders are prioritizing network infrastructures that offer reliability, scalability, and flexibility. Telecom Cloud solutions provide the agility necessary for telecom service providers to rapidly deploy services, efficiently manage resources, and meet evolving market demands. These solutions unlock the potential for innovation through edge computing capabilities, enabling real-time analytics for quicker decision-making and enhanced customer experiences which drive Telecom Cloud Market growth. As approach Industry 4.0, businesses encounter fresh challenges and opportunities, highlighting the importance of modern, scalable, and agile infrastructure. Such infrastructure seamlessly adapts to changing environments, diverse workloads, and evolving business requirements. The number of Internet of Things (IoT) connected devices continues to soar, surpassing billions globally. This growth is bolstered by the growth of telecom cloud market, enabling scalable infrastructure and services to support IoT deployments across various industries, driving innovation, efficiency, and connectivity in the digital ecosystem.Flexibility is evident in the connectivity, compatibility, and modularity of infrastructure components, facilitating seamless communication and adaptability. The skilled personnel have leveraged their expertise to manage and optimize IT capabilities. Embracing Agile IT methodologies and transitioning to cloud-enabled solutions are crucial steps for businesses aiming to bolster IT infrastructure flexibility and spur business growth. By embracing Agile principles and investing in suitable tools, organizations expedite their digital transformation efforts and enhance operational efficiency. Challenge Of Ensuring Robust Cybersecurity Measures to Hamper Market Growth The telecom Cloud industry involves the storage, processing, and transmission of vast amounts of sensitive data, including personal, financial, and business-critical information. This data is inherently attractive to malicious actors, making telecom cloud infrastructure prime targets for cyber-attacks. Any breach or compromise of this data lead to severe consequences, including financial losses, reputational damage, and regulatory penalties. The distributed nature of cloud computing exacerbates cybersecurity challenges. Telecom cloud services often rely on complex networks of interconnected servers, data centers, and third-party providers, increasing the attack surface and introducing potential vulnerabilities at various points in the infrastructure. Managing and securing this sprawling network infrastructure requires strong cybersecurity measures, including encryption, access controls, intrusion detection systems, and regular security audits. The evolving threat landscape poses a constant challenge to cybersecurity in the Telecom Cloud Market.

Telecom Cloud Market Segment Analysis

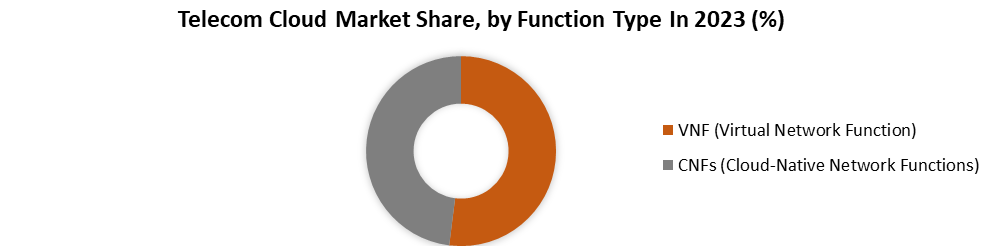

Based on the Component, the market is segmented into Hardware, Software and Services. Services is expected to dominate the Telecom Cloud Market during the forecast period. The telecom Cloud industry revolves around providing scalable, on-demand services to telecom operators and businesses, enabling them to efficiently manage their networks, applications, and services. Cloud services encompass a wide range of offerings such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), all of which are crucial for modernizing telecom infrastructure and enhancing service delivery. These services facilitate rapid deployment, scalability, and cost-effectiveness, allowing telecom companies to adapt quickly to changing market demands and customer preferences. Telecom cloud services often include value-added offerings such as network analytics, security solutions, and managed services, which enhance their appeal and value proposition. The Telecom Cloud Market is characterized by intense competition and evolving technological landscapes, driving companies to differentiate themselves through innovative service offerings, robust service-level agreements (SLAs), and superior customer support.Based on Function Type, the market is categorized into VNF (Virtual Network Function) and CNFs (Cloud-Native Network Functions). VNF (Virtual Network Function) dominated Telecom Cloud Market in 2023. VNFs represent a shift away from traditional, hardware-based networking towards virtualized network services deployed on open computing platforms. These virtualized services, such as routers, firewalls, WAN optimization, and NAT services, are executed within virtual machines (VMs) on standard virtualization infrastructure software including VMWare or KVM. The flexibility and scalability inherent in VNFs allow for agile provisioning and dynamic scaling of network services, significantly reducing time-to-market for new services and applications. The concept of service chaining, where VNFs are linked together to form service chains, streamlines the application provisioning process, enhancing operational efficiency. Beyond agility and flexibility, VNFs offer numerous other benefits to telecom operators. They enable better utilization of network infrastructure resources, leading to improved scalability and resource efficiency which boost Telecom Cloud Market growth. VNFs contribute to reduced power consumption, physical space requirements, and capital expenditures by replacing dedicated hardware with virtualized instances. This transition to VNFs not only enhances network scalability and agility but also drives cost savings and environmental sustainability.

Telecom Cloud Market Regional Insights

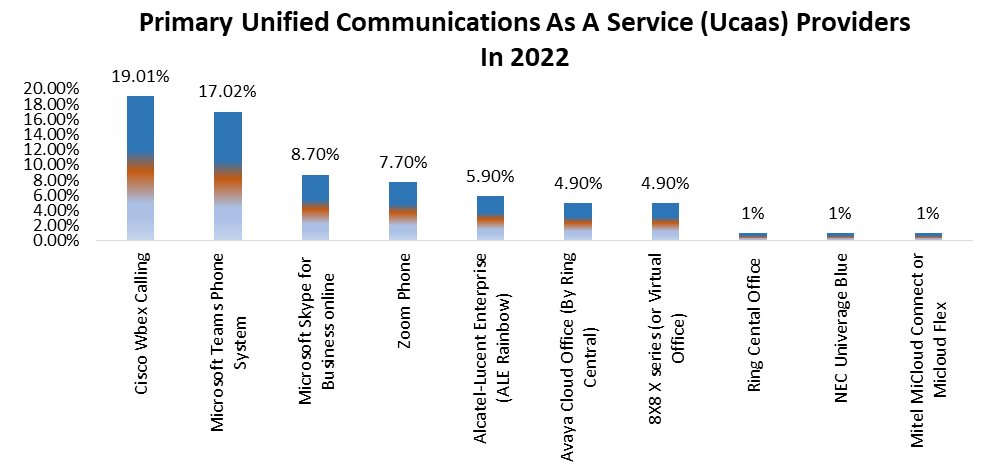

North America dominated the Telecom Cloud Market in 2023 and is expected to continue its dominance over the forecast period. The region boasts a mature telecommunications infrastructure coupled with a strong IT ecosystem, providing a solid foundation for the adoption of cloud-based solutions. Major players in the tech industry, including Google, Amazon, and Microsoft, have established strong footholds in North America, offering a wide array of cloud services tailored to the needs of telecom companies. The region is home to a large concentration of innovative startups and research institutions driving forward cloud technology development. The favorable regulatory environments and government initiatives promoting digital transformation have facilitated the rapid uptake of cloud solutions among telecom providers, enabling them to enhance operational efficiency, scale services more effectively, and meet the evolving demands of consumers and businesses alike. The presence of a diverse customer base, ranging from large enterprises to small and medium-sized businesses, boosts Telecom Cloud Market growth by stimulating demand for cloud-based services across various sectors. North America's leadership in 5G deployment and the Internet of Things (IoT) bolsters the demand for telecom cloud solutions, as these technologies rely heavily on scalable and flexible cloud infrastructure to deliver high-performance services. In North America, the Telecom Cloud solution has gained significant traction, with over 100 Communication Service Providers (CSPs) leveraging its capabilities. A collaboration between Amazon Web Services (AWS) and Alianza in 2023, Inc. was announced at AWS re: Invent, aimed at revolutionizing how CSPs deliver and monetize voice and cloud communications services. This strategic partnership combines AWS's strong cloud infrastructure with Alianza's cloud-native software offerings, providing a comprehensive solution for CSPs seeking to modernize their telecommunications infrastructure. By replacing traditional softswitch-based VoIP networks and legacy TDM hardware with Alianza's Cloud Communications Platform, CSPs significantly reduce ownership costs, simplify operations and launch new Unified Communications as a Service (UCaaS) and cloud communication products. AWS's expertise in cloud migration facilitates telco modernization, offering a seamless transition to a cloud environment. This collaborative solution not only enhances the customer experience but also drives telco business model transformation and fosters innovation, enabling CSPs to achieve greater market agility, faster time-to-market, and reduced risk in a future-ready platform. In 2022, primary Unified Communications as a Service (UCaaS) providers in North America include market leaders such as RingCentral, 8x8, Cisco Webex Calling, Microsoft Teams, and Zoom Phone. These providers offer comprehensive UCaaS solutions, leveraging the telecom cloud market to deliver seamless communication and collaboration experiences to businesses across the region.

Telecom Cloud Market Scope: Inquire before buying

Global Telecom Cloud Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 33.76 Bn. Forecast Period 2024 to 2030 CAGR: 15.6% Market Size in 2030: US $ 107.67 Bn. Segments Covered: by Component Hardware Software Services by Deployment Mode Public Private Hybrid by Organization Size Small and Medium Enterprises Large Enterprises by Function Type VNF (Virtual Network Function) CNFs (Cloud-Native Network Functions) by Application Consumer Mobile Services Enterprise Communication Solutions Data Services Digital TV and Streaming Services Network Infrastructure and Equipment Others Telecom Cloud Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Telecom Cloud Key Players

North America 1. T-Mobile US 2. Lumen Technologies 3. TelcoDR 4. In-Telecom 5. Trilogy Networks Europe 6. Orange S.A. 7. Telefónica 8. BT Group 9. Global Cloud Xchange 10. Intracom Telecom 11. Nordic Telecom 12. AMD Telecom 13. Telness APAC 14. Cyfuture 15. China Mobile 16. Bharti Airtel 17. Telstra 18. Chinatelecom Cloud 19. Klink.cloud 20. RevComm 21. Dr Peng Telecom and Media Group Company 22. ITI India 23. SoftBank Telecom ME 24. Oger Telecom Frequently Asked Questions: 1] What is the growth rate of the Global Telecom Cloud Market? Ans. The Global Telecom Cloud Market is growing at a significant rate of 15.6% during the forecast period. 2] Which region is expected to dominate the Global Telecom Cloud Market? Ans. North America is expected to dominate the Telecom Cloud Market during the forecast period. 3] What is the expected Global Telecom Cloud Market size by 2030? Ans. The Telecom Cloud Market size is expected to reach USD 107.67 Billion by 2030. 4] Which are the top players in the Global Telecom Cloud Market? Ans. The major top players in the Global Telecom Cloud Market are AT&T (Dallas, Texas, USA), Verizon Communications (New York City, New York, USA),China Mobile (Beijing, China), Vodafone Group (Newbury, United Kingdom), Deutsche Telekom AG (Bonn, Germany) and Others. 5] What are the factors driving the Global Telecom Cloud Market growth? Ans. The IoT Expansion and digital transformation are expected to drive market growth during the forecast period.

1. Telecom Cloud Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Telecom Cloud Market: Dynamics 2.1. Telecom Cloud Market Trends by Region 2.1.1. North America Telecom Cloud Market Trends 2.1.2. Europe Telecom Cloud Market Trends 2.1.3. Asia Pacific Telecom Cloud Market Trends 2.1.4. Middle East and Africa Telecom Cloud Market Trends 2.1.5. South America Telecom Cloud Market Trends 2.2. Telecom Cloud Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Telecom Cloud Market Drivers 2.2.1.2. North America Telecom Cloud Market Restraints 2.2.1.3. North America Telecom Cloud Market Opportunities 2.2.1.4. North America Telecom Cloud Market Challenges 2.2.2. Europe 2.2.2.1. Europe Telecom Cloud Market Drivers 2.2.2.2. Europe Telecom Cloud Market Restraints 2.2.2.3. Europe Telecom Cloud Market Opportunities 2.2.2.4. Europe Telecom Cloud Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Telecom Cloud Market Drivers 2.2.3.2. Asia Pacific Telecom Cloud Market Restraints 2.2.3.3. Asia Pacific Telecom Cloud Market Opportunities 2.2.3.4. Asia Pacific Telecom Cloud Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Telecom Cloud Market Drivers 2.2.4.2. Middle East and Africa Telecom Cloud Market Restraints 2.2.4.3. Middle East and Africa Telecom Cloud Market Opportunities 2.2.4.4. Middle East and Africa Telecom Cloud Market Challenges 2.2.5. South America 2.2.5.1. South America Telecom Cloud Market Drivers 2.2.5.2. South America Telecom Cloud Market Restraints 2.2.5.3. South America Telecom Cloud Market Opportunities 2.2.5.4. South America Telecom Cloud Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Telecom Cloud Industry 2.8. Analysis of Government Schemes and Initiatives For Telecom Cloud Industry 2.9. Telecom Cloud Market Trade Analysis 2.10. The Global Pandemic Impact on Telecom Cloud Market 3. Telecom Cloud Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Telecom Cloud Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 3.2.1. Public 3.2.2. Private 3.2.3. Hybrid 3.3. Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 3.3.1. Small and Medium Enterprises 3.3.2. Large Enterprises 3.4. Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 3.4.1. VNF (Virtual Network Function) 3.4.2. CNFs (Cloud-Native Network Functions) 3.5. Telecom Cloud Market Size and Forecast, by Application (2023-2030) 3.5.1. Consumer Mobile Services 3.5.2. Enterprise Communication Solutions 3.5.3. Data Services 3.5.4. Digital TV and Streaming Services 3.5.5. Network Infrastructure and Equipment 3.5.6. Others 3.6. Telecom Cloud Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Telecom Cloud Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Telecom Cloud Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 4.2.1. Public 4.2.2. Private 4.2.3. Hybrid 4.3. North America Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 4.3.1. Small and Medium Enterprises 4.3.2. Large Enterprises 4.4. North America Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 4.4.1. VNF (Virtual Network Function) 4.4.2. CNFs (Cloud-Native Network Functions) 4.5. North America Telecom Cloud Market Size and Forecast, by Application (2023-2030) 4.5.1. Consumer Mobile Services 4.5.2. Enterprise Communication Solutions 4.5.3. Data Services 4.5.4. Digital TV and Streaming Services 4.5.5. Network Infrastructure and Equipment 4.5.6. Others 4.6. North America Telecom Cloud Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Telecom Cloud Market Size and Forecast, by Component (2023-2030) 4.6.1.1.1. Hardware 4.6.1.1.2. Software 4.6.1.1.3. Services 4.6.1.2. United States Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 4.6.1.2.1. Public 4.6.1.2.2. Private 4.6.1.2.3. Hybrid 4.6.1.3. United States Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 4.6.1.3.1. Small and Medium Enterprises 4.6.1.3.2. Large Enterprises 4.6.1.4. United States Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 4.6.1.4.1. VNF (Virtual Network Function) 4.6.1.4.2. CNFs (Cloud-Native Network Functions) 4.6.1.5. United States Telecom Cloud Market Size and Forecast, by Application (2023-2030) 4.6.1.5.1. Consumer Mobile Services 4.6.1.5.2. Enterprise Communication Solutions 4.6.1.5.3. Data Services 4.6.1.5.4. Digital TV and Streaming Services 4.6.1.5.5. Network Infrastructure and Equipment 4.6.1.5.6. Others 4.6.2. Canada 4.6.2.1. Canada Telecom Cloud Market Size and Forecast, by Component (2023-2030) 4.6.2.1.1. Hardware 4.6.2.1.2. Software 4.6.2.1.3. Services 4.6.2.2. Canada Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 4.6.2.2.1. Public 4.6.2.2.2. Private 4.6.2.2.3. Hybrid 4.6.2.3. Canada Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 4.6.2.3.1. Small and Medium Enterprises 4.6.2.3.2. Large Enterprises 4.6.2.4. Canada Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 4.6.2.4.1. VNF (Virtual Network Function) 4.6.2.4.2. CNFs (Cloud-Native Network Functions) 4.6.2.5. Canada Telecom Cloud Market Size and Forecast, by Application (2023-2030) 4.6.2.5.1. Consumer Mobile Services 4.6.2.5.2. Enterprise Communication Solutions 4.6.2.5.3. Data Services 4.6.2.5.4. Digital TV and Streaming Services 4.6.2.5.5. Network Infrastructure and Equipment 4.6.2.5.6. Others 4.6.3. Mexico 4.6.3.1. Mexico Telecom Cloud Market Size and Forecast, by Component (2023-2030) 4.6.3.1.1. Hardware 4.6.3.1.2. Software 4.6.3.1.3. Services 4.6.3.2. Mexico Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 4.6.3.2.1. Public 4.6.3.2.2. Private 4.6.3.2.3. Hybrid 4.6.3.3. Mexico Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 4.6.3.3.1. Small and Medium Enterprises 4.6.3.3.2. Large Enterprises 4.6.3.4. Mexico Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 4.6.3.4.1. VNF (Virtual Network Function) 4.6.3.4.2. CNFs (Cloud-Native Network Functions) 4.6.3.5. Mexico Telecom Cloud Market Size and Forecast, by Application (2023-2030) 4.6.3.5.1. Consumer Mobile Services 4.6.3.5.2. Enterprise Communication Solutions 4.6.3.5.3. Data Services 4.6.3.5.4. Digital TV and Streaming Services 4.6.3.5.5. Network Infrastructure and Equipment 4.6.3.5.6. Others 5. Europe Telecom Cloud Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.2. Europe Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.3. Europe Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.4. Europe Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.5. Europe Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6. Europe Telecom Cloud Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.1.2. United Kingdom Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.1.3. United Kingdom Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.1.4. United Kingdom Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.1.5. United Kingdom Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.2. France 5.6.2.1. France Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.2.2. France Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.2.3. France Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.2.4. France Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.2.5. France Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.3.2. Germany Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.3.3. Germany Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.3.4. Germany Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.3.5. Germany Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.4.2. Italy Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.4.3. Italy Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.4.4. Italy Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.4.5. Italy Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.5.2. Spain Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.5.3. Spain Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.5.4. Spain Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.5.5. Spain Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.6.2. Sweden Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.6.3. Sweden Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.6.4. Sweden Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.6.5. Sweden Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.7.2. Austria Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.7.3. Austria Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.7.4. Austria Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.7.5. Austria Telecom Cloud Market Size and Forecast, by Application (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Telecom Cloud Market Size and Forecast, by Component (2023-2030) 5.6.8.2. Rest of Europe Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 5.6.8.3. Rest of Europe Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 5.6.8.4. Rest of Europe Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 5.6.8.5. Rest of Europe Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Telecom Cloud Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.3. Asia Pacific Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.4. Asia Pacific Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.5. Asia Pacific Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6. Asia Pacific Telecom Cloud Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.1.2. China Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.1.3. China Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.1.4. China Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.1.5. China Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.2.2. S Korea Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.2.3. S Korea Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.2.4. S Korea Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.2.5. S Korea Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.3.2. Japan Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.3.3. Japan Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.3.4. Japan Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.3.5. Japan Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.4. India 6.6.4.1. India Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.4.2. India Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.4.3. India Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.4.4. India Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.4.5. India Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.5.2. Australia Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.5.3. Australia Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.5.4. Australia Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.5.5. Australia Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.6.2. Indonesia Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.6.3. Indonesia Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.6.4. Indonesia Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.6.5. Indonesia Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.7.2. Malaysia Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.7.3. Malaysia Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.7.4. Malaysia Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.7.5. Malaysia Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.8.2. Vietnam Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.8.3. Vietnam Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.8.4. Vietnam Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.8.5. Vietnam Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.9.2. Taiwan Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.9.3. Taiwan Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.9.4. Taiwan Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.9.5. Taiwan Telecom Cloud Market Size and Forecast, by Application (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Telecom Cloud Market Size and Forecast, by Component (2023-2030) 6.6.10.2. Rest of Asia Pacific Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 6.6.10.3. Rest of Asia Pacific Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 6.6.10.4. Rest of Asia Pacific Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 6.6.10.5. Rest of Asia Pacific Telecom Cloud Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Telecom Cloud Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Telecom Cloud Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 7.3. Middle East and Africa Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 7.4. Middle East and Africa Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 7.5. Middle East and Africa Telecom Cloud Market Size and Forecast, by Application (2023-2030) 7.6. Middle East and Africa Telecom Cloud Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Telecom Cloud Market Size and Forecast, by Component (2023-2030) 7.6.1.2. South Africa Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 7.6.1.3. South Africa Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 7.6.1.4. South Africa Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 7.6.1.5. South Africa Telecom Cloud Market Size and Forecast, by Application (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Telecom Cloud Market Size and Forecast, by Component (2023-2030) 7.6.2.2. GCC Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 7.6.2.3. GCC Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 7.6.2.4. GCC Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 7.6.2.5. GCC Telecom Cloud Market Size and Forecast, by Application (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Telecom Cloud Market Size and Forecast, by Component (2023-2030) 7.6.3.2. Nigeria Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 7.6.3.3. Nigeria Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 7.6.3.4. Nigeria Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 7.6.3.5. Nigeria Telecom Cloud Market Size and Forecast, by Application (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Telecom Cloud Market Size and Forecast, by Component (2023-2030) 7.6.4.2. Rest of ME&A Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 7.6.4.3. Rest of ME&A Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 7.6.4.4. Rest of ME&A Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 7.6.4.5. Rest of ME&A Telecom Cloud Market Size and Forecast, by Application (2023-2030) 8. South America Telecom Cloud Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Telecom Cloud Market Size and Forecast, by Component (2023-2030) 8.2. South America Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 8.3. South America Telecom Cloud Market Size and Forecast, by Organisation Size(2023-2030) 8.4. South America Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 8.5. South America Telecom Cloud Market Size and Forecast, by Application (2023-2030) 8.6. South America Telecom Cloud Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Telecom Cloud Market Size and Forecast, by Component (2023-2030) 8.6.1.2. Brazil Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 8.6.1.3. Brazil Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 8.6.1.4. Brazil Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 8.6.1.5. Brazil Telecom Cloud Market Size and Forecast, by Application (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Telecom Cloud Market Size and Forecast, by Component (2023-2030) 8.6.2.2. Argentina Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 8.6.2.3. Argentina Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 8.6.2.4. Argentina Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 8.6.2.5. Argentina Telecom Cloud Market Size and Forecast, by Application (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Telecom Cloud Market Size and Forecast, by Component (2023-2030) 8.6.3.2. Rest Of South America Telecom Cloud Market Size and Forecast, by Deployment Type (2023-2030) 8.6.3.3. Rest Of South America Telecom Cloud Market Size and Forecast, by Organisation Size (2023-2030) 8.6.3.4. Rest Of South America Telecom Cloud Market Size and Forecast, by Function Type (2023-2030) 8.6.3.5. Rest Of South America Telecom Cloud Market Size and Forecast, by Application (2023-2030) 9. Global Telecom Cloud Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Telecom Cloud Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. T-Mobile US 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lumen Technologies 10.3. TelcoDR 10.4. In-Telecom 10.5. Trilogy Networks 10.6. Orange S.A. 10.7. Telefónica 10.8. BT Group 10.9. Global Cloud Xchange 10.10. Intracom Telecom 10.11. Nordic Telecom 10.12. AMD Telecom 10.13. Telness 10.14. Cyfuture 10.15. China Mobile 10.16. Bharti Airtel 10.17. Telstra 10.18. Chinatelecom Cloud 10.19. Klink.cloud 10.20. RevComm 10.21. Dr Peng Telecom and Media Group Company 10.22. ITI India 10.23. SoftBank Telecom 10.24. Oger Telecom 11. Key Findings 12. Industry Recommendations 13. Telecom Cloud Market: Research Methodology 14. Terms and Glossary