Surface Disinfectant Market size was valued at USD 3.71 Billion in 2023 and the total Surface Disinfectant revenue is expected to grow at 8.9 % through 2024 to 2030, reaching nearly USD 6.78 Billion.Overview:

The practical value of environmental or surface disinfection, compared to hand hygiene, has remained challenging. On the other hand, the importance of environmental disinfection has just lately started to be recognized. Many contemporary national and international infection control policies and guidelines include surface disinfection. Surface disinfectants need to have the right range of antimicrobial activity, which is a crucial part of the disease management strategy used in lab animal facilities. But there are many other things to consider, such as how it affects animal behavior, environmental safety, and human health. The method of disinfecting inanimate items involves getting rid of most or all pathogenic microorganisms on them, except bacterial spores. Based on their capacity to remove different germs, Surface disinfectants were classified as high-, intermediate-, or low-level in an original hierarchy created as per the present use of disinfectants classified as high-level are capable of killing a majority of pathogens, such as vegetative bacteria, mycobacteria, viruses, and bacterial spores, except spores in huge quantities. While most viruses, mycobacteria, fungi, and vegetative bacteria can typically be inactivated by intermediate-level disinfectants, most bacterial spores are unlikely to be destroyed by them. With several factors, including people adopting new lifestyles and changing their habits, the surface disinfectant market has experienced increased growth. These factors have also led to improved development of new surface disinfectants with new processes, increased efficiency of the surface disinfectant, and increased use of the surface disinfectant for cleaning purposes. Regional governments are expected to drive increased investment in surface disinfectant development during the forecast period, along with the enforcement of rules and regulations for environmental preservation and heightened sterilization procedures. During the forecast period, the major role players of Surface Disinfectant Market actively involved in the production of surface disinfectants are playing a key role. They are increasing their focus on research and development to enhance the effectiveness of surface disinfectants in killing microbes, thereby boosting the Surface Disinfectant Market for surface disinfectants. Throughout the Forecast Period, the Hypochlorite Segment is expected to hold a significant Surface disinfectant Market Share, because Sodium hypochlorite, also referred to as bleach, is used as a hypochlorite surface disinfectant. It is an efficient broad-spectrum disinfectant that can be used to kill bacteria, fungus, viruses, and mycobacterium.To know about the Research Methodology:-Request Free Sample Report

Dynamics:

Drivers: The growth of the senior population is fueled by the rising incidence of chronic disorders, the heightened occurrence of infectious diseases, and the spread of such illnesses. Moreover, the increased demand for surface disinfectants to address the production of microorganisms is driven by the higher number of surgeries conducted in hospitals and clinics. These factors actively drive and significantly enhance the Surface Disinfectant Market growth rate for surface disinfectants. The surface disinfectants market experiences a driving force through increased rules and regulations. The imposition of stringent guidelines and enhanced procedures for cleanliness, aimed at improving health and hygiene, along with a heightened focus on sanitation and the development of policies to maintain hygiene, contributes to driving the growth of the surface disinfectant market. This results in an increased growth rate during the forecast period. Surface Disinfectant Market growth has been propelled by advances in disinfectant formulation and delivery systems. These advancements encompass innovations in chemical formulations, with the development of eco-friendlier and sustainable disinfectants. Additionally, the adoption of advanced technologies, such as electrostatic sprayers and UV-C disinfection devices, serves as a driving force in enhancing the Surface Disinfectant Market. Restraint: Hazardous handling of chemicals in disinfectants attitudes risks to both the environment and human health, creating restraints on the surface disinfectant market. Chemicals like hypochlorite, peroxides, and acetic acid commonly utilized in disinfectants, are damaging. For example, sodium hypochlorite, a corrosive and flammable material, that cause burns, complicating the handling, storage, and transportation processes and resulting in increased costs. Research lead by the National Center for Biotechnology Information (NCBI) has exposed a significant rate of chronic disorders with severe health impacts among users. These factors significantly constrain the Surface Disinfectant Market. The toxic effects of sodium hypochlorite on human health and the environment upon direct contact restrain Surface Disinfectant Market revenue growth, despite its effectiveness in destroying blood-borne pathogens. The chemical is hazardous, corrosive, and possible to irritate the throat and nose and lungs when inhaled. Higher exposures to sodium hypochlorite can induce pulmonary health issues. Exposure to sodium hypochlorite generate symptoms such as headache, nausea, and vomiting. And these factors possibly hinder Surface Disinfectant Surface Disinfectant Market revenue growth. Challenges: The increased efficiency in cleaning and killing organisms over surfaces or other areas drives up the cost of surface disinfectants, posing a challenge. This elevated cost has the potential to decrease the Surface Disinfectant Market growth rate for surface disinfectants, as customers show reduced demand. The challenge lies in the side effects associated with surface disinfectants, which are chemically composed and inherently hazardous. These disinfectants exhibit toxic characteristics that can pose dangers to health, resulting in various side effects and adverse outcomes. It is crucial to keep these products away from children due to their harmful nature. The increased occurrence of side effects and other potential harms may contribute to a decline in the Surface Disinfectant Market growth rate of surface disinfectants during the forecast period. Opportunities: The emergence of the facilities with increased expense Opportunities arise with the development of surface disinfectants that exhibit increased efficiency, improved sanitization capabilities, and contribute to maintaining health and hygiene. The utilization of these advanced surface disinfectants for cleaning purposes has the potential to encourage Surface Disinfectant Market growth, fostering an enhanced growth rate for disinfectants. Opportunities arise from the government's provision of support Including increased funds allocated for research and development in surface disinfectants. The government's imposition of specific rules and regulations to ensure cleanliness, utilizing surface disinfectants for sanitization, and preventing the spread of diseases fosters an environment conducive to enhanced hygiene and cleanliness in various areas. In addition, key market players in the surface disinfectant sector are actively engaged in increased research and development efforts, introducing new products with enhanced disinfectant properties. These innovative products, designed for improved cleaning purposes, have the potential to drive an enhanced Surface Disinfectant Market growth rate and increased revenue share during the forecast period.Surface Disinfectant Segment Analysis:

By composition, in the composition segment, chemical composition emerges as the leading driver of Surface Disinfectant Market growth, securing the highest position with an increased revenue share in the surface disinfectant market. This dominance is fueled by growing customer demands for surface disinfectants, particularly for sanitization purposes, as individuals prioritize health and hygiene to prevent the spread of diseases. Alcohol plays a pivotal role in this market, experiencing heightened utilization in surface disinfectants. The surge in Surface Disinfectant Market demand is particularly notable for liquid sanitization products, driven by the increased strength required for effective cleaning and the elimination of microbes and pathogens. This surge in demand propels market growth, aligning with the expansion of industries involved in the production and manufacturing of chemicals used for cleaning purposes. As a result, the Surface Disinfectant Market experiences significant expansion within the composition segment.Within the composition segment, chlorine bleach stands out as an efficient method for eliminating unwanted bacteria. In the food industry, chlorine compounds are commonly employed to eradicate microorganisms and sanitize areas where food is processed. Hypochlorites, potent sanitizers, are formed by combining chlorine with inorganic substances like salt and calcium. Sodium Hypochlorite (NaOCl), comprising sodium and chlorine, and Calcium hypochlorite, identified as Ca (OCl) 2 and typically available in granular or tablet form, are examples of chlorine compounds. Hypochlorites, being the most dynamic chlorine compounds, exhibit increased antibacterial activity at higher temperatures. The recommended chlorine concentration for sterilizing food contact surfaces, including utensils, equipment, and tables, ranges from 40 to 180 parts per million (ppm). This recommendation plays a pivotal role in driving Surface Disinfectant Market revenue growth within the composition segment. Increased consumer awareness of the harmful effects of traditional disinfectants and a growing demand for natural ingredients are driving a heightened focus on environmentally friendly products in the bio-based surface disinfectant market. Bio-based surface disinfectants, derived from renewable sources and recognized for their non-toxic characteristics, are gaining popularity. This Surface Disinfectant Market segment is witnessing a significant increase in research and development activities, actively aimed at improving the efficacy and performance of these environmentally friendly products. Moreover, advancements in technology are actively enabling the development of innovative formulations within the composition segment, showcasing enhanced antimicrobial properties. By form of Disinfectant, in this segment, the liquid form stands out as the dominant force in the surface disinfectant market, exhibiting the highest growth rate. This prominence is attributed to the widespread adoption of liquid surface disinfectants across various applications, including hospitals, households, hotels, schools, malls, and others. The market experiences elevated demand for liquid surface disinfectants, driven by their enhanced antimicrobial properties, which contribute to more effective microbe elimination through liquid-based solutions. Notably, liquid surface disinfectants, such as sodium hypochlorite, play a significant role, constituting the largest share of market growth and increased revenue. The reduced risk of disease spread associated with liquid disinfectants further solidifies their position, contributing to the overall growth rate of surface disinfectants market during the forecast period.

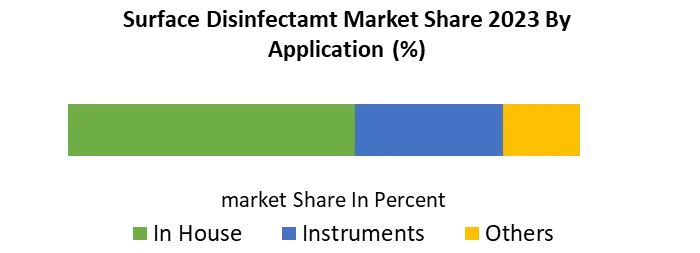

By Application, The worldwide market has been further categorized based on applications into in-house, instruments, and others. In 2022, the in-house application category led the global market, accounting for more than 73.00% of global revenue. The category is expected to maintain its dominance during the forecast period, growing at the quickest CAGR. In other application segment, surface disinfectants find additional uses in transportation and outdoor disinfection, leading to a significant increase in product demand. Chemical-based surface disinfectants are poised to dominate this segment due to their ease of application, cost-effectiveness, and widespread availability.

Surface Disinfectant Regional Insights:

From a regional perspective, North America takes the lead in Surface Disinfectant Market growth, showcasing an increased revenue share attributed to the widespread utilization of surface disinfectants, particularly in households and hospitals. The rising customer demand for surface disinfectants further contributes to this dominance. The Surface Disinfectant Market in North America experiences significant expansion, driven by the escalating prevalence of chronic disorders. The extensive application of disinfectants, coupled with improved antimicrobial activity, amplifies the effectiveness of these products, resulting in substantial growth in the surface disinfectant market within the region. In the regional analysis, Asia Pacific, Europe, Middle East, and Africa with significant growth of Surface Disinfectant Market with increased demands in the forecast period. Emerging economies like India, Brazil, and South Africa are gaining prominence as key participants in the sterilization and Surface Disinfectant markets. This creates appealing prospects for multinational infection control companies to extend their business operations into Surface Disinfectant Market. The increasing emphasis on healthcare expenditure and hygiene in these emerging economies is expected to drive the demand for surface disinfectants. Competitive Landscapes: To stay competitive in the Surface Disinfectant Market, manufacturers are concentrating on effectively managing and optimizing their supply efficiency. They are enhancing productivity, improving operational efficiency, and reducing lead time. The rising awareness among consumers about the toxicity of chemical-based products, along with the increasing disposable incomes of a significant portion of the population in developed economies, has compelled several manufacturers to delve into the production of bio based surface disinfectants. Reckitt Benckiser Group plc. (U.K.) approved the only air sanitizer by the EPA in June 2023. In April 2023, SC Johnson entered the competitive segment by introducing the Family Guard Brand Disinfectant Spray. This product line-up features specially formulated disinfectants designed to safeguard families against germs by disinfecting hard, non-porous surfaces. The Surface Disinfectant Market has emerged as a crucial asset to medicine in recent years, with major key players such as PDI Inc., Spartan Chemical Company, RCP Ranstadt GmbH (Germany), The Hygiene Company (U.K.), , KCWW (U.S.), Ecolab (U.S.), Uniwipe Europe Ltd (U.K.), CleanWell, LLC. (U.S), etc., actively engaging in competitive strategies. These companies are striving to boost market demand through substantial investments in research and development operations.Surface Disinfectant Market Scope: Inquire before buying

Surface Disinfectant Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.71 Bn. Forecast Period 2024 to 2030 CAGR: 9% Market Size in 2030: US $ 6.78 Bn. Segments Covered: by Composition Chemical Alcohol Ammonium Compounds Oxidizing Agents Phenolics Aldehydes Others

Biobasedby Form Liquid Wipes Sprays by Application In House Instruments Others by End-Use Hospitals Laboratories Households Hotel/Restaurants/Cafes (HORECA) Educational Institutes Others Surface Disinfectant Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Surface Disinfectant Key Players:

1. Dr. Deppe (Germany) 2. Reckitt Benckiser Group plc. (U.K.) 3. Codi Group (Netherlands) 4. Dreumex (Netherlands) 5. RCP Ranstadt GmbH (Germany) 6. The Hygiene Company (U.K.) 7. Uniwipe Europe Ltd (U.K.) 8. KCWW (U.S), Ecolab (U.S) 9. CleanWell, LLC. (U.S) 10. Seventh Generation Inc. (U.S) 11. The Claire Manufacturing Company (U.S) 12. Parker Laboratories (U.S) 13. GOJO Industries, Inc. (US) 14. Stepan Company (U.S) 15. Whiteley (U.S) 16. Linghai Zhan Wang Biotechnology Co., Ltd. (China) 17. Jainam Invamed Private Limited (India) 18. Hangzhou Wipex Nonwovens Co.,Ltd. (China) 19. PaxChem Ltd. (India) 20. Lonza (Switzerland) FAQs: 1. What are the growth drivers for the Surface Disinfectant market? Ans. The increasing prevalence of chronic pain diseases such as arthritis, cancer, and fibromyalgia, is expected to be the major driver for the Anime market. 2. What is the major restraint for the Surface Disinfectant growth? Ans. Stringent government regulations are expected to be the major restraining factor for the Surface Disinfectant growth. 3. Which region lead the global Surface Disinfectant during the forecast period? Ans. North America lead the global Surface Disinfectant during the forecast period. 4. What is the projected market size & growth rate of the Surface Disinfectant Market? Ans. Surface Disinfectant Market size was valued at USD 3.71 Billion in 2023 and the total Surface Disinfectant revenue is expected to grow at 8.9 % through 2024 to 2030, reaching nearly USD 6.78 Billion. 5. What segments are covered in the Surface Disinfectant report? Ans. The segments covered in the Surface Disinfectant Market report are based on Composition, Form, Application, End-use and Region.

1. Global Surface Disinfectant Market Size: Research Methodology 2. Global Surface Disinfectant Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Surface Disinfectant Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Surface Disinfectant Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Surface Disinfectant Market Size Segmentation 4.1. Global Surface Disinfectant Market Size, by Composition (2023-2030) • Chemical o Alcohol o Ammonium Compounds o Oxidizing Agents o Phenolics o Aldehydes o Others • Biobased 4.2. Global Surface Disinfectant Market Size, by Form (2023-2030) • Liquid • Wipes • Sprays 4.3. Global Surface Disinfectant Market Size, by Application (2023-2030) • In House • Instruments • Others 4.4. Global Surface Disinfectant Market Size, by End-use (2023-2030) • Hospitals • Laboratories • Households • Hotel/Restaurants/Cafes (HORECA) • Educational Institutes • Malls • Railways • Airports • Food Processing Industries • Others 5. North America Surface Disinfectant Market (2023-2030) 5.1. North America Surface Disinfectant Market Size, by Composition (2023-2030) • Chemical o Alcohol o Ammonium Compounds o Oxidizing Agents o Phenolics o Aldehydes o Others • Biobased 5.2. North America Surface Disinfectant Market Size, by Form (2023-2030) • Liquid • Wipes • Sprays 5.3. North America Surface Disinfectant Market Size, by Application (2023-2030) • In House • Instruments • Others 5.4. North America Surface Disinfectant Market Size, by End-use (2023-2030) • Hospitals • Laboratories • Households • Hotel/Restaurants/Cafes (HORECA) • Educational Institutes • Malls • Railways • Airports • Food Processing Industries • Others 5.5. North America Semiconductor Memory Market, by Country (2023-2030) • United States • Canada • Mexico 6. European Surface Disinfectant Market (2023-2030) 6.1. European Surface Disinfectant Market, by Composition (2023-2030) 6.2. European Surface Disinfectant Market, by Form (2023-2030) 6.3. European Surface Disinfectant Market, by Application (2023-2030) 6.4. European Surface Disinfectant Market, by End-use (2023-2030) 6.5. European Surface Disinfectant Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Surface Disinfectant Market (2023-2030) 7.1. Asia Pacific Surface Disinfectant Market, by Composition (2023-2030) 7.2. Asia Pacific Surface Disinfectant Market, by Form (2023-2030) 7.3. Asia Pacific Surface Disinfectant Market, by Application (2023-2030) 7.4. Asia Pacific Surface Disinfectant Market, by End-use (2023-2030) 7.5. Asia Pacific Surface Disinfectant Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Surface Disinfectant Market (2023-2030) 8.1. Middle East and Africa Surface Disinfectant Market, by Composition (2023-2030) 8.2. Middle East and Africa Surface Disinfectant Market, by Form (2023-2030) 8.3. Middle East and Africa Surface Disinfectant Market, by Application (2023-2030) 8.4. Middle East and Africa Surface Disinfectant Market, by End-use (2023-2030) 8.5. Middle East and Africa Surface Disinfectant Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Surface Disinfectant Market (2023-2030) 9.1. South America Surface Disinfectant Market, by Composition (2023-2030) 9.2. South America Surface Disinfectant Market, by Form (2023-2030) 9.3. South America Surface Disinfectant Market, by Application (2023-2030) 9.4. South America Surface Disinfectant Market, by End-use (2023-2030) 9.5. South America Surface Disinfectant Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Reckitt Benckiser Group PLC 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. PaxChem Ltd. 10.3. BODE Chemie GmbH 10.4. Star Brands Ltd. 10.5. The 3M Company 10.6. Ecolab 10.7. Medline Industries, Inc. 10.8. PDI, Inc. 10.9. GOJO Industries, Inc. 10.10. W.M. Barr 10.11. Spartan Chemical Company, Inc. 10.12. W.W. Grainger, Inc. 10.13. Carenowmedical 10.14. Procter & Gamble 10.15. The Clorox Company 10.16. Whiteley Corp. 10.17. Lonza 10.18. SC Johnson Professional 10.19. BASF SE 10.20. Evonik Industries AG 10.21. Kimberley-Clark Corporation (KCWW)