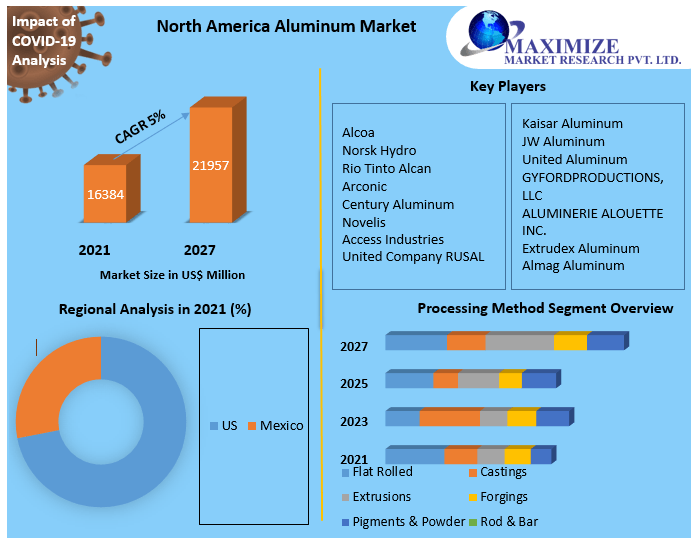

North America Aluminum Market was valued US$ 16384.81 Mn in 2021 and is forecast to reach US$ 21957.21 Mn by 2027 at a CAGR of 5% during the forecast period. Development of the automotive industry and technological advancements in product manufacturing technologies, processing equipment, and alloy development drives the North America aluminum market. Moreover, increase in applications across various end-user industries owed to its specific properties compare to other metals such as dampness and corrosion resistance further accelerate the market. Increase in use of recycled aluminum products is estimated to offer lucrative growth opportunities to the market players. However, substitutes such as composites poses a barrier to the market growth. The North American aluminum industry is gearing up for the anticipated demand growth in the automotive industry, which is striving to make lighter and more fuel-efficient vehicles.

To know about the Research Methodology :- Request Free Sample Report

The report study has analyzed revenue impact of covid-19 pandemic on the sales revenue of market leaders, market followers and disrupters in the report and same is reflected in our analysis. Extrusion segment dominated the market in 2021 followed by flat rolled and casting. Extrusion products have high demand in commercial applications precisely in construction, machinery and equipment, and consumer goods. Consumption of aluminum sheet and plate in North America has generally increased over the past five years. Aluminum is gaining robust popularity in the transportation segment. The transportation industry dominated the North America region with the growth in production and sales of vehicle. Transport accounts for 27% this figure is bound to keep growing over the next few years. Light, strong and flexibility of aluminum proved an ideal material for building heavier-than-air aircraft. U.S. held major share in the aluminum market due to presence of established end-use industries such as transportation and building & construction. Moreover, the U.S. is expected to remain dominant during the forecast period attributed to growth in investment by key players in the aluminum production expansion to cater to the rise in demand. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data and projections with a suitable set of assumptions and methodology. The report also helps in understanding grease market dynamics, structure by identifying and analyzing the market segments and project the market size. Further, the report also focuses on a competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence. The report also provides PEST analysis, PORTER's analysis, SWOT analysis to address questions of shareholders to prioritizing the efforts and investment in the near future to the emerging segment in grease market.North America Aluminum Market Scope: Inquire before buying

North America Aluminum Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2027 Historical Data: 2017 to 2021 Market Size in 2021: US $ 16384.81 Mn. Forecast Period 2022 to 2027 CAGR: 5% Market Size in 2027: US $ 21957.21 Mn. Segments Covered: by Processing Method • Flat Rolled • Castings • Extrusions • Forgings • Pigments & Powder • Rod & Bar by End Use Industry • Transport • Building & Construction • Electrical Engineering • Consumer Goods • Foil & Packaging • Machinery & Equipment • Others North America Aluminum Market, by Region:

• U.S. • MexicoNorth America Aluminum Market Key Players :

• Alcoa • Norsk Hydro • Rio Tinto Alcan • Arconic • Century Aluminum • Novelis • Access Industries • United Company RUSAL • Kaisar Aluminum • JW Aluminum • United Aluminum • GYFORDPRODUCTIONS, LLC • ALUMINERIE ALOUETTE INC. • Extrudex Aluminum • Almag Aluminum Frequently Asked Questions: 1. Which Country has the largest share in North America Aluminum Market? Ans: United State held the highest share in 2021. 2. What is the growth rate of North America Aluminum Market? Ans: The North America Aluminum Market is expected to grow at a CAGR of 5% during forecast period 2022-2027. 3. What is scope of the North America Aluminum market report? Ans: North America Aluminum Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in North America Aluminum market? Ans: The important key players in the North America Aluminum Market are – Alcoa, Norsk Hydro, Rio Tinto Alcan, Arconic, Century Aluminum, Novelis, Access Industries, United Company RUSAL, Kaisar Aluminum 5. What is the study period of this market? Ans: The North America Aluminum Market is studied from 2021 to 2027.

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Aluminum Market Size, by Market Value (US$ Bn) and Volume ( Metric ton) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. North America Aluminum Market Analysis and Forecast 6.1. North America Aluminum Market Analysis and Forecast 6.2. North America Aluminum Market Size& Y-o-Y Growth Analysis 7. North America Aluminum Market Analysis and Forecast, by Processing Method 7.1. Introduction and Definition 7.2. Key Findings 7.3. North America Aluminum Market Value Share Analysis, by Processing Method 7.4. Market Size (US$ Mn) Forecast, by Processing Method 7.5. Aluminum Market Analysis, by Processing Method 7.6. North America Aluminum Market Attractiveness Analysis, by Processing Method 8. North America Aluminum Market Analysis and Forecast, by End Use Industry 8.1. Introduction and Definition 8.2. North America Aluminum Market Value Share Analysis, by End Use Industry 8.3. North America Aluminum Market Size (US$ Mn) Forecast, by End Use Industry 8.4. North America Aluminum Market Analysis, by End Use Industry 8.5. North America Aluminum Market Attractiveness Analysis, by End Use Industry 9. North America Aluminum Market Analysis, by Region 9.1. North America Aluminum Market Value Share Analysis, by Region 9.2. Market Size (US$ Mn) Forecast, by Region 9.3. North America Aluminum Market Attractiveness Analysis, by Region 10. North America Aluminum Market Analysis 10.1. Key Findings 10.2. North America Aluminum Market Overview 10.3. North America Aluminum Market Value Share Analysis, by Processing Method 10.4. North America Aluminum Market Forecast, by Processing Method 10.4.1. Flat Rolled 10.4.2. Castings 10.4.3. Extrusions 10.4.4. Forgings 10.4.5. Pigments & Powder 10.4.6. Rod & Bar 10.5. North America Aluminum Market Value Share Analysis, by End Use Industry 10.6. North America Aluminum Market Forecast, by End Use Industry 10.6.1. Transport 10.6.2. Building & Construction 10.6.3. Electrical Engineering 10.6.4. Consumer Goods 10.6.5. Foil & Packaging 10.6.6. Machinery & Equipment 10.6.7. Others 10.7. North America Aluminum Market Value Share Analysis, by Country 10.8. North America Aluminum Market Forecast, by Country 10.8.1. U.S 10.8.2. Canada 10.9. North America Aluminum Market Analysis, by Country/ Sub-region 10.10. U.S Aluminum Market Forecast, by Processing Method 10.10.1. Flat Rolled 10.10.2. Castings 10.10.3. Extrusions 10.10.4. Forgings 10.10.5. Pigments & Powder 10.10.6. Rod & Bar 10.11. U.S Aluminum Market Forecast, by End Use Industry 10.11.1. Transport 10.11.2. Building & Construction 10.11.3. Electrical Engineering 10.11.4. Consumer Goods 10.11.5. Foil & Packaging 10.11.6. Machinery & Equipment 10.11.7. Others 10.12. Canada Aluminum Market Forecast, by Processing Method 10.12.1. Flat Rolled 10.12.2. Castings 10.12.3. Extrusions 10.12.4. Forgings 10.12.5. Pigments & Powder 10.12.6. Rod & Bar 10.13. Canada Aluminum Market Forecast, by End Use Industry 10.13.1. Transport 10.13.2. Building & Construction 10.13.3. Electrical Engineering 10.13.4. Consumer Goods 10.13.5. Foil & Packaging 10.13.6. Machinery & Equipment 10.13.7. Others 10.14. North America Aluminum Market Attractiveness Analysis 10.14.1. By Processing Method 10.14.2. By End Use Industry 10.15. PEST Analysis 10.16. Key Development 10.17. Key Trends 11. Company Profiles 11.1. Market Share Analysis, by Company 11.2. Competition Matrix 11.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 11.2.2. New Product Launches and Product Enhancements 11.2.3. Market Consolidation 11.2.3.1. M&A by Regions, Investment and Applications 11.2.3.2. M&A Key Players, Forward Integration and Backward Integration 11.3. Company Profiles: Key Players 11.3.1. Alcoa 11.3.1.1. Company Overview 11.3.1.2. Financial Overview 11.3.1.3. Product Portfolio 11.3.1.4. Business Strategy 11.3.1.5. Recent Developments 11.3.1.6. Manufacturing Footprint 11.3.2. Norsk Hydro 11.3.3. Rio Tinto Alcan 11.3.4. Arconic 11.3.5. Century Aluminum 11.3.6. Novelis 11.3.7. Access Industries 11.3.8. United Company RUSAL 11.3.9. Kaisar Aluminum 11.3.10. JW Aluminum 11.3.11. United Aluminum 11.3.12. GYFORDPRODUCTIONS, LLC 11.3.13. ALUMINERIE ALOUETTE INC. 11.3.14. Extrudex Aluminum 11.3.15. Almag Aluminum 12. Primary Key Insights