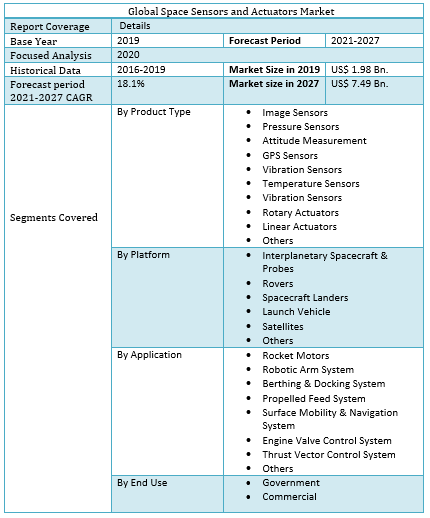

Global Space Sensors and Actuators Market size was valued at US$ 1.98 Bn. in 2019 and the total revenue is expected to grow at 18.1 % through 2020 to 2027, reaching nearly US$ 7.49 Bn.Global Space Sensors and Actuators Market Overview:

Projects related to space research and explorations are expensive in nature. The limitation in the number of scientific explorations has resulted in increased demand for machinery that is precise in nature and performs specifically designed work. Space Sensors and Actuators consist of an integrated mechanism that performs the work of imaging, reconnaissance, and simplified internal functioning of the space vehicle. Space Sensors are mounted on space vehicles and perform the work of collecting information related to light, temperature, environment, and biological contents. The Actuator performs the conversion of electrical signals to physical output. Limitations in sending humans in space and increased dependence on high precision machinery for collecting data in space have resulted in a growth in the Global Space Sensors and Actuators Market.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2019 is Considered a base year however 2020’s numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

Global Space Sensors and Actuators Market Dynamics:

Space exploration has always been a dream for mankind. Improvement in technology has resulted in sending probes and rovers into space and on different planets a preferable task for developed nations. The machinery used in these space vehicles requires an integrated system that consists of different sensors and actuators that helps in data collection, processing, analyzing, and reporting back to earth. An increase in the curiosity of mankind related to space has resulted in a rise in demand for Space Sensors and Actuators. Increased issues on earth like population explosion, scarcity of food, water, and other resources have resulted in a rise in joint efforts by governments and private players on finding a planet that is suitable for humans. An increase in the number of private players in space exploration has resulted in a rise in demand for Space Sensors and Actuators. The complex machinery used in Space vehicles also holds a large-scale application in the commercial sector. Satellites are used on a large scale for observing patterns in nature to forecast environmental conditions. Satellites play a crucial role in the telecommunication, ITES, and Service sector as it provides and maintains all essential things required by these sectors. An increase in demand for highly advanced technology by the commercial sector has propelled the demand for Space Sensors and Actuators. An increase in the number of countries sending space vehicles and small aerial machinery for forecasting weather, soil patterns, telecommunication, and border security has resulted in a boom in the small satellites market. The rising preference for small-sized satellites with high precision machinery has resulted in a growth in demand for Space Sensors and Actuators by governments and the commercial sector. An increase in the cooperative global effort to explore space has resulted in the formation of the International Space Station and International Space Agency that launches telescopes in space for detecting changes happening light-years away. To tap this highly saturated market, UK-based Teledyne e2v entered into an agreement with Leonardo for supplying specialized image sensors to the European Space Agency for their highly ambitious CHIME project in March 2021. An increase in the space research and exploration program by the Indian Space Agency ISRO has resulted in a rise in demand for advanced technology related to space in the region of the Indian Sub-continent. To tap this market Hical Technologies Private Ltd. successfully bid and won the contract to provide Electromechanical Actuators to ISRO in March 2020. This agreement will improve the market presence of Hical in the Asia-Pacific market.An increase in the budgets for space exploration and the rising number of private players act as the driving factor for the growth of the Global Space Sensors and Actuators Market.Restraints:

The presence of complex mechanisms to develop space-based technology has restricted the entry of new players in the highly saturated Space Sensors and Actuators Market.Global Space Sensors and Actuators Market Segment Analysis:

Global Space Sensors and Actuators Market is segmented By Product Type, The requirement of optical instruments on a large scale has forecasted Image Sensors to dominate the Product Type segment of the Global Space Sensors and Actuators Market in the coming years. An increase in the space exploration programs by private players like SpaceX has resulted in a 6.6% increase in demand for various sensors like Pressure Sensors, Attitude Measurement, GPS Sensors, Vibration Sensors, and Temperature Sensors in the second decade of this century. Different Actuators like Linear Actuators and Rotary Actuators are available in the product portfolio of the Global Space Sensors and Actuators Market.By Platform, An increase in the use of self-contained machinery has forecasted Satellites to dominate the Platform segment of the Global Space Sensors and Actuators Market. An increase in the space exploration programs by countries like China, Israel, and India has resulted in a 3.1% increase in demand for Space Sensors and Actuators for manufacturing Interplanetary Spacecraft & Probes in this decade. The rising number of unmanned missions in this century has resulted in a 1.7% increase in demand for Rovers from 2010 through 2020 by space agencies of countries like the US, China, and France. By Application, Different sensors are applied at different parts of space vehicles. Every system and sensor performs their work so as to perform a successful completion of the project related to space. The increased use by the commercial sector has resulted in a 3.3% increase in demand for Surface Mobility and Navigation System in 2020 as compared to the duration of 2015-2018 by the sectors like Mining and Defense. The rising preference for precise machinery to avoid loss while docking by the marine industry has resulted in a 1.8% increase in demand for the Berthing and Docking system from 2018 through 2020 by the commercial logistics and supply chain industry. By End User, An increase in the use of advanced technology for the betterment of business has forecasted the commercial sector to dominate the End User segment of the Global Space Sensors and Actuators Market. Rising expenditure by developing countries like Israel and India has resulted in a 6.8% increase in demand for Space Sensors and Actuators in this decade.

Global Space Sensors and Actuators Market Regional Insights

The presence of a big Aerospace industry and rising demand for advanced technology by the commercial sector has resulted in a 7.6% increase in demand for Space Sensors and Actuators in 2020 as compared to the period of 2014-2018 in North America. The presence of developed nations having established government and private space research and exploration agencies has resulted in a 6.1% increase in demand for Space Sensors and Actuators after 2017 in Europe. The rapidly developing space agencies in countries like China and India have resulted in a 4.5% increase in demand for Space Sensors and Actuators in the second decade of this century in the Asia-Pacific. The Middle East and Africa’s Market is showing a growth rate of 3%, the reason for which is the rising preference for satellites for research and scientific purposes by countries like Israel and Jordan. The South American Market is showing a low growth rate, the reason for which is the lack of facilities and capital required for space exploration by countries present in this region. The objective of the report is to present a comprehensive analysis of the global Space Sensors and Actuators market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Space Sensors and Actuators market dynamics, structure by analyzing the market segments and Project the global Space Sensors and Actuators market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Space Sensors and Actuators market make the report investor’s guide.

Global Space Sensors and Actuators Market Scope: Inquire before buying

Global Space Sensors and Actuators Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaGlobal Space Sensors and Actuators Market Key Players

• Honeywell International Inc. • Innovative Sensor Technology IST AG • Texas Instruments Inc. • Lockheed Martin Corporation • Northrop Grumman Corporation • Moog Inc. • Bradford Engineering B.V. • TE Connectivity • Renesas Electronics Corporation • Maxar Technologies • RUAG Aerospace Engineering Company • Teledyne e2v Limited • Analog Devices Inc. • MinebeaMitsumi Inc. • SiemensFAQs:

1) What is the market share of the Global Space Sensors and Actuators Market in 2019? Answer: The Global Space Sensors and Actuators Market was valued at US $ 1.98 Billion in the year 2019. 2) Which is the dominating region for the Global Space Sensors and Actuators Market? Answer: The presence of a big Aerospace industry and rising demand for technological transformation and updates in products used in space shuttles and satellites has resulted in making North America the biggest market for Space Sensors and Actuators. 3) What are the opportunities for technological development in the Global Space Sensors and Actuators Market? Answer: The rising preference for small-sized components for small satellites and the use of high-temperature resistance alloys for manufacturing miniature actuation devices are some of the opportunities for technological development in the Global Space Sensors and Actuators Market. 4) Which factor acts as the driving factor for the growth of the Global Space Sensors and Actuators Market? Answer: An increase in the research and development on the use of Radiation technology to improve accuracy acts as the major driving factor for the growth of the Global Space Sensors and Actuators Market. 5) What factors are restraining the growth of the Global Space Sensors and Actuators Market? Answer: The presence of stringent government policies acts as the major restraining factor for the growth of the Global Space Sensors and Actuators Market.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Space Sensors and Actuators Market Size, by Market Value (US$ Bn.) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Space Sensors and Actuators Market 3.4. Geographical Snapshot of the Space Sensors and Actuators Market, By Manufacturer share 4. Global Space Sensors and Actuators Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Space Sensors and Actuators Market 5. Supply Side and Demand Side Indicators 6. Global Space Sensors and Actuators Market Analysis and Forecast, 2019-2027 6.1. Global Space Sensors and Actuators Market Size & Y-o-Y Growth Analysis. 7. Global Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 7.1.1. Image Sensors 7.1.2. Pressure Sensors 7.1.3. Attitude Measurement 7.1.4. GPS Sensors 7.1.5. Vibration Sensors 7.1.6. Rotary Actuators 7.1.7. Linear Actuators 7.1.8. Others 7.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 7.2.1. Interplanetary Spacecraft and Probes 7.2.2. Rovers 7.2.3. Spacecraft Landers 7.2.4. Launch Vehicle 7.2.5. Satellites 7.2.6. Others 7.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 7.3.1. Rocket Motors 7.3.2. Robotic Arm Systems 7.3.3. Berthing & Docking System 7.3.4. Propelled Feed System 7.3.5. Surface Mobility and Navigation System 7.3.6. Engine Valve Vector System 7.3.7. Thrust Control Vector System 7.3.8. Others 7.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 7.4.1. Government 7.4.2. Commercial 8. Global Space Sensors and Actuators Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2027 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 9.1.1. Image Sensors 9.1.2. Pressure Sensors 9.1.3. Attitude Measurement 9.1.4. GPS Sensors 9.1.5. Vibration Sensors 9.1.6. Rotary Actuators 9.1.7. Linear Actuators 9.1.8. Others 9.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 9.2.1. Interplanetary Spacecraft and Probes 9.2.2. Rovers 9.2.3. Spacecraft Landers 9.2.4. Launch Vehicle 9.2.5. Satellites 9.2.6. Others 9.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 9.3.1. Rocket Motors 9.3.2. Robotic Arm Systems 9.3.3. Berthing & Docking System 9.3.4. Propelled Feed System 9.3.5. Surface Mobility and Navigation System 9.3.6. Engine Valve Vector System 9.3.7. Thrust Control Vector System 9.3.8. Others 9.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 9.4.1. Government 9.4.2. Commercial 10. North America Space Sensors and Actuators Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 11.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 11.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 12. Canada Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 12.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 12.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 12.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 13. Mexico Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 13.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 13.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 13.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 13.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 14. Europe Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 14.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 14.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 14.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 14.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 15. Europe Space Sensors and Actuators Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 16.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 16.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 16.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 16.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 17. France Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 17.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 17.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 17.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 17.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 18. Germany Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 18.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 18.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 18.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 18.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 19. Italy Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 19.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 19.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 19.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 19.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 20. Spain Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 20.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 20.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 20.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 20.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 21. Sweden Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 21.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 21.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 21.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 21.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 22. CIS Countries Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 22.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 22.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 22.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 22.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 23. Rest of Europe Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 23.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 23.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 23.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 23.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 24. Asia Pacific Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 24.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 24.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 24.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 24.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 25. Asia Pacific Space Sensors and Actuators Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 26.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 26.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 26.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 26.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 27. India Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 27.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 27.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 27.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 27.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 28. Japan Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 28.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 28.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 28.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 28.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 29. South Korea Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 29.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 29.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 29.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 29.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 30. Australia Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 30.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 30.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 30.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 30.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 31. ASEAN Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 31.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 31.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 31.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 31.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 32. Rest of Asia Pacific Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 32.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 32.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 32.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 32.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 33. Middle East Africa Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 33.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 33.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 33.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 33.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 34. Middle East Africa Space Sensors and Actuators Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 35.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 35.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 35.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 35.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 36. GCC Countries Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 36.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 36.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 36.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 36.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 37. Egypt Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 37.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 37.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 37.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 37.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 38. Nigeria Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 38.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 38.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 38.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 38.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 39. Rest of ME&A Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 39.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 39.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 39.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 39.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 40. South America Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 40.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 40.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 40.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 40.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 41. South America Space Sensors and Actuators Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 42.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 42.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 42.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 42.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 43. Argentina Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 43.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 43.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 43.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 43.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 44. Rest of South America Space Sensors and Actuators Market Analysis and Forecasts, 2019-2027 44.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2027 44.2. Market Size (Value) Estimates & Forecast By Platform, 2019-2027 44.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 44.4. Market Size (Value) Estimates & Forecast By End User, 2019-2027 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Space Sensors and Actuators Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Honeywell International Inc. 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Innovative Sensor Technology IST AG 45.3.3. Texas Instruments Inc. 45.3.4. Lockheed Martin Corporation 45.3.5. Northrop Grumman Corporation 45.3.6. Moog Inc. 45.3.7. Bradford Engineering B.V. 45.3.8. TE Connectivity 45.3.9. Renesas Electronics Corporation 45.3.10. Maxar Technologies 45.3.11. RUAG Aerospace Engineering Company 45.3.12. Teledyne e2v Limited 45.3.13. Analog Devices Inc. 45.3.14. MinebeaMitsumi Inc. 45.3.15. Siemens 46. Primary Key Insights