The Smart Pneumatics Market size was valued at USD 4.77 Billion in 2023 and the total Smart Pneumatics revenue is expected to grow at a CAGR of 7.7 % from 2024 to 2030, reaching nearly USD 8.02 Billion by 2030. The Smart Pneumatics Market is gaining speed as people pay more attention to energy efficiency, lowering costs and the requirement for exact control in industrial procedures. The main growth comes from smart pneumatic systems being used more often, which is driven by Industry 4.0. Such high-tech systems provide real-time data understanding, increase operational effectiveness and help with predicting maintenance needs; all these features make them very useful in many different sectors of business.To know about the Research Methodology :- Request Free Sample Report Smart Pneumatics Market's main participants are very involved in strategic activities like making partners, introducing new products and buying other companies. They also try to keep their competitive edge by putting money into research and development with the goal of offering smart solutions that meet changing needs in this industry. These efforts highlight the competitive environment of the market as companies strive to provide cutting-edge smart pneumatic solutions. Automation in Manufacturing and Predictive Maintenance: The trend of automation in manufacturing, combined with the increasing popularity of predictive maintenance, also boosts the use of smart pneumatic systems. Companies at the forefront of this field such as Festo are leading efforts to create intelligent pneumatic solutions that fit well with principles from Industry 4.0. These solutions give manufacturers power to make their processes better, improve productivity and achieve operational superiority by using real-time data analysis alongside connectivity (Festo Didactic SE). Further important driving factor is the focus on energy efficiency in industrial activities. For instance, SMC Corporation uses smart pneumatic solutions that have advanced sensors and control systems to enhance power use. These improvements greatly aid not only in promoting sustainable manufacturing methods but also fulfilling the demand for environmentally friendly answers from this sector. However, even though smart pneumatic systems offer various advantages, there are still some obstacles that prevent their wide use. These include difficulties in handling high first-time investment expenses and complexities in integrating them into existing systems. For example, companies such as Siemens may face barriers due to large initial capital needs and the complicated process of incorporating these technologies within current setups. Moreover, shortages of skilled workforce and risks related to cybersecurity hamper the growth of market. The Smart Pneumatics Market, in spite of these difficulties, is ready for significant expansion due to increasing need for automation along with energy efficiency and accurate control of industrial activities. As companies continue inventing and handling present obstacles, smart pneumatic solutions are expected to have an important in shaping the manufacturing industry.

Smart Pneumatics Market Dynamics:

Automation Trend in Manufacturing with Predictive Maintenance Adoption Driving Smart Pneumatics Market Growth The integration of Smart Pneumatics into industrial processes aligns seamlessly with the principles of Industry 4.0, driving the growth of Smart Pneumatics Market growth. Companies such as Festo, a renowned automation supplier, exemplify this trend by developing cutting-edge smart pneumatic solutions that integrate seamlessly with Industry 4.0 initiatives. These solutions offer real-time data analytics and connectivity, empowering manufacturers with the tools to optimize their processes. By providing advanced insights and connectivity options, smart pneumatics contribute to the efficient functioning of manufacturing ecosystems. Festo's innovations, for instance, enable manufacturers to enhance productivity, reduce downtime, and achieve operational excellence through the application of intelligent, Industry 4.0-ready pneumatic systems.Industry 4.0 technologies expected to have the greatest impact on organizations (2023)

Energy efficiency has emerged as a paramount concern in industrial operations, fostering the adoption of Smart Pneumatics as a key growth driver. Leading companies such as SMC Corporation are at the forefront of this movement, leveraging advanced sensors and control systems within their smart pneumatic solutions. These technologies optimize energy consumption, addressing the industry's demand for sustainable and environmentally friendly manufacturing practices. SMC Corporation's intelligent pneumatic components contribute not only to energy efficiency but also align with global efforts towards greener industrial operations. By embracing Smart Pneumatics, industries meet their energy reduction targets, enhance operational sustainability, and contribute to an eco-friendlier manufacturing landscape. In this way, the integration of smart pneumatic solutions becomes instrumental in addressing the pressing challenges of energy efficiency within industrial settings. The rising trend of automation in manufacturing facilities is another potent growth driver for the Smart Pneumatics market. Companies such as Parker Hannifin are pivotal in this regard, providing smart pneumatic components that facilitate precise control and automation. This not only enhances production efficiency but also contributes to significant reductions in labor costs. The automation capabilities of Smart Pneumatics play a crucial role in modernizing manufacturing processes, ensuring accuracy, speed, and reliability in operations. As industries increasingly prioritize automated solutions to stay competitive, Smart Pneumatics become an integral component, driving the demand for advanced pneumatic systems tailored for efficient automation in manufacturing. Integration Complexity and Downtime with Cybersecurity Risks Hinders the Smart Pneumatics Market Growth High initial investment costs associated with implementing advanced pneumatic systems integrated with smart technologies hindering the growth of Smart Pneumatics Market. Companies such as Siemens exemplify this challenge, as the substantial upfront capital required for deploying smart pneumatic solutions limit adoption, particularly for smaller businesses with budget constraints. The need for a considerable financial commitment becomes a barrier, hindering the widespread integration of these advanced technologies across various industries. The complexity of integrating Smart Pneumatics into existing systems is also a major challenge to the growth of Smart Pneumatics Market. For instance, Aventics, faces this restraint when integrating smart valves and actuators, as the process often necessitates significant modifications. This complexity lead to downtime and potential disruptions in operations, deterring businesses from embracing these advanced systems. The integration challenge underscores the need for seamless and user-friendly solutions that minimize operational disruptions and facilitate a smoother transition to smart pneumatic technologies. Skilled workforce shortages pose a significant challenge for the Smart Pneumatics market growth. Festo emphasizes the shortage of personnel with the necessary skills to operate and maintain smart pneumatic systems. This shortage underscores the need for specialized training programs to bridge the skills gap and ensure effective utilization of these advanced solutions. A lack of skilled professionals limits the industries' ability to fully leverage the capabilities of Smart Pneumatics, impeding the broader adoption of these technologies. The increasing connectivity of Smart Pneumatics raises cybersecurity concerns, particularly with features like remote monitoring provided by companies like ABB. Robust cybersecurity measures become crucial to protect against potential cyber threats and unauthorized access to critical industrial systems. As the reliance on connectivity grows, addressing these cybersecurity challenges is essential to ensure the integrity and security of smart pneumatic systems. The absence of standardized protocols for Smart Pneumatics components poses a challenge to interoperability. Parker Hannifin and other companies operating in diverse markets face difficulties in ensuring seamless communication between various smart pneumatic devices due to the lack of universal standards. This lack of standardization limits the flexibility and compatibility of smart pneumatic solutions, hindering their widespread integration and adoption. Compatibility issues with existing legacy systems present a restraint for Smart Pneumatics integration. Emerson highlights this challenge, as integrating smart pneumatic systems with older machinery may require additional investments in retrofitting. The need for retrofitting a deterrent, especially in industries with substantial existing infrastructure, slowing down the adoption of smart pneumatic technologies. Data security and privacy concerns arise with the collection and utilization of real-time data in Smart Pneumatics systems. Bosch Rexroth emphasizes the importance of robust data protection measures to address potential risks associated with sensitive industrial data. These concerns create hesitancy among businesses to fully embrace smart pneumatic technologies, particularly in sectors where data security is of utmost importance. Ensuring the reliability and ease of maintenance for Smart Pneumatics systems is another challenge. Emerson's offering of predictive maintenance through smart sensors introduces complexity that requires ongoing efforts to minimize downtime and maximize system longevity. The need for continuous maintenance and the potential complexities in predictive maintenance processes pose operational challenges for businesses adopting smart pneumatic solutions.

Smart Pneumatics Market Segment Analysis:

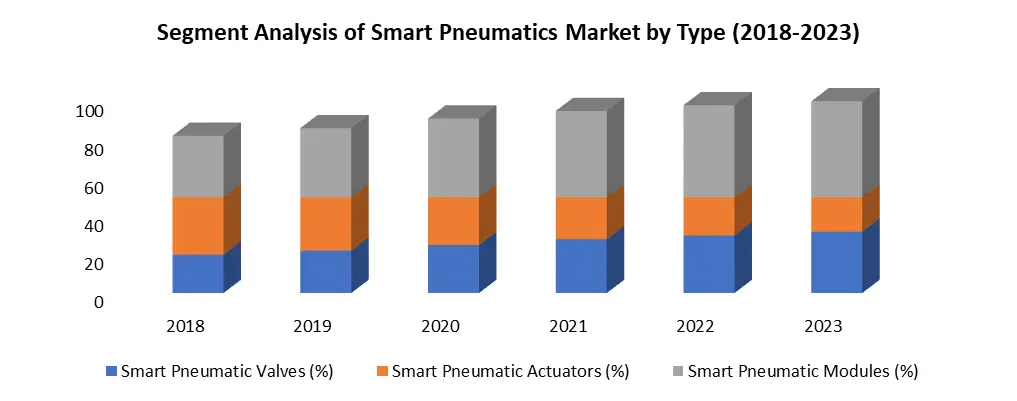

Based on Components, Hardware components dominated the growth of Smart Pneumatics Market in 2023 encompassing sensors, actuators, and controllers, form the backbone of Smart Pneumatics, driving the actual physical functionality. The adoption of hardware is particularly prominent in manufacturing applications, where precise control and automation are paramount. While Software, is a fast-growing segment serves as the intelligent core, enabling real-time data analytics, predictive maintenance, and remote monitoring. This segment finds extensive application across various industries, enhancing operational efficiency. Services, including maintenance, training, and consulting, complement the hardware and software components, ensuring seamless integration and optimized performance. As industries increasingly embrace automation and Industry 4.0 initiatives, the demand for hardware and software components grows, emphasizing the holistic importance of Smart Pneumatics in achieving enhanced efficiency and productivity. The services segment becomes pivotal in facilitating a smooth transition and maximizing the benefits of smart pneumatic systems, contributing to the overall growth and adoption of this transformative technology.Based on Type, Smart Pneumatic Valves dominated the Smart Pneumatics Market in 2023 as its functioning is importatnt components in industrial processes, are widely adopted for their precision control capabilities, particularly in manufacturing and automation. Smart Pneumatic Actuators, characterized by their ability to convert energy into mechanical motion, find extensive application in diverse sectors, enhancing operational efficiency and contributing to the growing trend of automation. Meanwhile, Smart Pneumatic Modules, encompassing integrated systems and components, offer a holistic approach to pneumatic control, fostering adoption in applications where seamless integration and comprehensive solutions are essential. As industries embrace the transformative power of smart technologies, the adoption of Smart Pneumatic Valves, Actuators, and Modules contributes collectively to the evolution of efficient, interconnected, and intelligent industrial ecosystems. The unique attributes of each type cater to diverse application needs, driving the overall growth and innovation within the Smart Pneumatics Market.

Smart Pneumatics Market Regional Insights:

Asia-Pacific Dominance in the Smart Pneumatics Market The Asia-Pacific region, particularly in developing powerhouses like China and India, is undergoing transformative changes characterized by an expanding population, increasing industrialization, and rapid urbanization. This significant shift is creating a surge in demand for agricultural products, food, and chemicals, all of which heavily rely on pneumatic equipment in manufacturing plants. The region is witnessing heightened investments in various sectors, including oil and gas, steel, power, and petrochemicals. The adoption of international safety standards and practices is a clear indication of the region's commitment to advancing industries, solidifying its role as a key driver of market growth. Remarkably, the Asia-Pacific region stands alone in recent years as the sole contributor to growth in oil and gas capacity, with the addition of four new refineries contributing approximately 750,000 barrels per day to global crude oil production. Strategic collaborations, such as the agreement between the Cambodian government and the Japanese International Cooperation Agency to construct a wastewater treatment plant in Dangkor district, underscore the region's dedication to infrastructure development. With an investment of USD 25 million, this project aims to enhance the drainage system, diverting wastewater directly to the plant rather than rivers, and is anticipated to significantly influence the Smart Pneumatics Market for smart valves and actuators across the Asia-Pacific region. The region's multifaceted growth, driven by industrial expansion, global standards adherence, and strategic infrastructure initiatives, establishes it as a pivotal focal point for the thriving market of smart pneumatic solutions.Scope of the Smart Pneumatics Market: Inquire before buying

Smart Pneumatics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.77 Bn. Forecast Period 2024 to 2030 CAGR: 7.7 % Market Size in 2030: US $ 8.02 Bn. Segments Covered: by Component Hardware Software & Services by Type Smart Pneumatic Valves Smart Pneumatic Actuators Smart Pneumatic Modules by End Use Industry Oil & Gas Energy & Power Water & Wastewater Automotive Semiconductor Food & Beverages Others Smart Pneumatics Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smart Pneumatics Market Key Players:

1. Emerson Electric-United States 2. Parker Hannifin - United States 3. Bimba Manufacturing - United States 4. Thomson Industries - United States 5. Advanced F.M.E Products, Inc. - United States 6. Chicago Pneumatic - United States 7. Gardner Denver - United States 8. Jiffy Air Tool - United States 9. P&F Industries - United States 10. Pneumatic Products - United States 11. SMC Corp. of America - United States (part of the global SMC Corporation based in Japan) 12. Stanley Black & Decker Inc. - United States 13. VAC-U-MAX - United States 14. Rotork - United Kingdom 15. Mesto - Germany 16. Bosch Rexroth - Germany 17. Eaton Corp. - Ireland 18. Festo - Germany 19. Ingersoll Rand Inc. - Ireland 20. Mann+Hummel - Germany 21. Basso Industry Corp. - Taiwan 22. Delton Pneumatics - India 23. Hitachi Koki - Japan 24. Makita Corp. - Japan 25. Mitsubishi Heavy Industries Ltd. - Japan FAQs: 1] What Major Key players in the Global Smart Pneumatics Market report? Ans. The Major Key players covered in the Smart Pneumatics Market report are based on Emerson Electric, Parker Hannifin, Bimba Manufacturing, Rotork, Mesto, Thomson Industries, Advanced Pneumatics, Basso Industry Corp., Bosch Rexroth, Chicago Pneumatic, Delton Pneumatics, Eaton Corp., Festo, Gardner Denver, Hitachi Koki, Ingersoll Rand Inc. 2] Which region is expected to hold the highest share in the Global Smart Pneumatics Market? Ans. Asia Pacific region is expected to hold the highest share in the Smart Pneumatics Market. 3] What is the market size of the Global Smart Pneumatics Market by 2030? Ans. The market size of the Smart Pneumatics Market by 2030 is expected to reach US$ 8.02 Billion. 4] What is the forecast period for the Global Smart Pneumatics Market? Ans. The forecast period for the Smart Pneumatics Market is 2024-2030. 5] What was the market size of the Global Smart Pneumatics Market in 2023? Ans. The market size of the Smart Pneumatics Market in 2023 was valued at US$ 4.77 Billion.

1. Smart Pneumatics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Smart Pneumatics Market: Dynamics 2.1. Smart Pneumatics Market Trends by Region 2.1.1. North America Smart Pneumatics Market Trends 2.1.2. Europe Smart Pneumatics Market Trends 2.1.3. Asia Pacific Smart Pneumatics Market Trends 2.1.4. Middle East and Africa Smart Pneumatics Market Trends 2.1.5. South America Smart Pneumatics Market Trends 2.2. Smart Pneumatics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Smart Pneumatics Market Drivers 2.2.1.2. North America Smart Pneumatics Market Restraints 2.2.1.3. North America Smart Pneumatics Market Opportunities 2.2.1.4. North America Smart Pneumatics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Smart Pneumatics Market Drivers 2.2.2.2. Europe Smart Pneumatics Market Restraints 2.2.2.3. Europe Smart Pneumatics Market Opportunities 2.2.2.4. Europe Smart Pneumatics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Smart Pneumatics Market Drivers 2.2.3.2. Asia Pacific Smart Pneumatics Market Restraints 2.2.3.3. Asia Pacific Smart Pneumatics Market Opportunities 2.2.3.4. Asia Pacific Smart Pneumatics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Smart Pneumatics Market Drivers 2.2.4.2. Middle East and Africa Smart Pneumatics Market Restraints 2.2.4.3. Middle East and Africa Smart Pneumatics Market Opportunities 2.2.4.4. Middle East and Africa Smart Pneumatics Market Challenges 2.2.5. South America 2.2.5.1. South America Smart Pneumatics Market Drivers 2.2.5.2. South America Smart Pneumatics Market Restraints 2.2.5.3. South America Smart Pneumatics Market Opportunities 2.2.5.4. South America Smart Pneumatics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Smart Pneumatics Industry 2.8. Analysis of Government Schemes and Initiatives For Smart Pneumatics Industry 2.9. Smart Pneumatics Market Trade Analysis 2.10. The Global Pandemic Impact on Smart Pneumatics Market 3. Smart Pneumatics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software & Services 3.2. Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 3.2.1. Smart Pneumatic Valves 3.2.2. Smart Pneumatic Actuators 3.2.3. Smart Pneumatic Modules 3.3. Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 3.3.1. Oil & Gas 3.3.2. Energy & Power 3.3.3. Water & Wastewater 3.3.4. Automotive 3.3.5. Semiconductor 3.3.6. Food & Beverages 3.3.7. Others 3.4. Smart Pneumatics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Smart Pneumatics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software & Services 4.2. North America Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 4.2.1. Smart Pneumatic Valves 4.2.2. Smart Pneumatic Actuators 4.2.3. Smart Pneumatic Modules 4.3. North America Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1. Oil & Gas 4.3.2. Energy & Power 4.3.3. Water & Wastewater 4.3.4. Automotive 4.3.5. Semiconductor 4.3.6. Food & Beverages 4.3.7. Others 4.4. North America Smart Pneumatics Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 4.4.1.1.1. Hardware 4.4.1.1.2. Software & Services 4.4.1.2. United States Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 4.4.1.2.1. Smart Pneumatic Valves 4.4.1.2.2. Smart Pneumatic Actuators 4.4.1.2.3. Smart Pneumatic Modules 4.4.1.3. United States Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.1.3.1. Oil & Gas 4.4.1.3.2. Energy & Power 4.4.1.3.3. Water & Wastewater 4.4.1.3.4. Automotive 4.4.1.3.5. Semiconductor 4.4.1.3.6. Food & Beverages 4.4.1.3.7. Others 4.4.2. Canada 4.4.2.1. Canada Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 4.4.2.1.1. Hardware 4.4.2.1.2. Software & Services 4.4.2.2. Canada Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 4.4.2.2.1. Smart Pneumatic Valves 4.4.2.2.2. Smart Pneumatic Actuators 4.4.2.2.3. Smart Pneumatic Modules 4.4.2.3. Canada Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.2.3.1. Oil & Gas 4.4.2.3.2. Energy & Power 4.4.2.3.3. Water & Wastewater 4.4.2.3.4. Automotive 4.4.2.3.5. Semiconductor 4.4.2.3.6. Food & Beverages 4.4.2.3.7. Others 4.4.3. Mexico 4.4.3.1. Mexico Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 4.4.3.1.1. Hardware 4.4.3.1.2. Software & Services 4.4.3.2. Mexico Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 4.4.3.2.1. Smart Pneumatic Valves 4.4.3.2.2. Smart Pneumatic Actuators 4.4.3.2.3. Smart Pneumatic Modules 4.4.3.3. Mexico Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.3.3.1. Oil & Gas 4.4.3.3.2. Energy & Power 4.4.3.3.3. Water & Wastewater 4.4.3.3.4. Automotive 4.4.3.3.5. Semiconductor 4.4.3.3.6. Food & Beverages 4.4.3.3.7. Others 5. Europe Smart Pneumatics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.2. Europe Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.3. Europe Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4. Europe Smart Pneumatics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.1.2. United Kingdom Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.1.3. United Kingdom Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.2. France 5.4.2.1. France Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.2.2. France Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.2.3. France Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.3.2. Germany Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.3.3. Germany Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.4.2. Italy Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.4.3. Italy Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.5.2. Spain Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.5.3. Spain Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.6.2. Sweden Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.6.3. Sweden Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.7.2. Austria Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.7.3. Austria Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 5.4.8.2. Rest of Europe Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 5.4.8.3. Rest of Europe Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Smart Pneumatics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4. Asia Pacific Smart Pneumatics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.1.2. China Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.1.3. China Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.2.2. S Korea Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.2.3. S Korea Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.3.2. Japan Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.3.3. Japan Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.4. India 6.4.4.1. India Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.4.2. India Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.4.3. India Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.5.2. Australia Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.5.3. Australia Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.6.2. Indonesia Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.6.3. Indonesia Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.7.2. Malaysia Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.7.3. Malaysia Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.8.2. Vietnam Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.8.3. Vietnam Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.9.2. Taiwan Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.9.3. Taiwan Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 6.4.10.2. Rest of Asia Pacific Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Smart Pneumatics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 7.4. Middle East and Africa Smart Pneumatics Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 7.4.1.2. South Africa Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 7.4.1.3. South Africa Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 7.4.2.2. GCC Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 7.4.2.3. GCC Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 7.4.3.2. Nigeria Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Nigeria Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 7.4.4.2. Rest of ME&A Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Rest of ME&A Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Smart Pneumatics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 8.2. South America Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 8.3. South America Smart Pneumatics Market Size and Forecast, by End Use Industry(2023-2030) 8.4. South America Smart Pneumatics Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 8.4.1.2. Brazil Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 8.4.1.3. Brazil Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 8.4.2.2. Argentina Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 8.4.2.3. Argentina Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Smart Pneumatics Market Size and Forecast, by Component (2023-2030) 8.4.3.2. Rest Of South America Smart Pneumatics Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Rest Of South America Smart Pneumatics Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Smart Pneumatics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Smart Pneumatics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Emerson Electric- United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Parker Hannifin - United States 10.3. Bimba Manufacturing - United States 10.4. Thomson Industries - United States 10.5. Advanced F.M.E Products, Inc. 10.6. Chicago Pneumatic - United States 10.7. Gardner Denver - United States 10.8. Jiffy Air Tool - United States 10.9. P&F Industries - United States 10.10. Pneumatic Products - United States 10.11. SMC Corp. of America - United States (part of the global SMC Corporation based in Japan) 10.12. Stanley Black & Decker Inc. - United States 10.13. VAC-U-MAX - United States 10.14. Rotork - United Kingdom 10.15. Mesto - Germany 10.16. Bosch Rexroth - Germany 10.17. Eaton Corp. - Ireland 10.18. Festo - Germany 10.19. Ingersoll Rand Inc. - Ireland 10.20. Mann+Hummel - Germany 10.21. Basso Industry Corp. - Taiwan 10.22. Delton Pneumatics - India 10.23. Hitachi Koki - Japan 10.24. Makita Corp. - Japan 10.25. Mitsubishi Heavy Industries Ltd. - Japan 11. Key Findings 12. Industry Recommendations 13. Smart Pneumatics Market: Research Methodology 14. Terms and Glossary